North America Polystyrene Packaging Market Analysis and Insights

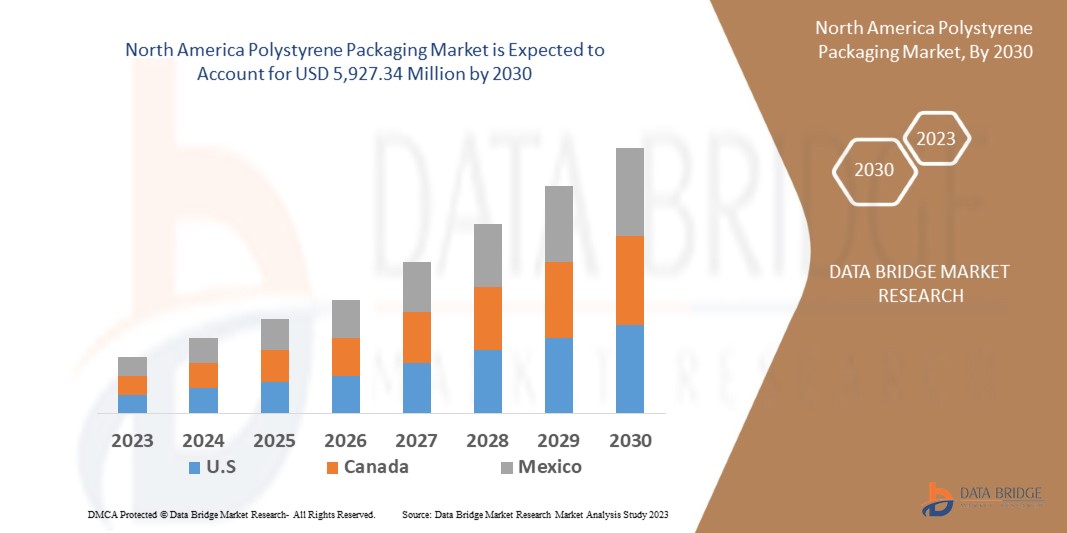

The North America polystyrene packaging market is expected to grow significantly from 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.0% in the forecast period of 2023 to 2030 and is expected to reach USD 5,927.34 million by 2030. The major factor driving the growth of the polystyrene packaging market is increasing use in the medical and pharmaceutical industries. The rising number of food outlets is expected to propel North America polystyrene packaging growth.

The North America polystyrene packaging market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. Contact us for an analyst brief to understand the analysis and the market scenario. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Bowls, Tubs, Boxes, Cups, Bags, Pouches, Bottles, Wraps and Films, Plate, and Others), Application (Fruits, Vegetable, Fish, Sea Products, Meat Products, Milk Products/Dairy Products, Bakery & Confectionery, Snacks, and Cooked Food), End-User (Food & Beverages, Pharmaceuticals, and Personal & Home Care) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Alpek S.A.B. de C.V., Sonoco Products Company, KANEKA CORPORATION, NEFAB GROUP, and Heubach Corporation, among others |

Market Definition

Polystyrene is a versatile polymer used to produce a wide range of consumer products. It is highly used as a packaging material due to its solid and hard plastic properties. It offers transparency to the full product. Plastic often combines with additives and other polymers to make it ideal for application in different industries such as pharmaceuticals, homes, personal care, and others.

North America Polystyrene Packaging Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise in the usage of polystyrene packaging in cosmetics and other personal goods due to enhanced durability

The demand for cosmetics and personal goods products has increased over the years because of the increasing disposable incomes, wishes to look beautiful, and maintain personal hygiene. However, the contents of such products are perishable and have a definite shelf life. Exposure to air, heat, light and cold can worsen the quality and stability of the ingredients in cosmetics and personal goods products. To overcome such challenges, polystyrene packaging offers a great solution. This not only helps to keep products in the desired physical state but also can be helpful in easy transportation.

- Increase use in packaging of the medical and pharmaceutical industry

Enhanced access to healthcare services, growing use of medical insurance, rising public awareness of healthcare, favorable demographics, increased research and development, and growing disposable incomes have increased the market of the medical and pharmaceutical industry. Pharmaceutical products are sensitive to contamination and must be supplied to consumers with great safety. To address this concern, polystyrene packaging offers to be one of the most widely used materials by the pharmaceutical companies

- Rise in the number of food outlets

The increasing urbanization, the introduction of North America food chains, increasing income, demographics, the advent of e-commerce in the food industry, and changing eating habits are forces driving the food industry's market. The metro cities dominate the food restaurant market as the consumers have high disposable incomes and increased spending ability. They are also exposed to various cuisines and packaged food-related items. The advent of e-commerce in the food and beverage industry also drives the rising number of food outlets.

Opportunities

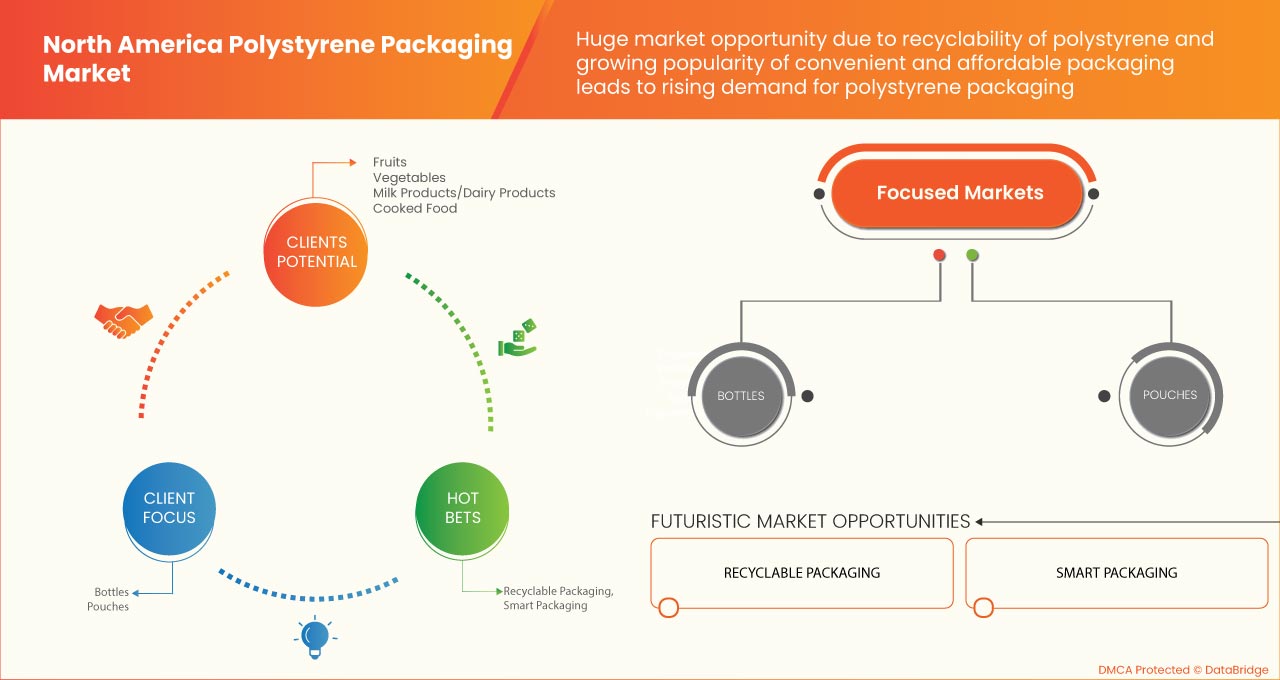

- Ability to recycle polystyrene materials

Polystyrene is a flexible polymer employed for various items, including packaging, transportation, consumer goods, etc. However, environmental harm occurs because it is non-degradable when these items are discarded. As a result, greater emphasis is placed on recycling and reusing polystyrene materials. After use, a significant amount of expanded PS is released from supermarkets, department stores, wholesale markets, shops and restaurants, businesses that sell electrical equipment, and industries where machines are made. The polystyrene-based materials that need to be recycled are washed to remove any dust or foreign particles and then crushed.

- Increase consumer's inclination toward convenient and affordable packaging

The core of the marketing plan is packaging since it raises the product's shelf value and facilitates handling. Additionally, it is crucial to consider how to make the package more appealing while safeguarding the product contained in the package from environmental effects and maintaining the product's freshness. According to the consumer's convenience, packaging entails placing the items in appealing packets. To increase product demand among consumers, appropriate and appealing packaging is utilized as a promotional strategy.

Restraints

- Availability of a wide range of substitutes

Polystyrene is one of the most flexible plastics because of its lightweight nature, ease of processing, and minimal cost. It has become the go-to takeout container for many restaurants and industries owing to its advantageous performance characteristics, including heat tolerance and retention. However, such materials negatively affect human health and the environment, forcing consumers to look for other sustainable alternatives. Consumer demands, awareness regarding sustainability, and regulations are the restraints causing the decrease in the North America polystyrene packaging market.

In recent times, other lightweight, low-cost, and green materials have replaced polystyrene packaging. The polylactic acid-lined paper has been used as containers or cups for packaging hot or cold food items. Edible cups made from natural grain products are in demand for packaging and serving hot and cold beverages in the restaurant industry.

- Health and environmental issues associated with polystyrene

Polystyrene has polluted and negatively impacted the environment and our health due to its extensive use. It takes almost 500 years to decompose naturally discarded, so it stays in the environment for a very long time. Such polystyrene-based materials add to landfills and water bodies, further degrading the soil and water quality. Small polystyrene fragments could be consumed by animals present on land and result in choking or intestinal blockage. After disintegrating in the ocean, polystyrene can potentially be eaten by fish which may get eaten by the marine species higher up the food chain, which would concentrate the contamination

Challenges

- Stringent regulations regarding the use of polystyrene

Polystyrene packaging has wide applications in food packaging, like disposable cutlery and plates, single-use hot or cold beverage cups, meat and egg trays, and containers for pharmaceuticals and personal care products. However, due to its diverse use, polystyrene materials often get up and are added to waste. Polystyrene, because of their lightweight nature, breaks into small fragments and is not easily biodegradable, causing it to be persistent in the environment and susceptible to microplastic contamination. Styrene is also a potential carcinogen from which polystyrene is made. Frequent exposure to polystyrene may cause adverse health effects

- Volatility in raw material prices

Made from the styrene monomer, polystyrene is an artificial aromatic hydrocarbon polymer. By combining ethylene and benzene, styrene is created. Styrene consists of 26% ethylene and 74% benzene. Along with benzene and ethylene, a catalyst such as aluminum trichloride, magnesium oxide, and iron oxide is the other raw materials involved in the production of polystyrene. It is reasonable to anticipate that since benzene and ethylene are products of the processing of petroleum and natural gas, their prices will follow the price of crude oil. In addition, the facilities required to produce such polystyrene require high capital and extensive infrastructure.

Recent Development

- In May 2022, Alpek, S.A.B. de C.V. received all necessary approvals from the regulatory authorities and finalized its acquisition of OCTAL Holding SAOC. The company acquired 100% of the shares of OCTAL for USD 620 million on a debt-free basis

North America Polystyrene Packaging Market Scope

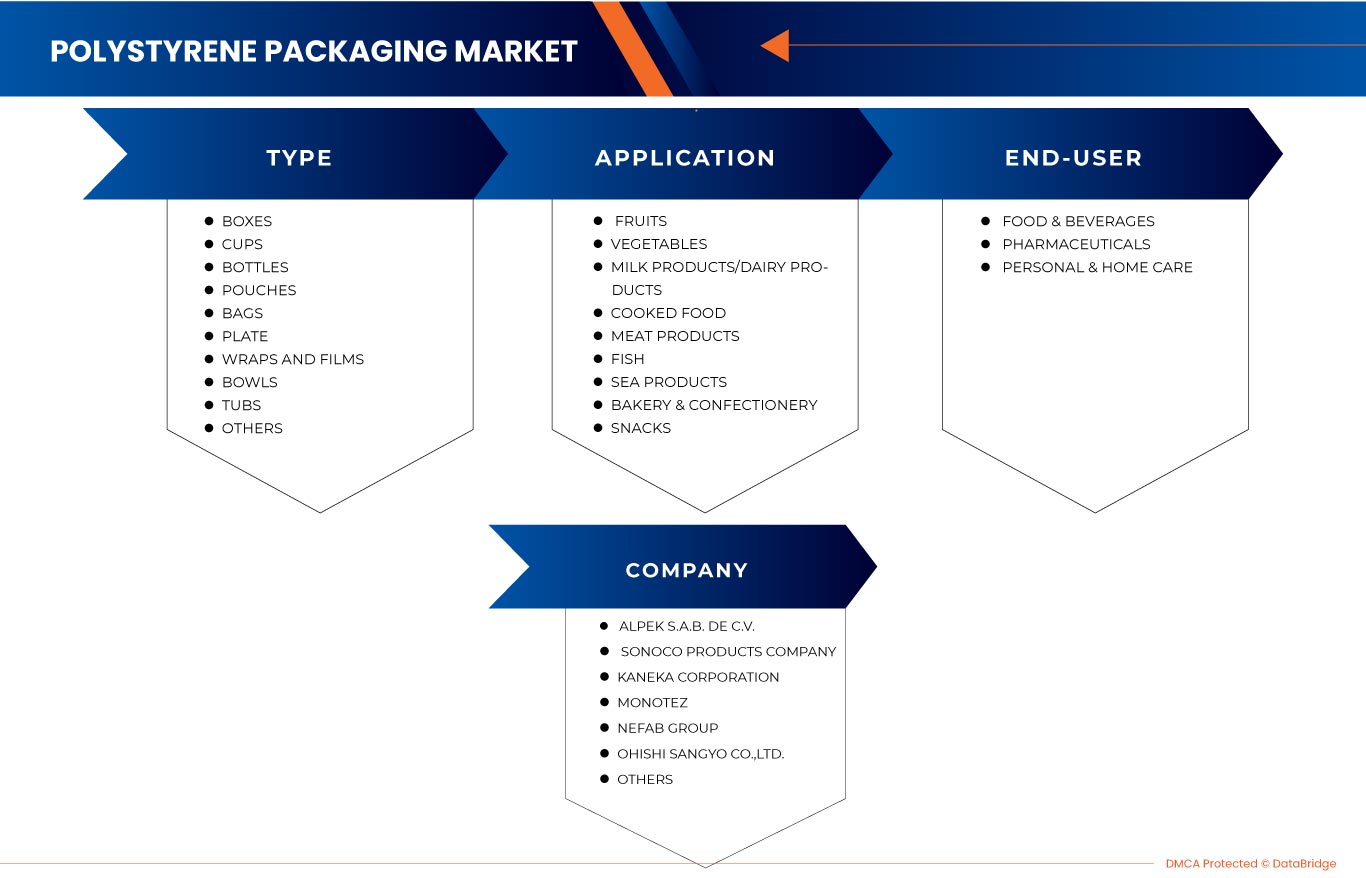

The North America polystyrene packaging market is categorized based on type, application, and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Bowls

- Tubs

- Boxes

- Cups

- Bags

- Pouches

- Bottles

- Wraps and Films

- Plate

- Others

Based on type, the North America polystyrene packaging market is classified into ten segments bowls, tubs, boxes, cups, bags, pouches, bottles, wraps and films, plate, and others.

Application

- Fruits

- Vegetable

- Fish

- Sea Products

- Meat Products

- Milk Products/Dairy Products

- Bakery & Confectionery

- Snacks

- Cooked Food

Based on product, the North America polystyrene packaging market is classified into nine segments fruits, vegetable, fish, sea products, meat products, milk products/dairy products, bakery & confectionery, snacks, and cooked food.

End-User

- Food & Beverages

- Pharmaceuticals

- Personal & Home Care

Based on the end-users, the North America polystyrene packaging market is classified into three segments food & beverages, pharmaceuticals, and personal & home care.

North America Polystyrene Packaging Market Regional Analysis/Insights

The North America polystyrene packaging market is segmented based on type, application, and end-users.

The countries in the North America polystyrene packaging market are the U.S., Canada, and Mexico.

The U.S. dominates in the North American region due to the increasing demand for plastic.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data point downstream and upstream value chain analysis, technological trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Polystyrene Packaging Market Share Analysis

North America polystyrene packaging market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies focusing on the North America polystyrene packaging market.

Some prominent participants operating in the North America polystyrene packaging market are Alpek S.A.B. de C.V., Sonoco Products Company, KANEKA CORPORATION, NEFAB GROUP, and Heubach Corporation, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA POLYSTYRENE PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 PRICE TREND ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 VENDOR SELECTION CRITERIA

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 RAW MATERIAL ANALYSIS

4.1 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN THE USE OF POLYSTYRENE PACKAGING IN COSMETICS AND OTHER PERSONAL GOODS DUE TO ENHANCED DURABILITY

5.1.2 INCREASE IN THE USE IN PACKAGING OF MEDICAL AND PHARMACEUTICAL INDUSTRY

5.1.3 RISE IN THE NUMBER OF FOOD OUTLETS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF A WIDE RANGE OF SUBSTITUTES

5.2.2 HEALTH AND ENVIRONMENTAL ISSUES ASSOCIATED WITH POLYSTYRENE

5.2.3 UNABLE TO TOLERATE HIGH MECHANICAL, CHEMICAL, AND THERMAL STRESS

5.3 OPPORTUNITIES

5.3.1 ABILITY TO RECYCLE POLYSTYRENE MATERIALS

5.3.2 INCREASING CONSUMER'S INCLINATION TOWARD CONVENIENT AND AFFORDABLE PACKAGING

5.4 CHALLENGES

5.4.1 STRINGENT REGULATIONS REGARDING THE USE OF POLYSTYRENE

5.4.2 VOLATILITY IN RAW MATERIAL PRICES

6 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY TYPE

6.1 OVERVIEW

6.2 BOXES

6.3 CUPS

6.4 BOTTLES

6.5 POUCHES

6.6 BAGS

6.7 PLATE

6.8 WRAPS AND FILMS

6.9 BOWLS

6.1 TUBS

6.11 OTHERS

7 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 FRUITS

7.3 VEGETABLES

7.4 MILK PRODUCTS/DAIRY PRODUCTS

7.5 COOKED FOOD

7.6 MEAT PRODUCTS

7.7 FISH

7.8 SEA PRODUCTS

7.9 BAKERY & CONFECTIONERY

7.1 SNACKS

8 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY END-USER

8.1 OVERVIEW

8.2 FOOD & BEVERAGES

8.2.1 BOXES

8.2.2 CUPS

8.2.3 BOTTLES

8.2.4 POUCHES

8.2.5 BAGS

8.2.6 PLATE

8.2.7 WRAPS AND FILMS

8.2.8 BOWLS

8.2.9 TUBS

8.2.10 OTHERS

8.2.10.1 FRUITS

8.2.10.2 VEGETABLES

8.2.10.3 MILK PRODUCTS/DAIRY PRODUCTS

8.2.10.4 COOKED FOOD

8.2.10.5 MEAT PRODUCTS

8.2.10.6 FISH

8.2.10.7 SEA PRODUCTS

8.2.10.8 BAKERY & CONFECTIONERY

8.2.10.9 SNACKS

8.3 PHARMACEUTICALS

8.3.1 BOXES

8.3.2 CUPS

8.3.3 BOTTLES

8.3.4 POUCHES

8.3.5 BAGS

8.3.6 PLATE

8.3.7 WRAPS AND FILMS

8.3.8 BOWLS

8.3.9 TUBS

8.3.10 OTHERS

8.4 PERSONAL & HOME CARE

8.4.1 BOXES

8.4.2 CUPS

8.4.3 BOTTLES

8.4.4 POUCHES

8.4.5 BAGS

8.4.6 PLATE

8.4.7 WRAPS AND FILMS

8.4.8 BOWLS

8.4.9 TUBS

8.4.10 OTHERS

9 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.2 EXPANSIONS

10.3 ACQUISITIONS

10.4 AWARDS

10.5 AGREEMENT

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 ALPEK S.A.B. DE C.V.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 SONOCO PRODUCTS COMPANY

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 KANEKA CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 MONOTEZ

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 NEFAB GROUP

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 HEUBACH CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 OHISHI SANGYO CO, LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 SUNPOR

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 SYNTHOS

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 VERSALIS S.P.A. (A SUBSIDIARY OF ENI S.P.A)

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF PLATES, SHEETS, FILM, FOIL, AND STRIPS OF PLASTICS, REINFORCED, LAMINATED, SUPPORTED, OR SIMILARLY COMBINED WITH OTHER MATERIALS, OR OF CELLULAR PLASTIC, UNWORKED OR MERELY SURFACE-WORKED OR MERELY CUT INTO SQUARES OR RECTANGLES (EXCLUDING SELF-ADHESIVE PRODUCTS, FLOOR, WALL AND CEILING COVERINGS; HS CODE – 3912 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PLATES, SHEETS, FILM, FOIL, AND STRIPS OF PLASTICS, REINFORCED, LAMINATED, SUPPORTED, OR SIMILARLY COMBINED WITH OTHER MATERIALS, OR OF CELLULAR PLASTIC, UNWORKED OR MERELY SURFACE-WORKED OR MERELY CUT INTO SQUARES OR RECTANGLES (EXCLUDING SELF-ADHESIVE PRODUCTS, FLOOR, WALL AND CEILING COVERINGS; HS CODE – 3912 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 6 NORTH AMERICA BOXES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA BOXES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 8 NORTH AMERICA CUPS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA CUPS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 10 NORTH AMERICA BOTTLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA BOTTLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 12 NORTH AMERICA POUCHES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA POUCHES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 14 NORTH AMERICA BAGS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA BAGS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 16 NORTH AMERICA PLATE IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA PLATE IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 18 NORTH AMERICA WRAPS AND FILMS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA WRAPS AND FILMS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 20 NORTH AMERICA BOWLS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA BOWLS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 22 NORTH AMERICA TUBS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA TUBS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 24 NORTH AMERICA OTHERS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 26 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 28 NORTH AMERICA FRUITS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA FRUITS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 30 NORTH AMERICA VEGETABLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA VEGETABLES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 32 NORTH AMERICA MILK PRODUCTS/DAIRY PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA MILK PRODUCTS/DAIRY PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 34 NORTH AMERICA COOKED FOOD IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA COOKED FOOD IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 36 NORTH AMERICA MEAT PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA MEAT PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 38 NORTH AMERICA FISH IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA FISH IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 40 NORTH AMERICA SEA PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA SEA PRODUCTS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 42 NORTH AMERICA BAKERY & CONFECTIONERY IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA BAKERY & CONFECTIONERY IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 44 NORTH AMERICA SNACKS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA SNACKS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 46 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 48 NORTH AMERICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 50 NORTH AMERICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 54 NORTH AMERICA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA PERSONAL & HOME CAREIN POLYSTYRENE PACKAGING MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 57 NORTH AMERICA PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY COUNTRY, 2021-2030 (MILLION UNITS)

TABLE 60 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 62 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 64 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 66 NORTH AMERICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 U.S. POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 72 U.S. POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 U.S. POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 74 U.S. POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 75 U.S. POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 76 U.S. FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 U.S. FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 U.S. PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 U.S. PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 82 CANADA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 83 CANADA POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 84 CANADA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 85 CANADA POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 86 CANADA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 CANADA FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 88 CANADA PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 CANADA PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 MEXICO POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 MEXICO POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 92 MEXICO POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 93 MEXICO POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (MILLION UNITS)

TABLE 94 MEXICO POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 95 MEXICO POLYSTYRENE PACKAGING MARKET, BY END-USER, 2021-2030 (MILLION UNITS)

TABLE 96 MEXICO FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO FOOD & BEVERAGES IN POLYSTYRENE PACKAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 MEXICO PHARMACEUTICALS IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO PERSONAL & HOME CARE IN POLYSTYRENE PACKAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA POLYSTYRENE PACKAGING MARKET

FIGURE 2 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: SEGMENTATION

FIGURE 14 RISING USE OF POLYSTYRENE PACKAGING IN COSMETICS AND OTHER PERSONAL GOODS DUE TO ENHANCED DURABILITY IS EXPECTED TO DRIVE THE NORTH AMERICA POLYSTYRENE PACKAGING MARKET IN THE FORECAST PERIOD

FIGURE 15 BOXES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA POLYSTYRENE PACKAGING MARKET IN 2022 & 2029

FIGURE 16 PRICE ANALYSIS FOR POLYSTYRENE PACKAGING PRODUCTS (USD/UNIT)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA POLYSTYRENE PACKAGING MARKET

FIGURE 18 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: BY TYPE, 2022

FIGURE 19 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: BY END-USER, 2022

FIGURE 21 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: BY TYPE (2023 - 2030)

FIGURE 26 NORTH AMERICA POLYSTYRENE PACKAGING MARKET: COMPANY SHARE 2022 (%)

North America Polystyrene Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Polystyrene Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Polystyrene Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.