Market Analysis and Insights: North America Polyalkylene Glycol (PAG) Base Oil Market

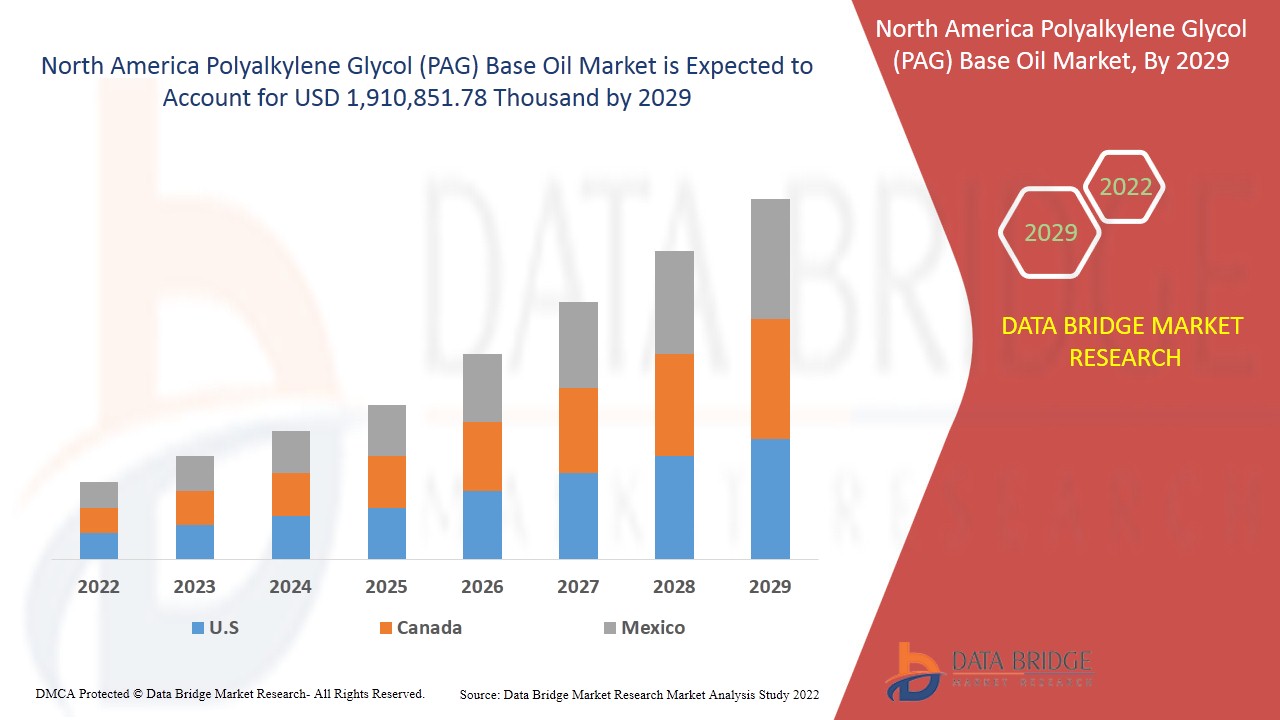

Polyalkylene glycol (PAG) base oil market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing at a CAGR of 3.5% in the forecast period of 2022 to 2029 and expected to reach USD 1,910,851.78 thousand by 2029. Growing use in food grade products have propelled the growth of the polyalkylene glycol (PAG) base oils market.

PAG oil or polyalkylene glycol is completely synthetic hygroscopic oil intended specifically for air conditioning compressors in automobiles. It is widely used as compressor oil. In addition, it is used in applications such as worn gear lubricant, anhydrous fire resistant hydraulic fluid, metal working fluid, and others. These PAG oils have high viscosity index, good water solubility, shear stability, and less volatility under high temperatures. PAG base oils are also used as textile lubricants and quenchants in metal heat treating.

Polyalkylene Glycol (PAG) base oils are classified by their weight percent composition of oxypropylene versus oxyethylene units in the polymer chain. Polyalkylene glycol (PAG) base oils with 100 weight percent oxypropylene groups are water insoluble; whereas those with 50 to 75 weight percent oxyethylene are water soluble at ambient temperatures. Although polyalkylene glycol (PAG) base oils have long been used as industrial lubricants, recent work has led to the development of polyalkylene glycol (PAG) lubricants for use in equipment in the food processing industry. These products are known as food-grade approved lubricants.

Rising technological advancements and modernization in the production techniques has propelled the growth of the polyalkylene glycol (PAG) base oils market. Growing use in food grade products is expected to further boost the market growth. The major restraint which is impacting the global polyalkylene glycol (PAG) base oil market negatively is volatility in the crude oil prices.

- On the other hand, growing research and development activities can bring opportunities for the global polyalkylene glycol (PAG) base oil market. However, presence of substitutes in the market is projected to challenge the market growth in the near future.

This polyalkylene glycol (PAG) base oil market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Polyalkylene Glycol (PAG) Base oil Market Scope and Market Size

North America polyalkylene glycol (PAG) base oil market is segmented on the basis of product, application and end-use. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product, the market is segmented into conventional (water insoluble) and water soluble. In 2022, the conventional (water insoluble) segment is expected to dominate the market as they have sealing properties and protects bearing surfaces from corrosion, which helps to boost its demand in the forecast year.

- On the basis of application, the market is segmented into hydraulic oil, gear oil, compressor oil, metal working fluids, greases and others. In 2022, the compressor oil segment is expected to dominate the market as compressor oil acts to seal the gaps between the screw elements, helping with the compression process, which helps to boost its demand in the forecast year.

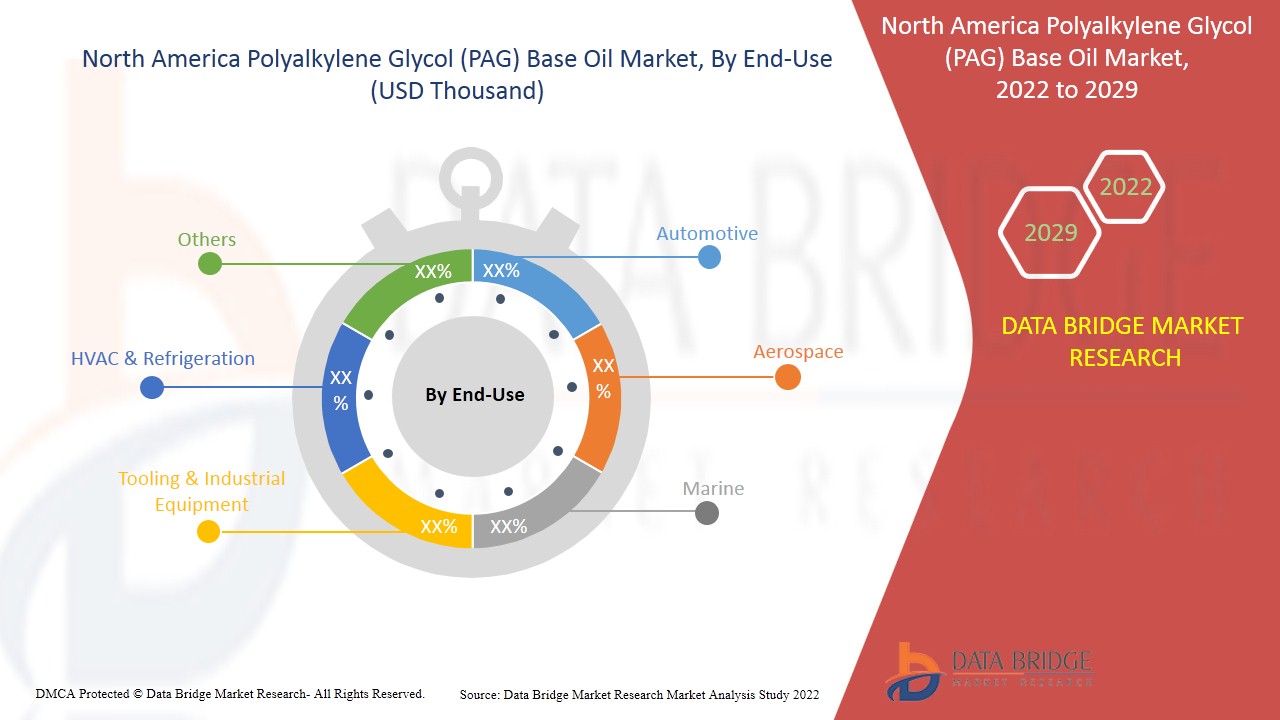

- On the basis of end-use, the market is segmented into automotive, aerospace, marine, tooling & industrial equipment, HVAC & refrigeration and others. In 2022, the automotive segment is expected to dominate the market as PAG oil improve the life span, efficiency and reliability of machinery, which helps to boost its demand in the forecast year.

Polyalkylene Glycol (PAG) Base Oil Market Country Level Analysis

North America polyalkylene glycol (PAG) base oil market is analysed and market size information is provided by country, product, application and end-use as referenced above.

The countries covered in North America polyalkylene glycol (PAG) base oil market report are U.S., Canada, and Mexico. North America is dominating the market due to considerable increase in construction activities and infrastructural development across the globe, which boosts demand of polyalkylene glycol (PAG) base oil in the region.

Global Polyalkylene Glycol (PAG) Base Oil Market

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Considerable Increase in Construction Activities and Infrastructural Development Across the Globe

North America polyalkylene glycol (PAG) base oil market also provides you with detailed market analysis for every country growth in installed base of different kind of products for polyalkylene glycol (PAG) base oil market, impact of technology using life line curves and changes in production techniques, regulatory scenarios and their impact on the polyalkylene glycol (PAG) base oil market. The data is available for historic period 2012 to 2020.

Competitive Landscape and Polyalkylene Glycol (PAG) Base Oil Market Share Analysis

North America polyalkylene glycol (PAG) base oil market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to North America polyalkylene glycol (PAG) base oil market.

The major players covered in the report are Phillips 66 Company, Exxon Mobil Corporation, Total Energies, Royal Dutch Shell Plc, Denso Corporation, BASF SE, ENI Oil Products, Chevron Corporation, FUCHS, Croda International Plc, Petronas Lubricants International, LIQUI MOLY GmbH, Ultrachem Inc and Idemitsu Kosan Co., Ltd., among other players domestic and global. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- In January 2021, BASF SE signed a joint development agreement with China BlueChemical Limited Company (China BlueChemical). The core of this partnership is to reduce carbon footprint via improved process efficiency and carbon efficiency is. This development will help BASF SE to attract a more customer base.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OILS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: DATA TRIANGULATION

2.7 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: DROC ANALYSIS

2.8 PRODUCT LIFE LINE CURVE

2.9 MULTIVARIATE MODELING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET END-USE COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 DBMR VENDOR SHARE ANALYSIS

2.15 IMPORT-EXPORT DATA

2.16 SECONDARY SOURCES

2.17 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT DEMAND FOR PAG IN AUTOMOTIVE INDUSTRY

5.1.2 RISING TECHNOLOGICAL ADVANCEMENTS AND MODERNIZATION IN PRODUCTION TECHNIQUES

5.1.3 CONSIDERABLE INCREASE IN CONSTRUCTION ACTIVITIES AND INFRASTRUCTURAL DEVELOPMENT ACROSS GLOBE

5.1.4 GROWING USE IN FOOD-GRADE PRODUCTS

5.2 RESTRAINTS

5.2.1 RISE IN COST OF SYNTHETIC FIBERS

5.2.2 VOLATILITY IN CRUDE OIL PRICES

5.3 OPPORTUNITIES

5.3.1 INCREASING USE OF BIO-DEGRADABLE PAG OILS

5.3.2 GROWING RESEARCH AND DEVELOPMENT ACTIVITIES

5.4 CHALLENGES

5.4.1 PRESENCE OF SUBSTITUTES IN MARKET

5.4.2 HIGH COST COMPARED TO CONVENTIONAL MINERAL OILS

6 IMPACT OF COVID-19 IMPACT ON THE NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET

6.3 STRATEGIC DECISIONS BY MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CONVENTIONAL (WATER INSOLUBLE)

7.3 WATER SOLUBLE

8 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 COMPRESSOR OIL

8.3 HYDRAULIC OIL

8.4 METAL WORKING FLUIDS

8.5 GEAR OIL

8.6 GREASES

8.7 OTHERS

9 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE

9.1 OVERVIEW

9.2 AUTOMOTIVE

9.3 TOOLING & INDUSTRIAL EQUIPMENT

9.4 MARINE

9.5 AEROSPACE

9.6 HVAC & REFRIGERATION

9.7 OTHERS

10 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 MERGERS & ACQUISITIONS

11.3 EXPANSIONS

11.4 NEW PRODUCT DEVELOPMENTS

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 PHILLIPS 66 COMPANY

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 EXXON MOBIL CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 TOTALENERGIES

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 ROYAL DUTCH SHELL PLC

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 DENSO CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 BASF SE

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT UPDATES

13.7 CHEVRON CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATES

13.8 CRODA INTERNATIONAL PLC

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 ENI OIL PRODUCTS

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 FUCHS

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATES

13.11 HANNONG CHEMICALS INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 HORNETT BROS & CO LTD.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

13.13 IDEMITSU KOSAN CO., LTD.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATES

13.14 LIQUI MOLY GMBH

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATES

13.15 MORRIS LUBRICANTS

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATES

13.16 PETRONAS LUBRICANTS INTERNATIONAL

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT UPDATES

13.17 ULTRACHEM INC.

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF PRODUCT: 3403 LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST… (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 3403 LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST… (USD THOUSAND)

TABLE 3 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 5 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRICE, 2020-2029 (USD/KILOTONNE)

TABLE 6 NORTH AMERICA CONVENTIONAL (WATER INSOLUBLE) IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA CONVENTIONAL (WATER INSOLUBLE) IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (THOUSAND KILOTONNES)

TABLE 8 NORTH AMERICA WATER SOLUBLE IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA WATER SOLUBLE IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (THOUSAND KILOTONNES)

TABLE 10 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA COMPRESSOR OIL IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA HYDRAULIC OIL IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA METAL WORKING FLUIDS IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA GEAR OIL IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA GREASES IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHERS IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA AUTOMOTIVE IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA TOOLING & INDUSTRIAL EQUIPMENT IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA MARINE IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA AEROSPACE IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA HVAC & REFRIGERATION IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA OTHERS IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY COUNTRY, 2022-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY COUNTRY, 2022-2029 (THOUSAND KILOTONNES)

TABLE 26 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 28 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 30 U.S. POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 31 U.S. POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 32 U.S. POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 33 U.S. POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 34 CANADA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 35 CANADA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 36 CANADA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 37 CANADA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 38 MEXICO POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 39 MEXICO POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 40 MEXICO POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 41 MEXICO POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 3 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 4 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: PRODUCT LIFE LINE CURVE

FIGURE 5 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: MULTIVARIATE MODELLING

FIGURE 6 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: MARKET END-USE COVERAGE GRID

FIGURE 9 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 10 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: SEGMENTATION

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 SIGNIFICANT DEMAND FOR PAGS IN AUTOMOTIVE INDUSTRY IS DRIVING THE NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 CONVENTIONAL (WATER INSOLUBLE) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET

FIGURE 16 VOLATILE CRUDE OIL PRICES

FIGURE 17 VOLATILITY IN CRUDE OIL PRICES BY THE U.S. ENERGY INFORMATION ADMINISTRATION

FIGURE 18 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2021

FIGURE 19 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2021

FIGURE 20 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2021

FIGURE 21 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY PRODUCT (2022-2029)

FIGURE 26 NORTH AMERICA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: COMPANY SHARE 2021 (%)

North America Pag Base Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Pag Base Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Pag Base Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.