North America Ophthalmology Lasers Market

Market Size in USD Million

CAGR :

%

USD

938.91 Million

USD

1,583.40 Million

2022

2030

USD

938.91 Million

USD

1,583.40 Million

2022

2030

| 2023 –2030 | |

| USD 938.91 Million | |

| USD 1,583.40 Million | |

|

|

|

|

North America Ophthalmology Lasers Market Analysis and Insights

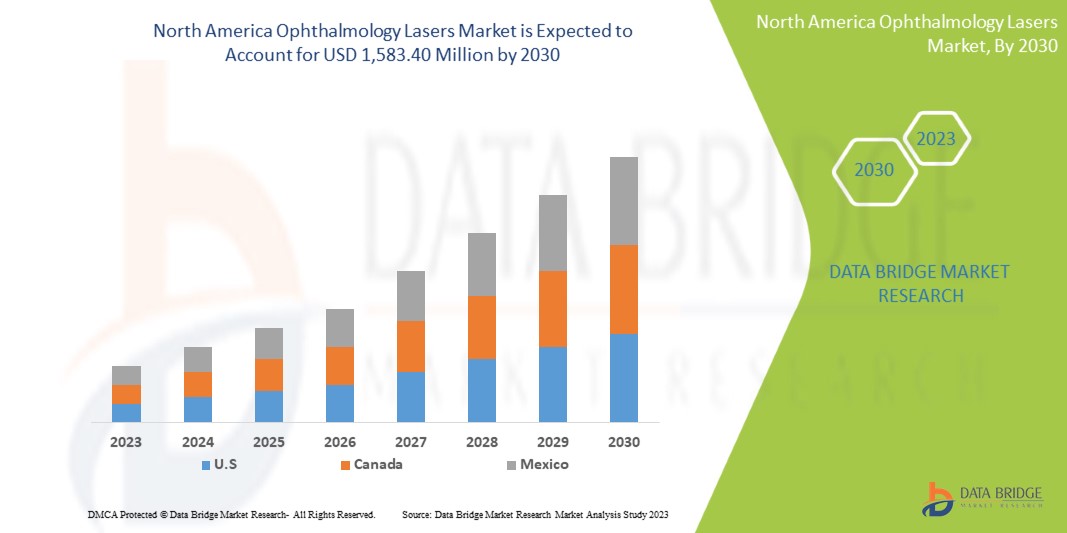

North America ophthalmology lasers market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.8% in the forecast period of 2023 to 2030 and is expected to reach USD 1,583.40 million by 2030 from USD 938.91 million in 2022.

This ophthalmology lasers market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the ophthalmology lasers market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Product (Femtosecond Lasers, Excimer Lasers, Nd:YAG Lasers, Diode Lasers, and Others), Type (Photodisruption Lasers, Selective Laser Trabeculoplasty (SLT), and Photocoagulation Lasers), Application (Diagnostics and Therapeutics), Gases (Noble Gas, Halogen Gas, Buffer Gas, and Others), End User (Hospitals, Clinics, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

NIDEK CO., LTD., Calmar Laser, LENSAR, INC., OD-OS, Quantel Medical (a subsidiary of Lumibird Medical), Alcon, Ziemer Ophthalmic Systems AG, LIGHTMED, Johnson & Johnson Inc., Bausch & Lomb Incorporated, MEDA Co., Ltd., Topcon, Lumenis Be Ltd., IRIDEX Corporation, and Zeiss among others |

Market Definition

Ophthalmology lasers are specialized medical devices that emit focused beams of light to treat various eye conditions. These lasers are commonly used in ophthalmology to perform various procedures, such as treating vision disorders, correcting refractive errors, and managing various eye diseases. The devices gained increased importance and adoption due to the high prevalence of several ophthalmic diseases, such as glaucoma, cataract, and other vision-related issues.

North America Ophthalmology Lasers Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing incidences of chronic and communicable eye diseases

The field of ophthalmology has seen a rise in the incidence of both chronic and communicable eye diseases in recent years. Some of the major factors contributing to this trend include a growing North America population, an aging population, increased urbanization, changing lifestyles, and increased exposure to environmental pollutants. One of the most common chronic eye diseases is Age-Related Macular Degeneration (AMD). AMD is a leading cause of blindness in people over the age of 60 and is caused by damage to the macula, a small part of the retina responsible for central vision. The prevalence of AMD is expected to increase with an aging North America population. Another chronic eye disease that is becoming more prevalent is glaucoma. Glaucoma is a group of eye diseases that cause damage to the optic nerve and can lead to blindness. It is often asymptomatic until it reaches an advanced stage, making regular eye exams crucial for early detection and treatment.

In March 2023, according to an article by Indian Express, North America, glaucoma is the second leading cause of blindness after cataracts. It is estimated to cause blindness in 4.5 million people worldwide. Despite this, glaucoma is largely undiagnosed, with more than 90 percent of untreated cases. Thus, increasing incidences of chronic and communicable eye diseases are expected to drive the market's growth.

- Increased consumer awareness for laser treatments

Consumer awareness of laser therapies has increased, which has benefited the market for ophthalmic lasers North America. Several factors have contributed to this trend, including advancements in technology, increased access to information, and greater emphasis on patient education. One of the main drivers of increased consumer awareness is the development of new laser systems that offer improved precision, reduced recovery times, and better outcomes. These systems have been shown to be effective in treating a range of eye conditions, from refractive errors to more complex retinal disorders. Patients are increasingly interested in these treatments and are seeking out ophthalmologists who are trained to use them. Another factor contributing to increased awareness is the availability of information about ophthalmology lasers. Patients can easily access information online about the different types of laser treatments available, their benefits, and potential risks. This has helped to demystify laser treatments and make them more accessible to a wider range of patients which is expected to drive the market's growth.

- Increasing adoption of outpatient procedures

The field of ophthalmology has seen significant advancements in recent years with the advent of laser technology. With the increasing adoption of outpatient procedures, the North America ophthalmology lasers market presents a significant opportunity for growth. Outpatient procedures are medical procedures that do not require an overnight stay in a hospital. These procedures can be performed in a medical office, ambulatory surgery center, or outpatient clinic. Thus, the increasing adoption of outpatient procedures is expected to drive the market's growth.

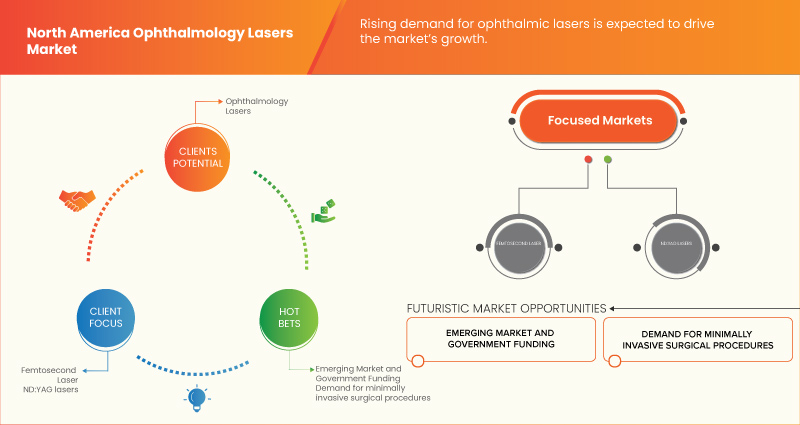

Opportunities

-

Technological advancements in ophthalmology

Technological advancements in the field of ophthalmology have revolutionized the diagnosis, treatment, and management of various eye diseases and conditions. These advancements have created significant opportunities in the North America ophthalmology lasers market, with the potential to improve patient outcomes, increase efficiency, and drive growth in the industry. One of the most significant technological advancements in ophthalmology has been the development of femtosecond lasers. These lasers are used for precision surgeries and can create incisions that are more precise and predictable than those created by traditional surgical tools. This technology has revolutionized procedures such as photocoagulation lasers, Selective Laser Trabeculoplasty (SLT), allowing for faster recovery times and better visual outcomes, which is expected to provide a lucrative opportunity for the market's growth.

Restraints/Challenges

- Lack of skilled professionals

Ophthalmology lasers are used in various procedures, including refractive surgeries, cataract surgeries, and glaucoma treatment. However, the effective use of these lasers requires skilled professionals who are proficient in handling them. The lack of such professionals can lead to errors, complications, and adverse outcomes, which can harm patients and damage the industry's reputation.

The main reason for the shortage of skilled professionals is the complexity of the equipment and the procedures involved. Ophthalmology lasers require specialized knowledge and expertise, and the training required to become proficient in using them can be time-consuming and expensive. In addition, the procedures themselves are often intricate and require a high level of skill and precision

Hence, a lack of skilled professionals will impede the growth rate of the ophthalmology lasers market. Additionally, stringent rules and regulations will further challenge the market in the forecast period.

Recent Development

- In November 2022, Alcon, the North America leader in eye care dedicated to helping people see brilliantly, announced that it had completed its acquisition of Aerie Pharmaceuticals, Inc. This transaction helps bolster Alcon's presence in the ophthalmic pharmaceutical space with its growing portfolio of commercial products and development pipeline.

- In March 2023, Bausch + Lomb Corporation and Novaliq GmbH announced that the American Journal of Ophthalmology had published results from MOJAVE, the second pivotal Phase 3 trial for NOV03 (perfluorohexyloctane). NOV03 is being investigated to treat the signs and symptoms of Dry Eye Disease (DED) associated with Meibomian Gland Dysfunction (MGD). Results from the first pivotal Phase 3 trial, GOBI, were published earlier this year in the American Journal of Ophthalmology.

North America Ophthalmology Lasers Market Scope

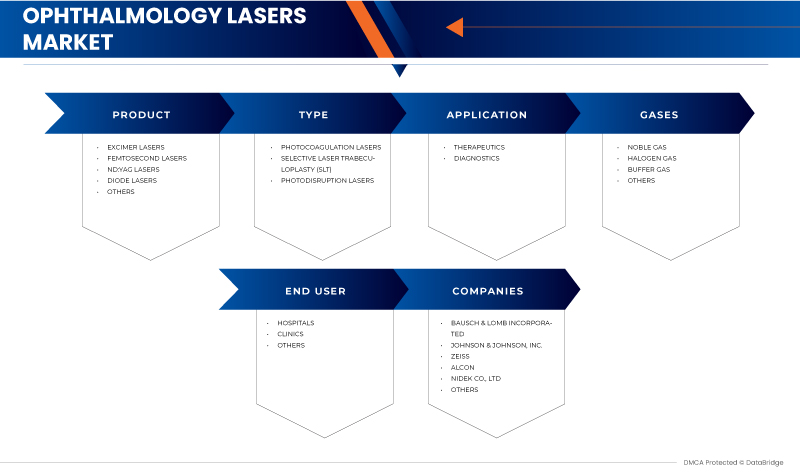

The North America ophthalmology lasers market is segmented into product, type, application, gases, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Femtosecond Lasers

- Excimer Lasers

- Nd: YAG Lasers

- Diode Lasers

- Others

On the basis of product, the market is segmented into femtosecond lasers, excimer lasers, Nd: YAG lasers, diode lasers, and others.

Type

- Photodisruption Lasers

- Selective Laser Trabeculoplasty (SLT)

- Photocoagulation Lasers

On the basis of type, the market is segmented into photodisruption lasers, selective laser trabeculoplasty (SLT), and photocoagulation lasers.

Application

- Diagnostics

- Therapeutics

On the basis of application, the market is segmented into diagnostics and therapeutics.

Gases

- Noble gas

- Halogen gas

- Buffer gas

- Others

On the basis of gases, the market is segmented into noble gas, halogen gas, buffer gas, and others.

End User

- Hospitals

- Clinics

- Others

On the basis of end user, the market is segmented into hospitals, clinics, and others.

North America Ophthalmology Lasers Market Regional Analysis/Insights

The North America ophthalmology lasers market is analyzed, and market size insights and trends are provided by country, product, type, application, gases, and end user, as referenced above.

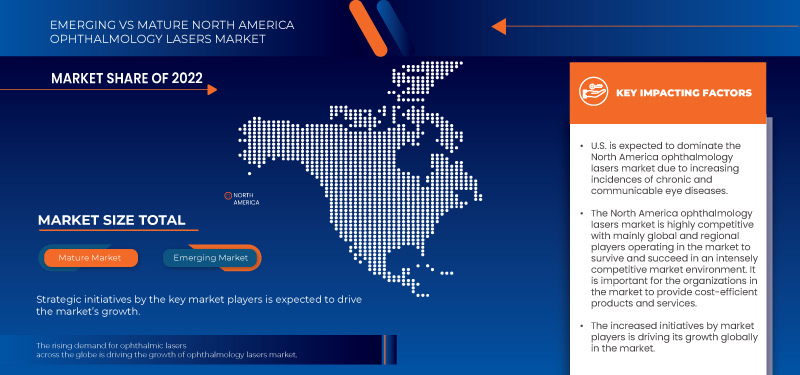

The countries covered in the North America ophthalmology lasers market are U.S., Canada, and Mexico.

U.S. is expected to dominate the North America ophthalmology lasers market due to the high prevalence of ophthalmic disorders in the region and rapid research development.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Ophthalmology Lasers Market Share Analysis

The North America ophthalmology lasers market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the North America ophthalmology lasers market.

Some of the major players operating in the North America ophthalmology lasers market are NIDEK CO., LTD., Calmar Laser, LENSAR, INC., OD-OS, Quantel Medical (a subsidiary of Lumibird Medical), Alcon, Ziemer Ophthalmic Systems AG, LIGHTMED, Johnson & Johnson Inc., Bausch & Lomb Incorporated, MEDA Co., Ltd., Topcon, Lumenis Be Ltd., IRIDEX Corporation, and Zeiss among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 STRATEGIC INITIATIVES

5 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INCIDENCES OF CHRONIC AND COMMUNICABLE EYE DISEASES

6.1.2 INCREASED CONSUMER AWARENESS FOR LASER TREATMENTS

6.1.3 INCREASING ADOPTION OF OUTPATIENT PROCEDURES

6.1.4 RISING DEMAND FOR MINIMALLY INVASIVE SURGICAL PROCEDURES

6.2 RESTRAINTS

6.2.1 HIGH COST OF OPHTHALMOLOGY LASER PROCEDURES

6.2.2 STRINGENT REGULATORY POLICIES

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS IN OPHTHALMOLOGY

6.3.2 EMERGING MARKETS AND GOVERNMENT FUNDING

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS

6.4.2 SAFETY CONCERNS

7 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 EXCIMER LASERS

7.2.1 ARF

7.2.2 KRF

7.2.3 XECL

7.2.4 XEFL

7.2.5 F2

7.2.6 XEBR

7.3 FEMTOSECOND LASERS

7.3.1 SEMICONDUCTOR LASERS

7.3.2 SOLID-STATE BULK LASERS

7.3.3 FREQUENCY-CONVERTED SOURCES

7.3.4 FIBER LASERS

7.3.5 DYE LASERS

7.3.6 OTHERS

7.4 ND:YAG LASERS

7.4.1 ND: YAG LASER AT 1064 NM

7.4.2 ND: YAG GREEN LASER AT 532 NM

7.5 DIODE LASERS

7.6 OTHERS

8 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY TYPE

8.1 OVERVIEW

8.2 PHOTOCOAGULATION LASERS

8.3 SELECTIVE LASER TRABECULOPLASTY (SLT)

8.4 PHOTODISRUPTION LASERS

9 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 THERAPEUTICS

9.2.1 CATARACT REMOVAL

9.2.2 GLAUCOMA TREATMENT

9.2.3 DIABETIC RETINOPATHY TREATMENT

9.2.4 REFRACTIVE ERROR CORRECTION

9.2.5 AMD TREATMENT

9.2.6 OTHERS

9.3 DIAGNOSTICS

9.3.1 OPTICAL COHERENCE TOMOGRAPHY (OCT)

9.3.2 SCANNING LASER OPHTHALMOSCOPE (SLO)

10 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY GASES

10.1 OVERVIEW

10.2 NOBLE GAS

10.2.1 ARGON

10.2.2 XENON

10.2.3 KRYPTON

10.3 HALOGEN GAS

10.3.1 CHLORINE

10.3.2 BROMINE

10.3.3 FLOURINE

10.4 BUFFER GAS

10.4.1 HELIUM

10.4.2 NEON

10.5 OTHERS

11 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 CLINICS

11.4 OTHERS

12 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, CPS

15.1 BAUSCH & LOMB INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 JOHNSON & JOHNSON, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ZEISS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 ALCON

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 NIDEK CO., LTD

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ARC LASER GMBH

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AUROLAB

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CALMAR LASER

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 IRIDEX CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 IVIS TECHNOLOGIES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 LENSAR, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 LUMENIS BE LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 LIGHTMED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MEDA CO., LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 OD-OS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 QUANTEL MEDICAL (A SUBSIDIARY OF LUMIBIRD MEDICAL)

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 SCHWIND EYE-TECH-SOLUTIONS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 TOPCON

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 ZIEMER OPHTHALMIC SYSTEMS AG

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 3 NORTH AMERICA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA DIODE LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA OTHERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PHOTOCOAGULATION LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA SELECTIVE LASER TRABECULOPLASTY (SLT) IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA PHOTODISRUPTION LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA DIAGNOSTICS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA NOBLE GAS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA HOSPITALS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA CLINICS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT , 2021-2030 (UNITS)

TABLE 35 NORTH AMERICA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 47 U.S. OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 48 U.S. OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 49 U.S. OPHTHALMOLOGY LASERS MARKET, BY PRODUCTS, 2021-2030, (ASP)

TABLE 50 U.S. EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 U.S. FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 52 U.S. ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 53 U.S. OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 55 U.S. THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 U.S. DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 U.S. OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 58 U.S. NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 59 U.S. HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 60 U.S. BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 61 U.S. OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 62 CANADA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 63 CANADA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 64 CANADA OPHTHALMOLOGY LASERS MARKET, BY PRODUCTS, 2021-2030, (ASP)

TABLE 65 CANADA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 66 CANADA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 67 CANADA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 68 CANADA OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 CANADA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 CANADA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 CANADA DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 CANADA OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 73 CANADA NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 74 CANADA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 75 CANADA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 76 CANADA OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 MEXICO OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 78 MEXICO OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 79 MEXICO OPHTHALMOLOGY LASERS MARKET, BY PRODUCTS, 2021-2030, (ASP)

TABLE 80 MEXICO EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 81 MEXICO FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 MEXICO ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 83 MEXICO OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 MEXICO OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 85 MEXICO THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 86 MEXICO DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 MEXICO OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 88 MEXICO NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 89 MEXICO HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 90 MEXICO BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 91 MEXICO OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SEGMENTATION

FIGURE 11 RISING TRAUMATIC INJURIES AND AN INCREASING GERIATRIC POPULATION ARE EXPECTED TO DRIVE THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 EXCIMER LASERS IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET IN THE FORECAST PERIOD 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET

FIGURE 14 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT, 2022

FIGURE 15 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE, 2022

FIGURE 19 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES, 2022

FIGURE 27 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES, LIFELINE CURVE

FIGURE 30 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER, 2022

FIGURE 31 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT (2023-2030)

FIGURE 39 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.