Market Analysis and Size

Chronic diseases-including cancer, musculoskeletal disorders and neurology disorders, chronic injuries, cardiovascular and gastrointestinal-can lead to hospitalization, long-term disability, reduced quality of life, and death.

The mesenchymal stem cells penetrate and integrate into multiple organs, repair cardiovascular, lung, and spinal cord injuries, and improve the state of autoimmune diseases, liver, and bone and cartilage diseases. Stems cells are a potent tool for the treatment of infections caused by inflammation, immune system failure, and, or tissue degeneration.

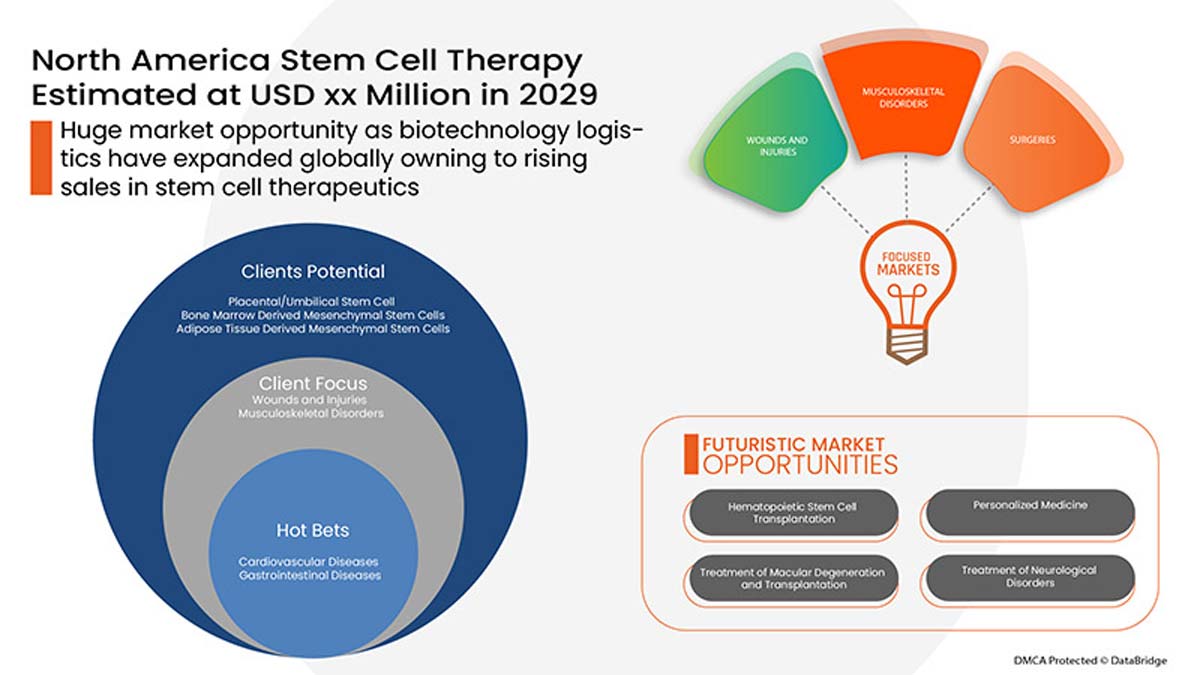

The drivers responsible for the growth of the North America stem cell therapy market are the increased incidence of chronic diseases, rise in GMP-certification approvals for cell therapy production facilities, growing biotechnology sector and rise in clinical trials for stem-cell-based therapies. However, factors that are expected to restrain the market growth are the rise in the cost of stem cell-based research, and the risks faced while undergoing stem cell therapy, and the availability of alternatives.

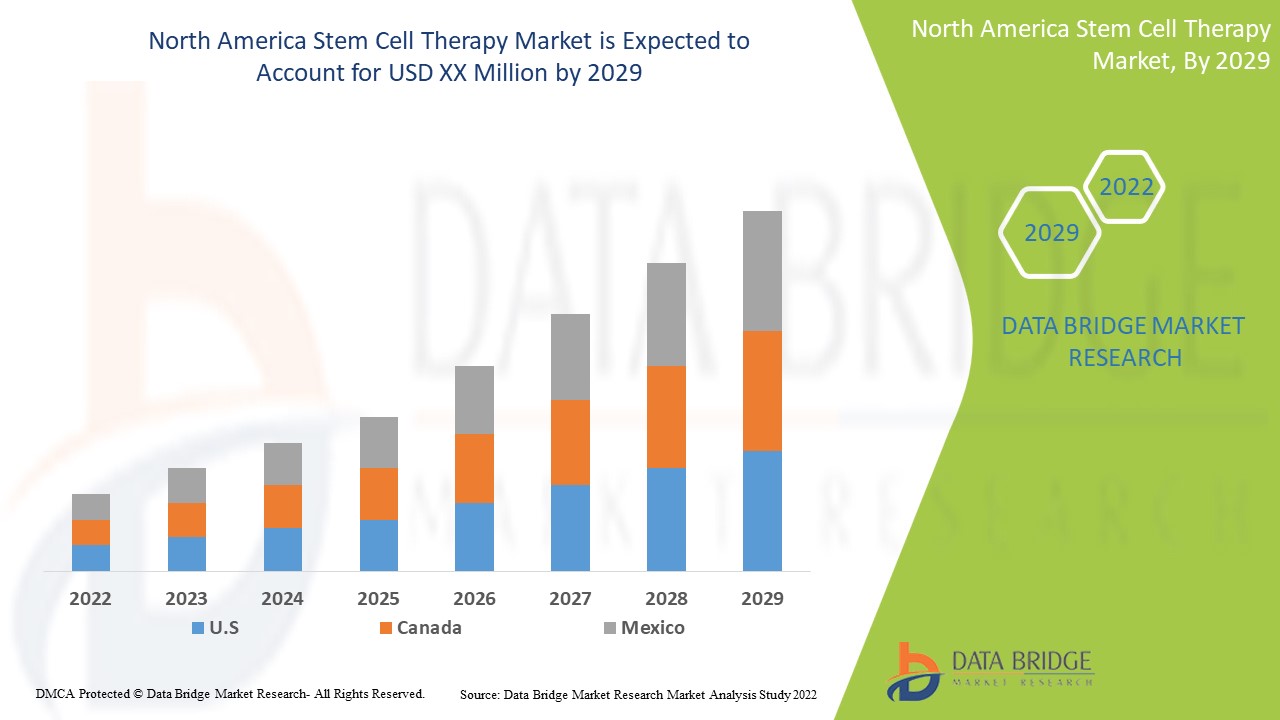

The North America stem cell therapy is supportive and aims to reduce the severity of the symptoms. Data Bridge Market Research analyses that the North America stem cell therapy market is expected to reach the value of USD 196.91 million and grow at a CAGR of 8.6% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Bone Marrow Derived Mesenchymal Cells, Placental or Umbilical Stem Cell, Adipose Tissue Derived Mesenchymal Stem Cells, and Others), Type (Allogenic Stem Cell Therapy and Autologous Stem Cell Therapy), Application (Musculoskeletal Disorders, Acute Graft-Versus-Host Disease (AGVHD), Wounds and Injuries, Cardiovascular Diseases, Surgeries, Gastrointestinal Diseases, and Others), End User (Hospitals and Surgical Centers, Therapeutic Companies, Services Companies, and Others), Distribution Channel (Direct Tender, Third Party Distributors) |

|

Countries Covered |

U.S., Canada |

|

Market Players Covered |

Osiris Therapeutics, Inc. (A subsidiary of Smith+Nephew), Orthofix Medical Inc., Takeda Pharmaceutical Company Limited, U.S. Stem Cell, Inc., BrainStorm Cell Limited, International Stemcell Corporation, Athersys, Inc., BioRestorative Therapies, Inc., JCR Pharmaceuticals Co., Ltd, ANTEROGEN.CO., LTD, MEDIPOST, Mesoblast Ltd, PHARMICELL Co., Ltd., STEMPEUTICS RESEARCH PVT LTD, among others |

Market Definition

Stem cells are the body's initial materials from which all other cells with specialized functions are generated. Under the right conditions in the body or a laboratory, stem cells divide to form more cells called daughter cells. The daughter cells become new stem cells or specialized cells (differentiation) with a more specific function, such as blood cells, brain cells, heart muscle cells, or bone cells. Much interest in stem cells has brought interest among the research scientists. Understanding how a disease develops and occurs by using stem cells, generating healthy cells to replace cells, and testing novel drug safety and efficacy are the scientific reasons why stem cell therapeutics are used.

Stem cell therapy promotes dysfunctional or injured tissue repair response using stem cells or derivatives. It is the next chapter in organ transplantation and uses cells instead of donor organs, which are limited in supply. The adult stem cells, such as adipose tissue-derived mesenchymal stem cells, bone marrow-derived mesenchymal stem cells, and placental or umbilical stem cells, are found in small numbers in most tissues. The embryonic stem cells originate from embryos, which are three to five days old. Emerging indications indicate that adult stem cells may be able to create various types of cells.

North America Stem Cell Therapy Market Dynamics

Drivers

- Rise in prevalence and incidence of chronic diseases

Chronic diseases are common health conditions around the world. Globally, one in three adults suffers from chronic conditions. Chronic diseases have affected the health and quality of life of many citizens. Chronic diseases—including cancer, musculoskeletal disorders and neurology disorders, chronic injuries, cardiovascular and gastrointestinal—can lead to hospitalization, long-term disability, reduced quality of life, and death.

The mesenchymal stem cells penetrate and integrate into multiple organs, repair cardiovascular, lung and spinal cord injuries, and improve the state of autoimmune diseases, liver, and bone and cartilage diseases. Stems cells are a potent tool for the treatment of diseases caused by inflammation, immune system failure, and or tissue degeneration

For instance,

- In 2022, the data by the United States Bone and Joint Initiative., states that musculoskeletal diseases affect more than one out of every two persons in the United States age 18 and over and nearly three out of four aged 65 and over. Trauma, back pain, and arthritis are the three most common musculoskeletal conditions reported, and for which health care visits to physicians' offices, emergency departments, and hospitals occur each year

- Rise in research and development

The stem cell research is funded by the National Institute of Health (NIH) budget. The private sector also funds stem cell research, but such investment generally occurs later, during the testing and development phase, then during initial basic research. With stem cell therapies being such a new field, it is crucial an unbiased governmental body supervise them. The FDA is cautious and thorough, but they are endlessly struggling for funding, making a long-term investment that aligns the payment with the potential future beneficiaries.

For instance,

- In March 2022, MEDIPOST had invested in a contract development and manufacturing company (CDMO) for cell gene therapy products in North America and clinical trials in the U.S., such as stem cell therapy. CARTISTEM is a stem cell therapy procedure for the treatment of degenerative osteoarthritis

- Growing biotechnology sector

People are getting more aware of their health, and also there is alertness for preventive healthcare. Emphasis on healthcare is gaining popularity. Awareness of disease and symptoms is essential for screening and early detection of infections due to advanced technology available in the healthcare system, such as stem cell technology which is helping the healthcare providers lead to higher survival rates. Many biotechnology companies focusing on the development of stem cell-based therapies are expected to drive the market's growth.

For instance,

As a huge contributor of 30% to the American Biotechnology sector and the overall global market, Biotech has also created an increased demand for the workforce and has opened up many opportunities for U.S. citizens

Opportunities

- The rise in healthcare expenditure

Moreover, the rise in the research and development activities and increasing investments by government and private organizations will boost new opportunities for the market's growth rate.

For instance,

- In 2021, according to Health Care Price Index (HCPI), the total U.S. healthcare budget had increased by 3.4%. The increase in growth states the federal government spending decreased significantly in the previous year from USD 287,000 million in 2020 to USD 170,000 million in 2021

- Strategic initiative by market players

The demand for stem cell therapy has increased the demand in the U.S. owing to the timely treatment of chronic conditions. These favorable factors enhance the need for medications, and to achieve the market demand, minor and major market players are utilizing various strategies.

The major players are also trying to devise specific strategies, such as product launches, acquisitions, approvals, expansions, and partnerships, to ensure the smooth running of the business, avoid risks, and increase the long-term growth in the sales of the market.

For instance,

- In May 2022, ViaCyte, Inc. partnered with SQZ Biotechnologies to develop and commercialize the search-use-only (RUO) microfluidic intracellular delivery system. The partnership will allow both the market players to present new cell engineering data in hematopoietic stem cells using mRNA

These strategic initiatives by the market players, including acquisition, conferences, and focused segment product launches, are helping the companies grow and improve the company's product portfolios, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players provide an opportunity that is helping them to drive market growth.

Restraints/Challenges

- The rise in cost of stem-cell based therapy research

Stem cell therapy is a developing and novel treatment option for the treatment of several disorders. Sometimes, the cost of the therapy is a concern for several conditions. The stem-cell therapy treatment procedures. The stem cell field is still highly specialized and has not been adopted by the mainstream and insurance companies. The cost of stem cell therapy-based research therapy is not covered by medical insurance. These costs are pushed on patients. Therefore, the present high cost is expected to show a descending trend.

For instance,

- In 2022, the data by the Bioinformant states that the cost of autologous stem cell therapy in the U.S. is around USD 150,000

- The lack of skilled professionals

The lack or shortage of skilled expertise would challenge the pace of recovery and growth in one place. Often, the unemployed people in one place have skills that are in short supply elsewhere. Moreover, rapid technological advancement in this field also leads to a lack of expertise.

Stem cell therapy uses modern technology to replace damaged cells with healthy new ones. Nowadays, Stem cell therapies provide substantial benefits to patients suffering from a wide range of diseases such as neuronal disease, diabetes, and injuries such as brain trauma and spinal cord injuries.

The haematologists dealing in stem cell therapies must have received proper stem cell therapy administration training. They must be familiar with the on-site well-organized system for specific emergency administration of treatments. The stem cell therapy coordinator ensures that all relevant personnel must be informed when a patient receives therapy. The coordinator can be the health professionals, including state registered nurses.

The North America stem cell therapy market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on The North America stem cell therapy market, contact Data Bridge Market Research for an Analyst Brief; our team will help you make an informed market decision to achieve market growth.

Patient Epidemiology Analysis

- In 2017, the data by the Global Burden of Disease (GBD) stated that lower back pain caused the maximum number of cases, followed by other musculoskeletal disorders (21.5%),

The North America stem cell therapy market also provides you with detailed market analysis for patient analysis, prognosis, and cures. Prevalence, incidence, mortality, and adherence rates are some of the data variables available in the report. Direct or indirect impact analyses of epidemiology to the market growth are analyzed to create a more robust and cohort multivariate statistical model for forecasting the market during the growth period.

Impact of COVID-19 on the North America Stem Cell Therapy Market

During the pandemic, stem cell therapy had a remarkable effect on reducing mortality and morbidity of patients with COVID-19. Further large-scale studies are needed to approve these results. A protocol for stem cell therapy in COVID-19 infection should be defined to achieve the best possible clinical outcomes. Clinical trials were conducted during COVID-19.

Recent Development

- In March 2020, during the pandemic, MEDIPOST received approval in Malaysia for its knee osteoarthritis drug CARTISTEM. The approval received would result in boosting the product's commercialization.

North America Stem Cell Therapy Market Scope

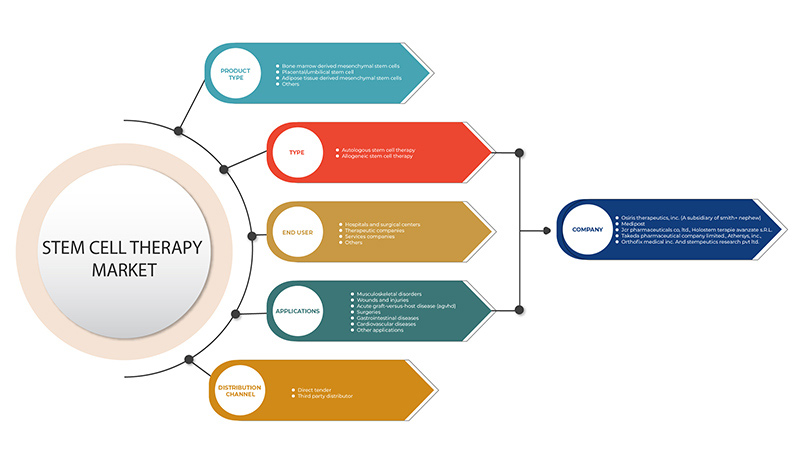

The North America stem cell therapy market is segmented into five segments based on product type, type, application, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Bone Marrow Derived Mesenchymal Stem Cells

- Placental or Umbilical Stem Cell

- Adipose Tissue Derived Mesenchymal Stem Cells

- Others

On the basis of product type, the North America stem cell therapy market is segmented into bone marrow derived mesenchymal stem cells, placental or umbilical stem cell, adipose tissue derived mesenchymal stem cells, and others.

Type

- Allogeneic Stem Cell Therapy

- Autologous Stem Cell Therapy

On the basis of type, the North America stem cell therapy market is segmented into allogenic stem cell therapy, and autologous stem cell therapy.

Application

- Musculoskeletal Disorders

- Wounds and Injuries

- Acute Graft-Versus-Host Disease (AGVHD)

- Surgeries

- Gastrointestinal Diseases

- Cardiovascular Diseases

- Others

On the basis of application, the North America stem cell therapy market is segmented into musculoskeletal disorders, wounds and injuries, acute graft-versus-host disease (AGVHD), surgeries, gastrointestinal diseases, cardiovascular diseases, and others.

End User

- Hospitals and Surgical Centers

- Therapeutic Companies

- Services Companies

- Others

On the basis of end user, the North America stem cell therapy market is segmented into hospitals and surgical centers, therapeutic companies, services companies, and others.

Distribution Channel

- Direct Tenders

- Third Party Distributors

On the basis of distribution channel, the North America stem cell therapy market is segmented into direct tender, and third party distributors.

North America Stem Cell Therapy Market Regional Analysis/Insights

The North America stem cell therapy market is analyzed, and market size insights and trends are provided by regions, product type, type, application, end user, and distribution channel. As referenced above.

Some of the countries covered in the North America stem cell therapy market report are the U.S. and Canada. The U.S. is expected to dominate the market due to a rise in the incidence of chronic diseases, healthcare expenditure, ongoing clinical trials, and therapeutic companies.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Stem Cell Therapy Market Share Analysis

The North America stem cell therapy market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, the North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, and product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the North America stem cell therapy market.

Some of the major players operating in the North America stem cell therapy market are Osiris Therapeutics, Inc. (A subsidiary of Smith+Nephew), Orthofix Medical Inc., Takeda Pharmaceutical Company Limited, U.S. Stem Cell, Inc., BrainStorm Cell Limited, International Stemcell Corporation, Athersys, Inc., BioRestorative Therapies, Inc., JCR Pharmaceuticals Co., Ltd, ANTEROGEN.CO., LTD, MEDIPOST, Mesoblast Ltd, PHARMICELL Co., Ltd., STEMPEUTICS RESEARCH PVT LTD, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or can drop down your inquiry. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America versus Regional, and Vendor Share Analysis. To know more about the research methodology, drop an inquiry to speak to our industry experts.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA STEM CELL THERAPY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA STEM CELL THERAPY MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 PIPELINE ANALYSIS FOR THE NORTH AMERICA STEM CELL THERAPY MARKET

7 NORTH AMERICA STEM CELL THERAPY MARKET: REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 THE RISE IN PREVALENCE AND INCIDENCE OF CHRONIC DISEASES

8.1.2 RISE IN INVESTMENT IN RESEARCH AND DEVELOPMENT AND AVAILABILITY OF FUNDING FOR STEM CELL RESEARCH

8.1.3 GROWING BIOTECHNOLOGY SECTOR

8.1.4 RISE IN GMP CERTIFICATION APPROVALS FOR CELL THERAPY PRODUCTION FACILITIES

8.1.5 RISE IN CLINICAL TRIALS FOR STEM-CELL-BASED THERAPIES

8.2 RESTRAINTS

8.2.1 THE RISE IN COST OF STEM-CELL-BASED THERAPY RESEARCH

8.2.2 THE RISKS FACED WHILE UNDERGOING STEM CELL THERAPY

8.2.3 ETHICAL CONCERNS RELATED TO STEM CELL THERAPY RESEARCH

8.2.4 AVAILABILITY OF ALTERNATIVES

8.3 OPPORTUNITIES

8.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

8.3.2 RISE IN HEALTHCARE EXPENDITURE

8.3.3 THE EMERGENCE OF INDUCED PLURIPOTENT STEM CELLS (IPSCS)

8.4 CHALLENGES

8.4.1 THE LACK OF SKILLED PROFESSIONALS REQUIRED FOR STEM CELL THERAPY

8.4.2 STRINGENT REGULATIONS

9 NORTH AMERICA STEM CELL THERAPY MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 BONE MARROW DERIVED MESENCHYMAL STEM CELLS

9.3 PLACENTAL/UMBILICAL STEM CELL

9.4 ADIPOSE TISSUE DERIVED MESENCHYMAL STEM CELLS

9.5 OTHERS

10 NORTH AMERICA STEM CELL THERAPY MARKET, BY TYPE

10.1 OVERVIEW

10.2 ALLOGENEIC STEM CELL THERAPY

10.2.1 MUSCULOSKELETAL DISORDERS

10.2.2 WOUNDS AND INJURIES

10.2.3 ACUTE GRAFT-VERSUS-HOST DISEASE (AGVHD)

10.2.4 SURGERIES

10.2.5 GASTROINTESTINAL DISEASES

10.2.6 OTHER APPLICATION

10.3 AUTOLOGOUS STEM CELL THERAPY

10.3.1 CARDIOVASCULAR DISEASES

10.3.2 GASTROINTESTINAL DISEASES

10.3.3 OTHER APPLICATION

11 NORTH AMERICA STEM CELL THERAPY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 MUSCULOSKELETAL DISORDERS

11.3 WOUNDS AND INJURIES

11.4 ACUTE GRAFT-VERSUS-HOST DISEASE (AGVHD)

11.5 SURGERIES

11.6 GASTROINTESTINAL DISEASES

11.7 CARDIOVASCULAR DISEASES

11.8 OTHER APPLICATION

12 NORTH AMERICA STEM CELL THERAPY MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL AND SURGICAL CENTERS

12.3 THERAPEUTIC COMPANIES

12.4 SERVICES COMPANIES

12.5 OTHERS

13 NORTH AMERICA STEM CELL THERAPY MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 THIRD PARTY DISTRIBUTORS

14 NORTH AMERICA STEM CELL THERAPY MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

15 NORTH AMERICA STEM CELL THERAPY MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 OSIRIS THERAPEUTICS, INC. (A SUBSIDIARY OF SMITH+NEPHEW) (2021)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 JCR PHARMACEUTICALS CO., LTD ( (2021)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 ORTHOFIX MEDICAL INC. (2021)

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 MEDIPOST (2021)

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 TAKEDA PHARMACEUTICAL COMPANY LIMITED (2021)

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 CORESTEM, INC. (2021)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 PHARMICELL CO., LTD. (2021)

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ANTEROGEN.CO., LTD (2021)

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ATHERSYS, INC.(2021)

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 BRAINSTORM CELL LIMITED (2021)

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BIORESTORATIVE THERAPIES, INC. (2021)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 HOLOSTEM TERAPIE AVANZATE S.R.L. (2021)

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 INTERNATIONAL STEMCELL CORPORATION (2021)

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 MESOBLAST LTD (2021)

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 PLURISTEM INC.(2021)

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 STEMPEUTICS RESEARCH PVT LTD

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 U.S. STEM CELL, INC. (2021)

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA STEM CELL THERAPY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA BONE MARROW DERIVED MESENCHYMAL STEM CELLS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA PLACENTAL/UMBILICAL STEM CELL IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA ADIPOSE TISSUE DERIVED MESENCHYMAL STEM CELLS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA OTHERS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA STEM CELL THERAPY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA ALLOGENEIC STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA ALLOGENEIC STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AUTOLOGOUS STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA AUTOLOGOUS STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA MUSCULOSKELETAL DISORDERS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA WOUNDS AND INJURIES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ACUTE GRAFT-VERSUS-HOST DISEASE (AGVHD) IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA SURGERIES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA GASTROINTESTINAL DISEASES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CARDIOVASCULAR DISEASES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA OTHER APPLICATION IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA STEM CELL THERAPY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA HOSPITAL AND SURGICAL CENTERS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA THERAPEUTIC COMPANIES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SERVICES COMPANIES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA OTHERS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA STEM CELL THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA DIRECT TENDER IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA STEM CELL THERAPY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA STEM CELL THERAPY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA STEM CELL THERAPY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ALLOGENEIC STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA AUTOLOGOUS STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA STEM CELL THERAPY MARKET, BY APPLICATIONS, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA STEM CELL THERAPY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA STEM CELL THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 U.S. STEM CELL THERAPY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 U.S. STEM CELL THERAPY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. ALLOGENEIC STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 U.S. AUTOLOGOUS STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 U.S. STEM CELL THERAPY MARKET, BY APPLICATIONS, 2020-2029 (USD MILLION)

TABLE 40 U.S. STEM CELL THERAPY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 41 U.S. STEM CELL THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 42 CANADA STEM CELL THERAPY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 CANADA STEM CELL THERAPY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 CANADA ALLOGENEIC STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 CANADA AUTOLOGOUS STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 CANADA STEM CELL THERAPY MARKET, BY APPLICATIONS, 2020-2029 (USD MILLION)

TABLE 47 CANADA STEM CELL THERAPY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 CANADA STEM CELL THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA STEM CELL THERAPY MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA STEM CELL THERAPY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA STEM CELL THERAPY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA STEM CELL THERAPY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA STEM CELL THERAPY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA STEM CELL THERAPY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA STEM CELL THERAPY MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA STEM CELL THERAPY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA STEM CELL THERAPY MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA STEM CELL THERAPY MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA STEM CELL THERAPY MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED INCIDENCE OF CHRONIC DISEASES, RISE IN CLINICAL TRIALS, GMP CERTIFICATION AND PRODUCT APPPROVALS IS EXPECTED TO DRIVE THE NORTH AMERICA STEM CELL THERAPY MARKET FROM 2022 TO 2029

FIGURE 13 PRODUCT TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA STEM CELL THERAPY MARKET FROM 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA STEM CELL THERAPY MARKET

FIGURE 15 NUMBER AND AGES OF PEOPLE 65 OR OLDER WITH ALZHEIMER'S DEMENTIA IN 2022

FIGURE 16 INCIDENCE OF VARIOUS TYPES OF CANCER IN 2020

FIGURE 17 NORTH AMERICA STEM CELL THERAPY MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 NORTH AMERICA STEM CELL THERAPY MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 19 NORTH AMERICA STEM CELL THERAPY MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 20 NORTH AMERICA STEM CELL THERAPY MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA STEM CELL THERAPY MARKET: BY TYPE, 2021

FIGURE 22 NORTH AMERICA STEM CELL THERAPY MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 23 NORTH AMERICA STEM CELL THERAPY MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 24 NORTH AMERICA STEM CELL THERAPY MARKET: BY TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA STEM CELL THERAPY MARKET: BY APPLICATION, 2021

FIGURE 26 NORTH AMERICA STEM CELL THERAPY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 27 NORTH AMERICA STEM CELL THERAPY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 28 NORTH AMERICA STEM CELL THERAPY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA STEM CELL THERAPY MARKET: BY END USER, 2021

FIGURE 30 NORTH AMERICA STEM CELL THERAPY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 31 NORTH AMERICA STEM CELL THERAPY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 32 NORTH AMERICA STEM CELL THERAPY MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA STEM CELL THERAPY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 34 NORTH AMERICA STEM CELL THERAPY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 35 NORTH AMERICA STEM CELL THERAPY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 36 NORTH AMERICA STEM CELL THERAPY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 NORTH AMERICA STEM CELL THERAPY MARKET: SNAPSHOT (2021)

FIGURE 38 NORTH AMERICA STEM CELL THERAPY MARKET: BY COUNTRY (2021)

FIGURE 39 NORTH AMERICA STEM CELL THERAPY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 40 NORTH AMERICA STEM CELL THERAPY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 41 NORTH AMERICA STEM CELL THERAPY MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 42 NORTH AMERICA STEM CELL THERAPY MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.