North America Lipid Poct Market

Market Size in USD Million

CAGR :

%

USD

396.07 Million

USD

580.74 Million

2025

2033

USD

396.07 Million

USD

580.74 Million

2025

2033

| 2026 –2033 | |

| USD 396.07 Million | |

| USD 580.74 Million | |

|

|

|

|

North America Lipid POCT Market Size

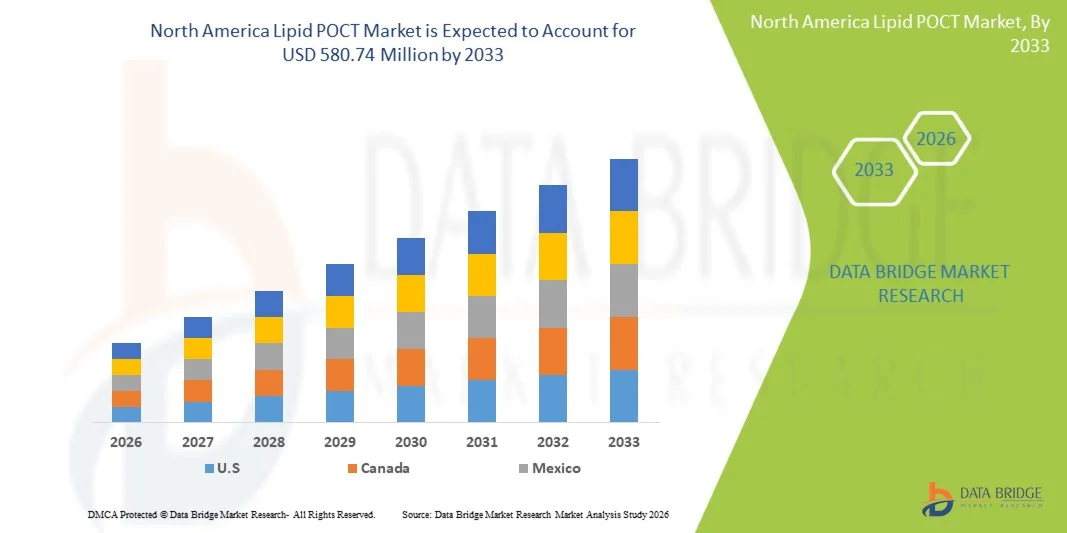

- The North America lipid POCT market size was valued at USD 396.07 million in 2025 and is expected to reach USD 580.74 million by 2033, at a CAGR of 4.9% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular and lipid‑related disorders, advancements in point‑of‑care diagnostic technologies, and the rising adoption of rapid, decentralized testing solutions within clinical and community healthcare settings across North America

- Furthermore, rising demand for quick, accessible lipid profiling for preventive care, consumer preference for real‑time results at clinics and home settings, and the strong healthcare infrastructure in the U.S. and Canada are driving the uptake of lipid POCT solutions as key tools for proactive cardiovascular risk management. These converging factors are accelerating the adoption of lipid POCT systems, thereby significantly boosting the region’s market growth

North America Lipid POCT Market Analysis

- Lipid point-of-care testing (POCT) devices, enabling rapid measurement of cholesterol and other lipid parameters, are increasingly vital components of modern preventive healthcare and cardiovascular risk management in both clinical and home settings due to their convenience, quick results, and seamless integration with healthcare workflows

- The escalating demand for lipid POCT is primarily fueled by the rising prevalence of cardiovascular and lipid disorders, growing awareness of preventive care, and a preference for real-time, on-site testing over conventional laboratory methods

- The U.S. dominated the North America lipid POCT market with the largest revenue share of 72.9% in 2025, characterized by advanced healthcare infrastructure, high adoption of point-of-care diagnostics, and a strong presence of key industry players, with substantial growth across hospitals, professional diagnostic centers, and home care settings

- Canada is expected to witness steady growth during the forecast period, supported by government initiatives promoting preventive healthcare, increasing patient awareness, and expanding access to point-of-care diagnostics across hospitals and clinics

- Instruments segment dominated the market with the largest market share of 55.2% 2025, driven by the critical need for accurate, rapid, and reliable lipid testing in hospitals, professional diagnostic centers, and home care settings, as well as by increased adoption of advanced point-of-care analyzers from leading brands

Report Scope and North America Lipid POCT Market Segmentation

|

Attributes |

North America Lipid POCT Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Lipid POCT Market Trends

“Rapid Adoption of Portable and Connected Testing Devices”

- A significant and accelerating trend in the North America lipid POCT market is the rising adoption of portable, connected testing devices that enable real-time lipid profiling at clinics, hospitals, and home settings

- For instance, the Alere Cholestech LDX device allows users to obtain instant cholesterol and triglyceride readings at outpatient clinics, facilitating immediate clinical decision-making

- Integration with digital health platforms enables automatic uploading of patient data to electronic health records (EHRs), allowing healthcare providers to monitor trends and provide personalized recommendations. For instance, Roche Reflotron analyzers can transmit results directly to patient management systems for efficient tracking

- Connected devices and mobile apps allow patients to monitor their lipid levels at home, receive alerts, and share results with clinicians, improving engagement and adherence to treatment. For instance, PTS Cardiochek systems offer mobile connectivity for patient data sharing and monitoring

- This trend towards portable, connected, and data-integrated POCT devices is reshaping expectations for preventive healthcare, driving manufacturers such as Samsung Labgeo to develop user-friendly analyzers with connectivity to health management apps

- The demand for rapid, connected, and home-accessible lipid POCT devices is increasing across both healthcare providers and patients, as real-time monitoring and convenience become key priorities

- Growing partnerships between POCT device manufacturers and telehealth platforms are enabling remote consultations and real-time monitoring, further driving market adoption. For instance, Alere Afinion systems are being integrated with telehealth services to allow clinicians to review patient results remotely

North America Lipid POCT Market Dynamics

Driver

“Increasing Prevalence of Cardiovascular and Lipid Disorders”

- The rising prevalence of cardiovascular diseases and lipid disorders in North America is a primary driver boosting demand for lipid POCT devices

- For instance, in 2024, Roche reported increased uptake of its Reflotron devices in outpatient clinics due to growing hyperlipidemia screening initiatives

- As patients and healthcare providers prioritize preventive care, lipid POCT enables rapid testing, immediate risk assessment, and timely intervention, offering an advantage over traditional laboratory testing

- Furthermore, government programs and insurance incentives promoting early detection and management of cardiovascular risk factors are expanding adoption of POCT devices across hospitals and diagnostic centers

- The convenience of rapid, point-of-care testing, integration with digital health platforms, and suitability for both clinical and home care settings are key factors propelling the adoption of lipid POCT solutions

- Rising patient awareness about personalized health monitoring and preventive care is motivating healthcare providers to adopt POCT for quick, actionable lipid results. For instance, clinics in the U.S. increasingly offer cholesterol testing as part of routine wellness checks

- Advances in compact, battery-operated devices are enabling lipid testing in remote and underserved areas, widening access and contributing to market growth. For instance, PTS Cardiochek and Samsung Labgeo analyzers are used in rural clinics and community health programs

Restraint/Challenge

“High Cost and Regulatory Compliance Hurdles”

- The relatively high cost of advanced lipid POCT devices and consumables poses a challenge to widespread adoption, particularly for smaller clinics or price-sensitive patients

- For instance, premium analyzers such as Roche Cobas B 101 come with a higher upfront cost compared to basic laboratory testing, limiting accessibility in some healthcare settings

- Regulatory compliance requirements, including FDA approvals and quality certifications, can slow product launch timelines and increase development costs, impacting market growth

- While costs are gradually decreasing, the perception of premium pricing for sophisticated POCT devices can hinder adoption among smaller healthcare facilities or home users

- Overcoming these challenges through affordable device options, streamlined regulatory approvals, and patient education on the benefits of rapid lipid testing will be essential for sustained market expansion

- Limited training and technical expertise among staff in smaller clinics may restrict optimal usage of advanced POCT devices, affecting adoption rates. For instance, some smaller diagnostic centers delay implementation due to perceived complexity of operation

- Data privacy concerns related to connected POCT devices can deter adoption, as patients and providers are cautious about sharing sensitive health information digitally. For instance, integration with mobile apps or cloud platforms requires robust data security measures to maintain trust

North America Lipid POCT Market Scope

The market is segmented on the basis of type, application, mode, brand, platform, end user, and distribution channel.

- By Type

On the basis of type, the North America lipid POCT market is segmented into instruments and consumables & kits. The instruments segment dominated the market with the largest revenue share of 55.2% in 2025, driven by the critical need for accurate, rapid, and reliable lipid measurements in hospitals, professional diagnostic centers, and home care settings. Instruments such as analyzers from Roche Reflotron and Alere Cholestech LDX are preferred due to their precision, portability, and integration with digital health platforms. The market demand is further supported by the increasing prevalence of cardiovascular and lipid disorders, which require frequent and immediate testing. Hospitals and clinics prioritize instruments for point-of-care screening, enabling physicians to make timely decisions. Moreover, the growing trend of connected devices that upload results to EHRs boosts the dominance of the instruments segment.

The consumables & kits segment is anticipated to witness the fastest growth with a CAGR of 8.5% from 2026 to 2033, fueled by rising demand for home-based lipid testing and preventive health monitoring. Consumables, including test strips and reagents, enable repeated and convenient testing without large equipment. The segment growth is supported by the increasing availability of affordable kits and mobile-compatible devices, making lipid monitoring accessible to patients outside clinical settings. Manufacturers are launching ready-to-use kits that simplify testing, attract home users, and expand adoption among small clinics. The convenience, low training requirements, and cost-effectiveness of consumables & kits are key factors driving their rapid market growth.

- By Application

On the basis of application, the market is segmented into hyperlipidemia, hypertriglyceridemia, hyperlipoproteinemia, familial hypercholesterolemia, Tangier disease, and others. The hyperlipidemia segment dominated the market with the largest revenue share of 38% in 2025, driven by the high prevalence of elevated cholesterol levels across adults in North America. Frequent screening for hyperlipidemia is essential for cardiovascular risk management, supporting continuous adoption in hospitals and diagnostic centers. Devices offering rapid hyperlipidemia testing are preferred for routine health check-ups and preventive programs. Manufacturers focus on developing accurate, portable devices tailored for hyperlipidemia detection, increasing segment adoption. Integration with mobile apps and telehealth platforms further supports the dominance of this segment by allowing patients to track trends remotely. Preventive healthcare initiatives and awareness campaigns are also contributing to its leading market position.

The familial hypercholesterolemia segment is expected to witness the fastest growth with a CAGR of 9% from 2026 to 2033, fueled by increasing genetic screening and early diagnosis initiatives. Early detection of familial hypercholesterolemia reduces cardiovascular risk and allows timely therapeutic interventions. Awareness campaigns and physician recommendations are encouraging more patients to opt for POCT-based screenings. Specialized devices with higher sensitivity for genetic lipid disorders are being adopted in outpatient and research settings. The growth of telehealth and mobile-enabled devices also supports accessibility and convenience for familial hypercholesterolemia testing. Rising patient education and genetic testing programs further accelerate segment expansion.

- By Mode

On the basis of mode, the market is segmented into prescription-based testing and OTC-based testing. The prescription-based testing segment dominated the market with the largest revenue share of 62% in 2025, driven by its critical role in clinical diagnosis and risk assessment for patients with cardiovascular conditions. Hospitals and professional diagnostic centers often prefer prescription-based devices for accuracy, reliability, and integration with medical records. Clinicians rely on these tests to monitor treatment response and guide therapeutic decisions. The segment also benefits from regulatory approval pathways and insurance reimbursement, making it widely accessible in clinical environments. Continuous technological advancements and device automation further reinforce its dominance. Integration with EHRs and telemedicine platforms enhances workflow efficiency and patient management.

The OTC-based testing segment is expected to witness the fastest growth with a CAGR of 10% from 2026 to 2033, fueled by rising demand for home-based preventive healthcare. OTC devices enable patients to test cholesterol and lipid levels conveniently at home, increasing adoption among health-conscious consumers. Manufacturers are developing user-friendly kits with mobile app connectivity to track results and share data with clinicians. Growing awareness of cardiovascular risk and proactive health monitoring supports segment expansion. The convenience, privacy, and real-time results offered by OTC testing are primary growth drivers. The expansion of e-commerce and retail channels further accelerates adoption in this segment.

- By Brand

On the basis of brand, the market is segmented into Roche Reflotron, Roche Cobas B 101, Alere Cholestech LDX, Alere Afinion, Samsung Labgeo, PTS Cardiochek, and others. The Roche Reflotron segment dominated the market with the largest revenue share of 29% in 2025, driven by its widespread adoption in hospitals and diagnostic centers across the U.S. and Canada. Its devices are recognized for accuracy, portability, and integration with digital platforms, enabling real-time monitoring and EHR connectivity. Roche invests in R&D to enhance ease-of-use and result reliability, strengthening brand loyalty. Clinicians prefer Roche Reflotron analyzers for routine hyperlipidemia screening and cardiovascular risk assessment. The extensive service network and product support also reinforce its dominant position. The brand’s established reputation among healthcare providers supports continuous growth and market leadership.

The Alere Cholestech LDX segment is expected to witness the fastest growth with a CAGR of 11% from 2026 to 2033, fueled by adoption in home care and smaller clinics. The device’s portability, user-friendly interface, and rapid results make it ideal for point-of-care settings. Integration with mobile apps and telehealth platforms further drives adoption. Rising awareness of preventive healthcare and cardiovascular monitoring programs among consumers accelerates growth. OTC availability and cost-effective consumables contribute to expanding market share. Alere’s focus on innovative features, including real-time trend tracking, supports rapid segment growth.

- By Platform

On the basis of platform, the market is segmented into lateral flow assays (immunochromatography tests), molecular diagnostics, immunoassays, dipsticks, and microfluidics. The lateral flow assays segment dominated the market with the largest revenue share of 41% in 2025, driven by its simplicity, rapid turnaround time, and suitability for point-of-care testing. Lateral flow devices are widely used in hospitals, diagnostic centers, and home settings for quick lipid profiling. They require minimal training, are portable, and provide reliable results. Their affordability and compatibility with digital reporting systems further support dominance. Clinicians and patients alike prefer lateral flow assays for their ease of use and efficiency. The segment’s integration with mobile apps and cloud-based platforms enhances its adoption.

The microfluidics segment is expected to witness the fastest growth with a CAGR of 12% from 2026 to 2033, fueled by technological innovation in miniaturized, high-throughput testing systems. Microfluidic devices enable rapid multi-analyte lipid profiling with minimal sample volume. Their adoption is growing in research laboratories and advanced clinical centers. Enhanced accuracy, automation, and portability make them appealing for next-generation POCT. Integration with mobile and digital health platforms accelerates usability in home and outpatient settings. Rising R&D investment in microfluidic technology drives rapid segment expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, professional diagnostic centers, home care, research laboratories, and other end users. The hospitals segment dominated the market with the largest revenue share of 48% in 2025, driven by the high patient volume, frequent lipid screenings, and integration with clinical workflows. Hospitals prefer reliable instruments for rapid testing and accurate diagnosis. Advanced analyzers with connectivity to EHR systems further reinforce dominance. Hospitals conduct routine preventive screenings for hyperlipidemia and cardiovascular risk. Government programs and insurance reimbursements also support higher adoption in hospital settings. Continuous upgrades in hospital infrastructure contribute to the segment’s leadership.

The home care segment is expected to witness the fastest growth with a CAGR of 13% from 2026 to 2033, fueled by rising consumer awareness of preventive healthcare and the convenience of self-monitoring. Home-based lipid POCT devices allow patients to track cholesterol and triglyceride levels without clinic visits. Integration with mobile apps and telehealth platforms facilitates remote monitoring and physician guidance. Affordable, easy-to-use devices support adoption among health-conscious consumers. Home care adoption is driven by lifestyle management programs and chronic disease monitoring. Convenience, privacy, and accessibility are key growth drivers.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The direct tender segment dominated the market with the largest revenue share of 57% in 2025, driven by bulk procurement by hospitals, professional diagnostic centers, and government programs. Direct tender agreements ensure timely delivery, maintenance, and cost efficiency for large-scale institutions. Vendors often provide training and support as part of tender contracts, enhancing adoption. Hospitals and clinics prefer direct procurement for reliable supply of instruments and consumables. Bulk orders reduce per-unit cost, encouraging larger institutions to invest. Strong relationships between manufacturers and institutional buyers support continued dominance.

The retail sales segment is expected to witness the fastest growth with a CAGR of 14% from 2026 to 2033, fueled by the growing home care market and online sales channels. Retail availability of OTC lipid POCT devices enables consumers to access affordable and user-friendly testing kits. E-commerce platforms further expand reach to suburban and rural areas. Rising preventive healthcare awareness among consumers drives retail adoption. Mobile-enabled devices and kits with simple instructions attract first-time users. Convenience, affordability, and increasing online presence support rapid segment growth

North America Lipid POCT Market Regional Analysis

- The U.S. dominated the North America lipid POCT market with the largest revenue share of 72.9% in 2025, characterized by advanced healthcare infrastructure, high adoption of point-of-care diagnostics, and a strong presence of key industry players, with substantial growth across hospitals, professional diagnostic centers, and home care settings

- Healthcare providers and patients in the region highly value the convenience, rapid results, and real-time monitoring capabilities offered by lipid POCT devices, along with their integration with mobile apps and electronic health record (EHR) systems for seamless patient data management

- This strong adoption is further supported by well-established healthcare infrastructure, high awareness of preventive care, government screening programs, and increasing investment in point-of-care diagnostic technologies, establishing lipid POCT as a preferred solution for both clinical and home-based cardiovascular risk management

U.S. Lipid POCT Market Insight

The U.S. lipid POCT market captured the largest revenue share of 72.9% in 2025 within North America, fueled by the high prevalence of cardiovascular and lipid disorders and the growing emphasis on preventive healthcare. Patients and healthcare providers increasingly prefer rapid, point-of-care testing for cholesterol and triglycerides to enable immediate clinical decisions. The growing trend of home-based monitoring, coupled with mobile app integration and telehealth platforms, further propels market adoption. Moreover, hospitals and diagnostic centers are adopting advanced analyzers from leading brands such as Roche Reflotron and Alere Cholestech LDX to enhance screening efficiency. Increasing patient awareness and government-led cardiovascular screening initiatives are significantly contributing to market growth.

Canada Lipid POCT Market Insight

The Canada lipid POCT market to witnessing significant growth in 2025, driven by government programs promoting early detection of cardiovascular and lipid disorders. Canadian healthcare providers prioritize accuracy, portability, and integration with EHR systems in their selection of POCT devices. Rising preventive health awareness and screening campaigns support the adoption of connected analyzers and test kits in hospitals and professional diagnostic centers. The availability of both prescription-based and OTC testing devices is increasing accessibility across urban and semi-urban areas. In addition, manufacturers such as Samsung Labgeo and PTS Cardiochek are introducing user-friendly devices compatible with mobile apps, facilitating remote monitoring. The Canadian market benefits from well-developed healthcare infrastructure and favorable reimbursement policies.

Mexico Lipid POCT Market Insight

The Mexico lipid POCT market is witnessing significant growth in 2025, with growth driven by the expanding prevalence of hyperlipidemia and cardiovascular disorders, particularly in urban regions. Healthcare facilities are increasingly adopting portable and rapid testing devices to provide immediate results and improve patient outcomes. Awareness campaigns by government and non-profit organizations are encouraging preventive screenings, supporting market growth. OTC and home-based testing solutions are gaining traction among consumers seeking convenience and early detection. Brands such as Alere Afinion and PTS Cardiochek are expanding their presence, providing accessible and reliable POCT devices. Increasing investment in urban healthcare infrastructure and telehealth integration further boosts the adoption of lipid POCT in Mexico.

North America Lipid POCT Market Share

The North America Lipid POCT industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- PTS Diagnostics (U.S.)

- ACON Laboratories (U.S.)

- Nova Biomedical (U.S.)

- F. Hoffmann La Roche Ltd. (Switzerland)

- SD Biosensor, Inc. (S. Korea)

- Sinocare Inc. (China)

- Callegari Srl (Italy)

- MiCo BioMed (S. Korea)

- Menarini Diagnostics (Italy)

- EKF Diagnostics Holdings plc (UK)

- Siemens Healthineers AG (Germany)

- Danaher (U.S.)

- BD (U.S.)

- Quidel Corporation (U.S.)

- ARKRAY Inc. (Japan)

- Trinity Biotech plc (Ireland)

- Bio Rad Laboratories Inc. (U.S.)

- Guilin Urit Electronic Group Co., Ltd. (China)

What are the Recent Developments in North America Lipid POCT Market?

- In August 2025, Abbott reportedly launched its next‑generation Afinion™ 2 lipid panel test for point‑of‑care diagnostics in the U.S., delivering lab‑accurate cholesterol and lipid panel results in under 8 minutes, significantly speeding clinical decision‑making for cardiovascular risk assessment at decentralized sites

- In June 2025, Quest Diagnostics partnered with community health centers to pilot point‑of‑care lipid testing programs aimed at improving early detection of dyslipidemia among underserved populations in the United States, expanding access to rapid lipid screening beyond traditional clinical lab settings

- In January 2025, Roche Diagnostics received FDA 510(k) clearance for the Tina‑quant® Lipoprotein (a) Gen.2 Molarity assay, marking the first U.S. cleared blood test to measure lipoprotein(a) in nanomoles per liter, enabling more precise cardiovascular risk assessment and enhanced lipid metabolism evaluation in clinical use

- In September 2024, the Family Heart Foundation launched Cholesterol Connect, a program providing free at‑home lipid screenings and personalized guidance, expanding access to POCT lipid testing and education for cardiovascular risk management

- In May 2024, the U.S. FDA granted Breakthrough Device Designation to Roche’s Tina‑quant® Lp(a) RxDx assay, accelerating development of a test to help identify patients with elevated Lp(a) who may benefit from emerging Lp(a)‑lowering therapies, advancing personalized lipid diagnostics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.