North America Saliva Test Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.57 Billion

USD

2.58 Billion

2024

2032

USD

1.57 Billion

USD

2.58 Billion

2024

2032

| 2025 –2032 | |

| USD 1.57 Billion | |

| USD 2.58 Billion | |

|

|

|

|

North America Saliva Test Devices Market Size

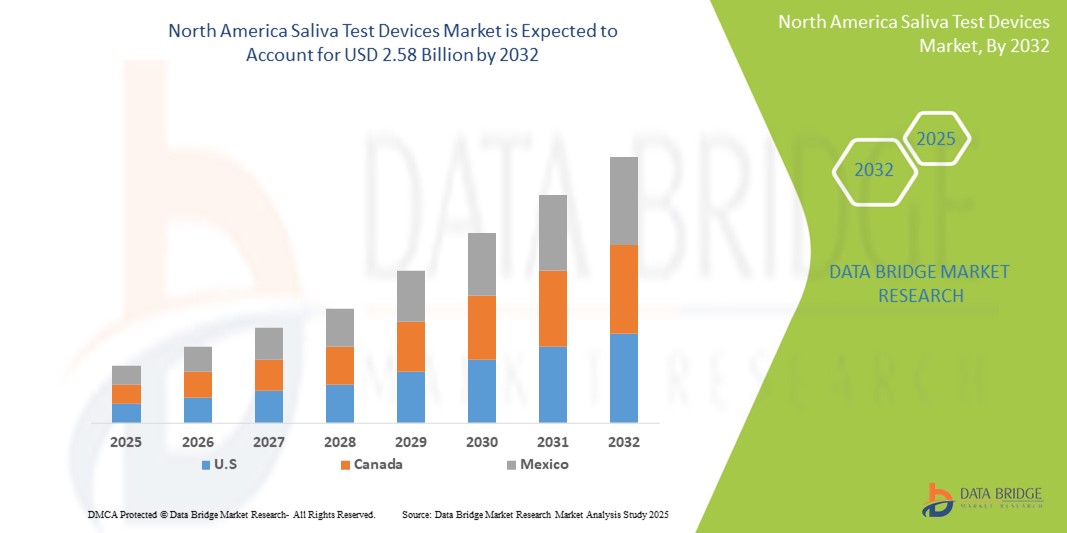

- The North America saliva test devices market size was valued at USD 1.57 billion in 2024 and is expected to reach USD 2.58 billion by 2032, at a CAGR of 6.4% during the forecast period

- The market growth is largely fueled by the increasing demand for non-invasive diagnostic methods, technological innovations in point-of-care testing, and the growing prevalence of chronic and infectious diseases in the region

- Furthermore, rising awareness of early disease detection and the need for rapid, easy-to-administer, and cost-effective testing solutions is driving adoption across clinical, workplace, and home-based settings. These converging factors are accelerating the uptake of saliva test devices, thereby significantly boosting the industry's growth

North America Saliva Test Devices Market Analysis

- Saliva test devices, providing non-invasive, rapid diagnostic solutions, are becoming essential tools in healthcare, workplace testing, and at-home health monitoring across North America due to their ease of use, cost-effectiveness, and ability to detect a wide range of conditions from infectious diseases to hormonal imbalances

- The growing demand for saliva-based diagnostics is primarily driven by increasing awareness of early disease detection, advancements in molecular diagnostic technologies, and a shift toward decentralized and remote healthcare solutions

- U.S. dominated the North America saliva test devices market with the largest revenue share of 79% in 2024, fueled by high healthcare spending, strong regulatory support for innovative diagnostics, and growing adoption of home-based testing kits, particularly during and post-COVID-19, with leading companies investing in portable, AI-enabled, and smartphone-integrated solutions

- Canada is expected to be the fastest growing country in the North America saliva test devices market during the forecast period, owing to increased public health initiatives and growing demand for accessible diagnostic tools in rural and underserved communities

- Portable devices segment dominated the North America saliva test devices market with a market share of 70.5% in 2024, driven by its ease of use, mobility, and suitability for point-of-care and remote testing environments

Report Scope and North America Saliva Test Devices Market Segmentation

|

Attributes |

North America Saliva Test Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Saliva Test Devices Market Trends

“Growing Shift Toward Non-Invasive, At-Home, and Rapid Diagnostics”

- A major and accelerating trend in the North America saliva test devices market is the increasing consumer and clinical preference for non-invasive, easy-to-administer testing solutions that can be used in decentralized or at-home settings. This shift is driven by the demand for rapid diagnostics that minimize discomfort and offer quicker turnaround times

- For instance, Cue Health’s molecular saliva test kits have gained traction in the U.S. for their ability to deliver lab-quality results at home through app-connected devices. Similarly, Salimetrics has expanded its portfolio with hormone and virus testing solutions tailored for remote and research-based applications

- Integration with mobile health apps and wearable ecosystems is another emerging trend, allowing users to track results, receive alerts, and share data with healthcare providers in real time. Some test kits now feature Bluetooth connectivity and app-based interpretation, enabling personalized and connected diagnostics

- The growing importance of saliva as a diagnostic fluid—capable of detecting stress markers, hormones, antibodies, and viral RNA—has led to a surge in R&D investments focused on expanding the capabilities of saliva-based test kits for diverse medical applications beyond COVID-19, such as fertility monitoring, drug screening, and chronic disease management

- This trend is reshaping consumer expectations for testing, with an emphasis on ease, speed, and integration with digital healthcare platforms. As a result, companies are increasingly launching portable, AI-enhanced saliva devices that offer multiplex testing and compatibility with telehealth platforms, especially across the U.S. and Canada

North America Saliva Test Devices Market Dynamics

Driver

“Increased Adoption of Rapid and Non-Invasive Testing Solutions”

- The growing preference for painless and user-friendly testing procedures, coupled with heightened awareness of disease prevention, is driving the adoption of saliva-based diagnostics in North America

- For instance, the COVID-19 pandemic accelerated public acceptance of saliva as a reliable diagnostic medium, prompting companies such as OraSure Technologies and Thermo Fisher Scientific to develop and distribute a broader range of saliva-based tests

- These devices provide quick results without the need for trained professionals, making them ideal for schools, workplaces, airports, and home testing scenarios. In addition, regulatory bodies such as the FDA have supported market growth by granting Emergency Use Authorization (EUA) and fast-tracking approvals for novel saliva-based kits

- The trend toward decentralization of healthcare, where consumers demand greater control over health data and diagnostic access, continues to fuel the integration of saliva testing devices into wellness apps, remote care services, and preventive health programs

Restraint/Challenge

“Regulatory Barriers and Concerns Over Accuracy and Sample Stability”

- Despite the growing acceptance of saliva testing, the market faces challenges related to regulatory compliance, variability in sample stability, and diagnostic accuracy, especially for complex conditions or in early-stage detection

- Inconsistent sensitivity and specificity across different saliva test formats have raised concerns among clinicians about reliability compared to traditional blood-based or nasopharyngeal samples

- Moreover, navigating the complex FDA regulatory environment for diagnostic devices in the U.S. requires companies to invest heavily in validation studies, compliance protocols, and documentation, which may slow product rollouts and increase time-to-market

- Cold chain requirements and sample degradation in certain test types also limit widespread usage, especially in rural or under-resourced settings. Addressing these challenges through innovation in sample preservation, quality control, and regulatory streamlining will be crucial to sustaining growth and consumer confidence

North America Saliva Test Devices Market Scope

The market is segmented on the basis of product type, type (test panel), form, detection, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the North America saliva test devices market is segmented into portable devices and table top devices. The portable devices segment dominated the market with the largest market revenue share of 70.5% in 2024, driven by its ease of use, suitability for point-of-care and home-based testing, and growing demand for decentralized diagnostics. These devices are preferred in workplaces, educational institutions, and field settings due to their mobility, affordability, and rapid result delivery.

The table top devices segment, while smaller in market share expected to witness fastest growth during forecast period, remains vital in centralized healthcare settings such as hospitals and diagnostic labs that require more detailed, lab-grade analyses.

- By Type

On the basis of type, the North America saliva test devices market is segmented into 5-panel saliva test kits, 6-panel saliva test kits, 10-panel saliva test kits, 12-panel saliva test kits, and others. The 5-panel test kits segment dominated the market with the largest market revenue share of 56.3% in 2024, supported by widespread use in workplace and legal drug screening programs. These kits test for the most commonly abused substances and are cost-effective, simple to administer, and widely available.

The 6-panel saliva test kits segment is anticipated to witness notable growth during the forecast period, driven by growing demand for expanded substance detection and compliance with more stringent drug testing protocols.

- By Form

On the basis of form, the North America saliva test devices market is segmented into strips, swabs, and cassettes. The strips segment led the market with the highest market revenue share in 2024, driven by its affordability, convenience, and ability to provide quick visual results. These are commonly used in both at-home and field testing scenarios.

The swabs and cassettes segments are also growing steadily during forecast period, particularly in professional diagnostic and clinical settings that require enhanced sample stability and multi-analyte testing formats.

- By Detection

On the basis of detection, the North America saliva test devices market is segmented into drugs, antibodies, virus and bacteria, hormones, antigens, and others. The drug detection segment dominated the market with the largest market revenue share in 2024, owing to the high demand for drug screening in employment, law enforcement, and legal proceedings. Saliva testing offers a less invasive, fast, and cost-effective alternative to urine or blood tests.

The virus and bacteria detection segment is expected to witness accelerated growth during forecast period, supported by increased investment in infectious disease diagnostics post-COVID-19 and rising interest in scalable, rapid, non-invasive testing solutions.

- By Application

On the basis of application, the North America saliva test devices market is segmented into criminal justice testing, workplace testing, and disease testing. The workplace testing segment dominated the market with the largest market revenue share of 48.6% in 2024, driven by corporate drug policies, occupational safety regulations, and increased awareness of substance use in professional environments.

The criminal justice testing segment is expected to witness fastest growth during forecast period, due to its role in parole, probation, and roadside testing, while disease testing is emerging as a promising area, especially for hormone, viral, and chronic disease diagnostics.

- By End User

On the basis of end user, the North America saliva test devices market is segmented into hospitals, investigation laboratories, diagnostic centers, and others. The hospitals segment dominated the market with the largest market revenue share in 2024, supported by increased diagnostic throughput, growing patient volumes, and early technology adoption.

The investigation laboratories and diagnostic centers segments are also expected to grow at faster CAGR rate during forecast period, particularly in forensic science, research institutions, and specialized screening services.

- By Distribution Channel

On the basis of distribution channel, the North America saliva test devices market is segmented into direct tenders, retail sales, and third-party distribution. The direct tenders segment dominated the market with the largest market revenue share of over 50% in 2024, driven by institutional purchases from hospitals, government agencies, and corporate programs requiring bulk and contract-based supply of test kits.

The retail sales and third-party distribution channels are expanding rapidly during forecast period, due to increasing demand for over-the-counter products, e-commerce availability, and self-testing kits for home use

North America Saliva Test Devices Market Regional Analysis

- The U.S. dominated the North America saliva test devices market with the largest revenue share of 79% in 2024, fueled by high healthcare spending, strong regulatory support for innovative diagnostics, and growing adoption of home-based testing kits, particularly during and post-COVID-19, with leading companies investing in portable, AI-enabled, and smartphone-integrated solutions

- Consumers in the U.S. highly value the ease of sample collection, fast result turnaround, and the ability of saliva-based tests to detect a wide range of conditions without the need for clinical visits

- This market dominance is further supported by advanced healthcare infrastructure, regulatory approvals, and the presence of leading diagnostic companies offering portable, digital, and app-connected testing solutions tailored for both home and institutional use

U.S. North America Saliva Test Devices Market Insight

The U.S. saliva test devices market captured the largest revenue share of 79% in 2024 within North America, fueled by a strong demand for non-invasive, rapid diagnostic tools across healthcare, workplace, and at-home settings. Consumers and institutions increasingly favor saliva-based tests for their ease of use, cost-effectiveness, and suitability for frequent screening. The market is further propelled by the growing popularity of telehealth, regulatory support for self-testing kits, and the widespread use of saliva diagnostics in drug screening, infectious disease detection, and hormone monitoring. Moreover, ongoing technological advancements—such as smartphone integration and AI-enhanced result interpretation—are accelerating adoption across both consumer and clinical domains.

Canada Saliva Test Devices Market Insight

The Canada saliva test devices market is projected to expand at a steady CAGR throughout the forecast period, driven by national healthcare initiatives promoting early disease detection and the increasing use of non-invasive testing methods in public health and research settings. Saliva testing is gaining traction in schools, workplaces, and remote communities due to its minimal training requirements and rapid turnaround times. With growing investment in digital health infrastructure and the presence of academic research institutions, Canada is strengthening its role in the regional market, particularly in the development and application of advanced diagnostic technologies.

Mexico Saliva Test Devices Market Insight

The Mexico saliva test devices market is anticipated to grow at a notable CAGR during the forecast period, supported by expanding healthcare access, rising public awareness of preventive diagnostics, and growing government focus on substance abuse monitoring and disease surveillance. Increased urbanization and demand for affordable, accessible testing solutions are encouraging adoption across both public and private sectors. Additionally, the market benefits from increasing partnerships with international diagnostic companies, which are introducing cost-effective, portable saliva test kits suitable for broader deployment across Mexico’s healthcare landscape.

North America Saliva Test Devices Market Share

The North America saliva test devices industry is primarily led by well-established companies, including:

- OraSure Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Salimetrics, LLC (U.S.)

- Abbott (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Labcorp (U.S.)

- Everlywell, Inc. (U.S.)

- Spectrum Solutions, LLC (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- NEOGEN Corporation (U.S.)

- Premier Biotech, Inc. (U.S.)

- DNAlite Therapeutics, Inc. (U.S.)

- ZRT Laboratory, LLC (U.S.)

- Biocompare, Inc. (U.S.)

- Avioq, Inc. (U.S.)

- Precision Analytical Inc. (U.S.)

- Vault Health, Inc. (U.S.)

- Viome Life Sciences, Inc. (U.S.)

- Mirimus, Inc. (U.S.)

- DNA Genotek Inc. (Canada)

What are the Recent Developments in North America Saliva Test Devices Market?

- In April 2024, OraSure Technologies, Inc., a U.S.-based leader in point-of-care diagnostic testing, announced the launch of an upgraded saliva-based COVID-19 and influenza combo test for home and clinical use. This next-generation product provides faster results and improved accuracy, aligning with increasing consumer demand for multi-pathogen, self-administered diagnostics. The development reflects OraSure’s commitment to enhancing public access to non-invasive testing solutions that support early detection and disease management

- In March 2024, Salimetrics, LLC, a Pennsylvania-based biotechnology company, expanded its clinical research applications by introducing saliva-based hormone and immune function test kits to academic and wellness institutions across North America. These kits are designed for non-invasive biomarker collection and analysis, supporting studies in stress, fertility, and chronic disease management. The initiative reinforces Salimetrics' position as a trusted provider of high-quality saliva testing solutions in both clinical and research domains

- In February 2024, Thermo Fisher Scientific Inc. partnered with U.S. public health departments to pilot saliva-based drug testing programs targeting substance abuse in community health centers and schools. This collaboration aims to provide rapid, low-cost, and minimally invasive testing to underserved populations, advancing the company’s role in supporting public health initiatives and enhancing early intervention efforts in addiction treatment

- In January 2024, Spectrum Solutions, LLC, a U.S. provider of molecular diagnostic collection devices, announced FDA emergency use authorization (EUA) for its saliva-based pathogen detection device that enables simultaneous screening of multiple viruses. This development signifies a leap forward in multiplex testing, offering clinical laboratories and at-home users a streamlined solution for broader infectious disease surveillance

- In January 2024, Everlywell, Inc., a prominent at-home diagnostics company, launched a saliva-based hormone testing kit focused on women's health, with digital result integration and telehealth support. This innovation highlights the growing trend toward personalized health monitoring and remote diagnostics, catering to consumer preferences for privacy, accessibility, and convenience in managing hormonal health and wellness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of North America saliva test devices market

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- PRODUCT type LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- market application coverage grid

- vendor share analysis

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- North America saliva test devices market: regulatory FRAMEWORK

- Market Overview

- DRIVERS

- Increasing number of applications of saliva in the medical sector

- Increasing number of product approvals for saliva collection

- Growing need for rapid diagnosis of life-threatening diseases

- Increasing research and development in saliva testing by key market players

- RESTRAINTS

- STRINGENT GOVERNMENT REGULATION

- SHORTAGE OF SKILLED PERSONNEL

- ALTERNATIVES TO SALIVA COLLECTION

- Opportunities

- Emergence of COVID-19

- Strategic initiatives by key market players

- Increasing healthcare infrastructure

- CHALLENGES

- LABORATORY SUPPLY SHORTAGES

- HIGH COST OF R&D

- IMPACT OF COVID-19 ON THE NORTH AMERICA SALIVA TEST DEVICES MARKET

- aftermath of COVID-19 and GOVERNMENT role

- IMPACT ON DEMAND

- IMPACT ON PRICE

- IMPACT ON SUPPLY CHAIN

- KEY INITIATIVES BY MARKET PLAYERS DURING COVID-19

- CONCLUSION

- NORTH AMERICA SALIVA TEST DEVICES MARKET, BY PRODUCT TYPE

- OVERVIEW

- PORTABLE DEVICES

- TABLE TOP DEVICES

- NORTH AMERICA SALIVA TEST DEVICES MARKET, BY TYPE

- OVERVIEW

- 6-PANEL SALIVA TEST KITS

- 12-PANEL SALIVA TEST KITS

- 5-PANEL SALIVA TEST KITS

- 10-PANEL SALIVA TEST KITS

- OTHERS

- NORTH AMERICA SALIVA TEST DEVICES MARKET, BY form

- OVERVIEW

- Strips

- Swabs

- Cassettes

- NORTH AMERICA SALIVA TEST DEVICES MARKET, BY Detection

- OVERVIEW

- Drugs

- Opioids

- Marijuana (THC)

- Cocaine

- Amphetamines

- Alcohol

- Other

- Antibodies

- Viruses and Bacteria

- Hormones

- Cortisol

- Estrogens

- Progesterone

- Androgens

- Antigens

- Others

- NORTH AMERICA SALIVA TEST DEVICES MARKET, BY Application

- OVERVIEW

- Criminal Justice Testing

- Workplace Testing

- Disease Testing

- NORTH AMERICA SALIVA TEST DEVICES MARKET, BY END USER

- OVERVIEW

- HOSPITALS

- Acute Care Hospitals

- Long-Term Care Hospitals

- Others

- Investigation Laboratories

- Diagnostic Centers

- OTHERS

- NORTH AMERICA SALIVA TEST DEVICES MARKET, BY DISTRIBUTION CHANNEL

- OVERVIEW

- DIRECT TENDER

- RETAIL SALES

- Third Party Distribution

- North America saliva test devices Market by country

- North America

- U.S.

- canada

- MEXICO

- North America saliva test devices Market: COMPANY landscape

- company share analysis: North America

- swot analysis

- Company profile

- Abbott

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- NEOGEN Corporation

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SOLUTION PORTFOLIO

- RECENT DEVELOPMENT

- OraSure Technologies, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Alfa Scientific Designs, Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- avellino

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BTNX Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- CONFIRM BIOSCIENCES

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- DNA Genotek Inc. (A subsidiary of OraSure Technologies, Inc.)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- GC America Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Immunalysis Corporation

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- oasis diagnostics corporation

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Oranoxis Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Premier Biotech, Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- salimetrics, LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Securetec

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Thermo Fisher Scientific Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Vitagene

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

List of Table

TABLE 1 Systemic & Oral Diseases Affecting Salivary Glands and Saliva

TABLE 2 North America Saliva Test Devices Market, By Product Type, 2020-2028 (USD Million)

TABLE 3 North America Saliva test devices Market, by type, 2019-2028 (USD Million)

TABLE 4 North America Saliva test devices Market, By form, 2019-2028 (USD Million)

TABLE 5 North America Saliva test devices Market, By Detection, 2019-2028 (USD Million)

TABLE 6 North America Drugs in Saliva Test Devices Market, By Detection, 2019-2028 (USD Million)

TABLE 7 North America Hormones in Saliva Test Devices Market, By Detection, 2019-2028 (USD Million)

TABLE 8 North America Saliva test devices Market, By Application, 2019-2028 (USD Million)

TABLE 9 North America Saliva test devices Market, By end user , 2019-2028 (USD Million)

TABLE 10 North America Hospitals in Saliva Test Devices Market, By End User, 2019-2028 (USD Million)

TABLE 11 North America Saliva test devices Market, By distribution channel, 2019-2028 (USD Million)

TABLE 12 North America Saliva test devices Market, By COUNTRY, 2019-2028 (USD Millions )

TABLE 13 U.S. Saliva Test Devices Market, By Product Type, 2019-2028 (USD Million)

TABLE 14 U.S. Saliva Test Devices Market, By Type, 2019-2028 (USD Million)

TABLE 15 U.S. Saliva Test Devices Market, By Form, 2019-2028 (USD Million)

TABLE 16 U.S. Saliva Test Devices Market, By Detection, 2019-2028 (USD Million)

TABLE 17 U.S. Drugs in Saliva Test Devices Market, By Detection, 2019-2028 (USD Million)

TABLE 18 U.S. Hormones in Saliva Test Devices Market, By Detection, 2019-2028 (USD Million)

TABLE 19 U.S. Saliva Test Devices Market, By Application, 2019-2028 (USD Million)

TABLE 20 U.S. Saliva Test Devices Market, By End User, 2019-2028 (USD Million))

TABLE 21 U.S. Hospitals in Saliva Test Devices Market, By End User, 2019-2028 (USD Million)

TABLE 22 U.S. Saliva Test Devices Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 23 CANADA Saliva Test Devices Market, By Product Type, 2019-2028 (USD Million)

TABLE 24 CANADA Saliva Test Devices Market, By Type, 2019-2028 (USD Million)

TABLE 25 CANADA Saliva Test Devices Market, By Form, 2019-2028 (USD Million)

TABLE 26 CANADA Saliva Test Devices Market, By Detection, 2019-2028 (USD Million)

TABLE 27 CANADA Drugs in Saliva Test Devices Market, By Detection, 2019-2028 (USD Million)

TABLE 28 CANADA Hormones in Saliva Test Devices Market, By Detection, 2019-2028 (USD Million)

TABLE 29 CANADA Saliva Test Devices Market, By Application, 2019-2028 (USD Million)

TABLE 30 CANADA Saliva Test Devices Market, By End User, 2019-2028 (USD Million))

TABLE 31 CANADA Hospitals in Saliva Test Devices Market, By End User, 2019-2028 (USD Million)

TABLE 32 CANADA Saliva Test Devices Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 33 MEXICO Saliva Test Devices Market, By Product Type, 2019-2028 (USD Million)

TABLE 34 MEXICO Saliva Test Devices Market, By Type, 2019-2028 (USD Million)

TABLE 35 MEXICO Saliva Test Devices Market, By Form, 2019-2028 (USD Million)

TABLE 36 MEXICO Saliva Test Devices Market, By Detection, 2019-2028 (USD Million)

TABLE 37 MEXICO Drugs in Saliva Test Devices Market, By Detection, 2019-2028 (USD Million)

TABLE 38 MEXICO Hormones in Saliva Test Devices Market, By Detection, 2019-2028 (USD Million)

TABLE 39 MEXICO Saliva Test Devices Market, By Application, 2019-2028 (USD Million)

TABLE 40 MEXICO Saliva Test Devices Market, By End User, 2019-2028 (USD Million))

TABLE 41 MEXICO Hospitals in Saliva Test Devices Market, By End User, 2019-2028 (USD Million)

TABLE 42 MEXICO Saliva Test Devices Market, By Distribution Channel, 2019-2028 (USD Million)

List of Figure

FIGURE 1 North America saliva test devices market: segmentation

FIGURE 2 North America saliva test devices market : data triangulation

FIGURE 3 North America saliva test devices market: DROC ANALYSIS

FIGURE 4 North America saliva test devices market: REGIONAL vs country MARKET ANALYSIS

FIGURE 5 North America saliva test devices market: COMPANY RESEARCH ANALYSIS

FIGURE 6 North America saliva test devices market: INTERVIEW DEMOGRAPHICS

FIGURE 7 North America saliva test devices market: DBMR MARKET POSITION GRID

FIGURE 8 North America saliva test devices market: MARKET APPLICATION COVERAGE GRID

FIGURE 9 North America saliva test devices market: vendor share analysis

FIGURE 10 North America saliva test devices market: SEGMENTATION

FIGURE 11 increasing number of applications of saliva in the medical sector is expected to drive THE north america saliva test devices market IN THE FORECAST PERIOD of 2021 to 2028

FIGURE 12 PORTABLE DEVICES segment is expected to account for the largest share of the North America saliva test devices market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGEs OF North America Saliva Test Devices Market

FIGURE 14 North America Saliva test devices Market: By PRODUCT TYPE, 2020

FIGURE 15 North America Saliva test devices Market: By PRODUCT TYPE, 2020-2028 (USD Million)

FIGURE 16 North America Saliva test devices Market: By PRODUCT TYPE, CAGR (2021-2028)

FIGURE 17 North America Saliva test devices Market: By PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 North America Saliva test devices Market: By Type, 2020

FIGURE 19 North America Saliva test devices Market: By Type, 2020-2028 (USD Million)

FIGURE 20 North America Saliva test devices Market: By Type, CAGR (2021-2028)

FIGURE 21 North America Saliva test devices Market: By Type, LIFELINE CURVE

FIGURE 22 North America Saliva test devices Market: By form, 2020

FIGURE 23 North America Saliva test devices Market: By form, 2020-2028 (USD Million)

FIGURE 24 North America Saliva test devices Market: By form, CAGR (2021-2028)

FIGURE 25 North America Saliva test devices Market: By form, LIFELINE CURVE

FIGURE 26 North America Saliva test devices Market: By Detection, 2020

FIGURE 27 North America Saliva test devices Market: By Detection, 2020-2028 (USD Million)

FIGURE 28 North America Saliva test devices Market: By Detection, CAGR (2021-2028)

FIGURE 29 North America Saliva test devices Market: By Detection, LIFELINE CURVE

FIGURE 30 North America Saliva test devices Market: By Application, 2020

FIGURE 31 North America Saliva test devices Market: By Application, 2020-2028 (USD Million)

FIGURE 32 North America Saliva test devices Market: By Application, CAGR (2021-2028)

FIGURE 33 North America Saliva test devices Market: By Application, LIFELINE CURVE

FIGURE 34 North America Saliva test devices Market: By end user, 2020

FIGURE 35 North America Saliva test devices Market: By end user, 2020-2028 (USD Million)

FIGURE 36 North America Saliva test devices Market: By end user, CAGR (2021-2028)

FIGURE 37 North America Saliva test devices Market: By end user, LIFELINE CURVE

FIGURE 38 North America Saliva test devices Market: By distribution channel, 2020

FIGURE 39 North America Saliva test devices Market: By distribution channel, 2020-2028 (USD Million)

FIGURE 40 North America Saliva test devices Market: By distribution channel, CAGR (2021-2028)

FIGURE 41 North America Saliva test devices Market: By distribution channel, LIFELINE CURVE

FIGURE 42 North America Saliva test devices Market: SNAPSHOT (2020)

FIGURE 43 North America Saliva test devices Market: BY COUNTRY (2020)

FIGURE 44 North America Saliva test devices Market: BY COUNTRY (2021 & 2028)

FIGURE 45 North America Saliva test devices Market: BY COUNTRY (2021 & 2028)

FIGURE 46 North America Saliva test devices Market: BY Product Type (2021-2028)

FIGURE 47 North AMERICA saliva test devices MARKET: company share 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.