Point Care Testing Poct Market

Market Size in USD Billion

CAGR :

%

USD

63.28 Billion

USD

136.84 Billion

2025

2033

USD

63.28 Billion

USD

136.84 Billion

2025

2033

| 2026 –2033 | |

| USD 63.28 Billion | |

| USD 136.84 Billion | |

|

|

|

|

Point-Of-Care-Testing (POCT) Market Size

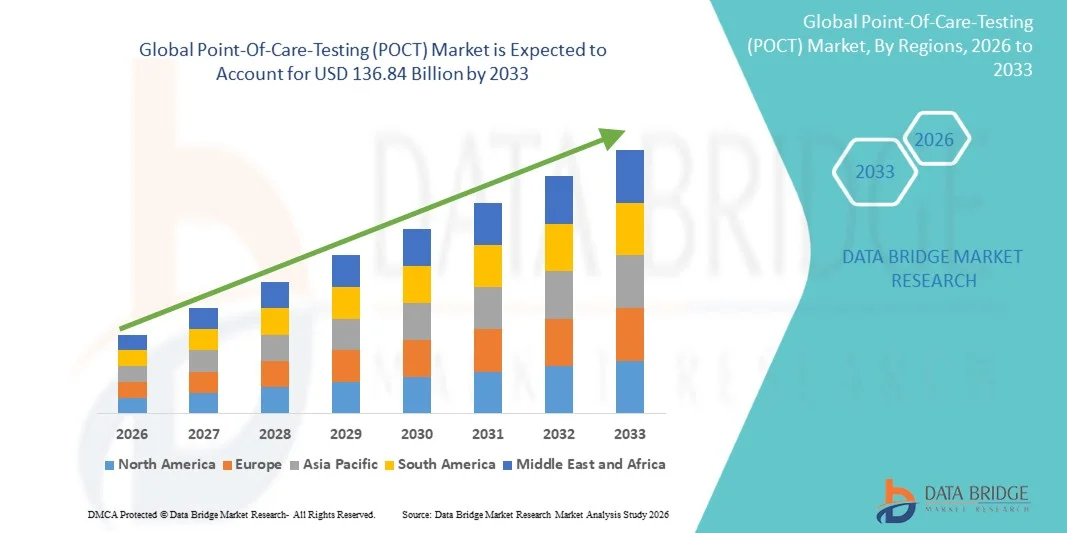

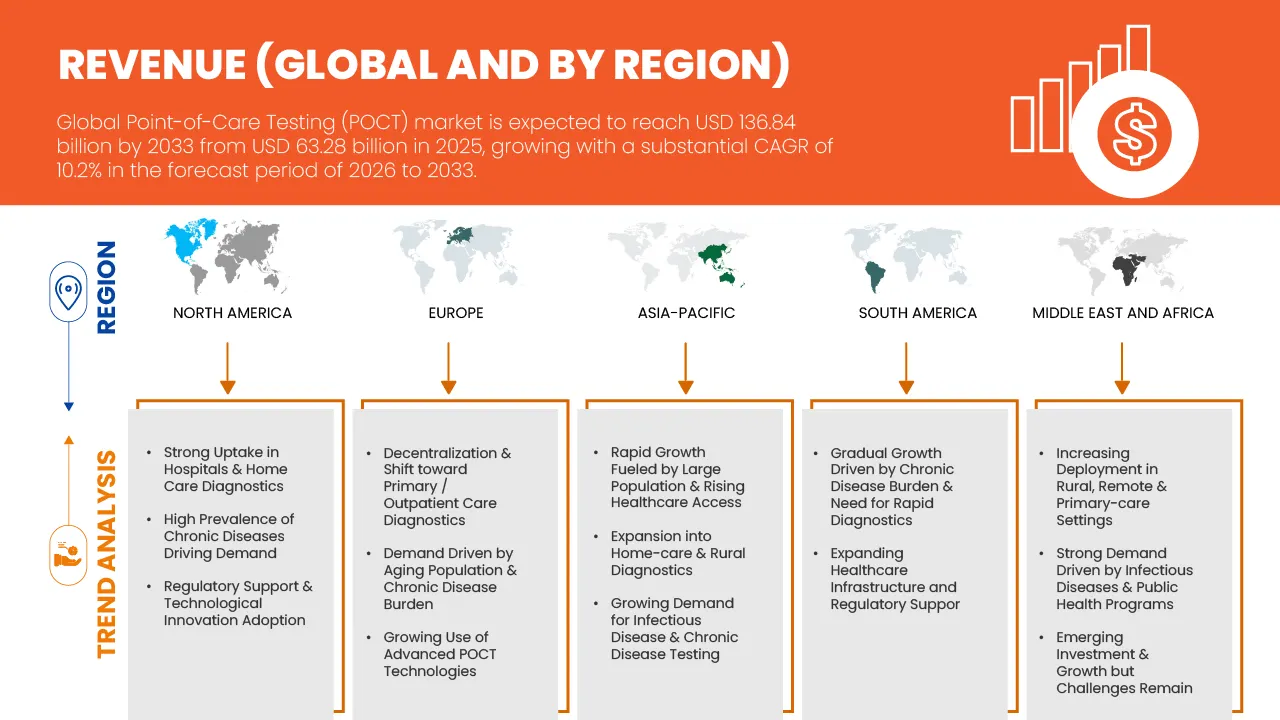

- The global Point-Of-Care-Testing (POCT) market size was valued at USD 63.28 billion in 2025 and is expected to reach USD 136.84 billion by 2033, at a CAGR of 10.2% during the forecast period

- The growth of the Global Point-Of-Care-Testing (POCT) market is primarily driven by the increasing demand for rapid diagnostic solutions that enable immediate clinical decision-making and reduce dependency on centralized laboratory testing. POCT devices allow faster turnaround times, early disease detection, and improved patient outcomes, which are critical in emergency care, remote healthcare, and home-based monitoring.

- The rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, infectious diseases, and respiratory illnesses is significantly increasing the adoption of POCT devices for real-time monitoring and management. Additionally, advancements in diagnostic technologies, microfluidics, biosensors, and connected healthcare platforms are enhancing accuracy, portability, and data integration capabilities, fueling market growth.

Point-Of-Care-Testing (POCT) Market Analysis

- The Global Point-Of-Care-Testing (POCT) market is a rapidly expanding segment of the diagnostic industry, offering immediate test results directly at patient locations such as clinics, hospitals, ambulances, and home settings. POCT devices provide rapid screening and monitoring for conditions including diabetes, infectious diseases, pregnancy, cardiac markers, electrolyte imbalance, and coagulation parameters, enabling enhanced clinical efficiency and reduced healthcare system burden.

- The growing demand for portable and user-friendly diagnostic technologies is largely driven by rising chronic disease prevalence, emergency care needs, and the expansion of home-based patient monitoring. Additionally, the integration of digital health platforms, smartphone-based diagnostics, AI-enabled detection, and wireless connectivity supports improved data traceability and remote patient management, further advancing market growth.

- North America is expected to dominate the Point-Of-Care-Testing (POCT) market with the largest revenue share of around 39.66% in 2026, driven by the strong presence of key market players, high healthcare expenditure, advanced medical infrastructure, and rising adoption of innovative diagnostic technologies across hospitals and home-care environments.

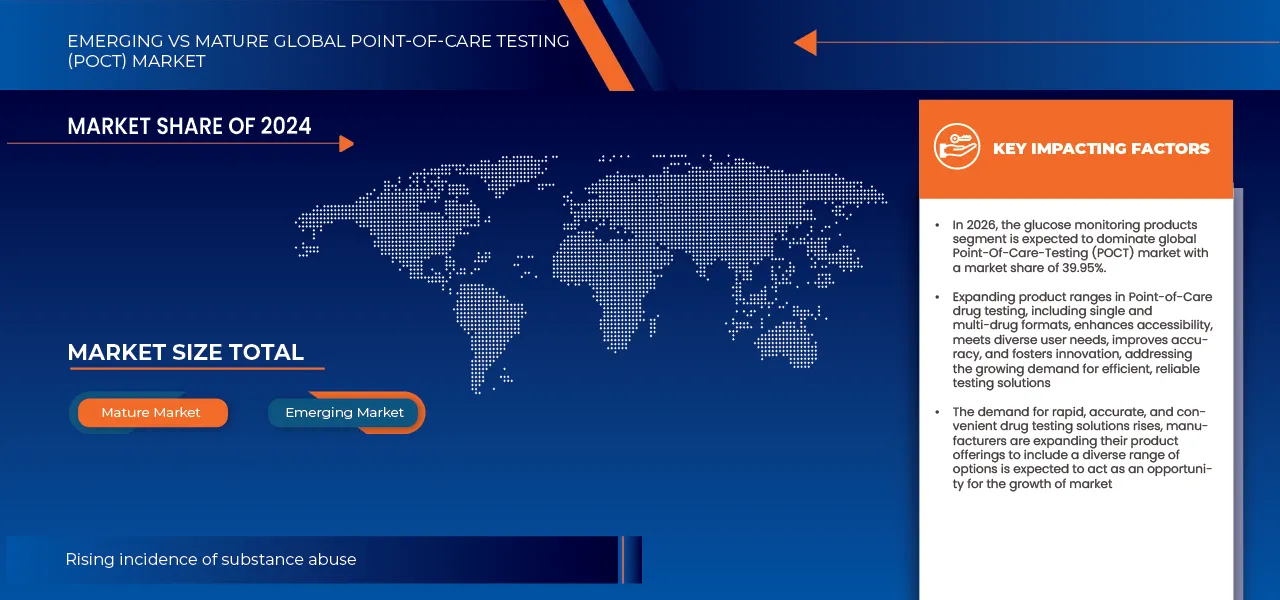

- The Glucose Monitoring Products segment is expected to dominate the global POCT market with a major share of over 39.95% in 2026, driven by the rising diabetic population, preference for real-time monitoring devices, and the growing use of portable blood glucose meters and continuous glucose monitoring tools among home-care patients.

Report Scope and Point-Of-Care-Testing (POCT) Market Segmentation

|

Attributes |

Point-Of-Care-Testing (POCT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include innovation tracker and strategic analysis, technological advancements, climate change scenario, supply chain analysis, value chain analysis, vendor selection criteria, PESTLE Analysis, Porter Analysis, patent analysis, industry eco-system analysis, raw material coverage, tariffs and their impact on market, regulation coverage, consumer buying behavior, brand outlook, cost analysis breakdown, and regulatory framework. |

Point-Of-Care-Testing (POCT) Market Trends

“Technological Advancements and Functional Expansion Through R&D and Digital Integration”

- A major and rapidly progressing trend in the global Point-Of-Care-Testing (POCT) market is the increasing focus on innovation, R&D, and advanced diagnostic technologies aimed at improving accuracy, speed, portability, and real-time decision-making. With rising demand for decentralized and patient-centric testing, healthcare providers, diagnostics companies, and medical device manufacturers are heavily investing in next-generation POCT platforms that support precision diagnostics and enhanced connectivity across care settings.

- Leading players such as Abbott, Roche, Siemens Healthineers, Danaher, and Thermo Fisher Scientific are accelerating research efforts to develop miniaturized devices, lab-on-chip technologies, and AI-enabled testing systems capable of delivering laboratory-quality results at the point of need. These technological advancements also include automated sample handling, improved biosensor sensitivity, and multiplex testing capabilities, enabling detection of multiple biomarkers simultaneously.

- In infectious disease diagnostics, extensive R&D initiatives are focused on producing rapid molecular testing solutions with high accuracy, shorter turnaround time, and suitability for emergency and outbreak situations. POCT devices designed for influenza, COVID-19, respiratory infections, HIV, and sepsis are being enhanced with microfluidics and isothermal amplification technologies, enabling reliable testing outside centralized labs.

- In chronic disease management, innovation in glucose monitoring, cardiac biomarker testing, coagulation tests, and renal function analysis is supporting continuous monitoring and providing real-time data for clinical intervention. Companies are integrating mobile applications, cloud-based reporting, and wearable diagnostics to enable seamless home monitoring and remote telehealth connectivity.

- The market is also witnessing expansion in personalized diagnostics, with POCT solutions being developed to support oncology, fertility, gastrointestinal disorders, and metabolic disease screening. These innovations aim to enable earlier detection, faster therapeutic decisions, and improved clinical outcomes, especially in outpatient and home-care settings.

- Furthermore, the integration of connected devices, digital data analytics, and AI-driven interpretation is enabling smarter POCT ecosystems that enhance workflow automation and reduce human error. These advancements are transforming POCT into a multifunctional and intelligent diagnostic tool capable of supporting preventive care, precision medicine, and population health management.

- This rapidly evolving, innovation-led environment is reshaping the POCT market, shifting the industry toward portable, integrated, and patient-centered diagnostic systems. As global healthcare systems prioritize efficiency, accessibility, and sustainability, R&D-driven digital transformation is expected to unlock new applications and expand market penetration across both developed and emerging regions.

Point-Of-Care-Testing (POCT) Market Dynamics

Driver

“Growing Demand for Rapid, Decentralized, and Patient-Centric Diagnostic Solutions”

- A significant driver accelerating the growth of the global Point-Of-Care-Testing (POCT) market is the increasing need for fast, accessible, and decentralized diagnostic tools that improve clinical decision-making and patient outcomes. As healthcare systems shift toward value-based and patient-centered models, POCT offers immediate test results at or near the site of care, reducing dependence on centralized laboratories and enabling early diagnosis and timely treatment interventions.

- Leading industry players such as Abbott, Roche, Siemens Healthineers, and Danaher are actively expanding R&D investments to develop portable, highly accurate, and digitally connected POCT devices capable of supporting real-time diagnostics across hospitals, clinics, emergency settings, and home-care environments. These innovations align with the rising demand for integrated digital health solutions, telemedicine expansion, and AI-assisted result interpretation.

- In chronic disease management, POCT devices for glucose monitoring, cardiac biomarkers, coagulation testing, and renal assessment are experiencing rapid growth due to increasing global prevalence of diabetes, cardiovascular diseases, and lifestyle disorders. Similarly, infectious disease POCT systems for COVID-19, influenza, sepsis, malaria, and HIV are becoming critical tools for outbreak control, especially in resource-limited regions.

- The growing focus on home-based and remote patient monitoring is also driving adoption, supported by the development of smartphone-enabled diagnostics, wearable testing solutions, cloud-based platforms, and remote reporting capabilities that enhance clinical connectivity and continuity of care.

- With healthcare infrastructure modernization, rising emphasis on rapid diagnostic turnaround, and strong public and private investments, POCT is emerging as an essential component for future healthcare delivery. As efficiency and accessibility become central to global healthcare reform, the demand for innovative, accurate, and patient-driven POCT systems is expected to accelerate significantly.

Restraint/Challenge

“High Costs, Regulatory Complexities, and Accuracy & Standardization Concerns”

- Despite strong market growth, the global Point-Of-Care-Testing (POCT) market faces notable challenges related to high equipment and testing costs, stringent regulatory approval pathways, and variability in diagnostic accuracy across different device platforms. Ensuring consistent analytical performance comparable to centralized laboratory standards remains a key barrier, particularly as POCT expands into critical care and high-complexity testing segments.

- Obtaining approvals from regulatory bodies such as the FDA, EMA, and other national authorities requires extensive clinical validation, quality compliance, and post-market surveillance. These processes can significantly slow product launch timelines and increase development expenses for manufacturers, especially in emerging diagnostic technologies like molecular POCT and multiplex testing.

- Cost constraints also limit adoption in developing regions, where limited healthcare budgets and inadequate reimbursement systems restrict widespread deployment. Additionally, operational challenges such as maintenance requirements, user training needs, and workflow integration can hinder large-scale implementation across hospitals and diagnostic centers.

- Concerns regarding result accuracy, reliability, and standardization—particularly in high-sensitivity tests for infectious diseases and cardiac markers—can create hesitation among clinicians and increase reliance on centralized confirmatory testing. Issues related to data integration and cybersecurity in digital POCT platforms also demand enhanced technology frameworks and investment.

- As POCT technology evolves, overcoming these financial, regulatory, and technical challenges will require extensive R&D funding, improved global harmonization of diagnostic standards, and strategic collaboration between device manufacturers, healthcare providers, and government health agencies. Until then, these barriers may continue to limit the pace of adoption in certain market segments and regions.

Point-Of-Care-Testing (POCT) Market Scope

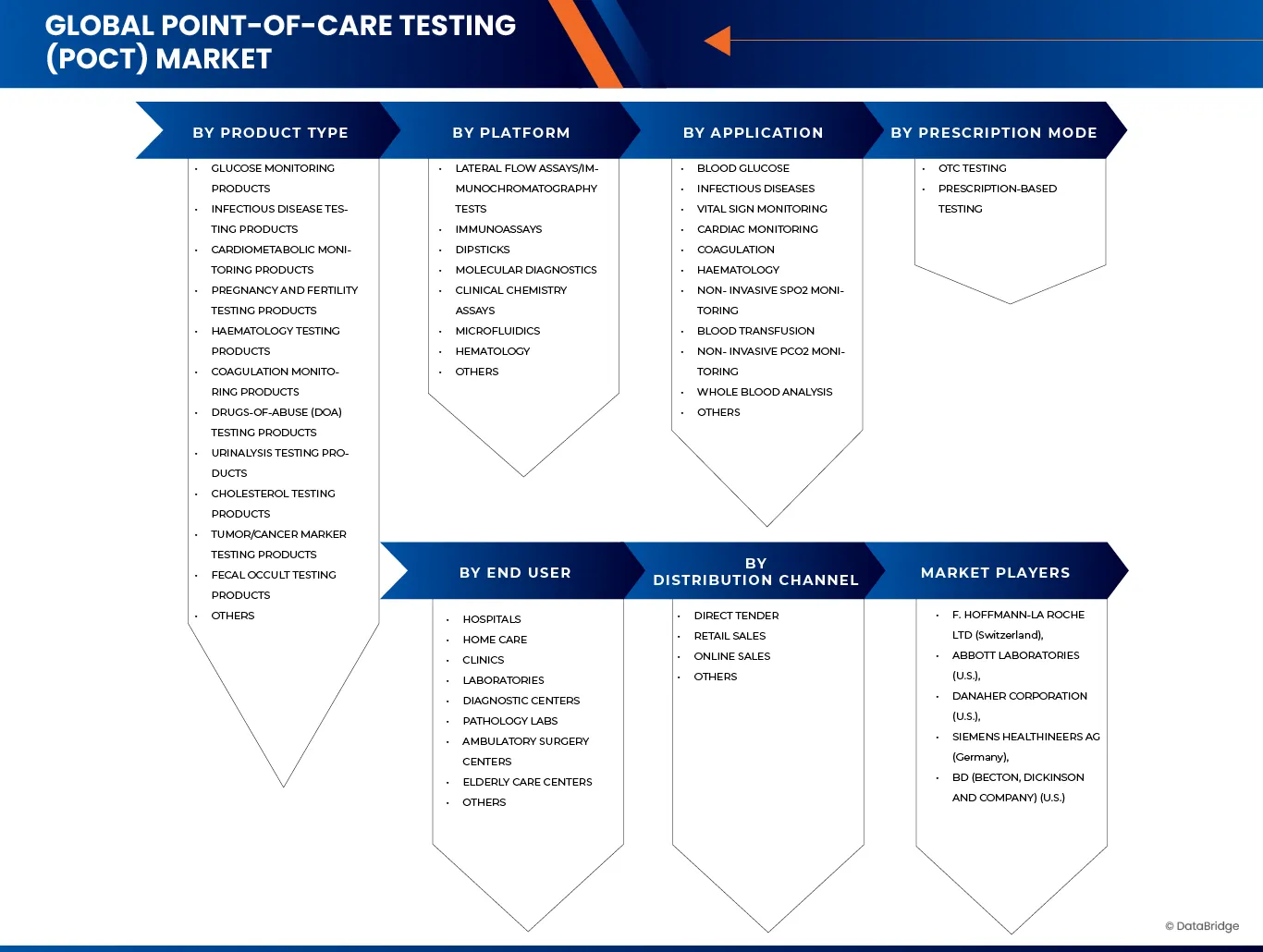

The market is segmented on the basis of Product Type, Platform, Application, Prescription Mode, End User and Distribution Channel.

- By Product Type

On the basis of Product Type, the Point-Of-Care-Testing (POCT) market is segmented into Glucose Monitoring Products, Infectious Disease Testing Products, Cardiometabolic Monitoring Products, Pregnancy and Fertility Testing Products, Hematology Testing Products, Coagulation Monitoring Products, Drugs-Of-Abuse (DOA) Testing Products, Urinalysis Testing Products, Cholesterol Testing Products, Tumor/Cancer Marker Testing Products, Fecal Occult Testing Products, and Others. The Glucose Monitoring Products segment is expected to dominate the largest market revenue share of 39.95% in 2026, driven by the growing global burden of diabetes, rising demand for home-based self-monitoring, and continuous technological advancements in blood glucose meters and connected digital health platforms.

- By Platform

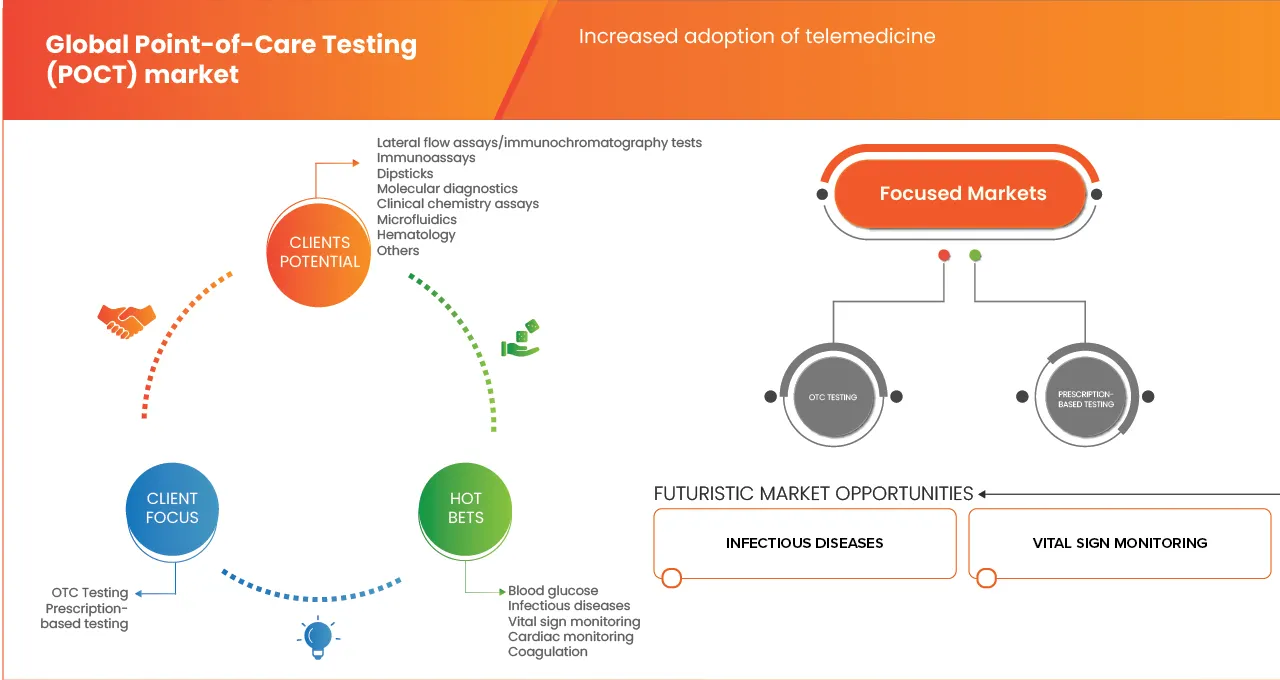

On the basis of Platform, the Point-Of-Care-Testing (POCT) market is segmented Lateral Flow Assays/Immunochromatography Tests, Immunoassays, Dipsticks, Molecular Diagnostics, Clinical Chemistry Assays, Microfluidics, Hematology, Others. The Lateral Flow Assays/Immunochromatography Tests is expected to dominate in 2026, supported by their widespread adoption in infectious disease screening, ease of use, rapid result turnaround, low cost, and extensive use during outbreaks such as COVID-19, influenza, malaria, and dengue. Their suitability for decentralized and remote healthcare settings further strengthens segment growth.

- By Application

On the basis of Application, the Point-Of-Care-Testing (POCT) market is segmented into Blood Glucose, Infectious Diseases, Vital Sign Monitoring, Cardiac Monitoring, Coagulation, Haematology, Non- Invasive SpO2 Monitoring, Blood Transfusion, Non- Invasive PCO2 Monitoring, Whole Blood Analysis, Others. The Blood Glucose is expected to dominate with the largest market revenue share in 2026, driven by rising diabetes prevalence, increasing patient preference for portable monitoring devices, and the availability of highly accurate, user-friendly glucometers and continuous glucose monitoring (CGM) technologies that support real-time diabetes management.

- By Prescription Mode

On the basis of Prescription Mode, the Point-Of-Care-Testing (POCT) market is segmented into OTC Testing, Prescription-Based Testing. The OTC Testing segment accounted for the largest market revenue share in 2026, by the increasing consumer preference for self-testing solutions, growing availability of rapid diagnostic kits, and the rising focus on preventive healthcare. OTC POCT devices enable individuals to monitor health parameters such as glucose levels, pregnancy, fertility, infectious diseases, and cardiovascular indicators without clinical supervision.

- By End User

On the basis of End User, the Point-Of-Care-Testing (POCT) market is segmented into Hospitals, Home Care, Clinics, Laboratories, Diagnostic Centers, Pathology Labs, Ambulatory Surgery Centers, Elderly Care Centers, Others. The Hospitals segment accounted for the largest market revenue share in 2026, driven by the high demand for rapid diagnostic testing to support emergency care, critical care, and routine clinical assessments. POCT devices—such as blood glucose meters, cardiac marker analyzers, infectious disease rapid tests, coagulation monitors, and blood gas analyzers—are increasingly utilized in hospital settings to enable faster clinical decision-making, reduce patient turnaround time, and improve workflow efficiency.

- By Distribution Channel

On the basis of Distribution Channel, the Point-Of-Care-Testing (POCT) market is segmented into Direct Tender, Retail Sales, Online Sales, Others. The Direct Tender segment accounted for the largest market revenue share in 2026, driven by the high-volume procurement of POCT devices by hospitals, diagnostic laboratories, and public health agencies. Large-scale tenders ensure consistent supply of essential diagnostic tools—such as glucose monitors, rapid infectious disease test kits, cardiac biomarker analyzers, and coagulation testing devices—required for routine testing and emergency care.

Point-Of-Care-Testing (POCT) Market Regional Analysis

- North America dominated the Point-Of-Care-Testing (POCT) market with the largest revenue share of over 39.83% in 2025, driven by the region’s rapidly expanding healthcare infrastructure, rising burden of chronic diseases, and increasing adoption of decentralized diagnostic technologies. Countries such as U.S., Canada and Mexico are witnessing strong demand for rapid diagnostic kits for diabetes, infectious diseases, cardiovascular conditions, and home-based monitoring.

- Growing investment in digital health, telemedicine expansion, and government initiatives supporting early diagnosis further accelerate POCT deployment. Additionally, the large geriatric population and rising consumer preference for affordable, quick medical testing are reinforcing market growth across the region.

U.S. Point-Of-Care-Testing (POCT) Market Insight

The U.S. dominated the North America POCT market in 2025, supported by its advanced healthcare infrastructure, high awareness of early disease detection, and increasing preference for home-based diagnostic solutions. The growing prevalence of diabetes, cardiac disorders, respiratory diseases, and infectious conditions continues to boost demand for rapid testing kits. Strong R&D capabilities, high adoption of connected and smartphone-integrated testing devices, and a mature regulatory environment further contribute to market expansion. Moreover, the shift toward personalized and point-of-need diagnostics—combined with rising retail clinics and pharmacy-based testing—continues to strengthen the U.S. POCT landscape.

Japan Point-Of-Care-Testing (POCT) Market Insight

The Japan POCT market is gaining strong momentum due to the country’s advanced healthcare systems, high technological adoption, and focus on precision diagnostics. Japan’s aging population has significantly increased demand for rapid testing solutions for chronic and lifestyle-related diseases, including diabetes, kidney diseases, and cardiovascular disorders. The country’s strong emphasis on preventive healthcare, coupled with innovations in miniaturized diagnostic platforms, supports market expansion. Additionally, Japan’s leadership in biotechnology, microfluidics, and sensor technology is fostering the development of highly accurate POCT devices tailored for both clinical and home-care settings.

China Point-Of-Care-Testing (POCT) Market Insight

China accounted for the largest share of the Asia-Pacific POCT market in 2025, driven by its fast-growing healthcare ecosystem, rising incidence of infectious and chronic diseases, and increasing reliance on portable diagnostics in primary care and rural healthcare settings. The government’s strong push toward improving healthcare accessibility and self-testing adoption has amplified demand for rapid antigen tests, glucose monitoring kits, and pregnancy/fertility tests. China’s cost-effective manufacturing capabilities and expansion of domestic diagnostic companies have also accelerated production and export of POCT devices. Growing adoption of digital connectivity in diagnostics and improved reimbursement pathways further support sustained market growth.

Europe Point-Of-Care-Testing (POCT) Market Insight

The European POCT market is projected to grow steadily during the forecast period, driven by rising demand for rapid diagnostics in emergency departments, home-care settings, and outpatient clinics. Strong emphasis on quality healthcare delivery, early diagnosis, and reduced hospital burden is accelerating the adoption of POCT for infectious diseases, cardiac biomarkers, metabolic disorders, and coagulation monitoring. Regulatory frameworks promoting safe and reliable diagnostic devices, coupled with advancements in microfluidic-based testing, support market growth. Additionally, Europe’s growing focus on digital health, remote monitoring, and integrated diagnostics continues to drive POCT adoption across key countries.

U.K. Point-Of-Care-Testing (POCT) Market Insight

The U.K. POCT market is expected to grow at a significant CAGR, supported by the country’s expanding healthcare digitization, rising chronic disease burden, and strong demand for rapid testing solutions in home-care and primary care settings. Increased awareness about preventive healthcare and early diagnosis has led to widespread use of POCT for glucose monitoring, infectious disease screening, pregnancy/fertility testing, and cardiovascular markers. The U.K.’s growing investment in telehealth, electronic health integration, and decentralized diagnostic services is further accelerating adoption.

Germany Point-Of-Care-Testing (POCT) Market Insight

The Germany POCT market is poised to expand considerably, driven by the country’s strong medical device manufacturing capabilities, highly developed diagnostic infrastructure, and focus on efficient patient management. Germany’s increasing adoption of rapid testing in hospitals, ambulatory care centers, and home-care environments is supported by rising cases of diabetes, cardiovascular diseases, and infectious conditions. The nation’s advancements in sensor technologies, regulatory compliance, and emphasis on high-quality medical devices continue to promote the development and commercialization of next-generation POCT platforms. Additionally, Germany’s focus on digital diagnostics and remote monitoring is strengthening long-term market growth.

Point-Of-Care-Testing (POCT) Market Share

The Point-Of-Care-Testing (POCT) industry is primarily led by well-established companies, including:

- Abbott Point of Care Inc. (U.S.)

- Sinocare Inc. (China)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Danaher Corporation (U.S.)

- Hologic, Inc. (U.S.)

- bioMérieux SA (France)

- Siemens Healthineers AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- BD Veritor (Becton, Dickinson and Company) (U.S.)

- QuidelOrtho Corporation (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Werfen (Spain)

- Sekisui Diagnostics (Japan)

- Trividia Health, Inc. (U.S.)

- Nova Biomedical Corporation (U.S.)

- Meridian Bioscience, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Shenzhen New Industry Biomedical Engineering Co., Ltd. (China)

- Sysmex Corporation (Japan)

- Wondfo (Guangzhou Wondfo Biotech Co., Ltd.) (China)

- QIAGEN N.V. (Germany)

- Abaxis, Inc. (U.S.)

- Autobio Diagnostics Co., Ltd. (China)

- Getein Biotech, Inc. (China)

- Chembio Diagnostics, Inc. (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- Trinity Biotech plc (Ireland)

- PTS Diagnostics (U.S.)

- QuantuMDx Group Ltd. (U.K.)

- Binx Health (U.S.)

- Xiamen Boson Biotech Co., Ltd. (China)

- Accubiotech Co., Ltd. (China)

- Sienco, Inc. (U.S.)

- LamdaGen Corporation (U.S.)

Latest Developments in Global Point-Of-Care-Testing (POCT) Market

- In May 2020, Abbott's ID NOW COVID-19 test provides rapid, reliable results in minutes, aiding in timely diagnosis and reducing infection risk. Studies show strong performance in urgent care settings, with ≥94.7% sensitivity and ≥98.6% specificity. Despite challenges from an NYU study, real-world data supports its effectiveness. Authorized under FDA's emergency use authorization, the test plays a crucial role in COVID-19 detection.

- In September 2025, Sinocare’s subsidiary Dongguan E-Test Technology has received FDA 510(k) clearance for its Multi-Series Smart Blood Pressure Monitors, highlighting their accuracy, safety, and wireless capabilities. The devices offer medical-grade monitoring, Bluetooth connectivity, and intelligent alerts, strengthening Sinocare’s global expansion strategy and enhancing its chronic disease management ecosystem across international markets, including the U.S. and Europe.

- In January 2025, Danaher Corporation has formed an investment partnership with Innovaccer Inc., a healthcare AI company. This collaboration aims to accelerate the adoption of precision diagnostics and value-based care by providing healthcare providers with unified patient data and advanced analytics, improving patient outcomes through personalized, timely interventions.

- In November 2023, Binx Health has partnered with Fisher Healthcare to expand distribution of the FDA-cleared binx io, a molecular point-of-care platform for detecting chlamydia and gonorrhea. This system provides lab-quality results in about 30 minutes, improving timely diagnoses and enabling clinicians to test and treat patients during a single visit, enhancing care access.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 HEALTHCARE ECONOMY

4.3.1 HEALTHCARE EXPENDITURE

4.3.2 CAPITAL EXPENDITURE

4.3.3 CAPEX TRENDS

4.3.4 CAPEX ALLOCATION

4.3.5 FUNDING SOURCES

4.3.6 INDUSTRY BENCHMARKS

4.3.7 GDP RATIO IN OVERALL GDP

4.3.8 HEALTHCARE SYSTEM STRUCTURE

4.3.9 GOVERNMENT POLICIES

4.3.10 ECONOMIC DEVELOPMENT

4.4 REIMBURSEMENT FRAMEWORK

4.5 OPPORTUNITY MAP ANALYSIS

4.6 VALUE CHAIN ANALYSIS

4.7 MICRO AND MACRO ECONOMIC FACTORS

4.7.1 CURRENT MARKET PENETRATION

4.7.2 GROWTH PROSPECTS

4.7.3 KEY PRICING STRATEGIES

4.8 TECHNOLOGY ROADMAP: GLOBAL POINT OF CARE TESTING

5 GLOBAL POINT-OF-CARE TESTING (POCT) MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING USE OF POC TESTING IN HEALTHCARE FACILITIES

6.1.2 RISING INCIDENCE OF SUBSTANCE ABUSE

6.1.3 INCREASED ADOPTION OF TELEMEDICINE

6.1.4 ADVANCEMENTS TECHNOLOGIES ENHANCING POC TESTING WITH BIOSENSORS AND MOBILE INTEGRATION

6.2 RESTRAINTS

6.2.1 DATA SECURITY AND PRIVACY CONCERNS

6.2.2 LACK OF ACCURACY AND TECHNICAL CHALLENGES

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS AND ADVOCACY FOR POINT-OF-CARE TESTING

6.3.2 STRATEGIC INITIATION AND DECISIONS TAKEN BY THE MARKET PLAYERS

6.3.3 EXPANDING PRODUCT RANGE FOR POINT-OF-CARE TESTING

6.4 CHALLENGES

6.4.1 LIMITED AWARENESS AND ACCEPTANCE

6.4.2 IMPACT OF HIGH MAINTENANCE COSTS THREATENING POINT-OF-CARE TESTING (POCT) SUSTAINABILITY IN LOW-RESOURCE SETTINGS

7 GLOBAL POINT-OF-CARE TESTING (POCT) MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 GLUCOSE MONITORING PRODUCTS

7.2.1 SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES

7.2.1.1 Strips

7.2.1.2 Meters

7.2.1.3 Lancets and Lancing Devices

7.2.2 CONTINUOUS GLUCOSE MONITORING (CGM) SYSTEMS

7.3 INFECTIOUS DISEASE TESTING PRODUCTS

7.3.1 COVID-19

7.3.2 HIV TESTING PRODUCTS

7.3.2.1 Testing Reagents

7.3.2.2 Testing Equipment

7.3.3 RESPIRATORY INFECTION TESTING PRODUCTS

7.3.4 SEXUALLY TRANSMITTED DISEASES (STD) TESTING

7.3.4.1 NAAT-Based Systems

7.3.4.2 NON–NAAT-Based Systems

7.3.5 HEPATITIS C TESTING PRODUCTS

7.3.5.1 HCV Antibody Tests

7.3.5.2 HCV Viral Load Tests

7.3.6 INFLUENZA TESTING PRODUCTS

7.3.6.1 Traditional Diagnostic Test

7.3.6.2 Molecular Diagnostic Assay

7.3.6.2.1 Rapid Influenza Diagnostic Test (RIDT)

7.3.6.2.2 Direct Fluorescent Antibody Test (DFAT)

7.3.6.2.3 Viral Culture

7.3.6.2.4 Serological Assay

7.3.6.3 RT-PCR

7.3.6.4 Loop-Mediated Isothermal Amplification-Based Assay (LAMP)

7.3.6.5 Nucleic Acid Sequence-Based Amplification Test (NASBAT)

7.3.6.6 Simple Amplification-Based Assay (SAMBA)

7.3.6.7 Healthcare Associated Infection (HAI) Testing

7.3.6.8 Tropical Disease Testing Products

7.3.6.9 Other Infectious Disease Testing Products

7.4 CARDIOMETABOLIC MONITORING PRODUCTS

7.4.1 CARDIAC MARKER TESTING PRODUCTS

7.4.1.1 HSTNL

7.4.1.2 BNP

7.4.1.3 D-DIMER

7.4.1.4 CK-MB

7.4.1.5 Myoglobin

7.4.2 BLOOD GAS/ELECTROLYTE TESTING PRODUCTS

7.4.2.1 Blood Gas/Electrolyte Testing Consumables

7.4.2.2 Blood Gas/Electrolyte Testing Instruments

7.4.3 CARTRIDGES

7.4.4 REAGENTS

7.4.4.1 Portable

7.4.4.2 Benchtop

7.4.4.3 Combined Analyzers

7.4.4.4 Blood Gas Analyzers

7.4.4.5 Electrolyte Analyzers

7.4.4.6 Combined Analyzers

7.4.4.7 Blood Gas Analyzers

7.4.4.8 Electrolyte Analyzers

7.4.5 HBA1C TESTING PRODUCTS

7.4.5.1 HBA1C Testing Instruments

7.4.5.2 HBA1C Testing Consumables

7.4.5.3 POC Analyzer

7.4.5.4 ECG Device

7.4.5.5 Resting ECG Devices

7.4.5.6 Stress ECG Devices

7.4.5.7 Holter Monitors

7.5 PREGNANCY AND FERTILITY TESTING PRODUCTS

7.5.1 PREGNANCY TESTING PRODUCTS

7.5.1.1 Strips/ Dip Sticks and Cards

7.5.1.2 Mid Stream Devices

7.5.1.3 Cassettes

7.5.1.4 Digital Devices

7.5.1.5 Line-Indicator Devices

7.5.2 FERTILITY TESTING PRODUCTS

7.5.2.1 Luteinizing Hormone (LH) Urine Test

7.5.2.2 FSH Test

7.5.2.3 others

7.6 HAEMATOLOGY TESTING PRODUCTS

7.7 COAGULATION MONITORING PRODUCTS

7.7.1 ANTICOAGULATION MONITORING DEVICES

7.7.1.1 Prothrombin Time/International Normalized Ratio (PT-INR) Testing Devices

7.7.1.2 Activated Clotting Time (ACT)

7.7.1.3 Activated Partial Thromboplastin Time (APPT)

7.7.1.4 Platelet Function Monitoring Devices

7.7.1.5 Viscoelastic Coagulation Monitoring Devices

7.7.1.6 Rotational Thromboelastometry (ROTEM)

7.7.1.7 Thromboelastography (TEG)

7.7.1.8 Drug-Of-Abuse (DOA) Testing Products

7.7.2 DOA ANALYSERS

7.7.2.1 Immunoassays

7.7.2.2 Chromatographic Devices

7.7.2.3 Breath Analysers

7.7.3 RAPID TESTING DEVICES

7.7.3.1 Urine Testing Devices

7.7.3.2 Oral Fluid Testing Devices

7.7.3.4 Others

7.8 URINALYSIS TESTING PRODUCTS

7.8.1.1 POC Urine Strip Self-Testing

7.8.1.2 POC Urine Test Strip Professional Testing

7.9 CHOLESTEROL TESTING PRODUCTS

7.9.1.1 Testing Kits

7.9.1.2 Instruments

7.9.1.3 Table-Top Analyzers

7.9.1.4 Hand-Held Analyzers

7.1 TUMOR/CANCER MARKER TESTING PRODUCTS

7.11 FECAL OCCULT TESTING PRODUCTS

7.11.1.1 Guaiac FOB Stool Test

7.11.1.2 Lateral Flow Immuno-FOB Test

7.11.1.3 Immuno-FOB Agglutination Test

7.11.1.4 Immuno-FOB ELISA Test

7.12 OTHERS

8 GLOBAL POINT-OF-CARE TESTING (POCT) MARKET, BY PLATFORM

8.1 OVERVIEW

8.2 LATERAL FLOW ASSAYS/IMMUNOCHROMATOGRAPHY TESTS

8.3 IMMUNOASSAYS

8.4 DIPSTICKS

8.5 MOLECULAR DIAGNOSTICS

8.6 CLINICAL CHEMISTRY ASSAYS

8.7 MICROFLUIDICS

8.8 HEMATOLOGY

8.9 OTHERS

9 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 BLOOD GLUCOSE

9.3 INFECTIOUS DISEASES

9.3.1 COVID-19 TESTING

9.3.2 HIV TESTING

9.3.3 HEPATITIS C TESTING

9.3.4 INFLUENZA TESTING

9.3.5 TUBERCULOSIS TESTING

9.3.6 OTHERS

9.4 VITAL SIGN MONITORING

9.5 CARDIAC MONITORING

9.6 COAGULATION

9.7 HAEMATOLOGY

9.8 NON-INVASIVE SPO2 MONITORING

9.9 BLOOD TRANSFUSION

9.1 NON-INVASIVE PCO2 MONITORING

9.11 WHOLE BLOOD ANALYSIS

9.12 OTHERS

10 GLOBAL POINT-OF-CARE TESTING (POCT) MARKET, BY PRESCRIPTION MODE

10.1 OVERVIEW

10.2 OTC TESTING

10.3 PRESCRIPTION-BASED TESTING

11 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

11.4 ONLINE SALES

11.5 OTHERS

12 GLOBAL POINT-OF-CARE TESTING (POCT) MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 PRIVATE

12.2.1.1 Tier 1

12.2.1.2 Tier 2

12.2.1.3 Tier 3

12.2.2 PUBLIC

12.2.2.1 Tier 1

12.2.2.2 Tier 2

12.2.2.3 Tier 3

12.3 HOME CARE

12.4 CLINICS

12.5 LABORATORIES

12.6 DIAGNOSTIC CENTERS

12.7 PATHOLOGY LABS

12.8 AMBULATORY SURGERY CENTERS

12.9 ELDERLY CARE CENTERS

12.1 OTHERS

13 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 FRANCE

13.3.3 U.K.

13.3.4 ITALY

13.3.5 SPAIN

13.3.6 RUSSIA

13.3.7 TURKEY

13.3.8 NETHERLANDS

13.3.9 SWITZERLAND

13.3.10 NORWAY

13.3.11 POLAND

13.3.12 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 CHINA

13.4.2 JAPAN

13.4.3 INDIA

13.4.4 SOUTH KOREA

13.4.5 AUSTRALIA

13.4.6 SINGAPORE

13.4.7 MALAYSIA

13.4.8 THAILAND

13.4.9 INDONESIA

13.4.10 PHILIPPINES

13.4.11 VIETNAM

13.4.12 REST OF ASIA-PACIFIC

13.5 MIDDLE EAST AND AFRICA

13.5.1 SAUDI ARABIA

13.5.2 SOUTH AFRICA

13.5.3 U.A.E.

13.5.4 ISRAEL

13.5.5 KUWAIT

13.5.6 EGYPT

13.5.7 REST OF MIDDLE EAST AND AFRICA

13.6 SOUTH AMERICA

13.6.1 BRAZIL

13.6.2 ARGENTINA

13.6.3 PERU

13.6.4 REST OF SOUTH AMERICA

14 GLOBAL POINT-OF-CARE TESTING (POCT) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ABBOTT POINT OF CARE INC(ABBOTT)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 SINOCARE.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 F. HOFFMANN-LA ROCHE LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 DANAHER

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 HOLOGIC, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACCUBIOTECH CO., LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ABAXIS (ABAXIS IS A PART OF ZOETIS)

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 AUTOBIO

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 BD VERITOR(BD)

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 BINX HEALTH

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 BIOMERIEUX

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 BIO- RAD LABORATORIES, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 CHEMBIO DIAGNOSTICS, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 EKF DIAGNOSTICS HOLDINGS PLC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 GETEIN BIOTECH, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 LAMDAGEN CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MERIDIAN BIOSCIENCE

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 NOVA BIOMEDICAL

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 PFIZER INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 PTS DIAGNOSTICS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 QIAGEN

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 QUIDELORTHO CORPORATION

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 QUANTUMDX GROUP LTD.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SEKISUI DIAGNOSTICS

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT. DEVELOPMENT

16.25 SHENZHEN NEW INDUSTRY BIOMEDICAL ENGINEERING CO., LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENT

16.26 SIEMENS HEALTHINEERS AG

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENT

16.27 SIENCO, INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT UPDATES

16.28 SYSMEX CORPORATION

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENT

16.29 TRINITY BIOTECH

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PR.ODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENT

16.3 TRIVIDIA HEALTH, INC.

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT UPDATES

16.31 THERMO FISHER SCIENTIFIC INC.

16.31.1 COMPANY SNAPSHOT

16.31.2 REVENUE ANALYSIS

16.31.3 PRODUCT PORTFOLIO

16.31.4 RECENT DEVELOPMENT

16.32 WERFEN

16.32.1 COMPANY SNAPSHOT

16.32.2 PRODUCT PORTFOLIO

16.32.3 RECENT DEVELOPMENT

16.33 WONDFO

16.33.1 COMPANY SNAPSHOT

16.33.2 REVENUE ANALYSIS

16.33.3 PRODUCT PORTFOLIO

16.33.4 RECENT DEVELOPMENT

16.34 XIAMEN BOSON BIOTECH CO., LTD.

16.34.1 COMPANY SNAPSHOT

16.34.2 PRODUCT PORTFOLIO

16.34.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 3 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 4 GLOBAL GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 5 GLOBAL GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 GLOBAL GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 7 GLOBAL GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 8 GLOBAL SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 GLOBAL SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 10 GLOBAL SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 11 GLOBAL INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 GLOBAL INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 13 GLOBAL INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 14 GLOBAL INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 15 GLOBAL HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 GLOBAL HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 17 GLOBAL HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 18 GLOBAL SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 GLOBAL SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 20 GLOBAL SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 21 GLOBAL HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 22 GLOBAL HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 23 GLOBAL HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 24 GLOBAL INFLUENZA TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 GLOBAL TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 GLOBAL TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 27 GLOBAL TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 28 GLOBAL MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 GLOBAL MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 30 GLOBAL MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 31 GLOBAL CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 GLOBAL CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 GLOBAL POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 34 GLOBAL POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 35 GLOBAL CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 GLOBAL CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 37 GLOBAL CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 38 GLOBAL BLOOD GAS/ELECTROLYTE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 GLOBAL BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 GLOBAL BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 41 GLOBAL BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 42 GLOBAL BLOOD GAS/ELECTROLYTE TESTING INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 GLOBAL PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 GLOBAL PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 45 GLOBAL PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 46 GLOBAL BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 47 GLOBAL BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 48 GLOBAL BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 49 GLOBAL HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 GLOBAL HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 51 GLOBAL HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 52 GLOBAL ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 GLOBAL ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 54 GLOBAL ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 55 GLOBAL PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 GLOBAL PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 GLOBAL PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 GLOBAL PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 59 GLOBAL PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 60 GLOBAL FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 GLOBAL FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 62 GLOBAL FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 63 GLOBAL HAEMATOLOGY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 64 GLOBAL COAGULATION MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 65 GLOBAL COAGULATION MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 66 GLOBAL ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 GLOBAL ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 68 GLOBAL ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 69 GLOBAL VISCOELASTIC COAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY METHOD, 2018-2033 (USD THOUSANDS)

TABLE 70 GLOBAL DRUGS-OF-ABUSE (DOA) TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 GLOBAL DRUG-OF-ABUSE (DOA) TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 GLOBAL DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 73 GLOBAL DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 74 GLOBAL DOA ANALYZERS MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 75 GLOBAL RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 GLOBAL RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 77 GLOBAL RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 78 GLOBAL URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 79 GLOBAL URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 GLOBAL URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 81 GLOBAL URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 82 GLOBAL CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 83 GLOBAL CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 GLOBAL CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 85 GLOBAL CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 86 GLOBAL INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 87 GLOBAL INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 88 GLOBAL INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 89 GLOBAL TUMOR/CANCER MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 90 GLOBAL FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 91 GLOBAL FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 GLOBAL FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 93 GLOBAL FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 94 GLOBAL OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 95 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY PLATFORM, 2018-2033 (USD THOUSAND)

TABLE 96 GLOBAL LATERAL FLOW ASSAYS/IMMUNOCHROMATOGRAPHY TESTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 97 GLOBAL IMMUNOASSAYS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 98 GLOBAL DIPSTICKS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 99 GLOBAL MOLECULAR DIAGNOSTICS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 100 GLOBAL CLINICAL CHEMISTRY ASSAYS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 101 GLOBAL MICROFLUIDICS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 102 GLOBAL HEMATOLOGY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 103 GLOBAL OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 104 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 105 GLOBAL BLOOD GLUCOSE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 106 GLOBAL INFECTIOUS DISEASES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 107 GLOBAL INFECTIOUS DISEASES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 GLOBAL VITAL SIGN MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 109 GLOBAL CARDIAC MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 110 GLOBAL COAGULATION IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 111 GLOBAL HAEMATOLOGY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 112 GLOBAL NON-INVASIVE SPO2 MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 113 GLOBAL BLOOD TRANSFUSION IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 114 GLOBAL NON-INVASIVE PCO2 MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 115 GLOBAL WHOLE BLOOD ANALYSIS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 116 GLOBAL OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 117 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY PRESCRIPTION MODE, 2018-2033 (USD THOUSANDS)

TABLE 118 GLOBAL OTC TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 119 GLOBAL PRESCRIPTION-BASED TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 120 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 121 GLOBAL DIRECT TENDER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 122 GLOBAL RETAIL SALES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 123 GLOBAL ONLINE SALES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 124 GLOBAL OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 125 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 126 GLOBAL HOSPITALS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSANDS)

TABLE 127 GLOBAL HOSPITALS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2032 (USD THOUSANDS)

TABLE 128 GLOBAL PRIVATE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2032 (USD THOUSANDS)

TABLE 129 GLOBAL PUBLIC IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2032 (USD THOUSANDS)

TABLE 130 GLOBAL HOME CARE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 131 GLOBAL CLINICS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 GLOBAL LABORATORIES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 133 GLOBAL DIAGNOSTIC CENTERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 GLOBAL PATHOLOGY LABS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 135 GLOBAL AMBULATORY SURGERY CENTERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 GLOBAL ELDERLY CARE CENTERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 137 GLOBAL OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 138 GLOBAL POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 139 NORTH AMERICA POINT-OF-CARE-TESTING (POCT) MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 140 NORTH AMERICA POINT-OF-CARE-TESTING (POCT) MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 141 NORTH AMERICA

TABLE 142 NORTH AMERICA POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 NORTH AMERICA POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 144 NORTH AMERICA POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 145 NORTH AMERICA GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 NORTH AMERICA GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 147 NORTH AMERICA GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 148 NORTH AMERICA SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 NORTH AMERICA SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 150 NORTH AMERICA SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 151 NORTH AMERICA INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 NORTH AMERICA INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 153 NORTH AMERICA INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 154 NORTH AMERICA HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 NORTH AMERICA HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 156 NORTH AMERICA HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 157 NORTH AMERICA SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 NORTH AMERICA SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 159 NORTH AMERICA SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 160 NORTH AMERICA HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 NORTH AMERICA HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 162 NORTH AMERICA HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 163 NORTH AMERICA INFLUENZA TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 NORTH AMERICA TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 NORTH AMERICA TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 166 NORTH AMERICA TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 167 NORTH AMERICA MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 NORTH AMERICA MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 169 NORTH AMERICA MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 170 NORTH AMERICA CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 NORTH AMERICA POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 172 NORTH AMERICA POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 173 NORTH AMERICA CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 NORTH AMERICA CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 175 NORTH AMERICA CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 176 NORTH AMERICA BLOOD GAS/ELECTROLYTE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 NORTH AMERICA BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 NORTH AMERICA BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 179 NORTH AMERICA BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 180 NORTH AMERICA BLOOD GAS/ELECTROLYTE TESTING INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 NORTH AMERICA PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 NORTH AMERICA PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 183 NORTH AMERICA PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 184 NORTH AMERICA BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 NORTH AMERICA BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 186 NORTH AMERICA BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 187 NORTH AMERICA HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 NORTH AMERICA HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 189 NORTH AMERICA HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 190 NORTH AMERICA ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 NORTH AMERICA ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 192 NORTH AMERICA ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 193 NORTH AMERICA PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 NORTH AMERICA PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 NORTH AMERICA PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 196 NORTH AMERICA PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 197 NORTH AMERICA FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 NORTH AMERICA FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 199 NORTH AMERICA FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 200 NORTH AMERICA COAGULATION MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 NORTH AMERICA ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 NORTH AMERICA ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 203 NORTH AMERICA ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 204 NORTH AMERICA VISCOELASTIC COAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY METHOD, 2018-2033 (USD THOUSAND)

TABLE 205 NORTH AMERICA DRUG-OF-ABUSE (DOA) TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 NORTH AMERICA DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 NORTH AMERICA DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 208 NORTH AMERICA DOA ANALYZERS MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 209 NORTH AMERICA RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 NORTH AMERICA RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 211 NORTH AMERICA RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 212 NORTH AMERICA URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 NORTH AMERICA URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 214 NORTH AMERICA URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 215 NORTH AMERICA CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 NORTH AMERICA CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 217 NORTH AMERICA CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 218 NORTH AMERICA INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 NORTH AMERICA INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 220 NORTH AMERICA INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 221 NORTH AMERICA FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 NORTH AMERICA FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 223 NORTH AMERICA FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 224 NORTH AMERICA POINT-OF-CARE-TESTING (POCT) MARKET, BY PLATFORM, 2018-2033 (USD THOUSAND)

TABLE 225 NORTH AMERICA POINT-OF-CARE-TESTING (POCT) MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 226 NORTH AMERICA INFECTIOUS DISEASES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 NORTH AMERICA POINT-OF-CARE-TESTING (POCT) MARKET, BY PRESCRIPTION MODE, 2018-2033 (USD THOUSAND)

TABLE 228 NORTH AMERICA POINT-OF-CARE-TESTING (POCT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 229 NORTH AMERICA HOSPITALS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 230 NORTH AMERICA PRIVATE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 231 NORTH AMERICA PUBLIC IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 232 NORTH AMERICA POINT-OF-CARE-TESTING (POCT) MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 233 U.S. POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 U.S. POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 235 U.S. POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 236 U.S. GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 U.S. GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 238 U.S. GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 239 U.S. SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 U.S. SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 241 U.S. SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 242 U.S. INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 U.S. INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 244 U.S. INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 245 U.S. HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 U.S. HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 247 U.S. HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 248 U.S. SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 U.S. SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 250 U.S. SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 251 U.S. HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 U.S. HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 253 U.S. HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 254 U.S. INFLUENZA TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 U.S. TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 U.S. TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 257 U.S. TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 258 U.S. MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 U.S. MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 260 U.S. MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 261 U.S. CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 U.S. POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 263 U.S. POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 264 U.S. CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 265 U.S. CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 266 U.S. CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 267 U.S. BLOOD GAS/ELECTROLYTE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 U.S. BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 U.S. BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 270 U.S. BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 271 U.S. BLOOD GAS/ELECTROLYTE TESTING INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 U.S. PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 273 U.S. PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 274 U.S. PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 275 U.S. BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 276 U.S. BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 277 U.S. BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 278 U.S. HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 U.S. HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 280 U.S. HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 281 U.S. ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 282 U.S. ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 283 U.S. ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 284 U.S. PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 285 U.S. PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 U.S. PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 287 U.S. PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 288 U.S. FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 289 U.S. FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 290 U.S. FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 291 U.S. COAGULATION MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 U.S. ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 U.S. ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 294 U.S. ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 295 U.S. VISCOELASTIC COAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY METHOD, 2018-2033 (USD THOUSAND)

TABLE 296 U.S. DRUG-OF-ABUSE (DOA) TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 297 U.S. DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 298 U.S. DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 299 U.S. DOA ANALYZERS MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 300 U.S. RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)