North America Unmanned Surface Vehicle (USV) Market Analysis and Size

The increasing use of solar batteries to power the autonomous surface vehicle (ASV) is accelerating the growth of unmanned surface vehicles (USV). The growing demand for water quality monitoring due to increased levels of pollution and ocean data mapping, which allows scientists to study past climatic conditions, is boosting the growth of unmanned surface vehicles (USV). In addition, rising maritime security threats are prompting North America navies to induce autonomous surface vehicles (ASV) in their fleet, giving them an edge, and further accelerating the North America unmanned surface vehicle (USV) market growth. Their diversifying uses in disaster management services especially in search and rescue and preventive maintenance, for protecting the integrity of territorial and enclosed water areas. The rapid adoption in the aquaculture industry, which allows them for real-time monitoring to cater to the growing demand for worldwide fishery products, is expected to create strong opportunities for the North America unmanned surface vehicle (USV) market. However, nascent collision detection technologies and further technological complexities associated with making them truly autonomous pose a challenge to the growth of the North America unmanned surface vehicle (USV) market.

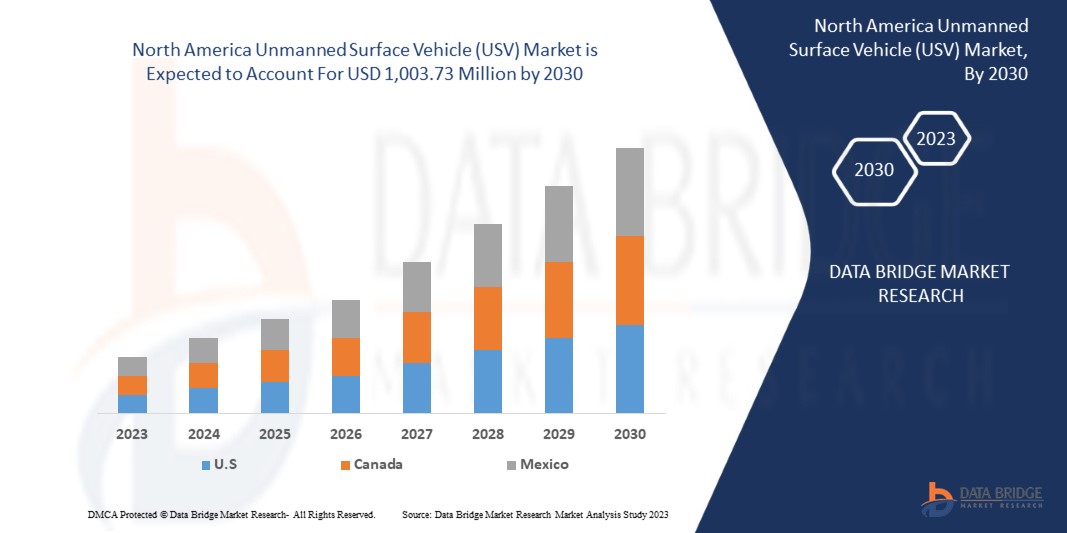

Data Bridge Market Research analyses that North America unmanned surface vehicle (USV) market is expected to reach the value of USD 1,003.73 million by 2030, at a CAGR of 13.8% during the forecast period. The unmanned surface vehicle (USV) market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Type (Surface and Sub-Surface), Application (Defense, Commercial, Scientific Research, and Others), Endurance (100-500 Hours, <100 Hours, 500-1000 Hours, and >1000 Hours), Operation (Remote Operated Surface Vehicle, and Autonomous Surface Vehicle), System (Propulsion, Chassis Material, Payload, Component, Software, and Communication), Hull Type (Catamaran (Twin Hulls), Kayak (Single Hull), Trimaran (Triple Hulls), and Rigid Inflatable Hull), Size (Medium (4 to 8 M), Small (Less than 4 M), Large (8 to 12 M), And Extra-Large (Above 12 M)) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Boeing, Utek, Seafloor Systems, Inc., SeaRobotics Corporation, Saildrone Inc., Deep Ocean Engineering, Inc., Kongsberg Maritime, Tecnologies, Inc., ATLAS ELEKTRONIK GmbH, Clearpath Robotics Inc., Teledyne Technologies Incorporated, Textron Inc., ECA GROUP and 5G Maritime |

Market Definition

The unmanned surface vehicle (USV) is a water-borne vessel that can operate without the requirement of human onboard operators. They can be either remotely operated by an operator or are pre-programmed to be able to run on their own. It is usually powered by rapidly rechargeable lithium-ion batteries or solar energy and is mainly used for ocean exploration and maritime purposes.

The unmanned surface vehicle offers various advantages, which can be used for different kinds of applications such as commercial and research, defense purposes, search and rescue, and many more. Its adoption is steadily growing across various industry verticals, such as aquaculture, and has a huge potential to be an ideal vehicle that can be used for disaster management purposes.

North America Unmanned Surface Vehicle (USV) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Increasing the Demand for Unmanned Vehicles for Clean Ocean

Marine pollution or the contamination of ocean has been growing over the years. Moreover, about 75% of Earth’s surface has been covered by water of which 97.5% is occupied by ocean and 2.5% by fresh water. The rapidly increasing population has led to the growing need of fresh water for drinking and other purposes.

Although, the growth in industrialization and North Americaization has led to a surge in water pollution. A huge amount of plastic waste is being deployed in the ocean which is contaminating the water. In addition, the history of oil and gas exploration and transportation has witnessed several oil spills which have destroyed the aquatic life and quality of water. Along with this, chemical contamination is concerning for health, environmental, and economic reason which has led to the demand for the cleaning of such water resources.

- Increasing Asymmetric Threats and Use of Unmanned Surface Vehicle (USV) in Defense

Unmanned Surface Vehicles are being revolutionised for naval purpose from past few years. These vehicles have been evolving from tools to carry out the number of tasks to systems capable operating with high degree of autonomy. Moreover, most of the countries are facing asymmetry in warfare because of different strategies framed by different defence departments.

However, asymmetric warfare can describe conflicts. Such conflicts often involves strategies and tactics of unconventional warfare. The resources of Asymmetric threats can be referred to as the attack by individuals, organizations or nation to target any government, military or some valuable asset in order to acquire the asset or destroy the state. These attacks need to be continuously monitored by countries in order to protect them from any form of attack or any other type of applications such as illegal drug trafficking, air crash, maritime search investigations, payload delivery and many others

Opportunity

- Growing Demand of USV for Disaster Management

Disasters, whether natural or man-made have ruthless consequences for human lives, environments and also artificial constructions. Man-made disasters can range from oil spills to heavy metals to forest fires namely Deepwater Horizon oil spill (2010), Chernobyl disaster (1986) and California wildfires (2018) among others.

The awareness has been growing regarding disasters over the years and even though ground, aerial and underwater robots have been used for Disaster Management (DM), surface vehicles are only starting to gain popularity. Although they are predominantly used for search and rescue purposes, they can be used for detection of crustal deformation with the help of on-board seismometers and other seaboard pressure sensors.

Restraints/Challenges

- Lack of Collision Detection Capability of Unmanned Surface Vehicle (USV)

The usage of unmanned surface vehicle is increasing with its wide range of application in commercial, military and research. These vehicles can work on their own and be fully autonomous, or they can be controlled by an operator to navigate their course and control their functioning.

The autonomous vehicles are facing the technological complexity of collision detection. As these vehicles can easily collide with any other marine vehicle, the lack of any proper collision system in the vehicle is acting as major restraint for the market.

- Increasing Investments by Governments and Private Players

More than half-a-century ago, wars were fought by show of force as countries focused on full-force attack. However, as times progressed and technologies advanced, various economies developed simultaneously and they relied more on other factors like reconnaissance and surveillance. Thus, North America leaders have shifted their focus to Autonomous Surface Vehicles (ASV), to make them more efficient. They can be generally used to accompany large warships and battleships as well as detect underwater mines and traps.

It is becoming essential to increase investment in unmanned platforms with an impenetrable command network. USVs have the potential to become the centrepiece for various maritime operations. This is further propelled by rising skirmishes between various economies resulting in trade wars, illegal land captures and surveillance. As a result, rising investments by North America naval forces to strengthen their capability as well as investments by private entities, is the factor which will create an opportunity for growth of the market.

Recent Developments

- In October 2022, ECA GROUP designed Critical Design Review to promote autonomous robotic systems in the 3rd generation MCM program. This product has helped the company to expand its product portfolio and enhance the offerings to the customers

- In April 2019, Kongsberg Maritime launched a brand-new unmanned surface vehicle (USV) and sounder USV System. The sounder USV system is a multipurpose platform that was designed to work across different market segments, including surveys. This has helped the company to enhance its product offerings and to grow in the market

North America Unmanned Surface Vehicle (USV) Market Scope

North America unmanned surface vehicle (USV) market is segmented six notable segments, which are based on type, application, endurance, operation, system, hull type, size. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Surface

- Sub-Surface

On the basis of type, the North America unmanned surface vehicle (USV) market is segmented into surface and sub-surface.

Application

- Defense

- Commercial

- Scientific Research

- Others

On the basis of application, the North America unmanned surface vehicle (USV) market has been segmented into defense, commercial, scientific research, and others.

Endurance

- 100-500 Hours

- <100 Hours

- 500-1000 Hours

- >1000 Hours

On the basis of endurance, the North America unmanned surface vehicle (USV) market has been segmented into 100-500 hours, <100 hours, 500-1000 hours, and >1000 hours.

Operation

- Remote Operated Surface Vehicle

- Autonomous Surface Vehicle

On the basis of operation, the North America unmanned surface vehicle (USV) market is segmented into remote operated surface vehicle, and autonomous surface vehicle.

System

- Propulsion

- Chassis Material

- Payload

- Component

- Software

- Communication

On the basis of system, the North America unmanned surface vehicle (USV) market is segmented into propulsion, chassis material, payload, component, software, and communication.

Hull Type

- Catamaran (Twin Hulls)

- Kayak (Single Hull)

- Trimaran (Triple Hulls)

- Rigid Inflatable Hull

On the basis of hull type, the North America unmanned surface vehicle (USV) market is segmented into catamaran (twin hulls), kayak (single hull), trimaran (triple hulls), and rigid inflatable hull.

Size

- Medium (4 to 8 M)

- Small (Less than 4 M)

- Large (8 to 12 M)

- Extra-Large (Above 12 M)

On the basis of size, the North America unmanned surface vehicle (USV) market is segmented into medium (4 to 8 m), small (less than 4 m), large (8 to 12 m), and extra-large (above 12 m).

North America Unmanned Surface Vehicle (USV) Market Regional Analysis/Insights

North America unmanned surface vehicle (USV) market is analysed and market size insights and trends are provided by country, type, application, endurance, operation, system, hull type, size as referenced above.

The countries covered in the unmanned surface vehicle (USV) market report are U.S., Canada and Mexico.

U.S. dominates the North America unmanned surface vehicle (USV) market owing to rising adoption of seafloor mapping, inspection of water quality and infrastructure such as bridges.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Unmanned Surface Vehicle (USV) Market Share Analysis

North America unmanned surface vehicle (USV) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies focus related to unmanned surface vehicle (USV) market.

Some of the major players operating in North America unmanned surface vehicle (USV) market are Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Boeing, Utek, Seafloor Systems, Inc., SeaRobotics Corporation, Saildrone Inc., Deep Ocean Engineering, Inc., Kongsberg Maritime, L3Harris Tecnologies, Inc., ATLAS ELEKTRONIK GmbH, Clearpath Robotics Inc., Teledyne Technologies Incorporated, Textron Inc., ECA GROUP, 5G Marine among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MARKET APPLICATION COVERAGE GRID

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR UNMANNED VEHICLES FOR CLEANING OCEAN

5.1.2 INCREASING ASYMMETRIC THREATS AND USE OF UNMANNED SURFACE VEHICLES (USV) IN DEFENSE

5.1.3 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION

5.1.4 INCREASING USE OF UNMANNED SURFACE VEHICLE (USV) FOR OCEANOGRAPHY

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF UNMANNED UNDERWATER VEHICLE (UUV) AS AN ALTERNATIVE

5.2.2 LACK OF COLLISION DETECTION CAPABILITY OF UNMANNED SURFACE VEHICLE (USV)

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR USV FOR DISASTER MANAGEMENT

5.3.2 APPLICATION IN TERRITORIAL AND PROTECTED WATERS

5.3.3 INCREASING INVESTMENTS BY GOVERNMENTS AND PRIVATE PLAYERS

5.3.4 REAL TIME MONITORING OF AQUACULTURE ENVIRONMENTS

5.4 CHALLENGES

5.4.1 DECREASING NAVY BUDGET OF VARIOUS COUNTRIES

6 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE

6.1 OVERVIEW

6.2 SURFACE

6.3 SUB-SURFACE

7 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 DEFENSE

7.2.1 TYPE

7.2.1.1 SURFACE

7.2.1.2 SUB-SURFACE

7.3 COMMERCIAL

7.3.1 BY PURPOSE

7.3.1.1 OCEANOGRAPHY AND ENVIRONMENTAL SCIENCES

7.3.1.2 OIL AND GAS

7.3.1.3 EXPLORATION

7.3.2 BY TYPE

7.3.2.1 SURFACE

7.3.2.2 SUB-SURFACE

7.4 SCIENTIFIC RESEARCH

7.4.1 TYPE

7.4.1.1 SURFACE

7.4.1.2 SUB-SURFACE

7.5 OTHERS

8 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE

8.1 OVERVIEW

8.2 100-500 HOURS

8.3 <100 HOURS

8.4 500-1000 HOURS

8.5 >1000 HOURS

9 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION

9.1 OVERVIEW

9.2 REMOTE OPERATED SURFACE VEHICLE

9.3 AUTONOMOUS SURFACE VEHICLE

10 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM

10.1 OVERVIEW

10.2 PROPULSION

10.3 CHASSIS MATERIAL

10.4 PAYLOAD

10.5 COMPONENT

10.6 SOFTWARE

10.7 COMMUNICATION

11 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE

11.1 OVERVIEW

11.2 CATAMARAN (TWIN HULLS)

11.3 KAYAK (SINGLE HULL)

11.4 TRIMARAN (TRIPLE HULLS)

11.5 RIGID INFLATABLE HULL

12 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE

12.1 OVERVIEW

12.2 MEDIUM (4 TO 8 M)

12.3 SMALL (LESS THAN 4 M)

12.4 LARGE (8 TO 12 M)

12.5 EXTRA LARGE (ABOVE 12 M)

13 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 L3HARRIS TECHNOLOGIES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 BOEING

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENTS

16.4 KONGSBERG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 TEXTRON, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 5G MARINE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ATLAS ELEKTRONIK GMBH

16.7.1 COMPANY SNAPSHOT

16.7.2 SOLUTION PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CLEARPATH ROBOTICS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ECA GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 ELBIT SYSTEMS LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 IXBLUE SAS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 SAILDRONE, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 TECHNOLOGY PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 SEAFLOOR SYSTEMS, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 SEAROBOTICS CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 TELEDYNE TECHNOLOGIES INCORPORATED

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 12 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 14 U.S. DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 U.S. COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 16 U.S. COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 U.S. SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 19 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 20 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 21 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 22 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 23 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 25 CANADA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 CANADA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 27 CANADA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 CANADA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 30 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 31 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 32 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 33 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 34 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 MEXICO DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 MEXICO COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 38 MEXICO COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 MEXICO SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 41 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 42 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 43 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 44 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: TYPE TIMELINE CURVE

FIGURE 12 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 13 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION IS EXPECTED TO DRIVE THE NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET IN THE FORECAST PERIOD

FIGURE 14 SURFACE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET

FIGURE 16 PLASTICS PRODUCTION ACROSS GLOBE

FIGURE 17 CRUDE OIL PRODUCTION DATA, BY REGION

FIGURE 18 DEFENCE EXPENDITURE ACROSS THE GLOBE

FIGURE 19 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE, 2022

FIGURE 20 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY APPLICATION, 2022

FIGURE 21 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY ENDURANCE, 2022

FIGURE 22 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY OPERATION, 2022

FIGURE 23 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY SYSTEM, 2022

FIGURE 24 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY HULL TYPE, 2022

FIGURE 25 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY SIZE, 2022

FIGURE 26 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE (2023-2030)

FIGURE 31 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.