North America Tomatoes Market Analysis and Insights

North America tomatoes market is gaining significant growth due to the increased usage of tomatoes in various cuisines and processing units. Tomatoes are used in producing different types of tomato products and have huge demand in the market. They are not only good in taste but also provide health benefits to humans.

The factors driving the market growth are growing demand for tomatoes in food processing industries as well as the development and production of new varieties of tomatoes in the market. The factor restraining the market growth is fluctuations in the prices of tomatoes, which depend on various factors such as rain, temperature, and season. The opportunity for market growth is growing tomatoes with the help of artificial intelligence (AI). Some of the factors that challenge market growth are rising post-harvesting losses due to lack of storage facilities.

Market players are more focused on new product development, partnership, and other strategies to increase their market share. Therefore, the rising standards and regulations laid by governmental bodies have to be followed by the manufacturer to sell their products into the market and to ensure the demand for consumers will boost the market growth. Whereas, the lack of technical expertise in small enterprises is likely to restrict market growth in the region.

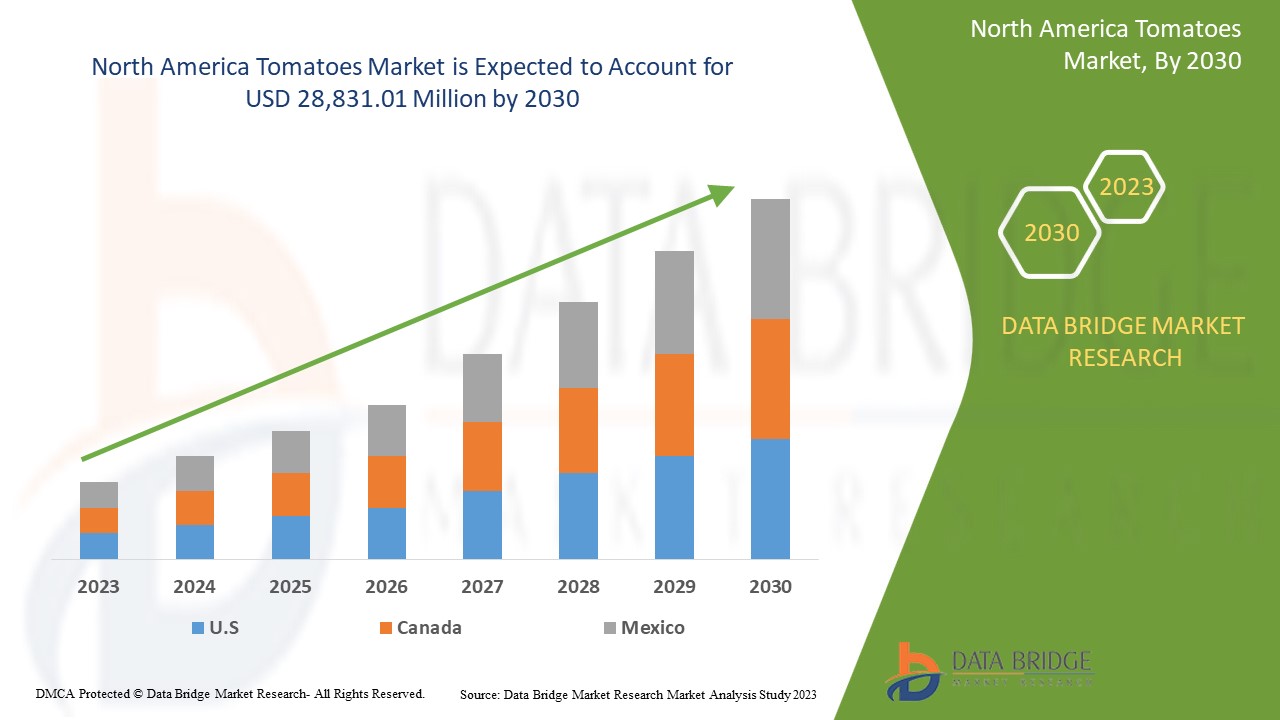

Data Bridge Market Research analyzes that the North America tomatoes market is expected to reach the value of USD 28,831.01 million by 2030, at a CAGR of 3.0% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Type (Cherry Tomatoes, Grape Tomatoes, Roma Tomatoes, Beefsteak Tomatoes, Heirloom Tomatoes, Tomatoes On The Vine, Green Tomatoes, and Others), Product Type (Fresh, Frozen, and Dried), Category (Conventional and Organic), End User (Food Service Industry and Household/Retail Industry), Distribution Channel (Direct and Indirect). |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Houwelings, Ontario Processing Vegetable Growers, Tomato Growers Supply Company, Magic Sun, PACIFIC RIM PRODUCE, Mucci Int'l Mrktg Inc., West Coast Tomato, LLC, Royalpride, Nature Fresh Farms, RedStar Sales BV, Streef Produce Ltd., Hnatiuk Gardens, Aylmer Family Farm, Exeter Produce, and AppHarvest among others. |

Market Definition

Tomatoes are basically round-shaped vegetables that can be eaten cooked or uncooked. They are edible, pulpy berries of the herb Solanum lycoperscium. They are of many colors such as red, yellow, orange, and many more. They are of many varieties having different tastes and applications.

Tomatoes have a wide application in the food and beverages industry. They are used in the production of soups, sauces, purees, juices, and ketchup among others. They are also used as raw vegetables in burgers, sandwiches, salads, pizza, and many more.

Tomatoes are an essential source in food processing industries having wide applications and also contain essential components useful for the human body. They help in maintaining blood pressure and healthy skin and also have anti-inflammatory action.

North America Tomatoes Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rising Domestic and International Demand for Tomatoes

The increase in tomato demand is due to improved efficiency at the grower and processor levels. Consumption of fresh fruit and vegetables is increased, driven by increasing consumer awareness of the benefits of adopting a diet rich in fruits and vegetables and public initiatives to promote their consumption. Tomato demand has increased significantly due to increased population, rising consumer demands for nutritious and healthy food, and potential use of improved technologies also due to concurrent developments in the areas of cold chain infrastructure, increase in productivity and quality through research, and modern post-harvest technologies.

- Surging Growth For Tomatoes In The Food Processing Industry

The B2B market needs tomatoes since they are utilized as a raw material to make other processed tomato products. Tomatoes are used in various forms, including juice, paste, puree, diced/peeled tomatoes, ketchup, pickles, sauces, and ready-to-eat curries. There are numerous uses for processed tomato products in the food sector such as in snacks, culinary, hotels, restaurants, and fast food retail chains. They can be eaten both cooked and uncooked and have a high demand in the North America market. Because of rapid urbanization, consumers in emerging and developed countries are enticed to eat readymade foods and tomato-processed products. To meet the growing demand, processed food manufacturers and tomato paste processors focus on ready-to-eat products.

Additionally, the range of tomato processed foods is expanding with the introduction of various tomato products, including powder-based products. Tomato paste and tomato puree are the primary processed tomato products. Secondary processed products for tomatoes are made possible by processing primary products. The main market for tomato paste and puree is the ketchup and sauce sector. The beverage and food industry is the second largest user of tomato paste and puree.

Restraints

- Fluctuations in the Prices of Tomatoes

Volatile and unpredictable North America marketplaces have far-reaching consequences for industrial companies. Unanticipated barriers such as rising energy costs and unexpected variations in raw material pricing are disrupting supply chains and making it harder for businesses to stay profitable. Variations in the prices of raw materials for making sauces, dressings, and condiments hot fill bottle packaging put up additional costs on the price of the finished product. A bumper crop or crop disaster in a major production region can change tomato prices quickly.

The prices of tomatoes are volatile as it depends on various factors such as seasonality in production, unseasonal rains, and prolonged drought. It also depends on location, preferences, consumers' age, and consumer buying power. Due to its seasonality, prices increase when the product is out of season and decreases when it is in season.

- Increasing Environmental Elements and Climate Conditions

Environment change affects food system sustainability by influencing farmer livelihoods, consumer choices, and food security through changes in agroecosystems' natural and human components. Annual precipitation and heavy rainfall events are becoming more common, especially in the spring. An excessive amount of spring rain slows crop establishment, interrupts planting, increases the prevalence of several fungal and bacterial crop diseases, and might cause labor problems due to delaying field operations. Variations in temperature and precipitation directly impact the quantity and quality of tomato crop production and indirectly impact the scheduling of important farm operations and the economic effects of pests, weeds, and diseases. Adverse weather conditions also hamper the supply chain and transportation of tomatoes.

Furthermore, temperature increases cause faster crop growth, resulting in shorter cropping seasons and lower yields. An increase in tropospheric (or ground-level) ozone leads to an increase in oxidative stress in plants, which inhibits photosynthesis and slows plant growth. Extreme events, especially floods and droughts, can harm crops and reduce yields, ultimately affecting the tomato market.

Opportunity

- Growing Tomatoes Using Artificial Intelligence (AI)

AI is a wide-ranging branch of computer science engaged in building smart machines capable of performing tasks that typically require human intelligence. It is a growing part of everyday life and is used in the agricultural sector. AI technology is focused on solving various problems to increase and optimize production and operation processes.

Advanced computational approaches are used in AI to solve many real-world issues. These methods can be used in the agricultural industry to conduct original research that will enhance the kind, speed, new variety, and protection. AI can automatically check crop quality, yield, pH value, nutrient proportion, amount of water needed, humidity, and oxygen components. Many nations use mini-bots to assess crop quality and ripeness in the agricultural industry. Mini-bots harvest ripe fruit and vegetables without damaging tomatoes' delicate skin.

Challenge

Scarcity of Water Resources and Salinity of Groundwater

Food production is greatly impacted by water scarcity. Without water, individuals lack the means to water their crops and, as a result, cannot feed the rapidly expanding population. According to the International Water Management Institute, agriculture competes continually with home, industrial, and environmental applications for a limited water supply, accounting for around 70% of North America water withdrawals.

Thus, the growth of the market is hindered due to high prices of raw materials as well as high building cost of these tables. This may challenge the growth of the North America tomatoes market.

Post-COVID-19 Impact on North America Tomatoes Market

Post the pandemic, the demand for tomatoes increased as there was an allowance of fruits and vegetables during the lockdown time and demand for vegetables increased at that time. Also, tomato having properties of increasing immunity led to high demand during COVID-19 time.

Recent Developments

- In September 2022, according to a USDA report, U.S. FTA (Free Trade Agreements) partners reported an annual increase in agricultural exports of the country ranging from 5% (Canada) to 46.2 % (Singapore) in the five years after the signing of their trade agreements.

- In March 2022, according to an article published in Fresh Plaza, Cherry tomato sales climbed 12.04% annually from January to March 2022, while their value increased 12.6% annually in the Jiaxing fruit market in China. Cherry tomato transaction volume climbed by 23.47% year on year, and transaction volume increased by 35.30% year on year.

North America Tomatoes Market Scope

North America tomatoes market is segmented into five notable segments based on type, product type, category, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Cherry Tomatoes

- Grape Tomatoes

- Roma Tomatoes

- Beefsteak Tomatoes

- Heirloom Tomatoes

- Tomatoes On The Vine

- Green Tomatoes

- Others

Based on type, the North America tomatoes market is segmented into cherry tomatoes, grape tomatoes, roma tomatoes, beefsteak tomatoes, heirloom tomatoes, tomatoes on the vine, green tomatoes, and others.

Product Type

- Fresh

- Frozen

- Dried

Based on product type, the North America tomatoes market is segmented into fresh, frozen, and dried.

Category

- Conventional

- Organic

Based on category, the North America tomatoes market is segmented into conventional and organic.

End User

- Food Service Industry

- Household/Retail Industry

Based on end user, the North America tomatoes market is segmented into food service industry and household/retail industry.

Distribution Channel

- Direct

- Indirect

Based on distribution channel, the North America tomatoes market is segmented into direct and indirect.

North America Tomatoes Market Regional Analysis/Insights

The North America tomatoes market is analyzed and market size insights and trends are provided by country, type, product type, category, end user, and distribution channel as referenced above

The countries covered in this report are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America tomatoes market in terms of market share and revenue. It is estimated to maintain its dominance during the forecast period due to the growing demand for these tomatoes, which is the major reason for the growth of tomatoes in the North America region.

The region section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Tomatoes Market Share Analysis

The competitive North America tomatoes market provides details about the competitors. Details include company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on the market.

Some of the major players operating in the North America tomatoes market are Houwelings, Ontario Processing Vegetable Growers, Tomato Growers Supply Company, Magic Sun, PACIFIC RIM PRODUCE, Mucci Int'l Mrktg Inc., West Coast Tomato, LLC, Royalpride, Nature Fresh Farms, REDSTAR Sales BV, Streef Produce Ltd., Hnatiuk Gardens, Aylmer Family Farm, Exeter Produce, and AppHarvest among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA Tomatoes Market

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CROP TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP EXPORTER OF TOMATOES MARKET

4.2 TOP IMPORTER OF TOMATOES MARKET

4.3 NEW PRODUCT LAUNCH STRATEGIES

4.3.1 LAUNCHING OF DISEASE RESISTANT VARIETIES

4.3.2 PROMOTING LAUNCH BY PACKAGING STRATEGIES

4.3.3 AUNCHING ORGANIC PRODUCTS

4.3.4 CONCLUSION

5 REGULATION COVERAGES

6 SUPPLY CHAIN OF THE NORTH AMERICA TOMATOES MARKET

6.1 RAW MATERIAL PROCUREMENT

6.2 PROCESSING

6.3 MARKETING AND DISTRIBUTION

6.4 END USERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GOVERNMENT INITIATIVES TO BOOST TOMATO PRODUCTION AND THE AGRICULTURAL SECTOR

7.1.2 SURGING GROWTH FOR TOMATOES IN THE FOOD PROCESSING INDUSTRY

7.1.3 INCREASED DEVELOPMENT OF NEW TOMATO VARIETIES

7.1.4 RISING DOMESTIC AND INTERNATIONAL DEMAND FOR TOMATOES

7.2 RESTRAINTS

7.2.1 FLUCTUATIONS IN THE PRICES OF TOMATOES

7.2.2 INCREASING ENVIRONMENTAL ELEMENTS AND CLIMATE CONDITIONS

7.2.3 STRINGENT RULES AND REGULATIONS IN TRADING AND EXPORT OF TOMATOES

7.3 OPPORTUNITY

7.3.1 GROWING TOMATOES USING ARTIFICIAL INTELLIGENCE

7.3.2 WIDE RANGE OF APPLICATIONS IN THE FOOD AND BEVERAGE SECTOR

7.3.3 RISING TECHNOLOGICAL ADVANCEMENTS FOR TOMATO PRODUCTION

7.3.4 HIGH DEMAND FOR ORGANIC AND CHEMICAL-FREE TOMATOES

7.4 CHALLENGES

7.4.1 SCARCITY OF WATER RESOURCES AND SALINITY OF GROUNDWATER

7.4.2 RISING POST HARVESTING LOSSES DUE TO LACK OF STORAGE FACILITY

7.4.3 RISING USAGE OF CROP PROTECTION PRODUCTS

8 NORTH AMERICA TOMATOES MARKET, BY TYPE

8.1 OVERVIEW

8.2 CHERRY TOMATOES

8.3 GRAPE TOMATOES

8.4 ROMA TOMATOES

8.5 TOMATOES ON THE VINE

8.6 BEEFSTEAK TOMATOES

8.7 HEIRLOOM TOMATOES

8.8 GREEN TOMATOES

8.9 OTHERS

9 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 FRESH

9.3 FROZEN

9.4 DRIED

10 NORTH AMERICA TOMATOES MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 NORTH AMERICA TOMATOES MARKET, BY END USER

11.1 OVERVIEW

11.2 FOOD SERVICE INDUSTRY

11.2.1 FOOD SERVICE INDUSTRY, BY TPYE

11.2.1.1 HOTELS

11.2.1.2 RESTAURANTS

11.2.1.3 CAFES

11.2.1.4 OTHERS

11.3 HOUSEHOLD/RETAIL INDUSTRY

12 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT

12.3 INDIRECT

13 NORTH AMERICA TOMATOES MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 MEXICO

13.1.3 CANADA

14 NORTH AMERICA TOMATOES MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 COMPANY PROFILE

15.1 APPHARVEST

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 MASTRONARDI PRODUCE LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 CASALASCO - SOCIETÀ AGRICOLA S.P.A.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 HOUWELINGS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 MUCCI INT’L MRKTG INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 REDSTAR SALES BV

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AYLMER FAMILY FARM

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DUIJVESTIJN TOMATEN

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 EXETER PRODUCE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 HNATIUK GARDENS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MAGIC SUN

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 NATURE FRESH FARMS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 ONTARIO PROCESSING VEGETABLE GROWERS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 PACIFIC RIM PRODUCE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 R&L HOLT LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ROYALPRIDE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SAHYADRI FARMS POST HARVEST CARE LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 STREEF PRODUCE LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TOMATO GROWERS SUPPLY COMPANY

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 WEST COAST TOMATO, LLC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 TOP EXPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 2 TOP IMPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 3 IN CASE SIZE CODES ARE APPLIED, THE CODES AND RANGES IN THE FOLLOWING TABLE HAVE TO BE RESPECTED:

TABLE 4 NORTH AMERICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CHERRY TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA GRAPE TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA ROMA TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TOMATOES ON THE VINE IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA BEEFSTEAK TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA HEIRLOOM TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA GREEN TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 14 COMPANIES PROVIDING FRESH TOMATOES

TABLE 15 NORTH AMERICA FRESH IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FROZEN IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA DRIED IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA CONVENTIONAL IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ORGANIC IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HOUSEHOLD/RETAIL INDUSTRY IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA DIRECT IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA INDIRECT IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA TOMATOES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 35 U.S. TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 36 U.S. TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 38 U.S. TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 39 U.S. FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 MEXICO TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 42 MEXICO TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 43 MEXICO TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 44 MEXICO TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 45 MEXICO FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 MEXICO TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 47 CANADA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 48 CANADA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 50 CANADA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 51 CANADA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA TOMATOES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TOMATOES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TOMATOES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TOMATOES MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA TOMATOES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TOMATOES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TOMATOES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA TOMATOES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA TOMATOES MARKET: SEGMENTATION

FIGURE 10 RISING DEMAND OF TOMATO ON FOOD PROCESSING INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE CHERRY TOMATO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SUPPLY CHAIN OF THE NORTH AMERICA TOMATOES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TOMATOES MARKET

FIGURE 14 THE AVERAGE CHANGE IN THE RETAIL PRICE OF TOMATO PER KG COMPARED TO THE LONG-TERM PRICE TREND

FIGURE 15 NORTH AMERICA TOMATOES MARKET, BY TYPE, 2022

FIGURE 16 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2022

FIGURE 17 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2022

FIGURE 18 NORTH AMERICA TOMATOES MARKET, BY END USER, 2022

FIGURE 19 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 NORTH AMERICA TOMATOES MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA TOMATOES MARKET: BY TYPE (2023 - 2030)

FIGURE 25 NORTH AMERICA TOMATOES MARKET: COMPANY SHARE 2022 (%)

North America Tomatoes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Tomatoes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Tomatoes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.