North America Menstrual Cramps Treatment Market

Market Size in USD Billion

CAGR :

%

USD

2.39 Billion

USD

4.21 Billion

2024

2032

USD

2.39 Billion

USD

4.21 Billion

2024

2032

| 2025 –2032 | |

| USD 2.39 Billion | |

| USD 4.21 Billion | |

|

|

|

|

Menstrual Cramps Treatment Market Size

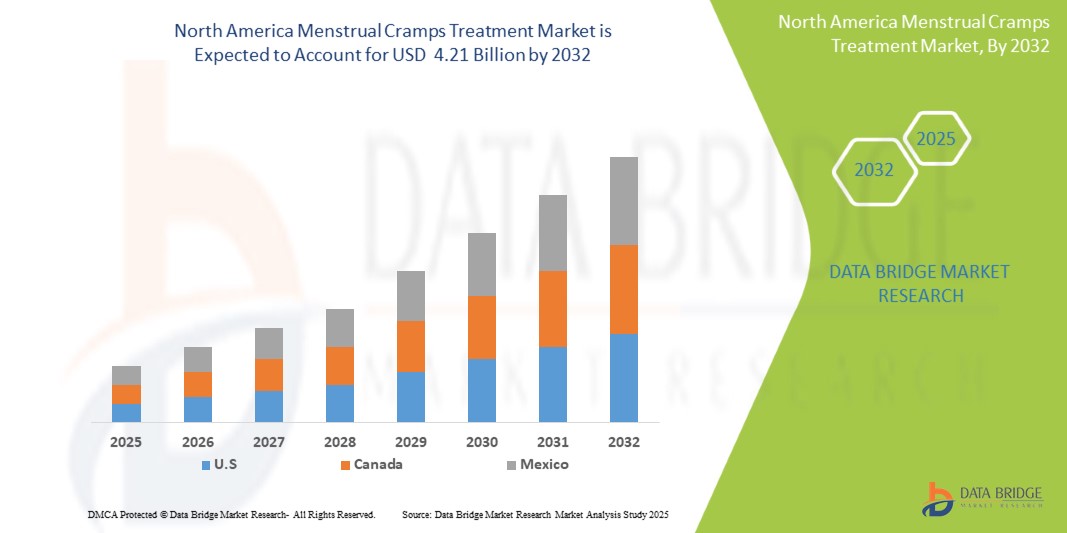

- The North America Menstrual Cramps Treatment Market size was valued at USD 2.39 billion in 2024 and is expected to reach USD 4.21 billion by 2032, at a CAGR of 7.6% during the forecast period

- The North America menstrual cramps treatment market growth is largely fueled by the increasing prevalence of dysmenorrhea and rising awareness regarding menstrual health, leading to a higher demand for effective treatment options across the region.

- Furthermore, rising consumer demand for safe, efficient, and readily available solutions for menstrual pain relief is establishing various treatment modalities, including over-the-counter medications and advanced non-pharmacological methods, as the modern choice. These converging factors are accelerating the uptake of menstrual cramp treatment solutions, thereby significantly boosting the industry's growth.

Menstrual Cramps Treatment Market Analysis

- Menstrual cramps treatments, offering relief for pain and discomfort associated with menstruation, are increasingly vital components of women’s health management in North America due to their proven effectiveness, diverse administration options, and a growing emphasis on personalized care.

- The escalating demand for menstrual cramps treatments across the U.S., Canada, and Mexico is primarily driven by the high prevalence of dysmenorrhea, rising awareness of menstrual health, and a strong preference for effective, convenient pain relief solutions.

- The United States holds a significant share of the North America menstrual cramps treatment market, accounting for 75% of regional revenue, supported by high healthcare spending, broad insurance coverage, and widespread availability of both prescription and over-the-counter (OTC) medications.

- Canada and Mexico are also experiencing steady growth, fueled by expanding access to healthcare services, increasing consumer education campaigns around women’s health, and a growing female population seeking reliable treatment options.

- The medication segment—particularly Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)—is expected to dominate the North America menstrual cramps treatment market, representing 60% of total market share, driven by their established reputation for efficacy, affordability, and wide availability as a first-line therapy for dysmenorrhea.

Report Scope and Menstrual Cramps Treatment Market Segmentation

|

Attributes |

Smart Lock Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Menstrual Cramps Treatment Market Trends

“Personalized Pain Management Through AI-Powered Digital Health Solutions”

- A significant and accelerating trend in the North America menstrual cramps treatment market is the deepening integration with artificial intelligence (AI) and digital health platforms. This fusion of technologies is significantly enhancing user convenience and control over their pain management strategies.

- For instance, AI-powered period tracking apps like Flo and Clue seamlessly integrate with user-reported symptoms and historical cycle data, allowing them to predict periods, ovulation, and fertile windows with increased accuracy, and often offering personalized insights into managing associated discomfort. Similarly, wearable devices utilizing technologies like TENS (Transcutaneous Electrical Nerve Stimulation) or heat therapy are integrating with smart apps to offer customizable pain relief programs.

- AI integration in menstrual cramps treatment enables features such as learning user pain patterns to potentially suggest optimal treatment timings and providing more intelligent alerts based on symptom severity. For instance, some digital therapeutics utilize AI to improve pain relief recommendations over time and can send intelligent alerts if unusual or severe pain patterns are detected. Furthermore, digital health platforms offer users the ease of tracking symptoms, medication intake, and lifestyle factors, allowing them to better understand and manage their individual menstrual health journey.

- The seamless integration of AI-powered solutions with broader digital health ecosystems facilitates centralized control over various aspects of menstrual well-being. Through a single interface, users can manage their pain relief strategies alongside mood tracking, activity levels, and other health data, creating a unified and automated approach to menstrual health management.

- This trend towards more intelligent, intuitive, and interconnected pain management systems is fundamentally reshaping user expectations for menstrual discomfort relief. Consequently, companies are developing AI-enabled digital health solutions with features such as automatic personalized recommendations for pain relief based on reported symptoms and integrating with other wellness apps.

- The demand for menstrual cramps treatments that offer seamless AI and digital health integration is growing rapidly across the North America market, as consumers increasingly prioritize convenience, personalized care, and comprehensive self-management functionalities.

Menstrual Cramps Treatment Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Dysmenorrhea and Increased Health Awareness”

- The increasing prevalence of menstrual cramps (dysmenorrhea) among women, coupled with the accelerating awareness and open discussion around menstrual health, is a significant driver for the heightened demand for effective menstrual cramps treatments.

- For instance, in recent years, companies have introduced innovative non-pharmacological solutions like wearable heat therapy devices or TENS units, aiming to provide convenient and drug-free pain relief. Such advancements by key companies are expected to drive the menstrual cramps treatment industry growth in the forecast period.

- As individuals become more aware of the impact of menstrual pain on their daily lives and seek enhanced relief and management options, modern treatments offer advanced features such as targeted pain relief, personalized approaches, and reduced side effects, providing a compelling alternative or complement to traditional methods.

- Furthermore, the growing popularity of holistic health approaches and the desire for comprehensive well-being are making menstrual cramps treatments an integral component of these broader health strategies, offering seamless integration with lifestyle modifications and self-care practices.

- The convenience of readily available over-the-counter medications, the accessibility of diverse therapeutic options, and the ability to manage symptoms through user-friendly digital health applications are key factors propelling the adoption of menstrual cramps treatments. The trend towards self-management and the increasing availability of varied treatment options further contribute to market growth.

Restraint/Challenge

“Concerns Regarding Side Effects and Stigma Associated with Treatments”

- Concerns surrounding the potential side effects of pharmaceutical treatments and the societal stigma associated with menstrual health issues pose a significant challenge to broader market penetration. As menstrual cramp treatments often involve medications or therapies, they can be associated with adverse reactions or a reluctance to seek help due to privacy concerns, raising anxieties among potential consumers about the safety and suitability of these options.

- For instance, public awareness of potential side effects from certain medications, or the perceived invasiveness of some therapies, has made some consumers hesitant to adopt conventional treatment solutions.

- Addressing these concerns through robust research, clear communication of benefits versus risks, and the development of more targeted therapies is crucial for building consumer trust. Companies emphasize their rigorous clinical trials and patient support programs to reassure potential buyers. Additionally, the relatively high cost of some advanced or long-term treatment regimens, or insufficient reimbursement policies, can be a barrier to adoption for price-sensitive consumers, particularly for those seeking specialized care. While basic over-the-counter pain relievers are affordable, premium features such as advanced wearable devices or personalized therapy plans often come with a higher price tag.

- While accessibility to various treatments is improving, the perceived burden of continuous management or the preference for non-pharmacological alternatives can still hinder widespread adoption, especially for those seeking more natural or less invasive approaches.

- Overcoming these challenges through enhanced patient education, transparent information on treatment outcomes, and the development of more affordable and accessible therapeutic options will be vital for sustained market growth.

Menstrual Cramps Treatment Market Scope

The market is segmented on the basis of type, treatment type, mode of prescription, route of administration, end user, and distribution channel.

By Type

On the basis of type, the North America menstrual cramps treatment market is segmented into primary dysmenorrhea and secondary dysmenorrhea. The primary dysmenorrhea segment is expected to hold the largest market revenue share of 68% in 2025, driven by the high prevalence among adolescent and young adult women. Increasing awareness campaigns and improved access to over-the-counter medications contribute to demand for effective treatments targeting primary menstrual pain. This segment is projected to expand at a CAGR of 6.5% from 2025 to 2032.

By Treatment Type

On the basis of treatment type, the market is segmented into medication, therapy, surgery, and others. The medication segment, particularly Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), accounted for the largest market revenue share in 2025, reflecting their established role as first-line therapy, affordability, and broad availability. The therapy segment, including heat therapy and transcutaneous electrical nerve stimulation (TENS), is expected to witness the fastest CAGR from 2025 to 2032, driven by growing consumer interest in non-pharmacological pain management solutions.

By Mode of Prescription

By mode of prescription, the market is divided into over-the-counter (OTC) and prescription treatments. The OTC segment dominates the market, supported by the widespread use of NSAIDs and analgesics without a prescription and strong retail pharmacy penetration. The prescription segment is also expanding, driven by demand for hormonal therapies and targeted treatments for secondary dysmenorrhea.

By Route of Administration

On the basis of route of administration, the market includes oral, parenteral, implants, and others. The oral segment held the largest revenue share in 2025, attributed to ease of use, rapid onset of action, and consumer familiarity with oral pain relievers. The implant segment is expected to grow steadily as hormonal intrauterine devices gain popularity for long-term management of dysmenorrhea.

By End User

By end user, the market is segmented into hospitals, specialty centers, ambulatory surgical centers, and others. Hospitals accounted for the largest revenue share, reflecting the high volume of consultations and treatments administered through hospital outpatient and inpatient services. Specialty centers are projected to grow rapidly, driven by the increasing role of gynecology clinics in providing tailored treatment plans and minimally invasive procedures.

By Distribution Channel

The distribution channel segment includes pharmacies, retail sales, direct tender, and others. Pharmacies remain the primary distribution channel, supported by strong OTC medication sales and prescription fulfillment. Retail sales, including e-commerce platforms, are witnessing robust growth due to consumer preference for convenient access and home delivery.

Menstrual Cramps Treatment Market Regional Analysis

- North America is expected to hold a significant market share in the menstrual cramps treatment market, driven by the high prevalence of dysmenorrhea among the female population and a well-established healthcare infrastructure. The United States is the primary contributor to this market, supported by rising awareness, strong insurance coverage, and a broad range of both over-the-counter and prescription-based treatments. Canada and Mexico are also witnessing steady growth due to improving access to women’s health services and increasing education around menstrual care.

- Consumers in the region highly value effective pain relief, convenience, and the ability to choose from multiple treatment options, including non-pharmacological therapies and advanced medications. There is a growing acceptance of proactively seeking medical solutions for menstrual discomfort, further encouraged by targeted awareness campaigns and initiatives that position menstrual health as an essential aspect of overall well-being.

- This widespread adoption is further supported by high healthcare expenditure, a technologically engaged population, and the growing popularity of e-commerce and retail pharmacy channels, establishing comprehensive menstrual pain management as a preferred approach across North American countries.

U.S. Menstrual Cramps Treatment Market Insight

The U.S. is the dominant market within North America for menstrual cramps treatment, accounting for the largest revenue share of 75 %. Growth is driven by high awareness of menstrual health, widespread availability of over-the-counter and prescription treatments, and robust insurance coverage. Consumers increasingly prioritize effective pain relief solutions, including both pharmaceutical and non-pharmacological options, supported by strong retail pharmacy networks and expanding e-commerce platforms. Public health initiatives, employer-supported wellness programs, and integration of menstrual health into broader women’s health policies further boost market demand.

Canada Menstrual Cramps Treatment Market Insight

Canada holds a significant position in the North America menstrual cramps treatment market, fueled by growing healthcare investments, universal healthcare coverage, and rising public awareness about menstrual health. There is an increasing focus on equitable access to menstrual products and education, which indirectly supports the demand for pain management solutions. The market benefits from a mix of traditional medications, alternative therapies, and rising interest in holistic and sustainable options for menstrual pain relief.

Mexico Menstrual Cramps Treatment Market Insight

The menstrual cramps treatment market in Mexico is experiencing steady growth, supported by expanding healthcare infrastructure, rising awareness of menstrual health issues, and efforts to reduce stigma around seeking treatment for menstrual pain. Consumers are increasingly turning to both pharmaceutical and non-drug solutions as access to healthcare services improves. Government and non-government initiatives promoting women’s health and menstrual hygiene further contribute to market expansion, alongside growing urbanization and disposable incomes

Menstrual Cramps Treatment Market Share

The smart lock industry is primarily led by well-established companies, including:

- Bayer AG (Leverkusen, Germany)

- GlaxoSmithKline plc (London, United Kingdom)

- Pfizer Inc. (New York, USA)

- Teva Pharmaceuticals USA, Inc. (Parsippany, New Jersey, USA)

- Color Seven Co., Ltd. (Seoul, South Korea)

- Beurer GmbH (Ulm, Germany)

- Mylan N.V. (Canonsburg, Pennsylvania, USA)

- Boehringer Ingelheim International GmbH (Ingelheim am Rhein, Germany)

- PMS4PMS, LLC (Headquarters information not readily available)

- Sanofi (Paris, France)

- Nobelpharma Co., Ltd. (Headquarters information not readily available)

- ObsEva (Geneva, Switzerland)

- Myovant Sciences Ltd. (Basel, Switzerland)

- AbbVie Inc. (North Chicago, Illinois, USA)

- BioElectronics Corporation (Frederick, Maryland, USA)

- LIVIA (Headquarters information not readily available)

- Alvogen (Pine Brook, New Jersey, USA)

- Cumberland Pharmaceuticals Inc. (Nashville, Tennessee, USA)

- Lupin Pharmaceuticals, Inc. (Baltimore, Maryland, USA)

- Janssen Pharmaceuticals, Inc. (Titusville, New Jersey, USA)

- Sun Pharmaceutical Industries Ltd. (Mumbai, India)

Latest Developments in North America Menstrual Cramps Treatment Market

- In March 2025, Samphire Neuroscience, a pioneer in neurotechnology, officially launched Nettle™, its CE-certified brain device designed to alleviate both mental and physical symptoms associated with menstruation. This initiative underscores the company's dedication to delivering innovative, non-pharmacological pain relief solutions tailored to the growing North America demand for alternative and technology-driven menstrual health management. By leveraging its expertise in transcranial direct current stimulation (tDCS), Samphire Neuroscience is not only addressing discomfort but also reinforcing its position in the rapidly expanding femtech and digital therapeutics market.

- In 2024, Bayer AG, strategically continued its focus on advancing treatments for endometriosis-associated pelvic pain, a significant cause of secondary dysmenorrhea in North America. This ongoing commitment, exemplified by the sustained research and commercialization of products like Visanne, underscores the company's dedication to delivering effective medical solutions tailored to complex gynecological pain conditions. By leveraging its extensive R&D capabilities and established pharmaceutical expertise, Bayer AG is not only addressing chronic pain but also reinforcing its dominant position in the rapidly evolving women's health sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.