Market Analysis and Insights

The North America patient temperature management market is driven by the factors such as an increase in the prevalence of chronic diseases such as diabetes & gastrointestinal disorders, a growing number of the up-coming players and the innovation in care services, which enhance its demand, as well as increasing investment in research and development, leads to the market growth. Currently, various research studies are taking place, which is expected to create a competitive advantage for manufacturers to develop new and innovative patient temperature management systems, which is expected to provide various other opportunities in the patient temperature management market. However, the strict government regulations on approval and device recalls due to errors during treatment are expected to hamper the growth.

North America patient temperature management market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal. The scalability and business expansion of the retail units in the developing countries of various regions and partnership with suppliers for safe distribution of machine and drugs products are the major drivers that propelled the market's demand in the forecast period.

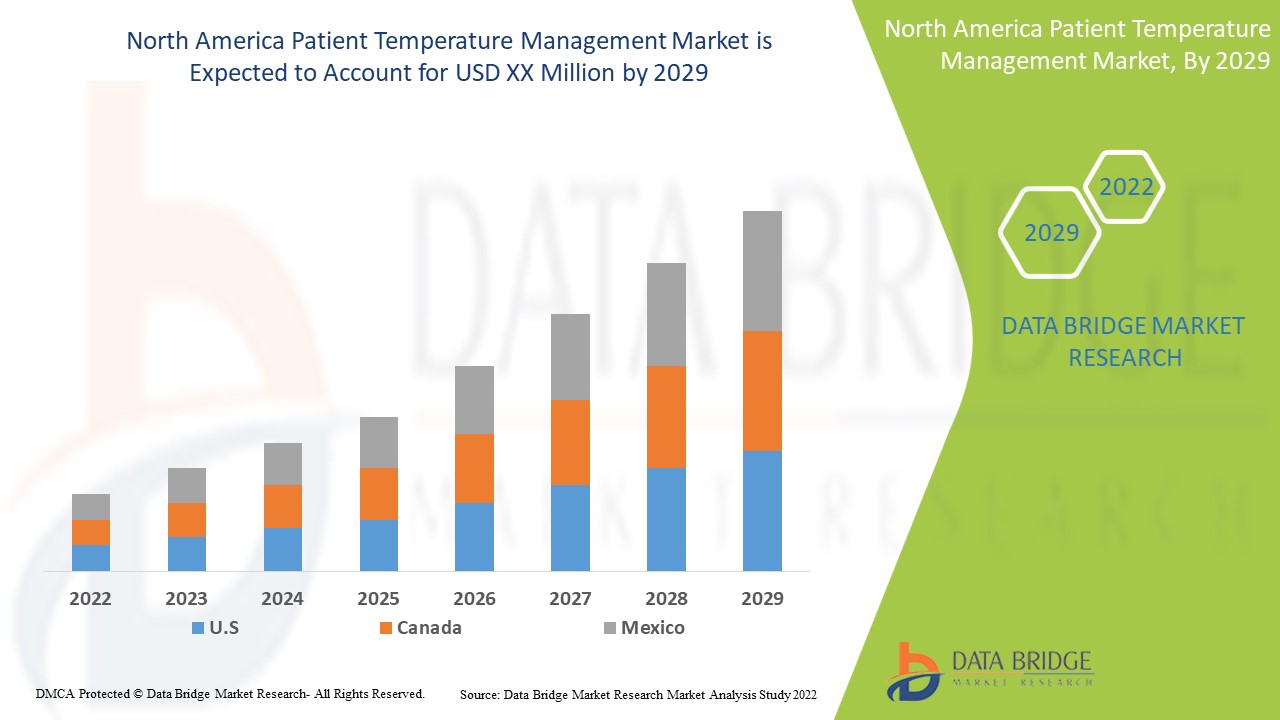

North America patient temperature management market is supportive and aims to reduce the progression of the disease. Data Bridge Market Research analyses that North America patient temperature management market will grow at a CAGR of 10.3% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Product Type (Patient Warming System and Patient Cooling System), Component (Warming and Cooling), Application (Preoperative Care, Operating Room, Postoperative Care, Acute Care, Intensive Care Unit, Emergency Rooms, Neonatal Intensive Care Units And Other Applications) Medical Speciality (General Surgery, Cardiology, Neurology, Pediatrics, Thoracic Surgery, Orthopedic Surgery and Other Medical Specialties) End User (Hospitals, Specialized Clinics, Ambulatory Surgical Centres and Others) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

BD, Medtronic, 3M, Stryker, ICU Medical, Inc., Ecolab, ZOLL Medical Corporation,Terumo Europe NV,Belmont Medical Technologies, GENTHERM, VYAIRE MEDICAL, INC., The Surgical Company PTM, pfm medical hico gmbh, ATTUNE MEDICAL, Augustine Surgical, Inc., GERATHERM, E-Control Systems, Inc., Advanced Cooling Technologies, Medika International and Mercury Biomed, LLC among others |

North America Patient Temperature Management Market Dynamics

Drivers

- Rise in surgical procedures in geriatric population

Geriatric patients are less able to control their body temperature, due to which they have a higher risk of intraoperative and postoperative hypothermia. The frequency of surgery involving the senior population has increased rapidly due to the aging population and better medical care.

With the increasing age comes a reciprocal increase in the elderly patients admitted to the hospitals. The rising number of surgical procedures is due to the rise in the number of the aged population undergoing. These increasing rates of the surgeries are directly proportional to the growth of temperature management products, as they are used to reduce complications before and after the surgery.

- Increase in incidence of chronic diseases

The encumbrance of chronic disease is briskly increasing across the globe. According to the WHO (world health organization), during 2001, the contribution of chronic disease was about 60%, which is accounted for the number of deaths. Cardiac complications or other Ischemia develop due to decreased blood flow and causes cellular damage.

The high prevalence of chronic diseases due to the rapidly increasing population of people can be seen North Americaly. The primary reason for using a temperature management system is to aid in cancer treatment for patients undergoing chemotherapy or radiation therapy for more effective results. Chronic diseases include cardiovascular diseases, stroke, cancer, chronic respiratory diseases, and diabetes, wherein cardiovascular disease is the primary cause of death North Americaly.

Opportunities

- Rise in healthcare expenditure

Between 2000 and 2017, overall health spending dramatically increased in 42 countries that experienced fast economic growth. On average, actual health spending per capita grew by 2.2 times and increased by 0.6 percentage points as a share of GDP. For most, the growth of health spending was faster than that of GDP

North America spending on health more than doubled in real terms over the past two decades, reaching USD 8.5 trillion in 2019, or 9.8% of North America GDP. But it was unequally distributed, with high-income countries accounting for approximately 80%

Health spending in low income countries was financed primarily by out-of-pocket spending (OOPS; 44%) and external aid (29%), while government spending dominated in high income countries (70%)

Restraints/Challenges

The high cost of intravascular patient temperature management systems, which increases the cost of drug therapies, is expected to hinder the market growth for patient temperature management systems. Moreover, the cost of the treatment varies with the type of specialty clinics, the complexity of the condition, and the age of the patients. Other countries and their respective regulatory boards have specific guidelines to approve these products into their market for public use. The rising geriatric population and increased prevalence of cardiovascular diseases have also surged the demand for treatment of patient temperature management.

Whereas the European Medicines Agency does not. Gene therapy products are regulated by FDA’s Center for Biologics Evaluation and Research (CBER). FDA requires the submission of an IND before initiating clinical studies, and an approved biologics license application (BLA) to market the product in the United States. The regulatory framework for the development and manufacturing of products comprises regulations and guidance documents, including the interpretation of these governing documents by regulators.

However, every country is bounded by the guidelines regulated by different authorities which are expected to act as a challenge to the growth of the North America patient temperature management market.

Recent Developments

- In January 2020, Gentherm announced that the company had received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for Astopad Patient Warming System can be utilized in all surgical procedures to prevent and treat hypothermia in patients throughout the perioperative journey. This results in expanding the product portfolio of the company in the U.S. market

- In January 2019, Smiths Medical, a leading North America medical device manufacturer announced that the company has launched the Level 1 convective warmer for maintaining normal body temperature through every stage of surgery. It is a next-generation high-flow convective warmer that gives health care providers a quiet, simple, and safe thermal care solution

North America Patient Temperature Management Market Segmentation

North America patient temperature management market is categorized into product, components, application, medical speciality and end user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product Type

- Patient Warming System

- Patient Cooling System

On the basis of product type, the patient temperature management market is segmented into patient warming system and patient cooling system.

Component

- Warming

- Cooling

On the basis of component, the patient temperature management market is segmented into warming and cooling.

Application

- Operating Room

- Preoperative Care

- Postoperative Care

- Acute Care

- Intensive Care Unit

- Emergency Rooms

- Neonatal Intensive Care Units

- Other Applications

On the basis of application, the patient temperature management market is segmented into operating room, preoperative care, postoperative care, acute care, intensive care unit, emergency rooms, neonatal intensive care units, and other applications.

Medical Speciality

- General Surgery

- Cardiology

- Neurology

- Pediatrics

- Thoracic Surgery

- Orthopedic Surgery

- Other Medical Specialties

On the basis of medical speciality, the patient temperature management market is segmented into general surgery, cardiology, neurology, pediatrics, thoracic surgery, orthopedic surgery, and other medical specialties.

End User

- Ambulatory Surgical Centers

- Hospitals

- Specialized Clinics

- Others

On the basis of end user, the patient temperature management market is segmented into ambulatory surgical centres, hospitals, specialized clinics, and others.

Patient Temperature Management Regional Analysis/Insights

The patient temperature management is analysed and market size insights and trends are provided by product, component, medical speciality, application and end user as referenced above.

The countries covered in the patient temperature management report are U.S., Canada, and Mexico.

The U.S. is expected to dominate due to an increase in technological advancement in the developing areas.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Patient Temperature Management Analysis

North America patient temperature management market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on patient temperature management market.

Some of the major players operating in the market are BD, Medtronic, 3M, Stryker, ICU Medical, Inc., Ecolab, ZOLL Medical Corporation,Terumo Europe NV,Belmont Medical Technologies, GENTHERM, VYAIRE MEDICAL, INC., The Surgical Company PTM, pfm medical hico gmbh, ATTUNE MEDICAL, Augustine Surgical, Inc., GERATHERM, E-Control Systems, Inc., Advanced Cooling Technologies, Medika International and Mercury Biomed, LLC and among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: REGULATIONS

5.1 REGULATION IN U.S

5.2 REGULATION IN EUROPE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING SURGICAL PROCEDURES IN GERIATRIC POPULATION

6.1.2 INCREASING INCIDENCE OF CHRONIC DISEASES

6.1.3 GROWING TECHNOLOGICAL ADVANCEMENTS IN THE TEMPERATURE MANAGEMENT SYSTEM

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH PATIENT TEMPERATURE MANAGEMENT SYSTEM

6.2.2 STRINGENT RULES & REGULATIONS

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 INCREASED REIMBURSEMENT POLICIES

6.4 CHALLENGES

6.4.1 PRODUCT RECALL

6.4.2 LACK OF SKILLED HEALTHCARE PROFESSIONALS

7 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 PATIENT WARMING SYSTEM

7.2.1 SURFACE WARMING SYSTEMS

7.2.2 CONVECTIVE WARMING SYSTEMS

7.2.3 CONDUCTIVE WARMING SYSTEMS

7.2.4 INTRAVASCULAR WARMING SYSTEMS

7.2.5 WARMING ACCESSORIES

7.3 PATIENT COOLING SYSTEM

7.3.1 SURFACE COOLING SYSTEMS

7.3.1.1 WATER CIRCULATING COOLING SYSTEM

7.3.1.2 AIR-CIRCULATING COOLING SYSTEM

7.3.1.3 GEL-COATED EXTERNAL COOLING DEVICE

7.3.2 CONVECTIVE COOLING SYSTEMS

7.3.3 CONDUCTIVE COOLING SYSTEMS

7.3.4 INTRAVASCULAR COOLING SYSTEMS

7.3.5 COOLING ACCESSORIES

8 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 WARMING

8.2.1 FORCED-AIR BLANKETS

8.2.2 FORCED-AIR WARMING GOWN

8.2.3 GEL PADS

8.2.4 CONDUCTIVE TABLE PADS

8.2.5 ELECTRIC PADS

8.2.6 HEATED WATER BOTTLES

8.2.7 WATER MATTRESSES

8.2.8 OTHERS

8.3 COOLING

8.3.1 WATER BLANKETS

8.3.2 COOLING CAPS

8.3.3 GEL PADS

8.3.4 COOLING CATHETERS

8.3.5 OTHERS

9 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 OPERATING ROOM

9.3 PREOPERATIVE CARE

9.4 POSTOPERATIVE CARE

9.5 ACUTE CARE

9.6 INTENSIVE CARE UNIT

9.7 EMERGENCY ROOMS

9.8 NEONATAL INTENSIVE CARE UNITS

9.9 OTHER APPLICATIONS

10 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY MEDICAL SPECIALTY

10.1 OVERVIEW

10.2 GENERAL SURGERY

10.3 CARDIOLOGY

10.4 NEUROLOGY

10.5 PEDIATRICS

10.6 THORACIC SURGERY

10.7 ORTHOPEDIC SURGERY

10.8 OTHER MEDICAL SPECIALTIES

11 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 AMBULATORY SURGICAL CENTERS

11.3 HOSPITALS

11.4 SPECIALIZED CLINICS

11.5 OTHERS

12 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT

15 COMPANY PROFILE

15.1 BD

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 MEDTRONIC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.2.6 INVESTMENT

15.2.7 PRODUCT LAUNCH

15.3 3M

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 STRYKER

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ICU MEDICAL INC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.5.6 ACQUISITION

15.6 ADVANCED COOLING TECHNOLOGIES, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.6.4 WEBINAR

15.7 ATTUNE MEDICAL

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.7.4 FUNDING

15.8 AUGUSTINE SURGICAL, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 BELMONT MEDICAL TECHNOLOGIES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 ECOLAB

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 E-CONTROL SYSTEMS INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 GENTHERM

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 GERATHERM MEDICAL AG

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.13.5 CONFERENCE

15.14 MEDIKA INTERNATIONAL P.R., INC

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.4 PARTNERSHIP

15.15 MERCURY BIOMED, LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.4 FUND GRANT

15.16 PFM MEDICAL HICO GMBH

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 TERUMO CORPORATION

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 THE SURGICAL COMPANY PTM

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 VYAIRE

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 ZOLL MEDICAL CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 HEALTHCARE EXPENDITURE IN ASIA-PACIFIC (USD MILLION)

TABLE 2 FEDERAL SPENDING AND TAX EXPENDITURE FOR HEALTHCARE IN 2018

TABLE 3 COMPOSITION OF FEDERAL SPENDING ON HEALTHCARE IN THE U.S.

TABLE 4 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 8 NORTH AMERICA PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 9 NORTH AMERICA PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 12 NORTH AMERICA PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 13 NORTH AMERICA SURFACE COOLING SYSTEMS IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA WARMING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA WARMING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA COOLING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA COOLING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA OPERATING ROOM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA PREOPERATIVE CARE IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA POSTOPERATIVE CARE IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ACUTE CARE IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA INTENSIVE CARE UNIT IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA EMERGENCY ROOMS IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA NEONATAL INTENSIVE CARE UNITS IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA OTHER APPLICATIONS IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY MEDICAL SPECIALTY, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA GENERAL SURGERY IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA CARDIOLOGY IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA NEUROLOGY IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PEDIATRICS IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA THORACIC SURGERY IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ORTHOPEDIC SURGERY IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHER MEDICAL SPECIALTIES IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HOSPITALS IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA SPECIALIZED CLINICS IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 45 NORTH AMERICA PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 46 NORTH AMERICA PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 48 NORTH AMERICA PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 49 NORTH AMERICA SURFACE COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA WARMING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA COOLING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY MEDICAL SPECIALTY, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 U.S. PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 59 U.S. PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 60 U.S. PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 62 U.S. PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 63 U.S. SURFACE COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 65 U.S. WARMING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 66 U.S. COOLING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 67 U.S. PATIENT TEMPERATURE MANAGEMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.S. PATIENT TEMPERATURE MANAGEMENT MARKET, BY MEDICAL SPECIALTY, 2020-2029 (USD MILLION)

TABLE 69 U.S. PATIENT TEMPERATURE MANAGEMENT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 CANADA PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 CANADA PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 CANADA PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 73 CANADA PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 74 CANADA PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 CANADA PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 76 CANADA PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 77 CANADA SURFACE COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 CANADA PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 79 CANADA WARMING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 80 CANADA COOLING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 81 CANADA PATIENT TEMPERATURE MANAGEMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 CANADA PATIENT TEMPERATURE MANAGEMENT MARKET, BY MEDICAL SPECIALTY, 2020-2029 (USD MILLION)

TABLE 83 CANADA PATIENT TEMPERATURE MANAGEMENT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 MEXICO PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 MEXICO PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 MEXICO PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 87 MEXICO PATIENT WARMING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 88 MEXICO PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 MEXICO PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 90 MEXICO PATIENT COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 91 MEXICO SURFACE COOLING SYSTEM IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 93 MEXICO WARMING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 94 MEXICO COOLING IN PATIENT TEMPERATURE MANAGEMENT MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 95 MEXICO PATIENT TEMPERATURE MANAGEMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 MEXICO PATIENT TEMPERATURE MANAGEMENT MARKET, BY MEDICAL SPECIALTY, 2020-2029 (USD MILLION)

TABLE 97 MEXICO PATIENT TEMPERATURE MANAGEMENT MARKET, BY END USER, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 RISING PREVALENCE OF CHRONIC DISEASE AS WELL AS GROWING SURGICAL PROCEDURES IN GERIATRIC POPULATION IS DRIVING THE NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET

FIGURE 14 HEALTH SPENDING BY MAJOR SOURCES OF FUNDS

FIGURE 15 RECENT YEAR HEALTHCARE EXPENDITURE (% OF GDP) 2018-2019-

FIGURE 16 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY COMPONENT, 2021

FIGURE 21 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 24 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY APPLICATION, 2021

FIGURE 25 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY MEDICAL SPECIALTY, 2021

FIGURE 29 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY MEDICAL SPECIALTY, 2022-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY MEDICAL SPECIALTY, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY MEDICAL SPECIALTY, LIFELINE CURVE

FIGURE 32 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY END USER, 2021

FIGURE 33 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY END USER, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: SNAPSHOT (2021)

FIGURE 37 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY COUNTRY (2021)

FIGURE 38 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 41 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.