North America Kickboxing Equipment Market, By Product (Gloves, Protective Gear, Hand Wraps, Punching Bags, Boxing Pads, Athletic Tapes, Clothing, Kettle Bell, and Others) Distribution Channel (Sports Outlets, E-Commerce, and Other) By Application (Individual and Commercial). Country (U.S., Canada, and Mexico) Industry Trends and Forecast to 2028

Market Analysis and Insights: North America Kickboxing Equipment Market

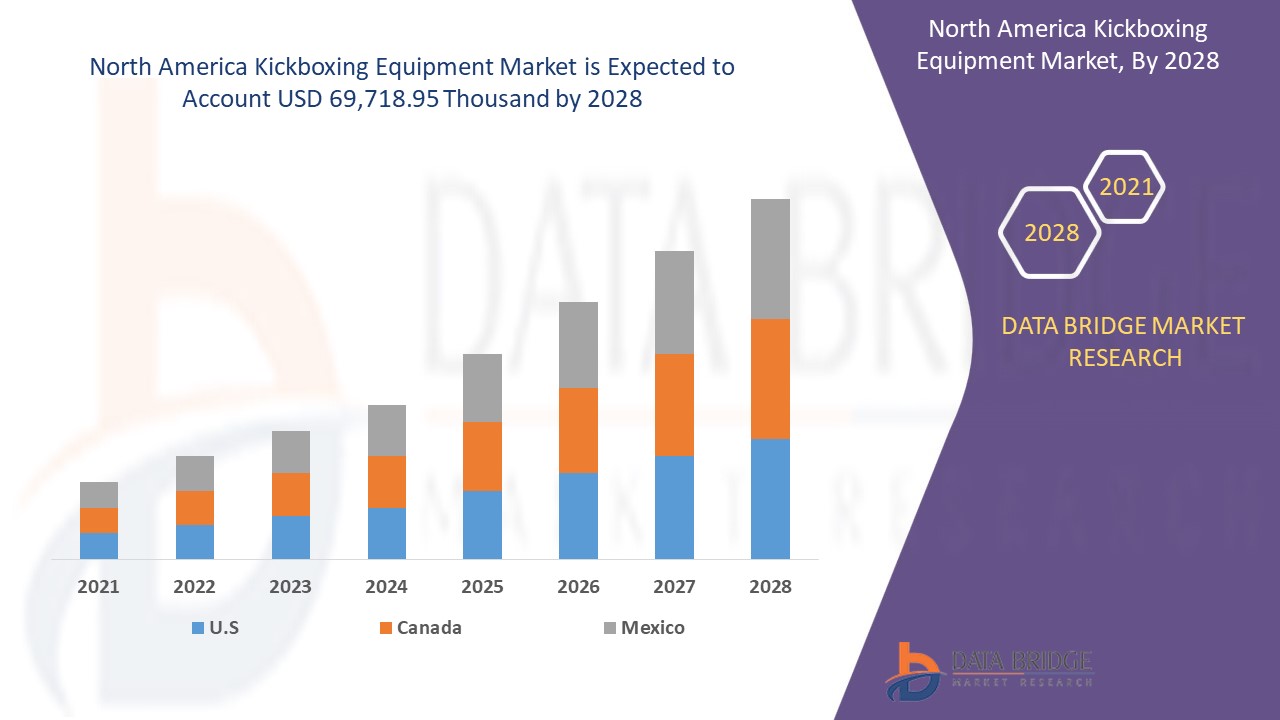

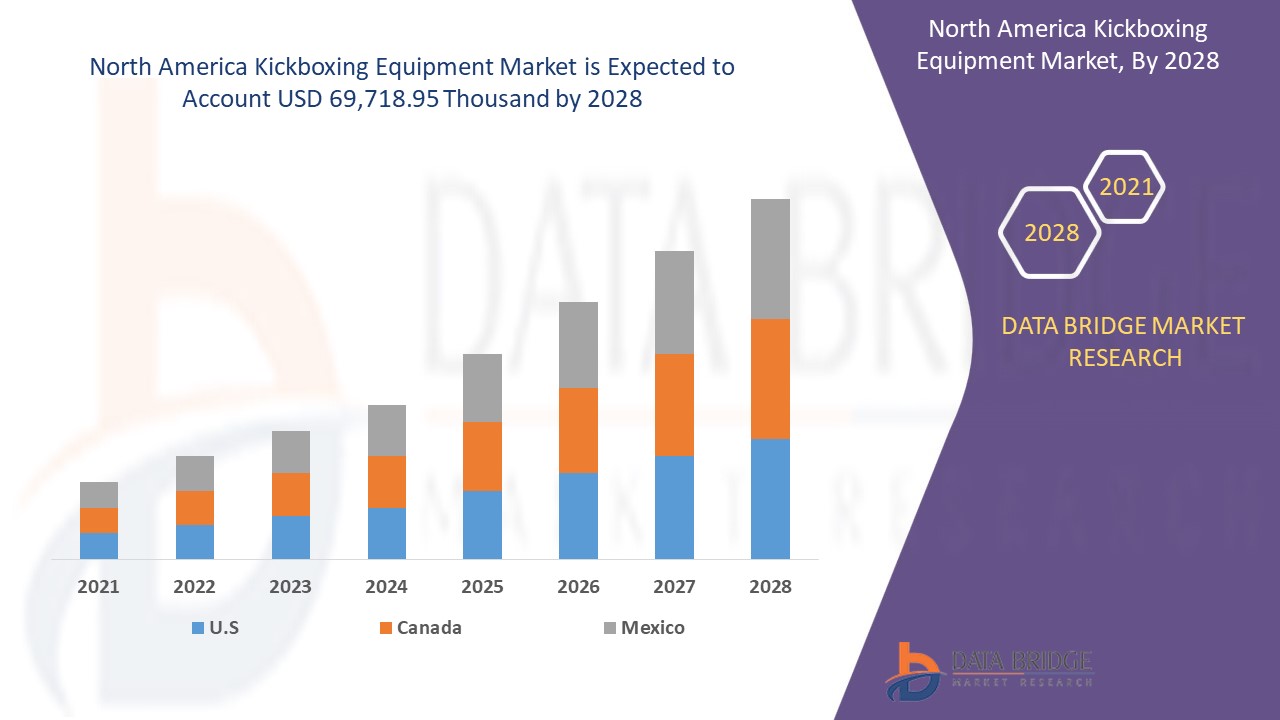

The North America kickboxing equipment market is expected to gain significant growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyzes that the market is growing with a CAGR of 4.1% in the forecast period of 2021 to 2028 and is expected to reach USD 69,718.95 thousand by 2028. Factors, such as rising trend of kickboxing exercise among people for burning calories, toning muscles and rapid emergence of new e-commerce platforms are expected to drive the growth the North America kickboxing equipment market.

Kickboxing is a form of martial art that involves punching, kicking, and footwork. It provides health benefits such as reduced body fat, increased flexibility, and a healthy heart. Kickboxing improves balance and builds body strength. Boxing involves forceful, repetitive punching, and precautions must be taken to prevent damage to bones in hand. Hand wraps are used to secure the hand bone, and the gloves are used to protect hands from blunt injury, which allows the boxers to throw punches with more force than if they did not use them. The mouth guard is important equipment that helps in protecting teeth and gums from injury and cushions the jaw, resulting in a decreased chance of knockout. The boxers use punching bags to test their punching skills. A small speed bag is used to hone reflexes and a repetitive punching skill, where a large cylindrical heavy bag filled with sand is used to practice power punching and body blows.

The kickboxing equipment market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the kickboxing equipment market scenario contact Data Bridge Market Research for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Kickboxing Equipment Market Scope and Market Size

The North America kickboxing equipment market is segmented based on product, distribution channel, and application, The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product, the North America kickboxing equipment market is segmented into gloves, protective gear, hand wraps, punching bags, boxing pads, athletic tapes, clothing , kettle bell, and others. In 2021, the gloves segment is expected to dominate the market as gloves are an essential part of equipment kit.

- On the basis of distribution channel, the North America kickboxing equipment market is segmented into sports outlets, E-commerce, and other. In 2021, the outlet segment is expected to dominate the market owing to several advantages including direct approach to academies and player’s promotion.

- On the basis of application, the North America kickboxing equipment market is segmented individual and commercial. In 2021, the commercial segment is expected to dominate the market due to more applications in commercial sector including gyms and coaching academies.

North America kickboxing equipment market Country Level Analysis

The kickboxing equipment market is analyzed and market size information is provided based on country, product, distribution channel, and application as referenced above.

Countries covered in the North America kickboxing equipment market report are the U.S., Canada, and Mexico. The U.S. dominates the market due high adoption rate of kickboxing and scope of implementation.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players to Enhance the Awareness for Kickboxing equipment are Boosting Growth of North America kickboxing equipment market.

The North America kickboxing equipment market also provides you with detailed market analysis for every country growth in particular market. Additionally, it provides the detail information regarding the market players’ strategy and their geographical presence. The data is available for historic period 2010 to 2019.

Competitive Landscape and North America Kickboxing Equipment Market Share Analysis

Kickboxing equipment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to North America kickboxing equipment market.

Major companies operating in the North America kickboxing equipment market are EVERLAST WORLDWIDE, INC., VENUM, RDX INC, CENTURY LLC, BUDOLAND, COMBAT BARANDS , LLC, FAITEX, FUJIAN WEIZHIXING SPORTS GOODS CO., LTD ,HAYABUSA FIGHTWEAR INC., PAFFEN SPORT GMBH & CO. KG, QINGDAO PLUS COMMERCE CO. LTD., REVGEAR, RIVAL BOXING GEAR USA, ADVANTEST CORPORATION, SMAI USA, STEYYX, and TWIN SPECIAL among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contracts and agreements are also initiated by the companies worldwide which are further accelerating the growth of the North America kickboxing equipment market.

For instance,

- In July 2021, Fairtex announced partnership with Cage Warriors. Under this agreement, Fairtex will be supplying gloves and equipment to the organization. This will help the company attract more customers.

- In April 2020, Fairtex collaborated with Urface to produce a unique, limited edition run of gloves and shorts. This helped the company strengthen its products portfolio of the company.

- In July 2020, Venum and UFC became exclusive outfitting partner. The company will be UFC’s new exclusive global outfitting and apparel partner. This helped Venum grow internationally.

SKU-