Saudi Arabia Dental CAD/CAM System Market Analysis and Size

The dental CAD/CAM system market is propelled by its capacity for precision and customization in dental restorations, ensuring optimal fit and patient outcomes. The time efficiency offered by same-day dentistry, where prosthetics can be rapidly designed and manufactured within the dental office, enhances convenience for practitioners and patients. The system's capability to produce aesthetically pleasing and natural-looking restorations and seamless digital workflow integration streamlines communication and treatment planning in dental practices. Cost-effectiveness, patient engagement through interactive treatment planning, continuous technological advancements, and the rising demand for cosmetic dentistry contribute to the market's growth.

Data Bridge Market Research analyses that the Saudi Arabia dental CAD CAM system market is expected to reach the value of USD 77,420.54 thousand by 2030, at a CAGR of 6.5% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand, Volume in Units, and Pricing in USD/Unit |

|

Segments Covered |

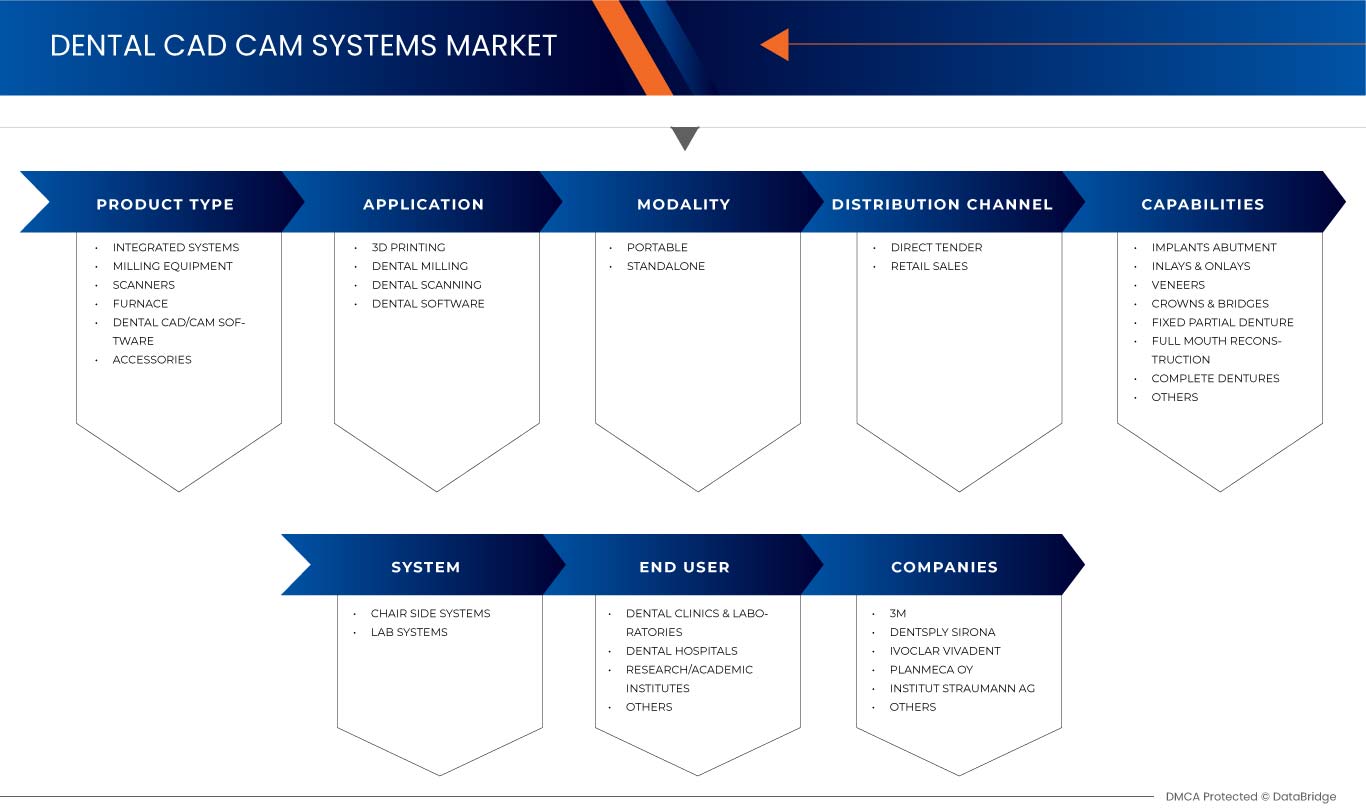

Product Type (Integrated Systems, Milling Equipment, Scanners, Furnace, Dental CAD/CAM Software, and Accessories), Capabilities (Implants Abutment, Inlays & Onlays, Veneers, Crowns & Bridges, Fixed Partial Denture, Full Mouth Reconstruction, Complete Dentures, and Others), Application (3D Printing, Dental Milling, Dental Scanning, and Dental Software), System (Chair Side Systems and Lab Systems), Modality (Portable and Standalone), End User (Dental Clinics & Laboratories, Dental Hospitals, Research/Academic Institutes, and Others), Distribution Channel (Direct Tender and Retail Sales) |

|

Country Covered |

Saudi Arabia |

|

Market Players Covered |

3M, Dentsply Sirona, Ivoclar Vivadent, PLANMECA OY, Institut Straumann AG, 3D Systems, Inc, imes-icore GmbH, and Kulzer GmbH, among others |

Market Definition

Dental CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) systems represent a transformative technology in dentistry, combining digital design and computer-controlled manufacturing for precise and customized dental prosthetics. CAD allows dental professionals to create detailed 3D models of restorations, considering factors like tooth anatomy and aesthetics. The CAM component involves using computer-controlled machinery, such as milling machines or 3D printers, to fabricate the physical prosthetics from materials like ceramics or resins. The integration of CAD/CAM enhances precision, efficiency, and customization in dental workflows, reducing the time needed for restorative procedures. These systems have revolutionized dental practices, offering streamlined processes, minimized errors, and improved overall quality in the creation of crowns, bridges, and other dental restorations, ultimately benefiting both dental professionals and patients with enhanced treatment outcomes.

Saudi Arabia Dental CAD/CAM System Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Growing Dental Healthcare Infrastructure for Dental Clinics and Care Facilities in Saudi Arabia

The expansion of dental healthcare infrastructure in Saudi Arabia is a significant driver for the Saudi Arabia CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) systems market in the country. The increasing number of dental facilities, coupled with the demand for quality, efficiency, and customization, propels the adoption of CAD/CAM technology. Dental clinics and care facilities embrace these systems to provide advanced patient-centric care. The growth of the market in Saudi Arabia is poised for continued expansion. Thus, the growing dental healthcare infrastructure for dental clinics and care facilities in Saudi Arabia is expected to drive market growth.

- Growing Demand for Advanced CAD/CAM Systems

The demand for advanced CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) systems in Saudi Arabia is a compelling driver for the growth of the market in the country. In Saudi Arabia, dental patients frequently want individualized care that meets their particular requirements and preferences. Because of the demand for tailored treatments, CAD/CAM technology enables dental professionals to design highly customized dental goods. The increasing need for high-quality, efficient, and customized dental care, government support, and technological advancements positions the market for robust growth. Dental clinics and care facilities continue to embrace these systems. They can offer cutting-edge treatments and enhance the overall quality of dental healthcare in Saudi Arabia. Thus, the demand for advanced CAD/CAM systems in Saudi Arabia is expected to drive market growth.

Opportunities

- Expanding Dental Industry in Saudi Arabia

The expanding dental industry in Saudi Arabia offers significant growth potential for the market growth. The dental healthcare sector in the country is experiencing remarkable growth, driven by several key factors, creating a favorable environment for the adoption and expansion of CAD/CAM technology. The demand for dental services continues to rise. Dental facilities must adopt advanced technologies to meet patient expectations and remain competitive. CAD/CAM systems, with their precision, efficiency, and ability to provide specialized care, are well-positioned to play a pivotal role in the modernization and enhancement of dental healthcare services in Saudi Arabia, benefiting both the industry and patients alike. In conclusion, the expanding dental industry is expected to create opportunities for market growth.

- CAD/CAM Allows for Highly Customized Dental Prosthetics

The ability of CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) systems to allow for highly customized dental prosthetics represents a compelling opportunity for market growth in Saudi Arabia. Dental prosthetics, including crowns, bridges, dentures, and implants, are crucial to modern dental healthcare. Patients seek personalized, aesthetically pleasing, and minimally invasive dental solutions. CAD/CAM technology is well-positioned to be pivotal in delivering patient-centric care. Thus, highly customized dental prosthetics provided by CAD/CAM are expected to act as an opportunity for market growth.

Restraints/ Challenges

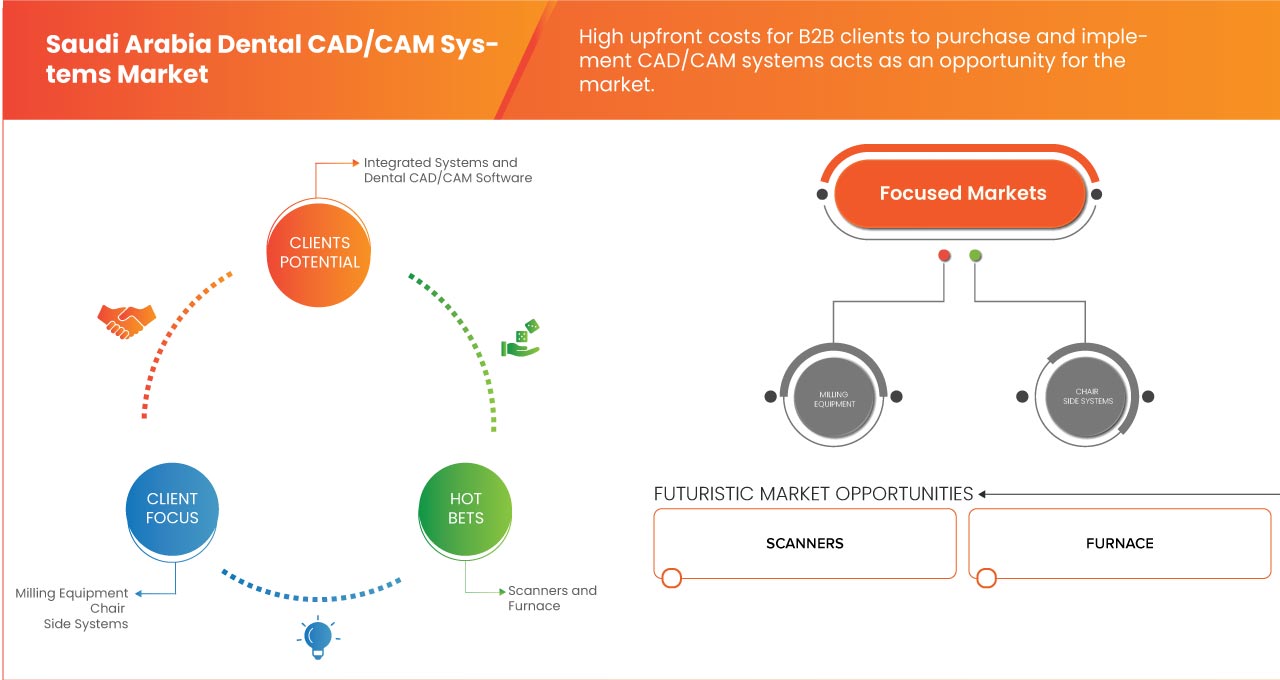

- High Upfront Costs for B2B Clients to Purchase and Implement CAD/CAM Systems

The high upfront cost for B2B (business-to-business) clients to purchase and implement CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) systems represents a significant restraint on the market in Saudi Arabia. While these systems offer numerous advantages, their substantial financial investment can pose several challenges for businesses adopting this technology. Stricter regulations can sometimes stifle innovation in the dental industry. Dental professionals and businesses may become cautious about adopting new technologies, including CAD/CAM systems, due to concerns about regulatory compliance and potential changes in standards. Hence, ensuring adherence to evolving healthcare regulations for the dental business in Saudi Arabia is expected to restrain the market growth.

- Increased Competition among B2B CAD/CAM System Providers

Increased competition among B2B (business-to-business) CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) system providers in the Saudi Arabian market presents a significant challenge. The demand for CAD/CAM technology grows in the dental healthcare sector as more providers enter the market, intensifying competition. CAD/CAM system providers in Saudi Arabia must focus on innovation, customer service, and value-added services. Providers can differentiate themselves in a crowded market and thrive despite increased competition by continually improving product offerings, providing excellent customer support, and delivering unique solutions that address the specific needs of dental clinics. In addition, collaboration with dental associations and organizations can help providers educate potential clients about the benefits and value of CAD/CAM technology, ensuring that the market remains receptive to these advanced systems. Thus, increased competition among B2B CAD/CAM system providers is expected to challenge the market growth.

- Security Risk of Patient Data and Designs

Ensuring the security of patient data and designs is a critical challenge in the market growth. CAD/CAM systems are important for dental healthcare operations, handling sensitive patient information and design data. Addressing data security concerns is essential to maintaining trust, compliance with regulations, and the overall integrity of the market. With the challenge of ensuring patient data and design security, CAD/CAM system providers in Saudi Arabia must invest in robust cybersecurity measures. However, CAD/CAM system providers can foster trust among dental clinics and ensure these systems' continued growth and adoption in the Saudi Arabian market. Hence, rising security risk related to patient data and designs is expected to create challenges for market growth.

Recent Developments

- In March 2023, Ivoclar Vivadent introduced the PrograScan PS7, the first high-end lab scanner that can scan upper and lower jaw models concurrently in under 10 seconds, completely automated and in one procedure. This new PrograScan PS7 is specifically designed for dentistry laboratories with high-volume throughputs. The new PrograScan PS7 works smoothly with all Ivoclar Vivadent operations, both traditional and digital.

- In March 2023, PLANMECA OY announced new chairside milling equipment capable of both dry and wet milling. The Planmeca PlanMill 35 milling unit processes a wide range of materials accurately and effectively, making it a perfect partner for dental practices seeking an all-in-one solution for fabricating dental restorations in-house - particularly from zirconium dioxide. This allows the organization to stay ahead of its inventive footprints with the greatest efficiency and precision.

- In March 2023, Planmeca Romexis was the most advanced software platform for dentistry, including features for dental imaging, diagnosis, and treatment planning for all indications and dental specializations. Planmeca is delighted to unveil various enhancements and new AI-based features to Romexis at the International Dental Show 2023, which assist in optimizing daily operations at a dental office and make dealing with patient photos and treatment planning even easier and faster.

- In September 2022, Dentsply Sirona presented innovative products and solutions from its "digital world" at Dentsply Sirona World 2022, intending to elevate dentistry to a new level. One of the highlights is the new Primescan Connect, a laptop-based version of Dentsply Sirona's easy-to-use, rapid, and precise intraoral scanner Primescan. DS Core completes the digital dentistry experience by adding new features. This facilitated the company's foray into digital dentistry.

- In February 2022, 3D Systems and Saremco Dental AG formed a strategic alliance to drive digital dentistry innovation. This collaboration combines the power of 3D Systems' industry-leading NextDent digital dentistry solution with the materials science expertise of Saremco, allowing dental laboratories and clinics to address a wide range of indications with unparalleled accuracy, repeatability, productivity, and lower total cost.

Saudi Arabia Dental CAD/CAM System Market Scope

The Saudi Arabia dental CAD/CAM system market is categorized into product type, capabilities, application, system, modality, and end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Integrated Systems

- Milling Equipment

- Scanners

- Furnace

- Dental CAD/CAM Software

- Accessories

On the basis of product type, the market is segmented into integrated systems, milling equipment, scanners, furnace, dental CAD/CAM software, accessories.

Capabilities

- Implants Abutment

- Inlays & Onlays

- Veneers

- Crowns & Bridges

- Fixed Partial Denture

- Full Mouth Reconstruction

- Complete Dentures

- Others

On the basis of capabilities, the market is segmented into implants abutment, inlays & onlays, veneers, crowns & bridges, fixed partial denture, full mouth reconstruction, complete dentures, and others.

Application

- 3D Printing

- Dental Milling

- Dental Scanning

- Dental Software

On the basis of application, the market is segmented into 3D printing, dental milling, dental scanning, and dental software.

System

- Chair Side Systems

- Lab Systems

On the basis of system, the market is segmented into chair side systems and lab systems.

Modality

- Portable

- Standalone

On the basis of modality, the market is segmented into portable and standalone.

End User

- Dental Clinics & Laboratories

- Dental Hospitals

- Research/Academic Institutes

- Others

On the basis of end user, the market is segmented into dental clinics & laboratories, dental hospitals, research/academic institutes, and others.

Distribution Channel

- Direct Tender

- Retail Sales

On the basis of distribution channel, the market is segmented into direct tender and retail sales.

Competitive Landscape and Saudi Arabia Dental CAD/CAM System Market Share Analysis

The Saudi Arabia dental CAD/CAM system market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies focus on the Saudi Arabia dental CAD/CAM system market.

Some of the major players operating in the Saudi Arabia dental CAD/CAM system market are 3M, Dentsply Sirona, Ivoclar Vivadent, PLANMECA OY, Institut Straumann AG, 3D Systems, Inc, imes-icore GmbH, and Kulzer GmbH, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 VALUE CHAIN ANALYSIS

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 RAW MATERIAL PROCUREMENT

4.2.2 MANUFACTURING AND DISTRIBUTION

4.2.3 END USERS

4.3 PORTER'S FIVE FORCES

4.3.1 BARGAINING POWER OF SUPPLIERS

4.3.2 BARGAINING POWER OF BUYERS/CONSUMERS

4.3.3 THREAT OF NEW ENTRANTS

4.3.4 THREAT OF SUBSTITUTES PRODUCTS

4.3.5 INTENSITY OF COMPETITIVE RIVALRY

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING PRODUCTION OF FEED ADDITIVES

5.1.2 INCREASING AWARENESS OF THE BENEFITS OF PLANT-BASED PRODUCTS

5.1.3 INCREASED DEMAND AND CONSUMPTION OF LIVESTOCK-BASED PRODUCTS

5.2 RESTRAINTS

5.2.1 STRICT RESTRICTIONS AND REGULATIONS IMPOSED BY THE GOVERNMENT

5.2.2 INADEQUATE RAW MATERIAL AVAILABILITY

5.3 OPPORTUNITIES

5.3.1 GROWING COMMERCIAL APPLICATION

5.3.2 RISING RESEARCH AND DEVELOPMENT ACTIVITIES

5.4 CHALLENGES

5.4.1 AVAILABILITY OF FEED ADDITIVES SUBSTITUTES

5.4.2 PRODUCT LABELLING AND TRADE ISSUES

6 NORTH AMERICA POULTRY PROBIOTIC INGREDIENTS MARKET BY REGION

6.1 NORTH AMERICA

6.1.1 U.S.

6.1.2 MEXICO

6.1.3 CANADA

7 COMPANY SHARE ANALYSIS: NORTH AMERICA

8 SWOT ANALYSIS

9 COMPANY PROFILE

9.1 LALLEMAND INC

9.1.1 COMPANY SNAPSHOT

9.1.2 PRODUCT PORTFOLIO

9.1.3 RECENT DEVELOPMENT

9.2 EVONIK INDUSTRIES AG

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENT

9.3 INTERNATIONAL FLAVORS & FRAGRANCES INC

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 ASAHI GROUP HOLDINGS, LTD

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENT

9.5 PHILEO BY LESAFFRE

9.5.1 COMPANY SNAPSHOT

9.5.2 PRODUCT PORTFOLIO

9.5.3 RECENT DEVELOPMENT

9.6 ADVANCED ENZYME TECHNOLOGIES

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENT

9.7 CHR. HANSEN HOLDING A/S

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT DEVELOPMENT

9.8 KEMIN INDUSTRIES, INC

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENT

9.9 NOVOZYMES

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENT

9.1 UNIQUE BIOTECH

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

List of Table

TABLE 1 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 3 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 4 SAUDI ARABIA INTEGRATED SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 SAUDI ARABIA INTEGRATED SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 6 SAUDI ARABIA INTEGRATED SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 7 SAUDI ARABIA IN-LAB SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 SAUDI ARABIA IN-LAB SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 9 SAUDI ARABIA IN-LAB SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 10 SAUDI ARABIA IN-OFFICE SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 SAUDI ARABIA IN-OFFICE SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 12 SAUDI ARABIA IN-OFFICE SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 13 SAUDI ARABIA MILLING EQUIPMENT IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 SAUDI ARABIA MILLING EQUIPMENT IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 15 SAUDI ARABIA MILLING EQUIPMENT IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 16 SAUDI ARABIA SCANNERS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 SAUDI ARABIA SCANNERS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 18 SAUDI ARABIA SCANNERS IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 19 SAUDI ARABIA FURNACE IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 SAUDI ARABIA FURNACE IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 21 SAUDI ARABIA FURNACE IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 22 SAUDI ARABIA DENTAL CAD/CAM SOFTWAR IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 SAUDI ARABIA ACCESSORIES IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 SAUDI ARABIA ACCESSORIES IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 25 SAUDI ARABIA ACCESSORIES IN DENTAL CAD/CAM SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (AVERAGE SELLING PRICE) (USD/UNIT)

TABLE 26 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY CAPABILITIES, 2021-2030 (USD THOUSAND)

TABLE 27 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 SAUDI ARABIA 3 D PRINTING IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 SAUDI ARABIA DENTAL MILLING IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 SAUDI ARABIA DENTAL SCANNING IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 SAUDI ARABIA DENTAL SOFTWARE IN DENTAL PRINTING IN CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 33 SAUDI ARABIA CHAIR SIDE SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 SAUDI ARABIA LAB SYSTEMS IN DENTAL CAD/CAM SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY MODALITY, 2021-2030 (USD THOUSAND)

TABLE 36 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 37 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET

FIGURE 2 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA CAD/CAM SYSTEMS MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: MARKET END USER COVERAGE GRID

FIGURE 11 SAUDI ARABIA CAD/CAM SYSTEMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: SEGMENTATION

FIGURE 14 GROWING DENTAL HEALTHCARE INFRASTRUCTURE FOR DENTAL CLINICS AND CARE FACILITIES IN SAUDI ARABIA IS EXPECTED TO DRIVE THE SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 THE INTEGRATED SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET IN 2023 AND 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET

FIGURE 17 THE BELOW GRAPH INDICATES THE DISTRIBUTION OF DENTISTS BY REGION.

FIGURE 18 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY PRODUCT TYPE, 2022

FIGURE 19 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY CAPABILITIES, 2022

FIGURE 20 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY APPLICATION, 2022

FIGURE 21 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY SYSTEM, 2022

FIGURE 22 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY MODALITY, 2022

FIGURE 23 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY END USER, 2022

FIGURE 24 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 25 SAUDI ARABIA DENTAL CAD/CAM SYSTEMS MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.