North America Physical Security Market

Market Size in USD Million

CAGR :

%

USD

268.90 Million

USD

688.72 Million

2024

2032

USD

268.90 Million

USD

688.72 Million

2024

2032

| 2025 –2032 | |

| USD 268.90 Million | |

| USD 688.72 Million | |

|

|

|

|

North America Physical Security Market Size

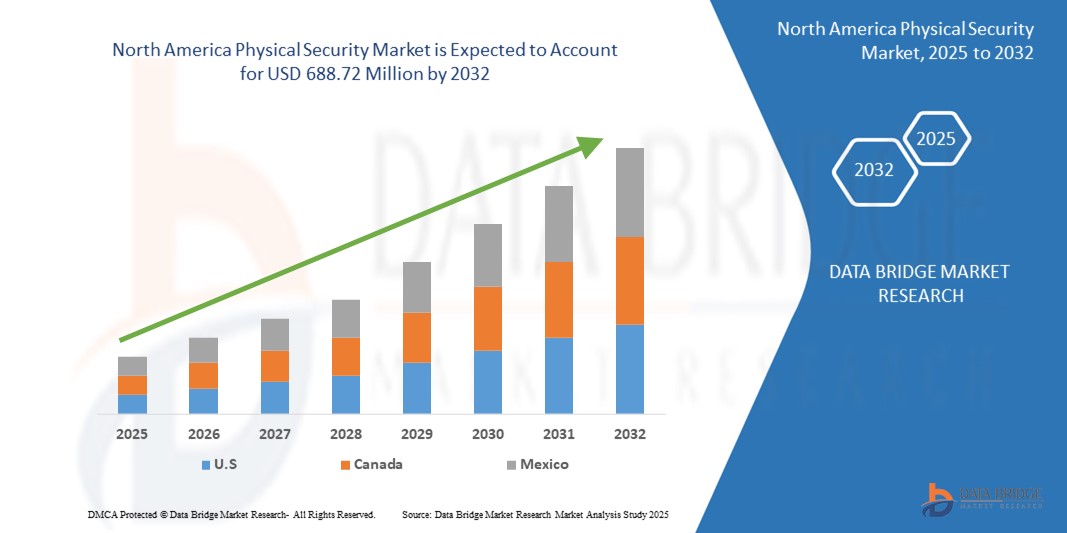

- The North America physical security market size was valued at USD 268.42 million in 2024 and is expected to reach USD 688.72 million by 2032, at a CAGR of 12.50% during the forecast period

- The market growth is largely fuelled by the increasing adoption of advanced surveillance systems and integrated access control solutions across commercial, residential, and critical infrastructure sectors

- Rising concerns over data breaches, workplace violence, and public safety are prompting organizations to invest in comprehensive physical security solutions, contributing to sustained market expansion

North America Physical Security Market Analysis

- The physical security market is experiencing strong demand due to the rising need for advanced surveillance and access control technologies across industries

- Companies are prioritizing security upgrades to protect assets and personnel, leading to steady investments in modern physical security systems

- U.S. dominates the physical security market within North America, capturing the majority of revenue share in 2024, propelled by the rapid adoption of cutting-edge security technologies

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America physical security market due to increasing urban development, growing demand for smart surveillance systems, and rising focus on integrating artificial intelligence and IoT solutions for enhanced security management

- The systems segment holds the largest market revenue share of 65.8% in 2024, driven by growing demand for advanced physical access control, video surveillance, and intrusion detection solutions across multiple industries. Systems provide the core infrastructure needed for security management, integrating hardware and software for real-time monitoring and threat response.

Report Scope and North America Physical Security Market Segmentation

|

Attributes |

North America Physical Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

North America Physical Security Market Trends

“Growing Adoption of AI-Powered Surveillance in Physical Security”

- The North America physical security market is increasingly adopting artificial intelligence to enhance surveillance capabilities and reduce reliance on manual monitoring

- AI-powered systems are being used for real-time threat detection, facial recognition, license plate reading, and behavioral analysis, enabling quicker and more informed responses

- Businesses and government institutions are integrating AI for improved efficiency and accuracy in monitoring security events

- For instance, U.S. airports have implemented AI-driven video analytics to track crowd movements and detect suspicious activities in real time

- Retail chains are also leveraging AI to monitor in-store behavior and prevent theft, contributing to a broader trend of automation and intelligent security management

North America Physical Security Market Dynamics

Driver

“Rising Need for Advanced Threat Detection Across Critical Infrastructure”

- The growing demand for advanced threat detection across critical infrastructure is a key driver for the North America physical security market, as facilities such as transportation hubs, power plants, and financial institutions seek to strengthen real-time surveillance and access control

- Increasing concerns over terrorism, cyber-physical threats, and workplace violence are prompting organizations to invest in intelligent video analytics, biometrics, and perimeter intrusion detection for enhanced situational awareness and rapid incident response

- For instance, John F. Kennedy International Airport in New York has deployed AI-based facial recognition systems to monitor and identify potential threats among large passenger flows, significantly improving detection and response capabilities

- The expansion of smart city initiatives across the U.S. and Canada is accelerating the adoption of command-and-control centers, video surveillance, and emergency communication networks to enhance urban security and emergency coordination

- Regulatory compliance, such as with the Homeland Security Presidential Directive and North American Electric Reliability Corporation standards, is encouraging both public and private sectors to upgrade their physical security infrastructure and adopt proactive threat mitigation strategies

Restraint/Challenge

“High Implementation and Maintenance Costs”

- One of the major challenges in the North America physical security market is the high cost associated with deploying advanced security infrastructure, including surveillance cameras, sensors, access control systems, and perimeter defenses

- Small and medium-sized businesses, educational institutions, and local organizations often struggle with the significant upfront investment required for equipment, installation, and software integration

- Ongoing maintenance expenses, such as system upgrades, cybersecurity protocols, and staff training, add financial pressure and hinder long-term sustainability of modern physical security setups

- For instance, smaller municipalities in the U.S. often face difficulties in funding the installation of smart surveillance networks while also ensuring compliance with evolving data protection laws

- As physical security solutions evolve to include artificial intelligence and cloud-based platforms, the challenge of integration, compatibility, and continuous monitoring demands further financial and technical resources that many entities cannot easily afford

North America Physical Security Market Scope

The market is segmented on the basis of component, systems type, service type, organization size, and vertical.

- By Component

On the basis of component, the North America physical security market is segmented into systems and services. The systems segment holds the largest market revenue share of 65.8% in 2024, driven by growing demand for advanced physical access control, video surveillance, and intrusion detection solutions across multiple industries. Systems provide the core infrastructure needed for security management, integrating hardware and software for real-time monitoring and threat response.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing adoption of managed security services, remote monitoring, and system integration that allow organizations to optimize security operations without heavy in-house investments.

- By Systems Type

On the basis of systems type, the market is segmented into physical access control systems, video surveillance systems, perimeter intrusion detection and prevention, physical security information management, physical identity and access management, security scanning, imaging and metal detection, and fire and life safety. Video surveillance systems dominate the market revenue share of 38.4% in 2024, benefiting from enhanced analytics and AI capabilities.

Physical access control systems is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising need for controlled entry across government and commercial facilities. The increasing integration of biometrics and smart card technologies enhances authentication accuracy and security. This growth is further supported by the demand for centralized access management in multi-site organizations.

- By Service Type

On the basis of service type, the market is segmented into access control as a service, video surveillance as a service, remote monitoring services, and security systems integration services. Security systems integration services hold the largest market share of 42.7%, supported by increasing demand for seamless connectivity and interoperability between various physical security components.

Access control as a service is expected to witness the fastest growth rate from 2025 to 2032, due to cloud adoption and subscription-based models. It offers real-time access updates and simplifies credential management across locations. The flexibility and scalability of cloud-based services attract both large enterprises and SMEs.

- By Organization Size

On the basis of organization size, the market is segmented into small and medium-sized enterprises and large enterprises. Large enterprises hold the majority of market revenue with 59.3% in 2024, owing to their greater security budgets and complex security needs.

The SMEs is expected to witness the fastest growth rate from 2025 to 2032, driven by affordable and scalable security solutions. Cost-effective service-based models and modular security packages are enabling smaller organizations to adopt modern security systems. Government incentives and increasing threat awareness are also contributing to adoption among SMEs.

- By Vertical

On the basis of vertical, the market is segmented into banking, financial services and insurance, government; retail, transportation, residential, telecom and information technology, and others. The government vertical commands the largest revenue share of 31.5%, backed by stringent security regulations and critical infrastructure protection initiatives.

The retail vertical segment is expected to witness the fastest growth rate from 2025 to 2032, as retailers invest in theft prevention and loss management systems. The adoption of AI-driven surveillance and real-time customer behaviour analytics is transforming in-store security. Retail chains are increasingly implementing integrated security platforms to manage access and video monitoring centrally.

North America Physical Security Market Regional Analysis

- U.S. dominates the physical security market within North America, capturing the majority of revenue share in 2024, propelled by the rapid adoption of cutting-edge security technologies

- End users are focusing on upgrading legacy systems with intelligent video analytics, biometrics, and automated access control for enhanced threat detection and response

- The rising integration of physical security with IT infrastructure, alongside government mandates on security standards, is significantly driving the market expansion across residential, commercial, and critical infrastructure segments

Canada Physical Security Market Insight

The Canada physical security market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing infrastructure development and urbanization. Demand for advanced surveillance and access control systems is rising across commercial, government, and healthcare sectors. Integration of technologies such as artificial intelligence and Internet of Things is enhancing security capabilities, enabling real-time monitoring and proactive threat management. Regulatory frameworks aimed at improving public safety are also encouraging adoption of sophisticated physical security solutions. Furthermore, growing investments in smart city initiatives are boosting market growth by promoting interconnected security systems for enhanced urban safety.

North America Physical Security Market Share

The North America Physical Security industry is primarily led by well-established companies, including:

- ADT (U.S.)

- Cisco Systems Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- TELUS (Canada)

- Anixter Inc. (U.S.)

- Genetec Inc. (Canada)

- HID Global (U.S.)

- Pelco, Inc. (U.S.)

- Allied Universal (U.S.)

- Dahua Technology USA Inc. (U.S.)

- STANLEY CONVERGENT SECURITY SOLUTIONS, INC. (U.S.)

- Hanwha Techwin America. (U.S.)

Latest Developments in North America Physical Security Market

- In 2021, ADT expanded into the rooftop solar industry by acquiring SunPro Solar, rebranding it as ADT Solar. This move aims to offer customers safe, interconnected solar energy solutions, broadening ADT’s service portfolio and strengthening its position in the clean energy and security markets

- In 2021, Honeywell entered into a collaboration with the Jacksonville Jaguars to provide stadium air quality monitoring and supply personal protective equipment kits. This partnership enhances safety for players and spectators, showcasing Honeywell’s commitment to health-focused technologies in large venues

- In 2021, Johnson Controls partnered with DigiCert, Inc. to develop advanced digital and physical security solutions for commercial and residential buildings. Leveraging DigiCert’s PKI technology, this collaboration aims to improve building security measures, driving innovation and increasing market competitiveness in smart building security

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.