North America Pet Equine Care E Commerce Market

Market Size in USD Million

CAGR :

%

USD

936.76 Million

USD

2,948.35 Million

2025

2033

USD

936.76 Million

USD

2,948.35 Million

2025

2033

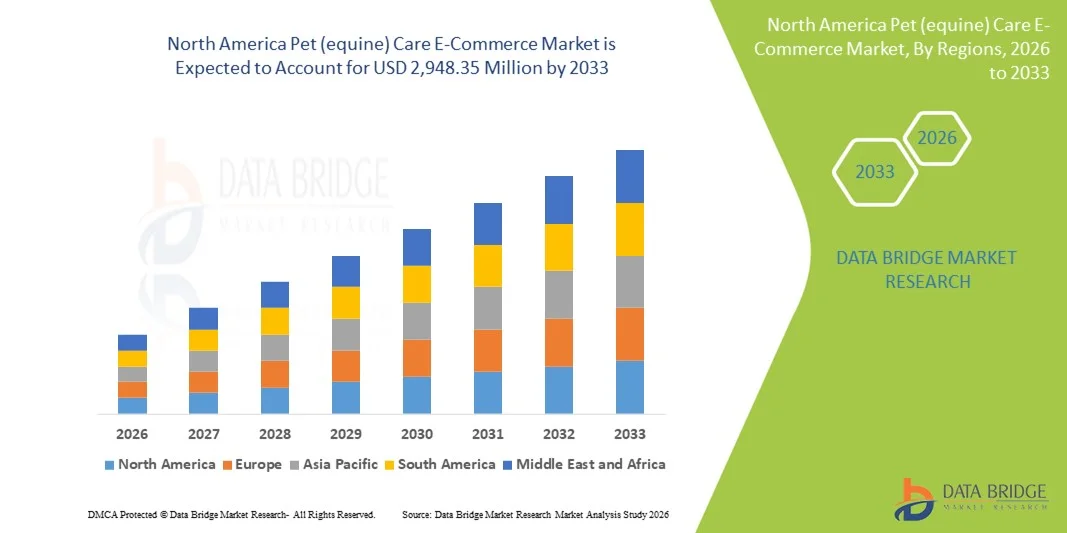

| 2026 –2033 | |

| USD 936.76 Million | |

| USD 2,948.35 Million | |

|

|

|

|

North America Pet (equine) Care E-Commerce Market Size

- The North America pet (equine) care e-commerce market size was valued at USD 936.76 million in 2025 and is expected to reach USD 2,948.35 million by 2033, at a CAGR of 15.41% during the forecast period

- The market growth is largely fuelled by increasing adoption of digital platforms for purchasing pet and equine care products, rising pet ownership, and growing awareness of equine health and wellness

- Convenience offered by online platforms, including doorstep delivery, subscription services, and access to a wide range of products, is driving consumer preference for e-commerce channels

North America Pet (equine) Care E-Commerce Market Analysis

- Growing digital penetration and internet accessibility are transforming the way equine care products are purchased in the region

- E-commerce platforms are increasingly collaborating with veterinarians, trainers, and specialty stores to expand product offerings and provide expert guidance to consumer

- U.S. dominated the North America pet (equine) care e-commerce market with the largest revenue share of 40.12% in 2025, driven by the growing adoption of online shopping for pet products and increasing awareness of equine health and wellness.

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America pet (equine) care e-commerce market due to rising pet ownership, increasing awareness of equine health and wellness, and the expansion of digital platforms offering convenient online purchasing options

- The Pet Food & Treats segment held the largest market revenue share in 2025, driven by the increasing demand for specialized nutrition, convenience of home delivery, and subscription-based services. Online platforms offering a wide variety of premium, organic, and therapeutic feed options have strengthened their adoption among equine owners

Report Scope and North America Pet (equine) Care E-Commerce Market Segmentation

|

Attributes |

North America Pet (equine) Care E-Commerce Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Pet (equine) Care E-Commerce Market Trends

Rising Demand For Online Pet And Equine Care Products

- The growing focus on convenience and accessibility is significantly shaping the North America pet (equine) care e-commerce market, as consumers increasingly prefer purchasing products online rather than visiting physical stores. E-commerce platforms provide a broad range of products, timely delivery, and ease of subscription services, which strengthens their adoption across equine nutrition, grooming, and healthcare categories

- Increasing awareness around equine health, wellness, and preventive care has accelerated demand for specialized products such as supplements, veterinary supplies, and grooming tools. Health-conscious equine owners are actively seeking reliable online platforms that offer certified, high-quality products, prompting marketplaces to expand offerings and improve logistics

- Digital trends and personalized recommendations are influencing purchasing behavior, with retailers emphasizing user-friendly interfaces, mobile apps, and targeted promotions. These factors help platforms differentiate in a competitive market, enhance consumer trust, and drive repeat purchases

- For instance, in 2024, major online pet care platforms in the U.S. expanded their equine product range and introduced subscription models for feed, supplements, and grooming supplies, responding to the growing demand for convenient, continuous delivery. These initiatives have improved customer loyalty and accelerated market penetration

- While market growth is promising, sustained expansion depends on continuous investment in e-commerce infrastructure, logistics, and technology to improve the consumer experience and manage delivery efficiency. Retailers are also focusing on scalability, partnership with equine professionals, and adoption of advanced digital tools for personalized service

North America Pet (equine) Care E-Commerce Market Dynamics

Driver

Growing Preference For Online And Specialized Equine Care Products

- Rising consumer adoption of digital channels and online shopping is a major driver for the North America pet (equine) care e-commerce market. E-commerce platforms provide convenience, wider product selection, competitive pricing, and access to expert advice, which are highly valued by equine owners

- Increasing focus on equine health, preventive care, and premium nutrition products is influencing market growth. Owners are willing to invest in high-quality, certified products available through online platforms, boosting sales across supplements, grooming, and healthcare categories

- Retailers are actively leveraging mobile apps, personalized recommendations, and subscription models to promote equine care products and enhance customer experience. This trend also encourages collaborations between veterinarians, trainers, and e-commerce platforms to ensure product credibility and improve service quality

- For instance, in 2023, leading North American online equine retailers reported an increase in subscription-based feed and supplement orders, driven by convenience and consistent product availability. Marketing efforts emphasized product quality, health benefits, and reliable delivery, strengthening brand trust and repeat purchases

- Although digital adoption supports growth, wider market penetration depends on technological investment, effective supply chain management, and user-friendly interfaces. Continuous innovation in logistics, AI-based recommendations, and customer service will be critical for capturing long-term growth

Restraint/Challenge

High Shipping Costs And Limited Awareness Of Specialized Online Equine Products

- The relatively higher cost of shipping bulky equine products, such as feed and bedding, remains a key challenge, limiting adoption among cost-conscious consumers. Logistics for timely delivery of perishable items also adds operational complexity and increases overall costs

- Awareness and trust in online equine care products remain uneven, particularly among first-time buyers or owners in rural areas. Limited knowledge of product benefits and platform reliability can restrict e-commerce adoption

- Supply chain and fulfillment challenges, including storage conditions, packaging, and cold chain requirements for certain supplements, further impact market growth. E-commerce operators must invest in robust logistics and handling systems to ensure product quality and timely delivery

- For instance, in 2024, some North American equine care distributors reported slower uptake of online feed and supplement subscriptions due to higher shipping costs and lack of awareness of digital purchasing options. Operational challenges also led to delayed deliveries in remote areas, affecting customer satisfaction

- Overcoming these challenges will require improved logistics, cost-efficient delivery models, and educational campaigns to raise awareness among equine owners. Strategic partnerships with local suppliers, investment in digital platforms, and customer support initiatives are critical to unlocking long-term growth potential in the North America pet (equine) care e-commerce market

North America Pet (equine) Care E-Commerce Market Scope

The North America pet (equine) care e-commerce market is segmented on the basis of type and equine type.

- By Type

On the basis of type, the market is segmented into Pet Food & Treats, Pet Medications, Pet Grooming Products, Pet Accessories, and Others. The Pet Food & Treats segment held the largest market revenue share in 2025, driven by the increasing demand for specialized nutrition, convenience of home delivery, and subscription-based services. Online platforms offering a wide variety of premium, organic, and therapeutic feed options have strengthened their adoption among equine owners.

The Pet Medications segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising awareness of equine health, preventive care, and the need for timely access to veterinary-approved medications. E-commerce platforms are increasingly popular for their ease of ordering, doorstep delivery, and access to certified products, ensuring proper care and management of equine health.

- By Equine Type

On the basis of equine type, the market is segmented into Horses/Ponies, Donkeys, Mules/Hinnies, and Others. The Horses/Ponies segment held the largest market share in 2025 due to the high ownership and recreational use of horses across North America, as well as growing investments in equine competitions and sports.

The Donkeys and Mules/Hinnies segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising interest in small-scale farming, equine-assisted therapy programs, and recreational activities. E-commerce platforms offering tailored products for these animals, including specialized feed, grooming tools, and health supplements, are driving segment adoption.

North America Pet (equine) Care E-Commerce Market Regional Analysis

- U.S. dominated the North America pet (equine) care e-commerce market with the largest revenue share of 40.12% in 2025, driven by the growing adoption of online shopping for pet products and increasing awareness of equine health and wellness

- Consumers in the country highly value the convenience, wide product variety, and doorstep delivery offered by e-commerce platforms, along with access to specialized equine care products

- This widespread adoption is further supported by rising disposable incomes, a digitally savvy population, and the growing preference for personalized pet care solutions, establishing e-commerce as a favored channel for both retail and professional equine products

Canada Pet (Equine) Care E-Commerce Market Insight

The Canada pet (equine) care e-commerce market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing inclination of consumers towards online purchases for convenience and safety. Consumers are prioritizing quick access to high-quality pet food, medications, and grooming products, as well as equine-specific items. The expansion of online platforms, improved logistics, and promotional campaigns by leading e-commerce retailers are further driving market growth. Moreover, the adoption of mobile apps and subscription-based services for recurring equine care needs is significantly contributing to the rapid expansion of the market.

North America Pet (equine) Care E-Commerce Market Share

The North America pet (equine) care e-commerce industry is primarily led by well-established companies, including:

- Chewy Inc (U.S.)

- Petco Health and Wellness Company Inc (U.S.)

- PetSmart Inc (U.S.)

- Zoetis Inc (U.S.)

- Manna Pro Products Inc (U.S.)

- Valley Vet Supply (U.S.)

- Dover Saddlery (U.S.)

- SmartPak Equine (U.S.)

- Jeffers Pet (U.S.)

- Absorbine Inc (U.S.)

- Cavalor North America (U.S.)

- TSC Stores (Canada)

- Ren’s Pets (Canada)

- Global Pet Foods (Canada)

- Topline Equine (Canada)

Latest Developments in North America Pet (equine) Care E-Commerce Market

- In July 2021, Purina entered into a strategic partnership with Natures Crops to develop plant-based equine supplements. This collaboration focuses on creating innovative, natural supplement solutions for horses, aiming to improve overall equine health and nutrition. The initiative leverages Purina’s expertise in animal nutrition and Natures Crops’ plant-based formulations to offer safer and sustainable alternatives. The launch of these supplements is expected to meet the growing demand for natural equine care products, enhance customer trust, and drive growth in the North America pet (equine) care e-commerce market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.