North America Synchronous Condenser Market Analysis and Size

A synchronous condenser or compensator is a motor running without a fixed load. It can generate or consume reactive volt-ampere (VAr) by varying the excitation of its field winding. It can be arranged to take a maximum current with over-excitation of its field winding. The increasing demand for condensers is due to the introduction of solid-state compensation devices, such as the static VAR compensator (SVC) that provides reactive power. Increasing demand for clean energy sources and the rising need for integrated systems in power plants are the major factors driving the market. However, high prices associated with installation and maintenance services are restraining the market's growth. Upsurges in decommissioning aging conventional power generation sources and rising government initiatives to reduce air pollution are estimated to provide market growth opportunities. However, the involvement of sophisticated and time-consuming installation processes creates a challenging environment for market growth.

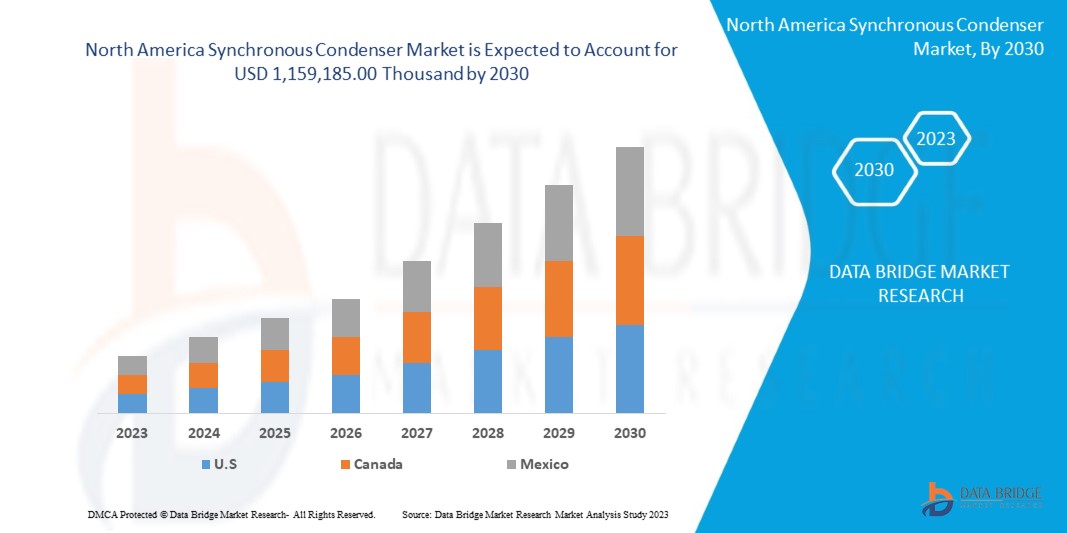

Data Bridge Market Research analyses that the North America synchronous condenser market is expected to reach a value of USD 1,159,185.00 thousand by 2030, at a CAGR of 3.7% during the forecast period. The North America synchronous condenser market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Cooling Technology (Hydrogen Cooled Synchronous Condenser, Air-Cooled Synchronous Condenser, and Water Cooled Synchronous Condenser), Starting Method (Static Frequency Convertor, Pony Motor, and Others), Reactive Power Rating (Above 200 MVAR, 101-200 MVAR, 61-100 MVAR, 31-60 MVAR, and 0-30 MVAR), End User (Electrical Utilities and Industrial Sectors), Type (New Synchronous Condenser and Refurbished Synchronous Condenser), Design (Salient Pole Design and Cylindrical Rotor Design), No. of Poles (4 to 8, Less Than 4, and More Than 8), Excitation System Type (Static Excitation and Brushless Excitation System) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

General Electric, ABB, Siemens, Eaton, WEG, Ansaldo Energia, Shanghai Electric Power Generation Equipment Co., Ltd. (A subsidiary of Shanghai Electric), Ingeteam, Hitachi Energy Ltd, Voith GmbH & Co. KGaA, Mitsubishi Electric Power Products, Inc., Baker Hughes Company, Power Systems & Controls, Inc., IDEAL ELECTRIC POWER CO., Doosan Škoda Power, and ANDRITZ among others |

Market Definition

A synchronous condenser is treated as a DC-excited synchronous motor that adjusts temperature and power according to electric power transmission and smart grid. Synchronous compensators, also called synchronous condensers, are designed to control the voltage level in a network area. They can produce or consume reactive power depending on the value of the excitation current. Synchronous condensers are an alternative to capacitor banks for power-factor correction in power grids.

One main advantage of the synchronous condenser is the amount of reactive power that can be continuously adjusted. The synchronous condenser is developed with advanced techniques to improve the power factor in a static capacitor bank. Synchronous condensers have traditionally been used at distribution and transmission voltage levels to improve stability and maintain voltages within desired limits under changing load conditions and contingency situations. The synchronous condenser consists of a stator and rotor with solid integral pole tips, a cooling system (hydrogen, air, or water), an excitation system, a lubrication oil supply, and a step-up transformer and auxiliary transformer.

A synchronous condenser is a long-standing well-known technology that provides advantages. High system inertia is an inherent feature of a synchronous condenser as it is a rotating machine. The benefit of inertia is improved voltage stiffness, improving the system's overall behavior. Increased short-term overload capability can provide more than two times its rating up to a few seconds, which enhances system support during emergencies or contingencies or even under extreme low voltage contingencies. It remains connected and provides smooth, reliable operation and real short-circuit strength to the grid, improving system stability with weak interconnections and enhancing system protection.

North America synchronous condenser Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing Demand for Clean Energy Sources

Clean energy is referred to the energy gained from sources without the release of air pollutants. Renewable energy is power generated from sources that are constantly being replenished. Unlike fossil fuels and gas, these renewable energy resources won't run out and include wind and solar energy. However, most green energy sources are renewable. Thus, perfect green clean energy can be called renewable energy sources.

- Growing Need for Integrated Systems In Power Plants

Energy Systems Integration (ESI) coordinates the operation and planning of energy systems to deliver reliable, cost-effective energy services with minimal environmental impact. Such systems involve interaction between energy factors such as electricity, thermal, fuels, water, and transmitters. Thus, ESI is a multidisciplinary area ranging from science, engineering, and technology.

Opportunity

- Rising Government Initiatives To Reduce Air Pollution

Energy consumption has been increasing across the globe due to the rise in electricity demand. Energy production through fossil fuels is responsible for more than one-third of the world's greenhouse gas emissions, which cause pollution and climate change.

Restraints/Challenges

- Higher Prices Associated With Capital and Maintenance

A synchronous condenser is a conventional solution used for decades for regulating power. This type of device comprises AC synchronous motor which can provide continuous reactive power control when used with a suitable automatic exciter. This has led to an upsurge in the usage of such electrical devices over the years.

- Higher Price Volatility of Raw Materials

The synchronous condensers are associated with various components and systems, such as rotors, stators, and cooling systems. These systems are manufactured with aluminum, copper, and stainless steel. Moreover, this system's construction or integration is sophisticated but useful for the power distribution system and high-power transistor modules.

Recent Developments

- In April 2023, Eaton announced the acquisition of a 9% stake in Jiangsu Ryan Electrical Co. Ltd., which manufactures power distribution and sub-transmission transformers in China. This acquisition will help the company to concentrate on electrical products and services. Moreover, it accelerates the company's global distribution, especially in Asia-Pacific.

- In January 2022, Siemens announced signing an agreement with Elering to construct three synchronous condensers at 330 kV junction stations in Estonia by 2024. This agreement helped the company to gain a business of USD 83.5 million and market recognition for synchronous condensers and enhanced the business in Germany.

North America Synchronous Condenser Market Scope

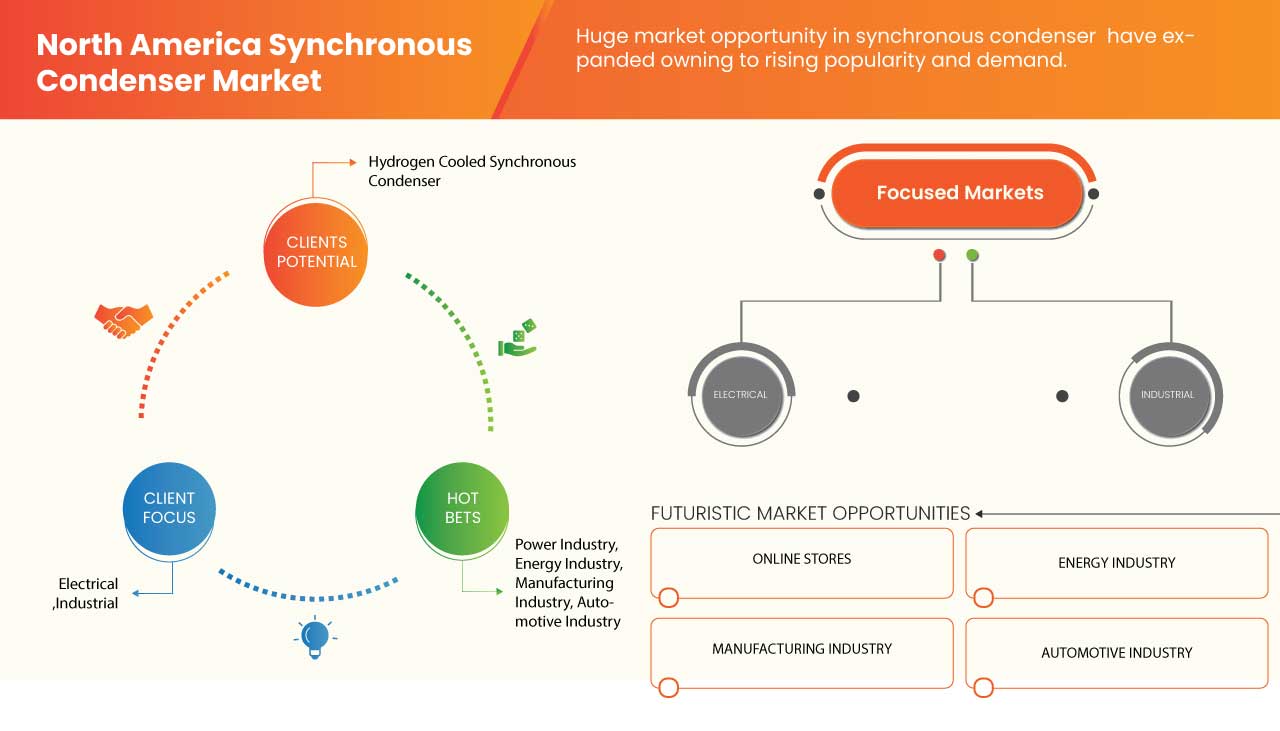

The North America synchronous condenser market is segmented into eight notable segments based on cooling technology, starting method, reactive power rating, end user, type, design, no. of poles, and excitation system type. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and insights to help them make strategic decisions for identifying core market applications.

Cooling Technology

- Hydrogen Cooled Synchronous Condenser

- Air-Cooled Synchronous Condenser

- Water Cooled Synchronous Condenser

On the basis of cooling technology, the North America synchronous condenser market is segmented into hydrogen-cooled synchronous condenser, air-cooled synchronous condenser, and water cooled synchronous condenser.

Starting Method

- Static Frequency Convertor

- Pony Motor

- Others

On the basis of starting method, the global synchronous condenser market is segmented into static frequency convertor, pony motor, and others.

Reactive Power Rating

- Above 200 MVAR

- 101-200 MVAR

- 61-100 MVAR

- 31-60 MVAR

- 0-30 MVAR

On the basis of reactive power rating, the global synchronous condenser market is segmented into above 200 MVAR, 101-200 MVAR, 61-100 MVAR, 31-60 MVAR, and 0-30 MVAR.

End User

- Electrical Utilities

- Industrial Sectors

On the basis of end-user, the global synchronous condenser market is segmented into electrical utilities and industrial sector.

Type

- New Synchronous Condenser

- Refurbished Synchronous Condenser

On the basis of type, the global synchronous condenser market is segmented into new synchronous condenser and refurbished synchronous condenser.

No. of Poles

- 4 To 8

- Less Than 4

- More Than 8

On the basis of no. of poles, the global synchronous condenser market is segmented into 4 to 8, less than 4, and more than 8.

Design

- Salient Pole Design

- Cylindrical Rotor Design

On the basis of design, the global synchronous condenser market is segmented into salient pole design and cylindrical rotor design.

Excitation System Type

- Static Excitation

- Brushless Excitation System

On the basis of excitation system type, the global synchronous condenser market is segmented into static excitation and brushless excitation system.

North America Synchronous Condenser Market Regional Analysis/Insights

North America synchronous condenser Market is analyzed, and market size insights and trends are provided by region, cooling technology, starting method, reactive power rating, end user, type, design, no. of poles, and excitation system type as referenced above.

The countries covered in the North America synchronous condenser market report are U.S., Canada, and Mexico.

The U.S. is expected to dominate in North America as there is a rising need for renewable energy, causing a demand for effective and dependable power transmission and distribution networks.

The region section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and North America Synchronous Condenser Market Share Analysis

North America synchronous condenser market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points only relate to the companies' focus on the market.

Some of the major players operating in the North America synchronous condenser market are General Electric, ABB, Siemens, Eaton, WEG, Ansaldo Energia, Shanghai Electric Power Generation Equipment Co., Ltd. (A subsidiary of Shanghai Electric), Ingeteam, Hitachi Energy Ltd, Voith GmbH & Co. KGaA, Mitsubishi Electric Power Products, Inc., Baker Hughes Company, Power Systems & Controls, Inc., IDEAL ELECTRIC POWER CO., Doosan Škoda Power, and ANDRITZ among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SYNCHRONOUS CONDENSER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 COOLING TECHNOLOGY CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FLYWHEEL ROLE IN SYNCHRONOUS CONDENSER SYSTEMS

5 REGIONAL REASONING

5.1 NORTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CLEAN ENERGY SOURCES

6.1.2 GROWING NEED FOR INTEGRATED SYSTEMS IN POWER PLANTS

6.1.3 RISING DEMAND FOR SAFE AND SECURE ELECTRICAL GRID SYSTEMS

6.1.4 EXPANSION OF HVDC NETWORK ACROSS THE WORLD

6.2 RESTRAINTS

6.2.1 HIGHER PRICES ASSOCIATED WITH CAPITAL AND MAINTENANCE

6.2.2 STRINGENT STANDARDS RELATED TO SYNCHRONOUS CONDENSER

6.2.3 HIGHER PRICE VOLATILITY OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 RISING GOVERNMENT INITIATIVES TO REDUCE AIR POLLUTION

6.3.2 UPSURGE IN DECOMMISSIONING OF AGING AND CONVENTIONAL POWER GENERATION SOURCES

6.3.3 INCREASE IN INVESTMENTS IN R&D TO DEVELOP EFFICIENT SYNCHRONOUS CONDENSER

6.4 CHALLENGES

6.4.1 AVAILABILITY OF LOW-COST SUBSTITUTES

6.4.2 INVOLVEMENT IN SOPHISTICATED AND TIME-CONSUMING INSTALLATION PROCESS

7 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY

7.1 OVERVIEW

7.2 HYDROGEN COOLED SYNCHRONOUS CONDENSER

7.3 AIR-COOLED SYNCHRONOUS CONDENSER

7.4 WATER COOLED SYNCHRONOUS CONDENSER

8 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD

8.1 OVERVIEW

8.2 STATIC FREQUENCY CONVERTOR

8.3 PONY MOTOR

8.4 OTHERS

9 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING

9.1 OVERVIEW

9.2 ABOVE 200 MVAR

9.3 101-200 MVAR

9.4 61-100 MVAR

9.5 31-60 MVAR

9.6 0-30 MVAR

10 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY END USER

10.1 OVERVIEW

10.2 ELECTRICAL UTILITIES

10.3 INDUSTRIAL SECTORS

11 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY TYPE

11.1 OVERVIEW

11.2 NEW SYNCHRONOUS CONDENSER

11.3 REFURBISHED SYNCHRONOUS CONDENSER

12 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY DESIGN

12.1 OVERVIEW

12.2 SALIENT POLE DESIGN

12.3 CYLINDRICAL ROTOR DESIGN

13 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES

13.1 OVERVIEW

13.2 4 TO 8

13.3 LESS THAN 4

13.4 MORE THAN 8

14 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE

14.1 OVERVIEW

14.2 STATIC EXCITATION

14.3 BRUSHLESS EXCITATION SYSTEM

15 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 GENERAL ELECTRIC

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 ABB

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 EATON

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 SERVICE PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 VOITH GMBH & CO. KGAA

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 BAKER HUGHES COMPANY

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT & SERVICES PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ANDRITZ

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 COMPANY SHARE ANALYSIS

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 ANSALDO ENERGIA

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 DOOSAN ŠKODA POWER

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 HITACHI ENERGY LTD

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 IDEAL ELECTRIC POWER CO.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 INGETEAM

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 SOLUTION PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 POWER SYSTEMS & CONTROLS, INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 SHANGHAI ELECTRIC POWER GENERATION EQUIPMENT CO.,LTD. (A SUBSIDIARY OF SHANGHAI ELECTRIC)

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 SIEMENS

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 WEG

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 UNINTERRUPTED OPERATION REQUIREMENTS FOR VOLTAGE DISTURBANCES

TABLE 2 COMPARISON BETWEEN SYNCHRONOUS CONDENSER, SVC, AND SATCOM

TABLE 3 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA HYDROGEN COOLED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA AIR-COOLED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA WATER COOLED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA STATIC FREQUENCY CONVERTOR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA PONY MOTOR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA OTHERS IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA ABOVE 200 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA 101-200 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA 61-100 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA 31-60 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA 0-30 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA ELECTRICAL UTILITIES IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA INDUSTRIAL SECTORS IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA NEW SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA REFURBISHED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA SALIENT POLE DESIGN IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA CYLINDRICAL ROTOR DESIGN IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA 4 TO 8 IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA LESS THAN 4 IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA MORE THAN 8 IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA STATIC EXCITATION IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 BRUSHLESS EXCITATION SYSTEM IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (UNITS)

TABLE 38 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 U.S. SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 44 U.S. SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 47 U.S. SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 U.S. SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 49 U.S. SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 50 U.S. SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 CANADA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 53 CANADA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 54 CANADA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 57 CANADA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 MEXICO SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 60 MEXICO SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 61 MEXICO SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 62 MEXICO SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 63 MEXICO SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 MEXICO SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 65 MEXICO SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 66 MEXICO SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: DBMR TRIPOD DATA VALIDATION MODEL

FIGURE 3 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: COOLING TECHNOLOGY CURVE

FIGURE 11 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: MARKET END-USER COVERAGE GRID

FIGURE 12 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND FOR CLEAN ENERGY SOURCES IS EXPECTED TO BE A KEY DRIVER FOR NORTH AMERICA SYNCHRONOUS CONDENSER MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 HYDROGEN COOLED SYNCHRONOUS CONDENSER IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SYNCHRONOUS CONDENSER MARKET IN 2023 TO 2030

FIGURE 15 SYNCHRONOUS CONDENSER WITH FLYWHEEL

FIGURE 16 SYNCHRONOUS CONDENSER WITH FLYWHEEL

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SYNCHRONOUS CONDENSER MARKET

FIGURE 18 SHARE OF DIFFERENT POWER GENERATING SOURCES

FIGURE 19 GENERATION OF WIND ENERGY

FIGURE 20 OPPORTUNITIES IN THE INTEGRATION OF SYSTEMS IN POWER PLANTS

FIGURE 21 AVERAGE ANNUAL INVESTMENT SPENDING ON ELECTRICITY GRIDS

FIGURE 22 PRICING LIST OF COPPER MATERIAL

FIGURE 23 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY COOLING TECHNOLOGY, 2022

FIGURE 24 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY STARTING METHOD, 2022

FIGURE 25 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY REACTIVE POWER RATING, 2022

FIGURE 26 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY TYPE, 2022

FIGURE 28 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY DESIGN, 2022

FIGURE 29 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY NO. OF POLES, 2022

FIGURE 30 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY EXCITATION SYSTEM TYPE, 2022

FIGURE 31 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: SNAPSHOT (2022)

FIGURE 32 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY COUNTRY (2022)

FIGURE 33 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 35 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY COOLING TECHNOLOGY (2023-2030)

FIGURE 36 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: COMPANY SHARE 2022 (%)

North America Synchronous Condenser Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Synchronous Condenser Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Synchronous Condenser Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.