South East And South Asia Diesel Engine Filtration Market

Market Size in USD Billion

CAGR :

%

USD

2.80 Billion

USD

4.60 Billion

2024

2032

USD

2.80 Billion

USD

4.60 Billion

2024

2032

| 2025 –2032 | |

| USD 2.80 Billion | |

| USD 4.60 Billion | |

|

|

|

|

Diesel Engine Filtration Market Size

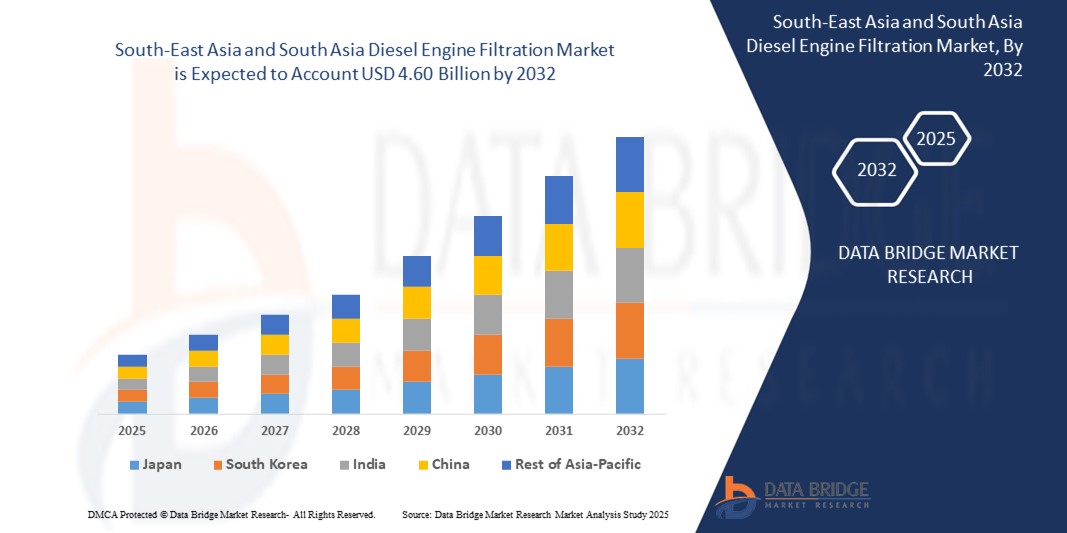

- The South-East Asia and South Asia Diesel Engine Filtration market size was valued at USD 2.80 billion in 2024 and is expected to reach USD 4.60 billion by 2032, at a CAGR of 6.4% during the forecast period

- Growth is driven by increasing demand for diesel-powered vehicles, rapid industrialization, and infrastructure development in emerging economies like India, China, and Indonesia. Stringent emission regulations and rising awareness of engine maintenance further propel market expansion.

- The region’s robust automotive and construction sectors, coupled with government initiatives promoting cleaner diesel technologies, are key contributors to market growth.

Diesel Engine Filtration Market Analysis

- Diesel engine filtration systems, encompassing fuel filters, oil filters, air filters, cabin filters, hydraulic filters, and other specialized filtration products, are essential for maintaining optimal engine performance, reducing harmful emissions, and extending the operational lifespan of diesel-powered equipment across diverse applications, including automotive vehicles, construction machinery, mining equipment, agricultural machinery, and industrial systems.

- The market is significantly fueled by the region’s high vehicle production, with Asia-Pacific contributing approximately 53% of global vehicle production in 2023, led by manufacturing powerhouses like China, India, and Thailand. The rapid expansion of heavy commercial vehicles (HCVs), coupled with large-scale infrastructure projects, drives substantial demand for advanced filtration systems to ensure engine efficiency and compliance with environmental standards.

- Technological advancements, such as nanofiber-based filtration media and IoT-enabled smart filters with real-time monitoring capabilities, are enhancing filtration efficiency and supporting compliance with stringent emission regulations, such as India’s Bharat Stage VI (BS-VI) and Southeast Asia’s Euro 4/5 standards. These innovations are critical for high-performance applications in heavy-duty machinery and industrial sectors.

- India is poised to be the fastest-growing market, projected to achieve a CAGR of 7.2% from 2025 to 2032, driven by its rapidly expanding automotive sector, government policies promoting cleaner fuels, and increasing infrastructure investments. China dominates the market with a commanding 40.1% revenue share in 2024, valued at USD 1.12 billion, attributed to its massive automotive and industrial manufacturing base, coupled with strong demand for diesel engine filtration solutions.

- Among product types, the fuel filter segment held the largest market share of 36.8% in 2024, valued at USD 1.03 billion, due to its critical role in ensuring clean fuel delivery, which is essential for optimizing engine performance and meeting emission standards in diesel-powered vehicles and machinery.

Report Scope and Diesel Engine Filtration Market Segmentation

|

Attributes |

Diesel Engine Filtration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

South-East Asia and South Asia

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diesel Engine Filtration Market Trends

“IoT-Enabled Smart Filters, Nanofiber Technology, Emission Compliance, and E-Commerce Growth”

- The adoption of IoT-enabled smart filtration technologies is a prominent trend, with over 20% of new filter deployments in 2024 incorporating advanced sensors for real-time performance monitoring, enhancing engine efficiency and reducing maintenance costs.

- Nanofiber-based filtration media, offering superior efficiency in capturing fine particles, accounted for 15% of new filter deployments in 2024, particularly in high-emission industries like mining, construction, and heavy-duty automotive applications.

- Increasing emphasis on sustainable and eco-friendly filter materials, aligning with regional emission regulations, with approximately 10% of new filters in 2024 certified for low environmental impact and recyclability.

- The aftermarket segment is experiencing rapid growth, with a 12% annual increase in sales through online retail channels, driven by the widespread adoption of e-commerce platforms in India, Thailand, and Indonesia.

- Integration of advanced filtration systems in hybrid diesel vehicles and machinery, supporting the region’s gradual shift toward cleaner energy solutions, is gaining significant traction in key markets like China, India, and Malaysia.

- Rising consumer awareness of preventive maintenance and the importance of high-quality filtration systems is driving demand for premium aftermarket products, particularly in urban areas with high vehicle density.

Diesel Engine Filtration Market Dynamics

Driver

“Rapid Industrialization, Booming Vehicle Production, Stringent Emission Regulations, Rising Vehicle Ownership, Government Support, and E-Commerce Expansion”

- Rapid industrialization and large-scale infrastructure development, with Asia-Pacific’s construction sector valued at USD 5.7 trillion in 2023, significantly drive demand for diesel engine filtration systems in heavy machinery used in construction, mining, and industrial applications, ensuring operational efficiency and equipment longevity.

- High vehicle production, with China and India collectively producing 38.8 million passenger vehicles and 7.05 million commercial vehicles in 2023, fuels demand for both OEM and aftermarket filtration solutions to ensure engine reliability, fuel efficiency, and compliance with environmental standards.

- Stringent emission regulations, such as India’s Bharat Stage VI (BS-VI) standards and Southeast Asia’s adoption of Euro 4/5 standards, necessitate advanced filtration systems to reduce particulate matter, nitrogen oxides, and other pollutants, driving market growth across automotive and industrial sectors.

- Rising vehicle ownership, driven by a growing middle class, rapid urbanization, and increasing disposable incomes in emerging economies like India, Indonesia, and Vietnam, boosts demand for aftermarket filters, as consumers prioritize regular maintenance to extend vehicle lifespan.

- Government initiatives promoting cleaner diesel technologies, such as India’s National Clean Air Programme, Thailand’s Eco-Friendly Vehicle Policy, and Malaysia’s Green Technology Master Plan, provide funding, tax incentives, and regulatory support to encourage the adoption of advanced filtration systems.

- The rapid expansion of e-commerce and logistics sectors, with Asia-Pacific’s e-commerce market projected to reach USD 3.5 trillion by 2027, drives demand for commercial vehicle filtration systems to support reliable transportation networks and ensure operational efficiency in logistics and delivery services.

Restraint/Challenge

“High Costs of Advanced Filters, Shift to Electric Vehicles, Supply Chain Disruptions, Technical Complexities, and Limited Rural Awareness”

- The high cost of advanced filtration systems, particularly IoT-enabled smart filters with integrated sensors and nanofiber-based media, poses a significant challenge to adoption among small and medium enterprises in cost-sensitive markets across South Asia, limiting market scalability.

- The gradual shift toward electric vehicles (EVs), with EV sales in Asia-Pacific projected to reach 10 million units by 2030, presents a long-term threat to the demand for diesel engine filtration systems, particularly in urban areas where EV adoption is accelerating.

- Supply chain disruptions, including raw material shortages, semiconductor constraints, and logistical challenges, have increased production costs by 8-10% since 2023, impacting market scalability, affordability, and timely delivery for manufacturers and end-users.

- Technical complexities in integrating smart filtration systems with existing diesel engines require specialized expertise, leading to higher deployment costs, extended time-to-market, and challenges in ensuring compatibility with older equipment.

- Rapid technological obsolescence in the filtration industry, driven by continuous advancements in materials and IoT integration, pressures manufacturers to invest heavily in research and development, reducing profitability for smaller companies and limiting innovation in cost-sensitive markets.

- Limited awareness of the benefits of advanced filtration technologies, such as nanofiber and smart filters, in rural and semi-urban areas of South Asia hinders market penetration and adoption among smaller end-users, particularly in agriculture and small-scale industries.

Diesel Engine Filtration Market Scope

The South-East Asia and South Asia Diesel Engine Filtration Market is segmented based on product type, technology, application, sales channel, end-user, and distribution channel.

- By Product Type

On the basis of component, the market is segmented into fuel filters, oil filters, air filters, cabin filters, hydraulic filters, and others. The fuel filter segment dominated with a 36.8% revenue share in 2024, valued at USD 1.03 billion, due to its critical role in ensuring clean fuel delivery for optimal engine performance, reduced wear, and compliance with emission standards.

The air filter segment is expected to grow at the fastest CAGR of 7.8% from 2025 to 2032, driven by increasing demand for emission control in heavy-duty applications across construction and mining sectors.

- By Technology

On the basis of technology, the market is segmented into conventional filters, advanced nanofiber filters, and IoT-enabled smart filters. The conventional filter segment held the largest share of 50.2% in 2024, attributed to its widespread use in cost-sensitive markets and traditional diesel engines.

The smart filter segment is projected to grow at the fastest CAGR of 8.1% from 2025 to 2032, fueled by IoT integration, real-time monitoring capabilities, and demand for predictive maintenance in modern applications.

- By Sales Channel

On the basis of sales channel, the market is segmented into OEM and aftermarket replacement. The OEM segment held a dominant 55.6% share in 2024, driven by high vehicle production and partnerships with manufacturers.

The aftermarket segment is projected to grow at the fastest CAGR of 7.0% from 2025 to 2032, fueled by increasing maintenance demand, vehicle ownership, and consumer awareness of engine maintenance.

- By End User

On the basis of end-user, the market is segmented into passenger vehicles, commercial vehicles, heavy-duty machinery, industrial equipment, and others. The commercial vehicles segment dominated with a 38.9% revenue share in 2024, driven by demand in logistics, transportation, and e-commerce sectors.

The heavy-duty machinery segment is expected to grow at the fastest CAGR of 7.6% from 2025 to 2032, fueled by growth in construction, mining, and industrial sectors.

- By End User

On market the basis for end-user, the market is segmented into direct sales to OEMs, authorized distributors, and online retail platforms. The direct sales segment held the largest share of 60.1% in 2024, driven by B2B contracts with vehicle and machinery manufacturers.

The online retail segment is expected to grow at the fastest CAGR of 8.5% from 2025 to 2032, fueled by the rapid growth of e-commerce platforms and increasing consumer preference for online purchasing.

Diesel Engine Filtration Market Regional Analysis

India Diesel Engine Filtration Market Insight

India is the fastest-growing market in the region, projected to achieve a CAGR of 7.2% from 2025 to 2032, driven by its rapidly expanding automotive sector, significant infrastructure development, and stringent Bharat Stage VI (BS-VI) emission standards. India accounted for 25.4% of the market share in 2024, supported by key players like MANN+HUMMEL and government initiatives such as the National Clean Air Programme, which promote cleaner diesel technologies and sustainable industrial practices. The growing aftermarket demand, fueled by increasing vehicle ownership and e-commerce adoption, further bolsters India’s market growth.

Indonesia Diesel Engine Filtration Market Insight

Indonesia accounted for 10.8% of the market in 2024, driven by its expanding construction and mining sectors, which rely heavily on diesel-powered equipment. The adoption of advanced filtration technologies and government investments in infrastructure projects, such as the Trans-Java Toll Road and urban development initiatives, support market growth. The rising demand for aftermarket filters in Indonesia’s growing automotive sector further contributes to market expansion.

Malaysia Diesel Engine Filtration Market Insight

Malaysia held a 9.5% market share in 2024, driven by its growing automotive and industrial sectors, as well as government initiatives like the Green Technology Master Plan, which promote sustainable practices and cleaner diesel technologies. The country’s strategic location and increasing demand for filtration systems in construction and logistics sectors contribute to steady market growth.

Diesel Engine Filtration Market Share

The Diesel Engine Filtration industry is primarily led by well-established companies, including:

- MANN+HUMMEL International GmbH & Co. KG (Germany)

- Donaldson Company, Inc. (United States)

- Cummins Inc. (United States)

- Hengst SE (Germany)

- K&N Engineering, Inc. (United States)

- Denso Corporation (Japan)

- Parker-Hannifin Corporation (United States)

- Sogefi SpA (Italy) Milas GmbH (Germany)

- Filtration Group Corporation (United States)

- ACDelco (United States)

- CAMFIL Group (Sweden)

- UFI Filters Group (Italy)

- ALCO Filters Ltd. (Cyprus)

- FRAM Group IP LLC (United States)

Latest Developments in South-East Asia and South Asia Diesel Engine Filtration Market

- In August 2022, Hengst Filtration showcased an innovative intelligent fuel filter concept at the IAA Transportation show in Hannover, designed specifically for modern diesel engines. The modular design improves fuel purity by 10%, supports easy integration with advanced diesel systems, and has gained significant traction in high-growth markets like India and Thailand.

- In March 2023, MANN+HUMMEL launched the FreciousPlus nanofiber-based cabin air filter, offering a 15% improvement in filtration efficiency for commercial vehicles in India and Southeast Asia. The product enhances air quality, complies with stringent emission regulations, and supports driver comfort in heavy-duty applications.

- In May 2024, Camfil expanded its manufacturing facility in Batu Gajah, Malaysia, to meet rising demand for air filters in the Asia-Pacific automotive and industrial sectors, increasing production capacity by 20% and strengthening its regional presence through localized manufacturing.

- In March 2024, Filtration Group acquired Universal Air Filter (UAF), enhancing its portfolio of diesel engine filtration solutions in South Asia, with a focus on IoT-enabled smart filters for heavy-duty applications in construction, mining, and industrial sectors.

- In April 2021, Donaldson Company introduced the Filter Minder Connect, a cutting-edge monitoring tool for fuel and oil filters, improving filtration performance by 12% in heavy-duty applications across India, Thailand, and Indonesia, enabling real-time maintenance insights and reducing operational downtime.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

TABLE OF CONTENTS SOUTH-EAST AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY 1.2 MARKET DEFINITION 1.3 OVERVIEW OF SOUTH-EAST ASIA AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET 1.4 CURRENCY AND PRICING 1.5 LIMITATION 1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS 2.2 ARRIVING AT THE SOUTH-EAST ASIA AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET SIZE

2.2.1 VENDOR POSITIONING GRID 2.2.2 TECHNOLOGY LIFE LINE CURVE 2.2.3 MARKET GUIDE 2.2.4 COMPANY POSITIONING GRID 2.2.5 MULTIVARIATE MODELLING 2.2.6 STANDARDS OF MEASUREMENT 2.2.7 TOP TO BOTTOM ANALYSIS 2.2.8 VENDOR SHARE ANALYSIS 2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS 2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 SOUTH-EAST ASIA AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET: RESEARCH SNAPSHOT 2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS 3.2 RESTRAINTS 3.3 OPPORTUNITIES 3.4 CHALLENGES

4. EXECUTIVE SUMMARY 5. PREMIUM INSIGHTS 6. INDUSTRY INSIGHTS 7. SOUTH-EAST ASIA AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET, BY OFFERING

7.1 OVERVIEW 7.2 HARDWARE 7.3 SOFTWARE

7.3.1 FLUID MONITORING SOFTWARE 7.3.2 CONTAMINATION CONTROL SOFTWARE

7.4 SERVICES

7.4.1 INTEGRATION 7.4.2 CONSULTING SERVICES 7.4.3 MAINTENCE & REPAIR

8. SOUTH-EAST ASIA AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET, BY FILTRATION TYPE

8.1 OVERVIEW 8.2 LUBE FILTER 8.3 AIR FILTER 8.4 FUEL FITER 8.5 COOLANT FILTER

9. SOUTH-EAST ASIA AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW 9.2 AFTERMARKET 9.3 OEM

10. SOUTH-EAST ASIA AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET, BY HEAVY DUTY VEHICLE

10.1 OVERVIEW 10.2 EXCAVATORS 10.3 DUMP TRUCKS 10.4 BLAST HOLE DRILL 10.5 OTHERS

11. SOUTH-EAST ASIA AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET, BY COUNTRY

11.1 SOUTH-EAST ASIA AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1.1 INDONESIA 11.1.2 INDIA 11.1.3 BANGLADESH 11.1.4 PAKISTAN 11.1.5 CAMBODIA 11.1.6 MALAYSIA 11.1.7 PHILIPPINES 11.1.8 SINGAPORE 11.1.9 THAILAND 11.1.10 VIETNAM 11.1.11 REST OF SOUTH-EAST ASIA AND SOUTH ASIA

11.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

12. SOUTH-EAST ASIA AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: SOUTH-EAST ASIA AND SOUTH ASIA 12.2 MERGERS & ACQUISITIONS 12.3 NEW PRODUCT DEVELOPMENT & APPROVALS 12.4 EXPANSIONS 12.5 REGULATORY CHANGES 12.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13. SOUTH-EAST ASIA AND SOUTH ASIA DIESEL ENGINE FILTRATION MARKET, COMPANY PROFILE(SWOT ANALYSIS FOR TO FIVE COMPANIES)

13.1 DONALDSON COMPANY, INC.

13.1.1 COMPANY OVERVIEW 13.1.2 REVENUE ANALYSIS 13.1.3 PRODUCT PORTFOLIO 13.1.4 GEOGRAPHIC PRESENCE 13.1.5 RECENT DEVELOPMENTS

13.2 CUMMINS INC.

13.2.1 COMPANY OVERVIEW 13.2.2 REVENUE ANALYSIS 13.2.3 PRODUCT PORTFOLIO 13.2.4 GEOGRAPHIC PRESENCE 13.2.5 RECENT DEVELOPMENTS

13.3 PARKER-HANNIFIN CORPORATION

13.3.1 COMPANY OVERVIEW 13.3.2 REVENUE ANAYSIS 13.3.3 PRODUCT PORTFOLIO 13.3.4 GEOGRAPHIC PRESENCE 13.3.5 RECENT DEVELOPMENTS

13.4 EATON

13.4.1 COMPANY OVERVIEW 13.4.2 REVENUE ANALYSIS 13.4.3 PRODUCT PORTFOLIO 13.4.4 GEOGRAPHIC PRESENCE 13.4.5 RECENT DEVELOPMENTS

13.5 MANN+HUMMEL HOLDING GMBH

13.5.1 COMPANY OVERVIEW 13.5.2 REVENUE ANALYSIS 13.5.3 PRODUCT PORTFOLIO 13.5.4 GEOGRAPHIC PRESENCE 13.5.5 RECENT DEVELOPMENTS

13.6 TRINITY FILTRATION

13.6.1 COMPANY OVERVIEW 13.6.2 PRODUCT PORTFOLIO 13.6.3 GEOGRAPHIC PRESENCE 13.6.4 RECENT DEVELOPMENTS

13.7 PT FTS INDONESIA

13.7.1 COMPANY OVERVIEW 13.7.2 PRODUCT PORTFOLIO 13.7.3 GEOGRAPHIC PRESENCE 13.7.4 RECENT DEVELOPMENTS

13.8 A.L FILTER

13.8.1 COMPANY OVERVIEW 13.8.2 PRODUCT PORTFOLIO 13.8.3 GEOGRAPHIC PRESENCE 13.8.4 RECENT DEVELOPMENTS

13.9 ELOFIC INDUSTRIES LIMITED

13.9.1 COMPANY OVERVIEW 13.9.2 PRODUCT PORTFOLIO 13.9.3 GEOGRAPHIC PRESENCE 13.9.4 RECENT DEVELOPMENTS

13.10 SAFRAN

13.10.1 COMPANY OVERVIEW 13.10.2 REVENUE ANALYSIS 13.10.3 PRODUCT PORTFOLIO 13.10.4 GEOGRAPHIC PRESENCE 13.10.5 RECENT DEVELOPMENTS

13.11 C.C.JENSEN A/S

13.11.1 COMPANY OVERVIEW 13.11.2 PRODUCT PORTFOLIO 13.11.3 GEOGRAPHIC PRESENCE 13.11.4 RECENT DEVELOPMENTS

13.12 KOMPASS INTERNATIONAL SA

13.12.1 COMPANY OVERVIEW 13.12.2 REVENUE ANALYSIS 13.12.3 PRODUCT PORTFOLIO 13.12.4 GEOGRAPHIC PRESENCE 13.12.5 RECENT DEVELOPMENTS

13.13 JOHNSON CONTROLS

13.13.1 COMPANY OVERVIEW 13.13.2 REVENUE ANALYSIS 13.13.3 PRODUCT PORTFOLIO 13.13.4 GEOGRAPHIC PRESENCE 13.13.5 RECENT DEVELOPMENTS

13.14 FILTER CONCEPT PVT. LTD.

13.14.1 COMPANY OVERVIEW 13.14.2 REVENUE ANALYSIS 13.14.3 PRODUCT PORTFOLIO 13.14.4 GEOGRAPHIC PRESENCE 13.14.5 RECENT DEVELOPMENTS

13.15 S.S FILTERS PVT. LTD.

13.15.1 COMPANY OVERVIEW 13.15.2 PRODUCT PORTFOLIO 13.15.3 GEOGRAPHIC PRESENCE 13.15.4 RECENT DEVELOPMENTS

13.16 TRICO CORPORATION

13.16.1 COMPANY OVERVIEW 13.16.2 PRODUCT PORTFOLIO 13.16.3 GEOGRAPHIC PRESENCE 13.16.4 RECENT DEVELOPMENTS

13.17 GENIUS FILTERS & SYSTEMS (P) LTD

13.17.1 COMPANY OVERVIEW 13.17.2 PRODUCT PORTFOLIO 13.17.3 GEOGRAPHIC PRESENCE 13.17.4 RECENT DEVELOPMENTS

13.18 FILSON FILTER

13.18.1 COMPANY OVERVIEW 13.18.2 PRODUCT PORTFOLIO 13.18.3 GEOGRAPHIC PRESENCE 13.18.4 RECENT DEVELOPMENTS

13.19 SOGEFI S.P.A.

13.19.1 COMPANY OVERVIEW 13.19.2 PRODUCT PORTFOLIO 13.19.3 GEOGRAPHIC PRESENCE 13.19.4 RECENT DEVELOPMENTS

13.20 HENGST SE

13.20.1 COMPANY OVERVIEW 13.20.2 PRODUCT PORTFOLIO 13.20.3 GEOGRAPHIC PRESENCE 13.20.4 RECENT DEVELOPMENTS

13.21 GLW OIL PURIFINER PTE LTD.

13.21.1 COMPANY OVERVIEW 13.21.2 PRODUCT PORTFOLIO 13.21.3 GEOGRAPHIC PRESENCE 13.21.4 RECENT DEVELOPMENTS

14. CONCLUSION

15. QUESTIONNAIRE

16. RELATED REPORTS

17. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.