Market Analysis and Insights

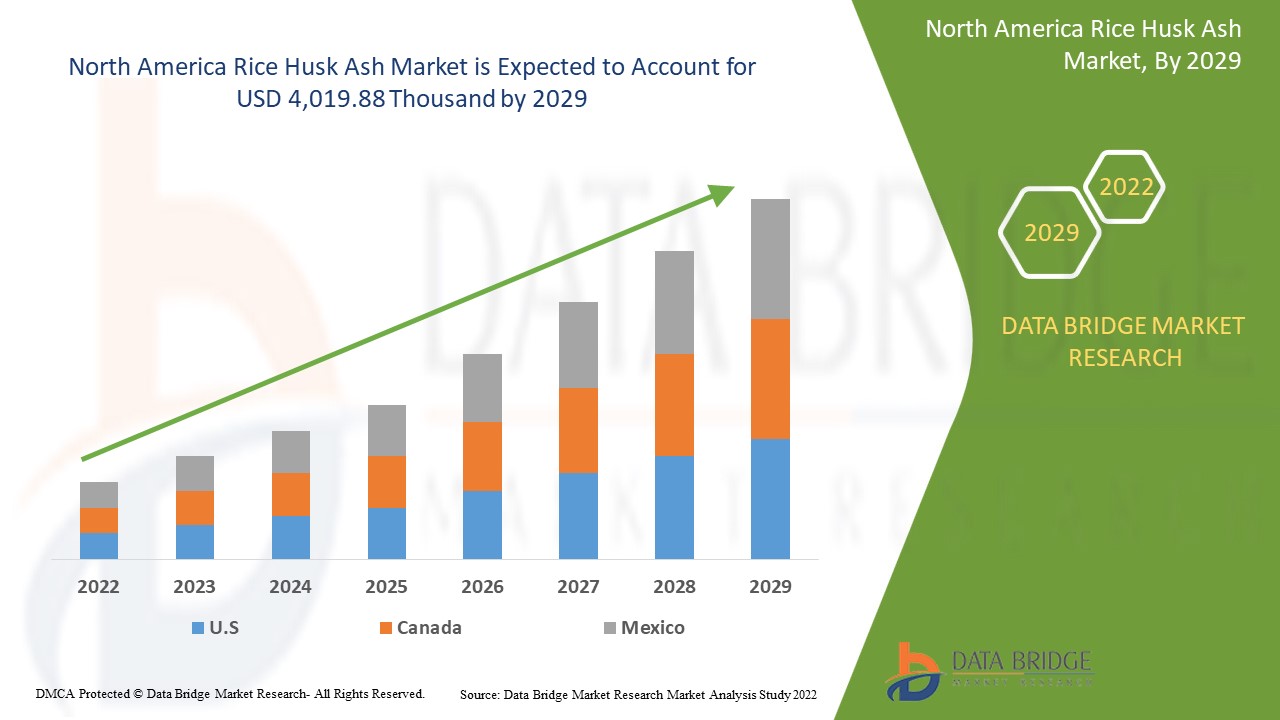

North America rice husk ash market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.4% in the forecast period of 2022 to 2029 and is expected to reach USD 4,019.88 thousand by 2029.

The major factor driving the growth of the North America rice husk ash market is the extensive product scope in the construction industry due to its high silica content.

Extensive product scope in the construction industry due to high silica content is expected to drive the North America rice husk ash market. Rising awareness about the technical benefits of using rice husk ash is expected to propel the growth of the North America rice husk ash market.

The major restraints that may negatively impact the North America rice husk ash market are the problems associated with the water/cement ratio by using rice husk ash and the strong market reach of substitutes.

Due to adherence to environmental regulatory norms and lower raw material costs and manufacturing costs, growing demand is expected to provide opportunities in the North America rice husk ash market.

However, disposal issues associated with rice husk ash and high dependency on rice paddy production are projected to challenge the North America rice husk ash market growth.

North America rice husk ash market report provides details of market share, new developments, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Kilo Tonne, Pricing in USD |

|

Segments Covered |

By Form (Pallets, Powder, Flake, Nodule/Granules), Silicon Content (80-84%, 85-89%, 90-94%, More Than 95%), Downstream Application (Concrete Mixes, Building Blocks, Refractory Bricks, Metal Sheets, Roofing Shingles, Insulators, Water Proofing Chemicals, Pesticides, Others) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

The Agrilectric Companies, among others |

Market Definition

Rice husk ash is a natural by-product recovered from the paddy rice field after rice husking. The casing of rice husk is generally composed of 30% lignin, 20% silica, and 50% cellulose, and if incinerated by controlled thermal decomposition, it turns the residue into ashes.

Rice husk ash is produced after controlled rice husk combustion and possesses a high pozzolanic property and reactivity. It is considered a suitable cementing material in the construction industry, either substitute for cement or an admixture. As an admixture, rice husk ash produces high-strength concrete, while substituting cement with rice husk ash produces low-cost building blocks. Rice husk ash is used for producing lightweight construction material as RHA addition makes concrete lighter.

North America Rice Husk Ash Market Dynamics

Drivers

- Extensive Product Scope in the Construction Industry due to High Silica Content

The application of rice husk ash is gaining dominance in the building & construction industry as it is widely being used as a pozzolan, a filler, additive, abrasive agent, oil adsorbent, sweeping component, and a suspension agent for porcelain enamels. In the cement industry, rice husk ash is used for its amorphous silica to manufacture concrete. It is used to substitute ordinary Portland cement (OPC), a highly expensive and major concrete component. The use of rice husk ash helps produce low-cost building blocks. Low-cost building blocks are highly preferred in many underdeveloped and developing countries such as Kenya, Nigeria, and Indonesia, among many others.

Thus, the growing use of rice husk ash in the construction industry to make concrete and concrete products and other products used, such as bathroom floors, is expected to drive the North America rice husk ash market.

- Rising Awareness About the Technical Benefits of Rice Husk Ash

The main use for rice husk ash stands in the building and construction industry as a supplementary cementitious material (SCM) in blended cement as rice husk ash is added to Portland cement to improve some aspects of the performance of the resulting blend

- In addition, rice husk ash-based concrete mixture offers superior resistance against chloride ion penetration in the marine environment. As a result, the application of these concrete mixtures is growing for construction activities in the marine environment. Besides these applications, rice husk ash is used in other sectors such as roofing shingles, waterproofing chemicals, oil spill absorbents, specialty paints, flame retardants, insecticides, and bio-fertilizers others, which in turn may fuel the growth of the North America rice husk ash market.

Growth in Production Of High-Quality Silica

Growing utilization of high-quality silica obtained from rice husk ash in the building and construction, steel, ceramic, and refractory industries, among many others. This gives a positive outlook on the market growth. The increase in the preference for rice husk ash instead of silica fume and fly ash in the cement and construction industry will influence the market. In addition to environmental and economic advantages, low-energy and simpler methods to obtain pure silica are expected to drive the market while creating new opportunities to develop new industrial applications of rice husk ash.

Opportunities

- Growing Demand Owing to Adherence to Environmental Regulatory Norms

Rice husk is organic waste and is produced in large quantities. It is a major by-product of the rice milling and agro-based biomass industry. Therefore, the use of rice husk ash by-product by other industries help in the reduction of waste, and rice husk ash is used as an additive in many materials and applications, such as refractory brick, manufacturing of insulation, and materials for flame retardants. In addition, rice husk ash is gaining popularity and getting approval from regulatory bodies due to its favorable soil effects in terms of acidity correction. Therefore, the adherence to rice husk ash for various other purposes is expected to provide lucrative opportunities for growth in the North America rice husk ash market.

- Increasing Use of Rice Husk Ash to Produce Rubber Tires

Using silica extracted from rice husk ash has other benefits as well. The energy consumed in extracting silica from the traditional source, such as sand, is much higher. It needs to be heated to 1,400 degrees Celsius to extract silica from sand. In comparison, the temperature required for extracting silica from rice husk ash is only 100 degrees Celsius. In addition, silica taken from rice husk ash gives the tread much better strength and stiffness and provides lower rolling resistance. This is expected to provide an opportunity for the growth of the North America rice husk ash market.

Restraints/Challenges

- Problems Associated with Water/Cement Ratio by Using Rice Husk Ash

Rice husk ash improves the properties of concrete when used in a specific amount, but as the amount of rice husk ash increases, the strength of the cement and concrete tends to decrease as rice husk ash is finer than the cement requires more quantity of water to settle down. This greatly impacts the strength, which is expected to limit the use of rice husk ash in the North America rice husk ash market

- Strong Market Reach of Substitutes

The need for silica cannot be fulfilled only by producing silica from the rice husk ash. The conventional methods for silica production are still preferred and employed to cover the increasing need for raw materials in various industries. In addition, the combustion of rice husk to produce rice husk ash produces a lot of pollution, impacting its growth and limiting its use in the forecast period. This will intensify and make the substitutes' market stronger.

- Disposal Issues Associated with Rice Husk Ash

Adoption of hi-tech technologies to tackle waste like rice husk ash and water, while some rice millers are also using the husk ash for good ecological use such as soil rejuvenation and increasing fertility. In addition, to solve this, rice husk ash is used in different applications for safe disposal. Several ways are being thought of for disposing of rice husk ash by making its commercial use more feasible and efficient. However, the improper disposal of rice husk ash and the lack of facilities in various rice mills is a serious challenge that may hinder the market's growth in the forecast period.

- High Dependency on the Production of Rice Paddy

The percentage of rice husk ash production also depends on the milling rate of rice and what type of rice is available. In addition, rice is a Kharif or winter crop and grows only at a specific time of the year, during the winters. Therefore, it may not be available in bulk quantities throughout the year, which may affect the availability of rice husk ash for other applications in other industries such as the cement industry, silica producing industry, tire industry, and many more. This is coupled with another problem that Asia's share is more than 90% in the world of paddy production. Rice paddy is a primary food grain crop in many Asian countries such as India and China. In 2018, India only accounted for about 21% of the world's rice production. Therefore, it becomes difficult for other parts to have good access to the resources, including the raw material and the finished products. Therefore, the limited geographical presence and total dependency on rice husk in paddy rice is a serious challenge that the North America rice husk ash market needs to overcome to register significant growth in the forecast period.

COVID-19 had a Minimal Impact on North America Rice Husk Ash Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, a significant impact was noticed on rice husk ash in the global operations and supply chain, with multiple manufacturing facilities still operating. The service providers continued offering rice husk ash following sanitation and safety measures in the post-COVID scenario.

North America Rice Husk Ash Market Scope

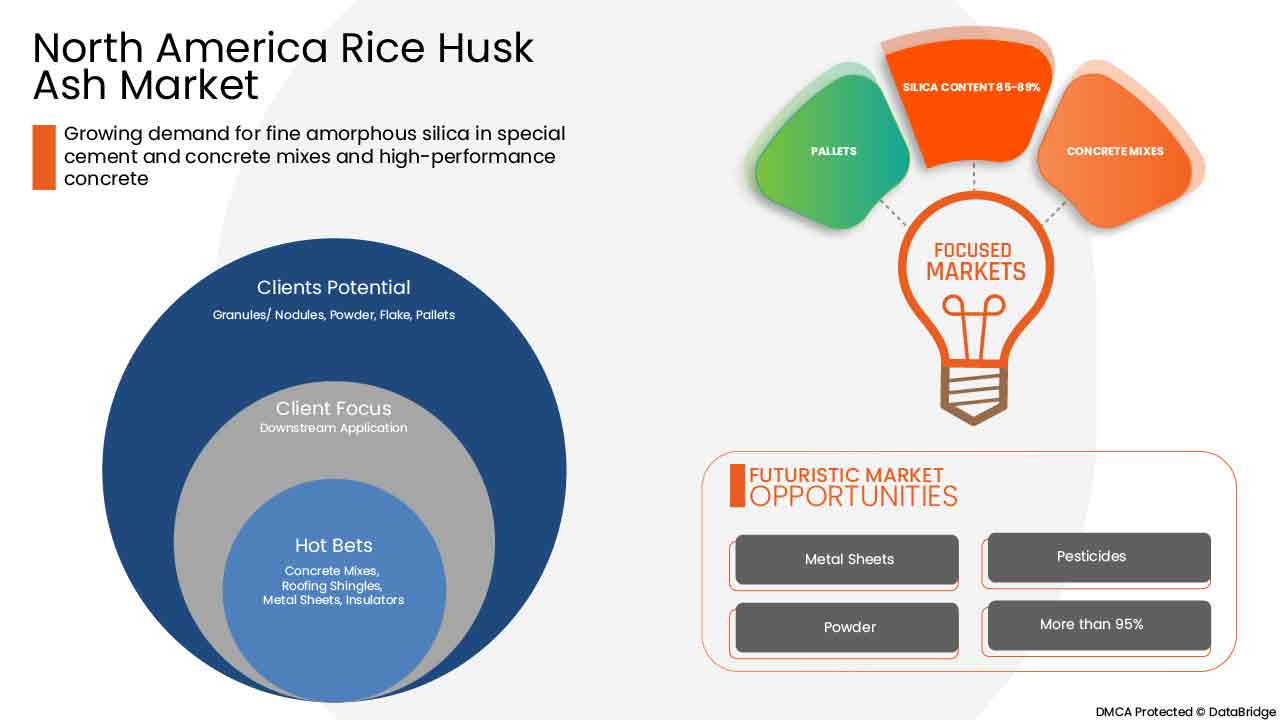

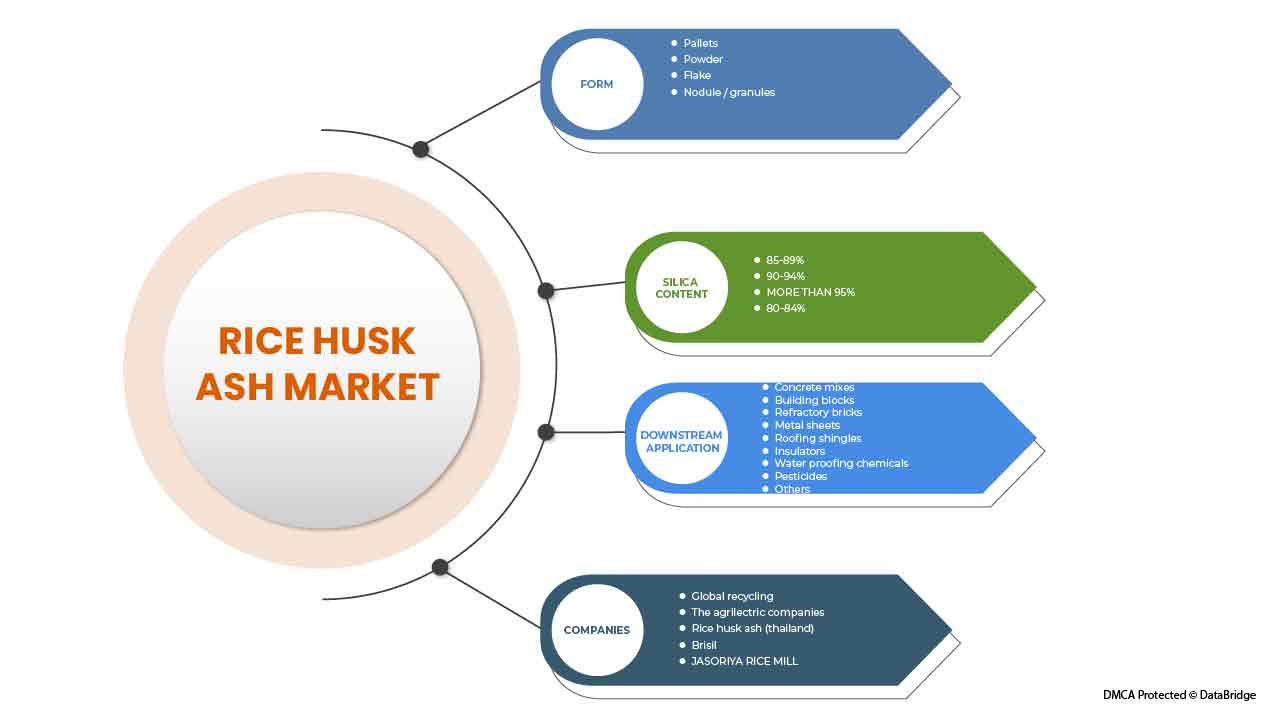

North America rice husk ash market is categorized based on form, silicon content, and downstream application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Form

- Granule/ Nodules

- Pallets

- Flake

- Powder

On the basis of form, the North America rice husk ash market is classified into granule/ nodules, pallets, flake, and powder.

Silicon Content

- 80-84%

- 85-89%

- 90-94%,

- More Than 95%

On the basis of silica content, the North America rice husk ash market is classified into 80-84%, 85-89%, 90-94%, and more than 95%.

Downstream Application

- Concrete Mixes

- Roofing Shingles

- Building Blocks

- Refractory Bricks

- Metal Sheets

- Insulators

- Water Proofing Chemicals

- Pesticides

- Others

On the basis of downstream application, the North America rice husk ash market is classified into concrete mixes, roofing shingles, building blocks, refractory bricks, metal sheets, insulators, water proofing chemicals, pesticides, and others.

North America Rice Husk Ash Regional Analysis/Insights

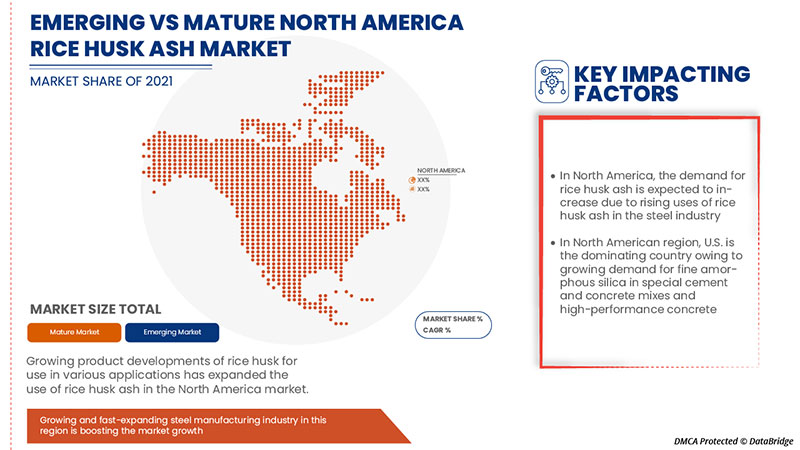

North America rice husk ash market is categorized based on country, form, silicon content, and downstream application. North America rice husk ash market is segmented into U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America rice husk ash market due to growing awareness about the technical benefits of using rice husk ash in the region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of the North American brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing a forecast analysis of the country data.

Competitive Landscape and North America Rice Husk Ash Market Share Analysis

The North America rice husk ash market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the North America rice husk ash market.

Some of the prominent participants operating in the North America rice husk ash market are The Agrilectric Companies, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA RICE HUSK ASH MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET DOWNSTREAM APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT’S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 NORTH AMERICA IMPORT EXPORT SCENARIO

4.3 LIST OF KEY BUYERS

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS

4.4.2 ECONOMIC FACTORS

4.4.3 SOCIAL FACTORS

4.4.4 TECHNOLOGICAL FACTORS

4.4.5 LEGAL FACTORS

4.4.6 ENVIRONMENTAL FACTORS

4.5 PORTER’S FIVE FORCES:

4.6 PRODUCTION CONSUMPTION ANALYSIS- NORTH AMERICA RICE HUSK ASH MARKET

4.6.1 RICE HUSK ASH PRODUCTION BY INCINERATION OF RICE HUSK

4.7 RAW MATERIAL PRODUCTION COVERAGE – NORTH AMERICA RICE HUSK ASH MARKET

RICE PADDY/RICE HUSK 58

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKAGING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATORY COVERAGE

4.11.1 INDIA’S CENTRAL POLLUTION CONTROL BOARD

4.11.2 EUROPEAN COMMISSION (EC)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXTENSIVE PRODUCT SCOPE IN THE CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT

5.1.2 RISING AWARENESS ABOUT THE TECHNICAL BENEFITS OF RICE HUSK ASH

5.1.3 GROWTH IN PRODUCTION OF HIGH-QUALITY SILICA

5.2 RESTRAINTS

5.2.1 PROBLEMS ASSOCIATED WITH WATER/CEMENT RATIO BY USING RICE HUSK ASH

5.2.2 STRONG MARKET REACH OF SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND OWING TO ADHERENCE TO ENVIRONMENTAL REGULATORY NORMS

5.3.2 INCREASING USE OF RICE HUSK ASH TO PRODUCE RUBBER TIRES

5.3.3 ABUNDANT AVAILABILITY OF RICE HUSK ASH

5.4 CHALLENGES

5.4.1 DISPOSAL ISSUES ASSOCIATED WITH RICE HUSK ASH

5.4.2 HIGH DEPENDENCY ON THE PRODUCTION OF RICE PADDY

6 NORTH AMERICA RICE HUSK ASH MARKET, BY FORM

6.1 OVERVIEW

6.2 PALLETS

6.3 POWDER

6.4 FLAKE

6.5 NODULE / GRANULES

7 NORTH AMERICA RICE HUSK ASH MARKET, BY SILICON CONTENT

7.1 OVERVIEW

7.2 85-89%

7.3 90-94%

7.4 MORE THAN 95%

7.5 80-84%

8 NORTH AMERICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION

8.1 OVERVIEW

8.2 CONCRETE MIXES

8.2.1 CONCRETE MIXES, BY TYPE

8.2.1.1 GREEN CONCRETE

8.2.1.2 HIGH PERFORMANCE CONCRETE

8.2.1.3 OTHERS

8.3 BUILDING BLOCKS

8.4 REFRACTORY BRICKS

8.5 METAL SHEETS

8.6 ROOFING SHINGLES

8.7 INSULATORS

8.8 WATER PROOFING CHEMICALS

8.9 PESTICIDES

8.1 OTHERS

9 NORTH AMERICA RICE HUSK ASH MARKET, BY GEOGRAPHY

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA RICE HUSK ASH MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 NORTH AMERICA RECYCLING

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATE

12.2 THE AGRILECTIC COMPANIES

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATE

12.3 RICE HUSK ASH (THAILAND)

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATE

12.4 JASORIYA RICE MILL

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATE

12.5 BRISIL

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATE

12.6 PIONEER CARBON

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATE

12.7 ASTRRA CHEMICALS

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATE

12.8 GURU CORPORATION

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 K V METACHEM

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATE

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 3 COMPRESSION STRENGTH OF CONCRETE WITH DIFFERENT PERCENTAGES OF RICE HUSK ASH

TABLE 4 NORTH AMERICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 6 NORTH AMERICA PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 8 NORTH AMERICA POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 10 NORTH AMERICA FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 12 NORTH AMERICA NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 14 NORTH AMERICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 16 NORTH AMERICA 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 18 NORTH AMERICA 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 20 NORTH AMERICA MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 22 NORTH AMERICA 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 24 NORTH AMERICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 26 NORTH AMERICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 28 NORTH AMERICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 30 NORTH AMERICA BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 32 NORTH AMERICA REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 34 NORTH AMERICA METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 36 NORTH AMERICA ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 38 NORTH AMERICA INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 40 NORTH AMERICA WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 42 NORTH AMERICA PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 44 NORTH AMERICA OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 46 NORTH AMERICA RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (KILO TONNE)

TABLE 48 NORTH AMERICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 50 NORTH AMERICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 52 NORTH AMERICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 54 NORTH AMERICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 56 U.S. RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 58 U.S. RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 59 U.S. RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 60 U.S. RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 U.S. RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 62 U.S. CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 U.S. CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 64 CANADA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 66 CANADA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 67 CANADA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 68 CANADA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 CANADA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 70 CANADA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 CANADA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 72 MEXICO RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 74 MEXICO RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 76 MEXICO RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 MEXICO RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 78 MEXICO CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 MEXICO CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

List of Figure

FIGURE 1 NORTH AMERICA RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA RICE HUSK ASH MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA RICE HUSK ASH MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RICE HUSK ASH MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA RICE HUSK ASH MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA RICE HUSK ASH MARKET: THE FORM LIFE LINE CURVE

FIGURE 7 NORTH AMERICA RICE HUSK ASH MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA RICE HUSK ASH MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA RICE RUSK ASH MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA RICE HUSK ASH MARKET: DOWNSTREAM APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA RICE HUSK ASH MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA RICE HUSK ASH MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA RICE HUSK ASH MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 EXTENSIVE PRODUCT SCOPE IN CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT IS EXPECTED TO DRIVE NORTH AMERICA RICE HUSK ASH MARKET IN THE FORECAST PERIOD

FIGURE 16 PALLETS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA RICE HUSK ASH MARKET IN 2022 & 2029

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 SUPPLY CHAIN ANALYSIS- NORTH AMERICA RICE HUSK ASH MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA RICE HUSK ASH MARKET

FIGURE 20 NORTH AMERICA RICE HUSK ASH MARKET, BY FORM, 2021

FIGURE 21 NORTH AMERICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2021

FIGURE 22 NORTH AMERICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2021

FIGURE 23 NORTH AMERICA RICE HUSK ASH MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA RICE HUSK ASH MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA RICE HUSK ASH MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA RICE HUSK ASH MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA RICE HUSK ASH MARKET: BY FORM (2022 & 2029)

FIGURE 28 NORTH AMERICA RICE HUSK ASH MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.