North America Magnet Wire Market

Market Size in USD Billion

CAGR :

%

USD

8.15 Billion

USD

13.81 Billion

2025

2033

USD

8.15 Billion

USD

13.81 Billion

2025

2033

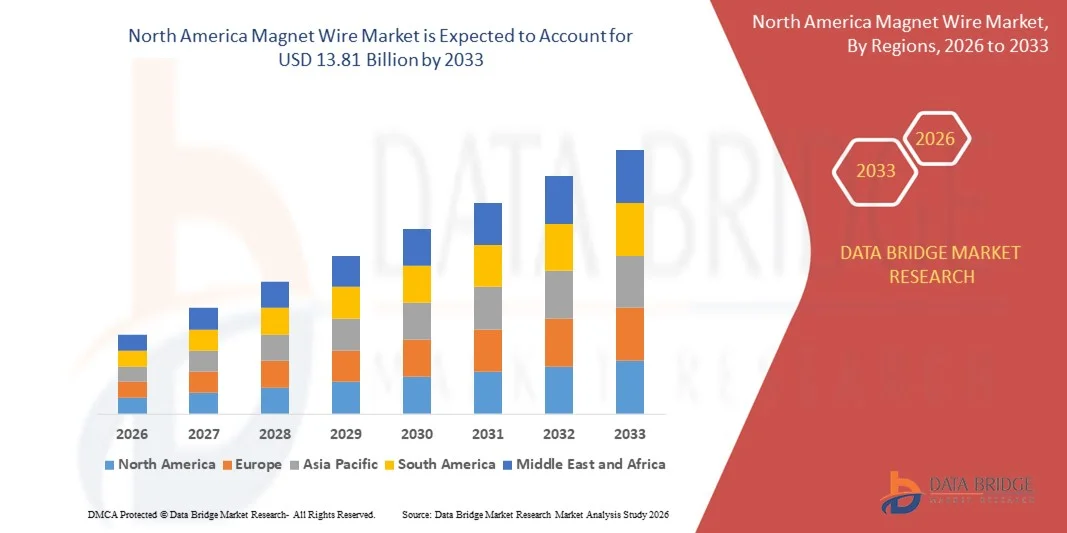

| 2026 –2033 | |

| USD 8.15 Billion | |

| USD 13.81 Billion | |

|

|

|

|

North America Magnet Wire Market Size

- The North America magnet wire market size was valued at USD 8.15 billion in 2025 and is expected to reach USD 13.81 billion by 2033, at a CAGR of 6.80% during the forecast period

- The market growth is largely fuelled by the rising demand for electric motors, transformers, and generators across industrial, automotive, and energy applications

- Increasing investments in electric vehicle production, renewable energy infrastructure, and power transmission upgrades are further supporting market expansion

North America Magnet Wire Market Analysis

- The market is characterised by steady technological advancements in insulation materials and manufacturing processes, enabling improved thermal performance, durability, and energy efficiency of magnet wires

- Strong industrial base, growing electrification trends, and consistent replacement demand for ageing electrical equipment continue to underpin the overall stability and long-term growth of the market

- U.S. retro-reflective materials market captured the largest revenue share in 2025 within North America, supported by extensive highway networks, high vehicle density, and strict federal and state safety regulations

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America magnet wire market due to rising investments in renewable energy projects, expansion of power grid infrastructure, and increasing adoption of electric vehicles and energy-efficient electrical equipment

- The copper segment dominated the market in 2025 due to its high electrical conductivity, superior thermal resistance, and long service life. Copper magnet wire is extensively used in motors, transformers, and generators where efficiency and reliability are critical. Its strong performance under high-load and high-temperature conditions continues to support widespread adoption across industrial and automotive applications

Report Scope and North America Magnet Wire Market Segmentation

|

Attributes |

North America Magnet Wire Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Magnet Wire Market Trends

Rising Electrification And Energy Efficiency Focus

- The increasing emphasis on electrification across industrial, automotive, and energy sectors is significantly shaping the North America magnet wire market, as manufacturers and utilities demand high-performance conductors for motors, transformers, and generators. Magnet wires are gaining traction due to their ability to support efficient power transmission, thermal stability, and compact designs, aligning with energy efficiency and performance requirements. This trend is strengthening adoption across manufacturing, power generation, and infrastructure applications, encouraging continuous innovation in insulation and conductor technologies

- Growing focus on energy efficiency standards and sustainability initiatives has accelerated the demand for advanced magnet wire solutions in electric vehicles, renewable energy systems, and smart grids. Manufacturers are increasingly adopting high-quality magnet wires to reduce energy losses, improve durability, and extend equipment lifespan. This has also driven investments in R&D to develop wires with enhanced thermal resistance and improved insulation properties

- Technological advancements in materials and production processes are influencing purchasing decisions, with end users prioritizing reliability, efficiency, and compliance with regulatory standards. These factors are helping suppliers differentiate products in a competitive market while supporting long-term partnerships with OEMs and utilities. Companies are also leveraging automation and digital manufacturing to improve quality consistency and reduce production costs

- For instance, in 2024, leading motor and transformer manufacturers in the U.S. and Canada expanded their use of advanced enamelled copper and aluminum magnet wires to support electric vehicle drivetrains and renewable energy installations. These products were integrated into high-efficiency motors and power equipment, supporting performance optimization and regulatory compliance while enhancing supplier competitiveness

- While demand for magnet wire continues to grow, sustained market expansion depends on continuous technological upgrades, raw material availability, and cost management. Manufacturers are focusing on improving production efficiency, securing stable copper and aluminum supplies, and developing innovative insulation systems that balance performance, durability, and cost-effectiveness

North America Magnet Wire Market Dynamics

Driver

Growing Demand From Electric Vehicles And Renewable Energy Systems

- Rising adoption of electric vehicles and renewable energy technologies is a major driver for the North America magnet wire market. Magnet wires are essential components in EV motors, charging infrastructure, wind turbines, and solar inverters, supporting efficient energy conversion and transmission. Increasing EV production and clean energy investments are directly contributing to higher magnet wire consumption

- Expanding applications in industrial motors, transformers, generators, and power distribution equipment are further supporting market growth. Magnet wires enable compact designs, improved efficiency, and reliable operation, allowing manufacturers to meet performance standards and energy efficiency regulations. The ongoing modernization of power grids across North America reinforces this demand

- Automotive, energy, and industrial equipment manufacturers are actively investing in advanced magnet wire solutions through product innovation and supplier collaborations. These efforts are supported by government incentives for electrification and renewable energy adoption, encouraging long-term supply agreements and technological partnerships

- For instance, in 2023, automotive and energy equipment manufacturers in the U.S. reported increased procurement of high-temperature and high-efficiency magnet wires for EV motors and renewable energy projects. These initiatives were driven by rising clean energy targets and electrification goals, supporting volume growth and long-term market stability

- Although strong demand from EVs and renewables supports market growth, maintaining momentum will require stable raw material supply, continuous innovation, and cost optimization. Investments in advanced manufacturing, recycling of conductive materials, and supply chain resilience will be critical for sustaining competitiveness

Restraint/Challenge

Volatility In Raw Material Prices And Supply Chain Constraints

- Fluctuating prices of copper and aluminum remain a key challenge for the North America magnet wire market, impacting production costs and profit margins. Volatility in global metal markets and supply disruptions can create pricing uncertainty for manufacturers and end users. This challenge is particularly significant for long-term contracts and large-scale infrastructure projects

- Supply chain constraints and dependence on raw material imports can also affect production schedules and delivery timelines. Geopolitical factors, trade policies, and logistics disruptions may limit material availability, increasing lead times and operational risks for manufacturers

- Compliance with stringent quality and safety standards further adds to operational complexity, as manufacturers must invest in advanced testing, certification, and quality control systems. These requirements can increase production costs, particularly for smaller players with limited resources

- For instance, in 2024, several magnet wire manufacturers in the U.S. and Mexico reported margin pressure due to rising copper prices and logistical delays affecting automotive and industrial customers. These challenges prompted some OEMs to renegotiate contracts or seek alternative suppliers, affecting short-term market dynamics

- Addressing these challenges will require strategic sourcing, long-term supplier agreements, and investments in recycling and material efficiency. Strengthening regional supply chains, adopting alternative conductor materials, and improving operational flexibility will be essential to support sustainable growth in the North America magnet wire market

North America Magnet Wire Market Scope

The market is segmented on the basis of type, product type, material, shape, application, distribution channel, and end-user.

- By Type

On the basis of type, the North America magnet wire market is segmented into Copper, Aluminum, and Others. The copper segment dominated the market in 2025 due to its high electrical conductivity, superior thermal resistance, and long service life. Copper magnet wire is extensively used in motors, transformers, and generators where efficiency and reliability are critical. Its strong performance under high-load and high-temperature conditions continues to support widespread adoption across industrial and automotive applications.

The aluminum segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its lightweight characteristics and lower cost compared to copper. Aluminum magnet wire is increasingly used in applications where weight reduction and cost efficiency are priorities. Growing use in automotive and select industrial equipment is supporting demand for this segment.

- By Product Type

On the basis of product type, the market is segmented into Enamelled Wire and Covered Conductor Wire. The enamelled wire segment accounted for the largest revenue share in 2025 owing to its compact insulation, efficient heat dissipation, and suitability for high-density windings. Enamelled wires are widely used in motors, transformers, and electrical devices requiring space-saving designs. Continuous improvements in enamel coating technologies further enhance durability and performance.

Covered conductor wire is expected to witness the fastest growth rate from 2026 to 2033 due to its added mechanical protection and resistance to external stress. This product type is preferred in applications where enhanced safety and durability are required. Growing industrial usage and demand for robust electrical systems are supporting its adoption.

- By Material

Based on material, the market is segmented into Polyamide-Imide (PAI), Polyimides (PI), Polyetherimide (PEI), Polyether Ether Ketone (PEEK), and Others. The PAI segment held a significant share in 2025 due to its excellent thermal endurance, chemical resistance, and mechanical strength. These properties make it suitable for high-temperature and high-performance applications, particularly in automotive and industrial motors.

Polyimides (PI) is expected to witness the fastest growth rate from 2026 to 2033 driven by the need for superior insulation performance in electric vehicles, renewable energy systems, and advanced electrical equipment. These materials support higher efficiency, longer lifespan, and improved operational reliability.

- By Shape

On the basis of shape, the market is segmented into Round Magnet Wire, Round Bondable Magnet Wire, Rectangle Magnet Wire, and Square Magnet Wire. The round magnet wire segment dominated the market in 2025 due to its ease of winding, manufacturing flexibility, and broad applicability across motors and transformers. Its compatibility with automated production processes further supports high-volume usage.

Rectangular magnet wires is expected to witness the fastest growth rate from 2026 to 2033 demand as they enable better space utilization and higher slot fill factors. These shapes help improve electrical efficiency and power density, making them suitable for high-performance motors and transformers used in industrial and energy applications.

- By Application

By application, the market is segmented into Motor, Home Appliance, Transformer, and Others. The motor segment accounted for the largest share in 2025, driven by extensive use in industrial machinery, electric vehicles, HVAC systems, and automation equipment. Rising electrification and industrial automation trends continue to support strong demand for magnet wires in motor applications.

The transformer segment is expected to witness the fastest growth rate from 2026 to 2033 due to increasing investments in power transmission, distribution networks, and renewable energy integration. Replacement of ageing transformers and grid modernization initiatives across North America are further supporting this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into E-Commerce, Supermarkets/Hypermarkets, Specialty Stores, B2B/Third Party Distributors, and Others. The B2B/third party distributors segment held the dominant share in 2025 due to bulk procurement by OEMs, utilities, and industrial manufacturers. These channels provide technical support, consistent supply, and long-term contractual arrangements.

E-commerce is expected to witness the fastest growth rate from 2026 to 2033, particularly for small-scale buyers and customized requirements. Improved digital platforms, wider product availability, and efficient logistics are supporting growth in these channels.

- By End-User

Based on end-user, the market is segmented into Electrical & Electronics, Industrial, Transportation, Energy, Automotive, Residential, Infrastructure, and Others. The industrial and automotive segments collectively represented a major share in 2025, driven by strong demand for motors, generators, and electric vehicle components. Ongoing industrial expansion and EV adoption continue to fuel magnet wire consumption.

The energy is expected to witness the fastest growth rate from 2026 to 2033, supported by renewable energy projects, power grid upgrades, and infrastructure development initiatives. Increasing focus on energy efficiency and electrification is further strengthening demand from these end-user segments.

North America Magnet Wire Market Regional Analysis

- U.S. retro-reflective materials market captured the largest revenue share in 2025 within North America, supported by extensive highway networks, high vehicle density, and strict federal and state safety regulations

- Demand is driven by continuous investments in road maintenance, smart transportation systems, and construction safety programs

- The growing adoption of high-performance reflective materials in traffic signage, workwear, and emergency vehicles further strengthens market growth

- In addition, the presence of leading manufacturers and steady technological advancements are contributing significantly to market expansion

Canada Retro-Reflective Materials Market Insight

The Canada retro-reflective materials market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing investments in infrastructure development and rising awareness of occupational and road safety. Harsh weather conditions and long winter seasons are encouraging the use of high-visibility materials for transportation and worker safety. Government initiatives aimed at improving road safety standards and construction regulations are further supporting adoption. Growing urban development and transportation modernization projects are expected to sustain strong demand across the forecast period.

North America Magnet Wire Market Share

The North America magnet wire industry is primarily led by well-established companies, including:

- 3M Company (U.S.)

- Avery Dennison Corporation (U.S.)

- Orafol Americas Inc. (U.S.)

- Nippon Carbide Industries USA (U.S.)

- Coats Group plc (U.S. Operations) (U.S.)

- Viz Reflectives Inc. (U.S.)

- Tapco (Traffic & Parking Control Co.) (U.S.)

- ATS Traffic (A Traction Services Company) (Canada)

- Brady Corporation (U.S.)

- JPS Composite Materials (U.S.)

- DM Reflective Materials (U.S.)

- CINTAS Corporation (High-Visibility Solutions) (U.S.)

- Excelsior Plastics (Canada)

- Alpha Industrial Supplies (U.S.)

- RoadSafe Traffic Systems (Reflective Solutions Division) (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Magnet Wire Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Magnet Wire Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Magnet Wire Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.