Market Definition and Insights

Methotrexate injection is employed alone or with other medicines to treat various types of cancer, such as breast, head and neck, lung, blood, bone, lymph node, and uterus cancers.

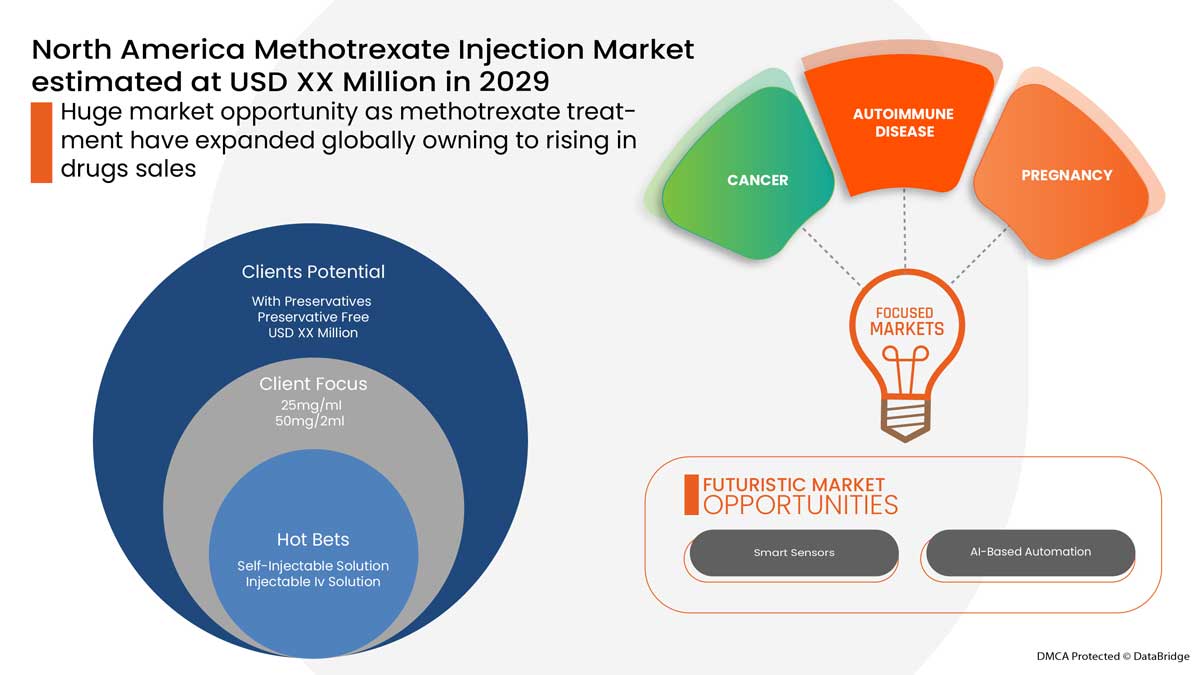

The high prevalence of autoimmune diseases, rise in the number of patients with inflammatory diseases, and rising healthcare expenditure is expected to drive the growth of the North America methotrexate injection market. However, the presence of alternatives for cancer treatment is expected to act as a restraining factor for market growth.

Methotrexate is a cancer therapy that prevents cancer cells from replicating. This helps to keep them from multiplying and spreading throughout your body. It may take up to 12 weeks after your methotrexate dose has been adjusted to the full level before you experience any benefits. The rising burden of autoimmune diseases and growing healthcare expenditure have accelerated the need for methotrexate injection, propelling the market's growth.

However, side effects and complications with the use of methotrexate hamper the growth of the North America Methotrexate Injection market in the forecast period.

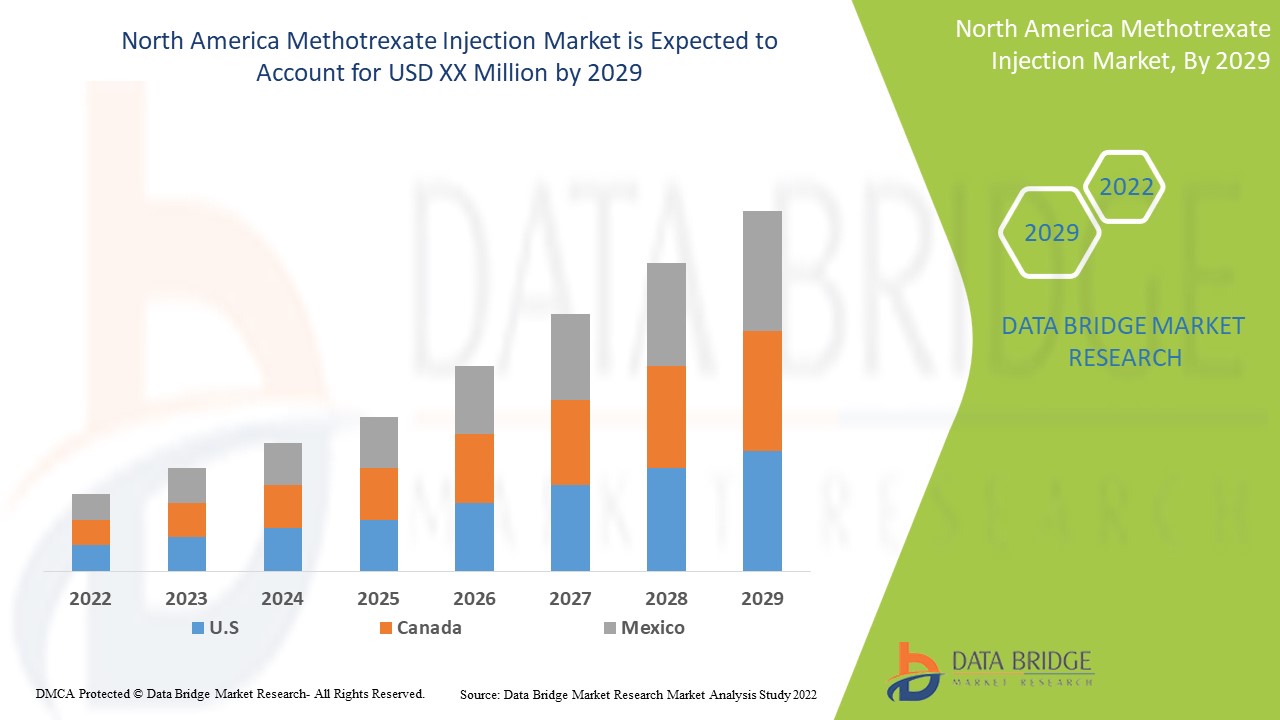

North America methotrexate injection market is supportive and aims to reduce the progression of the disease. Data Bridge Market Research analyses that North America North America methotrexate injection market will grow at a CAGR of 6.0% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Product (Without Preservatives, With Preservatives), Type (Injectable Solution, Self-Injectable Solution), Availability (25mg/ml, 50mg/2ml), Dosage Form (Solution, Powder) Application (Cancer, Autoimmune Diseases, Pregnancy), Age Group (Adults, Geriatric, Pediatrics) Route Of Administration (Intramuscular, Intravenous, Intra-Arterial, Intrathecal), End User (Hospitals, Clinics, Home Healthcare, Others) Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Others) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Pfizer Inc., Antares Pharma, Inc., Fresenius Kabi USA, Medexus Pharmaceuticals, Inc., Viatris Inc. , Sandoz AG (A Subsidiary of Novartis AG), Teva Pharmaceuticals USA, Inc., Accord BioPharma, Hikma Pharmaceuticals PLC, Cumberland Pharmaceuticals Inc., PV Pharma among others. |

Methotrexate Injection Market Dynamics

Drivers

- Increased prevalence of cancer

The increasing patient population with breast cancer, lung cancer, head and neck cancer, and blood cancer is fuelling the growth of North America methotrexate injection market. Breast cancer is the most recurrent invasive cancer in women, and it is the second leading cause of death in women after lung cancer. The American Cancer Society estimates that 41,760 women have breast cancer. Breast cancer starts quite small, to be felt. As the growth continues, the tumor spreads to the breast and other parts of the body. It results in serious health issues and can cause death. 80% of lung cancer deaths are caused due to smoking and exposure to tobacco. Lung cancer exists as the leading cause of death, with an estimated 1.8 million deaths.

- Government initiatives to spread awareness about lung and breast cancer

Government initiatives refer to statements or programs which are necessitated to solve the problem. The government raises awareness or delivers better health and safety initiatives to treat breast cancer in women and lung cancer. It promotes partnerships among healthcare organizations, facilities and manufacturers to necessitate the therapy and treatment for breast cancer in women and lung cancer.

The initiatives conducted by the government will result in the safety of the patient, cost savings, and less surgical care impact. In addition, hospitals and healthcare organizations will profit by enforcing protocols by collaborating with government organizations for supply and delivery. The government has already started funding such work in a small way but believes that more needs to be done. Therefore, this feature is expected to supplement the growth of the North America methotrexate injection market.

Opportunity

- Strategic initiatives by the market players

An increase in the burden of various types of cancers and thyroid nodules malignancy across the regions and the increase in the geriatric population has created more demand for diagnostic procedures for the timely treatment of patients. The main aim is to improve health management and diagnostics for quality performance before reaching the critical stages of the disease. Major market players focus on filling the demands of healthcare professionals and spending a quite noticeable amount for better products.

Major players are involved in making the strategies and implementing them, such as acquisition, and product launch.

Restraints/Challenges

Research and development are prerequisites for modifying the products of advanced nature. As the demand for diagnostic procedures for cancer increases, companies are investing more in research and development to offer the best diagnostic options for convenient patient outcomes.

Research laboratories are lately investing more in products and procedures due to rising cases of cancer and its requirement of early diagnosis to save the patient's life. Research and development have enhanced customization in diagnosis since all humans' cells and tissues are not the same.

The increasing tobacco consumption and the rising growing population have surged cancer cases globally. Thereby the demand for research and development in pharmaceutical industries for diagnosis of it is also getting hyped. Hence increasing research and development activities are anticipated to be a greater opportunity for North America methotrexate injection market.

Furthermore, the use of methotrexate across the globe is rapidly increasing, with the growth of the aged population and several carcinogenic diseases which are preventable by the early diagnosis. At the same time, the players of the methotrexate injection manufacturers in the market have to follow certain regulations to get approval from the upper authorities to launch the product in the market. These stringent guidelines need to be followed, and this is one of the most difficult tasks among all the steps. The pre-market approval of various medical devices varies from one country to another. The Food and Drug Administration (FDA) regulate the U.S.

North America methotrexate injection market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on North America methotrexate injection market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In March 2022, Viatris Inc. and Kindeva Drug Delivery L.P. announced that Mylan Pharmaceuticals Inc., a Viatris subsidiary, had received approval from the U.S. Food and Drug Administration (FDA) for its Abbreviated New Drug Application (ANDA) for Breyna (Budesonide and Formoterol Fumarate Dihydrate Inhalation Aerosol), the first approved generic version of AstraZeneca's Symbicort.

- In January 2022, Cumberland Pharmaceuticals Inc., a speciality pharmaceutical company, entered into and closed on a definitive agreement to acquire the FDA-approved oncology-supportive care medicine SANCUSO from Kyowa Kirin, Inc. the U.S. affiliate of Japan-based Kyowa Kirin Co., Ltd. a global speciality pharmaceutical company focused on discovering and delivering novel medicines. This has helped the company to expand its business.

North America Methotrexate Injection Market

North America Methotrexate Injection market is categorized into nine notable segments based on product, type, availability, dosage form, application, age group, route of administration, end-user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- By Product

- With Preservatives

- Preservative Free

Based on product, the North America methotrexate injection market is segmented into with preservatives and preservatives free.

- By Type

- Self-Injectable Solution

- Injectable Iv Solution

Based on type, the North America methotrexate injection market is segmented into with self-injectable solution and injectable IV solution

- Availability

- 25mg/ml

- 50mg/2ml

Based on availability, the North America methotrexate injection market is segmented into 25MG/ML and 50MG/2ML

- Dosage Form

- Solution

- Powder

Based on dosage, the North America methotrexate injection market is segmented into solution and powder

- Application

- Cancer

- Autoimmune Diseases

- Pregnancy

Based on application, the North America methotrexate injection market is segmented into cancer, autoimmune diseases, pregnancy.

- Age Group

- Pediatrics

- Adults

- Geriatric

Based on age group, the North America methotrexate injection market is segmented into pediatrics, adults and geriatrics

- Route of Administration

- Intramuscular

- Intravenous

- Intra-Arterial

- Intrathecal

Based on route of administration, the North America methotrexate injection market is segmented into intramuscular, intravenous, intra-arterial, intrathecal

- End User

- Hospitals

- Clinics

- Home Healthcare

- Others

Based on end user, the North America methotrexate injection market is segmented into hospitals, clinics, home healthcare and others

- Distribution Channel

- Hospital Pharmacies

- Retail Pharmacy

- Online Pharmacy

- Others

Based on distribution channel, the North America methotrexate injection market is segmented into hospital pharmacy, retail pharmacy, online pharmacy and others.

North America Methotrexate Injection Market Regional Analysis/Insights

The North America methotrexate injection market is analyzed and market size insights and trends are provided by country, product, type, availability, dosage form, application, age group, route of administration, distribution channel and end-user as referenced above.

The countries covered in the North America methotrexate injection market report are the U.S., Canada and Mexico.

The U.S. dominates the North America methotrexate injection market because of the presence of a large number of manufacturers, rise in government initiatives and organizations within the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Methotrexate Injection Market Share Analysis

North America methotrexate injection market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on methotrexate injection market.

Some of the major players in the market are Pfizer Inc., Antares Pharma, Inc., Fresenius Kabi USA, Medexus Pharmaceuticals, Inc., Viatris Inc., Sandoz AG (A Subsidiary of Novartis AG), Teva Pharmaceuticals USA, Inc., Accord BioPharma, Hikma Pharmaceuticals PLC, Cumberland Pharmaceuticals Inc., PV Pharma among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA METHOTREXATE INJECTION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION OVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

4.3 PRICING DYNAMICS

4.4 INDUSTRIAL INSIGHTS:

4.5 CONCLUSION:

5 NORTH AMERICA METHOTREXATE INJECTION MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF CANCER

6.1.2 GOVERNMENT INITIATIVES TO SPREAD AWARENESS ABOUT LUNG AND BREAST CANCER

6.1.3 RISE IN NUMBER OF PATIENTS WITH INFLAMMATORY DISEASES

6.2 RESTRAINTS

6.2.1 RISE IN COST OF METHOTREXATE

6.2.2 SIDE EFFECTS AND COMPLICATIONS WITH USE OF METHOTREXATE

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 RISE IN HEALTHCARE EXPENDITURE AND DISPOSABLE INCOME

6.3.3 INCREASE IN RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 STRINGENT RULES AND REGULATIONS

6.4.2 PRODUCT RECALLS

6.4.3 RISE IN COMPETITION BETWEEN MARKET PLAYERS

7 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 WITHOUT PRESERVATIVES

7.3 WITH PRESERVATIVES

8 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY TYPE

8.1 OVERVIEW

8.2 INJECTABLE SOLUTION

8.3 SELF-INJECTABLE SOLUTION

9 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY AVAILABILITY

9.1 OVERVIEW

9.2 25MG/ML

9.3 50MG/2ML

10 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY DOSAGE FORM

10.1 OVERVIEW

10.2 SOLUTION

10.3 POWDER

11 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CANCER

11.2.1 BREAST CANCER

11.2.2 LUNG CANCER

11.2.3 HEAD AND NECK CANCER

11.2.4 BLOOD CANCER

11.2.5 GESTATIONAL TROPHOBLASTIC TUMORS

11.2.6 OSTEOSARCOMA

11.2.7 OTHERS

11.3 AUTOIMMUNE DISEASES

11.3.1 RHEUMATOID ARTHRITIS

11.3.2 PSORIASIS

11.3.3 LUPUS

11.3.4 LOCALIZED SCLERODERMA

11.3.5 SARCOIDOSIS

11.3.6 VASCULITIS

11.3.7 JUVENILE DERMATOMYOSITIS

11.3.8 OTHERS

11.4 PREGNANCY

12 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY AGE GROUP

12.1 OVERVIEW

12.2 ADULTS

12.3 GERIATRIC

12.4 PEDIATRICS

13 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY ROUTE OF ADMINISTRATION

13.1 OVERVIEW

13.2 INTRAMUSCULAR

13.3 INTRAVENOUS

13.4 INTRA-ARTERIAL

13.5 INTRATHECAL

14 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 CLINICS

14.4 HOME HEALTHCARE

14.5 OTHERS

15 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 HOSPITAL PHARMACY

15.3 RETAIL PHARMACY

15.4 ONLINE PHARMACY

15.5 OTHERS

16 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY COUNTRY

16.1 U.S.

16.2 CANADA

16.3 MEXICO

17 NORTH AMERICA METHOTREXATE INJECTION MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 PFIZER INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENT

19.2 ANTARES PHARMA

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENT

19.3 FRESENIUS KABI USA (A SUBSIDIARY OF FRESENIUS SE & CO. KGAA)

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 MEDEXUS PHARMACEUTICALS, INC.

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENT

19.5 VIATRIS INC.

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENT

19.6 ACCORD HEALTHCARE

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENT

19.7 CUMBERLAND PHARMACEUTICALS INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 HIKMA PHARMACEUTICALS PLC

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENTS

19.9 PV PHARMA

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 SANDOZ INTERNATIONAL GMBH (A SUBSIDIARY OF NOVARTIS AG)

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENT

19.11 TEVA PHARMACEUTICAL INDUSTRIES LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY AVAILABILITY, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CANCER IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA AUTOIMMUNE DISEASES IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 13 U.S. METHOTREXATE INJECTION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 14 U.S. METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 U.S. METHOTREXATE INJECTION MARKET, BY AVAILABILITY, 2020-2029 (USD MILLION)

TABLE 16 U.S. METHOTREXATE INJECTION MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 17 U.S. METHOTREXATE INJECTION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 U.S. CANCER IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.S. AUTOIMMUNE DISEASES IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. METHOTREXATE INJECTION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 21 U.S. METHOTREXATE INJECTION MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 22 U.S. METHOTREXATE INJECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 U.S. METHOTREXATE INJECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 CANADA METHOTREXATE INJECTION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 CANADA METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 CANADA METHOTREXATE INJECTION MARKET, BY AVAILABILITY, 2020-2029 (USD MILLION)

TABLE 27 CANADA METHOTREXATE INJECTION MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 28 CANADA METHOTREXATE INJECTION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 CANADA CANCER IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 CANADA AUTOIMMUNE DISEASES IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 CANADA METHOTREXATE INJECTION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 32 CANADA METHOTREXATE INJECTION MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 33 CANADA METHOTREXATE INJECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 CANADA METHOTREXATE INJECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 MEXICO METHOTREXATE INJECTION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 36 MEXICO METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MEXICO METHOTREXATE INJECTION MARKET, BY AVAILABILITY, 2020-2029 (USD MILLION)

TABLE 38 MEXICO METHOTREXATE INJECTION MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 39 MEXICO METHOTREXATE INJECTION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 MEXICO CANCER IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 MEXICO AUTOIMMUNE DISEASES IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MEXICO METHOTREXATE INJECTION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 43 MEXICO METHOTREXATE INJECTION MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 44 MEXICO METHOTREXATE INJECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 MEXICO METHOTREXATE INJECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA METHOTREXATE INJECTION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA METHOTREXATE INJECTION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA METHOTREXATE INJECTION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA METHOTREXATE INJECTION MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 NORTH AMERICA METHOTREXATE INJECTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA METHOTREXATE INJECTION MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA METHOTREXATE INJECTION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA METHOTREXATE INJECTION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA METHOTREXATE INJECTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA METHOTREXATE INJECTION MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF CANCERS AUTOIMMUNE DISEASES IS EXPECTED TO DRIVE THE NORTH AMERICA METHOTREXATE INJECTION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 WITHOUT PRESERVATIVES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA METHOTREXATE INJECTION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA METHOTREXATE INJECTION MARKET

FIGURE 14 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY PRODUCT, 2021

FIGURE 15 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY TYPE, 2021

FIGURE 19 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AVAILABILITY, 2021

FIGURE 23 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AVAILABILITY, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AVAILABILITY, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AVAILABILITY, LIFELINE CURVE

FIGURE 26 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DOSAGE FORM, 2021

FIGURE 27 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DOSAGE FORM, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DOSAGE FORM, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 30 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY APPLICATION, 2021

FIGURE 31 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AGE GROUP, 2021

FIGURE 35 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 38 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 39 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 41 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 42 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY END USER, 2021

FIGURE 43 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 44 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 45 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY END USER, LIFELINE CURVE

FIGURE 46 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 47 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 48 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 49 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 50 NORTH AMERICA METHOTREXATE INJECTION MARKET: SNAPSHOT (2021)

FIGURE 51 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY COUNTRY (2021)

FIGURE 52 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 53 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 54 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY PRODUCT (2022-2029)

FIGURE 55 NORTH AMERICA METHOTREXATE INJECTION MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.