North America Wireless Data Radio Modem Market

Market Size in USD Million

CAGR :

%

USD

322.40 Million

USD

519.10 Million

2024

2032

USD

322.40 Million

USD

519.10 Million

2024

2032

| 2025 –2032 | |

| USD 322.40 Million | |

| USD 519.10 Million | |

|

|

|

|

North America Wireless Data Radio Modem Market Size

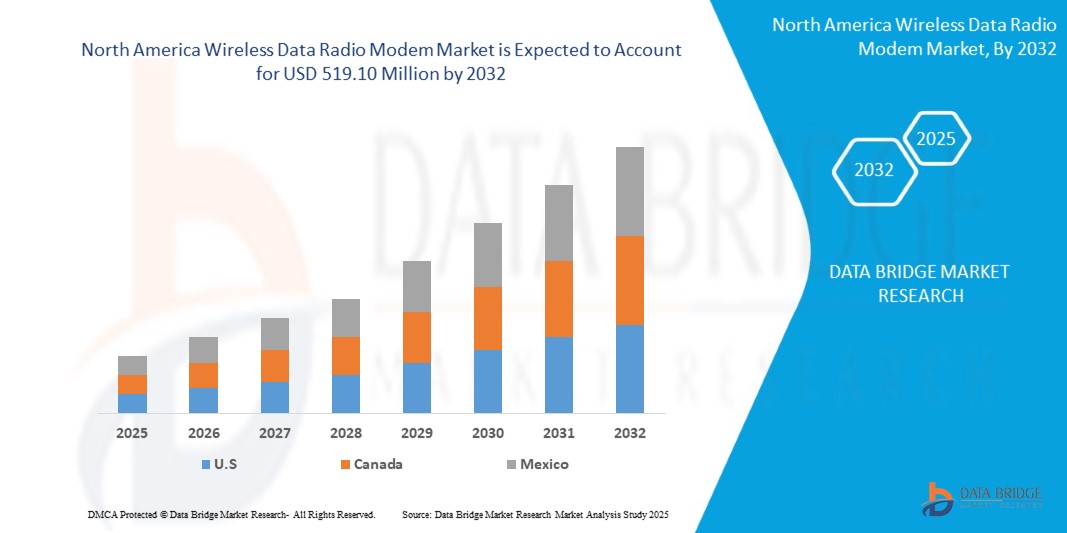

- The North America Wireless Data Radio Modem Market size was valued at USD 322.40 Million in 2024 and is expected to reach USD 519.10 Million by 2032, at a CAGR of 7.04% during the forecast period

- The rollout and adoption of 5G technology in North America is significantly boosting demand for wireless data radio modems, as 5G enables higher data speeds and lower latency, which are essential for modern wireless communication applications.

- Industries across North America are increasingly integrating automation solutions, driving the need for reliable wireless data transmission. Wireless data radio modems are critical for connecting sensors, controllers, and machinery in industrial environments.

North America Wireless Data Radio Modem Market Analysis

- Advancements in wireless communication technologies are enhancing the capabilities of radio modems, making them more energy-efficient and suitable for integration into IoT solutions. This integration facilitates remote monitoring and control of devices, meeting the growing demand for reliable connectivity in challenging environments. The emphasis on security and encryption features is also increasing, addressing concerns over data security in wireless communications.

- Despite the positive growth trajectory, the market faces challenges from alternative communication technologies like LoRa and Sigfox. These alternatives offer different benefits, such as extended range or lower power consumption, which may appeal to certain applications. The availability of these substitutes could impede the growth of traditional wireless data radio modems in specific segments.

- U.S. dominates the North America Wireless Data Radio Modem Market with the largest revenue share of 48.01% in 2025, adoption of advanced technologies and substantial investments in communication infrastructure. The presence of key market players and a strong focus on innovation contribute to the region's market dominance.

- Canada is expected to be the fastest growing region in the North America Wireless Data Radio Modem Market during the forecast period due to Investment in Broadband Infrastructure.

- The UAV Drone Data Modem segment is anticipated to hold the largest market share of 41.9% in the North America Wireless Data Radio Modem Market during the forecast period due to use of wireless radio modems in agricultural drones is rising, supporting precision agriculture, real-time monitoring, and data-driven farming practices, which increases modem demand in rural and agricultural sectors.

Report Scope and North America Wireless Data Radio Modem Market Segmentation

|

Attributes |

North America Wireless Data Radio Modem Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Wireless Data Radio Modem Market Trends

“Growing Demand for Industrial Automation and IoT Connectivity”

- The North America wireless data radio modem market is experiencing robust growth, driven by the region’s strong push toward industrial automation and the widespread adoption of Internet of Things (IoT) technologies. Industries such as manufacturing, oil & gas, utilities, and transportation are increasingly deploying wireless radio modems to enable real-time data communication between remote assets and centralized control systems. This shift is enhancing operational efficiency, reducing downtime, and supporting predictive maintenance strategies.

- A significant trend is the integration of wireless data radio modems with advanced communication protocols such as LTE, 5G, and private wireless networks. This integration is enabling higher data throughput, lower latency, and more reliable connectivity, which are essential for mission-critical applications in sectors like public safety, smart grids, and autonomous vehicles. The move toward hybrid solutions that combine traditional radio frequencies with cellular and satellite connectivity is also gaining traction, offering greater flexibility and coverage.

- With the increasing reliance on wireless communications for critical infrastructure, there is a heightened focus on cybersecurity and data integrity. Manufacturers and end-users are prioritizing solutions that offer robust encryption, authentication, and secure data transmission to protect against cyber threats and ensure regulatory compliance, particularly in sectors handling sensitive or regulated data.

- Wireless data radio modems are playing a pivotal role in the development of smart city infrastructure across North America. They are being used for applications such as remote meter reading, traffic management, environmental monitoring, and public safety networks. Utilities are leveraging these modems for advanced metering infrastructure (AMI), grid automation, and outage management, enabling more efficient and responsive services.

- North America remains the leading market for wireless data radio modems, supported by a mature technological ecosystem, substantial investments in R&D, and a high rate of digital transformation across industries. The presence of major technology providers and ongoing collaborations between industry and research institutions are fostering innovation, resulting in the development of more compact, energy-efficient, and intelligent modem solutions.

- The proliferation of edge computing is influencing the market, as businesses seek to process data closer to its source for faster decision-making and reduced network congestion. Wireless data radio modems are being integrated into edge devices, supporting decentralized data processing and enabling applications that require real-time analytics and local automation.

North America Wireless Data Radio Modem Market Dynamics

Driver

“Rising Demand for Reliable Wireless Communication in Industrial and Remote Environments”

- The increasing adoption of automation, smart manufacturing, and remote asset monitoring across sectors such as oil & gas, utilities, transportation, and agriculture is driving the demand for robust wireless data radio modems in North America.

- For instance, in early 2025, industrial automation systems in factories and remote field operations in oil & gas rely on wireless modems for real-time data transmission, process control, and equipment monitoring, ensuring operational efficiency and safety.

- Wireless data radio modems provide critical connectivity in environments where traditional wired infrastructure is impractical or where cellular coverage is unreliable or unavailable.

- The push for Industry 4.0 and the proliferation of IoT devices further accelerate the need for reliable, low-latency wireless communication solutions that can operate in harsh or isolated environments.

Restraint/Challenge

“High Interference, Spectrum Regulation, and Environmental Constraints”

- Wireless data radio modems face significant challenges due to spectrum congestion and interference, especially in urban and industrial areas where multiple wireless systems operate simultaneously.

- For example, in 2025, Microsoft co-founder Paul Allen invested $17.5 million in Metricom Inc., a networking company based in Los Gatos, California. Metricom was noted for its innovative approach to providing low-cost, high-speed networking services using unlicensed radio spectrum.

- Regulatory requirements for spectrum allocation and device certification can limit deployment flexibility and increase compliance costs for manufacturers and end-users.

- Environmental factors such as physical obstructions (buildings, terrain), electromagnetic interference from industrial equipment, and extreme weather conditions can degrade signal quality and reliability.

North America Wireless Data Radio Modem Market Scope

The market is segmented on the Product Type, Frequency Range, Spectrum Technology, Application.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Frequency Range |

|

|

By Spectrum Technology |

|

|

By Application |

|

North America Wireless Data Radio Modem Market Scope

The market is segmented on the basis of Product Type, Frequency Range, Spectrum Technology, Application.

- By Product Type

On the basis of Product Type, the North America Wireless Data Radio Modem Market is segmented into UAV Drone Data Modem, General-Purpose Data Modem. The UAV Drone Data Modem segment dominates the largest market revenue share of 42.1% in 2025, driven by The rollout and adoption of 5G technology in North America is significantly boosting demand for wireless data radio modems, as 5G enables higher data speeds and lower latency, which are essential for modern wireless communication applications.

The General-Purpose Data Modem segment is anticipated to witness the fastest growth rate of 8.1% from 2025 to 2032, Industries across North America are increasingly integrating automation solutions, driving the need for reliable wireless data transmission. Wireless data radio modems are critical for connecting sensors, controllers, and machinery in industrial environments.

- By Frequency Range

On the basis of Frequency Range, the North America Wireless Data Radio Modem Market is segmented into 900 Mhz, 2.4 Ghz, 5 Ghz. The 900 Mhz held the largest market revenue share in 2025 gaining traction in North America due to Government and private sector investments in expanding high-speed broadband infrastructure, such as the U.S. government’s multi-billion-dollar broadband initiatives, are creating new opportunities for wireless data radio modem deployment.

The 2.4 Ghz Systems segment is expected to witness the fastest CAGR from 2025 to 2032 Semiconductor qubits are driven by Investment in Broadband Infrastructure.

- By Spectrum Technology

On the basis of Spectrum Technology, the North America Wireless Data Radio Modem Market is segmented Frequency Hopping Spread Spectrum (FHSS), Direct Sequence Spread Spectrum (DSSS). The Frequency Hopping Spread Spectrum (FHSS) held the largest market revenue share in 2025, use of wireless radio modems in agricultural drones is rising, supporting precision agriculture, real-time monitoring, and data-driven farming practices, which increases modem demand in rural and agricultural sectors.

The Frequency Hopping Spread Spectrum (FHSS) segment is expected to witness the fastest CAGR from 2025 to 2032, North American industries pursue digital transformation, there is a growing need for robust wireless communication solutions to support IoT, smart manufacturing, and remote monitoring, fueling modem adoption.

- By Application

On the basis of Application, the North America Wireless Data Radio Modem Market is segmented into Precision Farming, Transportation, Supervisory Control and Data Acquisition (SCADA) and Telemetry. The Storage held the largest market revenue share in 2025, Precision Farming is driven by use of wireless radio modems in agricultural drones is rising, supporting precision agriculture, real-time monitoring, and data-driven farming practices, which increases modem demand in rural and agricultural sectors.

The Transportation segment is expected to witness the fastest CAGR from 2025 to 2032, due to Advancements in Wireless Communication Technology.

U.S Wireless Data Radio Modem Market Insight

The U.S. North America Wireless Data Radio Modem Market captured the largest revenue share of 48.01% within U.S. in 2025, U.S. is driven by Continuous innovation in wireless data transmission, including the adoption of ultra-high and very high-frequency bands, enhances the capabilities and reliability of radio modems, making them more attractive for diverse applications.

Canada Wireless Data Radio Modem Market Insight

The Canada North America Wireless Data Radio Modem Market is poised to grow at the fastest CAGR of over 9.1% in 2025, Sectors such as utilities, oil & gas, and environmental monitoring require remote data collection and control, which is efficiently enabled by wireless data radio modems.

North America Wireless Data Radio Modem Market Share

The North America wireless data radio modem market is primarily led by well-established companies, including:

- ABB

- ADVANTECH B+B SMARTWORX

- CAMPBELL SCIENTIFIC, Inc.

- COHDA WIRELESS

- ENCOM WIRELESS

- Digi International Inc.

- FREEWAVE TECHNOLOGIES, Inc.

- HARRIS CORPORATION

- HARXON CORPORATON

- Intuicom, Inc.

- JAVAD GNSS Inc.

- Motorola Solutions, Inc.

- Pro4 Wireless

- Raveon Technologies

- Schneider Electric

- SIMREX Corporation

- Pacific Crest

- SATEL

- Microhard

- Adeunis

Latest Developments in North America Wireless Data Radio Modem Market

- In December 2014, RacoWireless, a provider of wireless products and services focusing on the machine-to-machine (M2M) industry, was acquired by KORE Wireless Group in November 2014. The acquisition marked a significant consolidation in the M2M MVNO sector.

- In October 2017, DragonWave, a supplier of packet microwave radio systems for mobile and access IP networks, was acquired by Transform-X and rebranded as DragonWave-X. The company is headquartered in Ottawa, Ontario, Canada.

- In 2021, Airspan Networks completed a business combination with New Beginnings Acquisition Corp., commencing trading on the NYSE American under the ticker symbol MIMO. The company develops Radio Access Network technology, including the Sprint 'Magic Box' and cells for the Rakuten virtualized network.

- In November 2024, Cavli Wireless introduced several new products, including the CQS315 LTE Cat 4 Smart Module and the CQM220 5G RedCap Module, enhancing its portfolio of cellular IoT modules with embedded SIM technology.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Wireless Data Radio Modem Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Wireless Data Radio Modem Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Wireless Data Radio Modem Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.