Saudi Arabia, Turkey, and Egypt HbA1c Testing Market Analysis and Insights

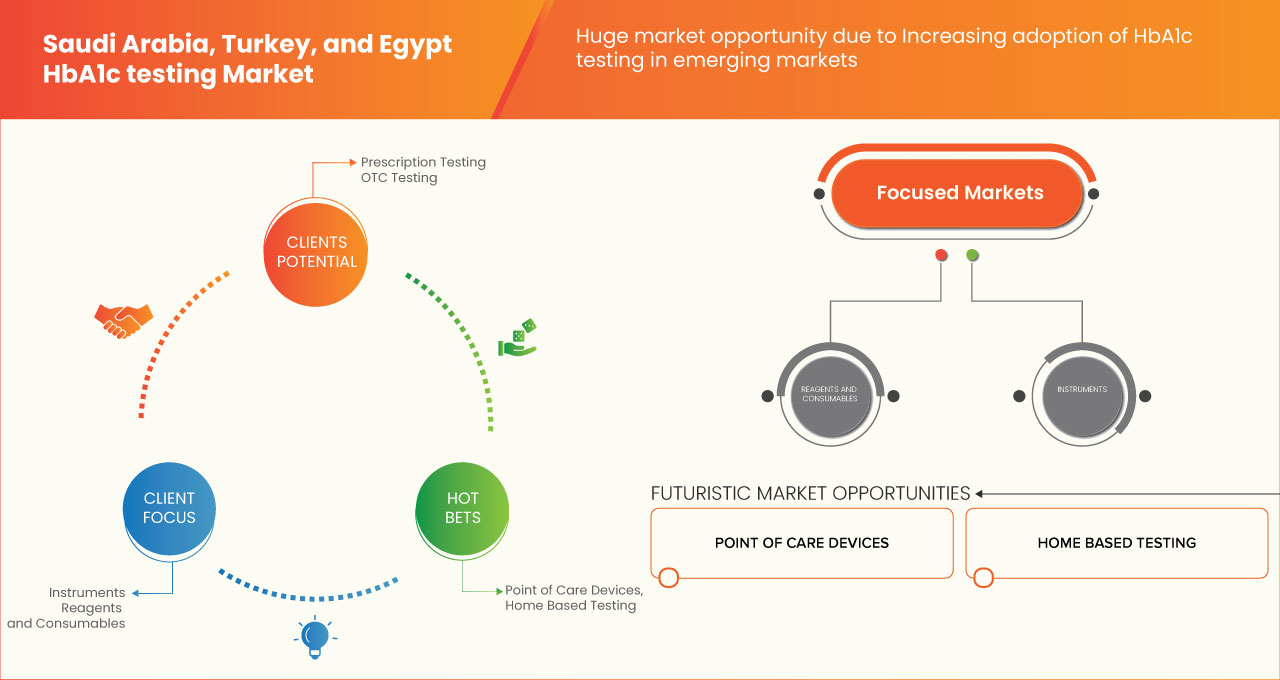

The rising awareness about diabetes and kidney diseases has enhanced the demand for the market. The rising healthcare expenditure for better health services also contributes to the market's growth. The major market players focus on various service launches and approvals during this crucial period. In addition, the increase in improved point of care devices for diabetes also contributes to the rising demand for diabetes or HBA1C testing.

Data Bridge Market Research analyzes that the HbA1c testing market is expected to grow with a CAGR of 4.4% in the forecast period of 2023 to 2030 and is expected to reach USD 61.59 million by 2030 in Saudi Arabia and the Turkey HbA1c testing market is expected to grow with a CAGR of 5.4% in the forecast period of 2023 to 2030 and is expected to reach USD 73.73 million by 2030 in Turkey and the Egypt hba1c testing market is expected to grow with a CAGR of 5.4% in the forecast period of 2023 to 2030 and is expected to reach USD 65.94 million by 2030 in Egypt. The instruments segment is projected to propel the market growth as the development of advanced technologies

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product Type (Instruments, Reagents and Consumables), Mode of Testing (Prescription Based Testing and OTC Testing), Technology (Ion-exchange HPCL, Enzymatic Assay, Affinity Binding Chromatography, Turbidimetric Inhibition Immunoassay and Others), End User (Laboratories, Hospitals, Clinics, Homecare, Ambulatory Centres, Pharmacies/Drug Stores and Others), Distribution Channel(Third Party Distribution, Direct Sales and Retail Sales), Country (Saudi Arabia, Egypt and Turkey) |

|

Countries Covered |

Saudi Arabia, Egypt and Turkey |

|

Market Players Covered |

Some of the key players operating in the Saudi Arabia, Egypt and Turkey HbA1c testing market are Siemens Healthcare GmbH, A. Menarini Diagnostics s.r.l , ARKRAY, Inc. , Trinity Biotech, Thermo Fisher Scientific Inc., Abbott, Wondfo, F. Hoffmann-La Roche Ltd, Ortho Clinical Diagnostics, DxGen Corp. and among others. |

Saudi Arabia, Turkey, and Egypt HbA1c Testing Market Definition

A blood test called a haemoglobin A1C (HbA1C) test reveals your average blood sugar (glucose) level over the previous two to three months. Your blood contains glucose; a form of sugar that is obtained from the food you eat. Glucose provides energy to your cells. The hormone insulin aids in the uptake of glucose by your cells. If you have diabetes, your body either produces insufficient insulin, or your cells don't properly utilize it. Because of the inability of glucose to enter your cells, your blood sugar levels rise.

Diabetes is a global endemic with rapidly increasing prevalence in developing and developed countries. Glycated hemoglobin (HbA1c) as a possible substitute to fasting blood glucose for diagnosis of diabetes HbA1c is an important indicator of long-term glycemic control with the ability to reflect the cumulative glycemic history of the preceding two to three months. HbA1c provides a reliable measure of chronic hyperglycemia and correlates well with the risk of long-term diabetes complications. Elevated HbA1c has also been regarded as an independent risk factor for coronary heart disease and stroke in subjects with or without diabetes. The valuable information provided by a single HbA1c test has rendered it a reliable biomarker for the diagnosis and prognosis of diabetes. However, the High cost of HBA1C testing devices and kits and standards for the approval and commercialization of products is expected to restrain the market growth.

Saudi Arabia, Turkey, and Egypt HbA1c Testing Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing prevalence of diabetes worldwide

The number of young people under age 20 with diabetes is likely to increase more rapidly in future. There are also various studies for the rise in type 2 diabetes including the increasing prevalence of childhood obesity. The presence of diabetes in people of childbearing age might is much important because maternal diabetes increases risk of diabetes in children.

The rising demand for hba1c testing with improved accuracy and less time constraint are pushing the key players for strategic initiatives. As people with diabetes are at higher risk for heart disease or a stroke, diabetes complications and premature death than those who do not have diabetes

- Growing awareness about the importance of glycemic control

Poor glycemic control is characterized by the chronically high levels of blood sugar and glycated hemoglobin such as diabetic patients especially those treated with insulin are at risk for developing hypoglycemia. Some studies suggest that an increase in non-exercise physical activity is effective in reducing postprandial hyperglycemia and improving glycemic control

Various studies revealed that many diabetic patients had inadequate and poor glycemic control levels. And this was associated with older age, longer duration of DM, insulin therapy, poor diet compliance, and failure to set control goals. This requires focusing on the identified factors and tailored management mechanisms to maintain good glycemic control. So, people are getting more concerned over this factor and preparing themselves to control their level of glycemic

However, a low level of knowledge of diabetes may act as a predictor of poor glycemic control but not as a medication adherence.

Restraint

- High cost OF hba1c testing devices and kits

The devices and kits cost plays important role in the hba1c testing market. As the development process for these devices and kits is quite expensive and take a long time to pass through R&D, regulatory and various other compliances. These devices and kits requires a start with a high-level understanding of the process from a design to production to the way the product will be manufactured as a single error in any stage can cause disruption in the whole production.

For Instance,

- In December 2020, as per NCBI article, in Saudi Arabia the health expenditure for people diagnosed with diabetes compared to expenditure in the absence of diabetes is ten times higher

However, these hba1c devices and kits demand an effective investment for successful operations along with a project risk management plan.

Opportunity

-

Increasing adoption of hba1c testing in emerging markets

The regulations and doctor recommendation plays important role in increasing adoption of hba1c testing. The stringent rules and regulations are necessary for government approval to ensure the security and safety of the humans and environment. As hba1c is one of the commonly used test to diagnose prediabetes and diabetes and is also considered the main test to help you and your health care team manage your diabetes. Pre-diabetics or people having borderline diabetes, are also advised by doctors to get tested to check how stable their blood sugar levels are. In general doctor’s opinion people having diabetes and pre-diabetes should get their HbA1c tested every 3 months.

Challenge

- Challenges in interpreting hba1c results in patients with anemia or kidney disease

The underlying challenges associated with the predictive ability of HbA1c persist in chronic kidney disease environments. Excess fluid and waste from blood remain in the body and may cause other health problems such as heart disease and stroke.

However, HbA1c levels may be falsely elevated or decreased in chronic kidney disease because a uremic environment shortens the red blood cell lifespan. Several studies have provided the speculation that in populations with a high prevalence of inflammation and malnutrition, such as chronic kidney disease HbA1c levels could be less predictive of clinical outcomes.

For instance-

- In February 2022 – As per ncbi article study conducted by researchers in the gulf cooperation council countries stated that HbA1c level of 7% to 8% may be the most favorable for the best outcomes for diabetes mellitus patients in advanced chronic kidney disease

However, mild-to-moderate anemia and chronic kidney disease may not affect the relationship between glycated hemoglobin and blood glucose level.

Recent Developments

- In March 2020, PTS Diagnostics recently announced that they would launch A1CNow+ Controls for the A1CNow®+ Test System. A1CNow+ Controls are initially accessible in the US, EU, and UK. They can be kept frozen for up to three years, chilled for eight months, or at room temperature for seven days. The solution has two levels, each in a dropper-style vial, and may be effectively used in minutes. Its goal is to ensure accurate A1C findings.

- In March 2023, Abbott announced a definitive agreement with Cardiovascular Systems, Inc. (CSI), a manufacturer of medical devices with a cutting-edge atherectomy system used to treat peripheral and coronary artery disease, under which Abbott would purchase CSI. Abbott's market-leading vascular device lineup will gain access to fresh, complementary innovations thanks to the purchase of CSI. This has caused the business to grow for the corporation.

Saudi Arabia, Turkey, and Egypt HbA1c Testing Market Scope

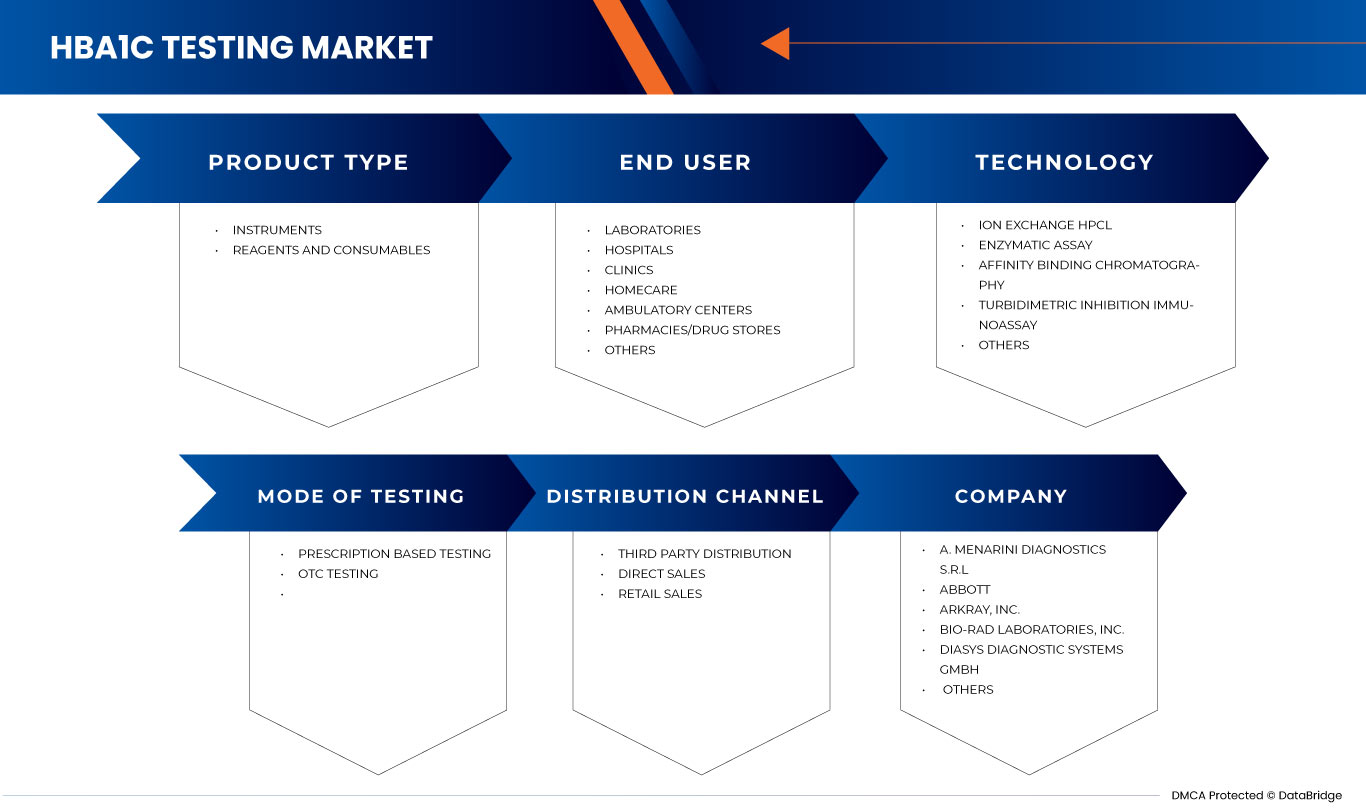

Saudi Arabia, Turkey, and Egypt HbA1c testing market is segmented into five notable segments such as product type, mode of testing, technology, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

BY PRODUCT TYPE

- Instruments

- Reagents And Consumables

On the basis of product type, the Saudi Arabia, Turkey, and Egypt HbA1c testing market is segmented into instruments, reagents, and consumables.

BY MODE OF TESTING

- Prescription Based Testing

- OTC Testing

On the basis of mode of testing, the Saudi Arabia, Turkey, and Egypt HbA1c testing market is segmented into prescription based testing and OTC testing.

BY TECHNOLOGY

- Turbidimetric Inhibition Immunoassay

- Ion-Exchange HPLC

- Affinity Binding Chromatography

- Enzymatic Assay

- Others

On the basis of technology, the Saudi Arabia, Turkey, and Egypt HbA1c testing market is segmented into ion exchange HPCL, enzymatic assay, affinity binding chromatography, turbidimetric inhibition immunoassay, and others.

BY END USER

- Laboratories

- Hospitals

- Clinics

- Homecare

- Ambulatory Centers

- Pharmacies/Drug Stores

- Others

On the basis of end user, the Saudi Arabia, Turkey, and Egypt HbA1c testing market is segmented into laboratories, hospitals, clinics, homecare, ambulatory centers, pharmacies/drug stores and others.

BY DISTRIBUTION CHANNEL

- Direct Sales

- Third Party Distribution

- Retail Sales

On the basis of distribution channel, the Saudi Arabia, Turkey, and Egypt HbA1c testing market is segmented into third party distribution, direct sales, and retail sales.

Saudi Arabia, Turkey, and Egypt HbA1c Testing Market Regional Analysis/Insights

The Saudi Arabia, Turkey, and Egypt HbA1c testing market is segmented into four notable segments such as product type, mode of testing, technology, end user and distribution channel.

The countries covered in this market report are Saudi Arabia, Turkey and Egypt. Turkey is expected to dominate the Saudi Arabia, Turkey, and Egypt HbA1c testing market because of the rising prevalence of diabetes and pre-diabetes among the population.

The states section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Saudi Arabia, Turkey, and Egypt HbA1c Testing Market Share Analysis

Saudi Arabia, Turkey, and Egypt HbA1c testing market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breath, application dominance, and technology lifeline curve. The above data points provided are only related to the company’s focus on the Saudi Arabia, Turkey, and Egypt HbA1c Testing market.

Some of the key players operating in the Saudi Arabia, Turkey, and Egypt HbA1c testing market are Siemens Healthcare GmbH, A. Menarini Diagnostics s.r.l , ARKRAY, Inc. , Trinity Biotech, Thermo Fisher Scientific Inc., Abbott, Wondfo, F. Hoffmann-La Roche Ltd, Ortho Clinical Diagnostics, DxGen Corp. and among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, INDUSTRY INSIGHTS

6 REGULATORY FRAMEWORK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF DIABETES WORLDWIDE

7.1.2 GROWING AWARENESS ABOUT THE IMPORTANCE OF GLYCEMIC CONTROL

7.1.3 GROWING DEMAND FOR POINT-OF-CARE TESTING DEVICES

7.2 RESTRAINTS

7.2.1 HIGH COST OF HBA1C TESTING DEVICES AND KITS

7.2.2 INADEQUATE HEALTHCARE INFRASTRUCTURE IN DEVELOPING COUNTRIES

7.3 OPPORTUNITIES

7.3.1 INCREASING ADOPTION OF HBA1C TESTING IN EMERGING MARKETS

7.3.2 INTEGRATION OF HBA1C TESTING WITH ELECTRONIC MEDICAL RECORDS AND TELEMEDICINE

7.4 CHALLENGES

7.4.1 INACCURATE RESULTS DUE TO INTERFERENCE FROM VARIOUS HEMOGLOBIN VARIANTS

7.4.2 CHALLENGES IN INTERPRETING HBA1C RESULTS IN PATIENTS WITH ANEMIA OR KIDNEY DISEASE

8 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 POINT OF CARE DEVICES

8.2.2 FACILITY BASED PLATFORM

8.3 REAGENTS AND CONSUMABLES

9 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY MODE OF TESTING

9.1 OVERVIEW

9.2 PRESCRIPTION BASED TESTING

9.3 OTC TESTING

10 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 TURBIDIMETRIC INHIBITION IMMUNOASSAY

10.3 ION-EXCHANGE HPLC

10.4 AFFINITY BINDING CHROMATOGRAPHY

10.5 ENZYMATIC ASSAY

10.6 OTHERS

11 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY END USER

11.1 OVERVIEW

11.2 LABORATORIES

11.3 HOSPITALS

11.4 CLINICS

11.5 HOMECARE

11.6 AMBULATORY CENTRES

11.7 PHARMACIES/ DRUG STORES

11.8 OTHERS

12 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 THIRD PARTY DISTRIBUTION

12.4 RETAIL SALES

12.4.1 HOSPITAL PHARMACY

12.4.2 ONLINE PHARMACY

12.4.3 OTHERS

13 SAUDI ARABIA, TURKEY AND EGYPT HBA1C TESTING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

13.2 COMPANY SHARE ANALYSIS: TURKEY

13.3 COMPANY SHARE ANALYSIS: EGYPT

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 F.HOFFMANN- LA ROCHE LTD.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 SIEMENS HEALTHINEERS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ORTHO CLINICAL DIAGNOSTICS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 ARKRAY, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 THERMO FISCHER SCIENTIFIC INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ABBOTT

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BIO RAD LABORATORIES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 DIASYS DIAGNOSTIC SYSTEMS GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 DXGEN CORP.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 A. MENARINNI DIAGNOSTICS S.R.L

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 PTS DIAGNOSTICS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 RADIOMETER MEDICAL APS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 TRINITY BIOTECH

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 VITROSENS BIOTECHNOLOGY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 WONDFO

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Figure

FIGURE 1 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: SEGMENTATION

FIGURE 11 GROWING AWARENESS OF DIABETES AND INCREASING HEALTHCARE EXPENDITURE IS EXPECTED TO DRIVE THE GROWTH OF THE SAUDI ARABIA HBA1C TESTING MARKET FROM 2023 TO 2030

FIGURE 12 GROWING AWARENESS OF DIABETES AND INCREASING HEALTHCARE EXPENDITURE IS EXPECTED TO DRIVE THE GROWTH OF THE TURKEY HBA1C TESTING MARKET FROM 2023 TO 2030

FIGURE 13 GROWING AWARENESS OF DIABETES AND INCREASING HEALTHCARE EXPENDITURE IS EXPECTED TO DRIVE THE GROWTH OF THE EGYPT HBA1C TESTING MARKET FROM 2023 TO 2030

FIGURE 14 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA HBA1C TESTING MARKET IN 2023 & 2030

FIGURE 15 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE TURKEY HBA1C TESTING MARKET IN 2023 & 2030

FIGURE 16 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EGYPT HBA1C TESTING MARKET IN 2023 & 2030

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SAUDI ARABIA, TURKEY & EGYPT HBA1C TESTING MARKET

FIGURE 18 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, 2022

FIGURE 19 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 21 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 22 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, 2022

FIGURE 23 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 24 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 25 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 26 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, 2022

FIGURE 27 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 28 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 29 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 30 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, 2022

FIGURE 31 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, 2023-2030 (USD MILLION)

FIGURE 32 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, CAGR (2023-2030)

FIGURE 33 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, LIFELINE CURVE

FIGURE 34 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, 2022

FIGURE 35 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, 2023-2030 (USD MILLION)

FIGURE 36 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, CAGR (2023-2030)

FIGURE 37 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, LIFELINE CURVE

FIGURE 38 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, 2022

FIGURE 39 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, 2023-2030 (USD MILLION)

FIGURE 40 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, CAGR (2023-2030)

FIGURE 41 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, LIFELINE CURVE

FIGURE 42 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, 2022

FIGURE 43 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 44 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 45 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 46 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, 2022

FIGURE 47 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 48 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 49 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 50 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, 2022

FIGURE 51 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 52 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 53 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 54 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, 2022

FIGURE 55 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 56 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 57 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 58 TURKEY HBA1C TESTING MARKET: BY END USER, 2022

FIGURE 59 TURKEY HBA1C TESTING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 60 TURKEY HBA1C TESTING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 61 TURKEY HBA1C TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 62 EGYPT HBA1C TESTING MARKET: BY END USER, 2022

FIGURE 63 EGYPT HBA1C TESTING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 64 EGYPT HBA1C TESTING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 65 EGYPT HBA1C TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 66 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 67 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 68 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 69 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 70 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 71 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 72 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 73 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 74 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 75 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 76 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 77 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 78 SAUDI ARABIA HBA1C TESTING MARKET: COMPANY SHARE 2022 (%)

FIGURE 79 TURKEY HBA1C TESTING MARKET: COMPANY SHARE 2022 (%)

FIGURE 80 EGYPT HBA1C TESTING MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.