North America Self Leveling Concrete Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

1.77 Billion

2024

2032

USD

1.20 Billion

USD

1.77 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 1.77 Billion | |

|

|

|

|

Self-leveling Concrete Market Size

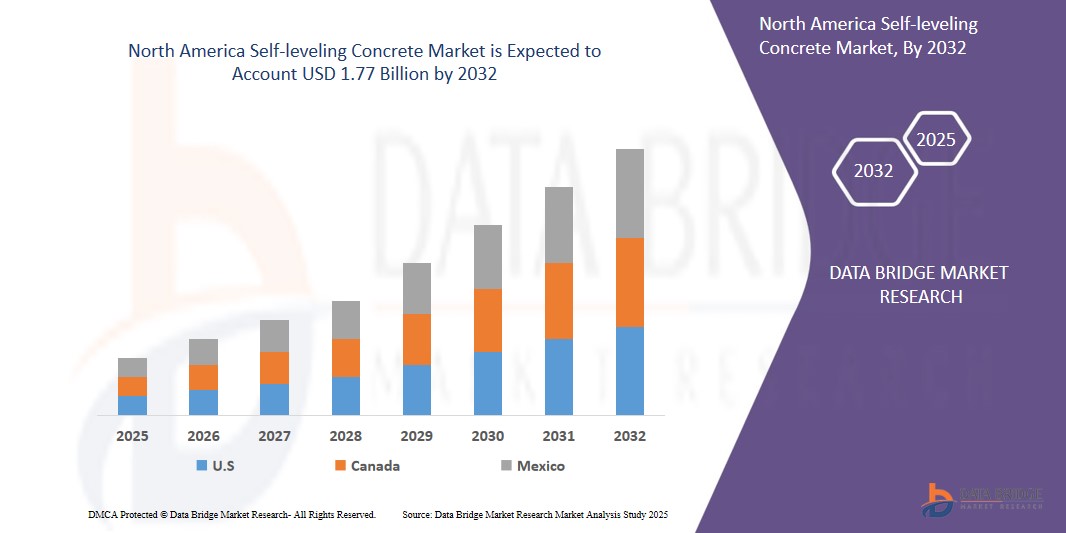

- The North America Self-leveling Concrete Market size was valued at USD 1.2 Billion in 2024 and is expected to reach USD 1.77 Billion by 2032, at a CAGR of 5.1% during the forecast period

- The market growth is largely fueled by rapid urbanization, infrastructure development, rising demand for smooth flooring solutions, increased commercial construction, government investments in smart cities, and growing awareness of the benefits of self-leveling concrete in both residential and industrial sectors.

- Furthermore, technological advancements in self-leveling formulations, increased renovation activities, rising adoption in healthcare and education infrastructure, and expanding construction sectors are enhancing market opportunities across the North America region.

Self-leveling Concrete Market Analysis

- The self-leveling concrete market is growing due to increasing construction activities, urbanization, and demand for fast, durable, and smooth flooring solutions across residential, commercial, and industrial sectors in emerging economies.

- Technological innovations, such as improved flowability and rapid curing formulations, combined with rising infrastructure investments in the North America, are driving market expansion and adoption across various applications.

- U.S. dominates the Self-leveling Concrete Market with the largest revenue share of 78% in 2025, characterized by extensive infrastructure projects under Vision 2030, rapid urbanization, increased government investments in smart cities, booming commercial and residential construction, and strong demand for durable, efficient flooring solutions across diverse industries.

- Mexico is expected to be the fastest-growing region in the Self-leveling Concrete Market, driven by massive infrastructure projects, booming real estate development, tourism expansion, and government initiatives aimed at establishing the country as a global business and urban innovation hub.

- Underlayment segment is expected to dominate the Self-leveling Concrete Market with a 58% share in 2025, driven by its critical role in providing smooth, durable flooring surfaces, rapid curing properties, wide use in residential and commercial projects, and growing renovation and new construction activities.

Report Scope and Self-leveling Concrete Market Segmentation

|

Attributes |

Self-leveling Concrete Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Self-leveling Concrete Market Trends

“Rising demand for fast, smooth, and durable flooring solutions”

- The growing construction sector is driving demand for self-leveling concrete due to its quick application, reducing project timelines and labor costs, which appeals to developers focused on fast-track residential, commercial, and industrial building projects.

- Increasing urbanization and infrastructure development worldwide are pushing the need for flooring materials that provide smooth, even surfaces suitable for various finishes, ensuring durability and longevity in high-traffic areas such as malls, airports, and hospitals.

- Advances in self-leveling concrete technology have improved flowability, strength, and curing times, attracting contractors and architects to prefer these materials for flooring underlayments, helping achieve high-quality finishes with fewer surface imperfections.

- Renovation and remodeling projects are increasingly adopting self-leveling concrete to correct uneven floors quickly, minimizing downtime and disruption, making it a preferred choice for commercial spaces, schools, and healthcare facilities upgrading their flooring.

- For Instance, The Duraamen article highlights self-leveling concrete’s advantages, including fast application, excellent flowability, and creating smooth, flat surfaces. It emphasizes enhanced durability, reduced labor costs, and versatility for various flooring types, making it ideal for both new construction and renovation projects seeking efficient, high-quality floor finishing solutions.

Self-leveling Concrete Market Dynamics

Driver

“Growing urbanization boosts demand for advanced flooring materials”

- Rapid urban population growth drives large-scale residential and commercial construction, increasing the need for durable, efficient flooring solutions that can be installed quickly to meet tight project deadlines.

- Expanding infrastructure in urban areas requires flooring materials that withstand heavy foot traffic, harsh environmental conditions, and long-term wear, making advanced materials like self-leveling concrete essential for sustainability.

- Urbanization encourages modernization of buildings, pushing demand for smooth, aesthetically pleasing flooring that complements contemporary architectural designs in offices, malls, hospitals, and schools.

- Limited space and rising construction costs in urban centers motivate builders to use materials that reduce labor and installation time, favoring fast-curing, self-leveling concrete solutions to optimize productivity.

- Increasing awareness of green building practices in cities boosts demand for environmentally friendly flooring materials that minimize waste and support energy-efficient construction, aligning with sustainable urban development goals.

Restraint/Challenge

“High material costs hinder widespread adoption of advanced flooring”

- Self-leveling concrete products often come with premium pricing compared to traditional materials, making them less accessible for budget-sensitive projects or contractors working in cost-restricted environments, especially in developing regions with limited construction funding.

- The high upfront cost of advanced flooring systems can discourage small and medium-sized construction firms from adopting them, despite their long-term benefits, as they often prioritize short-term budget constraints over long-term performance gains.

- Specialized additives and proprietary formulations used in self-leveling compounds contribute to higher production costs, which are passed on to buyers, making it challenging for mass adoption in large-scale, cost-competitive infrastructure projects.

- Price volatility in raw materials such as polymers, cement, and specialty aggregates can lead to fluctuating costs for self-leveling concrete, complicating budgeting and procurement planning for construction stakeholders.

- For Instance, The East Coast Flooring article explains that floor leveling, particularly with self-leveling concrete, involves significant preparation such as cleaning, priming, and repairing surfaces. These additional steps, along with specialized materials and labor, contribute to higher overall costs, making self-leveling solutions more expensive but effective for flawless, durable flooring installations.

- Despite offering durability and reduced labor, self-leveling systems often require skilled applicators and surface preparation equipment, which add to overall costs and discourage widespread use in regions lacking technical expertise or resources.

Self-leveling Concrete Market Scope

The market is segmented on the basis of type and application

- By Type

On the basis of type, the Self-leveling Concrete Market is segmented into underlayment and topping. The underlayment segment dominates the largest market revenue share of 58% in 2025, driven by its widespread use in preparing subfloors for final coverings, ensuring smooth surfaces, improved load distribution, and faster installation, making it ideal for residential and commercial applications..

The topping segment is anticipated to witness the fastest growth rate of 6.9% from 2025 to 2032, fueled by rising demand for durable, aesthetically appealing finished floors in commercial and industrial settings, reducing the need for additional floor coverings.

- By Application

On the basis of application, the Self-leveling Concrete Market is segmented into residential building and commercial building. The residential building held the largest market revenue share in 2025 , driven by rapid urbanization, increased housing projects, and the demand for smooth, durable flooring solutions that enhance aesthetics and support quick, efficient construction timelines.

The commercial building segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rapid expansion in retail, hospitality, and office infrastructure. Increasing demand for durable, low-maintenance, and aesthetically appealing flooring solutions to accommodate heavy foot traffic fuels this growth in commercial spaces.

Self-leveling Concrete Market Regional Analysis

- U.S. dominates the Self-leveling Concrete Market with the largest revenue share of 78% in 2025, rapid urbanization, increased government investments in smart cities, booming commercial and residential construction, and strong demand for durable, efficient flooring solutions across diverse industries.

- U.S.’s dominance in the self-leveling concrete market is driven by its ambitious Vision 2030 initiatives, focusing on modernizing infrastructure, developing smart cities, and expanding transportation networks, all requiring advanced flooring solutions that ensure longevity and fast installation in large-scale projects.

- Rapid urbanization and population growth in U.S. are fueling a surge in commercial and residential construction, increasing demand for high-performance self-leveling concrete. Government incentives and investments in sustainable building practices further support market growth by promoting durable and efficient flooring technologies across various sectors.

Self-leveling Concrete Market Share

The Self-leveling Concrete Market industry is primarily led by well-established companies, including:

- Sika AG (Switzerland)

- BASF SE (Germany)

- LafargeHolcim (Switzerland)

- MAPEI S.p.A. (Italy)

- ARDEX Group (Germany)

- Cemex S.A.B. de C.V. (Mexico)

- Gulf Construction Chemicals (MEXICO)

- Al-Jazeera Paints (U.S.)

- MBCC Group (Germany)

- KEMCO (South Africa)

- PENETRON (USA)

- Hanson Building Products (UK)

- Saint-Gobain Weber (France)

- Nippon Paint (Japan)

- DCP Middle East (MEXICO)

Latest Developments in North America Self-leveling Concrete Market

- In March 2020, MAPEI introduced ULTRAPLAN ECO 20, a locally manufactured self-leveling compound. This addition to their product portfolio was in response to market demand, offering enhanced flowability and rapid setting times for both commercial and residential applications.

- In 2022, LATICRETE International, Inc. commissioned its first manufacturing facility on the African continent, located in Nairobi, Kenya. This strategic move aimed to enhance production capabilities and meet the growing demand for high-quality construction materials in the region.

- In March 2024, Sika AG, a global leader in specialty chemicals for construction and industry, announced the acquisition of an infrastructure refurbishment company based in the United States. This strategic move is aimed at enhancing Sika's portfolio and expanding its capabilities in the infrastructure sector.

- In 2021, LATICRETE International, Inc. commissioned its third manufacturing facility for construction products. This strategic expansion was undertaken to meet the growing demand for high-quality construction materials in the region, reflecting LATICRETE's commitment to enhancing its production capabilities and service offerings in Asia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Self Leveling Concrete Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Self Leveling Concrete Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Self Leveling Concrete Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.