North America Stem Cell Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

11.07 Billion

USD

23.90 Billion

2025

2033

USD

11.07 Billion

USD

23.90 Billion

2025

2033

| 2026 –2033 | |

| USD 11.07 Billion | |

| USD 23.90 Billion | |

|

|

|

|

North America Stem Cell Manufacturing Market Size

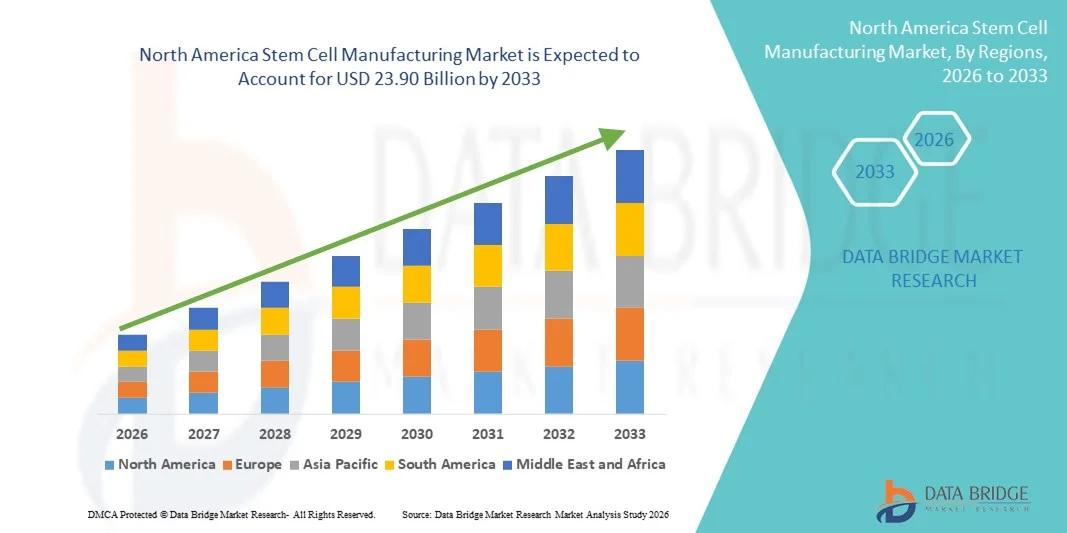

- The North America stem cell manufacturing market size was valued at USD 11.07 billion in 2025 and is expected to reach USD 23.90 billion by 2033, at a CAGR of 10.10% during the forecast period

- The market growth is largely fueled by increasing investments in regenerative medicine, cell-based therapies, and personalized medicine, along with rapid technological advancements in stem cell isolation, expansion, and processing techniques, leading to wider adoption across research, clinical, and commercial manufacturing settings

- Furthermore, rising demand for high-quality, scalable, and regulatory-compliant stem cell production for therapeutic, research, and drug discovery applications is establishing stem cell manufacturing as a critical component of modern biopharmaceutical development. These converging factors are accelerating the uptake of stem cell manufacturing solutions, thereby significantly boosting the industry's growth

North America Stem Cell Manufacturing Market Analysis

- Stem cell manufacturing, encompassing the large-scale production, processing, and quality control of pluripotent and multipotent stem cells for therapeutic, research, and drug discovery applications, is increasingly critical in the development of regenerative medicine and cell-based therapies across global healthcare and biopharmaceutical sectors

- The escalating demand for high-quality, scalable, and regulatory-compliant stem cell production is primarily fueled by the growth of cell and gene therapies, increasing clinical trials, and rising investments in biomanufacturing facilities, driving wider adoption across research institutions, contract development and manufacturing organizations (CDMOs), and biopharmaceutical companies

- U.S. dominated the Stem Cell Manufacturing market with the largest revenue share of approximately 38.7% in 2025, supported by strong healthcare infrastructure, high clinical trial activity, early adoption of advanced biomanufacturing technologies, and the presence of key market players

- Canada is expected to be the fastest-growing country in the Stem Cell Manufacturing market during the forecast period, registering a CAGR of around 20.3%, driven by increasing investments in regenerative medicine research, expanding biomanufacturing facilities, and favorable government support for cell and gene therapies

- The research applications segment held the largest revenue share of 45.7% in 2025, supported by the rising number of preclinical studies, drug discovery programs, and regenerative medicine research

Report Scope and Stem Cell Manufacturing Market Segmentation

|

Attributes |

Stem Cell Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Stem Cell Manufacturing Market Trends

Enhanced Process Efficiency and Advanced Manufacturing Techniques

- A significant and accelerating trend in the global stem cell manufacturing market is the adoption of advanced automation, bioreactor systems, and scalable manufacturing techniques. This shift is enhancing the efficiency, consistency, and quality of stem cell production for clinical, research, and therapeutic applications

- For instance, in March 2023, Miltenyi Biotec launched its CliniMACS Prodigy v2.0 automated cell processing platform, designed to streamline cell isolation, expansion, and differentiation in a fully closed and GMP-compliant environment. Such innovations are enabling large-scale, reproducible stem cell production while reducing manual intervention and contamination risks

- The integration of modular bioreactors, real-time process monitoring, and standardized culture protocols is allowing manufacturers to produce high-quality stem cells at greater scales and lower costs, accelerating the adoption of stem cell therapies in regenerative medicine

- Adoption of continuous manufacturing processes, closed-system automation, and high-throughput production tools is transforming traditional stem cell production from small-scale laboratory setups to industrial-scale GMP-compliant operations, improving overall operational efficiency and reducing production bottlenecks

- This trend toward more standardized, efficient, and scalable manufacturing processes is reshaping expectations for stem cell therapy availability and accessibility

North America Stem Cell Manufacturing Market Dynamics

Driver

Growing Demand for Regenerative Medicine and Cell-Based Therapies

- The rising incidence of chronic diseases, injuries, and degenerative conditions is driving demand for regenerative therapies and stem cell-based treatments

- For instance, in November 2024, Lonza expanded its contract development and manufacturing services (CDMO) for autologous and allogeneic stem cell therapies, targeting higher production capacity to meet growing clinical trial and commercial demand

- This expansion is expected to support significant market growth in the forecast period

- Increasing adoption of cell-based therapies in oncology, cardiovascular, and neurological disorders is fueling investment in large-scale production facilities and specialized infrastructure

- Expanding clinical trial pipelines, increasing FDA approvals for cell therapies, and rising public and private funding for regenerative medicine research are further driving the growth of the Stem Cell Manufacturing market

Restraint/Challenge

High Production Costs and Regulatory Complexity

- The high cost of stem cell manufacturing, including labor-intensive processes, GMP-compliant facilities, and quality control measures, poses a significant barrier to market expansion

- For instance, companies such as Athersys and Pluristem report that scaling up allogeneic cell therapies often requires multi-million-dollar investments in infrastructure and process optimization before achieving commercial viability

- Regulatory complexity, including stringent safety, efficacy, and traceability requirements across different regions, can delay product approvals and increase operational costs

- Challenges in standardizing cell quality, potency, and batch consistency further constrain the widespread adoption of stem cell therapies

- Overcoming these challenges through advanced automation, process optimization, and harmonized regulatory frameworks is essential for sustaining long-term growth in the Stem Cell Manufacturing market

North America Stem Cell Manufacturing Market Scope

The market is segmented on the basis of product, application, end user, and distribution channel.

- By Product

On the basis of product, the Stem Cell Manufacturing market is segmented into stem cell lines, instruments, consumables & kits. The stem cell lines segment dominated the largest market revenue share of 42.5% in 2025, driven by the increasing use of pluripotent and multipotent stem cell lines in both research and clinical applications. Strong demand for well-characterized and ethically sourced cell lines, coupled with regulatory support for standardized stem cell repositories, has boosted adoption. Academic research, regenerative medicine, and translational studies contribute heavily to revenue. In addition, collaborations between cell line providers and pharmaceutical companies for preclinical and drug development studies further strengthen this segment. Rising investments in cell therapy and tissue engineering also sustain long-term growth in this category.

The instruments segment is expected to witness the fastest CAGR of 20.8% from 2026 to 2033, fueled by technological advancements in automated cell culture systems, bioreactors, and high-throughput analysis instruments. The increasing adoption of robotics and AI-based cell handling platforms in laboratories and clinical manufacturing units is driving growth. Instruments are critical for standardizing procedures, improving reproducibility, and ensuring GMP compliance. The demand is further supported by expanding stem cell research, growing regenerative medicine applications, and the need for precise and scalable solutions in cell and tissue manufacturing.

- By Application

On the basis of application, the market is segmented into research applications, clinical applications, cell and tissue banking, and others. The research applications segment held the largest revenue share of 45.7% in 2025, supported by the rising number of preclinical studies, drug discovery programs, and regenerative medicine research. Academic and industrial research centers are increasingly adopting stem cell-based models to study disease mechanisms, screen therapeutics, and develop novel treatments. Availability of diverse stem cell lines, coupled with growing government funding for biotechnology research, has fueled segment dominance. Multi-disciplinary research efforts, including organoid development and gene editing studies, contribute significantly to revenue generation.

The clinical applications segment is projected to witness the fastest CAGR of 19.6% during 2026–2033, driven by the increasing use of stem cells in cell therapy, tissue regeneration, and transplantation procedures. Rising approval of stem cell-based therapies, expanding clinical trial pipelines, and growing patient demand for regenerative treatments are key factors accelerating growth. Integration with personalized medicine approaches and advanced delivery systems further fuels adoption. Hospitals, specialty clinics, and biotechnology firms are rapidly incorporating stem cell therapies for cardiovascular, neurological, and orthopedic applications.

- By End User

On the basis of end user, the market is segmented into biotechnology & pharmaceutical companies, research institutes & academic institutions, cell banks & tissue banks, hospitals & surgical centers, and others. The biotechnology & pharmaceutical companies segment dominated the largest market revenue share of 47.3% in 2025, supported by high R&D spending, collaborations with academic institutes, and increasing investment in stem cell-based drug development. Companies are focusing on therapeutic applications, cell therapy platforms, and regenerative medicine solutions, driving market leadership. Licensing of cell lines and proprietary technology platforms also contributes significantly to revenue.

The research institutes & academic institutions segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, fueled by the growing number of stem cell research programs, government grants, and expansion of specialized laboratories. Increasing focus on translational research, organoid modeling, and disease modeling drives segment growth. The segment benefits from partnerships with industry players and adoption of advanced instruments and consumables for high-throughput studies. Emerging academic biotech clusters in Asia-Pacific and Europe are further contributing to rapid expansion.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales and third-party distributors. The direct sales segment held the largest revenue share of 55.2% in 2025, driven by close collaboration between manufacturers and end users, ensuring quality assurance, regulatory compliance, and customized solutions for laboratories and clinical centers. Direct engagement also enables technical support, training, and seamless integration of stem cell lines, instruments, and consumables into workflows.

The third-party distributors segment is expected to witness the fastest CAGR of 17.5% during 2026–2033, supported by the increasing penetration of stem cell products in emerging markets, growing e-commerce adoption, and the need for widespread availability of consumables and kits. Distributors help manufacturers reach smaller research facilities, hospitals, and tissue banks in remote regions, facilitating market expansion. Strategic partnerships and distribution agreements further boost segment growth globally.

North America Stem Cell Manufacturing Market Regional Analysis

- North America dominated the stem cell manufacturing market with the largest revenue share in 2025, driven by strong healthcare infrastructure, high clinical trial activity, early adoption of advanced biomanufacturing technologies, and the presence of key market players

- This development underscores the region’s focus on scaling regenerative medicine manufacturing to meet rising demand

- This widespread adoption is further supported by a technologically advanced healthcare ecosystem, high investment in research and development, and growing collaborations between biotechnology companies and academic institutions, establishing North America as a global hub for stem cell manufacturing

U.S. Stem Cell Manufacturing Market Insight

The U.S. stem cell manufacturing market captured the largest revenue share of approximately 38.7% in 2025, reflecting the country’s leading role in clinical research, adoption of novel biomanufacturing platforms, and the presence of major biotechnology and pharmaceutical companies. The U.S. market is further bolstered by ongoing clinical trials for stem cell therapies targeting oncology, autoimmune diseases, and musculoskeletal disorders, alongside early regulatory approvals that facilitate faster commercialization of innovative treatments.

Canada Stem Cell Manufacturing Market Insight

Canada stem cell manufacturing market is expected to be the fastest-growing country in the Stem Cell Manufacturing market, registering a CAGR of around 20.3% during the forecast period. This growth is fueled by increasing investment in regenerative medicine research, the establishment of new biomanufacturing facilities, and strong government support for cell and gene therapy initiatives. For example, in June 2022, the Centre for Commercialization of Regenerative Medicine (CCRM) opened a state-of-the-art manufacturing hub in Toronto to support clinical and commercial-scale production, reflecting Canada’s commitment to expanding capacity and capabilities in stem cell manufacturing. In addition, Canadian universities and biotech companies are actively collaborating on R&D projects, further driving innovation and market growth in the region.

North America Stem Cell Manufacturing Market Share

The Stem Cell Manufacturing industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Lonza Group (Switzerland)

- Merck KGaA (Germany)

- GE Healthcare Life Sciences (U.S.)

- STEMCELL Technologies (Canada)

- Fujifilm Cellular Dynamics (U.S.)

- Miltenyi Biotec (Germany)

- BioTime Inc. (U.S.)

- Cellular Biomedicine Group (China)

- Charles River Laboratories (U.S.)

- Cryo-Save (Netherlands)

- CryoCell International (U.S.)

- BioCision (U.S.)

- CCRM (Canada)

- Catalent, Inc. (U.S.)

- ReproCELL Inc. (Japan)

- Axiogenesis AG (Germany)

- CellGenix (Germany)

- Cellular Dynamics International (U.S.)

- Hitachi Chemical (Japan)

Latest Developments in North America Stem Cell Manufacturing Market

- In April 2023, the U.S. Food and Drug Administration approved Omisirge (omidubicel), a substantially modified allogeneic cord blood‑based stem cell therapy aimed at accelerating neutrophil recovery in patients after bone marrow transplantation, highlighting regulatory momentum for cell therapy products that support and drive stem cell manufacturing demand. The approval underscores increasing clinical acceptance of complex cell products that require advanced production and quality control capabilities, boosting demand for scalable manufacturing platforms and high‑quality culture systems tailored to these therapies

- In October 2023, Bayer AG opened a new cell therapy production plant in Berkeley, California, to support global supply of cell therapies and stem cell‑derived products, emphasizing strategic investments by major pharma in commercial‑scale manufacturing capacity. This investment reflects the industry’s focus on expanding end‑to‑end production infrastructure for cell‑based therapies, encompassing bioprocessing, quality assurance, and logistics to meet anticipated clinical and commercial demand

- In March 2025, STEMCELL Technologies acquired Cellular Highways and its innovative Highway1 microfluidic sorting technology, strengthening its portfolio of tools for high‑throughput and gentle cell sorting — critical steps in scalable stem cell manufacture and purification. This acquisition supports increased efficiency and viability in stem cell production workflows, positioning STEMCELL Technologies to better serve research and commercial manufacturing segments

- In February 2025, Hemostemix Inc. secured a global, perpetual, royalty‑free license to CytoImmune’s bioreactor stem cell technology, providing the company with advanced manufacturing capability to scale autologous and allogeneic stem cell products more cost‑effectively. This licensing deal highlights the strategic value of bioreactor technologies in streamlining stem cell expansion and supporting more competitive manufacturing operations

- In January 2025, Kyoto University’s CiRA Foundation began automated production of induced pluripotent stem cells (iPSCs) at a new facility in Osaka, Japan, using advanced culture automation to reduce production costs and support large‑scale regenerative medicine research. This marks a practical milestone in transitioning stem cell production from predominantly manual processes to more automated, scalable systems suitable for clinical applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.