Market Analysis and Insights : North America Scleroderma Therapeutics Market

Market Analysis and Insights : North America Scleroderma Therapeutics Market

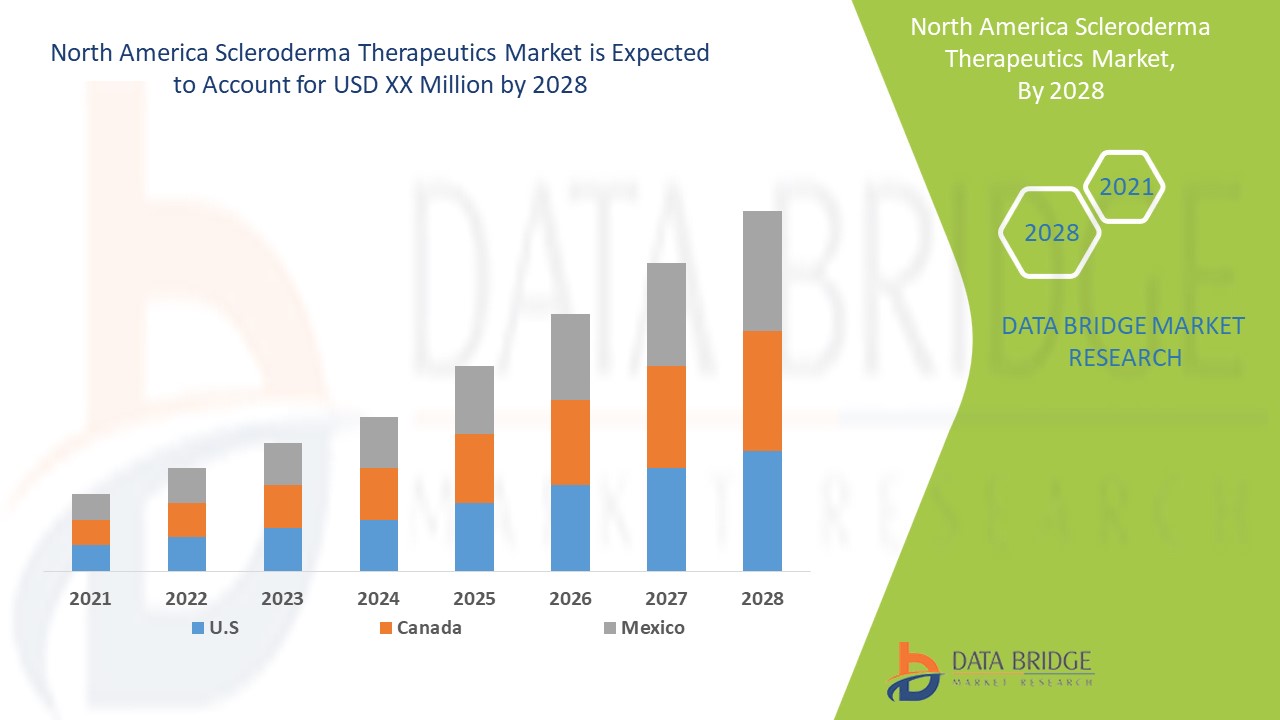

Scleroderma Therapeutics market is expected to gain market growth in the forecast period of 2021-2028. Data Bridge Market Research analyses the market to account to grow at a CAGR of 4.55% in the above mentioned forecast period.

Scleroderma is defined as an autoimmune disease whose cause is unknown and characterized by fibrosis and microvascular damage in the affected organs. In this disease, Raynaud's phenomenon is an initial symptom and presents with swelling of the fingers. Focal scleroderma and limited systemic scleroderma are two types of scleroderma. Local scleroderma shows fibrous patches of skin and subcutaneous tissue that also appear as linear fibrous bands on extremities such as skin and deeper tissues. Therefore, there are two types of focal scleroderma which include morphea scleroderma and linear scleroderma. Symptoms associated with this disease are joint pain, skin abnormalities, fatigue, morning stiffness, weight loss, etc.

The rise in the prevalence of scleroderma and rising incidences of genetic mutations along with drastic changes in the environment across the globe are the major factors influencing the market growth rate. Furthermore, presence of a well-defined regulatory framework supporting the emergence of effective therapies, surge in the number of clinical trials and proven efficacy of the immunosuppressant are the factors that will expand the scleroderma therapeutics market. In addition to this, growing awareness about the preventive healthcare and upsurge in the level of disposable income are the market drivers that will cushion the market growth rate.

Moreover, rise in the research and development activities, upcoming therapies from pharmaceutical companies and future approvals of the same will provide beneficial opportunities for the scleroderma therapeutics market in the forecast period of 2021-2028.

This scleroderma therapeutics market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the scleroderma therapeutics market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

North America Scleroderma Therapeutics Market Scope and Market Size

The scleroderma therapeutics market is segmented on the basis of type, treatment type, drugs, diagnosis, end-users and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries, and provide the users with valuable market overview and market insights to help them in making strategic decisions for identification of core market applications.

- On the basis of type, the scleroderma therapeutics market is segmented into localized scleroderma and systemic scleroderma. Localized scleroderma has been further sub-segmented into morphea and linear scleroderma. Systemic scleroderma has been further sub-segmented into diffused scleroderma and limited scleroderma.

- On the basis of treatment type, the scleroderma therapeutics market is segmented into drug treatment, surgical treatment, therapy.

- On the basis of drugs, the scleroderma therapeutics market is segmented into corticosteroids, immunosuppressive agents, endothelin receptor antagonists, calcium channel blockers, PDE-5 inhibitors, chelating agents, prostacyclin analogues and others. Others have been further sub-segmented into H2 blockers, ace inhibitors, proton pump inhibitors and others

- On the basis of diagnosis, the scleroderma therapeutics market is segmented into antibodies tests/blood tests, capillaroscopy, cardiac diagnosis, gastrointestinal diagnosis, imaging (CT and MRI), pulmonary diagnosis, skin viscoelasticity and general. Imaging has been further sub-segmented into CT and MRI. General has been further sub-segmented into electromyography and dubious diagnostic tests.

- On the basis of end-users, the scleroderma therapeutics market is segmented into hospital specialty clinics, homecare settings and others.

- The scleroderma therapeutics market is also segmented on the basis of distribution channel into hospital pharmacy, retail pharmacy and online pharmacy.

Scleroderma Therapeutics Market Country Level Analysis

Scleroderma Therapeutics market is analysed and market size information is provided by the country, type, treatment type, drugs, diagnosis, end-users and distribution channel as referenced above.

The countries covered in the scleroderma therapeutics market report are the U.S., Canada, and Mexico.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Patient Epidemiology Analysis

Scleroderma therapeutics market also provides you with detailed market analysis for patient analysis, prognosis and cures. Prevalence, incidence, mortality, adherence rates are some of the data variables that are available in the report. Direct or indirect impact analysis of epidemiology to market growth are analysed to create a more robust and cohort multivariate statistical model for forecasting the market in the growth period.

Competitive Landscape and North America Scleroderma Therapeutics Market Share Analysis

Scleroderma Therapeutics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to scleroderma therapeutics market research.

The major players covered in the scleroderma therapeutics market report are, Argentis Pharmaceuticals, LLC., F. Hoffmann-La Roche Ltd, AbbVie Inc., Pfizer Inc., Sanofi, ALLERGAN, viDA Therapeutics Inc., Novartis AG, Active Biotech AB., Bristol-Myers Squibb Company, GlaxoSmithKline plc., Johnson & Johnson Services, Inc., AstraZeneca, Daval International Limited among other. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.