North America Ophthalmic Surgical Instruments Market

Market Size in USD Billion

CAGR :

%

USD

4.07 Billion

USD

27.39 Billion

2024

2032

USD

4.07 Billion

USD

27.39 Billion

2024

2032

| 2025 –2032 | |

| USD 4.07 Billion | |

| USD 27.39 Billion | |

|

|

|

|

North America Ophthalmic Surgical Instruments Market Size

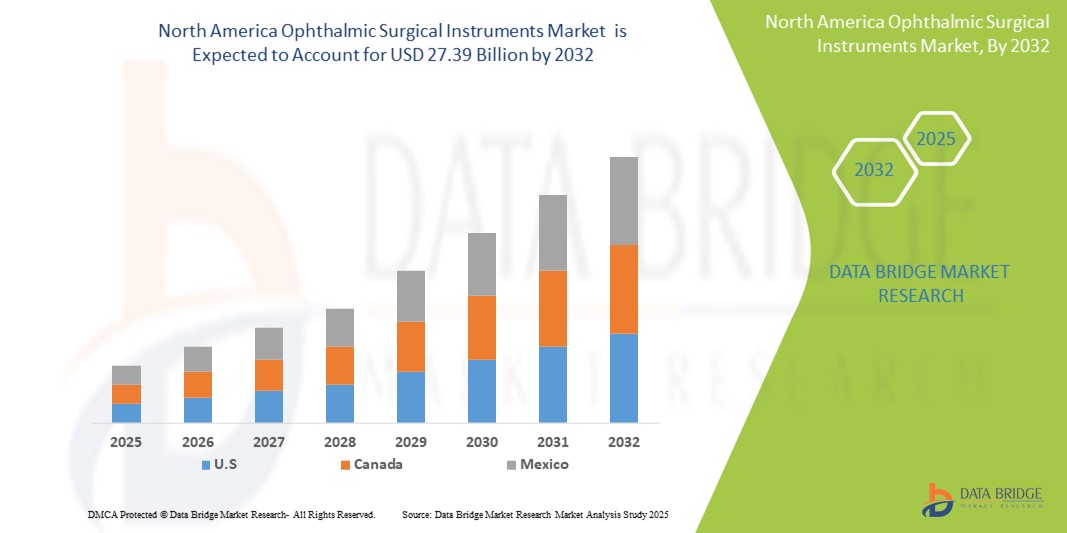

- The North America ophthalmic surgical instruments market size was valued at USD 4.07 billion in 2024 and is expected to reach USD 27.39 billion by 2032, at a CAGR of 26.90% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within minimally invasive surgical techniques and advanced laser systems in ophthalmology, leading to increased precision and improved patient outcomes in both hospital and ambulatory surgical settings

- Furthermore, rising consumer demand for safer, more effective, and integrated solutions for vision correction and ocular disease treatment is establishing innovative ophthalmic surgical instruments as the modern standard of care. These converging factors are accelerating the uptake of North America ophthalmic surgical instruments solutions, thereby significantly boosting the industry's growth

North America Ophthalmic Surgical Instruments Market Analysis

- Advanced ophthalmic surgical instruments, offering electronic or digital precision control for diagnostic and interventional eye procedures, are increasingly vital components of modern eye care and surgical systems in both clinical and hospital settings due to their enhanced accuracy, minimally invasive capabilities, and seamless integration with advanced imaging and diagnostic technologies

- The escalating demand for ophthalmic surgical instruments is primarily fueled by the widespread adoption of innovative surgical techniques, growing prevalence of age-related ocular disorders among an aging population, and a rising preference for the convenience and efficacy of vision correction and restoration

- U.S. dominates the North America ophthalmic surgical instruments market with the largest revenue share of 78.5% in 2024, fueled by the swift uptake of advanced surgical techniques and the expanding trend of integrated healthcare ecosystems

- Canada is expected to be the fastest growing country in the North America ophthalmic surgical instruments market during the forecast period due to increasing urbanization and rising disposable incomes

- The cataract surgery devices segment dominates the North America Ophthalmic surgical instruments market with a market share of 35.9% in 2024, driven by its established reputation for effectiveness in restoring vision and high volume of procedures performed annually

Report Scope and North America Ophthalmic Surgical Instruments Market Segmentation

|

Attributes |

North America Ophthalmic Surgical Instruments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Ophthalmic Surgical Instruments Market Trends

“Digital Integration in Ophthalmic Surgery”

- A significant and accelerating trend in the North America ophthalmic surgical instruments market is the deepening integration with artificial intelligence (AI) and the exploration of voice-controlled interfaces for surgical and diagnostic systems. This fusion of technologies is significantly enhancing clinician convenience and control over procedural outcomes

- For instance, certain robotic-assisted ophthalmic surgical platforms seamlessly integrate with AI-driven guidance, allowing surgeons to execute intricate retinal or cataract procedures with enhanced stability. Similarly, next-generation phacoemulsification devices can be controlled via voice commands or integrated digital platforms, offering hands-free adjustment during surgery

- AI integration in ophthalmic instruments enables features such as learning optimal surgical parameters, providing real-time feedback on instrument positioning, and offering intelligent alerts based on intraoperative data. For example, some advanced optical coherence tomography (OCT) systems utilize AI to improve disease detection accuracy over time and can send intelligent alerts if unusual retinal activity is detected. Furthermore, voice control capabilities offer users the ease of hands-free operation, allowing them to adjust settings or access data remotely using simple verbal commands

- The seamless integration of ophthalmic surgical instruments with digital assistants and broader hospital information systems facilitates centralized control over various aspects of the patient journey. Through a single interface, clinicians can manage their surgical planning, real-time intraoperative data, and post-operative monitoring, creating a unified and automated care experience

- This trend towards more intelligent, intuitive, and interconnected ophthalmic surgical systems is fundamentally reshaping user expectations for precision and efficiency in eye care. Consequently, companies are developing AI-enabled instruments with features such as automatic calibration based on patient biometrics and voice control compatibility for operating room environments

- The demand for ophthalmic surgical instruments that offer seamless AI and voice control integration is growing rapidly across both specialized and general healthcare sectors, as clinicians increasingly prioritize advanced precision and comprehensive digital functionality

North America Ophthalmic Surgical Instruments Market Dynamics

Driver

“Growing Need Due to Rising Disease Prevalence and Technological Advancements”

- The increasing prevalence of ocular diseases among the population, coupled with the accelerating pace of technological advancements in medical devices, is a significant driver for the heightened demand for ophthalmic surgical instruments

- For instance, ongoing innovations in minimally invasive surgical techniques are expected to drive the North America ophthalmic surgical instruments industry growth in the forecast period. Such strategies by key companies to enhance surgical efficacy are expected to fuel market expansion

- As patients and clinicians become more aware of complex eye conditions and seek enhanced treatment options, advanced ophthalmic instruments offer features such as precise imaging, guided surgical maneuvers, and real-time feedback, providing a compelling upgrade over traditional manual methods

- Furthermore, the growing popularity of integrated diagnostic and surgical platforms and the desire for interconnected healthcare ecosystems are making sophisticated ophthalmic instruments an integral component of these systems, offering seamless integration with other medical devices and patient data platforms

- The convenience of enhanced surgical precision, advanced diagnostic capabilities for complex cases, and the ability to manage patient data through integrated systems are key factors propelling the adoption of ophthalmic surgical instruments in both hospital and specialized clinic sectors. The trend towards optimizing surgical workflows and the increasing availability of user-friendly ophthalmic instrument options further contribute to market growth

Restraint/Challenge

“Concerns Regarding Regulatory Hurdles and High Initial Costs”

- Concerns surrounding the stringent regulatory approval processes for new medical devices, including ophthalmic surgical instruments, pose a significant challenge to broader market penetration. As these instruments require rigorous testing and compliance, they are susceptible to lengthy approval times and high development costs, raising anxieties among manufacturers about market entry and profitability

- For instance, complex regulatory pathways for novel surgical lasers have made some manufacturers hesitant to invest heavily in certain innovative ophthalmic solutions

- Addressing these regulatory concerns through streamlined approval processes, clear guidance from regulatory bodies, and collaborative efforts between industry and regulators is crucial for fostering innovation. Companies actively engage with regulatory bodies to ensure their advanced instruments meet all safety and efficacy standards.

- In addition, the relatively high initial cost of some advanced North America ophthalmic surgical instruments systems compared to conventional equipment can be a barrier to adoption for budget-sensitive healthcare providers, particularly in smaller clinics or for institutions with limited capital expenditure. While basic instruments have become more accessible, premium features such as robotic assistance or advanced imaging often come with a higher price tag

- While prices are gradually decreasing due to economies of scale, the perceived premium for cutting-edge technology can still hinder widespread adoption, especially for those who do not see an immediate return on investment for the advanced features offered

North America Ophthalmic Surgical Instruments Market Scope

The North America ophthalmic surgical instruments market is segmented on the basis of product, application, and end user.

- By Product

On the basis of product, the North America ophthalmic surgical instruments market is segmented into cataract surgery devices, refractive surgery devices, glaucoma surgery devices, vitreoretinal surgery devices, ophthalmic microscopes, and ophthalmic surgical accessories. The cataract surgery devices segment dominates the largest market revenue share of 35.9% in 2024, driven by the high global prevalence of cataracts and the established effectiveness of surgical intervention. Healthcare providers often prioritize advanced phacoemulsification systems and intraocular lenses for their perceived efficacy and the high volume of procedures performed. The market also sees strong demand for cataract devices due to their compatibility with various surgical techniques and the availability of diverse features enhancing visual outcomes and patient recovery.

The vitreoretinal surgery devices segment is anticipated to witness a significant growth rate from 2025 to 2032, fueled by increasing adoption in treating complex conditions such as diabetic retinopathy and macular degeneration. These devices offer enhanced precision, making them suitable for intricate posterior segment procedures, and their integration with advanced imaging provides surgeons with controlled, high-definition visualization. The continuous innovation and expanding application of vitreoretinal instruments also contribute to their growing popularity in modern ophthalmic centers.

- By Application

On the basis of application, the North America ophthalmic surgical instruments market is segmented into cataract, refractive, glaucoma, vitreoretinal, diabetic retinopathy, and others. The cataract segment held the largest market revenue share in 2024, driven by the widespread incidence of cataracts globally, particularly among the aging population, and the high success rate of modern cataract surgery. Procedures addressing cataracts offer significant patient benefits in restoring vision, making them a primary focus for ophthalmic instrument development and adoption.

The diabetic retinopathy segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing global prevalence of diabetes and the associated rise in diabetic eye complications. As the need for early detection and advanced treatment of diabetic retinopathy grows, demand for specialized instruments, including retinal lasers and vitrectomy devices, is rapidly expanding.

- By End User

On the basis of end user, the North America ophthalmic surgical instruments market is segmented into hospitals, specialty clinics, and ambulatory surgery centers. The hospitals for the largest market revenue share in 2024, driven by their comprehensive infrastructure, capacity for complex surgeries, and ability to handle a large volume of diverse ophthalmic cases. Hospitals often serve as primary sites for both routine and advanced eye surgeries, equipped with a wide range of specialized instruments.

The specialty clinics segment is expected to witness a strong CAGR from 2025 to 2032, driven by the growing need for focused eye care services, shorter waiting times, and often more cost-effective procedures compared to large hospitals. These specialized centers benefit from dedicated ophthalmic equipment and streamlined workflows, offering flexibility for multiple patient visits and procedures.

North America Ophthalmic Surgical Instruments Market Regional Analysis

- North America dominates the North America ophthalmic surgical instruments market with the largest revenue share of around 39.8% in 2024, driven by a growing demand for advanced eye care solutions and increased awareness of modern surgical technologies

- Healthcare providers in the region highly value the precision, advanced features, and seamless integration offered by ophthalmic instruments with other diagnostic systems

- This widespread adoption is further supported by high healthcare expenditure, a technologically inclined medical community, and the growing preference for minimally invasive procedures and improved patient outcomes, establishing advanced instruments as favored solutions for both routine and complex eye conditions

U.S. Ophthalmic Surgical Instruments Market Insight

The U.S. ophthalmic surgical instruments market captured the largest revenue share of 78.5% in 2024 within North America, fueled by the swift uptake of advanced surgical techniques and the expanding trend of integrated healthcare ecosystems. Clinicians are increasingly prioritizing the enhancement of surgical precision through intelligent, high-tech instrument systems. The growing preference for specialized eye care facilities, combined with robust demand for digitally-controlled systems and seamless electronic health record integration, further propels the ophthalmic surgical instruments industry. Moreover, the increasing integration of surgical platforms with advanced imaging and diagnostic technologies is significantly contributing to the market's expansion.

Mexico Ophthalmic Surgical Instruments Market Insight

The Mexico ophthalmic surgical instruments market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing healthcare demand, growing medical tourism, and a rising prevalence of eye disorders. The market is experiencing significant growth in both public and private healthcare sectors, with a particular focus on the development of specialized eye care facilities. The emphasis on enhancing access to quality healthcare services and the increasing adoption of modern diagnostic and surgical procedures are fostering the demand for advanced ophthalmic instruments. Mexico accounted for an estimated 5-8% share of the North America ophthalmic surgical instruments market in 2024.

Canada Ophthalmic Surgical Instruments Market Insight

The Canada ophthalmic surgical instruments market is anticipated to be the fastest growing region during the forecast period with a CAGR of 6.4%, fueled by a well-developed healthcare system, a growing geriatric population, and consistent technological advancements in medical devices. The country's strong public healthcare spending and the increasing demand for advanced treatment options for age-related eye conditions such as cataracts and glaucoma are key drivers. Canadian healthcare providers prioritize the adoption of high-quality, precise instruments that contribute to improved patient outcomes and operational efficiency.

North America Ophthalmic Surgical Instruments Market Share

The North America ophthalmic surgical instruments industry is primarily led by well-established companies, including:

- Carl Zeiss AG (Germany)

- Leica Microsystems (Germany)

- Johnson & Johnson Services, Inc. (U.S.)

- Lumibird Medical (France)

- Bausch Health Companies Inc. (Canada)

- NIDEK CO., LTD. (Japan)

- Novartis AG (Switzerland)

- Ziemer Ophthalmic Systems AG (Switzerland)

- HOYA Corporation (Japan)

- Lumenis Be Ltd. (Israel)

- STAAR SURGICAL (U.S.)

- IRIDEX Corporation (U.S.)

- TOPCON CORPORATION (Japan)

- Takagi Ophthalmic Instruments Europe LTD. (Japan)

- Medical Technical Products (U.S.)

- iVis Technologies (U.S.)

- Aurolab (India)

- Inami & Co., Ltd. (Japan)

Latest Developments in North America Ophthalmic Surgical Instruments Market

- In December 2023, Carl Zeiss Meditec AG announced an agreement to acquire 100% of the shares in D.O.R.C. Dutch Ophthalmic Research Center (International) B.V. for approximately USD 1.09 billion. This significant acquisition is poised to bring transformative advancements to ZEISS Medical Technology's extensive ophthalmic portfolio, reinforcing its position in the rapidly growing ophthalmic surgical instruments market

- In August 2023, Johnson & Johnson Vision presented its ELITA laser correction device in the U.S. launch. This platform is revolutionary for correcting short-sightedness through a minimally invasive laser-assisted lens removal procedure. This advancement highlights Johnson & Johnson Vision's commitment to developing cutting-edge safety technologies that safeguard vulnerable spaces, ensuring greater protection and peace of mind for patients and institutions

- In July 2024, Alcon Research, LLC. received U.S. FDA approval for the UNIPURE C3F8 Ophthalmic Gas, a gas injected into the eye to treat uncomplicated retinal detachment. This gas uses the company's UNIFEYE or UNIPEXY Gas Delivery Systems and will be commercially available in 2025. This initiative highlights Alcon's dedication to utilizing its expertise in innovative surgical systems, contributing to the development of safer, more effective treatments for retinal conditions

- In May 2023, Bausch + Lomb Corp. reported the launch in the U.S. of an ophthalmic viscosurgical device (OVD) designed to protect patients during cataract surgery. This collaboration is designed to enhance safety and streamline procedures for ophthalmic professionals, facilitating more efficient and secure surgical transactions. The initiative underscores Bausch + Lomb's commitment to driving innovation and improving operational effectiveness within the ophthalmic surgical sector

- In March 2023, WaveFront Dynamics Inc. announced the commercial launch of its WaveDyn Vision Analyzer. This innovative diagnostic system is designed to enhance the precision of refractive surgery planning, offering a reliable and effective solution for optimizing patient outcomes. This advancement highlights WaveFront Dynamics' commitment to developing cutting-edge technologies that safeguard vision, ensuring greater precision and peace of mind for institutions and their patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.