North America Water Sink Market

Market Size in USD Million

CAGR :

%

USD

12,394.77 Million

USD

15,701.33 Million

2022

2030

USD

12,394.77 Million

USD

15,701.33 Million

2022

2030

| 2023 –2030 | |

| USD 12,394.77 Million | |

| USD 15,701.33 Million | |

|

|

|

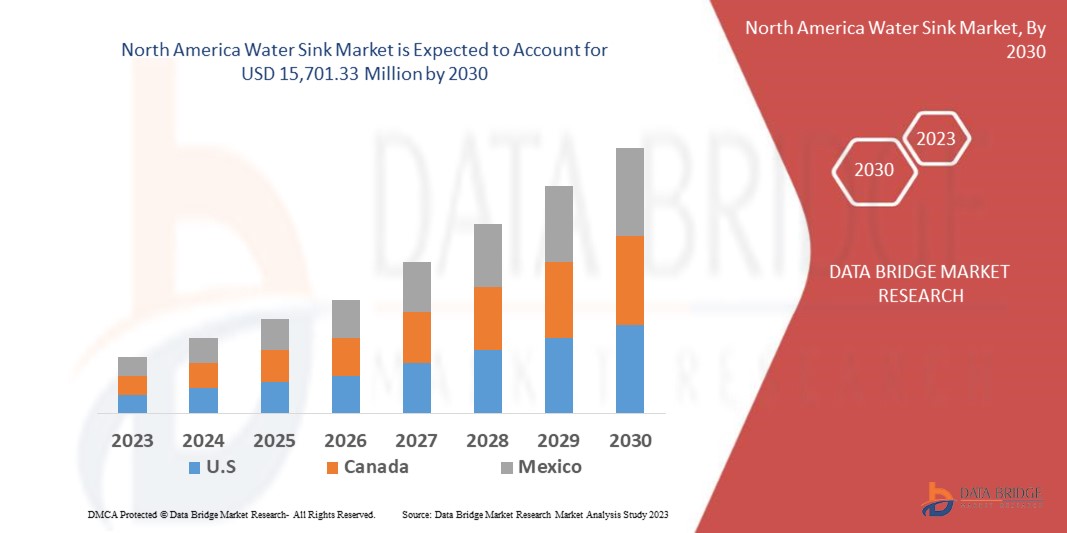

North America Water Sink Market Analysis and Size

The water sink market refers to the industry and marketplace that encompasses the manufacturing, distribution, and sale of various types of sinks for residential, commercial, and industrial purposes. It includes both the production of sink components and the finished sink products themselves.

Data Bridge Market Research analyses that the market which was USD 12,394.77 million in 2022, would rocket up to USD 15,701.33 million by 2030, and is expected to undergo a CAGR of 3.0% during the forecast period. This indicates that the market value. “Bathroom Sink” dominates the product segment of the Water Sink market due to their various properties such as multi-unit construction, commercial applications, renovation and remodelling projects. These technologies rely on physical interactions, such as adsorption or compression, to store hydrogen gas. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

North America Water Sink Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Bathroom Sink, Kitchen Sink), Material (Stainless Steel, Acrylic, Glass, Porcelain, Fireclay, Others), Price (Low, Medium, High), Distribution Channel (Distributors/Wholesalers, Multibrand Stores, Franchisee Stores, Specialized Stores, E-commerce), End-User (Shopping Malls, Hospitality, Corporate and Government Offices, Households, Public Toilets, Educational Facilities, Food Service, Others |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

TOTO LTD (Japan), ROHL LLC. (U.S.), Kohler Co. (U.S.), Kraus (U.S.), Ruvati (U.S.), Franke Kitchen Systems, LLC (Switzerland), American Standard Brand (A subsidiary of LIXIL Corporation) (U.S.), Artisan Manufacturing (U.S.), Roca Sanitario, S.A (Spain), Vigo Industries, SCI (U.S.), Moen Incorporated (A subsidiary of Fortune Brands Home & Security, Inc.) (U.S.), Elkay Manufacturing Company(U.S.), Mountain Plumbing Products (U.S.), among others |

|

Market Opportunities |

|

Market Definition

Water sink are plumbing fixtures that are used for washing hands, dishes and are also used for other purposes. Sink can also be called as sinker, washbowl, hand basin or wash basin. They constitute faucets for supplying hot and cold water. Various kinds of materials are employed in the production of water sink which include stainless steel, porcelain, stone, wood, marble, nickel, copper, concrete, fireclay and many others.

North America Water Sink Market Dynamics

Drivers

- Growing Demand of Stainless Steel Sink in Developed and Developing Countries

Stainless steels are iron alloys that consist of metals such as nickel, molybdenum, titanium and copper and non-metals such as carbon and nitrogen. All these materials enhance their structure and properties such as formability, strength and cryogenic toughness. The sink made from stainless steel helps in improving the hygiene and so is used extensively in public kitchen, restaurants, local health centers, schools etc. Natural color and texture of stainless steel can be retained for a very long time

- Lightweight Sink Gaining Traction in Small Snack Shops

There are a number of sink available in the market based on the material used for their production process. The sinks used for small snack shops include stainless steel the most. As the stainless steel sink are light in weight and provide durability, these sink are in great demand for small snack shops and restaurants. There are different types of sinks which are available; also there are different types of compartments which offer various purposes and helps in improving the efficiency of the establishment

- Growing Hospitality Industry to Create Substantial Demand for Sink

The growth of hospitality industry is contributing the largest share in the growth of sink industry. Sink produced using composites; come in standard styles and offer color choices, and distinctive shapes. Composites contain materials, for instance, squashed rock or quartz which is widely used in sink produced for hospitality industry. These sink may seem such as strong surface and can have a smooth or a somewhat harsh surface and provide toughness along with impervious to scratching and chipping

Opportunities

- Quartz Gaining Popularity in Sink Sector

Quartz is a synthetic material that contains natural quartz combined with acrylic resin. The material is non-porous in texture so, no protective sealant is required to be applied on it. The counter tops made of quartz material are durable in nature and do not require much care in cleaning. This material has a very good resistance for scratches, stains, cracks and heat. Since its surface is non-porous so, no amount of food, oils or acid can be caught in pores which makes the material hygienic and odor-resistant

- Trough Sink for Hospitality and Religious Places

Trough sink is long rectangular sink that are used in the areas frequently and also used by a large number of people at the same time. The sinks are utilized in the bathrooms of a large restaurant. Trough sink have a number of taps applied to it and are comfortably apart. This kind of fixture is used mostly at religious places where a large number of people gather. Trough sink are designed with various different materials such as stainless steel, porcelain, fireclay, copper, concrete, marble, wood, etc. Concrete trough sink are used in the farm houses only as they do not give a smooth elegant look but are durable in nature. The installation of these sink is very difficult in homes

Restraints/Challenges

- Chances of Cracks and Defects During Heating or Cooling Process

Sink are made of different materials based on their usage area. Before a raw material is completely molded into a sink, it has to go through many processes. These processes may include hammering, a very high or low temperature bearing. Porcelain sink are the most commonly used sink and is also susceptible to cracking. Therefore, it can be concluded that the manufacturers are facing challenges related to the cracks and defects which occurs not only at the time of heating or cooling process but also cracks and defects happen after manufacturing and installing the sinks which impacts the water sink market negatively

- High Production Cost

The cost of production depends directly on the cost of raw materials used in the manufacturing of final goods. The raw materials used are imported from other countries in case of deficiency. Risks such as fluctuations in the currency of country from which raw materials are being exported, affect the price of the products manufactured. Adhering to manufacturer guidelines and working with experienced HVAC professionals can provide valuable insights and ensure proper maintenance practices are followed. Also, the lack of favorable reimbursement scenarios and technology penetration in the developing economies, heavy custom duty imposed on medical devices, and lack of suitable infrastructure in low- and middle-income countries are projected to challenge the market in the forecast period from 2023 to 2030.

This water sink market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the water sink market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth

Recent Developments

- In July 2021, Blanco America, Inc. introduced coal-blck SILGRANIT color, a patented material sink claimed to be stronger and more durable as compared to other sinks

- In March 2018, Kohler Co. announced an agreement with Diamond Vista to purchase 100 megawatts of wind power per year from them. This agreement will help in reducing the fossil usage

North America Water Sink Market Scope

The water sink market is segmented on the basis of type, price, distribution channel, end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Bathroom Sink

- Kitchen Sink

- Others

Price

- Low

- Medium

- High

Distribution channel

- Distributors/Wholesalers

- Multibrand Stores

- Franchisee Stores

- Specialized Stores

- E-commerce

End-User

- Shopping Malls

- Hospitality

- Corporate and Government Offices

- Households

- Public Toilets

- Educational Facilities

- Food Service

- Others

North America Water Sink Market Regional Analysis/Insights

The North America water sink market is analysed and market size insights and trends are provided by country, type, price, distribution channel, end-user as referenced above.

The countries covered in the water sink market report are U.S., Canada, Mexico

U.S. is estimated to dominate the water sink market due to increasing demand for water sink in hotel, restaurants and household and the price of stainless steel is very low in the country.

Canada is expected to witness significant growth during the forecast period from 2023 to 2030 due to demand of bathroom sinks has been increased because the growth rate of GDP is very high in the countries.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Water Sink Market Share Analysis

The water sink market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the water sink market.

Some of the major players operating in the water Sink market are

- TOTO LTD (Japan)

- ROHL LLC. (U.S.)

- Kohler Co. (U.S.)

- Kraus USA.(U.S.)

- Ruvati (U.S.)

- Franke Kitchen Systems, LLC (Switzerland)

- American Standard Brand (A subsidiary of LIXIL Corporation) (U.S.)

- Artisan Manufacturing (U.S.)

- Roca Sanitario, S.A (Spain)

- Vigo Industries, SCI (U.S.)

- Moen Incorporated (A subsidiary of Fortune Brands Home & Security, Inc.) (U.S.)

- Elkay Manufacturing Company (U.S.)

- Mountain Plumbing Products (U.S.),

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Water Sink Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Water Sink Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Water Sink Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.