Market Analysis and Insights : North America IVD Regulatory Affairs Outsourcing Market

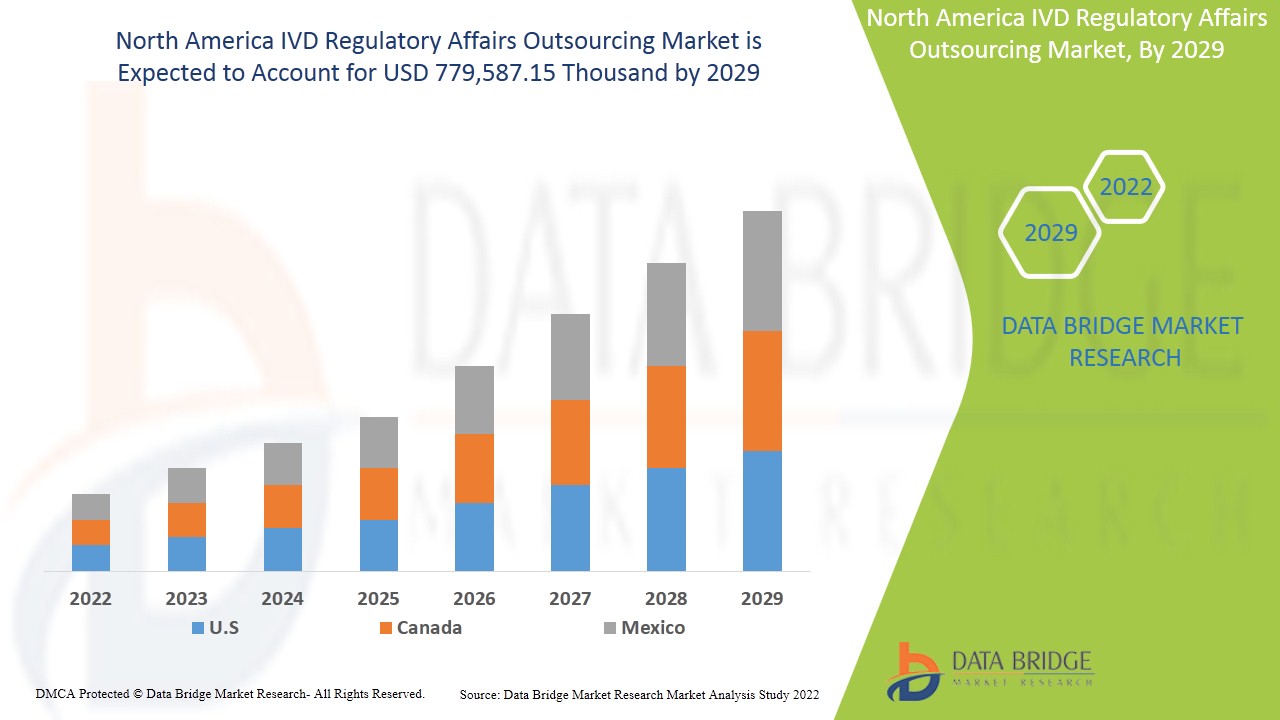

North America IVD regulatory affairs outsourcing market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with the CAGR of 13.4% in the forecast period of 2022 to 2029 and expected to reach USD 779,587.15 thousand by 2029.

- In vitro diagnostic products are reagents, devices, and systems used to diagnose disease or other conditions, including determining one's state of health to cure, mitigate, treat, or prevent disease. These products are intended for use in the collecting, preparation, and examination of human body specimens. Regulatory affairs play a crucial part in the in vitro diagnostic device (IVD) and medical device industry. The regulatory affairs outsourcing services entails medical writing and publication of regulatory documentation by professionals who contribute to the production of high-quality documents for clinical research projects. The demand for regulatory services outsourcing is substantially increasing in clinical studies conducted in emerging economies, providing a healthy platform for this industry's growth.

The major factors driving the growth of the IVD regulatory affairs outsourcing market are development of project based support leads to long term outsourcing agreement among organization and technological advancement in various in vitro diagnostic devices. Increase in R&D activities by companies across the region is creating opportunities for the growth of the market. Higher cost related to maintenance and outsourcing of IVD is acting as the major restraint for IVD regulatory affairs outsourcing market. Shortage of skilled personnel for handling in vitro diagnostic devices is acting as a major challenge for the growth of the market.

This IVD regulatory affairs outsourcing market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America IVD Regulatory Affairs Outsourcing Market Scope and Market Size

North America IVD regulatory affairs outsourcing market is segmented into seven notable segments which are based on the services, indication, deployment mode, organization size, stage, class and end user.

- On the basis of services, the North America IVD regulatory affairs outsourcing market is segmented into regulatory writing & submissions, regulatory registration & clinical trial applications, regulatory consulting, legal representation, data management services, chemistry manufacturing and controls (CMC) services, and others. In 2022, regulatory writing & submissions is expected to dominate the market as the industry is responding to several widespread developments, which have triggered innovations and expansion in IVD technologies. These large-scale trends include an aging population, an increase in the occurrence of infectious diseases, the influence of big tech innovators and acceptance of personalized care, and desire for ease of use.

- On the basis of indication, the North America IVD regulatory affairs outsourcing market is segmented into oncology, neurology, cardiology, clinical chemistry and immunoassays, precision medicine, infectious diseases, diabetes, genetic testing, HIV/AIDS, haematology, drug testing/pharmacogenomics, blood transfusion, point of care, and others. In 2022, the oncology segment is expected to dominate as it improves the predictability of the oncology drug development process and becomes a useful tool for oncologists when deciding on a treatment plan for a patient

- On the basis of deployment mode, the North America IVD regulatory affairs outsourcing market is segmented into cloud and on-premises. In 2022, the cloud segment is expected to dominate as it Cloud computing technology in IVD regulatory gives a stable infrastructure with maximum output to IVD systems dealing firms due to its cost-effective and solution-flexible properties.

- On the basis of organization size, the North America IVD regulatory affairs outsourcing market is segmented into small and medium enterprises (SMES) and large enterprises. In 2022, the large enterprises segment is expected to dominate as it involvement of the peer high quality technology and service portfolio related to the IVD regulatory.

- On the basis of stage, the North America IVD regulatory affairs outsourcing market is segmented into clinical, preclinical, and PMA (post-market authorization). In 2022, clinical segment is expected to dominate the market because clinical trials require clearance from authorities, every result must be filed and thoroughly recorded before submissions, regulatory affairs services are in high demand in this area.

- On the basis of class, the North America IVD regulatory affairs outsourcing market is segmented into class I, class II, and class III. In 2022, class I segment is expected to dominate the market as it involves no public health risk or low personal risk with lowest regulations. These are high in demand and 47% of medical devices fall under this category.

- On the basis of end user, the North America IVD regulatory affairs outsourcing market is segmented into pharmaceutical companies, medical device companies, biotechnology companies, and others. In 2022, medical device companies are expected to dominate the market by emerging in various efficient technological services and standards.

North America IVD Regulatory Affairs Outsourcing Market Country Level Analysis

North America IVD regulatory affairs outsourcing market is analysed and market size information is provided by the country, services, indication, deployment mode, organization size, stage, class and end user.

The countries covered in North America IVD regulatory affairs outsourcing market report are U.S., Mexico and Canada.

The U.S. is dominating the market in North America region due to increasing developments in new technologies in healthcare sector and strategic acquisition & partnership among organization.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of IVD Regulatory Affairs Outsourcing

North America IVD regulatory affairs outsourcing market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in IVD regulatory affairs outsourcing and changes in regulatory scenarios with their support for the IVD regulatory affairs outsourcing market. The data is available for historic period 2012 to 2020.

Competitive Landscape and North America IVD Regulatory Affairs Outsourcing Market Share Analysis

North America IVD regulatory affairs outsourcing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to North America IVD regulatory affairs outsourcing market.

Some of the major players operating in the report are IVD regulatory affairs outsourcing market are Freyr Solutions, AXSource, LORENZ Life Sciences Group, PPD Inc. (A Subsidiary of Thremofisher Scientific Inc.), Promedica International, a California Corporation, Assent Compliance Inc., MakroCare, EMERGO, ICON, Parexel International Corporation, CRITERIUM, INC., Groupe ProductLife S.A., Propharma Group, VCLS, Labcorp Drug Development, WuXi AppTec, Charles River Laboratories, Genpact, Medpace, Regulatory Compliance Associates Inc., RQM+, Saraca Solutions Private Limited, PBC BioMed, Dor Pharmaceutical Services, Qserve, mdiConsultants, Inc. among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of North America IVD regulatory affairs outsourcing market.

For instance,

- In September 2021, Tánaiste announces multi-million Euro R&D support of ICON plc accelerate decentralised clinical trial technology.The Tánaiste and Minister for Enterprise, Trade and Employment, Leo Varadkar TD announced that ICON plc (NASDAQ: ICLR), a Dublin-based global provider of drug development and commercialisation services to pharmaceutical, biotechnology and medical device industries, has been awarded USD 4 million in R&D support administered by Enterprise Ireland to further enhance its data solutions and decentralised clinical trial technology. This has helped company to improve its position in market.

- In October 2021, Propharma group acquired Pharmica Consulting. ProPharma Group, a portfolio company of Odyssey Investment Partners, has acquired Pharmica Consulting, a life science consulting company that provides Project Management (PM) consulting solutions and proprietary operations software to pharmaceutical and biotech companies for the execution of clinical trials. This has helped the company to expand their business globally in market.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for IVD regulatory affairs outsourcing through expanded range of size.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SERVICE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, REGULATORY SCENARIO

4.1.1 THE U.S.

4.1.2 REGULATIONS IN EUROPE

4.1.3 REGULATIONS IN ASIA

4.1.3.1 CHINA

4.1.3.2 SOUTH KOREA

4.1.3.3 MALAYSIA

4.1.3.4 THAILAND

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN PREVALENCE OF CHRONIC DISEASES ACROSS THE REGION

5.1.2 TECHNOLOGICAL ADVANCEMENT IN DEVELOPING VARIOUS IN VITRO DIAGNOSTIC DEVICES

5.1.3 DEVELOPMENT OF PROJECT-BASED SUPPORT LEADS TO LONG TERM OUTSOURCING AGREEMENT AMONG ORGANIZATION

5.1.4 INCREASE IN PRODUCT REGISTRATION NUMBERS AND CLINICAL TRIAL APPROVALS ACROSS THE REGION

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS REGARDING MEDICAL DEVICES IN DIFFERENT REGIONS

5.2.2 HIGHER COST RELATED TO MAINTENANCE AND OUTSOURCING OF IVD

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC ACQUISITION & PARTNERSHIP AMONG ORGANIZATION

5.3.2 EMERGENCE OF VARIOUS EFFICIENT TECHNOLOGICAL SERVICES AND STANDARDS

5.3.3 INCREASE IN R&D ACTIVITIES BY COMPANIES ACROSS THE REGION

5.4 CHALLENGES

5.4.1 LACK OF INFRASTRUCTURE IN HEALTHCARE SERVICE

5.4.2 SHORTAGE OF SKILLED PERSONNEL FOR HANDLING IN VITRO DIAGNOSTIC DEVICES

6 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE

6.1 OVERVIEW

6.2 REGULATORY WRITING & SUBMISSIONS

6.3 LEGAL REPRESENTATION

6.4 REGULATORY CONSULTING

6.5 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

6.6 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

6.7 DATA MANAGEMENT SERVICES

6.8 OTHERS

7 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION

7.1 OVERVIEW

7.2 CLINICAL CHEMISTRY AND IMMUNOASSAYS

7.3 INFECTIOUS DISEASES

7.3.1 VIROLOGY

7.3.2 MICROBIOLOGY AND MYCOLOGY

7.3.3 BACTERIOLOGY

7.3.4 SEPSIS

7.3.5 HEPATITIS B

7.3.6 HEPATITIS C

7.3.7 MALARIA

7.3.8 TUBERCULOSIS

7.3.9 SYPHILIS

7.3.10 HUMAN PAPILLOMAVIRUS (HPV) INFECTION

7.3.11 OTHERS

7.4 HAEMATOLOGY

7.5 DRUG TESTING/PHARMACOGENOMICS

7.6 PRECISION MEDICINE

7.7 DIABETES

7.8 BLOOD TRANSFUSION

7.9 CARDIOLOGY

7.1 POINT OF CARE

7.10.1 WAIVED TEST

7.10.2 AT HOME TESTS

7.11 ONCOLOGY

7.12 NEUROLOGY

7.13 HIV/AIDS

7.14 GENETIC TESTING

7.15 OTHERS

8 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS

8.1 OVERVIEW

8.2 CLASS I

8.3 CLASS III

8.4 CLASS II

9 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 SMALL & MEDIUM ENTERPRISES (SMES)

11 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE

11.1 OVERVIEW

11.2 CLINICAL

11.3 PRECLINICAL

11.4 PMA (POST MARKET AUTHORIZATION)

12 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER

12.1 OVERVIEW

12.2 MEDICAL DEVICE COMPANIES

12.2.1 BY ORGANIZATION SIZE

12.2.1.1 LARGE ENTERPRISES

12.2.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.2.2 BY SERVICE

12.2.2.1 REGULATORY WRITING & SUBMISSIONS

12.2.2.2 LEGAL REPRESENTATION

12.2.2.3 REGULATORY CONSULTING

12.2.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.2.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.2.2.6 DATA MANAGEMENT SERVICES

12.2.2.7 OTHERS

12.3 PHARMACEUTICAL COMPANIES

12.3.1 BY ORGANIZATION SIZE

12.3.1.1 LARGE ENTERPRISES

12.3.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.3.2 BY SERVICE

12.3.2.1 REGULATORY WRITING & SUBMISSIONS

12.3.2.2 LEGAL REPRESENTATION

12.3.2.3 REGULATORY CONSULTING

12.3.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.3.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.3.2.6 DATA MANAGEMENT SERVICES

12.3.2.7 OTHERS

12.4 BIOTECHNOLOGY COMPANIES

12.4.1 BY ORGANIZATION SIZE

12.4.1.1 LARGE ENTERPRISES

12.4.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.4.2 BY SERVICE

12.4.2.1 REGULATORY WRITING & SUBMISSIONS

12.4.2.2 LEGAL REPRESENTATION

12.4.2.3 REGULATORY CONSULTING

12.4.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.4.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.4.2.6 DATA MANAGEMENT SERVICES

12.4.2.7 OTHERS

12.5 OTHERS

13 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ICON PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MEDPACE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 PAREXEL INTERNATIONAL CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 LABCORP DRUG DEVELOPMENT

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 PPD INC. (A SUBSIDIARY OF THERMOFISHER SCIENTIFIC INC.)

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 CHARLES RIVER LABORATORIES

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 FREYR

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ASSENT COMPLIANCE INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ANDAMAN MEDICAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ASIA ACTUAL

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 AXSOURCE

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 CRITERIUM, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 DOR PHARMACEUTICAL SERVICES

16.13.1 COMPANY SNAPSHOT

16.13.2 SERVICE PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 EMERGO BY UL

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 GENPACT

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 GROUPE PRODUCTLIFE S.A.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 LORENZ LIFE SCIENCES GROUP

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MAKROCARE

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MARACA INTERNATIONAL BVBA

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MDICONSULTANTS, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 PBC BIOMED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 PROMEDICA INTERNATIONAL, A CALIFORNIA CORPORATION

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 PROPHARMA GROUP

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 QSERVE

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 REGULATORY COMPLIANCE ASSOCIATES INC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 RMQ+

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SARACA SOLUTIONS PRIVATE LIMITED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 VCLS

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENTS

16.29 WUXI APPTEC

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PRODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 2 NORTH AMERICA REGULATORY WRITING & SUBMISSIONS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 NORTH AMERICA LEGAL REPRESENTATION IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA REGULATORY CONSULTING IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA DATA MANAGEMENT SERVICES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA CLINICAL CHEMISTRY AND IMMUNOASSAYS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION,2020-2029 (THOUSAND)

TABLE 12 NORTH AMERICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA HAEMATOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA DRUG TESTING/PHARMACOGENOMICS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 15 NORTH AMERICA PRECISION MEDICINE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 16 NORTH AMERICA DIABETES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 17 NORTH AMERICA BLOOD TRANSFUSION IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 18 NORTH AMERICA CARDIOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 19 NORTH AMERICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 20 NORTH AMERICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA ONCOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 22 NORTH AMERICA NEUROLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 23 NORTH AMERICA HIV/AIDS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 24 NORTH AMERICA GENETIC TESTING IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 25 NORTH AMERICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 26 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA CLASS I IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA CLASS III IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 29 NORTH AMERICA CLASS II IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA CLOUD IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA ON-PREMISES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA LARGE ENTERPRISES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA SMALL & MEDIUM ENTERPRISES (SMES) IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA CLINICAL IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA PRECLINICAL IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA PMA (POST MARKET AUTHORIZATION) IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 67 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 68 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 69 U.S. INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 U.S. POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 72 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 73 U.S. REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 74 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 75 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 76 U.S. MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 77 U.S. MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 78 U.S. PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 79 U.S. PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 80 U.S. BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 81 U.S. BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 82 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 83 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 84 CANADA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 CANADA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 87 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 88 CANADA REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 89 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 90 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 91 CANADA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 92 CANADA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 93 CANADA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 94 CANADA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 95 CANADA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 96 CANADA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 97 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 98 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 99 MEXICO INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 MEXICO POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 102 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 103 MEXICO REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 104 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 105 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 106 MEXICO MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 107 MEXICO MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 108 MEXICO PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 109 MEXICO PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 110 MEXICO BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 111 MEXICO BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SEGMENTATION

FIGURE 11 RISE IN THE PREVALENCE OF CHRONIC DISEASES ACROSS IS EXPECTED TO DRIVE NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET

FIGURE 15 MULTIPLE CHRONIC CONDITIONS AMONG PEOPLE AGED 65 AND ABOVE IN EUROPEAN REGION (2017)

FIGURE 16 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY SERVICE, 2021

FIGURE 17 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY INDICATION, 2021

FIGURE 18 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY CLASS, 2021

FIGURE 19 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 20 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 21 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY STAGE, 2021

FIGURE 22 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY END USER, 2021

FIGURE 23 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY SERVICE (2022-2029)

FIGURE 28 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.