North America Paprika Powder Market Analysis and Insights

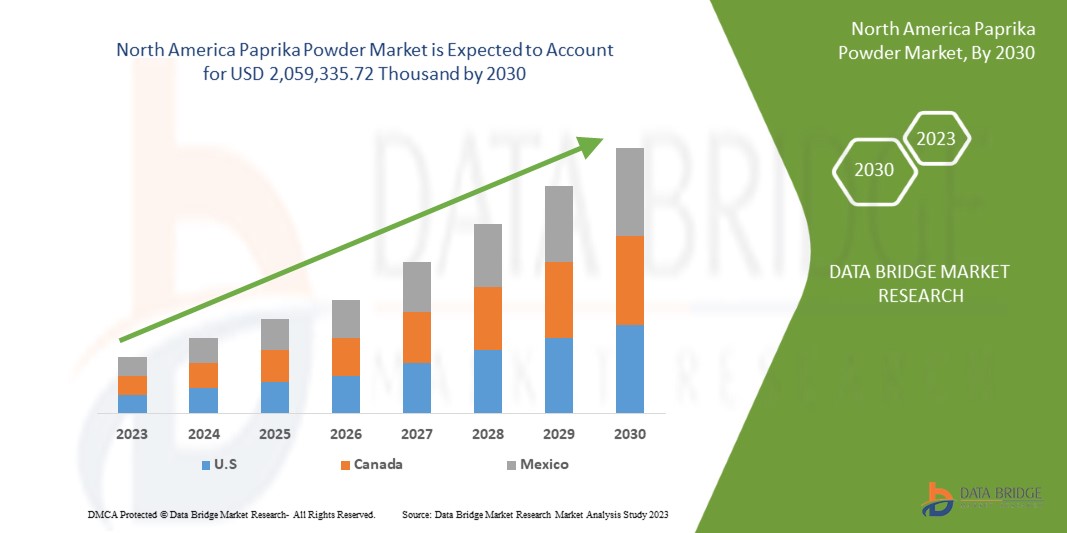

The North America paprika powder market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing at a CAGR of 6.3% in the forecast period of 2023 to 2030 and is expected to reach USD 2,059,335.72 thousand by 2030 as the paprika powder is used as a seasoning in various dishes across the globe, which is expected to drive the market growth.

The North America paprika powder market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Product (Regular Paprika Powder, Sweet Paprika Powder, and Smoked Paprika Powder), Nature (Conventional and Organic), Application (Food and Others), Distribution Channel (Direct, and Indirect) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

EVESA, Le Comptoir Colonial, Botanic Healthcare, Santa Maria UK Ltd, Foodchem International Corporation, Qingdao Taifoong Foods Co., Ltd, and Sri Ruthra Exports among others |

Market Definition

Paprika or paprika powder is a spice that is used to add flavor and color in a natural form to food. It is made from the dried pods of a type of pepper plant. Paprika is widely used as a seasoning in many cuisines, including Hungarian, Spanish, and Indian cuisines among many others. The product is widely used in meat products to enhance its flavor. It also finds application in bakery products for imparting flavors such as vanilla and chocolate. Moreover, it can be used to add taste to beverages such as tea and coffee. Considering its antibacterial and antioxidant benefits on health, paprika is used for various medical purposes and is thus used in the pharmaceutical industry. It is also useful for anti-dandruff oils and shampoos and is used in various hair and skin care products and as a coloring agent for the same. Paprika is used extensively as a natural coloring agent in food such as culinary, meat products, oil, and cheeses.

North America Paprika Powder Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

-

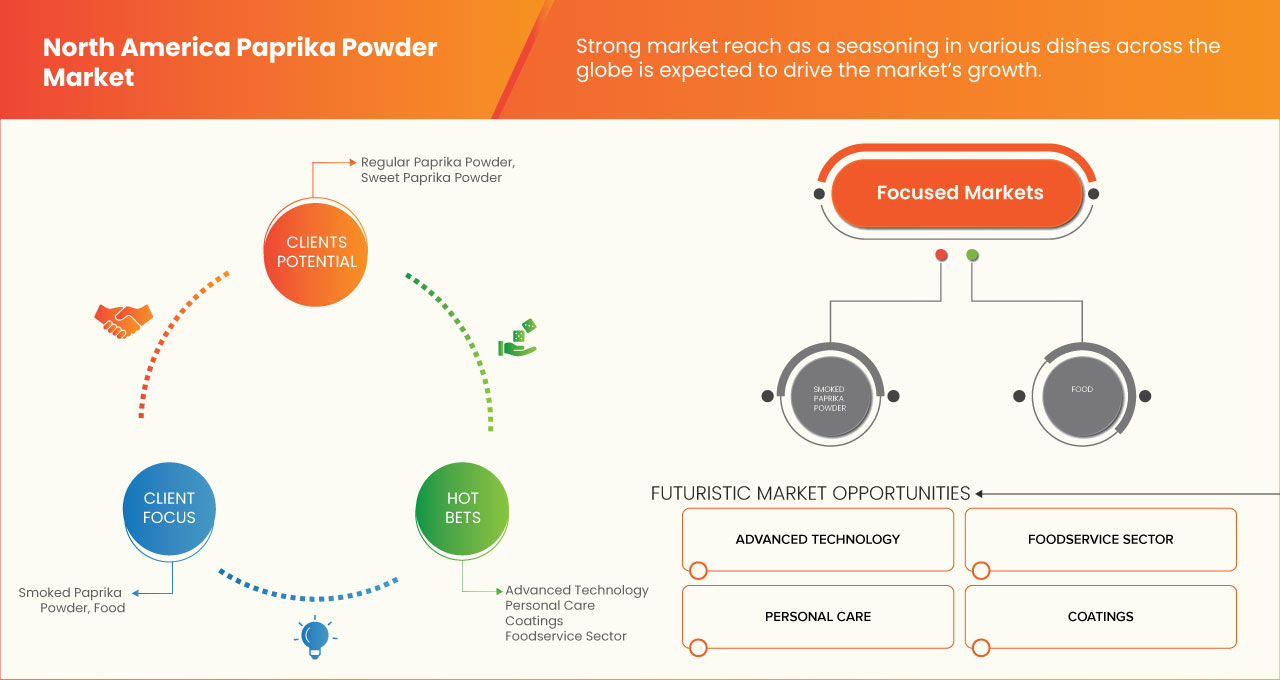

Strong market reach as a seasoning in various dishes across the Globe

Paprika is widely used as a seasoning in many cuisines, including Hungarian, Spanish, and Indian cuisines among many others. The growth in the market can be attributed to the increasing demand for paprika as a food seasoning and a natural colorant for food products. In addition, the increasing demand for paprika oleoresins as a poultry feed color additive is also contributing to the growth of the North America paprika powder market. Moreover, the product is widely used in meat products to enhance its flavor. It also finds application in bakery products for imparting flavors such as vanilla and chocolate. Moreover, it can be used to add taste to beverages such as tea and coffee. Therefore, the growing demand for paprika powder as a food seasoning and a natural colorant is expected to drive the growth of the North America paprika powder market.

-

Rising importance of paprika as a functional ingredient in various applications other than food

Paprika powder has various health benefits, depending on the pepper used to make the spice or the powder. Consuming paprika powder helps to prevent hyperacidity, and owing to its sweet taste, it helps in the reduction of the chances of acid regurgitation.

In addition, rising mindfulness among consumers with respect to the medical advantages of paprika powder is expected to drive the North America paprika powder market. Apart from this, paprika powder has applications in the pharmaceutical industry. They help diminish agony, tension, and stress when utilized in appropriate fixations and concentration in a product. Paprika additionally has characteristic properties such as pain relieving, calming, and hostile to heftiness properties and hence can be utilized in anti-cancer treatment. Incorporating capsaicin-containing paprika powder into one's diet may provide protection against a wide variety of cancers.

Opportunities

-

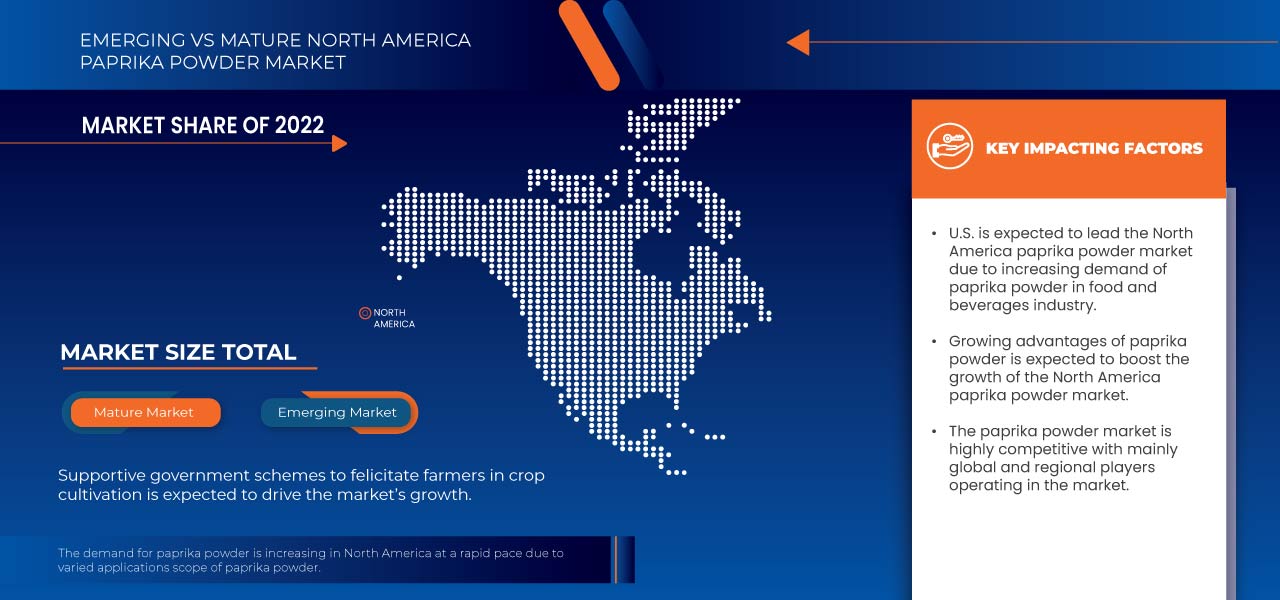

Supportive government schemes to felicitate farmers in crop cultivation

Agriculture is the economic backbone of many developing countries and contributes about 25% of the GDP in low-income countries and 80% of the poor population living in rural areas. Various countries and regional support for agriculture have grown by adding new programs and extending coverage to more regions and commodities. Production management schemes offered by governments for higher productivity help in increasing the production of various commodities, including cereals, pulses, spices, vegetables, and fruits, through area expansion and productivity enhancement in a sustainable manner. The promotion of good agricultural practices with respect to plant protection strategies and techniques also helps to promote uniformity in agriculture marketing by streamlining procedures across the integrated markets, removing information asymmetry between buyers and sellers, and promoting real-time price discovery based on actual demand and supply.

In addition, one more way for policymakers to support farmers is to enact regulations that enable a more efficient provision of agricultural inputs such as seeds, fertilizer, animal feed, veterinary medicinal products, and water, promote access to finance, and facilitate market transactions. These supportive measures, policies, and regulations regarding farmers and farming practices and facilities will provide a host of opportunities for the growth of the North America paprika powder market.

-

Rising spending toward incorporating natural ingredients while processing paprika powder

The demand for natural food additives, such as natural food colorants, is at an all-time high. This trend has been at the epicenter of the expansion of the paprika powder market. To process paprika powder, manufacturers are spending huge amounts to incorporate natural ingredients to produce different varieties and types of paprika powder. Moreover, some of the leading producers are looking to implement cutting-edge technologies to improve process efficiency. Organizations have started using microencapsulation for color delivery systems and final product formulation.

Therefore, with the rising importance and demand for natural ingredients based, demand for naturally extracted paprika powder is expected to rise. This will create an opportunity for the growth and development of the North America paprika powder market.

Restraint

- Substitutional threat from other seasonings

There are many different spices that give the same impact as a paprika powder in various food and dishes. Some of the smoky substitutions for paprika powder include chipotle chili powder (for smoked sweet paprika), cayenne pepper powder (for hot/sharp paprika), ancho pepper powder (for sweet paprika), guajillo pepper powder (for hot/sharp paprika) and chili powder (for hot/sharp paprika) among many others.

While smoked paprika gives a dish depth, sweet paprika is a classic staple and can be used in almost every dish alongside garlic and onion. Mild chili powder and tomato powder were used instead of paprika powder to get the paprika flavor as well.

The easy availability of a number of substitutes for various types of paprika power in the North America market is expected to act as a major restraint for the growth and development of the North America paprika powder market.

CHALLENGES

- Cultivation of other profitable crop alternatives

The paprika powder market generally depends on contract farming for procurement of raw materials, where manufacturers sign contracts with farmers to supply paprika for processing and manufacturing paprika powder. In this type of farming, the grower produces paprika for the purchaser only. Grower shall not sell or give any of the contracted paprika to a third party. However, there are certain drawbacks that make farmers move towards other modes of farming or cultivation of other crops. The major drawback of contract farming is that it does not allow side selling of crops to other purchasers. This limits the growth of the farmer as well as the industry.

Specialty crops are new and emerging crops that have been commercially grown in a particular region, and there is a need to spread the growth of these specialty crops. Ranging from exotic purple potatoes to more commonly known crops such as lettuce, producing specialty crops generally introduces farmers to a new way of growing and offers various opportunities. Therefore, with the availability of various other options in crop cultivation with farmers, this is expected to pose a major challenge for the North America paprika powder market growth.

Recent Development

- In February 2023, Botanic Healthcare got certified with the National Sanitation Foundation's (NSF) NSF/ANSI 173, Section 8 certification from the US. The certification will lead to new business relations as well as partnerships. Additionally, gaining a lot of attention from larger customers around the globe.

North America Paprika Powder Market Scope and Market Size

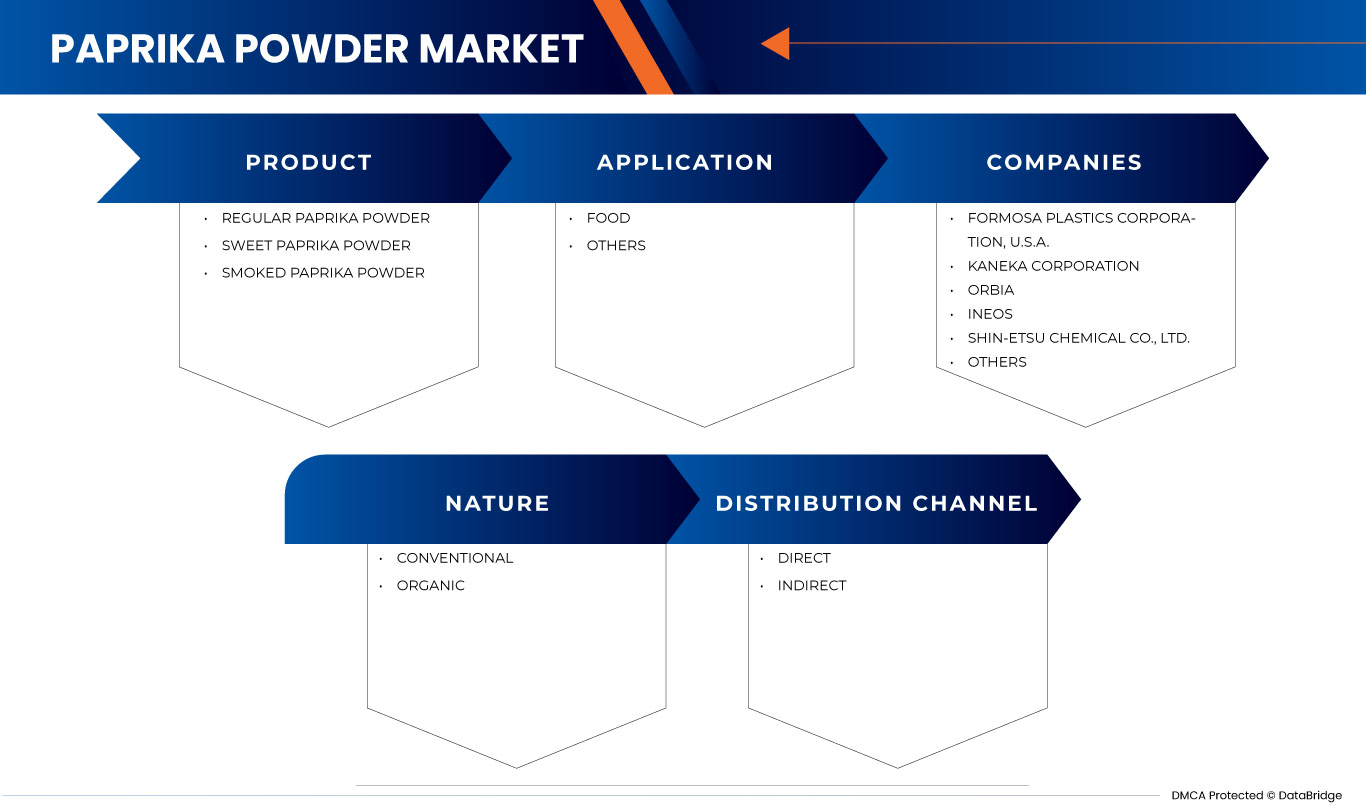

North America paprika powder market is categorized into product, nature, application, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product

- Regular paprika powder

- Sweet paprika powder

- Smoked paprika powder

On the basis of product, the market is segmented into regular paprika powder, sweet paprika powder, and smoked paprika powder.

Nature

- Conventional

- Organic

On the basis of nature, the market is segmented into conventional and organic.

Application

- Food

- Others

On the basis of application, the market is segmented into food and others.

Distribution Channel

- Direct

- Indirect

On the basis of distribution channel, the market is segmented into direct and indirect.

North America Paprika Powder Market Regional/Country-Level Analysis

The North America paprika powder market is analyzed, and market size information is provided by country, product, nature, application, and distribution channel as referenced above.

The countries covered in the North America paprika powder market are U.S., Canada, and Mexico.

U.S. is expected to dominate the North America paprika powder market as paprika powder makes it a preferred choice for application in various other industries apart from the food industry, such as cosmetics and skincare, pharmaceuticals and healthcare, and others.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Gaskets and Seals Market Share Analysis

North America paprika powder market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the North America paprika powder market.

The major players covered in the North America paprika powder market report are EVESA, Le Comptoir Colonial, Botanic Healthcare, Santa Maria UK Ltd, Foodchem International Corporation, Qingdao Taifoong Foods Co., Ltd, and Sri Ruthra Exports among others.

DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PAPRIKA POWDER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTE PRODUCTS

4.1.3 BARGAINING POWER OF BUYERS/CONSUMERS

4.1.4 BARGAINING POWER OF SUPPLIERS

4.1.5 INTENSITY OF COMPETITIVE RIVALRY

4.2 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 IMPACT OF ECONOMIC SLOWDOWN

4.4.1 IMPACT ON PRICE

4.4.2 IMPACT ON SUPPLY CHAIN

4.4.3 IMPACT ON SHIPMENT

4.4.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.6 OVERVIEW ON TECHNOLOGICAL INNOVATIONS

4.7 PAPRIKA POWDER SUBSTITUTE AND RISK ASSOCIATED OF BEING SUBSTITUTED FOR PAPRIKA POWDER

4.8 PRICING ANALYSIS

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 VALUE CHAIN ANALYSIS

4.11 REGULATORY FRAMEWORK AND GUIDLINES

4.11.1 REGULATORY FRAMEWORK AND GUIDELINES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 STRONG MARKET REACH AS A SEASONING IN VARIOUS DISHES ACROSS THE GLOBE

5.1.2 RISING IMPORTANCE OF PAPRIKA AS A FUNCTIONAL INGREDIENT IN VARIOUS APPLICATIONS OTHER THAN FOOD

5.1.3 POSITIVE OUTLOOK TOWARDS FOODSERVICE SECTOR IN EMERGING ECONOMIES

5.2 RESTRAINTS

5.2.1 SUBSTITUTIONAL THREAT FROM OTHER SEASONINGS

5.2.2 ADVERSE EFFECTS OF PAPRIKA POWDER ON SENSITIVE SKIN

5.3 OPPORTUNITIES

5.3.1 SUPPORTIVE GOVERNMENT SCHEMES TO FELICITATE FARMERS IN CROP CULTIVATION

5.3.2 RISING SPENDING TOWARD INCORPORATING NATURAL INGREDIENTS WHILE PROCESSING PAPRIKA POWDER

5.4 CHALLENGES

5.4.1 CULTIVATION OF OTHER PROFITABLE CROP ALTERNATIVES

5.4.2 FOOD SAFETY AND QUALITY ISSUES

5.4.3 VOLATILITY IN RAW MATERIAL AND LACK OF RELIABLE SUPPLY OF PAPRIKA

6 NORTH AMERICA PAPRIKA POWDER MARKET, BY REGION

6.1 NORTH AMERICA

6.1.1 U.S.

6.1.2 CANADA

6.1.3 MEXICO

7 NORTH AMERICA PAPRIKA POWDER MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.2 CERTIFICATION

7.3 FACILITY EXPANSION

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 BOTANIC HEALTHCARE

9.1.1 COMPANY SNAPSHOT

9.1.2 COMPANY SHARE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 EVESA

9.2.1 COMPANY SNAPSHOT

9.2.2 COMPANY SHARE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENTS

9.3 SRI RUTHRA EXPORTS

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENTS

9.4 LE COMPTOIR COLONIAL

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENTS

9.5 QINGDAO TAIFOONG FOODS CO., LTD.

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENTS

9.6 BRITISH AQUA FEEDS

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENTS

9.7 FOODCHEM INTERNATIONAL CORPORATION

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENTS

9.8 LAXCORN

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENTS

9.9 LÓPEZ MATENCIO S.A.

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENTS

9.1 LIZAZ FOOD PROCESSING INDUSTRIES

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENTS

9.11 NATURAL SPICES

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENTS

9.12 NATURESMITH FOODS LLP

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 RECENT DEVELOPMENTS

9.13 QINGDAO FUMANXIN FOODS CO., LTD.

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENTS

9.14 QINGDAO MEIRUYUAN FOODS CO., LTD.

9.14.1 COMPANY SNAPSHOT

9.14.2 PRODUCT PORTFOLIO

9.14.3 RECENT DEVELOPMENTS

9.15 RUBIN PAPRIKA PROCESSING LTD

9.15.1 COMPANY SNAPSHOT

9.15.2 PRODUCT PORTFOLIO

9.15.3 RECENT DEVELOPMENTS

9.16 SANTA MARIA UK LTD

9.16.1 COMPANY SNAPSHOT

9.16.2 PRODUCT PORTFOLIO

9.16.3 RECENT DEVELOPMENTS

9.17 SINOPAPRIKA CO., LTD

9.17.1 COMPANY SNAPSHOT

9.17.2 PRODUCT PORTFOLIO

9.17.3 RECENT DEVELOPMENTS

9.18 SILVERLINE CHEMICALS

9.18.1 COMPANY SNAPSHOT

9.18.2 PRODUCT PORTFOLIO

9.18.3 RECENT DEVELOPMENTS

9.19 SUNRISE SPICES EXPORTERS

9.19.1 COMPANY SNAPSHOT

9.19.2 PRODUCT PORTFOLIO

9.19.3 RECENT DEVELOPMENTS

9.2 WESTMILL FOODS

9.20.1 COMPANY SNAPSHOT

9.20.2 PRODUCT PORTFOLIO

9.20.3 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF FRUITS OF THE GENUS CAPSICUM OR OF THE GENUS PIMENTA, CRUSHED OR GROUND; HS CODE – 090422 (USD THOUSAND)

TABLE 2 EXPORT DATA OF FRUITS OF THE GENUS CAPSICUM OR OF THE GENUS PIMENTA, CRUSHED OR GROUND; HS CODE – 090422 (USD THOUSAND)

TABLE 3 NORTH AMERICA PAPRIKA POWDER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA PAPRIKA POWDER MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 5 NORTH AMERICA PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 7 NORTH AMERICA REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 9 NORTH AMERICA SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 11 NORTH AMERICA SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 13 NORTH AMERICA PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 15 NORTH AMERICA PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 17 NORTH AMERICA FOOD IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA FOOD IN PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA MEAT PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA FISH PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA SAVOURY BAKERY IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA SNACKS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA CONVENIENCE FOODS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (TONS)

TABLE 26 U.S. PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 U.S. PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 28 U.S. REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 29 U.S. REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 30 U.S. SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 31 U.S. SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 32 U.S. SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 33 U.S. SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 34 U.S. PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 35 U.S. PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 36 U.S. PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 37 U.S. PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 38 U.S. FOOD IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. FOOD IN PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. MEAT PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 U.S. FISH PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 U.S. SAVOURY BAKERY IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 U.S. SNACKS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 U.S. CONVENIENCE FOODS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (TONS)

TABLE 47 CANADA PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 49 CANADA REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 51 CANADA SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 53 CANADA SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 54 CANADA SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 55 CANADA PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 57 CANADA PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 59 CANADA FOOD IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 CANADA FOOD IN PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA MEAT PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA FISH PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 CANADA SAVOURY BAKERY IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA SNACKS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 CANADA CONVENIENCE FOODS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 CANADA PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 67 CANADA PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (TONS)

TABLE 68 MEXICO PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 69 MEXICO PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 70 MEXICO REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 71 MEXICO REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 72 MEXICO SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 73 MEXICO SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 74 MEXICO SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 75 MEXICO SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 76 MEXICO PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 77 MEXICO PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 78 MEXICO PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 79 MEXICO PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 80 MEXICO FOOD IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 MEXICO FOOD IN PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 82 MEXICO MEAT PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 MEXICO FISH PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 MEXICO SAVOURY BAKERY IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 MEXICO SNACKS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 MEXICO CONVENIENCE FOODS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 MEXICO PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 88 MEXICO PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (TONS)

List of Figure

FIGURE 1 NORTH AMERICA PAPRIKA POWDER MARKET

FIGURE 2 NORTH AMERICA PAPRIKA POWDER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PAPRIKA POWDER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PAPRIKA POWDER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PAPRIKA POWDER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PAPRIKA POWDER MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA PAPRIKA POWDER MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PAPRIKA POWDER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PAPRIKA POWDER MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PAPRIKA POWDER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA PAPRIKA POWDER MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA PAPRIKA POWDER MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA PAPRIKA POWDER MARKET: SEGMENTATION

FIGURE 14 STRONG MARKET REACH AS A SEASONING IN VARIOUS DISHES ACROSS THE GLOBE IS EXPECTED TO DRIVE THE NORTH AMERICA PAPRIKA POWDER MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 15 REGULAR PAPRIKA POWDER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PAPRIKA POWDER MARKET IN 2023 & 2030

FIGURE 16 PRICE ANALYSIS FOR NORTH AMERICA PAPRIKA POWDER (USD/TONS)

FIGURE 17 VALUE CHAIN OF THE NORTH AMERICA PAPRIKA POWDER MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA PAPRIKA POWDER MARKET

FIGURE 19 NORTH AMERICA PAPRIKA POWDER MARKET: SNAPSHOT (2022)

FIGURE 20 NORTH AMERICA PAPRIKA POWDER MARKET: BY COUNTRY (2022)

FIGURE 21 NORTH AMERICA PAPRIKA POWDER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 NORTH AMERICA PAPRIKA POWDER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 NORTH AMERICA PAPRIKA POWDER MARKET: BY PRODUCT (2023-2030)

FIGURE 24 NORTH AMERICA PAPRIKA POWDER MARKET: COMPANY SHARE 2022 (%)

North America Paprika Powder Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Paprika Powder Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Paprika Powder Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.