North America RFID (Radio Frequency Identification) Market Analysis and Size

RFID technology makes use of the electromagnetic field to detect the tags attached to products. The tags contain electronically stored information and can be attached to the products, animals, and a person. Primarily RFID tags were developed to replace the barcodes in supply chains. RFID tags can be read wirelessly and without any line of sight. RFID is a rapidly growing wireless technology that has helped the textile and apparel industry save billions of dollars by delivering precise data of different items located at any time. The growth of the market has been highly boosted by increasing the installation of RFID systems in manufacturing units to improve productivity. The growing acceptance of electronic identity cards and RFID tags in smart cards is boosting the growth of the North America RFID (Radio Frequency Identification) market.

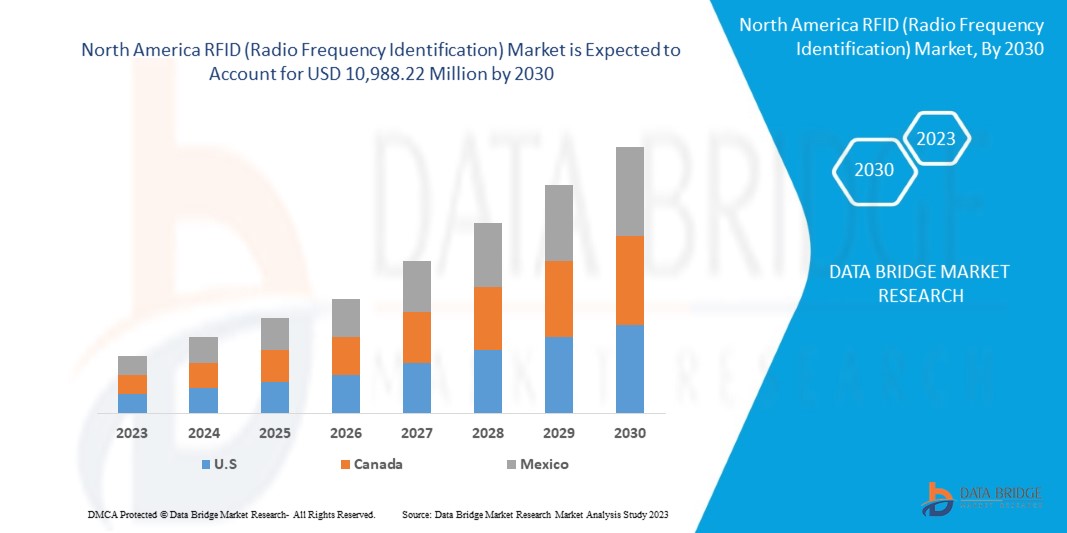

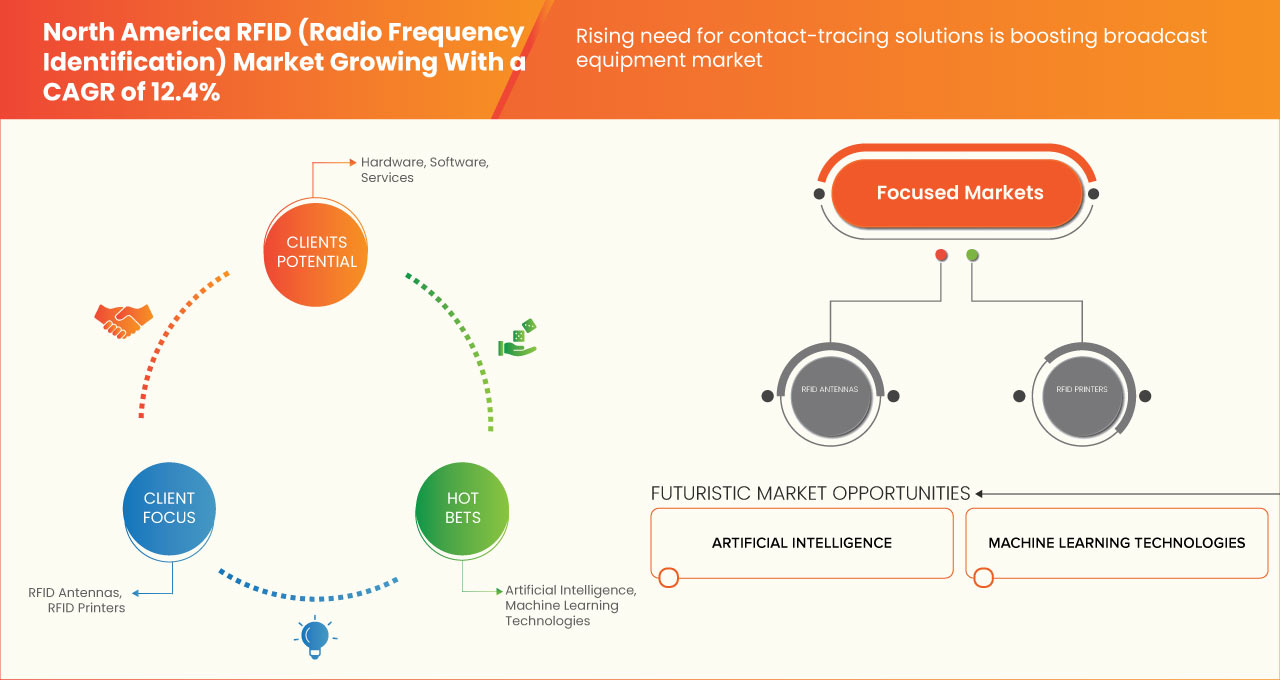

Data Bridge Market Research analyses that the North America RFID (Radio Frequency Identification) market is expected to reach a value of USD 10,988.22 million by 2030, at a CAGR of 12.4% during the forecast period. The North America RFID (radio frequency identification) market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Offering (Hardware, Software, and Services), Connectivity (Bluetooth, Ultrawide Band, and Others), Material Type (Plastic, Metal, Paper, Glass, and Others), End User (Retail/Commercial, Industrial, Healthcare, Consumer Package Goods, Automotive, Aerospace, Surveillance and Security, Logistics and Transportation, Sports, Defense, Education, Livestock & Wildlife, and Others) |

|

Country Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

CCL Industries, Honeywell International Inc., HL, Smart Label Solutions, Omnia Technologies, SES RFID GmbH, Invengo Technology Pte. Ltd., RFID4U, AVERY DENNISON CORPORATION, Jadak – A Novanta Company, Alien Technology, LLC, CoreRFID, Impinj, Inc., Nedap N.V., NXP Semiconductors, Zebra Technologies Corp., Pepperl+Fuchs SE, SimplyRFID, Identiv, Inc., HID Global Corporation, part of ASSA ABLOY among others |

Market Definition

RFID (radio frequency identification) is part of a tracking system that uses smart barcodes for identifying items through the use of radiofrequency technology. The radio waves transmit data from the tag to a reader, and the data received is then transmitted as information to an RFID computer program. RFID tags are equipped with integrated circuits and antennas that can be attached to products and packaging. The RFID tags transfer data through the radio waves, which RFID readers convert to form a more usable form of data that is then analyzed by the backend.

North America RFID (Radio Frequency Identification) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

Increasing installation of RFID systems in the manufacturing industry to improve productivity

Manufacturers are always looking for advanced ways to optimize operations and reduce expenses. Radio-frequency identification (RFID) technology can optimize the supply chain by improving material flow and tracking damages. Increased automation, paired with the widespread availability of smart gadgets and associated wireless networks such as RFID, allows for unprecedented levels of flexibility and efficiency. RFID technology is widely employed in manufacturing since it provides numerous benefits, such as better product monitoring, more accurate WIP status, fewer manufacturing errors, and a higher-quality product. RFID enables real-time sight of material and assets, which is essential for running the production process smoothly.

Growing acceptance of electronic identity cards and RFID tags located in smart cards,

In February 2023, the security technology alliance organization released a detailed report regarding smart card initiatives the U.S. government and institutes took. In this report, they mentioned that the U.S. federal government launched smart card programs to regulate smart cards for employee and contractor identification cards. They also specify smart cards for citizens, transportation workers, and first responders in new identity programs. This step taken by the U.S. federal government is boosting the acceptance of electronic identity cards and RFID tags in smart cards.

Opportunity

Rising need for contact-tracing solutions

Contact tracing is an important and recognized part of any strategy to prevent and monitor the outbreak and spreading of infectious diseases. Radiofrequency identification (RFID) technology uses electromagnetic fields to automatically identify and track tags attached to persons or objects to create a real-time location system. The COVID-19 impact reveals the importance of traceability and standardization to effectively monitor people, supply chains, and assets in the healthcare industry. The COVID-19 outbreak has heightened the risks posed by the global trade in counterfeit pharmaceutical products

Restraint/Challenge

High purchase, installation, and maintenance costs

Adoption of RFID systems in any industry requires high investments, including the purchase cost of RFID tags, readers, and software and the costs associated with replacement services and electricity. Add-on features such as continuous accuracy checking of systems, IoT integration, and training costs make RFID solutions more costly. This results in a low adoption rate of RFID systems. RFID Tags are of two types active and passive, passive RFID tags are of low cost as compared to active RFID tags but the infrastructure of passive RFID tags is quite expensive

Post-COVID-19 Impact on North America RFID (Radio Frequency Identification) market

COVID-19 negatively impacted the North America RFID (Radio Frequency Identification) market due to the shutdown of global logistics and transportation and the lack of testing for the system.

The COVID-19 pandemic has impacted the North America RFID (Radio Frequency Identification) market to an extent in negative manner. However, The word RAIN is derived from Radiofrequency Identification that acts as a nod to act as a link between UHF RFID and the cloud. The cloud helps store and manage the data that can be further shared through the internet. RAIN RFID is, therefore, a wireless technology that helps connect billions of everyday items to the internet, allowing several consumers to identify further, locate, authenticate, and engage each item. With increasing automation in various industries and increasing use of connected equipment, manufacturers are developing RAIN RFID tags to gain a larger market share, therefore, increasing the growth of the market.

The market players are conducting multiple research and development activities to improve the technology involved in the accessories. With this, the companies will bring advancement and innovation to the market. In addition, government funding for RFID has led the market growth.

Recent Developments

- In August 2023, HL announced that the company had launched a new UHF RFID industrial power connector. This step has allowed the company to increase its product portfolio under the North America radio frequency identification technology market and serve a wider consumer range in Europe and North America

- CCL Industries announced that the company had launched a new clinical system for the healthcare sector. This system will contain a new digital capability for the next generation of clinical labeling. The company has increased its dominance in the North America radio frequency identification technology market through this launch

North America RFID (Radio Frequency Identification) Market Scope

North America RFID (radio frequency identification) market is segmented based on the offering, connectivity, material type, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET, BY OFFERING

- HARDWARE

- SOFTWARE

- SERVICES

On the basis of offering, the market is segmented into hardware, software, and services.

NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET, BY CONNECTIVITY

- BLUETOOTH BAND

- ULTRA WIDE BAND

- OTHERS

On the basis of connectivity, the market has been segmented into bluetooth and ultrawide band, others.

NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET, BY MATERIAL TYPE

- PLASTIC

- METAL

- PAPER

- GLASS

- OTHERS

On the basis of material type, the market has been segmented into plastic, metal, paper, glass, and others.

NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET, BY END USER

- RETAIL/COMMERCIAL

- INDUSTRIAL

- HEALTHCARE

- CONSUMER PACKAGE GOODS

- AUTOMOTIVE

- AEROSPACE

- SURVEILLANCE AND SECURITY

- LOGISTICS AND TRANSPORTATION

- INFORMATION TECHNOLOGY (IT)

- SPORTS

- DEFENCE

- WILDLIFE

- EDUCATION

- LIVESTOCK

- OTHERS

On the basis of end user, the market is segmented into retail/commercial, industrial, healthcare, consumer package goods, automotive, aerospace, surveillance and security, logistics and transportation, information technology (IT), sports, defence, wildlife, education, livestock and others.

Country Analysis/Insights

North America RFID (radio frequency identification) market is analyzed, and market size insights and trends are provided by country, type, distribution channel, demographics, and price range as referenced above. The countries covered in the North America RFID (radio frequency identification) market report are the U.S., Canada, and Mexico. The U.S. is expected to dominate the market as the country has an increasing adoption of RFID tags for industry 4.0, IoT, and smart manufacturing compared to other regions. The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America RFID (Radio Frequency Identification) Market Share Analysis

North America RFID (Radio Frequency Identification) market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points provided are only related to the companies' focus related to North America RFID (Radio Frequency Identification) market.

Some of the major players operating in the North America RFID (Radio Frequency Identification) market are CCL Industries, Honeywell International Inc., HL, Smart Label Solutions, Omnia Technologies, SES RFID GmbH, Invengo Technology Pte. Ltd., RFID4U, AVERY DENNISON CORPORATION, Jadak – A Novanta Company, Alien Technology, LLC, CoreRFID, Impinj, Inc., Nedap N.V., NXP Semiconductors, Zebra Technologies Corp., Pepperl+Fuchs SE, SimplyRFID, Identiv, Inc., HID Global Corporation, part of ASSA ABLOY among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE INSTALLATION OF RFID SYSTEMS IN THE MANUFACTURING INDUSTRY TO IMPROVE PRODUCTIVITY

5.1.2 RISE IN ACCEPTANCE OF ELECTRONIC IDENTITY CARDS AND RFID TAGS LOCATED IN SMART CARDS

5.1.3 INCREASE IN REGULATIONS AND GOVERNMENT INITIATIVES FOR VARIOUS INDUSTRIES

5.1.4 GROWTH IN THE USAGE OF RFID TAGS IN DIFFERENT INDUSTRIES

5.2 RESTRAINTS

5.2.1 HIGH PURCHASE, INSTALLATION, AND MAINTENANCE COSTS

5.2.2 CYBER ATTACKS AND DATA BREACHES WITH RFID

5.3 OPPORTUNITIES

5.3.1 RISE IN NEED FOR CONTACT-TRACING SOLUTIONS

5.3.2 INCREASE IN ADOPTION OF RFID TAGS FOR INDUSTRY 4.0, IOT, AND SMART MANUFACTURING

5.3.3 INCREASE IN DEVELOPMENTS IN RAIN RFID

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS ABOUT RFID SOLUTIONS AND EXPERT WORKFORCE

6 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 TAGS

6.2.1.1 BY PRODUCT TYPE

6.2.1.1.1 INLAY TAGS

6.2.1.1.2 COMPOSITE TAGS

6.2.1.1.3 CERAMIC TAGS

6.2.1.2 BY TYPE

6.2.1.2.1 PASSIVE TAGS

6.2.1.2.2 ACTIVE TAGS

6.2.1.2.3 BATTERY-ASSISTED PASSIVE (BAP) RFID TAGS

6.2.1.3 BY WAFER SIZE

6.2.1.3.1 300MM

6.2.1.3.2 200MM

6.2.1.3.3 OTHERS

6.2.1.4 BY FREQUENCY

6.2.1.4.1 LOW FREQUENCY

6.2.1.4.2 ULTRA-HIGH FREQUENCY

6.2.1.4.3 HIGH FREQUENCY

6.2.1.5 BY APPLICATION

6.2.1.5.1 RETAIL

6.2.1.5.2 ASSET MANAGEMENT

6.2.1.5.3 ACCESS CONTROL/ TICKETING

6.2.1.5.4 LOGISTICS

6.2.1.5.5 AIRLINES

6.2.1.5.6 HEALTHCARE

6.2.1.5.7 PEOPLE MANAGEMENT

6.2.1.5.8 EMBEDDED SYSTEMS

6.2.1.5.9 OTHERS

6.2.1.6 BY FORM FACTOR

6.2.1.6.1 CARD

6.2.1.6.2 IMPLANT

6.2.1.6.3 KEY FOB

6.2.1.6.4 LABEL

6.2.1.6.5 PLASTIC MOULDING

6.2.1.6.6 WRISTBAND

6.2.1.6.7 BUTTONS

6.2.1.6.8 BADGES

6.2.1.6.9 OTHERS

6.2.1.7 BY MATERIAL TYPE

6.2.1.7.1 PLASTIC

6.2.1.7.2 PAPER

6.2.1.7.3 GLASS

6.2.1.7.4 METAL

6.2.1.7.5 OTHERS

6.2.2 READERS

6.2.2.1 BY PRODUCT TYPE

6.2.2.1.1 FIXED RFID READERS

6.2.2.1.2 PORTABLE/HANDHELD RFID

6.2.2.1.2.1 HANDHELD TABLET READERS

6.2.2.1.2.2 HANDHELD PDA/EDA READERS

6.2.2.1.2.3 HANDHELD PISTOL GRIP READERS

6.2.2.1.3 USB RFID READERS

6.2.2.1.4 BLUETOOTH RFID READERS

6.2.2.1.5 RUGGED & VEHICLE MOUNTED RFID READERS

6.2.2.1.6 GPS RFID READERS

6.2.2.1.7 OTHERS

6.2.2.2 BY TECHNOLOGY

6.2.2.2.1 RAIN RFID READER

6.2.2.2.2 ANDROID RFID READER

6.2.2.2.3 IPHONE RFID READER

6.2.2.2.4 OTHER

6.2.2.3 BY FREQUENCY

6.2.2.3.1 LOW FREQUENCY READERS

6.2.2.3.2 ULTRA-HIGH FREQUENCY READERS

6.2.2.3.3 HIGH FREQUENCY READERS

6.2.2.4 BY APPLICATION

6.2.2.4.1 RETAIL

6.2.2.4.2 ASSET MANAGEMENT

6.2.2.4.3 ACCESS CONTROL/TICKETING

6.2.2.4.4 LOGISTICS

6.2.2.4.5 AIRLINES

6.2.2.4.6 HEALTHCARE

6.2.2.4.7 PEOPLE MANAGEMENT

6.2.2.4.8 EMBEDDED SYSTEMS

6.2.2.4.9 OTHERS

6.2.3 RFID ANTENNAS

6.2.4 RFID PRINTERS

6.2.4.1 DESKTOP PRINTER

6.2.4.2 MOBILE PRINTER

6.3 SOFTWARE

6.3.1 OPERATING SYSTEM

6.3.1.1 ANDROID

6.3.1.2 WINDOW

6.3.1.3 IOS

6.3.1.4 WEB

6.3.1.5 OTHERS

6.3.2 BY DEPLOYMENT

6.3.2.1 ON-PREMISE

6.3.2.2 CLOUD

6.3.3 BY APPLICATION

6.3.3.1 ACCESS CONTROL RFID SOFTWARE

6.3.3.2 ASSET TRACKING RFID SOFTWARE

6.3.3.3 PARKING CONTROL RFID SOFTWARE

6.3.3.4 PERSONAL TRACKING RFID SOFTWARE

6.3.3.5 AUTO-ID ENGINE

6.3.3.6 OTHERS

6.4 SERVICES

6.4.1 SYSTEM IMPLEMENTATION/MAINTENANCE

6.4.2 SYSTEM DESIGNING/DEVELOPMENT/TESTING

6.4.3 CONSULTING, SELECTION GUIDANCE

7 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY

7.1 OVERVIEW

7.2 BLUETOOTH

7.3 ULTRA WIDE BAND

7.4 OTHER

8 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PLASTIC

8.3 PAPER

8.4 GLASS

8.5 METAL

8.6 OTHERS

8.6.1 SILICON

8.6.2 CERAMIC

8.6.3 RUBBER

9 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER

9.1 OVERVIEW

9.2 RETAIL/COMMERCIAL

9.2.1 APPAREL

9.2.2 JEWELLER TRACKING

9.2.3 KIOSK

9.2.4 IT ASSET TRACKING

9.2.5 ADVERTISEMENT

9.2.6 LAUNDRY

9.2.7 OTHER

9.3 LOGISTICS AND TRANSPORTATION

9.4 SURVEILLANCE AND SECURITY

9.5 AUTOMOTIVE

9.6 INDUSTRIAL

9.7 AEROSPACE/AVIATION

9.7.1 BAGGAGE TRACKING

9.7.2 MATERIALS MANAGEMENT

9.7.3 FLY PARTS TRACKING

9.7.4 LIFETIME TRACEABILITY

9.7.5 MRO

9.7.6 OTHER

9.8 CONSUMER PACKAGE GOODS

9.9 HEALTHCARE

9.9.1 PATIENTS MANAGEMENT

9.9.2 WASTE MANAGEMENT

9.9.3 DRUGS MANAGEMENT

9.9.4 LABORATORY MANAGEMENT

9.9.5 EQUIPMENT MANAGEMENT

9.9.6 OTHER

9.1 LIVESTOCK & WILDLIFE

9.11 SPORTS

9.12 EDUCATION

9.13 DEFENSE

9.13.1 BORDER SECURITY

9.13.2 WEAPON MANAGEMENT TRACKING

9.13.3 SOLDIER MOVEMENT TRACKING

9.13.4 OTHER

9.14 OTHER

10 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILING

13.1 ZEBRA TECHNOLOGIES CORP.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 AVERY DENNISON CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 HONEYWELL INTERNATIONAL INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 CCL INDUSTRIES

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 IMPINJ, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALIEN TECHNOLOGY, LLC

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 CORERFID

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 HID GLOBAL CORPORATION, PART OF ASSA ABLOY

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 HL

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 IDENTIV, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 INVENGO TECHNOLOGY PTE. LTD.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 JADAK – A NOVANTA COMPANY

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 NEDAP N.V.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 NXP SEMICONDUCTORS

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 OMNIA TECHNOLOGIES

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PEPPERL+FUCHS SE

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 RFID4U

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 SES RFID GMBH

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 SIMPLYRFID

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

13.2 SMART LABEL SOLUTION

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET, BY OFFERING, 2023-2030 (USD MILLION)

TABLE 2 NORTH AMERICA HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 3 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

TABLE 4 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 5 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2023-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2023-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2023-2030 (USD MILLION)

TABLE 9 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

TABLE 11 NORTH AMERICA PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 12 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

TABLE 13 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2023-2030 (USD MILLION)

TABLE 14 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 15 NORTH AMERICA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 16 NORTH AMERICA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 17 NORTH AMERICA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SERVICES IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 20 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2023-2030

TABLE 21 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY MATERIAL TYPE, 2023-2030

TABLE 22 NORTH AMERICA OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET: BY END USER, 2023-2030

TABLE 24 NORTH AMERICA RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 30 U.S. HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 32 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 34 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 35 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 37 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.S. PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 41 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 42 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 43 U.S. RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 45 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 46 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 47 U.S. SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 49 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 52 U.S. RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.S. AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 57 CANADA HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 59 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 61 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 62 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 64 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 65 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 66 CANADA PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 68 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 69 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 CANADA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 72 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 73 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 CANADA SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 76 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 79 CANADA RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 84 MEXICO HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 88 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 89 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 91 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 92 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 93 MEXICO PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 95 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 96 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 97 MEXICO RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 99 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 100 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 101 MEXICO SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 103 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 104 MEXICO OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 106 MEXICO RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 MEXICO AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 MEXICO HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 MEXICO DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SEGMENTATION

FIGURE 10 INCREASE IN THE INSTALLATION OF RFID SYSTEMS IN MANUFACTURING UNITS TO IMPROVE PRODUCTIVITY IS EXPECTED TO DRIVE THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET IN THE FORECAST PERIOD

FIGURE 11 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

FIGURE 13 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY OFFERING, 2022

FIGURE 14 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2022

FIGURE 15 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY MATERIAL TYPE, 2022

FIGURE 16 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET: BY END USER, 2022

FIGURE 17 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SNAPSHOT (2022)

FIGURE 18 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2022)

FIGURE 19 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 20 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 21 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY OFFERING (2023-2030)

FIGURE 22 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY SHARE 2022 (%)

North America Rfid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Rfid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Rfid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.