North America Pharmacogenetics Testing in Psychiatry/Depression Market Analysis and Insights

Pharmacogenetic testing helps medical professionals by providing information on how a person metabolizes a medication. This information can help doctors and others avoid prescribing antidepressants that could produce undesirable outcomes. Pharmacogenomics has shown promise for predicting antidepressant response and tolerability in treating major depressive disorder (MDD). Pharmacogenomics can improve clinical outcomes by guiding antidepressant selection and dosing. The growing biotechnology sector, and increasing health expenditure, have accelerated the demand for pharmacogenetic testing in psychiatry/depression.

The growing prevalence of cancer disease, novel technology in the treatment of depression and or other psychiatric conditions are increasing the adoption of pharmacogenetics testing in psychiatry/depression devices and procedures, and the rising preference for non-surgical procedures are the major drivers which propelled the demand of the market in the forecast period. However, the high cost associated with the tests, stringent regulation, and lack of awareness may expect to hamper the pharmacogenetics testing in psychiatry/depression market growth in the forecast period.

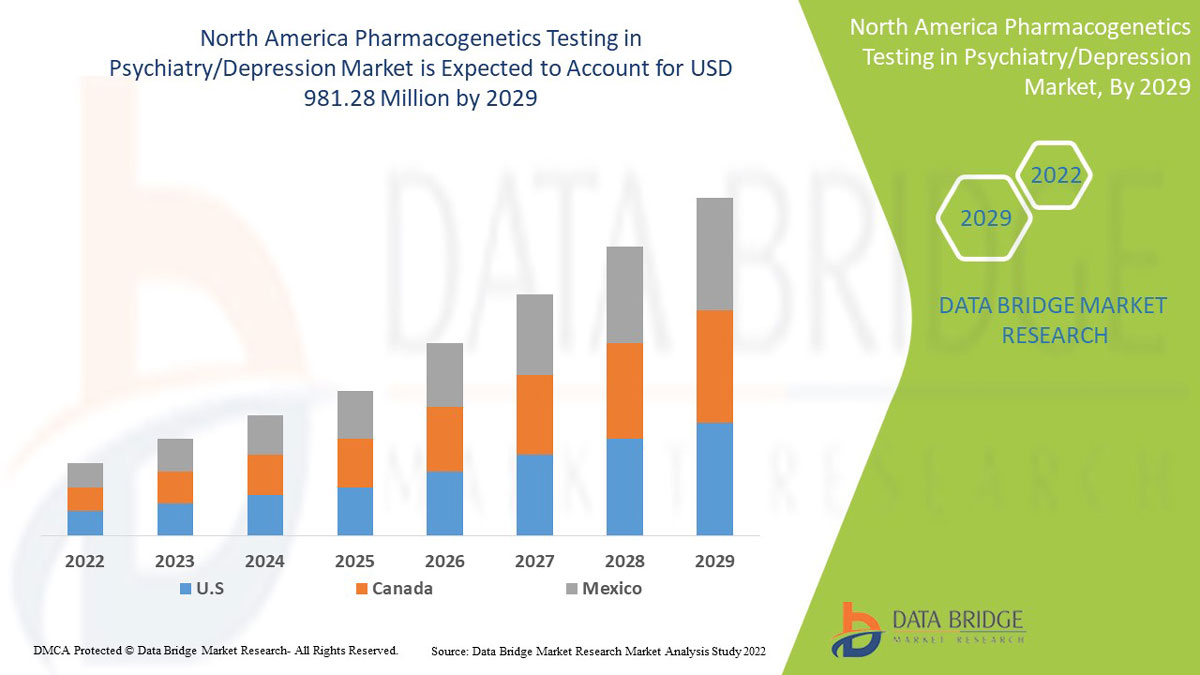

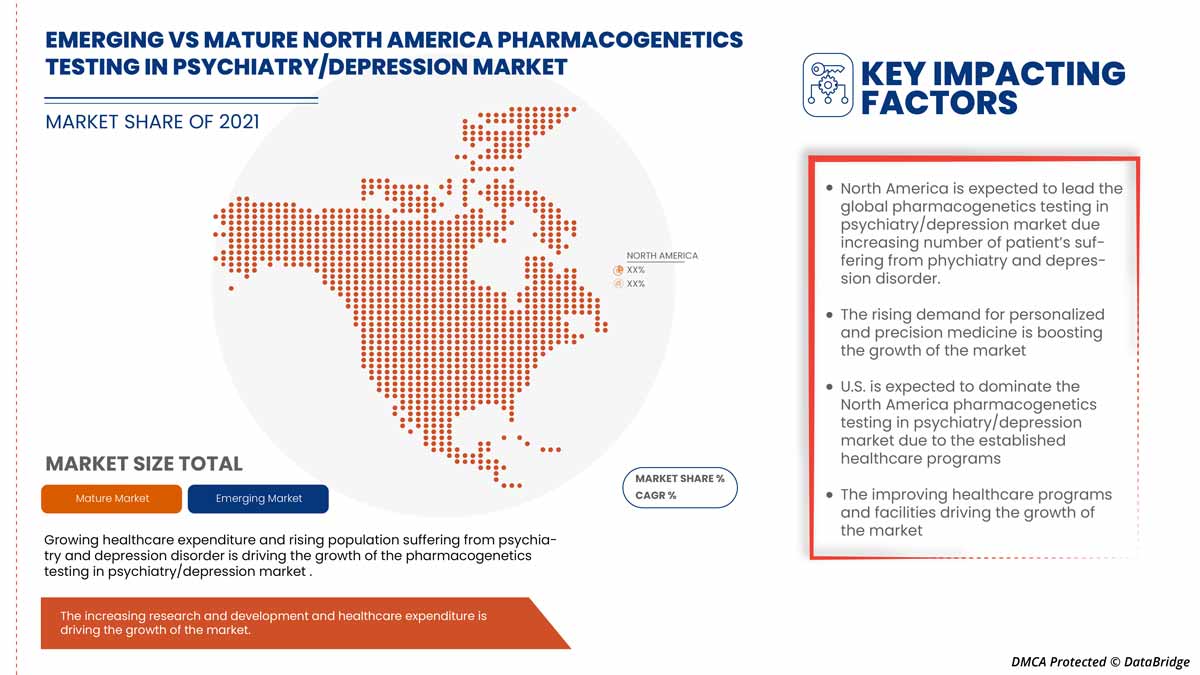

Data Bridge Market Research analyzes that the North America pharmacogenetics testing in psychiatry/depression market is expected to reach the value of USD 981.28 million by 2029, at a CAGR of 9.7% during the forecast period. Anxiety accounts for the largest type segment in the market due to the increasing depression rate among the North American population. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

North America Pharmacogenetics Testing in Psychiatry/Depression Market, By Application (Novel Drug Candidates, Drug Optimization & Repurposing Preclinical Testing and Approval, Drug Monitoring, Finding New Diseases Associated Targets and Pathways, Understanding Disease Mechanisms, Aggregating and Synthesizing Information, Formation & Qualification of Hypotheses, De Novo Drug Design, Finding Drug Targets of an Old Drug, and Others), Technology (Machine Learning, Deep Learning, Natural Language Processing, and Others), Drug Type (Small Molecule, and Large Molecule), Offering (Software, and Services), Indication (Immuno-Oncology, Neurodegenerative Diseases, Cardiovascular Diseases, Metabolic Diseases, and Others), End Use (Contract Research Organizations (CROs), Pharmaceutical & Biotechnology Companies, Research Centers and Academic Institutes, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Genelex (Part of Invitae corporation), Genewiz (Part of Azenta Life Sciences), MD Labs, BiogeneiQ, Inc., ONEOME, LLC, Myriad Genetics, Inc., GenXys, Castle Biosciences, Inc., PacBio, QIAGEN, Thermo Fisher Scientific Inc., AB-Biotics.S.A., Coriell Life Sciences, Eurofins Scientific, Illumina, Inc., Dynamic DNA Laboratories, STADAPHARM GmbH, Color, cnsdose, Genomind, Inc., Healthspek, myDNA Life Australia Pty Ltd., HudsonAlpha, Sonic Healthcare Limited, among others. |

North America Pharmacogenetics Testing in Psychiatry/Depression Market Definition

Pharmacogenomic testing has recently become scalable and available to guide major depressive disorder (MDD). Clinicians increasingly recognize Pharmacogenomic (PGx) testing as an essential tool to guide medication decisions for psychiatric illnesses. Extensive implementation of PGx testing is driving the market in the forecast period.

The terms personalized medicine, stratified medicine, and precision medicine are close relatives of pharmacogenetics, but these are broader terms that also cover additional non-genetic factors. Nevertheless, pharmacogenetics is an important component of these areas. Pharmacogenetics is primarily concerned with human germline DNA variation, but there have also been important recent advances in understanding mood disorders, and mental illnesses.

Pharmacogenetics testing studies the interaction between drug and gene response of a person and searches for the gene variation which is responsible for influencing the drug effect. The test is gaining high demand as many researchers and scientists identified the unique interaction between drugs and individual genes and provides valuable insights which subsequently be used to develop customized or personalized medication.

North America Pharmacogenetics Testing in Psychiatry/Depression Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- INCREASE IN THE NUMBER OF PATIENTS SUFFERING FROM PSYCHIATRIC AND DEPRESSION DISORDER

Depression is a common illness worldwide, with an estimated 3.8% of the population affected, including 5.0% among adults and 5.7% among adults older than 60 years. Depression can become a serious health condition of mild to extreme severity, affecting the person to suffer greatly and can lead to suicide in the worst cases. Although over 45 antidepressants are available, suboptimal response poses a challenge and is considered a result of genetic variation, psychiatry/depression. Depending on the severity and pattern of depressive episodes over time, healthcare providers may offer psychological diagnosis such as behavioral activation, cognitive behavioral therapy, interpersonal psychotherapy, and/or antidepressant medication such as selective serotonin reuptake inhibitors (SSRIs) and tricyclic antidepressants (TCAs). Different drugs are used for this kind of mental disorder.

With the growth in the prevalence of depression, the demand for pharmacogenetics testing is also increasing as it studies the effect of genetic variants intending to furnish tailored diagnosis. The market is expected to grow in foresting period.

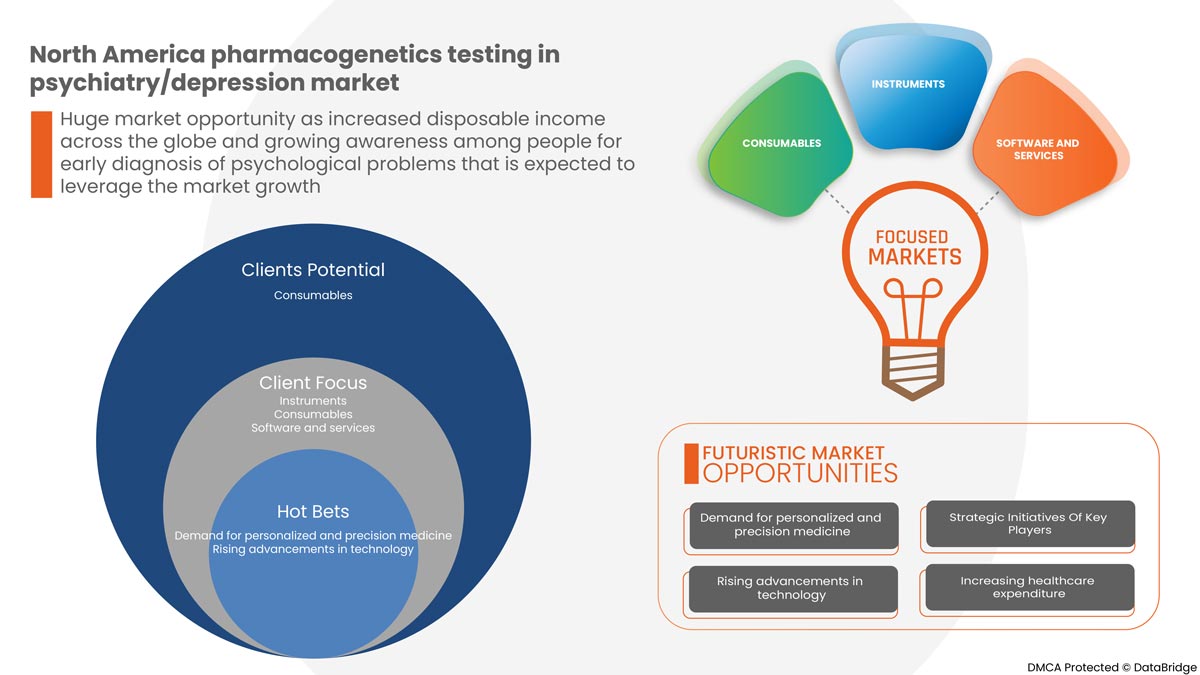

- RISE IN DEMAND FOR PERSONALIZED AND PRECISION MEDICINE

Pharmacogenetics test aids the medical professional in choosing the best medicine for the person because the test searches for the gene variant that may be responsible for influencing the effect of the drug.

Medicine is beginning to get personal, and patients are gradually expressing interest in improved outcomes and less adverse effects with personalized medications. Personalized medicine has the potential to tailor the therapy with a high safety margin and the best response. This trend is largely driven by genome sequencing improvements.

The move toward personal healthcare means changes in the manufacturing of medicines. Manufacturers are moving from creating small molecules to the combination of small molecule and gene therapies. Sponsors focus on replacing inefficient large-scale batch production with investment in new technology and producing personalized drugs.

Restraint

- Lack of skilled Medical and genomic expert

Most clinicians still lack confidence in pharmacogenetic (PGx) testing and subsequent data interpretation, indicating insufficient knowledge in this field. It emphasizes the need to improve literacy among healthcare professionals regarding expertise in and understanding of pharmacogenetic (PGx) testing.

Lack of practitioners awareness about the possibilities of pharmacogenetics and poor or insufficient explanation of the test results also reduce personalization technologies for patients. In addition to developing thematic training courses at medical universities, including the educational cycles in continuing professional education systems, and free placement of information for practicing doctors are required: academic internet portals, webinars, etc. A clinical pharmacologist plays a crucial role in the implementation of pharmacogenetic testing.

The competence of a clinical pharmacologist in the field of pharmacogenetics is critical: he or she is the one who organizes the application of genotyping in clinical practice, interprets tests, and informs doctors about the possibilities of pharmacogenetics for patients with specific nosologies, that is, acts as the main link between the scientific world, the healthcare system and practicing physicians in the process of introducing pharmacogenetics.

Opportunity

-

Rising advancements in technology

Advances in pharmacogenomics have introduced an increasing number of opportunities to bring personalized medicine into clinical practice for psychiatric disorders. Personalized medicine may be defined as a comprehensive, prospective approach to preventing, diagnosing, treating, and monitoring disease in ways that achieve optimal individual health care decisions. Over 100 medications now contain United States Food and Drug Administration (FDA) labelling related to potentially applicable pharmacogenomic biomarkers with technological advancements in healthcare. Also, new and advanced methods are being developed to promote pharmacogenetics testing in depression-like disorders. These tests use advanced genetic testing methods to give precise results to form a treatment regimen. The improvements in technology supporting tests improved accessibility of testing options, and the growing number of resources that help clinicians understand how to use this information when it is available are making this aspect of personalized or precision medicine a reality. Thus, providers need to become more aware of the scientific and clinical relevance of pharmacogenomic tests.

The tests also help to establish a meaningful relationship between a drug and the individual genetic makeup. This helps in deciding the drugs to be administered to the patient to treat major depressive disorders and other psychiatric conditions.

Challenge

- Strict government regulation on new products and instruments approval

The concerns regarding the efficacy and safety of products have caused most governments to develop regulatory agencies and policies to look after the development of new medical products or tests. The use of these medical products can be done after passing stringent regulatory standards, which ensure the product is safe, well studied, and has no adverse reactions.

The recent guidelines and the amendment have adequate guidance for manufacturers. International regulations such as food, drug, and administration play a major role in the new launch of medical products or test into the market. Thus, it can be a major restraint for the market. Therefore, strict government regulation on new products and instrument approval will likely impact the market.

Post-COVID-19 Impact on North America pharmacogenetics testing in psychiatry/depression market

The COVID-19 outbreak had a beneficial impact on the expansion of the pharmacogenetics testing industry. The pandemic has had a negative impact on the pharmacogenomics market growth on account of the temporary halt in research activities in this field, coupled with the low influx of patients in hospitals and diagnostic centers. Since the second half of 2020, with the rising demand for research on certain drugs and testing kits for COVID-19, pharmacogenomic practices have been in vogue.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities, product launches, and strategic partnerships to improve the technology and test results involved in the pharmacogenetics testing market.

Recent Developments

- In April 2022, Blue Care Network (BCN) launched a precision medicine program, Blue Cross Personalized Medicine, which leverages pharmacogenomics, or genetic testing, to personalize and tailor medication treatments more effectively for select members based on a review of their prescribed medications for various diagnosis including behavioral health, cardiology, cardiovascular, and oncology. OneOme LLC has helped BCN achieve its precision medicine program goals and reduce the total cost of care and improve patient health outcomes by reducing adverse drug reactions. This has helped the company to enhance its product portfolio.

- In February 2022, PacBio, a leading provider of high-quality, highly accurate sequencing platforms, announced that it is supporting The Hospital for Sick Children (SickKids) in Toronto, Canada, in using HiFi whole genome sequencing (HiFi WGS) to potentially identify genetic variants that may be associated with medical and developmental conditions. Samples that are examined using HiFi WGS were previously sequenced using short-read DNA sequencing technology but still lack the identification of a disease-causing variant. This has helped the company to enhance the use of its products.

- In July 2022, according to a new nationwide study of nearly 2,000 veterans conducted by the U.S. Department of Veterans Affairs (VA), and Major Depressive Disorder (MDD) remission rates were significantly improved when clinicians had access to GeneSight Psychotropic test results from Myriad Genetics, Inc. in largest ever mental health PGx randomized controlled trial. This has helped the company to show its progress in pharmacogenetic testing.

- In January 2021, myDNA Life Australia Pty Ltd, announced a merger with the U.S., Houston-based consumer DNA test company, FamilyTreeDNA, and its parent company, Gene by Gene, for revolutionizing the field of pharmacogenomics, making truly personalized medicine a reality before expanding into nutrigenomics to deliver actionable, personalized nutrition, fitness and skincare recommendations. This has helped the company to expand its business.

North America Pharmacogenetics Testing in Psychiatry/Depression Market Scope

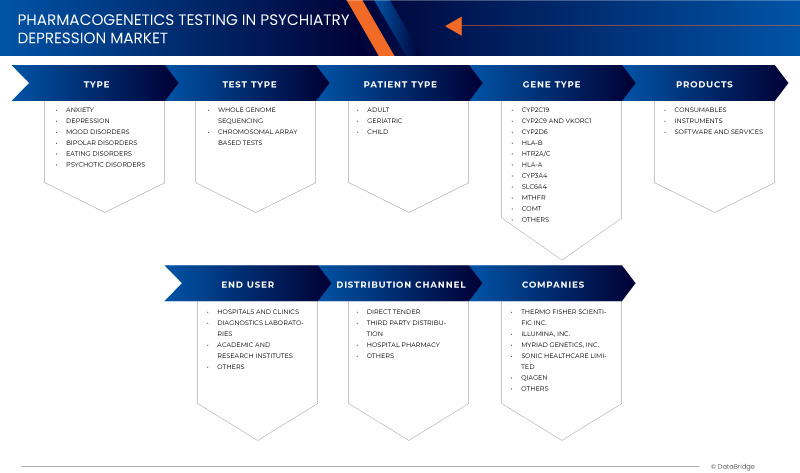

North America pharmacogenetics testing in psychiatry/depression market is segmented into type, test type, gene type, patient type, product, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- North America Pharmacogenetics Testing In Psychiatry/Depression Market, By Type

- Anxiety

- Mood Disorders

- Depression

- Bipolar Disorders

- Psychotic Disorders

- Eating Disorders

On the basis of type, North America pharmacogenetics testing in psychiatry/depression market is segmented into anxiety, mood disorders, depression, bipolar disorders, psychotic disorders, and eating disorders.

- North America Pharmacogenetics Testing In Psychiatry/Depression Market, By Test Type

- Whole Genome Sequencing

- Chromosomal Array-Based Tests

On the basis of test type, North America pharmacogenetics testing in psychiatry/depression market is segmented into whole genome sequencing, and chromosomal array-based tests.

- North America Pharmacogenetics Testing In Psychiatry/Depression Market, By Gene Type

- CYP2C19

- CYP2C9 AND VKORC1

- CYP2D6

- HLA-B

- HTR2A/C

- HLA-A

- CYP3A4

- SLC6A4

- MTHFR

- COMT

- OTHERS

On the basis of gene type, North America pharmacogenetics testing in psychiatry/depression market is segmented into CYP2C19, CYP2C9, VKORC1, CYP2D6, HLA-B, HTR2A/C, HLA-A, CYP3A4, SLC6A4, MTHFR, COMT, and others.

- North America Pharmacogenetics Testing In Psychiatry/Depression Market, By Patient Type

- Child

- Adult

- Geriatric

On the basis of patient type, the North America pharmacogenetics testing in psychiatry/depression market is segmented into children, adults, and geriatrics.

- North America Pharmacogenetics Testing In Psychiatry/Depression Market, By Product

- Instruments

- Consumables

- Software & Services

On the basis of product type, North America pharmacogenetics testing in psychiatry/depression market is segmented into instruments, consumables, and software & services.

- North America Pharmacogenetics Testing In Psychiatry/Depression Market, By End User

- Hospitals & Clinics

- Dignostics Laboratories

- Academic And Research Institutes

- Others

On the basis of end user, North America pharmacogenetics testing in psychiatry/depression market is segmented into hospitals and clinics, diagnostics laboratories, academic and research institutes, and others.

- North America Pharmacogenetics Testing In Psychiatry/Depression Market, By Distribution Channel

- Direct Tender

- Third-Party Distribution

- Hospital Pharmacy

- Others

On the basis of distribution channel, the North America pharmacogenetics testing in psychiatry/depression market is segmented into direct tender, third-party distribution hospital pharmacy, and others.

North America Pharmacogenetics Testing in Psychiatry/Depression Market Regional Analysis/Insights

The North America pharmacogenetics testing in psychiatry/depression market is analyzed, and market size information is provided by the type, test type, gene type, patient type, product, end user, and distribution channel. The countries covered in this market report are the U.S., Canada, and Mexico.

In 2022, North America is dominating due to the presence of key market players in the largest consumer market with high GDP. The U.S is expected to grow due to the rise in technological advancement in pharmacogenetics testing.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape And North America Pharmacogenetics Testing In Psychiatry/Depression Market Share Analysis

North America pharmacogenetics testing in psychiatry/depression market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America pharmacogenetics testing in psychiatry/depression market.

Some of the major players operating in the North America pharmacogenetics testing in psychiatry/depression market are

- Genelex (Part of Invitae corporation)

- Genewiz (Part of Azenta Life Sciences)

- MD Labs

- BiogeneiQ, Inc.

- ONEOME, LLC

- Myriad Genetics, Inc.

- GenXys

- Castle Biosciences, Inc.

- PacBio

- QIAGEN

- Thermo Fisher Scientific Inc.

- AB-Biotics.S.A.

- Coriell Life Sciences

- Eurofins Scientific

- Illumina, Inc.

- Dynamic DNA Laboratories

- STADAPHARM GmbH

- Color

- Cnsdose

- Genomind, Inc.

- Healthspek

- myDNA Life Australia Pty Ltd.

- HudsonAlpha

- Sonic Healthcare Limited

Research Methodology: North America Pharmacogenetics Testing in Psychiatry/Depression Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include the Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of North America pharmacogenetic testing in psychiatry/depression market

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- type LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- market application coverage grid

- vendor share analysis

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- REGULATIONS: North America pharmacogenetic testing IN PSYCHIATRY/DEPRESSION MARKET

- UNITED STATES

- ROLE OF FDA

- ROLE OF CDC AND HCFA

- market overview

- drivers

- RISING NUMBER OF POPULATION SUFFERING FROM DEPRESSIVE DISORDER

- INITIATIVES TAKEN BY MANUFACTURERS

- GROWING BIOTECHNOLOGY SECTOR ALONG WITH RISING HEALTHCARE EXPENDITURE

- INCREASING INTEREST FOR PERSONALIZED AND PRECISION MEDICATION

- RESTRAINTS

- LACK OF STRONG CLINICAL EVIDENCE

- HIGH COST

- LACK OF REIMBURSEMENT

- OPPORTUNITIES

- TECHNOLOGICAL ADVANCEMENTS

- EMERGENCE OF NEW PLAYERS

- Untapped market

- CHALLENGES

- STRINGENT GOVERNMENT REGULATION

- SHORTAGE OF SKILLED PERSONNEL

- COVID-19 IMPACT ON North America pharmacogenetic testing IN PSYCHIATRY/DEPRESSION MARKET

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY

- KEY INITIATIVES BY MARKET PLAYER DURING COVID 19

- CONCLUSION:

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY TYPE

- overview

- WHOLE GENOME SEQUENCING

- array-based TESTS

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY GENES

- overview

- cyp2c19

- CYP2C9 and VKORC1

- cyp2d6

- HLA-B

- htr2a/c

- HLA-A

- cyp3A4

- slc6a4

- MTHFR

- COMT

- others

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY DRUG TYPE

- overview

- PRESCRIPTION DRUGS

- Over-the-counter medications

- RECREATIONAL DRUGS

- VITAMINS/NUTRACEUTICals

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY SAMPLE TYPE

- overview

- SALIVA

- BLOOD

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY application

- overview

- DRUG DEVELOPMENT

- CLINICAL PRACTICE

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY END USER

- overview

- pharmaceutical and biotechnology companies

- HEALTHCARE PROVIDERS

- research centers and academic institutes

- others

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY DISTRIBUTION CHANNEL

- overview

- RETAIL PHARMACIES

- HOSPITAL PHARMACIES

- MAIL-ORDER PHARMACIES

- DIRECt-to-customer services

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, by Country

- u.s.

- canada

- mexico

- North America pharmacogenetic testing in psychiatry/depression market: COMPANY landscape

- company share analysis: North America

- swot analysis

- company profile

- MYRIAD GENETICS, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- THERMO FISHER SCIENTIFIC INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- sonic healthcare

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Illumina, Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AB-Biotics, S.A.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- 6.3 PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ALTHEADX

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- biogeniq inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Color

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- cnsdose

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- CORIELL LIFE SCIENCES

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Dynamic DNA Laboratories

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GENELEX

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- genomind, inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- genxys

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- HEALTHSPEK

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- HudsonAlpha Health Alliance (A Division of HudsonAlpha)

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- luminex corporation

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- MILLENNIUM HEALTH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- mydna life australia pty ltd.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- oneome

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- OMECARE

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- PerkinElmer Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- R-Biopharm AG

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

List of Table

TABLE 1 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY TYPE, 2019-2028 (USD Million)

TABLE 2 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY GENES, 2019-2028 (USD Million)

TABLE 3 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY DRUG TYPE, 2019-2028 (USD Million)

TABLE 4 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY SAMPLE TYPE, 2019-2028 (USD Million)

TABLE 5 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY APPLICATION, 2019-2028 (USD Million)

TABLE 6 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY END USER, 2019-2028 (USD Million)

TABLE 7 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 8 North America pharmacogenetic testing in psychiatry/depression Market, By COUNTRY, 2019-2028 (USD MILLION)

TABLE 9 u.s. pharmacogenetic testing in psychiatry/depression Market, By type, 2019-2028 (USD MILLION)

TABLE 10 u.s. pharmacogenetic testing in psychiatry/depression Market, By genes, 2019-2028 (USD MILLION)

TABLE 11 u.s. pharmacogenetic testing in psychiatry/depression Market, By drug type, 2019-2028 (USD MILLION)

TABLE 12 u.s. pharmacogenetic testing in psychiatry/depression Market, By sample, 2019-2028 (USD MILLION)

TABLE 13 u.s. pharmacogenetic testing in psychiatry/depression Market, By application, 2019-2028 (USD MILLION)

TABLE 14 u.s. pharmacogenetic testing in psychiatry/depression Market, By end user, 2019-2028 (USD MILLION)

TABLE 15 u.s. pharmacogenetic testing in psychiatry/depression Market, By distribution channel, 2019-2028 (USD MILLION)

TABLE 16 canada pharmacogenetic testing in psychiatry/depression Market, By type, 2019-2028 (USD MILLION)

TABLE 17 canada pharmacogenetic testing in psychiatry/depression Market, By genes, 2019-2028 (USD MILLION)

TABLE 18 canada pharmacogenetic testing in psychiatry/depression Market, By drug type, 2019-2028 (USD MILLION)

TABLE 19 canada pharmacogenetic testing in psychiatry/depression Market, By sample, 2019-2028 (USD MILLION)

TABLE 20 canada pharmacogenetic testing in psychiatry/depression Market, By application, 2019-2028 (USD MILLION)

TABLE 21 canada pharmacogenetic testing in psychiatry/depression Market, By end user, 2019-2028 (USD MILLION)

TABLE 22 canada pharmacogenetic testing in psychiatry/depression Market, By distribution channel, 2019-2028 (USD MILLION)

TABLE 23 mexico pharmacogenetic testing in psychiatry/depression Market, By type, 2019-2028 (USD MILLION)

TABLE 24 mexico pharmacogenetic testing in psychiatry/depression Market, By genes, 2019-2028 (USD MILLION)

TABLE 25 mexico pharmacogenetic testing in psychiatry/depression Market, By drug type, 2019-2028 (USD MILLION)

TABLE 26 mexico pharmacogenetic testing in psychiatry/depression Market, By sample, 2019-2028 (USD MILLION)

TABLE 27 mexico pharmacogenetic testing in psychiatry/depression Market, By application, 2019-2028 (USD MILLION)

TABLE 28 mexico pharmacogenetic testing in psychiatry/depression Market, By end user, 2019-2028 (USD MILLION)

TABLE 29 mexico pharmacogenetic testing in psychiatry/depression Market, By distribution channel, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 North America PHARMACOGENETIC TESTIG IN PSYCHIATRY/DEPRESSION market: segmentation

FIGURE 2 North America pharmacogenetic testing IN PSYCHIATRIC/DEPRESSION market: data triangulation

FIGURE 3 North America pharmacogenetic testing IN PSYCHIATRIC/DEPRESSION market: DROC ANALYSIS

FIGURE 4 North America pharmacogenetic testing IN PSYCHIATRIC/DEPRESSION market: Region vs country MARKET ANALYSIS

FIGURE 5 North America pharmacogenetic testing IN PSYCHIATRIC/DEPRESSION market: COMPANY RESEARCH ANALYSIS

FIGURE 6 North America pharmacogenetic testing IN PSYCHIATRIC/DEPRESSION market: DBMR MARKET POSITION GRID

FIGURE 7 North America pharmacogenetic testing in psychiatry/depression market: MARKET APPLICATION COVERAGE GRID

FIGURE 8 North America pharmacogenetic testing in psychiatry/depression market: vendor share analysis

FIGURE 9 North America pharmacogenetic testing in psychiatry/depression market: SEGMENTATION

FIGURE 10 initiatives taken by manufacturers is expected to drive THE North America pharmacogenetic testing in psychiatry/depression market IN THE FORECAST PERIOD of 2021 to 2028

FIGURE 11 whole genome sequencing segment is expected to account for the largest share of the North America pharmacogenetic testing in psychiatry/depression market in 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF North America pharmacogenetic testing IN PSYCHIATRY/DEPRESSION MARKET

FIGURE 13 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY TYPE, 2021-2028

FIGURE 14 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY TYPE, 2019-2028 (USD MILLION)

FIGURE 15 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY TYPE, CAGR (2021-2028)

FIGURE 16 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY TYPE, LIFELINE CURVE

FIGURE 17 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY GENES, 2019-2028 (USD MILLION)

FIGURE 18 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY GENES, 2019-2028 (USD MILLION)

FIGURE 19 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY GENES, CAGR 2019-2028 (USD MILLION)

FIGURE 20 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY GENES, LIFELINE CURVE

FIGURE 21 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DRUG TYPE, 2021-2028

FIGURE 22 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DRUG TYPE, 2019-2028 (USD MILLION)

FIGURE 23 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DRUG TYPE, CAGR 2019-2028 (USD MILLION)

FIGURE 24 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY SAMPLE TYPE, 2019-2028 (USD MILLION)

FIGURE 26 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY SAMPLE TYPE, 2019-2028 (USD MILLION)

FIGURE 27 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DRUG TYPE, CAGR (2021-2028)

FIGURE 28 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY SAMPLE TYPE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY APPLICATION, 2019-2028 (USD MILLION)

FIGURE 30 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY APPLICATION, 2019-2028 (USD MILLION)

FIGURE 31 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY APPLICATION, CAGR 2019-2028 (USD MILLION)

FIGURE 32 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 33 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY END USER, 2019-2028 (USD MILLION)

FIGURE 34 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY END USER, 2019-2028 (USD MILLION)

FIGURE 35 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY END USER, CAGR 2019-2028 (USD MILLION)

FIGURE 36 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

FIGURE 38 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

FIGURE 39 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DISTRIBUTION CHANNEL, CAGR 2019-2028 (USD MILLION)

FIGURE 40 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 North America PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: SNAPSHOT (2020)

FIGURE 42 North America PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY COUNTRY (2020)

FIGURE 43 North America PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY COUNTRY (2021 & 2028)

FIGURE 44 North America PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY COUNTRY (2020 & 2028)

FIGURE 45 North America PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY type (2021-2028)

FIGURE 46 North America pharmacogenetic TESTING IN psychiatry/depression market: company share 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.