North America Nutraceutical Excipients Market

Market Size in USD Billion

CAGR :

%

USD

1.42 Billion

USD

2.65 Billion

2024

2032

USD

1.42 Billion

USD

2.65 Billion

2024

2032

| 2025 –2032 | |

| USD 1.42 Billion | |

| USD 2.65 Billion | |

|

|

|

|

North America Nutraceutical Excipients Market Size

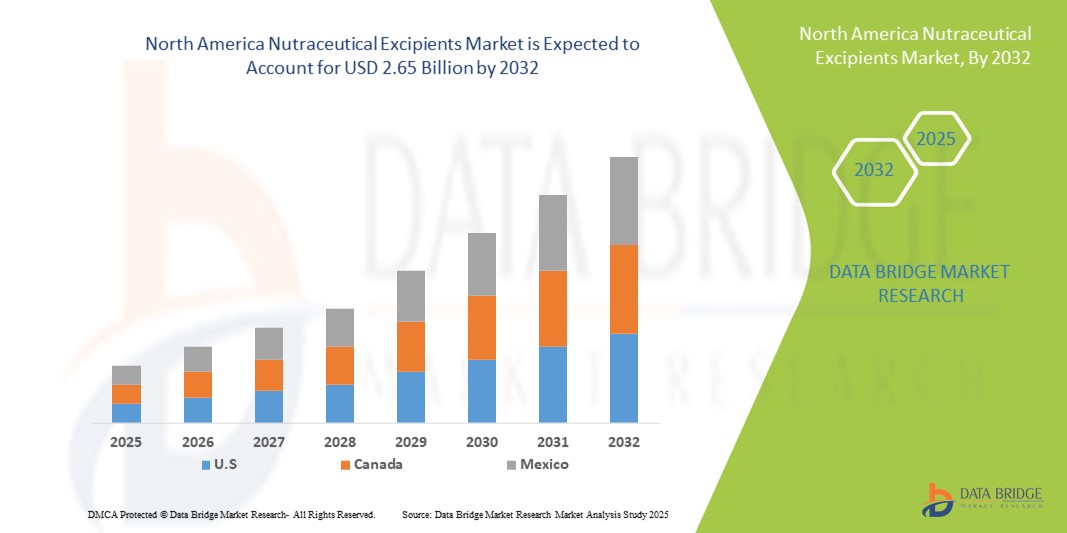

- The North America nutraceutical excipients market size was valued at USD 1.42 billion in 2024 and is expected to reach USD 2.65 billion by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is largely fueled by the increasing demand for nutraceutical products, coupled with technological advancements in excipient formulations, leading to enhanced product stability, bioavailability, and consumer acceptance across dietary supplements, functional foods, and beverages

- Furthermore, rising consumer awareness of health and wellness, along with a growing preference for safe, effective, and convenient nutraceutical solutions, is driving manufacturers to develop innovative excipient solutions. These converging factors are accelerating the adoption of advanced nutraceutical excipients, thereby significantly boosting the overall market growth

North America Nutraceutical Excipients Market Analysis

- Nutraceutical excipients, serving as functional ingredients in dietary supplements, functional foods, and nutraceutical formulations, are increasingly vital for enhancing stability, bioavailability, and overall efficacy of active compounds. Their adoption is driven by the rising consumer focus on health and wellness, increasing demand for fortified products, and ongoing innovation in formulation technologies

- The market growth is largely fueled by increasing demand for high-quality excipients in dietary supplements, functional foods, and nutraceutical formulations, driven by rising health awareness and preventive healthcare trends in the U.S.

- U.S. dominated the nutraceutical excipients market with the largest revenue share of 71.5% in 2024, supported by strong healthcare infrastructure, high consumer awareness regarding health and wellness, and the presence of leading ingredient suppliers. Rising consumption of dietary supplements and functional foods, along with ongoing innovations in nutraceutical formulations, is driving market growth

- Canada is expected to be the fastest-growing country in the nutraceutical excipients market during the forecast period, projected to expand at a CAGR of 11.5% from 2025 to 2032, supported by increasing government focus on health, growing availability of advanced nutraceutical products, and rising consumer adoption of preventive healthcare solutions

- The Dry form segment dominated the nutraceutical excipients market with a share of 62.1% in 2024, supported by its ease of handling, stability, and longer shelf life

Report Scope and Nutraceutical Excipients Market Segmentation

|

Attributes |

Nutraceutical Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Nutraceutical Excipients Market Trends

Enhanced Formulation and Functional Integration

- A significant and accelerating trend in the North America nutraceutical excipients market is the increasing focus on developing excipients that enhance the stability, bioavailability, and efficacy of active nutraceutical ingredients. This trend is driving innovation in both dietary supplements and functional foods

- For instance, companies are introducing advanced excipients that improve solubility, mask unpleasant flavors, and support controlled-release formulations, thereby increasing the overall performance of nutraceutical products

- Innovative excipients now allow formulators to combine multiple active ingredients without compromising stability, making it easier to develop multi-functional health products

- The seamless integration of these excipients in nutraceutical formulations enables manufacturers to meet consumer demands for high-quality, safe, and effective products, while complying with regulatory standards

- This trend towards more efficient, functional, and versatile excipients is fundamentally reshaping product development strategies in the nutraceutical industry. Companies are investing in R&D to create next-generation excipients that support immunity, cognitive health, digestive wellness, and other health benefits

- The demand for advanced nutraceutical excipients is growing rapidly across both dietary supplement and functional food sectors, as consumers increasingly prioritize product efficacy, safety, and convenience

North America Nutraceutical Excipients Market Dynamics

Driver

Growing Demand Due to Health Awareness and Nutraceutical Adoption

- The increasing focus on health, wellness, and preventive nutrition among consumers is a major driver for the heightened demand for nutraceutical excipients. Rising awareness about the benefits of dietary supplements, functional foods, and fortified beverages is prompting manufacturers to develop high-quality excipients that improve bioavailability, stability, and sensory appeal

- For instance, in April 2024, Ingredion Incorporated announced the launch of a new line of natural prebiotic excipients designed to enhance the effectiveness of dietary supplements. Such strategic innovations by key companies are expected to propel the growth of the Nutraceutical Excipients market during the forecast period

- As consumers increasingly seek functional and convenient health products, excipients that enable sustained release, improved solubility, and palatability are becoming essential components in product formulations

- Furthermore, the rising preference for plant-based, clean-label, and natural ingredients is encouraging the adoption of specialized excipients that meet regulatory and consumer expectations for transparency and safety

- The versatility of nutraceutical excipients across various product formats, including powders, capsules, liquids, and functional beverages, and their compatibility with advanced formulation technologies are key factors driving market expansion

- Manufacturers’ focus on research and development, combined with collaborations with supplement producers, ensures the availability of innovative and user-friendly excipient solutions, further boosting market growth

Restraint/Challenge

Regulatory Compliance and Cost Constraints

- Stringent regulatory requirements for food-grade and nutraceutical-grade excipients pose a challenge for market players, as compliance with FDA, EFSA, and other standards requires rigorous testing and certification

- High-quality excipients often involve complex production processes and raw material sourcing, which can increase production costs and impact pricing for end products, making them less accessible for small-scale manufacturers or price-sensitive consumers

- Ensuring consistency in functional performance, purity, and stability across batches is crucial, as deviations can affect the efficacy and safety of nutraceutical products, creating an additional challenge for manufacturers

- Market growth may also be hindered by supply chain constraints, particularly for natural and plant-based excipients, which are dependent on agricultural outputs and seasonal availability

- Limited awareness among smaller manufacturers about advanced excipient functionalities and innovations may slow adoption, especially for specialized formulations requiring technical expertise

- The competitive pressure from low-cost, generic excipient providers can reduce profit margins for premium-quality excipient manufacturers, making it challenging to sustain long-term investment in innovation and quality improvements

- Overcoming these challenges through investments in R&D, advanced manufacturing technologies, strategic sourcing of raw materials, and education of end-users will be vital to ensure high-quality, cost-effective, and compliant nutraceutical excipient offerings for sustained market growth

North America Nutraceutical Excipients Market Scope

The market is segmented on the basis of type, end product, form, excipient source, and distribution channel.

- By Type

On the basis of type, the nutraceutical excipients market is segmented into flavoring agents, coloring agents, sweeteners, coating agent, buffers, solvents, carriers, antifoams, gliding agents, wetting agents, thickeners/gelling agents, preservatives, binders, disintegrates, lubricants, fillers and diluents, and others. The sweeteners segment dominated the largest market revenue share of 28.5% in 2024, driven by the increasing demand for sugar-free and low-calorie nutraceutical formulations. Sweeteners enhance taste profiles while maintaining product stability, making them essential for consumer-friendly dietary supplements. The growing preference for clean-label and natural sweetening agents further strengthens market dominance. Regulatory approvals and safety standards compliance also support widespread adoption. Sweeteners are compatible with multiple delivery forms such as tablets, powders, and beverages, boosting their utilization across diverse product lines. Manufacturers continue to innovate with novel sweetening agents to improve solubility, flavor masking, and functional benefits, reinforcing the leading position of this sub-segment.

The thickeners/gelling agents segment is expected to witness the fastest CAGR of 19.6% from 2025 to 2032, fueled by rising applications in functional foods and beverages. These agents enhance texture, mouthfeel, and stability of nutraceutical products, particularly in prebiotic and protein formulations. Increasing consumer preference for visually appealing, high-viscosity beverages and ready-to-drink supplements accelerates demand. Innovations in plant-based and natural gelling agents are further boosting growth. Thickeners/Gelling Agents also enable better encapsulation of active ingredients, improving bioavailability and shelf-life. Market players are expanding R&D to develop multifunctional thickeners that also act as stabilizers or carriers, enhancing their market potential.

- By End Product

On the basis of end product, the nutraceutical excipients market is segmented into prebiotics, probiotics, protein and amino acid supplements, mineral supplements, vitamin supplements, omega-3 supplements, and other supplements. The vitamin supplements segment dominated with a market share of 34.2% in 2024, driven by increasing awareness of micronutrient deficiencies and growing consumer focus on immunity and overall wellness. Vitamins are essential across age groups and are widely incorporated in multivitamin formulations, supporting high market penetration. The segment benefits from easy integration with various excipients and supplement formats. Regulatory support for fortification and clean-label products further strengthens adoption. Vitamins are increasingly combined with other bioactive ingredients to deliver enhanced health benefits, bolstering revenue growth.

The protein and amino acid supplements segment is projected to witness the fastest CAGR of 17.8% from 2025 to 2032, fueled by rising adoption among fitness enthusiasts, athletes, and aging populations. High-protein diets for muscle building, recovery, and weight management are increasing demand. The development of flavored and ready-to-mix protein powders supports growth. Advancements in natural protein excipients that improve solubility and texture further accelerate market uptake. Protein supplements are also expanding into functional beverages and meal replacements, enhancing market visibility and driving rapid growth.

- By Form

On the basis of form, the nutraceutical excipients market is segmented into dry and liquid. The dry form segment dominated the market with a share of 62.1% in 2024, supported by its ease of handling, stability, and longer shelf life. Dry excipients are highly versatile, being suitable for tablets, capsules, and powdered products, while allowing precise dosing and enhancing manufacturing efficiency. The segment benefits from continuous innovations in granulation techniques, flowability, and compressibility, which improve product consistency and process efficiency. Demand from both pharmaceutical and dietary supplement manufacturers sustains the dominance of dry excipients across North America, as they form the backbone of large-scale production.

The liquid form segment is expected to witness the fastest CAGR of 15.4% from 2025 to 2032, driven by the rising popularity of ready-to-drink nutraceutical beverages and functional syrups. Liquid excipients provide advantages such as faster absorption, improved bioavailability, and effective taste masking, making them ideal for pediatric, geriatric, and sports nutrition products. They also enable the encapsulation and stabilization of sensitive bioactive compounds, expanding formulation possibilities. The increasing demand for convenient, ready-to-consume nutraceutical products is accelerating adoption of liquid excipients, supporting rapid growth in the market.

- By Excipient Source

On the basis of excipient source, the nutraceutical excipients market is segmented into natural and synthetic. The natural source segment dominated with a market share of 56.3% in 2024, driven by rising consumer preference for clean-label and plant-based products. Natural excipients offer safety, regulatory compliance, and enhanced marketing appeal. They are widely used in organic and functional supplement formulations. The segment benefits from ongoing innovations in extraction and processing technologies, ensuring consistency and purity. Consumer awareness about the potential side effects of synthetic ingredients further supports dominance.

The synthetic source segment is expected to witness the fastest CAGR of 16.1% from 2025 to 2032, driven by the increasing demand for cost-effective, scalable, and highly functional nutraceutical excipients. Synthetic excipients offer advantages such as controlled solubility, enhanced stability, and consistent uniformity across diverse formulations, making them particularly valuable for large-scale commercial production. Their predictable performance ensures reliable manufacturing outcomes and helps maintain product quality standards. Continuous research and development in high-performance synthetic carriers, binders, stabilizers, and other functional excipients are fueling rapid adoption in the market. Manufacturers are increasingly leveraging synthetic sources to optimize formulation efficiency, reduce production variability, and meet the growing demand for nutraceutical products worldwide. The ability to customize synthetic excipients for specific product requirements further strengthens their appeal and accelerates market growth.

- By Distribution Channel

On the basis of distribution channel, the nutraceutical excipients market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market with a revenue share of 48.7% in 2024, primarily driven by large-scale supply agreements with major dietary supplement manufacturers and pharmaceutical companies. This segment ensures a consistent and reliable supply of nutraceutical excipients, allowing companies to maintain uninterrupted production cycles. Direct tenders provide competitive pricing advantages, long-term contractual stability, and bulk-order efficiencies that are highly valued by leading industry players. Strong B2B relationships, streamlined procurement processes, and the ability to meet large-volume demands further reinforce the dominance of this segment. In addition, the segment benefits from preferential access to new excipient formulations and innovations, enabling companies to stay ahead in the competitive market landscape.

The retail sales segment is expected to witness the fastest CAGR of 14.9% from 2025 to 2032, driven by the rapid expansion of online and offline retail channels catering to small- and medium-scale nutraceutical manufacturers. Retail availability allows a broader consumer base to access pre-mixed formulations, capsules, powders, and other nutraceutical products conveniently. The growing trend of e-commerce platforms, coupled with increased consumer preference for ready-to-use and convenient products, is accelerating growth in this segment. Retail channels also support increased product visibility, faster market penetration, and the ability to reach niche and regional markets effectively. Rising demand for personalized and small-batch nutraceutical solutions further strengthens the adoption of retail distribution models

North America Nutraceutical Excipients Market Regional Analysis

- North America dominated the nutraceutical excipients market with the largest revenue share in 2024, driven by growing consumer awareness of health and wellness, rising demand for dietary supplements and functional foods, and the presence of key nutraceutical ingredient suppliers in the region

- The market growth is further fueled by ongoing innovations in excipient technologies that enhance bioavailability, stability, taste, and solubility of nutraceutical products. Manufacturers are investing in R&D to develop clean-label, natural, and plant-based excipients, aligning with evolving consumer preferences

- High disposable incomes, strong healthcare infrastructure, and well-established distribution channels in the region support widespread adoption of nutraceutical excipients across both the dietary supplement and functional food segments. The growing focus on preventive healthcare and functional nutrition further reinforces the market’s leadership position in North America

U.S. Nutraceutical Excipients Market Insight

The U.S. nutraceutical excipients market dominated the Nutraceutical Excipients market with the largest revenue share of 71.5% in 2024, supported by a strong healthcare infrastructure, high consumer awareness regarding health and wellness, and the presence of leading excipient and ingredient suppliers. Rising consumption of dietary supplements, protein and amino acid formulations, vitamins, and functional foods, along with ongoing innovations in excipient technologies that enhance bioavailability, stability, and sensory appeal, is driving market growth. The market is further fueled by increasing R&D activities by manufacturers to develop clean-label, natural, and plant-based excipients tailored for the U.S. nutraceutical industry.

Canada Nutraceutical Excipients Market Insight

The Canada nutraceutical excipients market is expected to be the fastest-growing country in the Nutraceutical Excipients market during the forecast period, projected to expand at a CAGR of 11.5% from 2025 to 2032. Growth is supported by increasing government initiatives promoting preventive healthcare, growing availability of advanced nutraceutical products, and rising consumer adoption of functional foods and dietary supplements. The expanding interest in clean-label, natural, and plant-based excipients, combined with a strong focus on health-conscious consumption, is expected to drive sustained market expansion in Canada.

North America Nutraceutical Excipients Market Share

The nutraceutical excipients industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- DuPont (U.S.)

- Ingredion (U.S.)

- W.R. Grace and Co (U.S.)

- Kerry Group plc (Ireland)

- Sensient Technologies Corporation (U.S.)

- Roquette Frères (France)

- Cargill, Incorporated (U.S.)

- Ashland (U.S.)

- SEPPIC (France)

- Gatefosse (France)

- Pioma Chemicals (India)

- Omya International AG (Switzerland)

- Gangwal Chemicals Private Limited (India)

- Grain Processing Corporation (U.S.)

- IMCD (Netherlands)

- JRS PHARMA (Germany)

- Azelis (Belgium)

- Jigs Chemical (India)

- Sigaichi Industries (Japan)

- Beneo (Germany)

- ABITEC (U.S.)

Latest Developments in North America Nutraceutical Excipients Market

- In March 2024, International Flavors & Fragrances (IFF) announced the sale of its Pharma Solutions business, which includes pharmaceutical excipients and the Global Specialty Solutions division, to French ingredients company Roquette for up to USD2.85 billion, including debt. This strategic move allows IFF to concentrate on its core growth strategies. The transaction is expected to close in the first half of 2025

- In April 2024, Glanbia plc, an Irish global food corporation, announced the acquisition of Aroma Holding Company, a U.S.-based flavoring business, for USD300 million (EUR 281 million) plus deferred consideration of up to USD55 million, dependent on performance in 2024. This acquisition enhances Glanbia's capabilities in the nutraceutical excipients market, particularly within its Glanbia Nutritionals division

- In August 2023, Akums Drugs and Pharmaceuticals, an Indian pharmaceutical company, launched a formulation for managing Type-2 Diabetes in elderly patients, combining multiple medications to help control blood sugar levels. In addition, the company began manufacturing nutraceutical gummies, expanding its product offerings in the nutraceutical excipients sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.