North America Traffic Road Marking Coatings Market

Market Size in USD Billion

CAGR :

%

USD

1.46 Billion

USD

2.30 Billion

2025

2033

USD

1.46 Billion

USD

2.30 Billion

2025

2033

| 2026 –2033 | |

| USD 1.46 Billion | |

| USD 2.30 Billion | |

|

|

|

|

North America Traffic Road Marking Coatings Market Size

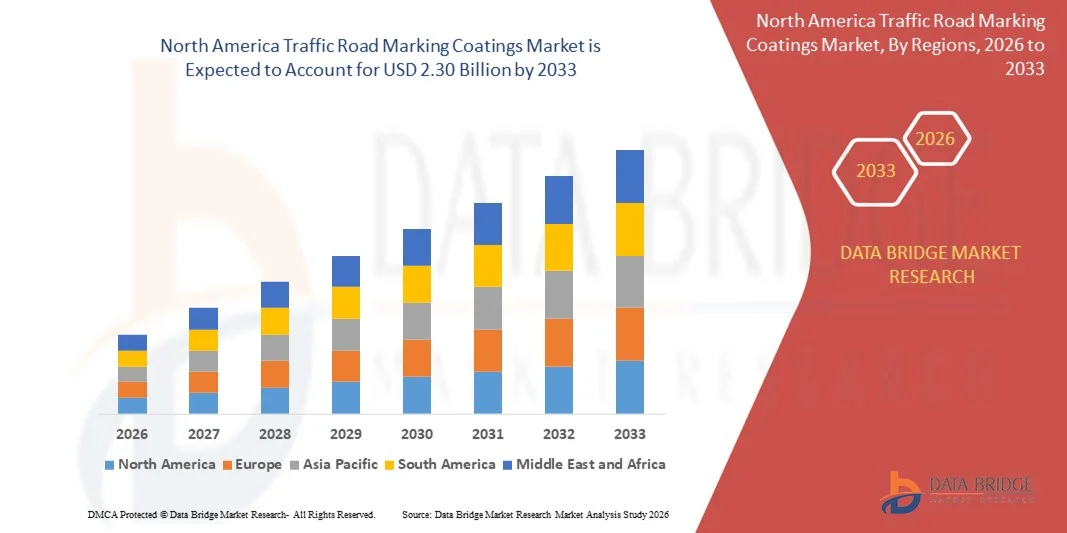

- The North America traffic road marking coatings market size was valued at USD 1.46 billion in 2025 and is expected to reach USD 2.30 billion by 2033, at a CAGR of 5.80% during the forecast period

- The market growth is largely fuelled by increasing investments in road infrastructure and urban development, as governments focus on building safer and more efficient transportation networks

- Rising emphasis on road safety and stringent government regulations are encouraging the use of high-quality, durable coatings that improve lane visibility and reduce accidents

North America Traffic Road Marking Coatings Market Analysis

- The market is witnessing a shift toward advanced coating technologies, such as thermoplastic, epoxy, preformed, and water-based coatings, which offer better adhesion, durability, and reflectivity

- Growing awareness about road safety is driving demand for highly visible and reflective coatings for pedestrian crossings, lane markings, and road signs, which help prevent accidents

- U.S. dominated the traffic road marking coatings market with the largest revenue share in North America in 2025, driven by extensive highway networks, urban infrastructure investments, and modernization projects

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America traffic road marking coatings market due to ongoing infrastructure development, government initiatives to improve road safety, and increasing demand for durable and eco-friendly road marking coatings

- The Paints segment held the largest market revenue share in 2025, driven by their cost-effectiveness, ease of application, and wide adoption in urban and rural road projects. Paint-based coatings offer quick drying and adequate durability for moderate traffic conditions, making them suitable for frequent maintenance and short-term applications

Report Scope and North America Traffic Road Marking Coatings Market Segmentation

|

Attributes |

North America Traffic Road Marking Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Traffic Road Marking Coatings Market Trends

Rising Demand for Durable and High-Visibility Road Markings

- The growing focus on road safety, traffic management, and urban infrastructure development is significantly shaping the traffic road marking coatings market, as governments and municipalities increasingly prioritize long-lasting and highly visible road markings. Advanced coatings are gaining traction due to their ability to improve lane visibility, reduce maintenance frequency, and withstand extreme weather and traffic conditions. This trend strengthens their adoption across highways, urban roads, and smart city initiatives, encouraging manufacturers to innovate with high-performance formulations

- Increasing awareness around sustainable infrastructure and environmental impact has accelerated the demand for eco-friendly, low-VOC, and waterborne traffic road marking coatings. Municipal authorities and construction companies are actively seeking solutions that are both safe for the environment and cost-efficient, prompting brands to focus on green formulations that maintain durability, reflectivity, and adhesion

- Technological advancements, such as thermoplastic, preformed, epoxy, and reflective coatings, are influencing market growth. These innovations improve application efficiency, longevity, and night-time visibility, while reducing the need for frequent reapplications, which enhances safety and reduces maintenance costs

- Growing emphasis on intelligent transportation systems and smart road networks is encouraging the adoption of coatings that integrate with modern traffic management solutions, such as reflective markings for lane guidance and pedestrian crossings. High-quality coatings are also being promoted to enhance driver awareness and reduce accident rates

- For instance, in 2024, infrastructure projects implemented reflective thermoplastic coatings on highways and urban intersections to improve visibility and reduce maintenance intervals. Leading manufacturers launched fast-drying, anti-skid coatings in commercial road construction projects to enhance durability and traffic safety

- Sustained market growth depends on continuous R&D, cost-effective production, and maintaining performance standards that can withstand heavy traffic, extreme temperatures, and UV exposure. Manufacturers are focusing on scalability, supply chain efficiency, and the development of innovative solutions that balance cost, durability, and environmental compliance

North America Traffic Road Marking Coatings Market Dynamics

Driver

Growing Focus on Road Safety and Durable Coatings

- Rising infrastructure investments and increasing government focus on road safety are major drivers for the traffic road marking coatings market. Authorities are adopting durable and highly visible coatings to improve lane management, pedestrian safety, and accident prevention, while also complying with safety regulations and standards

- Expanding applications in highways, urban roads, airports, and parking facilities are influencing market growth. Traffic road marking coatings enhance adhesion, reflectivity, and longevity, enabling infrastructure developers to meet operational and safety expectations

- Construction companies and municipal authorities are increasingly promoting high-performance coatings through modern application techniques and performance certifications. These efforts are supported by the rising demand for sustainable, low-maintenance, and reflective road markings, which reduce lifecycle costs and improve road safety

- For instance, a major highway redevelopment project applied reflective epoxy markings on pedestrian crossings and turn lanes, reducing maintenance frequency and improving night-time visibility. Similarly, a commercial airport runway upgrade utilized waterborne thermoplastic coatings to enhance durability and reduce environmental impact

- Increasing vehicle population and traffic density are driving steady demand for reliable and long-lasting road marking solutions. The need for clear lane demarcation, pedestrian crossings, and traffic guidance is creating opportunities for innovative coating technologies

- Although rising road safety and infrastructure development support market growth, wider adoption depends on cost efficiency, raw material availability, and scalable production methods. Investment in durable formulations, supply chain reliability, and environmentally compliant technologies is essential to meet global demand and maintain competitive advantage

Restraint/Challenge

High Cost and Limited Awareness Compared to Conventional Coatings

- The relatively higher cost of advanced traffic road marking coatings compared to traditional paint-based solutions remains a key challenge, limiting adoption among price-sensitive projects. Higher raw material costs, specialized application requirements, and advanced production processes contribute to elevated pricing, impacting small-scale or budget-constrained infrastructure projects

- Awareness and technical knowledge about high-performance and eco-friendly coatings remain uneven, particularly among smaller construction contractors and municipal agencies. Limited understanding of long-term cost savings, durability, and environmental benefits restricts adoption and slows technology uptake

- Supply chain and logistical complexities also affect market growth, as specialized coatings often require certified suppliers, controlled storage, and precise application techniques. Operational challenges, including temperature sensitivity and surface preparation requirements, increase project timelines and costs

- For instance, during recent road rehabilitation and urban intersection upgrades, slower adoption of advanced reflective and waterborne coatings was observed due to higher pricing and limited awareness of functional advantages compared to conventional paints. Some projects also faced delays due to specialized application and storage requirements

- Overcoming these challenges will require cost-effective production processes, improved distribution networks, and targeted awareness campaigns for infrastructure developers and contractors. Collaboration with government bodies, construction companies, and certification organizations can help unlock the long-term growth potential of the global traffic road marking coatings market

- Developing innovative, cost-competitive formulations with superior adhesion, reflectivity, and environmental compliance will be essential to promote wider adoption and ensure sustained market expansion

North America Traffic Road Marking Coatings Market Scope

The market is segmented on the basis of product, type, type of marking, application, and end use

- By Product

On the basis of product, the North America traffic road marking coatings market is segmented into Paints, Preformed Polymer Tapes, Thermoplastics, Epoxy, Field-Reacted Systems, and Permanent Markers. The Paints segment held the largest market revenue share in 2025, driven by their cost-effectiveness, ease of application, and wide adoption in urban and rural road projects. Paint-based coatings offer quick drying and adequate durability for moderate traffic conditions, making them suitable for frequent maintenance and short-term applications.

The Thermoplastics segment is expected to witness the fastest growth rate from 2026 to 2033, driven by their superior durability, reflectivity, and resistance to heavy traffic and adverse weather. Thermoplastic coatings are increasingly preferred for highways and busy intersections due to their long lifespan and high visibility, reducing maintenance frequency and improving road safety.

- By Type

On the basis of type, the market is segmented into Permanent and Removable coatings. The Permanent segment held the largest revenue share in 2025, supported by long-term infrastructure projects and government initiatives focused on road safety. Permanent coatings are favored for highways and main roads due to their extended lifespan and ability to withstand heavy vehicle loads.

The Removable segment is expected to grow at a significant CAGR during 2026–2033, driven by demand for temporary lane markings, construction zones, and event-specific applications. Removable coatings provide flexibility for frequent updates or changes in road layouts, enabling better traffic management and reduced disruption.

- By Type of Marking

On the basis of type of marking, the market is divided into Flat Marking and Extruded Marking. Flat Marking held the largest market revenue share in 2025, attributed to its quick application, cost-effectiveness, and suitability for urban roads and pedestrian areas. Flat markings are commonly used for lane demarcation, pedestrian crossings, and parking zones.

Extruded Marking is expected to witness the fastest growth from 2026 to 2033, driven by its enhanced thickness, durability, and skid resistance. Extruded markings are ideal for highways, airport runways, and heavy traffic zones, providing superior visibility and long-term performance.

- By Application

On the basis of application, the market is segmented into Road Marking Lines and Road Marking Labels. Road Marking Lines held the largest revenue share in 2025, supported by extensive use in lane demarcation, pedestrian crossings, and highway markings. These lines improve traffic safety and compliance with regulatory standards across various road types.

Road Marking Labels are expected to grow at a faster rate during 2026–2033, driven by increasing demand for customizable, preformed, and reflective markings for parking lots, intersections, and special signage. Labels offer easy installation and precise placement, making them suitable for temporary or specialized applications.

- By End Use

On the basis of end use, the market is segmented into Roads and Highways, Parking Lots, Airport, Factory, Anti-Skid, Sports Field, and Others. Roads and Highways held the largest market share in 2025, owing to continuous infrastructure development, expansion of urban road networks, and government initiatives to enhance traffic safety.

The Airport segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing air traffic, runway expansion projects, and stringent safety requirements. Advanced coatings for airports provide high reflectivity, durability, and resistance to heavy aircraft loads, ensuring compliance with international safety standards.

North America Traffic Road Marking Coatings Market Regional Analysis

- U.S. dominated the traffic road marking coatings market with the largest revenue share in North America in 2025, driven by extensive highway networks, urban infrastructure investments, and modernization projects

- Road authorities and contractors highly prioritize long-lasting, reflective, and skid-resistant coatings to improve traffic safety and reduce maintenance costs

- Widespread adoption is further supported by regulatory standards, advanced application techniques, and growing demand for eco-friendly and sustainable coatings, making the U.S. a leading market for innovative road marking solutions

Canada Traffic Road Marking Coatings Market Insight

The Canada traffic road marking coatings market is expected to witness the fastest growth rate from 2026 to 2033, driven by government-led infrastructure development and urban road expansion projects. Increased adoption of thermoplastic, epoxy, and reflective coatings for highways, pedestrian zones, and airports is supporting market growth. In addition, rising awareness around eco-friendly and durable solutions is encouraging broader use across public and private infrastructure projects.

North America Traffic Road Marking Coatings Market Share

The North America traffic road marking coatings industry is primarily led by well-established companies, including:

• The Sherwin‑Williams Company (U.S.)

• 3M Company (U.S.)

• PPG Industries, Inc. (U.S.)

• Ennis‑Flint, Inc. (U.S.)

• Dow Inc. (U.S.)

• Crown Technology, LLC (U.S.)

• Ozark Materials LLC (U.S.)

• SealMaster (U.S.)

• Kelly Bros (U.S.)

• Reda National Co (U.S.)

• W. R. Meadows, Inc. (U.S.)

• Axalta Coating Systems (U.S.)

• Integrated Traffic Systems (U.S.)

• Kataline Group (U.S.)

• National Coating Systems (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Traffic Road Marking Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Traffic Road Marking Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Traffic Road Marking Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.