Market Analysis and Size

Smart homes are being high preferred among population as these are incorporated with advanced automated systems that are capable of controlling, temperature, multi-media, entertainment systems, security, thermostats, and window and door operations.

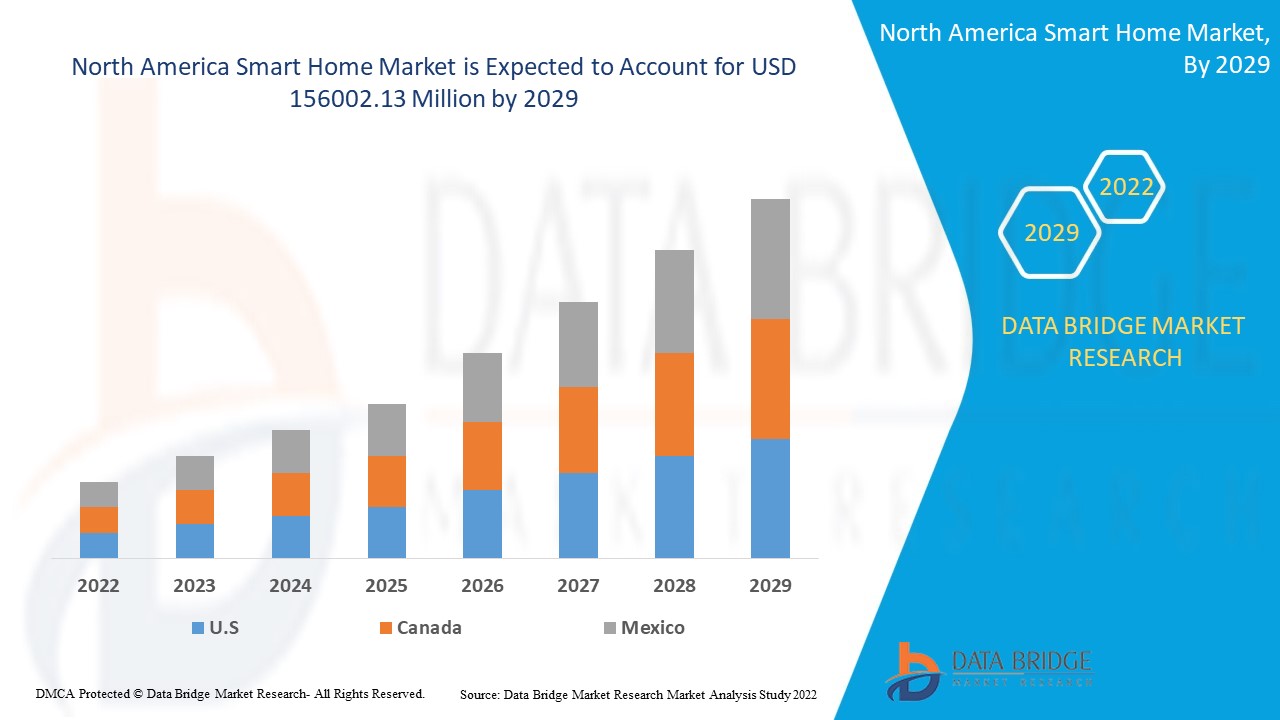

North America Smart Home Market was valued at USD 33150.75 million in 2021 and is expected to reach USD 156002.13 million by 2029, registering a CAGR of 18.30% during the forecast period of 2022-2029. Wireless accounts for the largest technology segment in the respective market owing to the rising number of IoT based devices. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Market Definition

Smart home devices are appropriate for a home setup in which devices may be operated remotely using a mobile or other networked device from any Internet-connected location in the world. The consumer may control services such as security access, temperature, lighting, and home entertainment in a smart home because all of its gadgets are connected to the Internet.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Entertainment Controls, Security and Access Control, HVAC Control, Home Appliances, Smart Kitchen, Lighting Control, Smart Furniture, Home Healthcare, Others), Technology (Wireless, Wired), Software and Service (Behavioral, Proactive), Sales Channel (Direct, Indirect) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Honeywell International Inc. (U.S.), Siemens (Germany), Johnson Controls (Ireland), Axis Communications AB (Sweden), Schneider Electric (France), ASSA ABLOY (Sweden), Amazon (U.S.), Apple Inc., (U.S.), ADT (US), ABB (Switzerland), Robert Bosch GmbH (Germany), Sony Corporation (Japan), Samsung (South Korea), Ooma Inc., (U.S.), Delta Controls (Canada), Comcast (U.S.), Crestron Electronics Inc., (U.S.), SimpliSafe Inc., (U.S.), Armorax (U.S.), LG Electronics (South Korea), Lutron Electronics Co., Inc (U.S.) and Legrand (France) |

|

Market Opportunities |

|

North America Smart Home Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Energy Efficiency and Low Carbon Emissions

The growing need for energy-saving and low-carbon-emission-oriented solutions propels the global smart home market. Energy efficiency is an important aspect of a country's economic development. There has been a growing demand to reduce energy usage and carbon emissions as a result of rising global warming and regulatory regulations. Smart homes account for a significant percentage of the world's total energy consumption. This factor is projected to be the most significant factor driving the growth for this market.

- Surge in Number of Smart Buildings

Additionally, with the growing urbanization in developing economies, there has been a surge in smart buildings, which is estimated to bolster the market's overall growth. Furthermore, the increasing number of internet users, growing adoption of smart devices, and increasing customer preference for video doorbells, voice-assisted technologies (such as Alexa and Google Home) and surveillance systems also further fuels market growth.

- Concerns Regarding Safety

Growing concerns regarding safety, security and public convenience also cushions the market's growth within the forecasted period. Moreover, the connected devices help consumers control and monitor the home appliances and office devices remotely from their smartphones or tablets, which acts as a market driver.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the smart home market.

Opportunities

- Technology Penetration and Investment

The penetration of IoT, z-wave, Wi-Fi, Bluetooth technology coupled with the investment in smart home security devices are estimated to generate lucrative opportunities for the market, which will further expand the smart home market's growth rate in the future. Additionally, the shifted focus on improving energy efficiency will also offer numerous growth opportunities within the market.

Restraints/Challenges North America Smart Home Market

- High Cost

The high cost for smart home setups is serving as a market restraint. The price range is expected to obstruct market growth.

- Increased Security and Privacy Concerns

Also, the consumer security and privacy concerns with more connected devices are projected to be challenge for the smart home market over the forecast period.

This smart home market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on smart home market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Covid-19 Impact on North America Smart Home Market

The smart home market was immensely impacted by the outbreak of COVID-19. The pandemic has significantly damaged and disrupted supply chain hubs across all major end verticals across the globe. The lockdown harmed production across the globe and will exacerbate the existing manufacturing slump and trade uncertainty. The United States has been hit the worst in manufacturing, with China's production capacity falling by over 14% and worldwide electronic component sales falling by nearly 40%. The industrial industry, which accounts for roughly 17% of global GDP, is one of the worst-affected sectors during the COVID-19 epidemic. China is in the epicenter of the pandemic and the hub for most raw material suppliers who supply raw materials and components to a variety of manufacturing units around the world. This has had a direct influence on global FDI inflows, and as a result, some economies around the world have experienced significant declines. The worldwide standoff has stifled production at these plants, causing the entire supply chain to fall apart.

To combat the spread of the virus and for economic reasons, large industrial corporations have closed their facilities and laid off their personnel. To survive during the pandemic, some manufacturers have begun to change their companies in order to be able to provide crucial or high-demand products.

Recent Developments

- In January 2021, Samsung introduced big capacity Variable Refrigerant Flow (VRF) air conditioning systems that can be placed in upscale apartments, villas, bungalows, houses, and commercial and retail businesses, in just 0.5 sq. m of area in India. Using the SmartThings app on any smartphone, the Wi-Fi-enabled DVM S Eco series delivers smart features like voice control and a linked home experience. For added convenience, each indoor unit can be controlled independently. Current, daily, weekly, or even monthly energy consumption can be tracked based on the use of outside equipment to provide energy efficiency. The DVM S Eco series is simple to install, with up to 16 indoor devices able to be set up at once.

North America Smart Home Market Scope

The smart home market is segmented on the basis of product type, technology, software and service and sales channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Entertainment Controls

- Security and Access Control

- HVAC Control

- Home Appliances

- Smart Kitchen

- Lighting Control

- Smart Furniture

- Home Healthcare

- Others

On the basis of product type, the smart home market is segmented into entertainment controls, security and access control, HVAC control, home appliances, smart kitchen, lighting control, smart furniture, home healthcare and others. The home appliances will hold the largest market share owing to the market availability of wireless solutions that have enabled smart appliances to connect with smartphones and tablets wirelessly via the Internet or Bluetooth.

Technology

- Wireless

- Wired

On the basis of technology, the smart home market is segmented into wireless and wired.

Software and Service

- Behavioral

- Proactive

On the basis of software and service, the smart home market is segmented into behavioral and proactive.

Sales Channel

- Direct

- Indirect

On the basis of sales channel, the smart home market is segmented into direct and indirect.

North America Smart Home Market Regional Analysis/Insights

The smart home market is analysed and market size insights and trends are provided by country, product type, technology, software and service and sales channel as referenced above.

The countries covered in the smart home market report are U.S., Canada and Mexico in North America.

U.S. country is dominating the North America smart home market due to supporting infrastructure and strong product offering owing to strong manufactures base. North America smart home market is growing due to the increasing adoption of IoT based home devices and supporting strong connectivity solution.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Smart Home Market

The smart home market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to smart home market.

Some of the major players operating in the smart home market are

- Honeywell International Inc. (U.S.)

- Siemens (Germany)

- Johnson Controls (Ireland)

- Axis Communications AB (Sweden)

- Schneider Electric (France)

- ASSA ABLOY (Sweden)

- Amazon (U.S.)

- Apple Inc., (U.S.)

- ADT (US)

- ABB (Switzerland)

- Robert Bosch GmbH (Germany)

- Sony Corporation (Japan)

- Samsung (South Korea)

- Ooma Inc., (U.S.)

- Delta Controls (Canada)

- Comcast (U.S.)

- Crestron Electronics Inc., (U.S.)

- SimpliSafe Inc., (U.S.)

- Armorax (U.S.)

- LG Electronics (South Korea)

- Lutron Electronics Co., Inc (U.S.)

- Legrand (France)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SMART HOMEMARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF INTERNET-ENABLED DEVICES

5.1.2 INCREASE IN USE OF SMARTPHONES FOR CONTROLLING SMART HOME APPLIANCES

5.1.3 GROWING AWARENESS ABOUT NEED OF ENERGY-EFFICIENT SOLUTIONS

5.1.4 INCREASING DISPOSABLE INCOME

5.2 RESTRAINTS

5.2.1 INCREASING CYBER SECURITY CONCERN TOWARDS AUTOMATION

5.2.2 HIGH INITIAL COST OF SMART HOME DEVICES

5.3 OPPORTUNITIES

5.3.1 INCREASING GREEN BUILDINGS BY GOVERNMENTS

5.3.2 INTEGRATION OF POWER LINE COMMUNICATION TECHNOLOGY IN SMART HOMES

5.3.3 LARGE NUMBER OF MANUFACTURERS EXPANDING THEIR SMART HOME PRODUCT PORTFOLIOS

5.3.4 INCREASING POPULARITY OF SMART HOME DEVICES IN DEVELOPING NATIONS

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS AND SKILLED WORKFORCE

6 NORTH AMERICA SMART HOME MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 ENTERTAINMENT CONTROLS

6.2.1 AUDIO, VOLUME, AND MULTIMEDIA ROOM CONTROLS

6.2.2 HOME THEATER SYSTEM CONTROLS

6.2.3 TOUCHSCREENS AND KEYPADS

6.3 SECURITY AND ACCESS CONTROL

6.3.1 VIDEO SURVEILLANCE

6.3.1.1 HARDWARE

6.3.1.1.1 SECURITY CAMERAS

6.3.1.1.2 STORAGE DEVICES

6.3.1.1.3 MONITORS

6.3.1.1.4 ACCESSORIES

6.3.1.2 SOFTWARE/VIDEO ANALYTICS

6.3.1.3 SERVICES

6.3.2 ACCESS CONTROL

6.3.2.1 NON-BIOMETRIC ACCESS CONTROL

6.3.2.1.1 SMART KEYPADS

6.3.2.1.2 VIDEO DOORBELLS

6.3.2.2 BIOMETRIC ACCESS CONTROL

6.3.2.2.1 FINGERPRINT RECOGNITION

6.3.2.2.2 FACIAL RECOGNITION

6.3.2.2.3 IRIS RECOGNITION

6.3.2.2.4 OTHERS

6.4 HVAC CONTROL

6.4.1 SMART THERMOSTATS

6.4.2 SENSORS

6.4.3 ACTUATORS

6.4.4 DAMPERS

6.4.5 CONTROL VALVES

6.4.6 HEATING AND COOLING COILS

6.4.7 PUMPS & FANS

6.4.8 SMART VENTS

6.5 HOME APPLIANCES

6.5.1 SMART WASHERS

6.5.2 SMART DRYERS

6.5.3 SMART WATER HEATERS

6.5.4 SMART VACUUM CLEANERS

6.6 SMART KITCHEN

6.6.1 SMART REFRIGERATORS

6.6.2 SMART DISHWASHERS

6.6.3 SMART COOKERS

6.6.4 SMART OVENS

6.6.5 SMART COOKTOPS

6.6.6 SMART COFFEE MAKERS

6.6.7 SMART KETTLES

6.7 LIGHTING CONTROL

6.7.1 DIMMERS

6.7.2 SWITCHES

6.7.3 RELAYS

6.7.4 DAYLIGHT SENSORS

6.7.5 TIMERS

6.7.6 OCCUPANCY SENSORS

6.7.7 ACCESSORIES AND OTHER PRODUCTS

6.8 SMART FURNITURE

6.8.1 SMART TABLES

6.8.2 SMART STOOLS AND BENCHES

6.8.3 SMART SOFAS

6.8.4 SMART CHAIRS

6.8.5 SMART DESKS

6.9 HOME HEALTHCARE

6.9.1 HEALTH STATUS MONITORS

6.9.2 PHYSICAL ACTIVITY MONITORS

6.1 OTHERS

6.10.1 SMART PLUGS

6.10.2 SMOKE DETECTORS

6.10.3 SMART METERS

7 NORTH AMERICA SMART HOME MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 WIRELESS

7.2.1 WI-FI

7.2.2 BLUETOOTH

7.2.3 ZIGBEE

7.2.4 Z-WAVE

7.2.5 ENOCEAN

7.2.6 OTHERS

7.3 WIRED

8 NORTH AMERICA SMART HOME MARKET, BY SOFTWARE & SERVICE

8.1 OVERVIEW

8.2 BEHAVIORAL

8.3 PROACTIVE

9 NORTH AMERICA SMART HOME MARKET, BY GEOGRAPHY

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA SMART HOME MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 COMPANY PROFILE

11.1 SAMSUNG

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENTS

11.2 ROBERT BOSCH GMBH

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENT

11.3 HAIER GROUP

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT DEVELOPMENTS

11.4 SIEMENS

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT & SERVICE PORTFOLIO

11.4.5 RECENT DEVELOPMENTS

11.5 SCHNEIDER ELECTRIC

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 COMPANY SHARE ANALYSIS

11.5.4 PRODUCT PORTFOLIO

11.5.5 RECENT DEVELOPMENTS

11.6 ABB

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENTS

11.7 ACUITY BRANDS LIGHTING, INC.

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT DEVELOPMENTS

11.8 ADT

11.8.1 COMPANY SNAPSHOT

11.8.2 REVENUE ANALYSIS

11.8.3 PRODUCT PORTFOLIO

11.8.4 RECENT DEVELOPMENTS

11.9 BRINKS HOME SECURITY

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENT

11.1 CARRIER

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENTS

11.11 CRESTRON ELECTRONICS, INC.

11.11.1 COMPANY SNAPSHOT

11.11.2 SOLUTION PORTFOLIO

11.11.3 RECENT DEVELOPMENTS

11.12 EMERSON ELECTRIC CO.

11.12.1 COMPANY SNAPSHOT

11.12.2 REVENUE ANALYSIS

11.12.3 PRODUCT PORTFOLIO

11.12.4 RECENT DEVELOPMENTS

11.13 GENERAL ELECTRIC COMPANY (A SUBSIDIARY OF GENERAL ELECTRIC)

11.13.1 COMPANY SNAPSHOT

11.13.2 REVENUE ANALYSIS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT DEVELOPMENTS

11.14 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

11.14.1 COMPANY SNAPSHOT

11.14.2 REVENUE ANALYSIS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT DEVELOPMENT

11.15 HANWHA TECHWIN AMERICA.

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENTS

11.16 JOHNSON CONTROLS

11.16.1 COMPANY SNAPSHOT

11.16.2 REVENUE ANALYSIS

11.16.3 PRODUCT PORTFOLIO

11.16.4 RECENT DEVELOPMENTS

11.17 KUNA SYSTEMS

11.17.1 COMPANY SNAPSHOT

11.17.2 PRODUCT PORTFOLIO

11.17.3 RECENT DEVELOPMENTS

11.18 LEGRAND

11.18.1 COMPANY SNAPSHOT

11.18.2 REVENUE ANALYSIS

11.18.3 SOLUTION PORTFOLIO

11.18.4 RECENT DEVELOPMENTS

11.19 LEVITON MANUFACTURING CO., INC.

11.19.1 COMPANY SNAPSHOT

11.19.2 PRODUCT PORTFOLIO

11.19.3 RECENT DEVELOPMENTS

11.2 LIFI LABS, INC.

11.20.1 COMPANY SNAPSHOT

11.20.2 PRODUCT PORTFOLIO

11.20.3 RECENT DEVELOPMENT

11.21 LUTRON ELECTRONICS CO., INC.

11.21.1 COMPANY SNAPSHOT

11.21.2 PRODUCT PORTFOLIO

11.21.3 RECENT DEVELOPMENTS

11.22 NICE S.P.A.

11.22.1 COMPANY SNAPSHOT

11.22.2 REVENUE ANALYSIS

11.22.3 SOLUTION PORTFOLIO

11.22.4 RECENT DEVELOPMENTS

11.23 RESIDEO TECHNOLOGIES INC.

11.23.1 COMPANY SNAPSHOT

11.23.2 REVENUE ANALYSIS

11.23.3 PRODUCT PORTFOLIO

11.23.4 RECENT DEVELOPMENTS

11.24 SLEEP NUMBER CORPORATION

11.24.1 COMPANY SNAPSHOT

11.24.2 REVENUE ANALYSIS

11.24.3 PRODUCT PORTFOLIO

11.24.4 RECENT DEVELOPMENT

11.25 SWITCHMATE

11.25.1 COMPANY SNAPSHOT

11.25.2 PRODUCT PORTFOLIO

11.25.3 RECENT DEVELOPMENT

11.26 THE CHAMBERLAIN GROUP INC.

11.26.1 COMPANY SNAPSHOT

11.26.2 PRODUCT PORTFOLIO

11.26.3 RECENT DEVELOPMENT

11.27 VIVINT, INC.

11.27.1 COMPANY SNAPSHOT

11.27.2 PRODUCT PORTFOLIO

11.27.3 RECENT DEVELOPMENTS

12 SWOT & DATA BRIDGE MARKET RESEARCH ANALYSIS

12.1 DATA BRIDGE MARKET RESEARCH ANALYSIS

13 CONCLUSION

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 2 NORTH AMERICA ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 NORTH AMERICA ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 4 NORTH AMERICA SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE ,2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 7 NORTH AMERICA HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 8 NORTH AMERICA ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2020-2027 (USD MILLION)

TABLE 11 NORTH AMERICA HVAC CONTROL IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2020-2027 (USD MILLION)

TABLE 13 NORTH AMERICA HOME APPLIANCES IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 15 NORTH AMERICA SMART KITCHEN IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA LIGHTING CONTROL IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 NORTH AMERICA LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA SMART FURNITURE IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA HOME HEALTHCARE IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA OTHERS IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS IN SMART HOME MARKET, BY TYPE, 2020-2027 (USD MILLION)

TABLE 25 NORTH AMERICA SMART HOME MARKET, BY TECHNOLOGY 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICA WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA WIRED TECHNOLOGY IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICA SMART HOME MARKET, BY SOFTWARE & SERVICE 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA BEHAVIORAL IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA PROACTIVE IN SMART HOME MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA SMART HOME MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 34 NORTH AMERICA ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 35 NORTH AMERICA SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 36 NORTH AMERICA VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 37 NORTH AMERICA HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 38 NORTH AMERICA ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICA BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 41 NORTH AMERICA HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 42 NORTH AMERICA HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 43 NORTH AMERICA SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 44 NORTH AMERICA LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 47 NORTH AMERICA OTHERS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 48 NORTH AMERICA SMART HOME MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 49 NORTH AMERICA WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 50 NORTH AMERICA SMART HOME MARKET, BY SOFTWARE & SERVICE, 2018-2027 (USD MILLION)

TABLE 51 U.S. SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 52 U.S. ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 53 U.S. SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 54 U.S. VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 55 U.S. HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 56 U.S. ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 U.S. NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 58 U.S. BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 59 U.S. HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 60 U.S. HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 61 U.S. SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 U.S. LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 63 U.S. SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 64 U.S. HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 65 U.S. OTHERS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 66 U.S. SMART HOME MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 67 U.S. WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 68 U.S. SMART HOME MARKET, BY SOFTWARE & SERVICE, 2018-2027 (USD MILLION)

TABLE 69 CANADA SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 70 CANADA ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 71 CANADA SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 CANADA VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 73 CANADA HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 74 CANADA ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 75 CANADA NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 76 CANADA BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 77 CANADA HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 78 CANADA HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 79 CANADA SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 80 CANADA LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 81 CANADA SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 82 CANADA HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 83 CANADA OTHERS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 84 CANADA SMART HOME MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 85 CANADA WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 86 CANADA SMART HOME MARKET, BY SOFTWARE & SERVICE, 2018-2027 (USD MILLION)

TABLE 87 MEXICO SMART HOME MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 88 MEXICO ENTERTAINMENT CONTROLS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 89 MEXICO SECURITY AND ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 90 MEXICO VIDEO SURVEILLANCE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 91 MEXICO HARDWARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 92 MEXICO ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 93 MEXICO NON-BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 94 MEXICO BIOMETRIC ACCESS CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 95 MEXICO HVAC CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 96 MEXICO HOME APPLIANCES IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 97 MEXICO SMART KITCHEN IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 98 MEXICO LIGHTING CONTROL IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 99 MEXICO SMART FURNITURE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 100 MEXICO HOME HEALTHCARE IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 101 MEXICO OTHERS IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 102 MEXICO SMART HOME MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 103 MEXICO WIRELESS TECHNOLOGY IN SMART HOME MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 104 MEXICO SMART HOME MARKET, BY SOFTWARE & SERVICE, 2018-2027 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA SMART HOME MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SMART HOME MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SMART HOME MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SMART HOME MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SMART HOME MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SMART HOME MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SMART HOME MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SMART HOME MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SMART HOME MARKET: SEGMENTATION

FIGURE 10 INCREASING DISPOSABLE INCOME IS EXPECTED TO DRIVE THE NORTH AMERICA SMART HOME MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 ENTERTAINMENT CONTROLS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA SMART HOME MARKET IN 2020 & 2027

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE THE MARKET WHEREAS ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE NORTH AMERICA SMART HOME MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 DRIVERS, RESTRAINS, OPPORTUNITIES & CHALLENGE OF NORTH AMERICA SMART HOME MARKET

FIGURE 14 NORTH AMERICA SMART HOME MARKET: BY PRODUCT TYPE, 2019

FIGURE 15 NORTH AMERICA SMART HOME MARKET: BY TECHNOLOGY, 2019

FIGURE 16 NORTH AMERICA SMART HOME MARKET: BY SOFTWARE & SERVICE, 2019

FIGURE 17 NORTH AMERICA SMART HOME MARKET: SNAPSHOT (2019)

FIGURE 18 NORTH AMERICA SMART HOME MARKET: BY COUNTRY (2019)

FIGURE 19 NORTH AMERICA SMART HOME MARKET: BY COUNTRY (2020 & 2027)

FIGURE 20 NORTH AMERICA SMART HOME MARKET: BY COUNTRY (2019 & 2027)

FIGURE 21 NORTH AMERICA SMART HOME MARKET: BY PRODUCT TYPE (2020-2027)

FIGURE 22 NORTH AMERICA SMART HOME MARKET: COMPANY SHARE 2019 (%)

North America Smart Home Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Smart Home Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Smart Home Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.