North America Textile Garment Market Analysis and Insights

The textile market industry is concerned with the design, production and distribution of yarn, cloth, clothing and garments. The raw material may be natural, or synthetic, which may be using products of the chemical industry. The textile and garment industries contribute significantly to the national economy of many countries. Growing awareness of the latest fashion trends among the young generation helps to propel the textile garment market. Increasing spending on apparel and accessories from online platforms and rising willingness to pay a premium for high-quality apparel, and increasing awareness towards sustainable and eco-friendly clothing help to boost the growth of the textile garment market.

The North America textile garment market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

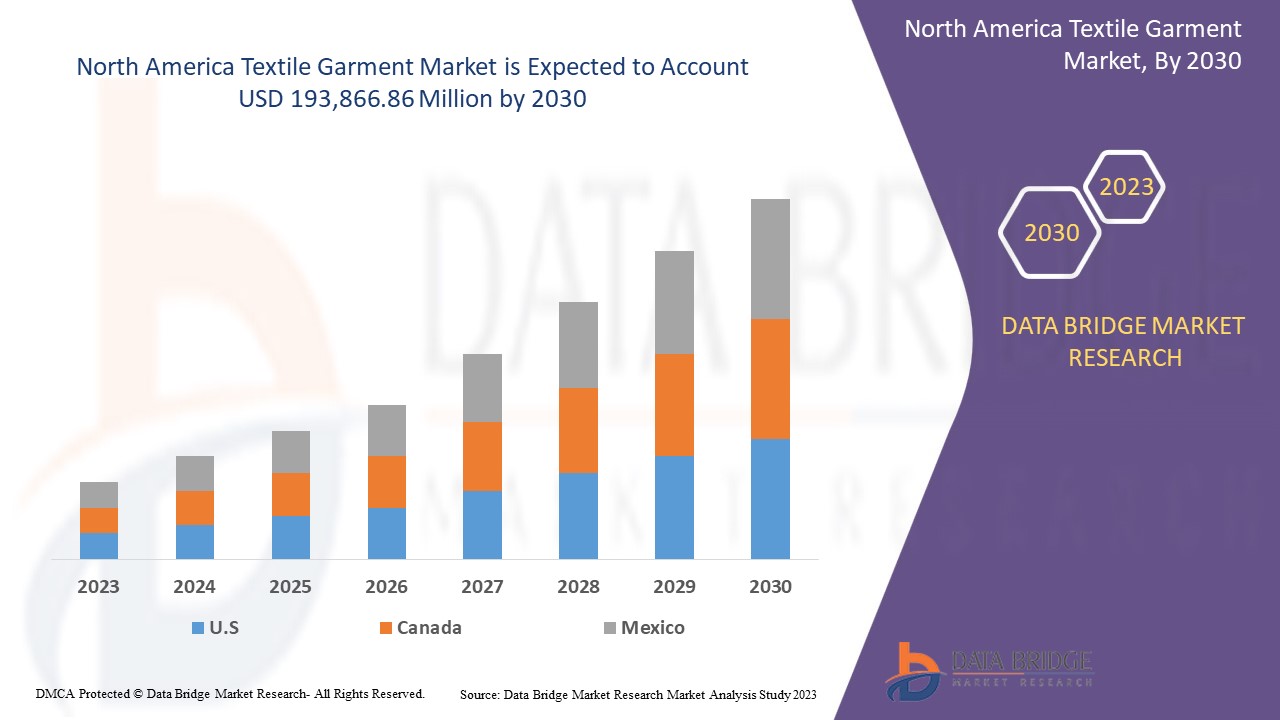

The North America textile garment market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.8% in the forecast period of 2023 to 2030 and is expected to reach USD 193,866.86 million by 2030. The major factor driving the growth of the textile garment market is the inclination toward the latest fashion trends among young generation is expected to drive the market growth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020- 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Material Type (Cotton, Denim, Wool, Silk, and Others), Product (Women, Men, and Kids). |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

TORAY INDUSTRIES, INC., Arvind Limited, Grasim industries limited, YOUNGOR, PVH Corp, Tabb Textile Company Inc., Ruby Mills, Alok Industries Ltd, DIOR, KPR MILL LIMITED, HYOSUNG TNC, Texhong Textile Group Limited, Apparel Production, The TJX Companies, Inc, and Vardhman Textiles Limited. |

Market Definition

The textile market industry is concerned with the design, production and distribution of yarn, cloth, clothing and garments. The raw material may be natural, or synthetic, which may be using products of the chemical industry. The textile and garment industries contribute significantly to the national economy of many countries.

North America Textile Garment Market Dynamics

Drivers

- Growing Awareness of the Latest Fashion Trends Among Young Generation

The adolescents are preoccupied with social acceptance and the coolness associated with their clothes. For this reason, teenagers will exhibit a more brand-oriented decision when they go shopping. Most teenagers will go shopping at stores where they sell quality, high-end designer clothes. Therefore, owing to fast fashion, competitive pressures are becoming higher, and North America demand continues to ask for new collections rapidly. Changing collections about every three weeks has induced consumers to act with new behavior. Fast fashion is an economic phenomenon that has allowed everyone to dress following the latest trends. Customers love to see different products every week or month in their favorite stores, and this has led to an increase in the demand for new fashion collections over a smaller period of time, which is expected to drive the demand and sales in North America textile garment market.

- Increasing Spending on Apparel and Accessories from Online Platforms

The fashion industry is more and more interconnected with the digital world. Digital platforms and digital marketing strategies are becoming prevalent in the fashion market, and many new brands have emerged with the development of e-commerce, which allows companies to engage consumers through virtual reality. The fashion and online apparel industry is the one that marks the biggest growth with regard to e-commerce sales. Therefore, the advent of online platforms has increased consumer spending on clothing through these channels, which will drive the sales and revenue in the North America textile garment market.

Opportunities

- Increasing Trend of Smart Textiles

Continuous innovation in this segment and their increasing trend can lead the North America textile garment market to face extreme growth in the near future. Some of the applications of smart textiles include color change in the garments in radiation zone or where environmental hazards are higher in quantity. Some examples of medical monitoring of patients are also there for the pharmaceutical industries as well. Actuators and sensors associated with synthesized fabrics enables some wearables to measure some exact data related to health and fitness as well.

Restraints/Challenges

- High Wastage

Despite a long history of resource conservation in the textile sector, a significant amount of unwanted waste is generated in garment manufacturing. The amount of textile waste generated depends on how much textile product is produced; the more product produced, the more waste there will be. This is a consequence of consumer demand, which in turn depends on the economic growth of the country. The dominance of fast fashion and just-in-time production in the textile industry has led to more frequent seasons and mini collections in-between seasons, which has led to the arrival of new cheap items to the stores every week, even, in some cases, every day. This fast-changing fashion changes a huge amount of waste, which is a bottleneck in the growth of the North America textile garment market.

Recent Development

In September 2022, Christian Dior showcased its Dior spring-summer 2023 ready-to-wear defile range at their set, which was inspired by baroque grottos at once shadowy and marvelous. A dreamy landscape evoking architecture both natural and imaginary, embodying interiority and mystery. This has allowed the company to showcase its new range to a larger consumer base.

North America Textile Garment Market Scope

The North America textile garment market is categorized based on material type and product. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Material Type

- Cotton

- Wool

- Silk

- Denim

- Others

Based on material type, the North America textile garment market is classified into five segments cotton, wool, silk, denim, and others.

Product

- Women

- Men

- Kids

Based on product, the North America textile garment market is classified into three segments women, men, and kids.

North America Textile Garment Market Regional Analysis/Insights

The North America textile garment market is segmented on the basis of material type and product.

The countries in the North America textile garment market are the U.S., Canada, and Mexico. The U.S is dominating the North America textile garment market in terms of market share and market revenue, growing awareness regarding the properties of fiber-based textiles.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Textile Garment Market Share Analysis

North America textile garment market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America textile garment market.

Some of the prominent participants operating in the North America textile garment market are TORAY INDUSTRIES, INC., Arvind Limited, Grasim industries limited, YOUNGOR, PVH Corp, Tabb Textile Company Inc., Ruby Mills, Alok Industries Ltd, DIOR, KPR MILL LIMITED, HYOSUNG TNC, Texhong Textile Group Limited, Apparel Production, The TJX Companies, Inc, and Vardhman Textiles Limited.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands’ understanding of the market for additional countries (ask for the list of countries), clinical trial results in data, literature review, refurbished market, and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors as you require data about in the format and data style you are looking for. Our team of analysts can also provide you with data in crude raw excel files pivot tables (Factbook) or can assist you in creating presentations from the data sets available in the report.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TEXTILE GARMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING AWARENESS TOWARD LATEST FASHION TRENDS AMONG YOUNG GENERATION

5.1.2 INCREASING SPENDING ON APPAREL AND ACCESSORIES FROM ONLINE PLATFORMS

5.1.3 RISING WILLINGNESS TO PAY PREMIUM FOR HIGH QUALITY APPAREL

5.1.4 SHIFTING INCLINATION TOWARD NATURAL FIBER-BASED TEXTILE GARMENTS

5.2 RESTRAINTS

5.2.1 HIGH WASTAGE OF RESOURCES

5.2.2 USE OF HAZARDOUS CHEMICALS

5.2.3 NORTH AMERICA TRADE LIMITATIONS AS A RESULT OF SUPPLY CHAIN DISRUPTION

5.3 OPPORTUNITIES

5.3.1 INCREASING TREND OF SMART TEXTILES

5.3.2 GROWING INFLUENCE OF SOCIAL MEDIA AND E-COMMERCE PLATFORM

5.3.3 RAISING ADOPTION OF TECHNICAL APPLICATION IN TEXTILE INDUSTRY

5.3.4 RECENT ADVANCEMENTS IN THE TEXTILE INDUSTRY AND RAPID INDUSTRIALIZATION

5.4 CHALLENGES

5.4.1 INCREASING AWARENESS TOWARDS SUSTAINABILITY

5.4.2 SAFETY AND HEALTH ISSUES RELATED TO TEXTILE INDUSTRY

5.4.3 RAPID PRICE FLUCTUATIONS OF RAW MATERIALS

5.4.4 REGULATIONS FROM ENVIRONMENTAL REGULATORY AUTHORITY

6 NORTH AMERICA TEXTILE GARMENT MARKET, BY MATERIAL TYPE

6.1 OVERVIEW

6.2 COTTON

6.3 DENIM

6.4 WOOL

6.5 SILK

6.6 OTHERS

7 NORTH AMERICA TEXTILE GARMENT MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 WOMEN

7.2.1 WOMEN, BY PRODUCT

7.2.1.1 TOPS AND DRESSES

7.2.1.2 BOTTOM WEAR

7.2.1.3 INNERWEAR AND SLEEPWEAR

7.2.1.4 COATS, JACKETS AND SUITS

7.2.1.5 ETHNIC WEARS

7.2.1.6 OTHERS

7.3 MEN

7.3.1 MEN, BY PRODUCT

7.3.1.1 SHIRTS AND T-SHIRTS

7.3.1.2 TROUSERS

7.3.1.3 DENIMS

7.3.1.4 ETHNIC WEARS

7.3.1.5 OTHERS

7.4 KIDS

7.4.1 KIDS, BY PRODUCT

7.4.1.1 SHIRTS OR SHIRTS

7.4.1.2 BOTTOM WEAR

7.4.1.3 DRESSES

7.4.1.4 DENIMS

7.4.1.5 UNIFORM

7.4.1.6 ETHNIC WEAR

7.4.1.7 OTHERS

8 NORTH AMERICA TEXTILE GARMENT MARKET, BY REGION

8.1 NORTH AMERICA

8.1.1 U.S.

8.1.2 CANADA

8.1.3 MEXICO

9 NORTH AMERICA TEXTILE GARMENT MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

9.2 COLLABORATION

9.3 EXPANSIONS

9.4 EVENT

9.5 LAUNCH

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 THE TJX COMPANIES, INC.

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATES

11.2 PVH CORP

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATES

11.3 CHRISTIAN DIOR

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT UPDATES

11.4 HYOSUNG TNC

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT UPDATES

11.5 YOUNGOR

11.5.1 COMPANY SNAPSHOT

11.5.2 COMPANY SHARE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT UPDATES

11.6 APPAREL PRODUCTION

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT UPDATES

11.7 ALOK INDUSTRIES LIMITED

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT UPDATES

11.8 ARVIND LIMITED

11.8.1 COMPANY SNAPSHOT

11.8.2 REVENUE ANALYSIS

11.8.3 PRODUCT PORTFOLIO

11.8.4 RECENT UPDATES

11.9 GRASIM INDUSTRIES LIMITED

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT UPDATES

11.1 KPR MILL LIMITED

11.10.1 COMPANY SNAPSHOT

11.10.2 REVENUE ANALYSIS

11.10.3 PRODUCT PORTFOLIO

11.10.4 RECENT UPDATES

11.11 RUBY MILLS

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT UPDATE

11.12 TORAY INDUSTRIES, INC.

11.12.1 COMPANY SNAPSHOT

11.12.2 REVENUE ANALYSIS

11.12.3 PRODUCT PORTFOLIO

11.12.4 RECENT UPDATE

11.13 TABB TEXTILE COMPANY

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT UPDATES

11.14 TEHXONG TEXTILE GROUP LIMITED

11.14.1 COMPANY SNAPSHOT

11.14.2 REVENUE ANALYSIS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT UPDATES

11.15 VARDHMAN TEXTILES LIMITED.

11.15.1 COMPANY SNAPSHOT

11.15.2 REVENUE ANALYSIS

11.15.3 PRODUCT PORTFOLIO

11.15.4 RECENT UPDATE

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF GARMENTS MADE UP OF FELT OR NONWOVENS, WHETHER OR NOT IMPREGNATED, COATED, COVERED OR LAMINATED; HS CODE – 6210 (USD THOUSAND)

TABLE 2 EXPORT DATA OF GARMENTS MADE UP OF FELT OR NONWOVENS, WHETHER OR NOT IMPREGNATED, COATED, COVERED OR LAMINATED; HS CODE – 6210 (USD THOUSAND)

TABLE 3 NORTH AMERICA TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA COTTON IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA DENIM IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA WOOL IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA SILK IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA OTHERS IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA TEXTILE GARMENT MARKET, BY PRODUCT , 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA WOMEN IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA MEN IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA KIDS IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TEXTILE GARMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA TEXTILE GARMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 U.S. TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 23 U.S. TEXTILE GARMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 24 U.S. WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 U.S. MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 U.S. KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 CANADA TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 28 CANADA TEXTILE GARMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 29 CANADA WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 CANADA MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 CANADA KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 MEXICO TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 33 MEXICO TEXTILE GARMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 MEXICO WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 MEXICO MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 MEXICO KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA TEXTILE GARMENT MARKET

FIGURE 2 NORTH AMERICA TEXTILE GARMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TEXTILE GARMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TEXTILE GARMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TEXTILE GARMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TEXTILE GARMENT MARKET: THE MATERIALTYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA TEXTILE GARMENT MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA TEXTILE GARMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA TEXTILE GARMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA TEXTILE GARMENT MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA TEXTILE GARMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA TEXTILE GARMENT MARKET: SEGMENTATION

FIGURE 13 GROWING AWARENESS TOWARD LATEST FASHION TRENDS AMONG YOUNG GENERATION IS EXPECTED TO DRIVE NORTH AMERICA TEXTILE GARMENT MARKET IN THE FORECAST PERIOD

FIGURE 14 COTTON SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TEXTILE GARMENT MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA TEXTILE GARMENTS MARKET

FIGURE 16 NORTH AMERICA TEXTILE GARMENT MARKET: BY MATERIAL TYPE, 2022

FIGURE 17 NORTH AMERICA TEXTILE GARMENT MARKET: BY PRODUCT, 2022

FIGURE 18 NORTH AMERICA TEXTILE GARMENT MARKET: SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA TEXTILE GARMENT MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA TEXTILE GARMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA TEXTILE GARMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA TEXTILE GARMENT MARKET: BY MATERIAL TYPE (2023-2030)

FIGURE 23 NORTH AMERICA TEXTILE GARMENT MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.