North America Phytogenic Feed Additives Market

Market Size in USD Million

CAGR :

%

USD

172.07 Million

USD

338.63 Million

2022

2030

USD

172.07 Million

USD

338.63 Million

2022

2030

| 2023 –2030 | |

| USD 172.07 Million | |

| USD 338.63 Million | |

|

|

|

|

North America Phytogenic Feed Additives Market Analysis and Size

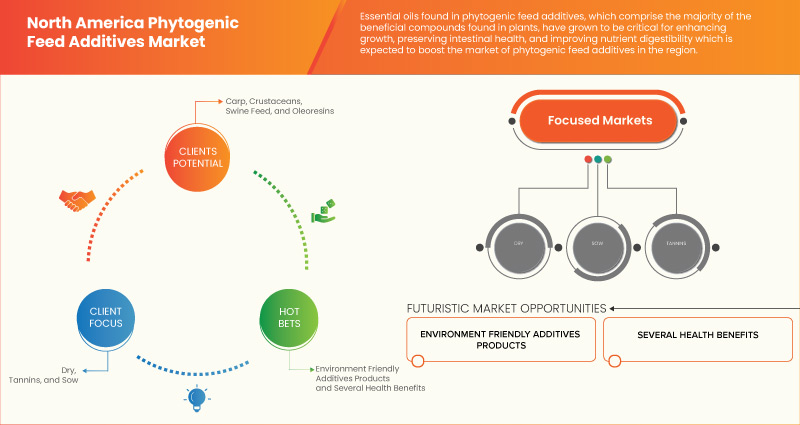

The surging demand for natural feed additives, the increase in consumption of animal protein, stringent regulations on antibiotic feed additives, and the escalating concern regarding animal welfare, are some of the factors expected to drive market growth. However, the availability of established alternatives for feed additives in the market is expected to restrain market growth.

The North America phytogenic feed additives market report provides details of market share, new developments, and the impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

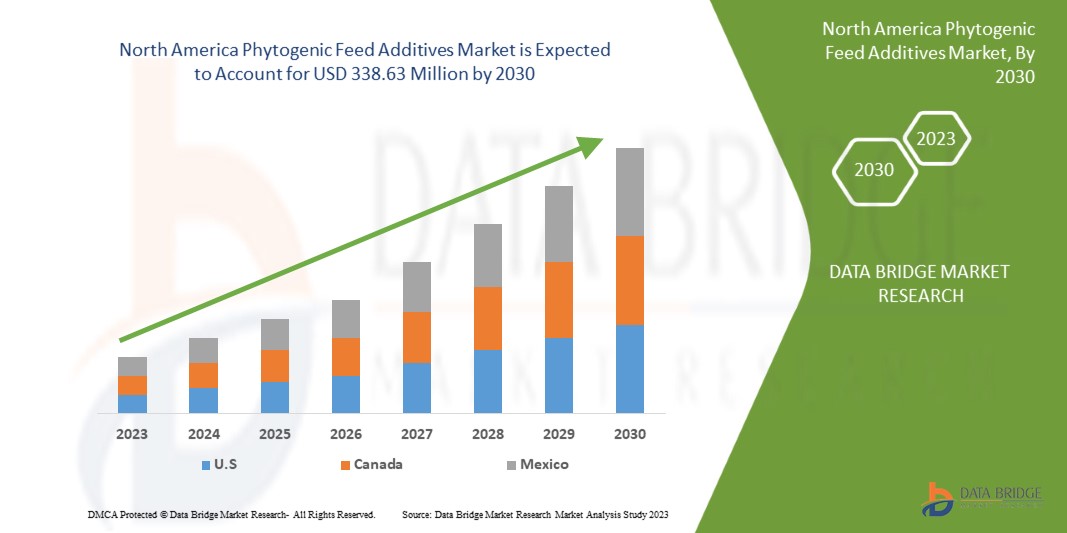

The North America phytogenic feed additives market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyzes that the market is growing with a CAGR of 9.0% in the forecast period of 2023 to 2030 and is expected to reach USD 338.63 million by 2030 from USD 172.07 million by 2022.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

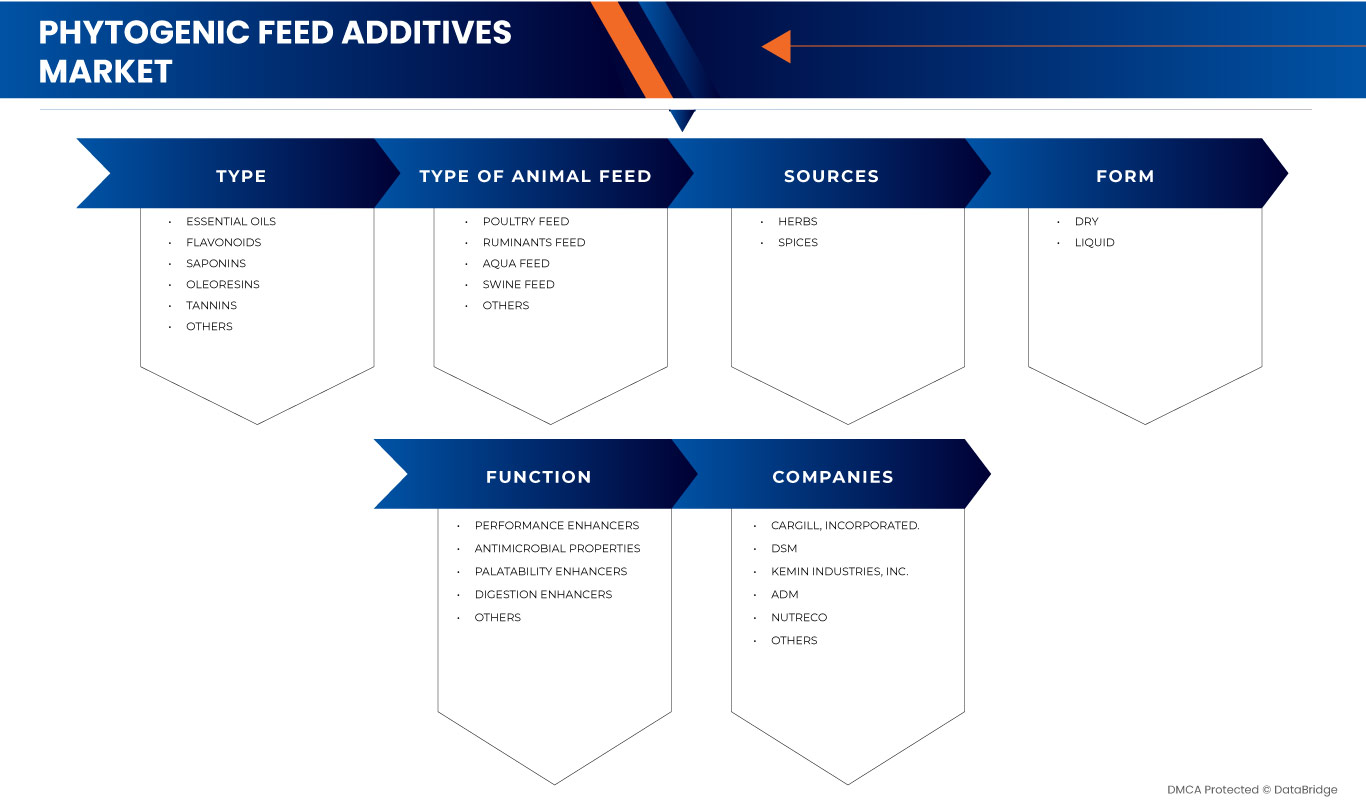

Type (Essential Oils, Flavonoids, Saponins, Oleoresins, Tannins, and Others), Type of Animal Feed (Poultry Feed, Ruminants Feed, Aqua Feed, Swine Feed, and Others), Sources (Herbs and Spices), Form (Dry and Liquid), Function (Performance Enhancers, Antimicrobial Properties, Palatability Enhancers, Digestion Enhancers, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Cargill, Incorporated., DSM, Kemin Industries, Inc., ADM, Nutreco, Natural Remedies., Himalaya Wellness Company, Vinayak Ingredients. India, Silvateam S.p.a., Phytobiotics Futterzusatzstoffe GmbH, Tegasa, MIAVIT GMBH, Indian Herbs, Customer DOSTOFARM GmbH, British Horse Feeds, Orffa, Igusol, Glamac International Private Limited., and Nor-Feed among others |

Market Definition

Phytogenic is a class of organic growth promoters used as feed additives that are derived from herbs, spices, or other plants. The range of phytogenic feed additives is broad and includes essential oils and active ingredient classes such as saponins, flavonoids, mucilages, tannins, and bitter and pungent substances. Phytogenic feed additives are substances of plant origin added to animal diets at recommended levels to enhance animal growth and nutrition.

North America Phytogenic Feed Additives Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Stringent Regulations on Antibiotic Feed Additives

Antibiotics are a class of organic, semi-organic, or synthetic compounds with anti-microbial activity that are widely used to treat and prevent infectious illnesses in humans and animals. They may also be added to feed as growth promoters to aid in the development of animals.

The use of antibiotics in poultry and livestock production is seen as advantageous by farmers and the economy as a whole because it has generally improved poultry performance economically and effectively. However, the potential spread of antibiotic-resistant strains of pathogenic and non-pathogenic organisms into the environment and their subsequent transmission to humans via the food chain could seriously affect public health. Legislation and other restrictions on antibiotic usage in farm animals are being established worldwide due to these health concerns.

For instance,

- In November 2017, the WHO published an article against frequently administering antibiotics to stimulate growth and prevent sickness in healthy animals. By minimizing their needless use in animals, the new WHO recommendations seek to conserve the potency of antibiotics that are crucial for human health.

- According to European Commission, antibiotics have been utilized extensively in livestock agriculture worldwide for decades. They enhance the growth performance of farm animals when added in small dosages to their feed. However, the Commission decided to gradually phase out and ultimately ban the marketing and use of antibiotics as growth promoters in feed beginning in 2006 due to the rise in bacterial resistance towards antibiotics used to treat human and animal diseases.

It is unlikely that antibiotics will ever be eliminated from animal agriculture since doing so would harm the livestock sector. It is crucial to look for naturally occurring, accessible, affordable, and efficient growth promoters to replace Antibiotic Growth Promoters (AGPs) in livestock diets, especially in regions where antibiotics are prohibited. As a result, for the sake of environmental sustainability, human health, and food safety, researchers have recently focused more on natural alternatives that might replace the use of antibiotics in livestock production. This leads to effective alternatives called natural feed additives, such as phytogenic feed additives. These factors are expected to drive market growth.

Opportunity

- Rising Demand for Phytogenic Feed Additives in Aquaculture and Pet Feeds

The market of organic aquaculture is escalating as it tends to protect the consumers' health by the reduced usage of any synthetic or harmful chemicals. The growth of organic aquaculture leads to the increased involvement of organic feed additives in manufacturing organic aquaculture feed such as phytogenic feed additives. So, the increase in organic aquaculture is expected to create an opportunity for market growth.

For instance,

- In August 2020, Delacon launched a product named Syrena Boost. The product is a premixture of saponins, spices, and essential oils, providing complete phytogenic solutions to modern aquaculture practices. It was designed in a way that it could target gut performance and productivity. It comes in a micro-encapsulated manner to sustain its thermal stability and for the gradual intestinal release of the sensitive ingredients involved.

- In December 2020, according to the Philippines Journal of Fisheries, drugs were used for chemotherapy to reduce, prevent, and treat diseases in aquaculture. Thus, chemotherapy has some negative impacts on fish and human health. As a substitute, phytogenic feeds have shown exceptional results, such as appetite stimulation and weight gain. In addition to that, it is said to act as an immunostimulant inheriting anti-pathogenic properties in fishes.

Using phytogenic feed additives in aquaculture feed improves fish's appetite and acts as an organic growth promotor. In addition, the anti-microbial and anti-fungal properties of phytogenics are said to improve the health of fish by preventing and curing various diseases.

In conclusion, the aquaculture market is growing because of fish consumption by meat eaters and involvement in medicinal supplements such as fish oils. As aquaculture is now inclined towards organic methods, the consumption of organic-based feeds is increasing. Due to all reasons stated above, the usage of phytogenic feed additives in aquaculture is expected to provide an opportunity for market growth and all the phytogenic feed additive manufacturers.

Restraint/Challenge

- Availability of Established Alternatives for Feed Additives

Phytogenic feed additives are sought in animal husbandry to enhance immunity, performance, and overall health. The offset effects of antibiotics and increased production, the phytogenic feed additives introduced various feed components and the required adjustments in animal management.

Although phytogenic feed additives have various benefits and enhance animal performance and health, other natural feed additives such as prebiotics, probiotics, enzymes, organic acids, salts, essential oils, and seaweed are marketed. These additives are made from organic sources, including minerals, plants, and microbes. They are employed in animal nutrition to boost an animal's performance, health, and welfare. Besides phytogenic feed additives, numerous feed additives companies have recently introduced new products for some natural feed additives.

For instance,

- In November 2022, according to the article published in Feed-lot Magazine Inc, prebiotics are substances found in food that stimulate the development or activity of good bacteria and fungus. In the digestive system, prebiotics can change the composition of the bacteria in the gut microbiome. Precision prebiotic Amaferm from BioZyme, Inc. is made from a complete fermentation product from a particular strain of Aspergillus oryzae.

Thus, other natural feed additives are gaining prominence around the world. These additives have almost equal benefits compared to phytogenic feed additives, which are expected to restrain market growth.

Post-COVID-19 Impact on North America Phytogenic Feed Additives Market

The uncertainty caused due to the outbreak of the COVID-19 pandemic in the world had affected and changed the complete dynamics of North America industries and had a negative impact on the market growth of North America economics. The effects can be seen over the intensity and efficacy of containment efforts, behavioral changes (such as avoiding purchase and investment), shifts in spending patterns, containment efforts to the supply of disruptions, after-effects of dramatic tightening in the market, volatile commodity prices, and increasing debt burdens. Due to COVID-19, all the countries had faced a multi-layered crisis comprising domestic economic disruptions, plummeting external demand, collapse in prices, and collapse in the supply and demand of products.

Recent Developments

- In March 2023, Indian Herbs announced the launch of a new product named HEATBEAT for poultry. This product is a combination of natural vitamin C, organic chromium complex, and mint. This launch helped the company in the expansion of its product portfolio.

- In February 2022, Orffa announced a new distribution agreement with Eigenmann & Veronelli, a leading solution provider in the specialty chemicals and food ingredients industry in Rho (MI), Italy. This agreement would help the company to promote its products in Italy.

North America Phytogenic Feed Additives Market Scope

The North America phytogenic feed additives market is segmented into five notable segments based on type, type of animal feed, sources, form, and function. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Essential Oils

- Flavonoids

- Saponins

- Oleoresins

- Tannins

- Others

On the basis of type, the market is segmented into essential oils, flavonoids, saponins, oleoresins, tannins, and others.

Type of Animal Feed

- Poultry feed

- Ruminants feed

- Aqua feed

- Swine feed

- Others

On the basis of type of animal feed, the market is segmented into poultry feed, ruminants feed, aqua feed, swine feed, and others.

Sources

- Herbs

- Spices

On the basis of sources, the market is segmented into herbs and spices.

Form

- Dry

- Liquid

On the basis of form, the market is segmented into dry and liquid.

Function

- Performance Enhancers

- Antimicrobial Properties

- Palatability Enhancers

- Digestion Enhancers

- Others

On the basis of function, the market is segmented into performance enhancers, antimicrobial properties, palatability enhancers, digestion enhancers, and others.

North America Phytogenic Feed Additives Market Regional Analysis/Insights

The North America phytogenic feed additives market is segmented into five notable segments based on type, type of animal feed, sources, form, and function.

The countries covered in this market report are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America phytogenic feed additives market due to the easy availability of raw materials for phytogenic feed additives.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Phytogenic Feed Additives Market Share Analysis

The North America phytogenic feed additives market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the major market players operating in the North America phytogenic feed additives market are Cargill, Incorporated., DSM, Kemin Industries, Inc., ADM, Nutreco, Natural Remedies., Himalaya Wellness Company, Vinayak Ingredients. India, Silvateam S.p.a., Phytobiotics Futterzusatzstoffe GmbH, Tegasa, MIAVIT GMBH, Indian Herbs, Customer DOSTOFARM GmbH, British Horse Feeds, Orffa, Igusol, Glamac International Private Limited., and Nor-Feed among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASE DECISION

4.1.1 PRODUCT PRICING

4.1.2 INGREDIENTS

4.1.3 AUTHENTICITY OF PRODUCT

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.3.1 GROWING DEMAND FOR NATURAL ADDITIVES

4.3.2 MANUFACTURERS OFFERING CERTIFIED FEED SUPPLEMENTS

4.3.3 BUSINESS EXPANSIONS THROUGH DIFFERENT STRATEGIC DECISIONS

4.4 FUTURE PERSPECTIVE

4.5 PORTER’S FIVE FORCES ANALYSIS FOR THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.6.2 DISTRIBUTION

4.6.3 END USERS

4.7 TECHNOLOGICAL ADVANCEMENT

4.8 VALUE CHAIN ANALYSIS: NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

5 PRICING INDEX

6 PRODUCTION CAPACITY OF KEY MANUFACTURERS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON SUPPLY CHAIN

8.3 IMPACT ON SHIPMENT

8.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

9 BRAND OUTLOOK

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 SURGING DEMAND FOR NATURAL FEED ADDITIVES

10.1.2 INCREASE IN THE CONSUMPTION OF ANIMAL PROTEIN

10.1.3 STRINGENT REGULATIONS ON ANTIBIOTIC FEED ADDITIVES

10.1.4 ESCALATING CONCERN REGARDING ANIMAL WEALTH

10.2 RESTRAINTS

10.2.1 AVAILABILITY OF ESTABLISHED ALTERNATIVES FOR FEED ADDITIVES

10.2.2 HIGHER-END PRODUCT PRICES CAUSE LOW-PROFIT MARGIN

10.2.3 LIMITED R&D IN PHYTOGENIC FEED ADDITIVES

10.3 OPPORTUNITIES

10.3.1 RISING DEMAND FOR PHYTOGENIC FEED ADDITIVES IN AQUACULTURE AND PET FEEDS

10.3.2 MEDICINAL PROPERTIES OF HERBS AND SPICES

10.3.3 GROWING DEMAND FOR ORGANIC MEAT

10.4 CHALLENGES

10.4.1 AVAILABILITY AND VOLATILITY OF ORGANIC RAW MATERIALS

10.4.2 THE PREVALENCE OF ADULTERATION AND SIDE EFFECTS OF PHYTOGENIC MATERIALS

11 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 MEXICO

11.1.3 CANADA

12 COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT

14 COMPANY PROFILE

14.1 CARGILL, INCORPORATED

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 DSM

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 KEMIN INDUSTRIES, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 ADM

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 NUTRECO

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 BRITISH HORSE FEEDS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 CUSTOMER DOSTOFARM GMBH

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 GLAMAC INTERNATIONAL PRIVATE LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 HIMALAYA WELLNESS COMPANY

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 IGUSOL

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 INDIAN HERBS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MIAVIT GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 NATURAL REMEDIES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NOR-FEED

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ORFFA

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 PHYTOBIOTICS FUTTERZUSATZSTOFFE GMBH

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SILVATEAM S.P.A.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 TEGASA

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 VINAYAK INGREDIENTS INDIA

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 17 U.S. PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 U.S. PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 19 U.S. POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 U.S. RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 U.S. SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 U.S. AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 U.S. FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 U.S. MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 U.S. CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 U.S. PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 27 U.S. HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 U.S. SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 U.S. PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 30 U.S. PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 31 MEXICO PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 MEXICO PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 33 MEXICO POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 MEXICO RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 MEXICO SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 MEXICO AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 MEXICO FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 MEXICO MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 MEXICO CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MEXICO PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 41 MEXICO HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 MEXICO SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 MEXICO PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 44 MEXICO PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 45 CANADA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CANADA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 47 CANADA POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 CANADA RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CANADA AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CANADA FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 CANADA CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 CANADA PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 55 CANADA HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 CANADA PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 58 CANADA PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: SEGMENTATION

FIGURE 9 SURGING DEMAND FOR NATURAL FEED ADDITIVES IS DRIVING THE GROWTH OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET IN THE FORECAST PERIOD

FIGURE 10 THE ESSENTIAL OILS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET IN 2023 AND 2030

FIGURE 11 SUPPLY CHAIN OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 12 VALUE CHAIN ANALYSIS OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 14 AUSTRALIAN PRODUCTION AND CONSUMPTION OF CHICKEN MEAT (IN KT/KG)

FIGURE 15 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 16 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2022)

FIGURE 17 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 18 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 19 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: BY TYPE (2023-2030)

FIGURE 20 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.