North America Medical Devices Market

Market Size in USD Million

CAGR :

%

USD

4,694.22 Million

USD

6,882.84 Million

2022

2030

USD

4,694.22 Million

USD

6,882.84 Million

2022

2030

| 2023 –2030 | |

| USD 4,694.22 Million | |

| USD 6,882.84 Million | |

|

|

|

|

North America Medical Devices Market Analysis and Size

According to the Centres for Disease Control and Prevention (CDC), in the United States, approximately 25 million people (including both adults and children) have asthma, with an estimated incidence rate of 8.4% in adults and 8.1% in children, In the United States, it is estimated that around 16 million adults have been diagnosed with COPD, with an additional estimated 16 million individuals having undiagnosed COPD. The increasing incidence of respiratory diseases is acting as a driver for the growth of medical devices market in North America.

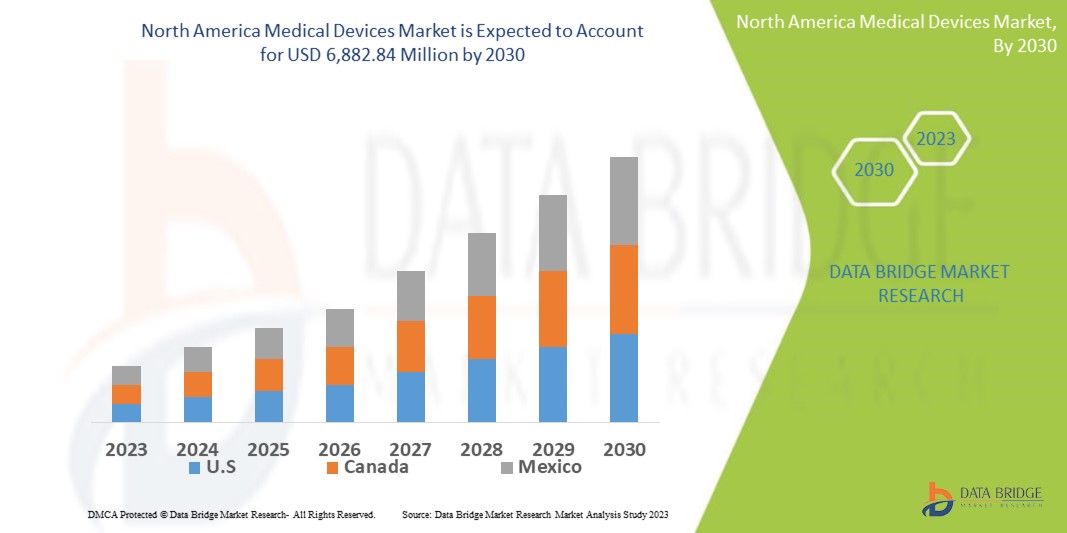

Data Bridge Market Research analyses that the North America medical devices market which was USD 4,694.22 million in 2022, is expected to reach USD 6,882.84 million by 2030, and is expected to undergo a CAGR of 4.9% during the forecast period 2023-2030. This indicates the market value. “Ventilator” dominates the product segment of the medical devices market owing to the growing demand for better treatment methods. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Medical Devices Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, and Pricing in USD |

|

Segments Covered |

Product (Ventilator, Spirometers, Oxygen Concentrators, Anaesthesia Machines and CPAP/BIPAP), Mode (Portable, Table Top and Standalone), Application (Diagnostic and Therapeutic), Facility (Large, Small and Medium), End User (Hospital, Ambulatory Surgical Centres, Specialty Clinics, Long Term Care Centres, Rehabilitation Centres, Homecare Settings), Distribution Channel (Direct Sales and Third Party Distributor) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

GE Healthcare (U.S.), Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), Drägerwerk AG & Co. KGaA (Germany), VYAIRE (U.S.), Getinge AB (Sweden), Smiths Medical Inc. (A part of Smiths Group plc.) (U.S.), NDD Medical Technologies (Switzerland), ResMed (U.S.), Invacare Corporation (U.S.), NIDEK MEDICAL (Japan), O2 CONCEPTS, LLC (U.S.), Teijin Limited (Japan), GCE Healthcare (U.K.), Inogen, Inc (U.S.), Teleflex Incorporated (U.S.), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), MGC Diagnostics Corporation (U.S.), HILL-ROM (U.S.), Drive DeVilbiss Healthcare Inc. (U.S.), Midmark Corporation (U.S.), CAIRE Inc. (U.S.), GCE Group (Sweden), Fisher & Paykel Healthcare Limited (New Zealand) and Schiller (Switzerland) |

|

Market Opportunities |

|

Market Definition

Medical devices are any appliance, machine, implement, apparatus, instrument, implant, reagent for in vitro usage, material, software, or another related or similar article, intended by the manufacturer to be utilized, separately or in consolidation, for any healthcare purpose. Medical devices are utilized for alleviation, treatment, monitoring, prevention, or diagnosis of disease. Additionally, medical devices are also utilized for support, modification, replacement, or investigation of the physiological process or anatomy. Furthermore, medical devices are also use in sustain or supporting the life. Medical devices include a broad range of products varying in application and complexity. Examples include X-ray machines, ventilators, diagnostic medical devices, therapeutic medical devices, and oxygen concentrators among others.

North America Medical Devices Market Dynamics

Drivers

- Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases, such as cardiovascular diseases, diabetes, and respiratory disorders, is driving the demand for medical devices. These devices help in diagnosis, monitoring, and treatment of these conditions, improving patient outcomes and quality of life.

- Growing Awareness and Patient Empowerment

Patients are becoming more aware of available treatment options and are actively participating in healthcare decisions. This increased awareness and empowerment drive the demand for medical devices that can improve patient outcomes and provide personalized car.

Opportunities

- Increasing Demand for Home Healthcare

The shift towards home healthcare services presents an opportunity for medical device manufacturers. With advancements in technology, devices such as wearable monitors, telehealth solutions, and home diagnostic tools, enable patients to receive care in the comfort of their own homes. This trend opens up new markets and revenue streams for medical device companies.

- Rise of Digital Health and Connected Devices

The integration of digital health technologies, such as Internet of Things (IoT), artificial intelligence (AI), and big data analytics, is revolutionizing the healthcare industry. Connected devices and remote patient monitoring solutions offer opportunities for improved patient care, real-time data analysis, and personalized treatment plans. Medical device companies can capitalize on this trend by developing innovative connected devices and software solutions.

Restraints/Challenges

- Technological Challenges and Product Complexity

Developing and commercializing complex medical devices, such as advanced imaging systems or implantable devices, can pose technical challenges. The high costs, technical expertise, and lengthy development timelines associated with such devices can be a restraint for companies.

- Stringent Regulatory Environment

While regulatory standards ensure patient safety and product quality, the stringent regulatory requirements can pose challenges for medical device manufacturers. Obtaining approvals and clearances from regulatory bodies such as the U.S. Food and Drug Administration (FDA) can be time-consuming and expensive, delaying product launches and increasing costs

This North America medical devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the North America medical devices market contact Data Bridge Market Research for an analyst brief, our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In May 2021, Medtronic announced the launch of its Hugo robotic-assisted surgery system in the United State

- In March 2021, Johnson & Johnson's subsidiary, Janssen Pharmaceuticals, received FDA approval for its COVID-19 vaccine, developed in collaboration with Janssen Vaccines & Prevention B.V

North America Medical Device Market Scope

The North America medical devices market is segmented on the basis of product, mode, application, facility, end users and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Ventilator

- Spirometers

- Oxygen Concentrators

- Anaesthesia Machines

- CPAP/BIPAP

Mode

- Portable

- Table Top

- Standalone

Application

- Diagnostic

- Therapeutic

Facility

- Large

- Small

- Medium

End Users

- Hospital

- Ambulatory Surgical Centres

- Specialty Clinics

- Long Term Care Centres

- Rehabilitation Centres

- Homecare Settings

Distribution Channel

- Direct Sales

- Third Party Distributor

North America Medical Devices Market Regional Analysis/Insights

The North America medical devices market is analysed and market size insights and trends are provided by country, product, mode, application, facility, end users and distribution channel as referenced above.

The countries covered in the North America medical devices market report are U.S., Canada and Mexico.

U.S. dominates the North America medical devices market because of the strong base of healthcare facilities, the strong presence of major players in the market, the extraordinary healthcare infrastructure, and the large pool of people having chronic diseases.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The North America medical devices market also provides you with a detailed market analysis for every country's growth in healthcare expenditure for capital equipment, installed base of different kinds of products for the North America medical devices market, the impact of technology using lifeline curves and changes in healthcare regulatory scenarios and their impact on the medical devices market. This data is available for historic period 2015-2020.

Competitive Landscape and North America Medical Devices Market Share Analysis

The North America medical devices market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the North America medical devices market.

Some of the major players operating in the North America medical devices market are:

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (Ireland)

- Drägerwerk AG & Co. KGaA (Germany)

- VYAIRE (U.S.)

- Getinge AB (Sweden)

- Smiths Medical Inc. (A part of Smiths Group plc.) (U.S.)

- NDD Medical Technologies (Switzerland)

- ResMed (U.S.)

- Invacare Corporation (U.S.)

- NIDEK MEDICAL (Japan)

- O2 CONCEPTS, LLC (U.S.)

- Teijin Limited (Japan)

- GCE Healthcare (U.K.)

- Inogen, Inc (U.S.)

- Teleflex Incorporated (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- MGC Diagnostics Corporation (U.S.)

- HILL-ROM (U.S.)

- Drive DeVilbiss Healthcare Inc. (U.S.)

- Midmark Corporation (U.S.)

- CAIRE Inc. (U.S.)

- GCE Group (Sweden)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Schiller (Switzerland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.