North America Point Of Care Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

19.77 Billion

USD

32.00 Billion

2024

2032

USD

19.77 Billion

USD

32.00 Billion

2024

2032

| 2025 –2032 | |

| USD 19.77 Billion | |

| USD 32.00 Billion | |

|

|

|

|

North America Point-Of-Care Diagnostics Market Size

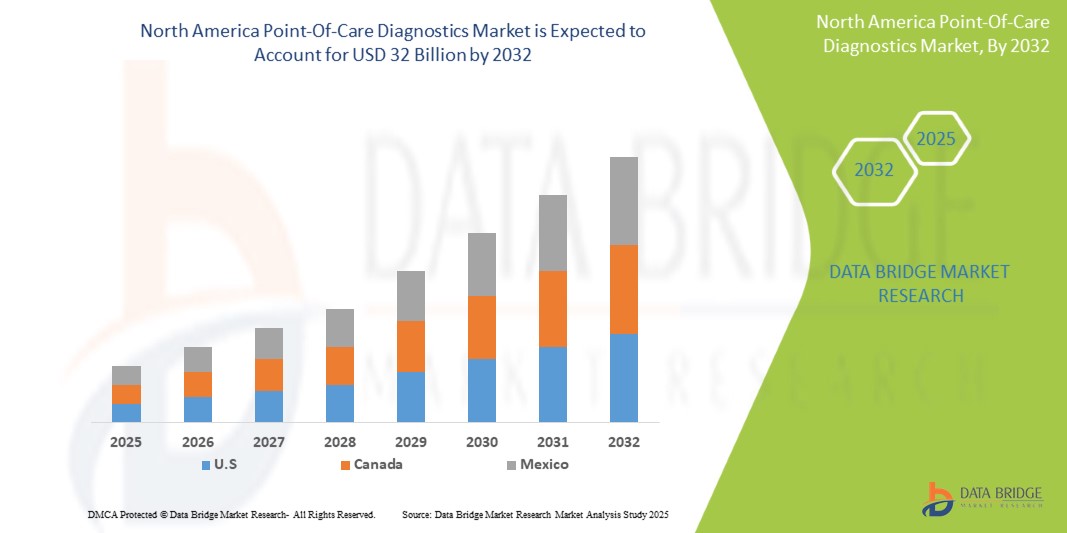

- The North America point-of-care diagnostics market size was valued at USD 19.77 billion in 2024 and is expected to reach USD 32 billion by 2032, at a CAGR of 6.20% during the forecast period

- This growth is driven by factors such as the aging population, increasing prevalence of chronic diseases, and advancements in diagnostic technologies

North America Point-Of-Care Diagnostics Market Analysis

- Point-of-care diagnostics are essential tools used for quick and accurate medical testing at or near the site of patient care, enabling immediate results for conditions such as diabetes, cardiovascular diseases, and infectious diseases

- The demand for point-of-care diagnostics is significantly driven by the increasing prevalence of chronic diseases, advancements in diagnostic technology, and the need for quicker healthcare responses

- U.S. is expected to dominate the North America point-of-care diagnostics market with largest market share of 45.6%, due to the presence of key players such as Abbott, BIOMERIEUX, BD, Siemens Healthineers AG, QIAGEN, Quidel Corporation, and Quest Diagnostics is positively influencing the market growth

- Canada is expected to be the fastest growing country in the North America point-of-care diagnostics market during the forecast period due to country’s aging population, with projections indicating that by 2036, one-fifth of Canadians will be over the age of 65. This demographic shift leads to a higher prevalence of chronic conditions, creating a greater demand for efficient and accessible diagnostic solutions

- Hospitals segment is expected to dominate the market with a largest market share of 37.69% due to the increasing demand for rapid, on-site diagnostic testing in hospital settings, which facilitates timely decision-making and enhances patient care. The integration of miniaturized and wireless POC devices within hospitals allows for efficient bedside testing, reducing the need for centralized laboratory services and expediting the diagnostic process

Report Scope and North America Point-Of-Care Diagnostics Market Segmentation

|

Attributes |

North America Point-Of-Care Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Point-Of-Care Diagnostics Market Trends

“Technological Advancements and Miniaturization in Point-of-Care Diagnostics”

- One prominent trend in the North America point-of-care diagnostics market is the rapid advancement and miniaturization of diagnostic technologies, enabling more portable, user-friendly, and faster testing solutions

- These innovations enhance diagnostic efficiency by delivering real-time results at the patient’s side, reducing turnaround times and facilitating quicker clinical decision-making in both hospital and home settings

- For instance, the development of handheld molecular testing devices and smartphone-integrated diagnostic platforms allows for accurate detection of conditions such as COVID-19, influenza, and chronic diseases outside traditional laboratory environments

- These advancements are reshaping the diagnostic landscape, expanding access to healthcare, improving patient outcomes, and driving demand for compact, connected, and high-performance point-of-care testing devices across North America

North America Point-Of-Care Diagnostics Market Dynamics

Driver

“Rising Burden of Chronic and Infectious Diseases Driving Diagnostic Demand”

- The increasing prevalence of chronic conditions such as diabetes, cardiovascular diseases, and infectious diseases is a major driver of growth in the North America point-of-care diagnostics market

- With a growing aging population and lifestyle-related health risks, the region is experiencing a surge in demand for rapid, accessible diagnostic tools that support early detection and real-time health monitoring

- As more patients require ongoing monitoring and quick diagnosis, the healthcare industry is increasingly turning to point-of-care diagnostics to reduce hospital visits, streamline treatment, and improve outcomes

For instance,

- According to the Centers for Disease Control and Prevention (CDC), in 2023, more than 37 million Americans were living with diabetes, and cardiovascular diseases remain the leading cause of death—highlighting the urgent need for fast, reliable diagnostic solutions

- This surge in chronic and infectious diseases across the U.S. and Canada is fueling the demand for point-of-care diagnostics, supporting market growth through improved disease management and early intervention

Opportunity

“Integration of Artificial Intelligence to Enhance Diagnostic Accuracy and Efficiency”

- The integration of artificial intelligence (AI) into point-of-care diagnostics presents a transformative opportunity for the North American healthcare landscape, offering improved accuracy, speed, and personalized care

- AI algorithms can analyze complex diagnostic data in real-time, assisting healthcare providers with faster decision-making and reducing diagnostic errors, especially in high-burden conditions like diabetes, cardiovascular diseases, and infectious diseases

- Additionally, AI-driven diagnostic platforms can streamline workflows, optimize resource utilization, and enable remote testing capabilities, which are particularly valuable in underserved or high-demand settings

For instance,

- In 2024, multiple AI-powered diagnostic devices received FDA clearance in the U.S., including tools capable of detecting diabetic retinopathy, COVID-19, and early cardiac events with high precision—highlighting the potential of AI in revolutionizing rapid care delivery

- The integration of AI into point-of-care diagnostics opens new opportunities for improving clinical outcomes, expanding access to care, and building a more responsive and data-driven healthcare system in North America

Restraint/Challenge

“High Cost of Advanced Diagnostic Devices Limiting Widespread Adoption”

- The high cost of advanced point-of-care diagnostic devices poses a significant restraint for market penetration, particularly among smaller clinics, rural healthcare providers, and low-budget institutions in North America

- These devices, while offering rapid and accurate results, often come with substantial upfront investment and ongoing maintenance costs, which can deter adoption despite their clinical benefits

- Smaller healthcare facilities may struggle to justify the investment without guaranteed reimbursement or sufficient patient volume, leading to slower uptake of cutting-edge diagnostic technologies

For instance,

- According to a 2024 report by the American Hospital Association (AHA), many rural and community hospitals in the U.S. face financial constraints that limit their ability to adopt newer diagnostic tools, including POC molecular testing platforms and AI-integrated devices

- This financial barrier can hinder equitable access to advanced diagnostics, creating disparities in patient outcomes and slowing the overall growth of the point-of-care diagnostics market in North America

North America Point-Of-Care Diagnostics Market Scope

The market is segmented on the basis of product, platform, prescription, and end user

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Platform |

|

|

By Prescription |

|

|

By End User |

|

In 2025, the hospitals is projected to dominate the market with a largest share in end user segment

The hospitals segment is expected to dominate the North America point-of-care diagnostics market with the largest share of 37.69% due to the increasing demand for rapid, on-site diagnostic testing in hospital settings, which facilitates timely decision-making and enhances patient care. The integration of miniaturized and wireless POC devices within hospitals allows for efficient bedside testing, reducing the need for centralized laboratory services and expediting the diagnostic process

The other infectious disease is expected to account for the largest share during the forecast period in product segment

In 2025, the other infectious disease segment is expected to dominate the market with the largest market share of 25.4% due to increasing cases of dengue fever, enteric, malaria, syphilis, tuberculosis, and others in the region. The significant demand for rapid tests has encouraged market players to offer point-of-care solutions to decentralized regions

North America Point-Of-Care Diagnostics Market Regional Analysis

“U.S. Holds the Largest Share in the Ophthalmic Operational Microscope Market”

- U.S. dominates the North America point-of-care diagnostics market with largest market share of 45.6%, due to the presence of key players such as Abbott, BIOMERIEUX, BD, Siemens Healthineers AG, QIAGEN, Quidel Corporation, and Quest Diagnostics is positively influencing the market growth

- Additionally, robust government support and funding from agencies like the National Institutes of Health (NIH) and the Department of Defense (DoD) have accelerated the development and deployment of advanced POC diagnostic technologies

- The U.S. also benefits from a highly developed healthcare infrastructure that enables the widespread adoption of these tools across hospitals, clinics, and home-care settings. Furthermore, the high prevalence of chronic and infectious diseases has created a sustained demand for rapid and reliable diagnostic solutions, solidifying the U.S.'s dominant position in the regional market

“Canada is Projected to Register the Highest CAGR in the North America Point-Of-Care Diagnostics Market”

- Canada is expected to experience the highest growth rate in the North American point-of-care diagnostics market, driven by factors such as the expansion of healthcare infrastructure, increased demand for rapid diagnostic solutions, and rising healthcare expenditure

- The Canadian healthcare system is increasingly adopting advanced point-of-care diagnostic technologies, with particular growth in areas like diabetes monitoring, cardiovascular disease detection, and infectious disease testing, as the demand for decentralized testing rises

- Additionally, the government’s focus on improving healthcare access, combined with initiatives to expand telemedicine and remote healthcare services, is fostering the widespread integration of point-of-care diagnostic solutions across the country

- As the Canadian population ages, there is also a growing need for chronic disease management and preventative health measures, further propelling the demand for fast, reliable diagnostic tools to manage health conditions more efficiently

North America Point-Of-Care Diagnostics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- BD (U.S.)

- Siemens Healthineers AG (Germany)

- bioMérieux SA (France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- QuidelOrtho Corporation (U.S.)

- Danaher Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Cardinal Health, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Nova Biomedical (U.S.)

- Sekisui Diagnostics (U.S.)

- Trinity Biotech (Ireland)

- OraSure Technologies, Inc. (U.S.)

- Chembio Diagnostics, Inc. (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- Werfen (Spain)

- GenBody Inc. (South Korea)

Latest Developments in North America Point-Of-Care Diagnostics Market

- In 2023, QIAGEN received CE certification for its In Vitro Diagnostic (IVD) kit and NeuMoDx automated testing platform. This certification significantly enhanced the company’s market position and revenue, reflecting a key milestone in the adoption of their advanced diagnostic technologies. The approval paves the way for the broader integration of QIAGEN's innovative solutions across healthcare settings, facilitating quicker and more accurate diagnostic results, which are crucial for improving patient outcomes and expanding access to decentralized care

- In 2023, Danaher Corporation launched the Dxl 9000 Access Immunoassay Analyzer, which is capable of performing up to 215 tests per hour. This strategic move strengthened Danaher’s portfolio within the point-of-care diagnostics sector, focusing on enhancing testing efficiency. The introduction of this high-throughput analyzer addresses the growing demand for rapid, high-volume diagnostic testing, particularly in clinical environments where efficiency and accuracy are critical for improving patient care and operational workflows

- In 2022, Genes2Me Pvt. Ltd introduced the Rapi-Q Point of Care RT-PCR solution, designed for the detection of human papillomavirus (HPV) and tuberculosis. The device, which holds CE-IVD certification, delivers rapid results in under 45 minutes, offering superior performance, high sensitivity, and ease of use. This innovation meets the increasing demand for fast, reliable diagnostic solutions that enhance patient management and treatment outcomes, particularly in the detection of infectious diseases such as HPV and tuberculosis

- In 2022, LumiraDx Healthcare introduced its highly sensitive C-Reactive Protein (CRP) point-of-care antigen test in India. This innovative diagnostic solution is designed to meet the needs of clinical settings by helping reduce unnecessary antibiotic prescriptions, a crucial step in combating antimicrobial resistance (AMR). This development aligns with the increasing focus on improving diagnostic accuracy and promoting responsible antibiotic use. The introduction of such advanced diagnostic tools supports efforts to address AMR while enhancing patient care and optimizing healthcare resources in the region

- In 2022, Genes2Me Pvt. Ltd. introduced the Rapi-Q Point of Care RT-PCR solution for the detection of human papillomavirus (HPV) and tuberculosis. This device, which carries CE-IVD certification, is distinguished by its user-friendly design, providing rapid results in less than 45 minutes, alongside exceptional sensitivity and reliable detection capabilities. The launch of this solution addresses the growing need for efficient, accurate, and timely diagnostic tools, particularly in the detection of infectious diseases like HPV and tuberculosis, thereby supporting improved patient outcomes and streamlining healthcare processes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.