Market Analysis and Insights : North America Wall Bed Market

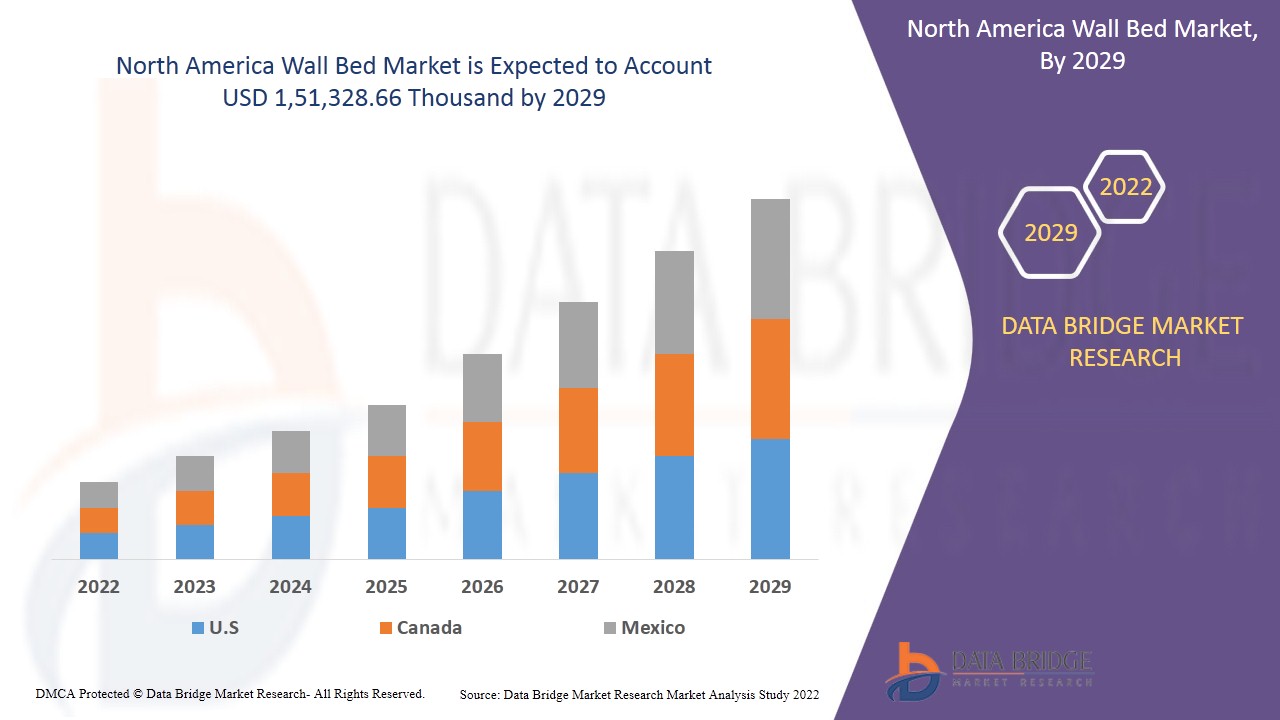

North America wall bed market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing at a CAGR of 3.7% in the forecast period of 2022 to 2029 and is expected to reach USD 1,51,328.66 thousand by 2029. The rising population and widespread concept of co-living is expected to propel the growth of the North America wall bed market.

A wall bed is used for space-saving purposes and is popular where floor space is limited, such as small homes, apartments, hotels, mobile homes, and college dormitories. In recent years, wall bed units have had options such as lighting, storage cabinets, and office components. Most wall beds do not have box springs. Instead, the mattress usually lies on a platform or mesh and is held in place so as not to sag when in a closed position. The mattress is attached to the bed frame, often with elastic straps to hold the mattress in position when the unit is folded upright.

Since the first model of the wall bed, several other variations and designs have been created, which include sideways-mounted beds, bunk beds, and solutions that include other functions such as office cabinets and lighting options. Wall beds with tables or desks that fold down when the bed is folded up are becoming popular, and there are also models with sofas and shelving solutions.

The rising population and widespread co-living concept are anticipated to propel the growth of the North America wall bed market. Moreover, the increased standard of living and awareness for home decor has propelled the growth of the wall bed market. This has increased the demand for wall beds due to confined spaces and the multipurpose use of these wall beds. On the other hand, the major restraint that may impede the North America wall bed market is the high cost of wall beds compared to normal beds.

The growing use in the construction of studio apartments is expected to bring opportunities for the North America wall bed market. However, wall beds are not suitable for people who are renting, which may challenge the market’s growth in the near future.

This North America wall bed market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

North America Wall Bed Market Scope and Market Size

North America wall bed market is segmented on the basis of operation, type, distribution channel, and end use. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

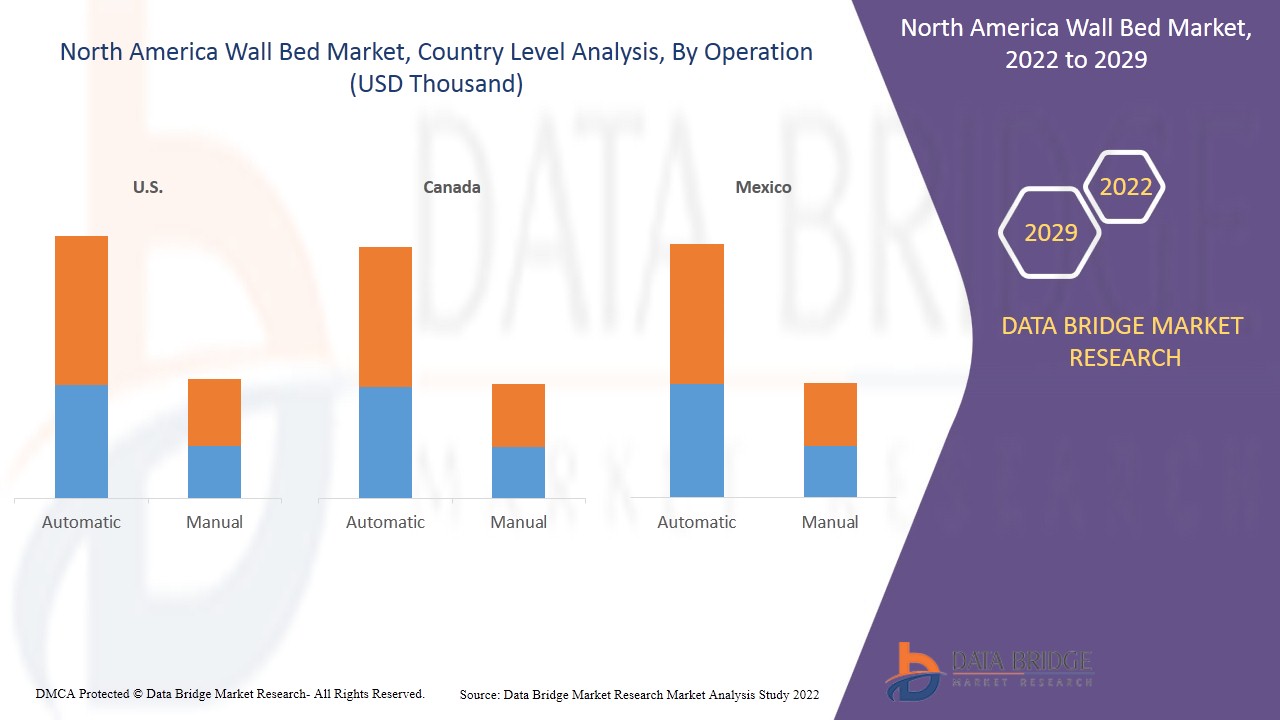

- On the basis of operation, the North America wall bed market is segmented into automatic and manual. In 2022, the automatic segment is expected to dominate the North America wall bed market as automatically operated wall beds are easy to fold and unfold, which is likely to boost demand in the forecast year. Even children and old age people find it convenient to use it without anybody’s help.

- On the basis of type, the North America wall bed market is segmented into a single bed and double bed. In 2022, the single bed segment is expected to dominate the North America wall bed market as it provides the convenience of sleeping on the bed and serves as storage or table when not in use. In addition, single beds are in high demand from people who live in studio apartments that have less space for furniture.

- On the basis of distribution channel, the North America wall bed market is segmented into online and offline. In 2022, the offline segment is expected to dominate the North America wall bed market as a lot of people prefer visiting stores and checking the quality of wall beds, and also bulk purchasing is done offline in most cases. This is expected to help the growth of this segment in the forecast period.

- On the basis of end use, the North America wall bed market is segmented into residential and non-residential. In 2022, the residential segment is expected to dominate the North America wall bed market. These beds save a lot of space that can be used as living areas or kids playing areas, which is expected to boost its demand in the forecast period.

North America Wall bed Market Country Level Analysis

North America wall bed market is analyzed, and market size information is provided by country, operation, type, distribution channel, and end use as referenced above.

The countries covered in the North America wall bed market report are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America wall bed market due to high demand from residential users. Canada is expected to dominate the North America wall bed market due to the growing standard of living and awareness for home decor in this region. Mexico is expected to dominate the North America wall bed market due to improved standard of living and increased disposable income, and urbanization in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Rising population and widespread concept of co-living

North America wall bed market also provides you with detailed market analysis for every country growth in the installed base of different kinds of products for the wall bed market, the impact of technology using lifeline curves and changes in production techniques, regulatory scenarios, and their impact on the wall bed market. The data is available for the historical period 2011 to 2020.

Competitive Landscape and North America Wall Bed Market Share Analysis

North America wall bed market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the North America wall bed market.

Some of the major market players engaged in the North America wall bed market are SICO Incorporated, Wilding Wallbeds, Wall Beds Manufacturing, Inc., Zoom Room Inc, B.O.F.F. Wall Beds, Twin Cities Closet Company, Wallbeds “n” more, Wallbeds & Closets North West, Bestar Modern Home and Office furniture, The Bedder Way Co., Murphy Wall Beds Hardware Inc., Modern Furniture and Interior Design, Superior Wall Beds, among other players domestic and global. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- In January 2020, Bestar Modern Home and Office Furniture announced its private equity partnership with MB Capital. This development has helped the company to expand its business

- In January 2020, Bestar Modern Home and Office Furniture acquired Bush Industries, a leading American manufacturer of case goods and RTA furniture for the office and home. This development has helped company to attract more customers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WALL BED MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 DEMOGRAPHIC ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING POPULATION AND WIDESPREAD CONCEPT OF CO-LIVING

5.1.2 GROWING INSTALLATION OF WALL BEDS IN THE HOSPITALITY INDUSTRY

5.1.3 INCREASING AWARENESS REGARDING HOME DÉCOR AND HOME FURNISHING

5.1.4 IMPROVED STANDARD OF LIVING COUPLED WITH RISING DISPOSABLE INCOME AND URBANIZATION

5.2 RESTRAINTS

5.2.1 HIGH COST OF WALL BEDS AS COMPARED TO NORMAL BEDS

5.2.2 AVAILABILITY OF MULTIPURPOSE SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 GROWING USE IN THE CONSTRUCTION OF STUDIO APARTMENTS

5.4 CHALLENGES

5.4.1 WALL BEDS ARE NOT SUITABLE FOR PEOPLE WHO ARE RENTING

5.4.2 WALL BEDS ARE NOT PORTABLE AND REQUIRE A WALL MOUNTING SYSTEM

6 IMPACT OF COVID 19 IMPACT ON THE NORTH AMERICA WALL BED MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA WALL BED MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE GLOBAL PACKAGING PRINITNG MARKET

6.3 STRATERGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA WALL BED MARKET, BY OPERATION

7.1 OVERVIEW

7.2 AUTOMATIC

7.3 MANUAL

8 NORTH AMERICA WALL BED MARKET, BY TYPE

8.1 OVERVIEW

8.2 SINGLE BED

8.3 DOUBLE BED

9 NORTH AMERICA WALL BED MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 OFFLINE

9.3 ONLINE

10 NORTH AMERICA WALL BED MARKET, BY END USE

10.1 OVERVIEW

10.2 RESIDENTIAL

10.2.1 OFFLINE

10.2.2 ONLINE

10.3 NON-RESIDENTIAL

10.3.1 OFFLINE

10.3.2 ONLINE

11 NORTH AMERICA WALL BED MARKET, BY COUNTRY

11.1 U.S.

11.2 CANADA

11.3 MEXICO

12 NORTH AMERICA WALL BED MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 PARTNERSHIP & ACQUISITION

12.3 PRODUCT DEVELOPMENT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 SICO INCORPORATED

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT UPDATE

14.2 WILDING WALLBEDS

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT UPDATE

14.3 WALL BEDS MANUFACTURING, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT UPDATES

14.4 ZOOM ROOM INC

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT UPDATE

14.5 B.O.F.F. WALL BEDS

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATE

14.6 BESTAR MODERN HOME AND OFFICE FURNITURE

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 MODERN FURNITURE AND INTERIOR DESIGN

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 MURPHY WALL BEDS HARDWARE INC

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 SUPERIOR WALL BEDS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 THE BEDDER WAY CO

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 TWIN CITIES CLOSET COMPANY

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 WALLBEDS “N” MORE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 WALLBEDS & CLOSETS NORTH WEST

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF WOODEN FURNITURE FOR BEDROOMS; HS CODE - 940350 (USD THOUSAND)

TABLE 2 EXPORT DATA OF WOODEN FURNITURE FOR BEDROOMS; HS CODE - 940350 (USD THOUSAND)

TABLE 3 NORTH AMERICA WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 4 NORTH AMERICA WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA WALL BED MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA WALL BED MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 12 U.S. WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 13 U.S. WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 14 U.S. WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND )

TABLE 15 U.S. WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 16 U.S. WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND )

TABLE 17 U.S. RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 18 U.S. NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 19 CANADA WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 20 CANADA WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 21 CANADA WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND )

TABLE 22 CANADA WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 23 CANADA WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND )

TABLE 24 CANADA RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 25 CANADA NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 26 MEXICO WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 27 MEXICO WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 28 MEXICO WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND )

TABLE 29 MEXICO WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 30 MEXICO WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND )

TABLE 31 MEXICO RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 32 MEXICO NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

List of Figure

FIGURE 1 NORTH AMERICA WALL BED MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WALL BED MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WALL BED MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WALL BED MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WALL BED MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WALL BED MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA WALL BED MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA WALL BED MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA WALL BED MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA WALL BED MARKET: END USE COVERAGE GRID

FIGURE 11 NORTH AMERICA WALL BED MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA WALL BED MARKET: SEGMENTATION

FIGURE 13 RISING POPULATION AND WIDESPREAD CONCEPT OF CO-LIVING IS DRIVING NORTH AMERICA WALL BED MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 AUTOMATIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WALL BED MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WALL BED MARKET

FIGURE 16 NORTH AMERICA POPULATION GROWTH RATE

FIGURE 17 URBANIZATION IN DIFFERENT REGIONS

FIGURE 18 RENTER OCCUPIED HOUSING UNITS IN U.S. IN QUARTER 4 OF 2015 TO 2021

FIGURE 19 NORTH AMERICA WALL BED MARKET, BY OPERATION, 2021

FIGURE 20 NORTH AMERICA WALL BED MARKET, BY TYPE, 2021

FIGURE 21 NORTH AMERICA WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 NORTH AMERICA WALL BED MARKET, BY END USE, 2021

FIGURE 23 CONSTRUCTION OF SINGLE UNIT IN NORTH AMERICAN CITIES, 2020

FIGURE 24 NORTH AMERICA WALL BED MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA WALL BED MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA WALL BED MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA WALL BED MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA WALL BED MARKET: BY OPERATION (2022-2029)

FIGURE 29 NORTH AMERICA WALL BED MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.