North America Waterproof Breathable Textiles (WBT) Market Analysis and Size

Waterproof breathable textiles (WBT) are the type of fabrics that are used in the manufacturing of garments. They are manufactured from various types of materials such as polyurethane, polyester, polypropylene, nylon, silk, wool, cotton, and many other kinds of materials that are water repellent and provide durability to the fabric. The major property of the waterproof-breathable textiles (WBT) is that they dry up easily as well as keep the body moisture-free.

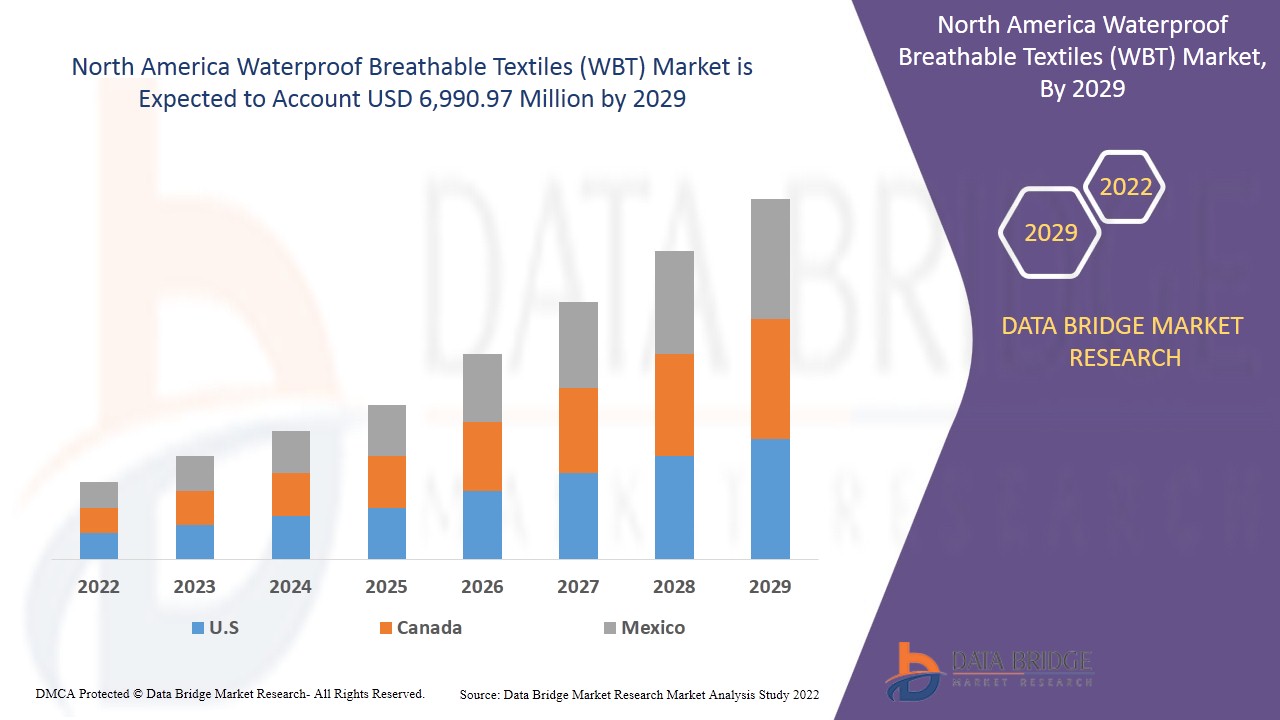

Waterproof breathable textiles (WBT) are used in the home, general clothing & accessories, sports goods, protective clothing and at many other places with the aim to fight the harsh weather. Data Bridge Market Research analyses that the Waterproof Breathable Textiles (WBT) Market is expected to reach the value of USD 6,990.97 million by the year 2029, at a CAGR of 5.2% during the forecast period. "Sports Goods" accounts for the most prominent application segment in the respective market owing to increased sports activities. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Metres, Pricing in USD |

|

Segments Covered |

By Type (Closely Woven Fabrics, Microporous Membranes and Coatings, Hydrophilic Membranes and Coatings, Combination Of Microporous and Hydrophilic Membranes and Coatings, Retroreflective Microbeads, Smart Breathable Fabrics, Fabrics based on Biomimetics, and Others), Raw Material (Polyurethane, ePTFE, Polyester, Polypropylene, Nylon, Silk, Wool, Cotton, Viscose Rayon, High-Density Fabrics (HDF) and Others), Form (Laminated and Coated), Fabric Type (Densely Woven, Membrane and Coated), Application (General Clothing & Accessories, Sports Goods, Protective Clothings, Hometech, Mobitech, Healthcare and Others), Distribution Channel (Online, Offline) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Nike Inc., Toray Industries Inc., The North Face (Subsidiary of VF Corporation), W. L. Gore & Associates, Inc., Helly Hansen, Schweitzer-Mauduit International, Inc., Rudolf GmbH, HeiQ Materials AG, Schoeller Switzerland, Polartec, Marmot Mountain LLC., ALPEX PROTECTION, Nextec Applications, Derekduck Industries Corp., Mountain Hardwear, and Tanatex Chemicals B.V. |

Market Definition

Waterproof breathable textiles (WBT) are a kind of textiles that are used in the manufacturing of water repellent as well as breathable garments. They are produced from various kinds of materials such as polyester, silk, and many more. Some of the recycled PET material is used in the manufacturing process which can easily be recycled. Waterproof breathable textiles (WBT) are used in the home, sportswear, military uniforms, and at many more places as it suits almost all kinds of weather which have increased the preferences among consumers and retailers. The U.S. is the largest consumer of waterproof breathable textiles.

Regulatory Framework

National Emission Standards for Hazardous Air Pollutants (NESHAP): This regulation is implemented by Environmental Protection Agency (EPA). This prohibits the use of methylene chloride for the production and fabrication of polyurethane (a major raw material used for manufacturing of WBT textiles), as it contributes significantly to air pollution which may reasonably be anticipated to endanger public health or welfare. This action will result in improved monitoring, compliance, and implementation of the existing standards and codify existing industry practices to prevent backsliding.

COVID-19 had a Minimal Impact on Waterproof Breathable Textiles (WBT) Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Amidst the COVID-19 outbreak, investors and manufacturers are pulling back the production and reconsidering investments. This is expected to act as a key headwind for the growth of the waterproof breathable textiles (WBT) market. However, growing awareness about the waterproof breathable textiles (WBT) product, increasing disposable income, and presence of a large consumer base are the prominent factors driving the market. In addition, there is huge demand for waterproof breathable textiles (WBT) from sports goods sector which will continue to drive the market growth but is not sufficient for the growth of market solely. However, the long-term growth of the market is expected to remain positive as there is increase in demand from general clothing and accessories, protective clothing, healthcare, mobitech and hometech sectors as well.

The Market Dynamics of the Waterproof Breathable Textiles (WBT) Market Include:

- Increase in the Usage of Sportswear Garments

The textile industry prefers various kinds of new technologies in order to manufacture the innovative designs which maximize the level of comfort at the time of usage. The demand for sportswear is growing at a very fast pace as compared to other clothing categories. The material as well as technology used in the manufacturing of the sportswear garments is different from generic clothing production. The preference of the sportswear garments is increasing as these garments are lightweight, flexible, durable as well as softer that resists water, body odor resistance which increases the athlete’s performance and provides the huge level of comfort as well.

- Growing Demand of Waterproof Breathable Textiles in Medical Practices

In the medical textiles, breathability plays a major role as this prevents the accumulation of any kind of the liquid on the skin. The innovative featured medical textiles are used in patient lifting slings, hospital laundry bags, wound care dressing, doctors outwear at the time of patients’ treatment and many more. The growing use of the waterproof breathable textile (WBT) in the medical textiles on account of their unique features helps in maximizing the demand of the waterproof breathable textile (WBT) in the market.

- Rising Fitness Awareness Among Youngsters in Developing Countries

Youngsters have increased their interests in the physical activities in order to keep their body in shape and attain an attractive physique. Rising awareness among people towards their health also helps them to increase their level of concentration on their work. The regular exercise and the physical activity provides people with a peaceful and healthy living.

- Increasing Demand for Comfortable and High-Performance Apparel

Increasing usage of waterproof and breathable membranes in various backpacks and cycling garments, owing to ability to resist sweat & dirt is driving the growth in the global waterproof breathable textile market. Breathable membranes can also provide improved durability. Moreover, customers are nowadays shifting towards sustainable active wear, which, in turn, is set to result in the growing usage of environmentally sustainable membranes in the upcoming years. These factors such as increasing demand for comfortable and highly durable clothing is expected to be a key driver for the growth of global waterproof breathable textile market.

- Growing Utilization in the Manufacturing and Design of Uniforms and Protective Gear for Military and Law Enforcement Agencies

There is rising development of medical protective clothing with waterproof breathable films. In addition, various companies are increasingly investing in the manufacturing of new range of products in order to boost application of waterproof breathable textiles across general clothing & accessories and protective clothing.

- Innovation Leads to Ecofriendly Solutions for Waterproof Breathable Textiles

The innovation leads to eco-friendly solutions for waterproof breathable textiles (WBT) which is suitable to the natural environment has led to increasing preference towards the consumption of eco-friendly waterproof breathable textiles (WBT). Such WBTs are suitable to even sensitive skin that can act as an opportunity for the waterproof breathable textiles (WBT) market globally.

Restraints/Challenges Faced by the Waterproof Breathable Textiles (WBT) Market

- Increasing Involvement in Indoor Activities

Increasing involvement of the consumers in the indoor activities has minimized the usage of the sportswear due to which the demand of the waterproof breathable textiles (WBT) has decreased in the market. So, the increasing involvement of the consumers in the indoor activities with the minimization of the interest in the physical activities which can affect the health of the individuals can act as a restraint in the production of the waterproof breathable textiles (WBT) for the manufacturers in the future.

- Increasing Risk Associated with the Consumer Preferences and Fashion Trends

Global push towards greater sustainability in fashion has changed consumers’ behavior towards fashion clothing and has changed the balance between biggest retailers and local brands. Also, majority of the customers now prefer buying higher quality clothing that would last longer. This demonstrates the shift towards more sustainable fashion.

This waterproof breathable textiles (WBT) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Waterproof Breathable Textiles (WBT) Market contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In October 2021, Scapa Healthcare, an SWM International business and Synedgen Inc. announced that they have signed an exclusive worldwide licensing agreement for two novel innovative wound care treatments developed using Synedgen’s proprietary glycochemistry technology platform. The agreement gives Scapa Healthcare the right to use Synedgen’s glycopolymer technology in conjunction with other wound care technologies.

- In October 2021, Nike launched the LeBron James Innovation Center where the Nike Sport Research Lab (NSRL) was reborn, housing the world’s largest motion-capture installation (400 cameras), 97 force plates, body-mapping equipment and so much more. This development will help Nike Inc. to provide customized and innovative products to its customers.

North America Waterproof Breathable Textiles (WBT) Market Scope

The waterproof breathable textiles (WBT) market is segmented on the basis of type, raw material, form, fabric type, distribution channel and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Closely Woven Fabrics

- Microporous Membranes and Coatings

- Hydrophilic Membranes and Coating

- Combination of Microporous and Hydrophilic Membranes and Coating

- Retroreflective Microbeads

- Smart Breathable Fabrics

- Fabrics Based On Biomimetics

- Others

On the basis of type, the waterproof breathable textiles (WBT) market is segmented into closely woven fabrics, microporous membranes and coatings, hydrophilic membranes and coating, combination of microporous and hydrophilic membranes and coating, retroreflective microbeads, smart breathable fabrics, fabrics based on biomimetics, and others.

Raw Material

- Polyurethane

- ePTFE

- Polyester

- Polypropylene

- Nylon

- Silk

- Wool

- Cotton

- Viscose Rayon

- High-Density Fabrics (HDF)

- Others

On the basis of first-generation, the waterproof breathable textiles (WBT) market is segmented into polyurethane, EPTFE, polyester, polypropylene, nylon, silk, wool, cotton, viscose rayon, high-density fabrics (HDF) and others.

Form

- Laminated

- Coated

On the basis of second-generation, the waterproof breathable textiles (WBT) market is segmented into laminated and coated.

Fabric Type

- Densely Woven

- Membrane

- Coated

On the basis of mode of application, the waterproof breathable textiles (WBT) market is segmented into densely woven, membrane and coated.

Distribution Channel

- Online

- Offline

On the basis of end-user, the waterproof breathable textiles (WBT) market is segmented into online and offline.

Application

- General Clothing & Accessories

- Sports Goods

- Protective Clothings

- Hometech

- Mobitech

- Healthcare

- Others

On the basis of end-user, the waterproof breathable textiles (WBT) market is segmented into general clothing & accessories, sports goods, protective clothings, hometech, mobitech, healthcare, and others.

Waterproof Breathable Textiles (WBT) Market Regional Analysis/Insights

The waterproof breathable textiles (WBT) market is analyzed and market size insights and trends are provided by country, type, raw material, form, fabric type, distribution channel and application.

The countries covered in the waterproof breathable textiles (WBT) market report are the U.S., Canada and Mexico.

In North America, U.S. dominates the waterproof breathable textiles (WBT) market because sports goods in waterproof breathable textiles (WBT) are gaining prevalence among consumers due to its properties and increased sports activities within the regional country.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Waterproof Breathable Textiles (WBT) Market Share Analysis

The waterproof breathable textiles (WBT) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to waterproof breathable textiles (WBT) market.

Some of the major players operating in the waterproof breathable textiles (WBT) market are Nike Inc., Toray Industries Inc., The North Face (Subsidiary of VF Corporation), W. L. Gore & Associates, Inc., Helly Hansen, Schweitzer-Mauduit International, Inc., Rudolf GmbH, HeiQ Materials AG, Schoeller Switzerland, Polartec, Marmot Mountain LLC., ALPEX PROTECTION, Nextec Applications, Derekduck Industries Corp., Mountain Hardwear, and Tanatex Chemicals B.V. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT SCENARIO

4.2 PRICING TREND SCENARIO

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS:

4.3.2 ECONOMIC FACTORS:

4.3.3 SOCIAL FACTORS:

4.3.4 TECHNOLOGICAL FACTORS:

4.3.5 LEGAL FACTORS:

4.3.6 ENVIRONMENTAL FACTORS:

4.4 PORTER’S FIVE FORCES:

4.4.1 THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT

4.6.2 MANUFACTURING AND PACKING

4.6.3 MARKETING AND DISTRIBUTION

4.6.4 END USERS

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

4.9 PRODUCTION & CONSUMPTION ANALYSIS

5 REGULATORY FRAMEWORK- NORTH AMERICA WATERPROOF BREATHABLE TEXTILES MARKET

5.1 ISO STANDARDS

5.2 AMERICAN SOCIETY FOR TESTING AND MATERIALS (ASTM) REGULATIONS

5.3 ISO 17699:2003 STANDARD

5.4 AATCC TM42-2017E

5.5 NATIONAL EMISSION STANDARDS FOR HAZARDOUS AIR POLLUTANTS (NESHAP)

5.6 AB 2379

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN USAGE OF SPORTSWEAR GARMENTS

6.1.2 GROWING DEMAND FOR WATERPROOF BREATHABLE TEXTILES IN MEDICAL PRACTICES

6.1.3 RISING FITNESS AWARENESS AMONG YOUNGSTERS IN DEVELOPING COUNTRIES

6.1.4 INCREASING DEMAND FOR COMFORTABLE AND HIGH-PERFORMANCE APPAREL

6.1.5 GROWING UTILIZATION IN MANUFACTURING AND DESIGN OF UNIFORMS AND PROTECTIVE GEAR FOR MILITARY AND LAW ENFORCEMENT AGENCIES

6.2 RESTRAINTS

6.2.1 INCREASING INVOLVEMENT IN INDOOR ACTIVITIES

6.2.2 INCREASING RISK ASSOCIATED WITH CONSUMER PREFERENCES AND FASHION TRENDS

6.3 0PPORTUNITIES

6.3.1 INNOVATIONS LEADING TO ECO-FRIENDLY SOLUTIONS FOR WATERPROOF BREATHABLE TEXTILES

6.3.2 INCREASING RESEARCH ACTIVITIES DUE TO HIGH DEMAND FOR ENVIRONMENTALLY SUSTAINABLE APPAREL

6.4 CHALLENGES

6.4.1 REDUCED CONDENSATION OF WATER INSIDE FABRIC

6.4.2 CHALLENGES ASSOCIATED WITH SUSTAINABILITY

7 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE

7.1 OVERVIEW

7.2 CLOSELY WOVEN FABRICS

7.3 MICROPOROUS MEMBRANES AND COATINGS

7.4 HYDROPHILIC MEMBRANES AND COATINGS

7.5 COMBINATION OF MICROPOROUS AND HYDROPHILIC MEMBRANES AND COATINGS

7.6 RETROREFLECTIVE MICROBEADS

7.7 SMART BREATHABLE FABRICS

7.8 FABRICS BASED ON BIOMIMETICS

7.9 OTHERS

8 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY RAW MATERIAL

8.1 OVERVIEW

8.2 EPTFE

8.3 POLYURETHANE

8.4 POLYESTER

8.5 POLYPROPYLENE

8.6 NYLON

8.7 COTTON

8.8 SILK

8.9 WOOL

8.1 VISCOSE RAYON

8.11 HIGH-DENSITY FABRICS (HDF)

8.12 OTHERS

9 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM

9.1 OVERVIEW

9.2 LAMINATED

9.2.1 LAMINATED, BY MEMBRANE

9.2.1.1 MICROPOROUS MEMBRANES

9.2.1.2 HYDROPHILIC MEMBRANES

9.3 COATED

9.3.1 COATED, BY MEMBRANE

9.3.1.1 MICROPOROUS MEMBRANES

9.3.1.2 HYDROPHILIC MEMBRANES

10 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FABRIC TYPE

10.1 OVERVIEW

10.2 MEMBRANE

10.3 DENSELY WOVEN

10.4 COATED

11 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 SPORTS GOODS

11.2.1 SPORTS GOODS, BY APPLICATION

11.2.1.1 ACTIVE SPORTSWEAR GARMENTS

11.2.1.2 LEISUREWEAR

11.2.1.2.1 JACKETS

11.2.1.2.2 TROUSERS

11.2.1.2.3 OVER TROUSERS

11.2.1.2.4 ANORAKS

11.2.1.2.5 RAINCOATS

11.2.1.2.6 OTHERS

11.2.1.3 SWIMWEAR

11.2.1.4 RAINWEAR

11.2.1.5 MOUNTAINEERING GARMENTS

11.2.1.6 SPORTS FOOTWEAR

11.2.1.7 TREKKING SHOES

11.2.1.8 CAMPING BOOTS

11.2.1.9 SLEEPING BAGS

11.2.1.10 TENTS

11.2.1.11 GLOVES

11.2.1.12 HATS

11.2.1.13 OTHERS

11.2.2 SPORTS GOODS, BY TYPE

11.2.2.1 CLOSELY WOVEN FABRICS

11.2.2.2 MICROPOROUS MEMBRANES AND COATINGS

11.2.2.3 HYDROPHILIC MEMBRANES AND COATINGS

11.2.2.4 COMBINATION OF MICROPOROUS AND HYDROPHILIC MEMBRANES AND COATINGS

11.2.2.5 RETROREFLECTIVE MICROBEADS

11.2.2.6 SMART BREATHABLE FABRICS

11.2.2.7 FABRICS BASED ON BIOMIMETICS

11.2.2.8 OTHERS

11.3 PROTECTIVE CLOTHING

11.3.1 PROTECTIVE CLOTHING, BY APPLICATION

11.3.1.1 MILITARY CLOTHING

11.3.1.2 FUNCTIONAL WORK WEAR

11.3.1.3 SURVIVAL SUITS

11.3.1.4 CLEAN ROOM CLOTHING

11.3.1.5 FIREMAN GARMENTS

11.3.1.6 OTHERS

11.3.2 PROTECTIVE CLOTHING, BY TYPE

11.3.2.1 CLOSELY WOVEN FABRICS

11.3.2.2 MICROPOROUS MEMBRANES AND COATINGS

11.3.2.3 HYDROPHILIC MEMBRANES AND COATINGS

11.3.2.4 COMBINATION OF MICROPOROUS AND HYDROPHILIC MEMBRANES AND COATINGS

11.3.2.5 RETROREFLECTIVE MICROBEADS

11.3.2.6 SMART BREATHABLE FABRICS

11.3.2.7 FABRICS BASED ON BIOMIMETICS

11.3.2.8 OTHERS

11.4 GENERAL CLOTHING AND ACCESSORIES

11.4.1 GENERAL CLOTHING AND ACCESSORIES, BY APPLICATION

11.4.1.1 INTERLININGS

11.4.1.2 UMBRELLA CLOTH

11.4.1.3 WATERPROOF FASTENERS AND SEALING

11.4.1.4 OTHERS

11.4.2 GENERAL CLOTHING AND ACCESSORIES, BY TYPE

11.4.2.1 CLOSELY WOVEN FABRICS

11.4.2.2 MICROPOROUS MEMBRANES AND COATINGS

11.4.2.3 HYDROPHILIC MEMBRANES AND COATINGS

11.4.2.4 COMBINATION OF MICROPOROUS AND HYDROPHILIC MEMBRANES AND COATINGS

11.4.2.5 RETROREFLECTIVE MICROBEADS

11.4.2.6 SMART BREATHABLE FABRICS

11.4.2.7 FABRICS BASED ON BIOMIMETICS

11.4.2.8 OTHERS

11.5 HOMETECH

11.5.1 HOMETECH, BY APPLICATION

11.5.1.1 MATTRESS COVER AND BEDDING

11.5.1.2 OUTDOOR FABRICS

11.5.1.3 OUTDOOR UPHOLSTERY

11.5.1.4 OTHERS

11.5.2 HOMETECH, BY TYPE

11.5.2.1 CLOSELY WOVEN FABRICS

11.5.2.2 MICROPOROUS MEMBRANES AND COATINGS

11.5.2.3 HYDROPHILIC MEMBRANES AND COATINGS

11.5.2.4 COMBINATION OF MICROPOROUS AND HYDROPHILIC MEMBRANES AND COATINGS

11.5.2.5 RETROREFLECTIVE MICROBEADS

11.5.2.6 SMART BREATHABLE FABRICS

11.5.2.7 FABRICS BASED ON BIOMIMETICS

11.5.2.8 OTHERS

11.6 MOBITECH

11.6.1 MOBITECH, BY APPLICATION

11.6.1.1 CAR SEATING

11.6.1.2 CAR COVERS

11.6.1.3 CARGO WRAPS

11.6.1.4 SHIP CURTAINS

11.6.1.5 OTHERS

11.6.2 MOBITECH, BY TYPE

11.6.2.1 CLOSELY WOVEN FABRICS

11.6.2.2 MICROPOROUS MEMBRANES AND COATINGS

11.6.2.3 HYDROPHILIC MEMBRANES AND COATINGS

11.6.2.4 COMBINATION OF MICROPOROUS AND HYDROPHILIC MEMBRANES AND COATINGS

11.6.2.5 RETROREFLECTIVE MICROBEADS

11.6.2.6 SMART BREATHABLE FABRICS

11.6.2.7 FABRICS BASED ON BIOMIMETICS

11.6.2.8 OTHERS

11.7 HEALTHCARE

11.7.1 HEALTHCARE, BY APPLICATION

11.7.1.1 SURGICAL GARMENTS

11.7.1.2 HOSPITAL BEDWEAR

11.7.1.3 WOUND DRESSING

11.7.1.4 OTHERS

11.7.2 HEALTHCARE, BY TYPE

11.7.2.1 CLOSELY WOVEN FABRICS

11.7.2.2 MICROPOROUS MEMBRANES AND COATINGS

11.7.2.3 HYDROPHILIC MEMBRANES AND COATINGS

11.7.2.4 COMBINATION OF MICROPOROUS AND HYDROPHILIC MEMBRANES AND COATINGS

11.7.2.5 RETROREFLECTIVE MICROBEADS

11.7.2.6 SMART BREATHABLE FABRICS

11.7.2.7 FABRICS BASED ON BIOMIMETICS

11.7.2.8 OTHERS

11.8 OTHERS

11.8.1 CLOSELY WOVEN FABRICS

11.8.2 MICROPOROUS MEMBRANES AND COATINGS

11.8.3 HYDROPHILIC MEMBRANES AND COATINGS

11.8.4 COMBINATION OF MICROPOROUS AND HYDROPHILIC MEMBRANES AND COATINGS

11.8.5 RETROREFLECTIVE MICROBEADS

11.8.6 SMART BREATHABLE FABRICS

11.8.7 FABRICS BASED ON BIOMIMETICS

11.8.8 OTHERS

12 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 ONLINE

12.3 OFFLINE

13 NORTH AMERICA

13.1 U.S.

13.2 CANADA

13.3 MEXICO

14 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.2 MERGERS & ACQUISITIONS

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENTS

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 NIKE INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT UPDATES

16.2 TORAY INDUSTRIES, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT UPDATES

16.3 THE NORTH FACE (SUBSIDIARY OF VF CORPORATION)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATES

16.4 W. L. GORE & ASSOCIATES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT UPDATES

16.5 ALPEX PROTECTION

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT UPDATE

16.6 DEREKDUCK INDUSTRIES CORP.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT UPDATES

16.7 HEIQ MATERIALS AG Z

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 HELLY HANSEN

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATES

16.9 MARMOT MOUNTAIN LLC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT UPDATE

16.1 MOUNTAIN HARDWEAR

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATES

16.11 NEXTEC APPLICATIONS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

16.12 POLARTEC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 RUDOLF GMBH

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT UPDATES

16.14 SCHOELLER SWITZERLAND

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT UPDATES

16.15 SCHWEITZER-MAUDUIT INTERNATIONAL, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 TANATEX CHEMICALS B.V.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATES

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF TEXTILE FABRICS IMPREGNATED, COATED, COVERED OR LAMINATED WITH PLASTICS (EXCLUDING TYRE CORD.., HS CODE: 5903 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TEXTILE FABRICS IMPREGNATED, COATED, COVERED OR LAMINATED WITH PLASTICS (EXCLUDING TYRE CORD.., HS CODE: 5903 (USD THOUSAND)

TABLE 3 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (MILLION METERS)

TABLE 5 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA LAMINATED IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY MEMBRANE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA COATED IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY MEMBRANE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FABRIC TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA SPORTS GOOD IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA LEISURE WEAR IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SPORTS GOOD IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PROTECTIVE CLOTHING IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PROTECTIVE CLOTHING WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA GENERAL CLOTHING AND ACCESSORIES IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA GENERAL CLOTHING AND ACCESSORIES IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HOMETECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA HOMETECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA MOBITECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA MOBITECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA HEALTHCARE IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HEALTHCARE IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY COUNTRY, 2020-2029 (MILLION METERS)

TABLE 28 U.S. WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 U.S. WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (MILLION METERS)

TABLE 30 U.S. WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 31 U.S. WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 32 U.S. LAMINATED IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 33 U.S. COATED IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 34 U.S. WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FABRIC TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.S. WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 U.S. SPORTS GOOD IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 U.S. LEISURE WEAR IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 U.S. SPORTS GOOD IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. PROTECTIVE CLOTHING IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 U.S. PROTECTIVE CLOTHING WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. GENERAL CLOTHING AND ACCESSORIES IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 U.S. GENERAL CLOTHING AND ACCESSORIES IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. HOMETECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 U.S. HOMETECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. MOBITECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 U.S. MOBITECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. HEALTHCARE IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 U.S. HEALTHCARE IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. OTHERS IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY DISTRIBUTION CHANNEL , 2020-2029 (USD MILLION)

TABLE 51 CANADA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (MILLION METERS)

TABLE 53 CANADA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 54 CANADA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 55 CANADA LAMINATED IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 56 CANADA COATED IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 57 CANADA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FABRIC TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 CANADA SPORTS GOOD IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 CANADA LEISURE WEAR IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 CANADA SPORTS GOOD IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA PROTECTIVE CLOTHING IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CANADA PROTECTIVE CLOTHING WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA GENERAL CLOTHING AND ACCESSORIES IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 CANADA GENERAL CLOTHING AND ACCESSORIES IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 CANADA HOMETECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 CANADA HOMETECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 CANADA MOBITECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 CANADA MOBITECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CANADA HEALTHCARE IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 CANADA HEALTHCARE IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 CANADA OTHERS IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 CANADA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 74 MEXICO WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (MILLION METERS)

TABLE 76 MEXICO WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 77 MEXICO WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 78 MEXICO LAMINATED IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 MEXICO COATED IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 80 MEXICO WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FABRIC TYPE, 2020-2029 (USD MILLION)

TABLE 81 MEXICO WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 MEXICO SPORTS GOOD IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 MEXICO LEISURE WEAR IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 MEXICO SPORTS GOOD IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 MEXICO PROTECTIVE CLOTHING IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 MEXICO PROTECTIVE CLOTHING WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 MEXICO GENERAL CLOTHING AND ACCESSORIES IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 MEXICO GENERAL CLOTHING AND ACCESSORIES IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 MEXICO HOMETECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 MEXICO HOMETECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO MOBITECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 MEXICO MOBITECH IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 MEXICO HEALTHCARE IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 MEXICO HEALTHCARE IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO OTHERS IN WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY DISTRIBUTION CHANNEL , 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: SEGMENTATION

FIGURE 13 GROWING UTILIZATION IN THE MANUFACTURING AND DESIGN OF UNIFORMS AND PROTECTIVE GEAR FOR MILITARY AND LAW ENFORCEMENT AGENCIES IS DRIVING THE NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 CLOSELY WOVEN FABRICS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET IN 2022 & 2029

FIGURE 15 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 PRICE ANALYSIS FOR WATERPROOF BREATHABLE TEXTILES (WBT), 2021-2023

FIGURE 17 SUPPLY CHAIN ANALYSIS- NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET

FIGURE 18 VENDOR SELECTION CRITERI

FIGURE 19 PRODUCTION AND CONSUMPTION ANALYSIS FROM 2020-2022 (USD MILLION)

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET

FIGURE 21 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY TYPE, 2021

FIGURE 22 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY RAW MATERIAL, 2021

FIGURE 23 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FORM, 2021

FIGURE 24 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY FABRIC TYPE, 2021

FIGURE 25 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY APPLICATION, 2021

FIGURE 26 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: BY TYPE (2022-2029)

FIGURE 32 NORTH AMERICA WATERPROOF BREATHABLE TEXTILES (WBT) MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.