North America Smoking Cessation And Nicotine De Addictions Market

Market Size in USD Billion

CAGR :

%

USD

74.27 Billion

USD

425.98 Billion

2024

2032

USD

74.27 Billion

USD

425.98 Billion

2024

2032

| 2025 –2032 | |

| USD 74.27 Billion | |

| USD 425.98 Billion | |

|

|

|

Smoking Cessation and Nicotine De-Addictions Market Analysis

The number of people addicted to smoking is rapidly growing all over the world. This population subset consists primarily of teenagers and the working population. The mortality rate from smoking is extremely high. The growing desire to quit smoking and the numerous health risks associated with smoking provide strong incentives for companies to develop novel smoking cessation products.

Smoking Cessation and Nicotine De-Addictions Market Size

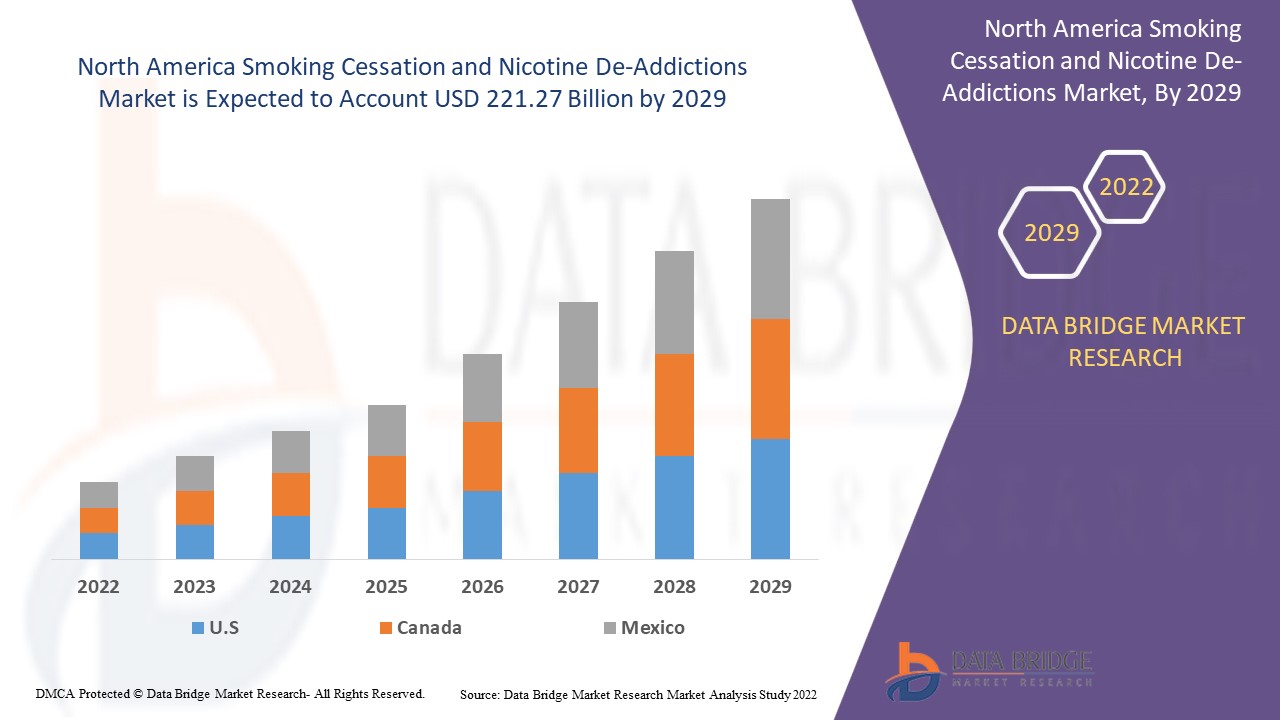

North America smoking cessation and nicotine de-addictions market size was valued at USD 74.27 billion in 2024 and is projected to reach USD 425.98 billion by 2032, with a CAGR of 1.5% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Smoking Cessation and Nicotine De-Addictions Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada and Mexico |

|

Key Market Players |

Imperial Brands (UK), 22nd Century Group, Inc (U.S), Pfizer Inc. (U.S). Dr. Reddy’s Laboratories Ltd (India), Glaxosmithkline Plc. (UK), British American Tobacco (UK), Cambrex Corporation (U.S), Cipla Inc. (U.S), Fertin Pharma (Denmark), Johnson & Johnson private limited (U.S), Perrigo Company Plc (Ireland) |

|

Market Opportunities |

|

Smoking Cessation and Nicotine De-Addictions Market Definition

Tobacco withdrawal is part of smoking cessation or nicotine de-addiction. Tobacco contains nicotine, which is known to cause addiction by releasing neurotransmitters such as dopamine, gamma-aminobutyric acid (GABA), and glutamate. Smoking cessation aids in the treatment of cigarette and tobacco addicts.

Smoking Cessation and Nicotine De-Addictions Market Dynamics

Drivers

- Rise in the number of people attempting to quit smoking around the world

One of the major factors driving the growth of the smoking cessation and nicotine de-addiction market is the increase in the number of people attempting to quit smoking around the world. Due to the toxic effects of nicotine and cigarette addiction on the cardiac and respiratory systems, the government emphasizes strict regulations to control nicotine and cigarette addiction, and high taxes on tobacco products accelerate market growth. Furthermore, high adoption of unhealthy lifestyle options, rapid urbanization, and an increase in disposable income all benefit the smoking cessation and nicotine de-addiction market.

- Strict regulations laid down by government to control nicotine and cigarette addiction

The government is emphasising strict regulations to control nicotine and cigarette addiction due to the toxic effects on the cardiac and respiratory systems. Smoking bans in public places, high taxes on tobacco products, and financial support for smoking cessation therapies are examples of government smoking cessation policies. As a result, during the forecast period, the global market for smoking cessation and nicotine de-addiction products is expected to grow rapidly.

Opportunities

The introduction of improved and innovative nicotine replacement therapy products is expected to be a significant driving force in the growth of the smoking cessation and nicotine de-addiction market. The rising prevalence of target diseases such as chronic obstructive pulmonary disease (COPD), asthma, cardiac diseases, and lung cancer, as well as growing public awareness of the dangers of smoking, are expected to drive market growth. An educational institution continue to be active in organising various campaigns and programmes to spread information about the harmful effects and consequences of smoking in order to raise the awareness of the young population.

Restraints

Reluctance to accept the treatment, on the other hand, is expected to stymie market growth. The smoking cessation and nicotine de-addiction market is expected to face challenges due to a lack of awareness in the forecast period.

This smoking cessation and nicotine de-addictions market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the smoking cessation and nicotine de-addictions market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Smoking Cessation and Nicotine De-Addictions Market Scope

The smoking cessation and nicotine de-addictions market is segmented on the basis of product type, treatment type, distribution channel and end-use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- With Nicotine

- Without Nicotine

Treatment type

- Pharmacological

- Therapies

- Others

Distribution channels

- Online

- Offline

End user

- Generation Z

- Millennials

- Generation X

- Silent Generation

Smoking Cessation and Nicotine De-Addictions Market Regional Analysis

The smoking cessation and nicotine de-addictions market is analyzed and market size insights and trends are provided by country, product type, treatment type, distribution channel and end-user as referenced above.

The countries covered in the smoking cessation and nicotine de-addictions market report are U.S., Canada and Mexico.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Smoking Cessation and Nicotine De-Addictions Market Share

The smoking cessation and nicotine de-addictions market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to smoking cessation and nicotine de-addictions market.

Smoking Cessation and Nicotine De-Addictions Market Leaders Operating in the Market Are:

- Imperial Brands (UK)

- 22nd Century Group, Inc (U.S)

- Pfizer Inc. (U.S)

- Dr. Reddy’s Laboratories Ltd (India)

- Glaxosmithkline Plc. (UK)

- British American Tobacco (UK)

- Cambrex Corporation (U.S)

- Cipla Inc. (U.S)

- Fertin Pharma (Denmark)

- Johnson & Johnson private limited (U.S)

- Perrigo Company Plc (Ireland)

Latest Developments in Smoking Cessation and Nicotine De-Addictions Market

- JB Chemicals & Pharmaceuticals will introduce medicated nicotine lozenges in May 2021 to help reduce the desire to consume or smoke tobacco.

- NFL Biosciences SA, a biopharmaceutical company developing botanical drugs for the treatment of addictions, will begin its CESTO II Phase II/III clinical trial in December 2021 to evaluate the efficacy and safety of its NFL-101 smoking cessation treatment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.