North America Safety Systems Market Segmentation, By Type (Safety Controllers & Relays, Safety Machine Vision, Safety Sensors, and Safety Switches), Technology (Digital Sensor, Smart Sensor, and Analog Sensor), Function (Machine Protection, Process Monitoring, Energy Management, Parking Assistance, Collision Avoidance, Vibration Monitoring Systems, Emergency Stop Systems, and Others), Organization Size (Large Scale Organization and Small & Medium Size Organization), End-User (Automotive, Aerospace & Defense, Healthcare, Oil & Gas, Transportation & Logistics, Consumer Electronics, Food & Beverages, Construction Industry, and Others), Distribution Channel (Direct Sales and Indirect Sales) – Industry Trends and Forecast to 2031

Safety Systems Market Analysis

The north america safety systems market focuses on technologies that enhance safety by monitoring and detecting risks in industrial, commercial, and consumer applications. These sensors play a critical role in preventing accidents, ensuring compliance with safety regulations, and enabling smooth operations. The key factors driving market growth of safety sensors include the increasing adoption of automation, strict safety regulations across industries, and rising demand for smart systems capable of real-time monitoring. As industries continue to prioritize operational safety, the demand for advanced sensors is expected to grow steadily, especially with the rise of autonomous systems and connected factories.

Safety Systems Market Size

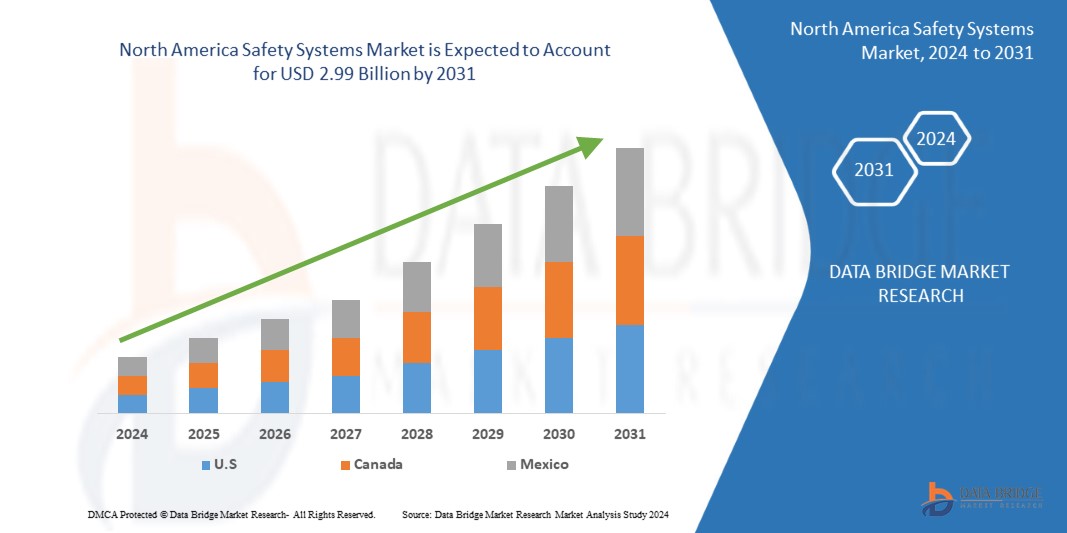

North America safety systems market size was valued at USD 1.79 billion in 2023 and is projected to reach USD 2.99 billion by 2031, with a CAGR of 6.8% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Safety Systems Market Trends

“Rapid Industrialization In Emerging Markets Of Asia-Pacific”

The rapid industrialization across emerging markets in the Asia-Pacific region, including countries such as China, India, Vietnam, and Indonesia, has created significant opportunities for safety system manufacturers in the global market. With an increasing number of factories, manufacturing facilities, and infrastructure projects being developed to support economic growth, the need for safety technologies to protect workers and prevent accidents has surged.

In addition, stringent government regulations and workplace safety standards are driving demand for safety solutions, as industries seek to comply with international norms while enhancing operational efficiency. The region’s emphasis on reducing workplace incidents is propelling the adoption of advanced safety technologies, thus creating a robust demand for safety systems.

Report Scope and Safety Systems Market Segmentation

|

Attributes

|

Safety Systems Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada, and Mexico

|

|

Key Market Players

|

Siemens (Germany), Panasonic Corporation (Japan), ABB (Switzerland), Honeywell International Inc. (U.S.), Rockwell Automation (U.S.), Festo SE & Co. KG (Europe), Schneider Electric (France), SICK AG (Europe), KEYENCE CORPORATION (Japan), OMRON Corporation (Japan), Sensata Technologies, Inc. (U.S.), Pepperl+Fuchs SE (Germany), Balluff GmbH (Germany), TankScan (U.S.), Autonics Corporation (South Korea), and Hans Turck GmbH & Co. KG (Europe)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Safety Systems Market Definition

The safety system refers to the industries focused on the production and sale of safety-related devices such as controllers, relays, switches, and various sensors. It is driven by increasing demand for automation, stricter safety regulations, and the need for efficient worker protection across industries like automotive, oil & gas, food & beverage, and manufacturing. Safety sensors are devices used to monitor, detect, and respond to unsafe conditions in industrial environments to protect equipment, personnel, and processes. Safety controllers coordinate multiple safety inputs and outputs to trigger shutdowns or corrective actions. Safety relays isolate and switch circuits when risks are detected, ensuring systems operate safely. Safety switches monitor access points, stopping machinery when guards or doors are opened. Analog sensors provide continuous signals to measure variables like pressure or temperature, while digital sensors offer discrete on/off signals. Smart sensors incorporate real-time monitoring, diagnostics, and predictive maintenance capabilities, enhancing automation and operational safety.

Safety Systems Market Dynamics

Drivers

- Advancements In Safety System Technology

As industrial automation and workplace safety standards continue to evolve, the demand for more advanced and reliable safety systems has increased significantly. These systems play a crucial role in detecting potential hazards, preventing accidents, and ensuring safe working environments across various sectors, including manufacturing, automotive, healthcare, and logistics. However, traditional safety systems often face limitations in terms of precision, durability, and adaptability to different environments. This has led to a growing need for advancements in safety system technology that can enhance detection accuracy, minimize false alarms, and perform effectively in harsh or dynamic conditions..

For Instance:

In August 2024, Rockwell Automation showcased its Smart Safety Solutions at MINEXPO 2024, featuring the 440E Lifeline cable pull switches combined with GuardLink technology. These switches provided enhanced safety solutions tailored for the mining industry, offering real-time status monitoring and diagnostics that improved operational transparency and minimized downtime.

- Rising Adoption Of Smart Machine And Industry 4.0

The rapid adoption of smart machines and the widespread implementation of Industry 4.0 technologies are significant drivers for the North America Safety Systems market. Industry 4.0, characterized by the fusion of digital technologies with traditional manufacturing, has led to the increased use of advanced machinery, automation systems, and interconnected devices in industrial environments. These innovations have created a growing need for safety systems to ensure the safe operation of machines and safeguard workers.For instance,

For instance,

Rockwell Automation offers ControlLogix and GuardLogix 5580 controllers provided increased performance, capacity, productivity, and security. Utilizing the Studio 5000 design environment, they optimized productivity and reduced commissioning time. The framework managed Integrated Motion over EtherNet/IP for high-speed applications and offered SIL2/PLd and SIL3/PLe safety solutions. These controllers help to meet the growing demands of smart machines and equipment for manufacturing

Opportunities

- Integration Of Iot, and AI In Safety Systems

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) in safety systems is revolutionizing the North America Safety Systems market, creating significant growth opportunities for manufacturers. These advancements enable smarter, real-time monitoring and predictive maintenance, drastically improving industrial safety standards across sectors such as manufacturing, automotive, and healthcare..

For instance,

In June 2022, Siemens expanded its Cerberus PRO fire safety system by introducing updated FC720 fire control panels, an IoT-enabled OOH740 detector, and the Cerberus Connect mobile app. These enhancements aimed to optimize resources, simplify planning and maintenance, and improve convenience for system integrators, service providers, and customers

- Strategic Partnerships And Acquisitions Of Market Players

In the highly competitive North America Safety Systems market, strategic partnerships and acquisitions among key market players are creating new growth opportunities for safety system manufacturers. Collaborations enable companies to enhance their product portfolios, tap into new markets, and integrate advanced technologies to offer innovative solutions. For example, partnerships with technology firms specializing in AI and IoT are allowing safety system manufacturers to develop smart and connected systems that cater to the growing demand for automated safety systems across industries like automotive, manufacturing, and healthcare.

Acquisitions, on the other hand, help safety system manufacturers expand their global footprint and gain access to new customer bases, while leveraging the acquired company’s expertise and resources. This often results in the development of more sophisticated products with enhanced safety features and improved performance. Moreover, mergers can create synergies that improve operational efficiency, reduce costs, and foster faster innovation in response to evolving safety regulations and industry standards.

For instance,

In January 2024, ABB announced it had agreed to acquire Real Tech, a Canadian company specializing in innovative optical sensor technology for real-time water monitoring and testing. This acquisition allowed ABB to enhance its presence in the water segment by incorporating Real Tech's advanced optical solutions into its product portfolio. The integration of this technology aimed to bolster smart water management capabilities, a growing need in the sector. The acquisition enabled ABB to expand its offerings in water monitoring, further strengthening its position in the market. This move aligned with ABB’s focus on sustainable and efficient water management solutions

Restraints/Challenges

- Global Shortage Of Manpower In Manufacturing Facilities

The global shortage of manpower in manufacturing facilities has emerged as a significant restraint factor. Safety systems, essential for ensuring machine and worker safety, depend heavily on precise installation, maintenance, and real-time monitoring, tasks that require skilled professionals. However, with manufacturing sectors worldwide facing a growing gap in skilled labour, particularly in technical and specialized roles, this shortage is creating bottlenecks in the safety system market.

For instance,

In December 2023, as reported by Bennett, Coleman & Co. Ltd., a survey by Ultimate Kronos Group revealed that 76% of over 300 Indian manufacturers faced skilled labor shortages in 2023, impacting sectors like engineering, automotive, and electronics. The shortage affected profitability, with 35% of organizations describing the impact as "severe." Key industries such as pharmaceuticals and food processing were also hit, causing operational challenges across the board. This shortage posed a major hurdle for manufacturers, limiting growth potential and increasing costs

- Increasing Regulatory Requirements And Compliance Standards

In the global safety system market, increasing regulatory requirements and compliance standards are becoming significant challenges. As industries like automotive, aerospace, and manufacturing push toward more advanced safety protocols, regulatory bodies across different regions are continually tightening safety regulations. These evolving standards, such as ISO 13849 for machinery safety or IEC 61508 for functional safety, demand that companies not only invest in state-of-the-art safety systems but also ensure that these systems are fully compliant with local and international laws. This creates additional pressure for manufacturers to upgrade their existing systems, which can be costly and time-consuming, especially in sectors that rely heavily on legacy equipment.

For instance,

In January 2024, according to Springer Nature, the establishment of effective standards and regulations for sensor-based health, wellness, and environmental domains faces significant challenges, especially the slow progress in mHealth regulations and the need for international consensus on medical device regulations. As regulatory requirements and compliance standards increase, the Safety System (Sensor) Market will encounter substantial hurdles. Manufacturers may face intensified scrutiny, which will require greater investment in compliance efforts and could hinder innovation. Furthermore, the absence of international harmonization may complicate market entry and elevate costs for companies developing sensor technologies, particularly in the rapidly evolving field of mobile health applications that must quickly adapt to new standards.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Safety Systems Market Scope

The market is segmented on the basis of type, technology, function, Organization size, End user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Safety Controllers & Relays

- Relays

- Controllers

- 8-Bit Safety Controllers

- 16-Bit Safety Controllers

- Safety Machine Vision

- Safety Monitoring Systems

- Fall Detection Systems

- Safety Compliance Verification

- Intrusion Detection Systems

- Others

- Safety Sensors

- Light Curtains

- Laser / Safety Scanner

- Photoelectric Sensors

- Ultrasonic Safety Sensors

- Safety Mat

- Tilt Sensors

- Others

- Safety Switches

- Emergency Stop Switches

- Push Buttons

- Pull-Cord Emergency Stop Buttons

- Safety Interlock Switches

- Safety Limit Switches

- Safety Relay Switches

- Safety Light Curtain Switches

- Safety Two Hand Control Switches

- Others

Technology

- Digital Sensor

- Smart Sensor

- Analog Sensor

Function

- Machine Protection

- Process Monitoring

- Energy Management

- Parking Assistance

- Collision Avoidance

- Vibration Monitoring System

- Emergency Stop Systems

- Other

Organization Size

- Small & Medium Size Organization

- Large Scale Organization

End User

- Automotive

- Safety Controllers & Relays

- Safety Machine Vision

- Safety Sensors

- Safety Switches

- Aerospace & Defence

- Safety Controllers & Relays

- Safety Machine Vision

- Safety Sensors

- Safety Switches

- Healthcare

- Safety Controllers & Relays

- Safety Machine Vision

- Safety Sensors

- Safety Switches

- Oil & Gas

- Safety Controllers & Relays

- Safety Machine Vision

- Safety Sensors

- Safety Switches

- Transportation & Logistics

- Safety Controllers & Relays

- Safety Machine Vision

- Safety Sensors

- Safety Switches

- Consumer Electronics

- Safety Controllers & Relays

- Safety Machine Vision

- Safety Sensors

- Safety Switches

- Food And Beverages

- Safety Controllers & Relays

- Safety Machine Vision

- Safety Sensors

- Safety Switches

- Construction Indsutry

- Safety Controllers & Relays

- Safety Machine Vision

- Safety Sensors

- Safety Switches

- Other

- Safety Controllers & Relays

- Safety Machine Vision

- Safety Sensors

- Safety Switches

Distribution Channel

- Direct Sales

- Indirect Sales

- Wholesaler

- E-Commerce

- Retail

- Others

Safety Systems Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, technology, function, organization size, end user, and distribution channel as referenced above.

The countries covered in the market are U.S., Canada, and Mexico.

The U.S. dominates the North American safety sensors market also it is the highest growing country in the market due to its technological leadership, robust industrial base, and stringent safety regulations. Continuous innovation in sectors like automotive, healthcare, and manufacturing drives demand for advanced safety sensors. The rise of autonomous vehicles, smart cities, and IoT further accelerates growth, while regulatory standards push companies to adopt safety technologies. Additionally, significant investments in infrastructure and automation contribute to the expanding market

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Safety Systems Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Safety Systems Market Leaders Operating in the Market Are:

- Siemens (Germany)

- Panasonic Corporation (Japan)

- ABB (Switzerland)

- Honeywell International Inc. (U.S.)

- Rockwell Automation (U.S.)

- Festo SE & Co. KG (Europe)

- Schneider Electric (France)

- SICK AG (Europe)

- KEYENCE CORPORATION (Japan)

- OMRON Corporation (Japan)

- Sensata Technologies, Inc. (U.S.)

- Pepperl+Fuchs SE (Germany)

- Balluff GmbH (Germany)

- TankScan (U.S.)

- Autonics Corporation (South Korea)

- Hans Turck GmbH & Co. KG (Europe)

Latest Developments in North America Safety Systems Market

- In August 2024, Siemens Smart Infrastructure launched the SICAM Enhanced Grid Sensor (EGS), aimed at improving distribution network transparency for grid operators. This new technology facilitates the digitalization of distribution grids, ensuring optimized use of existing infrastructure by continuously monitoring networks to prevent overloading. The plug-and-play solution enhances efficiency and supports renewable energy integration. This advancement solidified Siemens' position as a leader in energy solutions, benefiting the company by attracting new clients focused on digital transformation

- In December 2023, Panasonic Holdings Corporation has launched a 6-in-1 inertial sensor aimed at enhancing automotive safety and performance. This innovative sensor integrates multiple functionalities, improving vehicle stability and driver assistance systems. The new technology positions Panasonic as a leader in automotive sensor solutions, potentially increasing market share and strengthening partnerships in the growing automotive sector

- In May 2023, ABB has completed its acquisition of Siemens' low-voltage NEMA motor business, originally announced in August 2022, enhancing its position as a leading manufacturer of industrial NEMA motors. This strategic move strengthens ABB's ability to serve global customers in key industries like automation

- In January 2023, Honeywell International Inc. and Nexceris strengthened their partnership to improve safety for electric vehicles. By combining Honeywell’s battery sensors and manufacturing expertise with Nexceris’ Li-Ion Tamer gas detection technology, they aimed to prevent thermal runaway, a key risk causing EV battery fires. This collaboration offered advanced automotive sensing technology to enhance vehicle safety. This strengthened partnership allowed Honeywell to expand its safety solutions portfolio, boosting its reputation and market presence in the growing EV sector

- In August 2022, Rockwell Automation has launched the economical Allen-Bradley 42EA RightSight S18 and 42JA VisiSight M20A photoelectric sensors, offering versatile sensing modes and compact designs. Ideal for various industries, these sensors simplify installation and maintenance while delivering reliable performance in space-constrained applications

SKU-