North America Small Molecule Sterile Injectable Drugs Market

Market Size in USD Billion

CAGR :

%

USD

72.66 Billion

USD

127.67 Billion

2025

2033

USD

72.66 Billion

USD

127.67 Billion

2025

2033

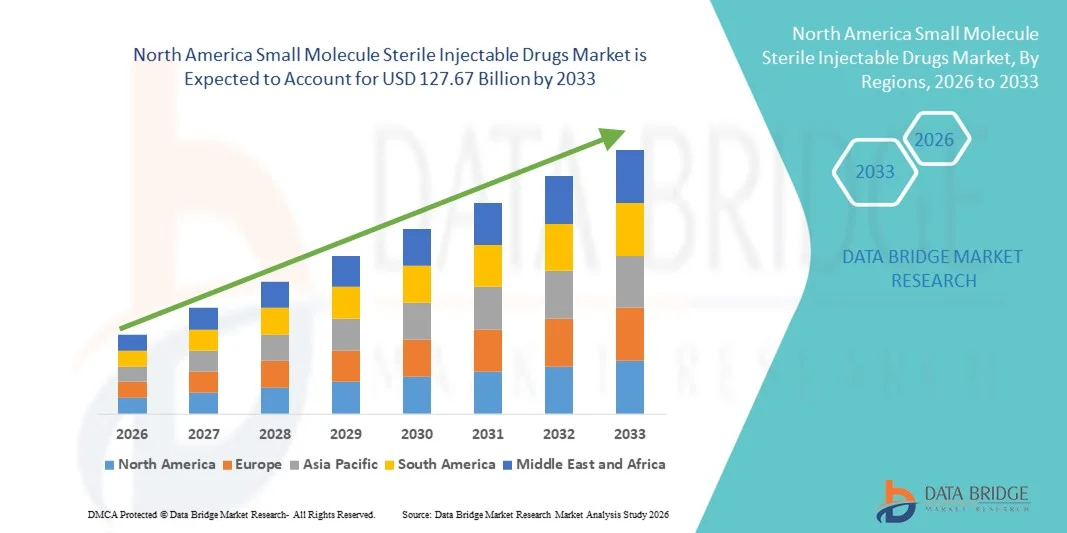

| 2026 –2033 | |

| USD 72.66 Billion | |

| USD 127.67 Billion | |

|

|

|

|

North America Small Molecule Sterile Injectable Drugs Market Size

- The North America small molecule sterile injectable drugs market size was valued at USD 72.66 billion in 2025 and is expected to reach USD 127.67 billion by 2033, at a CAGR of 7.3% during the forecast period

- The market growth is largely fueled by rising prevalence of chronic diseases, increased demand for oncology and specialty injectable treatments, and expanding hospital and specialty clinic infrastructure in North America, driving higher adoption of advanced small molecule sterile injectable therapies

- Furthermore, strong healthcare systems, technological progress in vial and syringe filling, growing preference for direct tender and hospital distribution channels, and investments in drug delivery innovation are accelerating uptake of small molecule sterile injectables across clinical and acute care settings, significantly boosting industry growth

North America Small Molecule Sterile Injectable Drugs Market Analysis

- Small molecule sterile injectable drugs, used for precise therapeutic delivery of active pharmaceutical ingredients, are increasingly vital in treating chronic, oncology, and specialty diseases in both hospital and clinical settings due to their rapid onset, controlled dosing, and stability compared to oral formulations

- The escalating demand for small molecule sterile injectables is primarily fueled by the rising prevalence of chronic and complex diseases, advancements in sterile manufacturing technologies, and a growing preference for hospital-administered injectable therapies over traditional oral medications

- The United States dominated the small molecule sterile injectable drugs market with the largest revenue share of 70.6% in 2025, characterized by advanced healthcare infrastructure, high per capita healthcare spending, and a strong presence of key pharmaceutical manufacturers, experiencing substantial growth in hospital and specialty clinic adoption driven by innovations in vial filling, prefilled syringes, and biologically stable formulations

- Canada is expected to be the fastest-growing country in the small molecule sterile injectable drugs market during the forecast period due to increasing investments in sterile drug manufacturing facilities and rising adoption of injectable therapies for chronic disease management

- Vial filling segment dominated the small molecule sterile injectable drugs market with a market share of 44.3% in 2025, driven by its established reliability, compatibility with a wide range of drug formulations, and widespread adoption across hospitals and specialty clinics

Report Scope and North America Small Molecule Sterile Injectable Drugs Market Segmentation

|

Attributes |

North America Small Molecule Sterile Injectable Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Small Molecule Sterile Injectable Drugs Market Trends

Enhanced Convenience Through Prefilled Syringes and Automation

- A significant and accelerating trend in the North America small molecule sterile injectable drugs market is the increasing adoption of prefilled syringes and automated filling systems, which streamline drug delivery, reduce dosing errors, and enhance patient safety across hospital and clinical settings

- For instance, prefilled syringe systems from Becton Dickinson allow precise dosing and reduce preparation time, supporting safer administration of oncology and specialty drugs. Similarly, Gerresheimer’s automated filling lines are widely used in North American facilities for high-volume sterile injectables

- Automation in sterile injectable manufacturing enables features such as reduced human contact with drugs, consistent dosing accuracy, and enhanced sterility, improving overall quality assurance. For instance, automated vial filling lines from Flexicon improve throughput and minimize contamination risks in hospital and specialty clinic environments

- The integration of prefilled syringes and automated filling systems facilitates centralized and scalable production, allowing pharmaceutical companies to efficiently supply multiple hospitals and specialty clinics from a single production line

- This trend toward more precise, safe, and efficient injectable drug delivery is fundamentally reshaping expectations for sterile therapies. Consequently, companies such as Pfizer and Fresenius Kabi are developing prefilled and automated injectable solutions with enhanced dosing accuracy and reduced preparation time

- The demand for prefilled syringes and automated sterile drug delivery systems is growing rapidly across both hospital and specialty clinic settings, as healthcare providers increasingly prioritize efficiency, safety, and reduced handling errors

- Emerging AI-driven monitoring in automated filling systems allows predictive maintenance and reduces downtime, ensuring uninterrupted supply of high-demand injectables. For instance, some hospital-based filling systems now alert technicians to potential equipment failures before they occur

North America Small Molecule Sterile Injectable Drugs Market Dynamics

Driver

Growing Need Due to Rising Chronic Disease Prevalence and Hospital Adoption

- The increasing prevalence of chronic and complex diseases, coupled with growing hospital and specialty clinic adoption, is a significant driver for the heightened demand for small molecule sterile injectables

- For instance, in March 2025, Pfizer expanded its sterile injectable production capacity in the U.S. to meet growing demand for oncology therapies, reflecting investments in state-of-the-art vial filling and prefilled syringe capabilities

- As hospitals and clinics seek reliable injectable therapies for targeted treatment, sterile injectables offer advanced features such as consistent dosing, rapid therapeutic onset, and reduced contamination risk, providing a compelling advantage over oral medications

- Furthermore, the growing expansion of hospital networks and specialty care centers and the increasing adoption of advanced drug delivery devices are making sterile injectables an integral component of modern healthcare

- The convenience of prefilled syringes, ready-to-use vials, and automated filling systems, along with the ability to efficiently manage high patient volumes, are key factors propelling the adoption of small molecule sterile injectables in both acute and outpatient settings

- Government healthcare initiatives and reimbursement policies supporting hospital-administered injectable therapies are further driving market growth. For instance, U.S. CMS programs reimburse certain injectable treatments, encouraging hospitals to adopt prefilled and automated solutions

- Rising collaborations between pharmaceutical companies and contract manufacturing organizations (CMOs) for sterile injectables production are accelerating availability and distribution. For instance, Lonza and Catalent partnerships have expanded capacity for oncology and specialty injectables across U.S. hospitals

- Increased patient awareness and physician preference for safer, ready-to-use injectable formulations also contribute to higher demand, reducing medication errors and preparation time in clinical workflows. For instance, hospitals report higher adoption rates of prefilled oncology injectables due to improved safety and convenience

Restraint/Challenge

Production Complexity and Regulatory Compliance Hurdles

- Concerns surrounding the complex manufacturing processes and stringent regulatory requirements for sterile injectables pose a significant challenge to broader market penetration. As sterile drugs require aseptic processing, they are susceptible to contamination risks, raising compliance challenges among manufacturers

- For instance, high-profile FDA warning letters for sterile injectable facilities have made some smaller manufacturers hesitant to expand capacity or enter the market

- Addressing these challenges through advanced cleanroom technology, validated aseptic processes, and robust quality management systems is crucial for building regulatory compliance. Companies such as Baxter and Becton Dickinson emphasize their sterile manufacturing standards and quality certifications to reassure regulators and buyers

- In addition, the relatively high cost of establishing and maintaining sterile production lines compared to conventional oral drug manufacturing can be a barrier for new entrants or smaller players, particularly in cost-sensitive markets. While investments in automation are reducing per-unit costs, advanced technologies often require substantial upfront capital

- Overcoming these challenges through enhanced manufacturing practices, regulatory guidance adherence, and strategic investment in automated systems will be vital for sustained market growth

- Stringent post-market surveillance requirements and documentation obligations increase operational complexity for manufacturers. For instance, FDA and Health Canada require extensive batch testing and reporting, adding time and cost to sterile injectable production

- Skilled workforce shortages in aseptic manufacturing further constrain capacity expansion and innovation. For instance, hospitals and CMOs report difficulties hiring trained aseptic technicians to operate advanced vial filling and prefilled syringe systems

North America Small Molecule Sterile Injectable Drugs Market Scope

The market is segmented on the basis of product, application, end-users, and distribution channels.

- By Product

On the basis of product, the market is segmented into vial filling, syringe filling, cartridge filling, and others. The vial filling segment dominated the market with the largest market revenue share of 44.3% in 2025, driven by its widespread adoption in hospitals and specialty clinics due to reliability, compatibility with various drug formulations, and long-standing use in sterile injectable delivery. Vial filling systems support high-volume production and allow accurate dosing for complex treatments such as oncology and cardiovascular drugs. Hospitals often prefer vial-based injectables for multi-patient administration, as they provide flexibility in dosing and storage. In addition, vial filling lines are well-supported by automation and quality control technologies, reducing contamination risks and ensuring regulatory compliance. The segment benefits from established infrastructure and training, which facilitates rapid adoption across North American healthcare facilities. The familiarity and proven efficacy of vials continue to reinforce their dominant market position.

The syringe filling segment is expected to witness the fastest growth rate of 13.5% from 2026 to 2033, fueled by the rising demand for prefilled syringes that enhance patient safety, reduce preparation errors, and improve convenience in hospital, specialty clinic, and home care settings. Prefilled syringes reduce handling time for nurses and healthcare providers, particularly for high-risk drugs such as biologics and oncology injectables. They also minimize the risk of contamination, making them ideal for outpatient and home care environments. Manufacturers are increasingly investing in automated syringe filling lines to meet growing demand, supported by trends in ready-to-use formulations. The segment also benefits from favorable reimbursement policies and government initiatives promoting safe injectable therapies. Design innovations, such as compact and ergonomically optimized syringes, further contribute to accelerating adoption.

- By Application

On the basis of application, the market is segmented into oncology, infectious diseases, cardiovascular diseases, metabolic diseases, neurology, dermatology, urology, autoimmune diseases, respiratory disorders, and others. The oncology segment dominated the market with a market share of 41.5% in 2025, driven by the high prevalence of cancer in North America and the critical need for precise, controlled injectable therapies. Oncology injectables often require strict dosing schedules, sterile handling, and specialized administration techniques, which make vial and prefilled syringe formats essential. Hospitals and specialty cancer centers prefer established injectable formats for multi-patient use and safe handling. The segment also benefits from continuous R&D in oncology drugs, leading to the introduction of novel sterile injectable therapies. Advanced treatments, such as combination chemotherapy and targeted biologics, further boost the demand for sterile injectables in oncology. In addition, regulatory approvals and reimbursement policies for cancer therapies enhance the market’s revenue potential. Patient and clinician awareness of injectable efficacy strengthens the segment’s dominance.

The infectious diseases segment is expected to witness the fastest growth rate of 14.2% from 2026 to 2033, driven by rising vaccination campaigns, hospital-based therapies, and the increasing prevalence of drug-resistant infections requiring injectable treatment. Prefilled and vial-based injectables are preferred for consistent dosing and sterility in immunization and antibiotic delivery. Manufacturers are expanding production capacities to meet seasonal spikes and emerging pathogen outbreaks. Growth is supported by government initiatives, such as vaccination programs and infectious disease treatment subsidies. The adoption of rapid, ready-to-use injectable formulations reduces preparation time and errors in hospitals and clinics. Awareness programs targeting healthcare providers and patients further contribute to segment growth.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, specialty clinics, home care settings, and others. The hospitals segment dominated the market with the largest revenue share of 47.8% in 2025, driven by the high patient volume, complex treatment requirements, and preference for sterile injectable administration under controlled conditions. Hospitals often use vial and prefilled syringe formats for oncology, cardiovascular, and infectious disease therapies. Advanced infrastructure and trained healthcare personnel facilitate safe handling and compliance with regulatory standards. Hospitals also adopt automation in vial and syringe filling for efficiency and sterility. The growing prevalence of chronic and specialty diseases increases hospital demand for injectable therapies. Hospitals’ strong purchasing power enables bulk procurement and adoption of technologically advanced systems. Integration with electronic health records further supports streamlined administration.

The home care settings segment is expected to witness the fastest growth rate of 15.1% from 2026 to 2033, fueled by the rising preference for at-home treatments, particularly for chronic diseases and long-term therapies. Prefilled syringes and ready-to-use injectables enable patients to self-administer medications safely. Increasing awareness of home care advantages, such as convenience and reduced hospital visits, supports adoption. Telehealth and nurse-assisted programs provide guidance for proper administration, boosting confidence in home-based injectable therapies. The segment benefits from innovations in compact, easy-to-use delivery devices. Reimbursement policies and insurance coverage for home care also accelerate growth. Home care settings increasingly prefer prefilled systems for error reduction and improved patient adherence.

- By Distribution Channels

On the basis of distribution channels, the market is segmented into direct tender, retail pharmacy, online pharmacy, and others. The direct tender segment dominated the market with the largest revenue share of 43.9% in 2025, driven by bulk procurement by hospitals and specialty clinics to ensure steady supply and regulatory compliance. Direct tender allows healthcare institutions to secure high-demand injectable drugs at negotiated prices, often with guaranteed delivery schedules. Manufacturers benefit from predictable demand and long-term contracts. The approach ensures consistent quality and reduces the risk of counterfeiting. Hospitals and clinics prefer direct tender for critical injectable therapies, such as oncology and cardiovascular drugs. The segment is supported by strong manufacturer-hospital partnerships and streamlined logistics networks. High-volume procurement further reinforces the segment’s dominance.

The online pharmacy segment is expected to witness the fastest growth rate of 18.3% from 2026 to 2033, fueled by the rising adoption of digital healthcare platforms, increasing e-commerce penetration, and patient demand for home delivery of prefilled syringes and ready-to-use injectables. Online pharmacies provide convenience, easy access, and subscription-based delivery for chronic disease therapies. Growth is supported by regulatory approvals for online dispensing and secure digital prescription systems. Patients increasingly prefer online purchase to reduce hospital visits. Telehealth services complement online pharmacies by guiding proper injectable administration. Innovations in cold-chain logistics for injectable delivery further enhance segment growth.

North America Small Molecule Sterile Injectable Drugs Market Regional Analysis

- The United States dominated the small molecule sterile injectable drugs market with the largest revenue share of 70.6% in 2025, characterized by advanced healthcare infrastructure, high per capita healthcare spending, and a strong presence of key pharmaceutical manufacturers

- Healthcare providers in the country highly value the reliability, dosing accuracy, and sterility offered by vial and prefilled syringe injectables, as well as the seamless integration of automated filling and delivery systems in hospital and specialty clinic workflows

- This widespread adoption is further supported by favorable reimbursement policies, large hospital networks, government healthcare initiatives, and increasing patient awareness of safe injectable therapies, establishing small molecule sterile injectables as a preferred treatment option for both acute and chronic disease management

The U.S. Small Molecule Sterile Injectable Drugs Market Insight

The U.S. small molecule sterile injectable drugs market captured the largest revenue share of 70.6% in 2025 within North America, fueled by a high prevalence of chronic and specialty diseases and the country’s advanced healthcare infrastructure. Hospitals and specialty clinics are increasingly prioritizing reliable, ready-to-use injectables such as vial and prefilled syringe formats to ensure patient safety and dosing accuracy. The growing adoption of automated filling lines and prefilled syringe systems further propels market growth. Moreover, favorable reimbursement policies, government healthcare initiatives, and strong pharmaceutical manufacturing capabilities are significantly contributing to the expansion of the U.S. market.

Canada Small Molecule Sterile Injectable Drugs Market Insight

The Canada small molecule sterile injectable drugs market is projected to grow at a substantial CAGR throughout the forecast period, driven by increasing investments in sterile manufacturing facilities and rising adoption of injectable therapies for chronic and specialty diseases. Healthcare providers in Canada are adopting prefilled syringes and automated vial filling technologies to improve patient safety and reduce preparation errors. The region also benefits from strong regulatory support, government programs promoting hospital-administered therapies, and growing awareness among clinicians and patients regarding injectable treatment efficacy.

Mexico Small Molecule Sterile Injectable Drugs Market Insight

The Mexico small molecule sterile injectable drugs market is anticipated to expand at a noteworthy CAGR during the forecast period, fueled by improvements in healthcare infrastructure and increasing access to advanced injectable therapies. Growing prevalence of infectious diseases, oncology treatments, and chronic condition management is driving demand for sterile injectables. In addition, partnerships with multinational pharmaceutical companies and contract manufacturing organizations (CMOs) are accelerating the availability of prefilled syringes and vial-based products. Rising patient awareness and preference for hospital-administered injectables further support market growth.

North America Small Molecule Sterile Injectable Drugs Market Share

The North America Small Molecule Sterile Injectable Drugs industry is primarily led by well-established companies, including:

- Pfizer Inc., (U.S.)

- Merck & Co. Inc., (U.S.)

- American Injectables, (U.S.)

- Grand River Aseptic Manufacturing, (U.S.)

- Hikma Pharmaceuticals PLC, (U.K.)

- Amgen Inc., (U.S.)

- Gilead Sciences, Inc., (U.S.)

- Bristol‑Myers Squibb Company, (U.S.)

- AbbVie Inc., (U.S.)

- Teligent, Inc., (U.S.)

- Fresenius Kabi USA, (U.S.)

- Par Pharmaceutical, Inc., (U.S.)

- Sandoz, (Switzerland)

- Civica Rx, (U.S.)

- Baxter (U.S.)

- Gland Pharma Limited, (India)

- Sun Pharmaceutical Industries Ltd., (India)

- 3M (U.S.)

- BioCryst Pharmaceuticals, Inc., (U.S.)

What are the Recent Developments in North America Small Molecule Sterile Injectable Drugs Market?

- In May 2025, Avenacy launched Doxycycline for Injection, USP in the U.S. market. Avenacy expanded its injectable portfolio with the FDA‑approved generic Doxycycline for Injection, indicated for treating various bacterial infections. The introduction supports broader adoption of injectable antibiotics and demonstrates the company’s continued momentum in supplying high‑demand sterile injectables. This launch also reflects the industry focus on expanding essential sterile drug availability

- In March 2025, Avenacy announced the launch of five major injectable antibiotic products in the U.S. market. Avenacy, a specialty pharmaceutical company focused on critical injectables, launched five widely used antibiotic injectables including Ampicillin and Piperacillin‑Tazobactam for Injection significantly expanding its portfolio of FDA‑approved injectable medicines

- In June 2024, Avenacy launched Prochlorperazine Edisylate Injection, USP in the U.S. Avenacy added Prochlorperazine Edisylate Injection a generic injectable indicated to control severe nausea and vomiting to its growing U.S. sterile injectable portfolio, further diversifying the range of available critical care sterile therapies. This launch highlights ongoing expansion in key therapeutic segments within the small molecule injectable space

- In April 2024, Avenacy announced the launch of Propofol Injectable Emulsion, USP in the U.S. Avenacy introduced Propofol Injectable Emulsion, a generic equivalent of a widely used anesthetic, into the U.S. sterile injectable market. This launch marked continued expansion of its portfolio and aided healthcare facilities in securing essential injectable sedation agents, particularly important in surgical and critical care environments

- In March 2023, Hikma Pharmaceuticals launched four new sterile injectable medicines in Canada. Hikma expanded its North American presence by introducing four sterile injectable medicines including Dantrolene Sodium and Micafungin Sodium for Injection into the Canadian market. These represented the first or second generic versions of these drugs in Canada and broadened treatment options for healthcare providers across therapeutic areas

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.