North America Wound Debridement Devices Market, by Product (Hydrosurgical Debridement Devices, Low Frequency Ultrasound Devices, Surgical Wound Debridement Devices, Mechanical Debridement Pads, Traditional Wound Debridement Devices, Larval Therapy), Wound Type (Diabetic Foot Ulcers, Venous Leg, Pressure Ulcers, Burns, Other Wounds), End User (Hospital, Ambulatory Surgical Centers, Specialized Clinics, Nursing Facilities, Other End Users), Country (U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, UAE, Egypt, Israel, Rest of Middle East & Africa) Industry Trends and Forecast to 2028

Market Analysis and Insights : North America Wound Debridement Devices Market

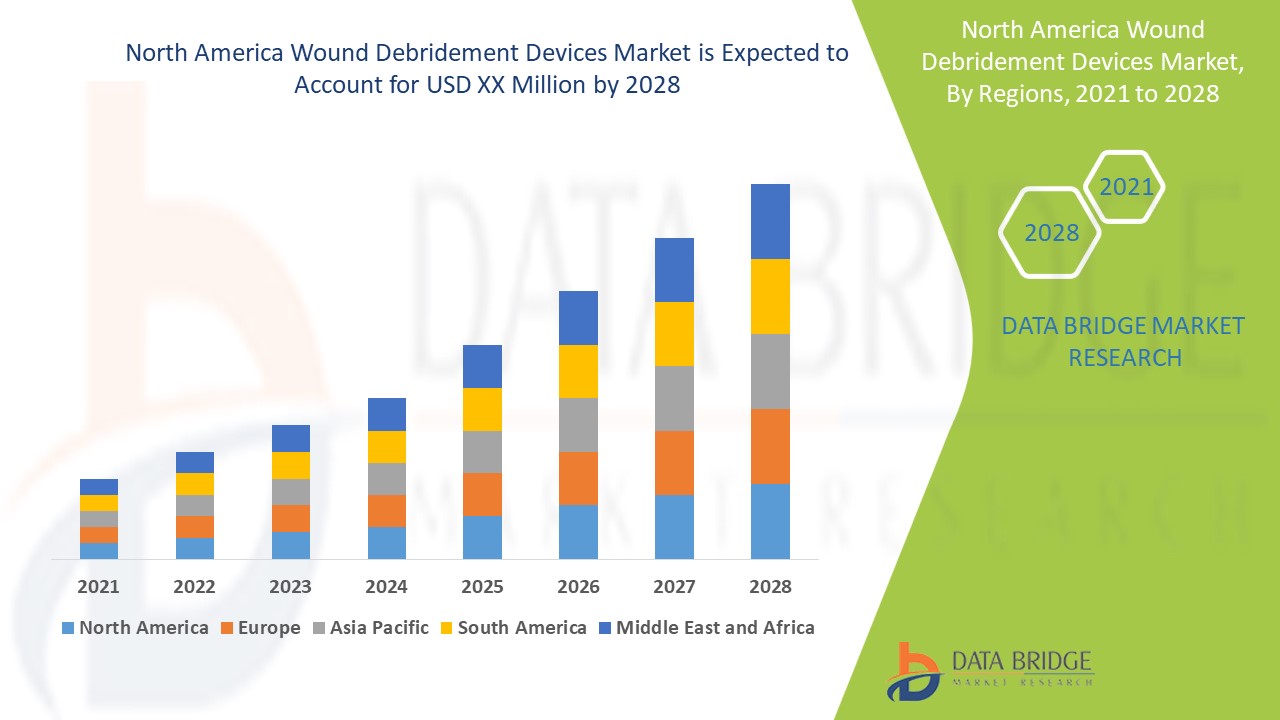

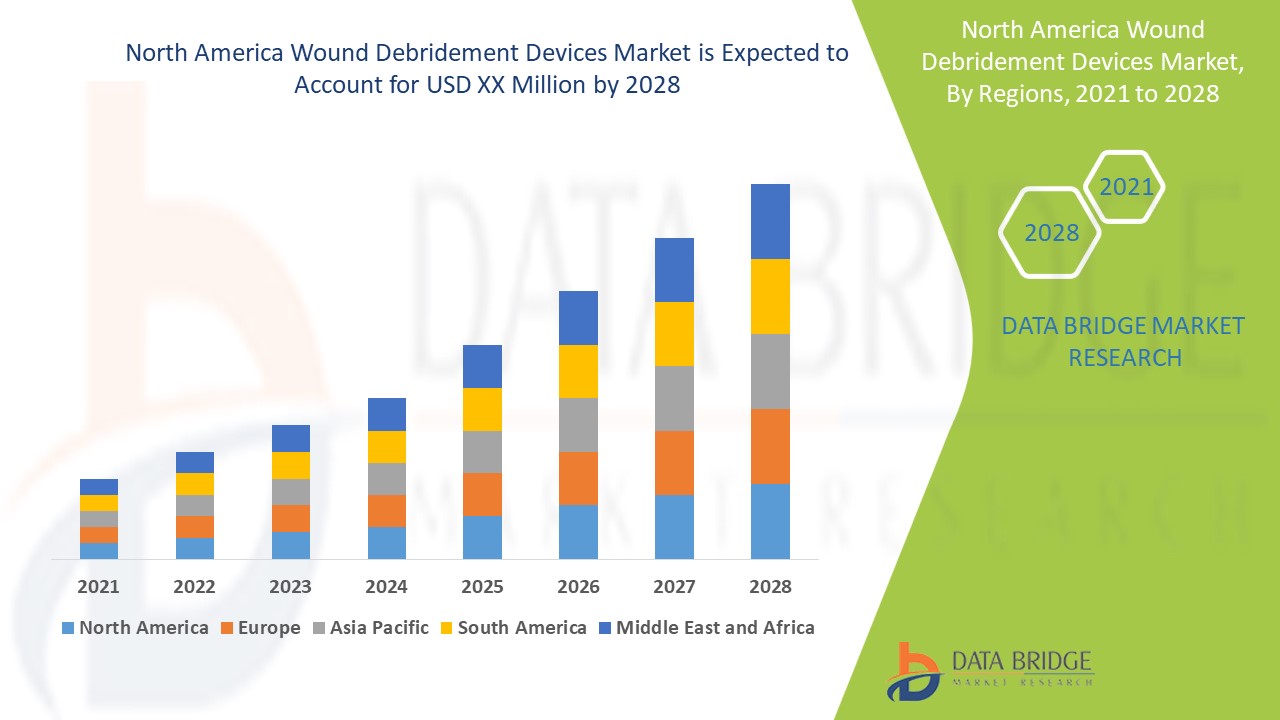

The North America wound debridement devices market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with the CAGR of 12.3% in the forecast period of 2021 to 2028. The growing number of cases of injuries and trauma will help in escalating the growth of the wound debridement devices market.

Wound debridement is referred to the process of removal of dead, contaminated, and unhealthy tissue from a wound to help the wound healing. The wound debridement can be carried out by chemical, enzymatic, surgical, mechanical, and autolytic procedures (natural processes) to remove the unwanted tissue. The dead skin prevents the formation of new tissue and hides the signs of infections if any present, therefore which makes it problematic for treatment.

Major factors that are expected to boost the growth of the wound debridement market in the forecast period, the alertness programs for the wound care and management, rise in the elderly population and the focus on autolytic debridement and disposable products. Furthermore, the increasing prevalence of diabetes and associated wounds and the growing occurrences of burn injuries are further anticipated to propel the growth of the wound debridement market. On the other hand, absence of standard utilization of the strategies and trained manpower and the shortage of skilled professionals to aid the patients in the utilization of these devices for different conditions in the long-term treatment plan are further projected to impede the growth of the wound debridement market in the coming years. In addition, the developmental potential in the emerging economies will further offer opportunities for the growth of the wound debridement market in the near future.

This North America wound debridement devices market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on North America wound debridement devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Wound Debridement Devices Market Scope and Market Size

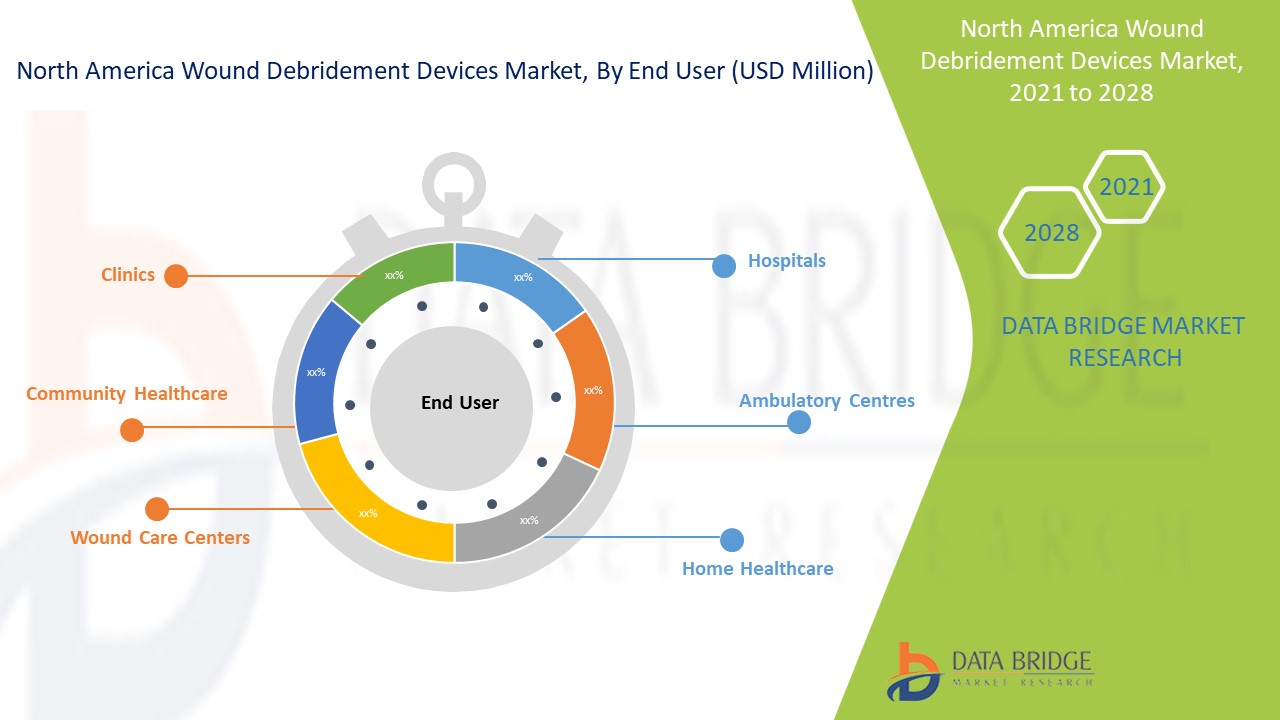

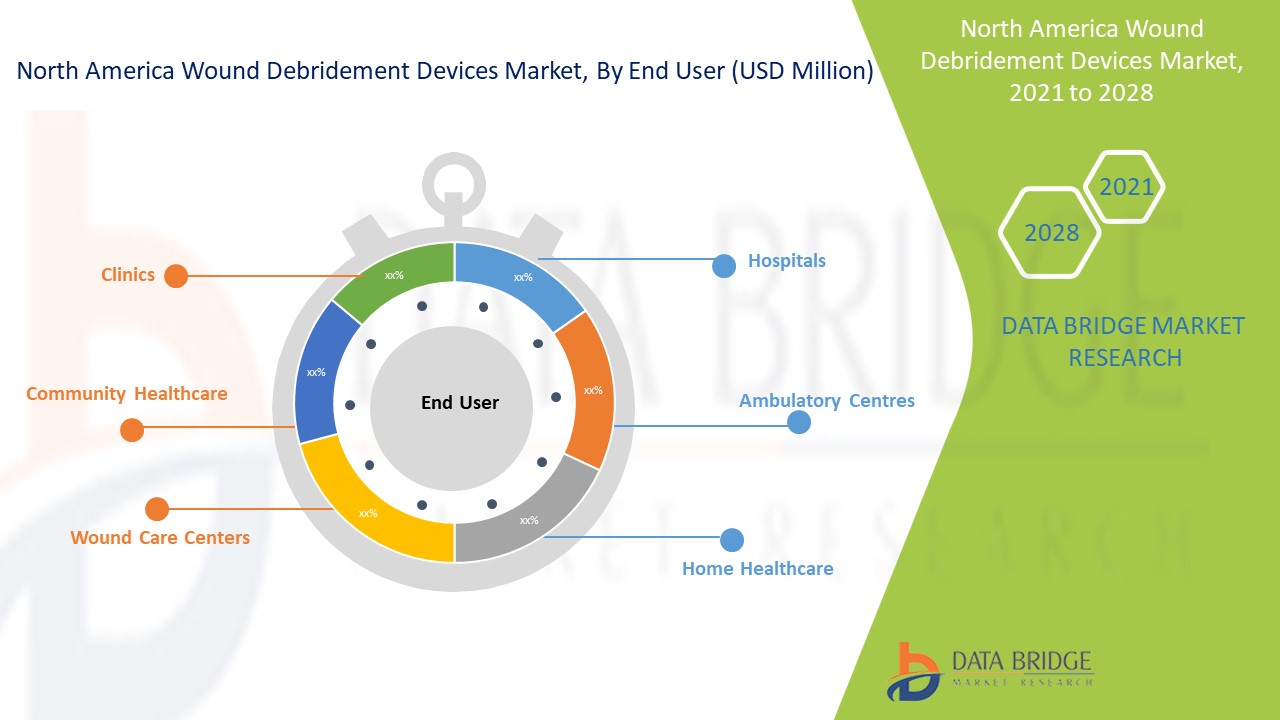

The North America wound debridement devices market is segmented on the basis of product, wound type and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users with valuable market overview and market insights to help them in making strategic decisions for identification of core market applications.

- On the basis of product, the North America wound debridement market is segmented into hydrosurgical debridement devices, low frequency ultrasound devices, surgical wound debridement devices, mechanical debridement pads, traditional wound debridement devices, larval therapy.

- On the basis of wound type, the North America wound debridement market is segmented into diabetic foot ulcers, venous leg, pressure ulcers, burns, other wounds. Other wounds is further sub segmented into infectious wounds and radiation wounds.

- On the basis of end user, the wound debridement market is segmented into Hospital, Ambulatory Surgical Centers, Specialized Clinics, Nursing Facilities, other end users.

North America Wound Debridement Devices Market Country Level Analysis

The North America wound debridement devices market is analysed and market size insights and trends are provided by country, product, wound type and end user as referenced above.

The countries covered in the North America wound debridement devices market report are the U.S., Canada and Mexico.

U.S. dominates the North America wound debridement devices market due to the increase in the elderly population.

The country section of the wound debridement devices market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The North America wound debridement devices market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for wound debridement devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the wound debridement devices market. The data is available for historic period 2010-2019.

Competitive Landscape and Wound Debridement Devices Market Share Analysis

The North America wound debridement devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to wound debridement devices market.

The major players covered in the wound debridement devices market report are Integra Lifesciences Corporation, Zimmer Biomet, Misonix, Medline Industries, Inc., PulseCare Medical, Arobella Medical, LLC, DeRoyal Industries, EZ Debride, among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

SKU-