North America Non Stick Cookware Market

Market Size in USD Billion

CAGR :

%

USD

10.06 Billion

USD

14.86 Billion

2025

2033

USD

10.06 Billion

USD

14.86 Billion

2025

2033

| 2026 –2033 | |

| USD 10.06 Billion | |

| USD 14.86 Billion | |

|

|

|

|

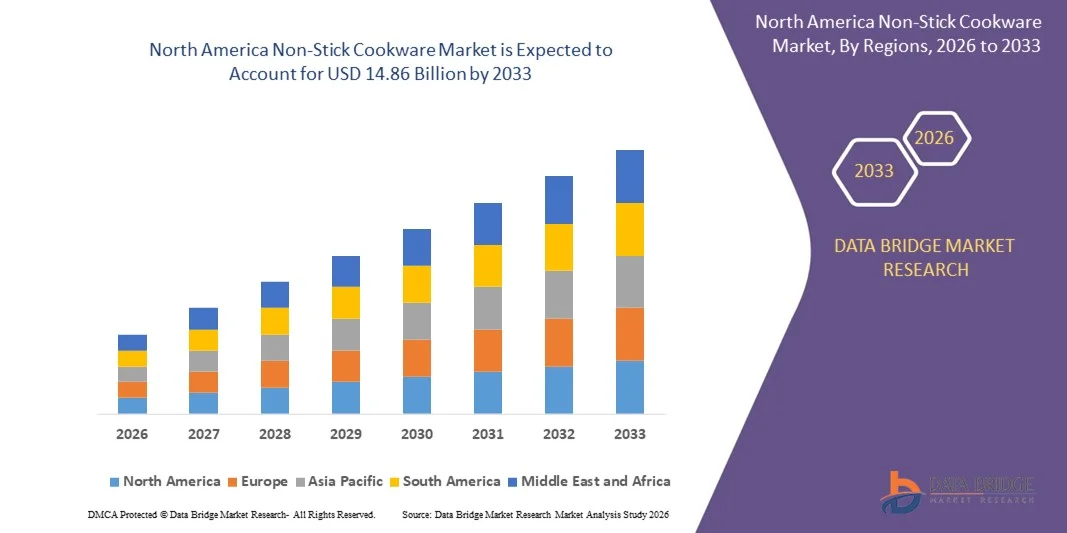

What is the North America Non-Stick Cookware Market Size and Growth Rate?

- The North America non-stick cookware market size was valued at USD 10.06 billion in 2025 and is expected to reach USD 14.86 billion by 2033, at a CAGR of 5.00% during the forecast period

- Availability of numerous types of non-stick cookware products is expected to drive and boost the demand for the non-stick cookware market

- Tendency of certain non-stick materials to release toxic chemicals into food is expected to hamper the demand for the non-stick cookware market

What are the Major Takeaways of Non-Stick Cookware Market?

- Growing participation of men in cooking is expected to act as an opportunity for the non-stick cookware market. The tendency of non-stick cookware to get easily scorched and scratched if proper care is not provided is expected to act as challenge for the non-stick cookware market

- U.S. dominated the North America non-stick cookware market with an estimated 45.6% revenue share in 2025, supported by high household adoption, strong demand for premium and branded cookware, and a well-developed retail ecosystem

- Mexico is projected to register the fastest CAGR of 9.54% from 2026 to 2033, supported by expanding middle-class population, rising disposable incomes, and increasing adoption of modern kitchen appliances

- The Pan segment dominated the market with an estimated 34.6% share in 2025, driven by its widespread daily usage for frying, sautéing, and quick cooking across households and foodservice outlets

Report Scope and Non-Stick Cookware Market Segmentation

|

Attributes |

Non-Stick Cookware Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Non-Stick Cookware Market?

Growing Shift Toward Lightweight, Durable, and Health-Conscious Non-Stick Cookware

- The non-stick cookware market is witnessing rising demand for lightweight, easy-to-clean, and ergonomically designed cookware driven by modern cooking habits and time-saving preferences

- Manufacturers are increasingly developing PFOA-free coatings, ceramic non-stick surfaces, and advanced multilayer constructions to enhance durability, heat distribution, and food safety

- Growing consumer focus on healthy cooking, reduced oil usage, and hassle-free maintenance is accelerating adoption across residential and commercial kitchens

- For instance, companies such as Tefal, Cuisinart, Tramontina, Le Creuset, and Hawkins are expanding their premium and eco-friendly non-stick cookware portfolios

- Rising use of non-stick cookware in urban households, quick-service restaurants, and cloud kitchens is driving sustained market growth

- As consumers prioritize convenience, performance, and safety, non-stick cookware will remain central to modern kitchen solutions

What are the Key Drivers of Non-Stick Cookware Market?

- Increasing demand for easy-to-use, low-maintenance cookware that supports faster cooking and simple cleaning

- For instance, during 2024–2025, leading brands introduced ceramic-coated and toxin-free non-stick cookware to meet evolving health regulations

- Growing urbanization, rising disposable income, and expanding home-cooking and culinary experimentation trends are boosting product adoption

- Advancements in coating technology, scratch resistance, and thermal efficiency are improving product lifespan and performance

- Rising awareness around oil-free cooking and healthier food preparation supports demand across global markets

- Supported by lifestyle changes and premium kitchen upgrades, the Non-Stick Cookware market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Non-Stick Cookware Market?

- Higher costs associated with premium coatings, multilayer materials, and branded products limit adoption in price-sensitive regions

- During 2024–2025, fluctuations in raw material prices and coating inputs increased manufacturing and retail costs

- Concerns over coating durability, scratching, and long-term safety affect consumer trust in low-quality products

- Limited awareness regarding proper usage and maintenance reduces cookware lifespan and satisfaction

- Intense competition from stainless steel, cast iron, and low-cost unbranded alternatives creates pricing pressure

- To overcome these challenges, manufacturers are focusing on consumer education, quality assurance, and innovation in safer coating technologies

How is the Non-Stick Cookware Market Segmented?

The market is segmented on the basis of product, raw material, coating layer, distribution channel, and end-user.

- By Product

On the basis of product, the non-stick cookware market is segmented into Pan, Pot, Bakeware, Pressure Cooker, Skillet, Square Grill, Oven Tray, Dutch Oven, Loaf Tin, Sandwich Toaster, Wok, Egg Poacher, and Others. The Pan segment dominated the market with an estimated 34.6% share in 2025, driven by its widespread daily usage for frying, sautéing, and quick cooking across households and foodservice outlets. Non-stick pans offer fast heat distribution, reduced oil usage, and easy cleaning, making them a preferred choice in urban kitchens.

The Bakeware segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising home baking trends, increasing consumption of baked goods, and growing influence of online cooking content. Expanding café culture, premium kitchen upgrades, and demand for specialized cookware such as woks, grills, and pressure cookers further support product diversification and long-term market growth.

- By Raw Material

Based on raw material, the market is segmented into Base Material and Coating. The Base Material segment dominated the market with approximately 57.8% share in 2025, as materials such as aluminum, stainless steel, and hard-anodized metals form the structural foundation of cookware. Aluminum-based cookware, in particular, is widely adopted due to its lightweight nature, affordability, and excellent heat conductivity.

The Coating segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising consumer awareness of PFOA-free, ceramic, and eco-friendly coatings. Innovations in scratch-resistant, long-lasting, and toxin-free coatings are enhancing durability and safety. As consumers increasingly prioritize health, performance, and sustainability, advanced coating technologies are becoming a key differentiating factor in non-stick cookware adoption.

- By Coating Layer

On the basis of coating layer, the non-stick cookware market is segmented into Single Layer, Double Layer, and Triple Layer. The Double Layer segment dominated the market with around 41.2% share in 2025, owing to its balanced combination of durability, cost-effectiveness, and improved non-stick performance compared to single-layer coatings. Double-layer cookware is widely used in mid-range household products and commercial kitchens.

The Triple Layer segment is expected to register the fastest CAGR from 2026 to 2033, supported by growing demand for premium cookware with superior scratch resistance, longer lifespan, and enhanced heat distribution. Increasing preference for high-performance cookware in professional kitchens and premium households is accelerating adoption of multi-layer coating technologies globally.

- By Distribution Channel

Based on distribution channel, the market is segmented into Supermarkets/Hypermarkets, Utensil Stores, E-Commerce, and Others. The Supermarkets/Hypermarkets segment dominated the market with an estimated 46.5% share in 2025, driven by strong brand visibility, product variety, in-store promotions, and consumer preference for physical inspection before purchase.

The E-Commerce segment is anticipated to grow at the fastest CAGR from 2026 to 2033, supported by increasing online penetration, doorstep delivery, competitive pricing, and detailed product comparisons. Rising digital adoption, influencer marketing, and direct-to-consumer strategies by cookware brands are further strengthening online sales channels, particularly among younger and urban consumers.

- By End-User

On the basis of end-user, the non-stick cookware market is segmented into Residential and Commercial. The Residential segment dominated the market with approximately 62.9% share in 2025, driven by rising home cooking trends, nuclear families, urban lifestyles, and increasing demand for convenient and easy-to-maintain cookware. Growth in health-conscious cooking and premium kitchen upgrades further supports residential demand.

The Commercial segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by expansion of restaurants, hotels, cloud kitchens, and quick-service restaurants (QSRs). High-volume cooking requirements, time efficiency, and consistent food quality are accelerating adoption of durable non-stick cookware across commercial foodservice establishments.

Which Region Holds the Largest Share of the Non-Stick Cookware Market?

- U.S. dominated the North America non-stick cookware market with an estimated 45.6% revenue share in 2025, supported by high household adoption, strong demand for premium and branded cookware, and a well-developed retail ecosystem

- Growing trends toward home cooking, healthier food preparation, and replacement of traditional cookware with PFOA-free and ceramic-coated products are key growth drivers. Expansion of online retail and strong brand loyalty further reinforce market leadership

Canada Non-Stick Cookware Market Insight

Canada represents a steadily growing market, driven by rising urbanization, increasing preference for energy-efficient and easy-to-clean cookware, and growing health-conscious consumer behavior. Demand for durable, eco-friendly, and induction-compatible non-stick cookware is rising across residential kitchens and foodservice establishments. Strong retail penetration, growing e-commerce adoption, and preference for premium kitchenware support consistent market expansion.

Mexico Non-Stick Cookware Market Insight

Mexico is projected to register the fastest CAGR of 9.54% from 2026 to 2033, supported by expanding middle-class population, rising disposable incomes, and increasing adoption of modern kitchen appliances. Growing urban households, improving retail infrastructure, and rising awareness of non-stick cookware benefits are driving demand. Expansion of supermarkets, specialty utensil stores, and online platforms further accelerates market penetration across the country.

Which are the Top Companies in Non-Stick Cookware Market?

The non-stick cookware industry is primarily led by well-established companies, including:

- Tramontina USA Inc. (Brazil)

- TEFAL S.A.S (a subsidiary of Groupe SEB) (France)

- Le Creuset (France)

- Cuisinart (U.S.)

- Swiss Diamond (Switzerland)

- Crown Cookware (Canada)

- Hawkins Cookers Limited (India)

- Sub Zero Group, Inc. (U.S.)

- John Wright Company (U.S.)

- Newell Brands (U.S.)

- SCANPAN USA, INC. (Denmark)

- RangeKleen (U.S.)

- Gibson Overseas, Inc. (U.S.)

- Moneta Cookware (Italy)

- The Vollrath Company, LLC (U.S.)

- Berndes Cookware (Germany)

- ZHEJIANG HANXIN COOKWARE CO., LTD. (China)

- Zhejiang Zhongxin Cookware Co., Ltd. (China)

What are the Recent Developments in Global Waterless Cosmetic Market?

- In October 2024, celebrity chef Bobby Flay introduced a new cookware collection in collaboration with GreenPan, headquartered in New York, expanding premium non-stick offerings focused on performance and sustainability, reinforcing innovation-led growth in the cookware market

- In September 2024, California-based SKB unveiled its non-stick cookware range at the Pan Pacific Sonargaon Hotel, marking a strategic product showcase aimed at strengthening brand visibility and regional market penetration

- In August 2024, Paris Hilton launched a stylish cookware collection under her Epoca brand, featuring pastel pink and glittery fuchsia designs, highlighting the growing influence of celebrity branding and aesthetics in the cookware segment

- In April 2024, Los Angeles–based Our Place introduced the Titanium Always Pan Pro, a virtually indestructible non-stick pan, underscoring rising consumer demand for durability, premium materials, and long-lasting cookware solutions

- In January 2024, Guy Fieri’s Tennessee-based Flavortown brand partnered with Mon Chateau to roll out three new cookware lines, signaling continued expansion of chef-led brands targeting both home and professional cooking enthusiasts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.