North America Internet Of Medical Things Iomt Market

Market Size in USD Billion

CAGR :

%

USD

62.50 Billion

USD

310.77 Billion

2025

2033

USD

62.50 Billion

USD

310.77 Billion

2025

2033

| 2026 –2033 | |

| USD 62.50 Billion | |

| USD 310.77 Billion | |

|

|

|

|

North America Internet of Medical Things (IoMT) Market Size

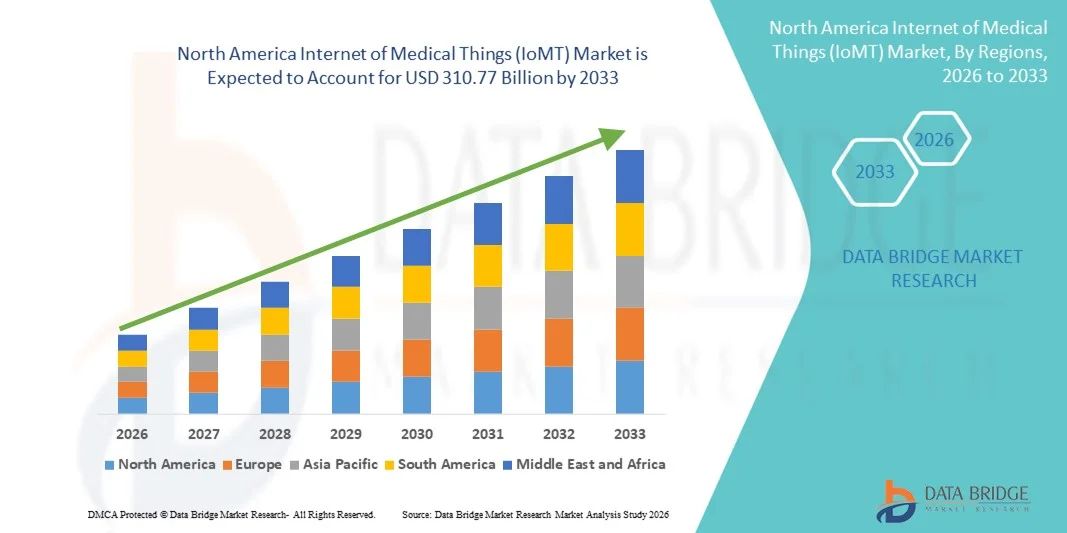

- The North America Internet of Medical Things (IoMT) market size was valued at USD 62.50 billion in 2025 and is expected to reach USD 310.77 billion by 2033, at a CAGR of 22.2% during the forecast period

- The market growth is primarily driven by the rising adoption of connected medical devices, telehealth solutions, and remote patient monitoring systems, which are increasingly integrated into hospital networks and home healthcare settings

- In addition, growing demand for real-time patient data, enhanced operational efficiency, and improved healthcare outcomes is positioning IoMT solutions as critical components of the digital healthcare ecosystem. These factors are accelerating the deployment of IoMT devices across hospitals, clinics, and home care environments, thereby significantly propelling market growth

North America Internet of Medical Things (IoMT) Market Analysis

- IoMT devices, including connected medical devices, wearable health monitors, and remote patient monitoring systems, are increasingly essential in modern healthcare due to their ability to provide real-time patient data, enable telehealth services, and integrate seamlessly with hospital IT infrastructure

- The rising adoption of IoMT is primarily driven by the demand for improved patient outcomes, operational efficiency, and remote healthcare capabilities, alongside growing investments in digital health technologies by hospitals and healthcare provider

- The United States dominated the North America Internet of Medical Things (IoMT) market with the largest revenue share of 86.2% in 2025, supported by advanced healthcare infrastructure, high healthcare IT spending, and the presence of key market players

- Canada is expected to be the fastest-growing country in the North America Internet of Medical Things (IoMT) market during the forecast period, due to increasing adoption of on-body devices and home-use medical devices, along with government initiatives to expand digital healthcare infrastructure and remote patient monitoring programs

- Hardware segment dominated the North America Internet of Medical Things (IoMT) market with a share of 45.2% in 2025, driven by the growing deployment of medical sensors, wearable monitors, and connected diagnostic devices across hospitals and homecare settings

Report Scope and North America Internet of Medical Things (IoMT) Market Segmentation

|

Attributes |

North America Internet of Medical Things (IoMT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Internet of Medical Things (IoMT) Market Trends

Enhanced Patient Care Through Connected Devices and Cloud Integration

- A significant and accelerating trend in the North America Internet of Medical Things (IoMT) market is the increasing integration of connected medical devices with cloud-based platforms and healthcare IT systems, significantly improving patient monitoring and care coordination

- For instance, wearable glucose monitors now sync seamlessly with cloud-based applications, allowing healthcare providers to track patients’ blood sugar levels in real-time and adjust treatment plans remotely

- AI integration in IoMT devices enables predictive analytics for early detection of anomalies, personalized health recommendations, and intelligent alerts based on patient activity. For instance, some wearable cardiac monitors use AI to detect arrhythmias and notify clinicians automatically

- The seamless integration of IoMT devices with electronic health records (EHRs) and telehealth platforms facilitates centralized patient management, allowing clinicians to monitor multiple patients from a single dashboard and coordinate interventions more efficiently

- This trend towards more intelligent, data-driven, and interconnected medical devices is reshaping expectations for digital healthcare. Consequently, companies such as Philips and Medtronic are developing AI-enabled IoMT devices that integrate cloud management, predictive analytics, and remote monitoring features

- The demand for IoMT devices with advanced AI and cloud capabilities is growing rapidly across hospitals and homecare settings, as healthcare providers increasingly prioritize patient safety, convenience, and remote healthcare efficiency

- Telehealth and mobile health (mHealth) applications are increasingly leveraging IoMT devices for continuous patient engagement, improving adherence to treatment plans and reducing hospital visits. For instance, wearable blood pressure monitors can transmit data directly to mobile health apps for real-time monitoring and feedback

North America Internet of Medical Things (IoMT) Market Dynamics

Driver

Rising Demand Due to Chronic Diseases and Remote Patient Monitoring

- The increasing prevalence of chronic diseases and aging populations, coupled with the adoption of remote patient monitoring solutions, is a significant driver of the North America Internet of Medical Things (IoMT) market

- For instance, in April 2025, Dexcom announced an upgraded CGM system with cloud integration to improve diabetes management through real-time data access by clinicians and patients

- IoMT devices allow continuous monitoring of vital signs, early detection of health deterioration, and timely intervention, offering a compelling advantage over conventional hospital-based care

- Furthermore, government initiatives promoting telehealth adoption and reimbursement policies for remote monitoring devices are supporting widespread deployment of IoMT solutions

- The convenience of remote monitoring, real-time alerts, and data-driven insights for personalized care is a key factor driving adoption in both hospitals and homecare sectors

- The increasing availability of user-friendly IoMT devices and the trend toward patient-centered care models further contribute to sustained market growth

- Rising investments from venture capital and healthcare technology companies are accelerating the development and deployment of innovative IoMT devices. For instance, companies such as Withings and iRhythm are expanding their product portfolios with cloud-enabled monitoring solutions

- Integration of AI-driven predictive analytics into IoMT platforms is enhancing chronic disease management, allowing healthcare providers to proactively adjust treatments. For instance, AI-enabled wearables can predict heart failure events before they occur, reducing hospital admissions

Restraint/Challenge

Data Privacy Concerns and High Implementation Costs

- Concerns surrounding data privacy and cybersecurity vulnerabilities of connected medical devices pose a significant challenge to the broader adoption of IoMT solutions

- For instance, reports of unauthorized access to patient data in remote monitoring systems have made some hospitals cautious about deploying connected devices widely

- Addressing these privacy and security concerns through robust encryption, secure authentication protocols, and compliance with HIPAA regulations is crucial for building trust among healthcare providers and patients

- In addition, the relatively high cost of advanced IoMT devices, software platforms, and cloud infrastructure can hinder adoption, particularly for small clinics and budget-conscious homecare providers

- While prices for basic wearable monitors and sensors are gradually decreasing, premium features such as AI-based analytics or continuous multi-parameter monitoring often come at a higher price, limiting uptake

- Overcoming these challenges through enhanced cybersecurity, regulatory compliance, and development of cost-effective IoMT solutions will be vital for sustained growth in the North America IoMT market

- Limited digital literacy among healthcare staff and patients can slow adoption, requiring training programs and support infrastructure. For instance, older patients may need guidance to use wearable monitoring devices effectively

- Integration challenges between legacy hospital IT systems and new IoMT platforms may restrict deployment. For instance, some hospitals face difficulties connecting older EHR systems with cloud-based remote monitoring devices

North America Internet of Medical Things (IoMT) Market Scope

The market is segmented on the basis of component, platform, mode of service delivery, connectivity devices, application, and end-user.

- By Component

On the basis of component, the North America IoMT market is segmented into hardware, software, and services. Hardware segment dominated the market with the largest revenue share of 45.2% in 2025, driven by the extensive deployment of medical sensors, wearable monitors, and connected diagnostic devices in hospitals and homecare settings. Hardware adoption is fueled by the increasing need for accurate and continuous monitoring of vital signs, chronic disease management, and remote patient care. Healthcare providers prioritize high-quality IoMT devices that can reliably capture and transmit patient data in real-time. In addition, hardware components often form the foundation for broader IoMT solutions, including integration with software platforms and cloud management systems. The increasing number of IoMT-enabled hospitals and homecare setups in the U.S. has reinforced the dominance of this segment.

Software segment is anticipated to witness the fastest growth during the forecast period, at a CAGR of 19.8% from 2026 to 2033. Software solutions for IoMT, including device management platforms, analytics applications, and AI-enabled monitoring tools, are increasingly in demand to process and interpret large volumes of patient data. The surge in telehealth adoption and cloud-based healthcare solutions is accelerating the deployment of software-driven IoMT systems. Software also enables predictive healthcare insights, remote diagnostics, and workflow automation, which are essential for modern healthcare providers. Increasing investment in AI and machine learning-based analytics is further boosting the software segment’s growth.

- By Platform

On the basis of platform, the North America IoMT market is segmented into device management, application management, and cloud management. Cloud Management segment dominated the market in 2025 due to its ability to store, manage, and analyze large volumes of patient data securely. Cloud platforms allow healthcare providers to remotely access patient information, integrate multiple devices, and ensure seamless interoperability across hospitals and homecare setups. The scalability and flexibility offered by cloud management systems make them ideal for handling diverse IoMT devices, enabling real-time monitoring and predictive analytics. Cloud platforms also simplify updates, security compliance, and integration with electronic health record (EHR) systems. Hospitals and homecare providers are increasingly adopting cloud solutions for centralized patient data management.

Device Management segment is expected to witness the fastest growth from 2026 to 2033. Device management platforms facilitate the monitoring, configuration, and maintenance of a variety of IoMT devices, ensuring optimal performance and security. With the increasing number of connected medical devices in hospitals, clinics, and homecare, device management solutions are critical for interoperability and real-time control. These platforms also provide tools for remote troubleshooting, firmware updates, and compliance monitoring. Growing adoption of connected healthcare ecosystems and the need for efficient device administration are driving this segment’s expansion.

- By Mode of Service Delivery

On the basis of service delivery, the North America IoMT market is segmented into on-premise and cloud. Cloud segment dominated in 2025 due to the growing preference for scalable, remotely accessible, and cost-efficient healthcare solutions. Cloud-based IoMT platforms enable healthcare providers to access patient data from multiple locations, support telehealth consultations, and integrate analytics for real-time decision-making. The flexibility to manage numerous connected devices remotely makes cloud delivery ideal for hospitals and homecare providers. In addition, cloud systems reduce upfront IT infrastructure costs and provide rapid deployment capabilities. Healthcare providers in the U.S. and Canada increasingly rely on cloud-based services for patient monitoring and operational efficiency.

On-Premise segment is expected to witness the fastest growth during the forecast period, driven by hospitals and research institutes that require higher control over sensitive patient data. On-premise solutions offer enhanced security and compliance with stringent healthcare regulations such as HIPAA. They are preferred by large hospitals and clinics with in-house IT teams capable of managing the infrastructure. The ability to integrate legacy systems, customize software, and maintain full control over data is fueling adoption in critical care and specialized medical facilities. On-premise deployment also addresses latency and connectivity challenges, which is essential for certain high-acuity applications.

- By Connectivity Devices

On the basis of connectivity, the North America IoMT market is segmented into wired and wireless. Wireless segment dominated the market in 2025 due to the increasing adoption of wearable devices, wireless sensors, and remote patient monitoring systems that require mobility and flexibility. Wireless connectivity enables real-time transmission of vital data, reduces installation complexity, and supports integration with mobile and cloud applications. Hospitals and homecare setups prefer wireless solutions for their ease of deployment and patient comfort. The proliferation of Wi-Fi, Bluetooth, and other short-range wireless technologies further strengthens this segment. Wireless IoMT devices also facilitate continuous monitoring of patients without restricting movement.

Wired segment is expected to witness the fastest growth during the forecast period, driven by specialized medical devices and equipment in critical care environments that require high reliability and stable connectivity. Wired devices ensure minimal data loss, consistent power supply, and reduced interference, making them ideal for intensive monitoring in hospitals. Healthcare providers prioritize wired solutions in operating rooms, intensive care units, and diagnostic laboratories where uninterrupted data flow is crucial. The segment is also supported by ongoing infrastructure upgrades in modern hospitals.

- By Application

On the basis of application, the North America IoMT market is segmented into on-body devices, healthcare providers, home-use medical devices, community, and others. Healthcare Providers segment dominated in 2025, driven by the adoption of IoMT solutions in hospitals, clinics, and diagnostic centers. Connected medical devices allow healthcare providers to monitor patient vitals, track treatment outcomes, and streamline operations efficiently. Hospitals leverage IoMT platforms for real-time analytics, predictive alerts, and integration with electronic health records. The need for improved patient safety, workflow automation, and cost-effective care delivery reinforces the dominance of this segment. IoMT devices also enhance clinical decision-making and reduce manual errors in healthcare workflows.

On-Body Devices segment is expected to witness the fastest growth during the forecast period, fueled by increasing adoption of wearable health monitors, smart patches, and fitness trackers. These devices enable continuous monitoring of heart rate, blood pressure, glucose levels, and other critical health parameters outside clinical settings. The growing trend of remote patient monitoring, chronic disease management, and preventive healthcare is accelerating the deployment of on-body devices. In addition, patient preference for convenient, non-invasive monitoring solutions contributes to strong demand. Advanced AI analytics and cloud integration further enhance the functionality of these devices.

- By End-User

On the basis of end-user, the North America IoMT market is segmented into hospitals, clinics, research institutes & academics, homecare, and others. Hospitals segment dominated in 2025 due to large-scale deployment of IoMT devices for inpatient monitoring, surgical applications, and critical care management. Hospitals require connected devices to monitor multiple patients simultaneously, streamline operations, and ensure compliance with healthcare standards. The adoption is driven by increasing patient volumes, demand for real-time analytics, and integration with hospital IT systems. Leading hospitals in the U.S. and Canada are early adopters of AI-enabled IoMT solutions for efficiency and patient safety. IoMT devices also enhance telemedicine and remote consultation capabilities.

Homecare segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising preference for home-based healthcare, chronic disease management, and remote monitoring solutions. Homecare users benefit from wearable devices, connected monitoring systems, and cloud-enabled platforms to manage health conditions conveniently. The growth is supported by government initiatives for telehealth, increasing patient awareness, and technological advancements in portable IoMT devices. Homecare solutions reduce hospital visits, lower healthcare costs, and provide continuous monitoring for elderly and chronic patients.

North America Internet of Medical Things (IoMT) Market Regional Analysis

- The United States dominated the North America Internet of Medical Things (IoMT) market with the largest revenue share of 86.2% in 2025, supported by advanced healthcare infrastructure, high healthcare IT spending, and the presence of key market players

- Healthcare providers and patients in the region increasingly value real-time monitoring, predictive analytics, and remote patient care capabilities offered by IoMT solutions, enhancing treatment outcomes and operational efficiency

- This widespread adoption is further supported by favorable government policies, reimbursement frameworks for telehealth and remote monitoring, and a robust ecosystem of hospitals, clinics, and homecare providers, establishing IoMT devices as essential tools in modern healthcare delivery

The U.S. Internet of Medical Things (IoMT) Market Insight

The U.S. captured the largest revenue share of 86.2% in the North America Internet of Medical Things (IoMT) market in 2025, fueled by rapid adoption of connected medical devices and remote patient monitoring solutions. Healthcare providers increasingly prioritize real-time patient monitoring, predictive analytics, and telehealth services to improve clinical outcomes and operational efficiency. The growing demand for AI-enabled diagnostics and cloud-integrated IoMT platforms further propels the market. Moreover, favorable government policies, reimbursement frameworks, and robust investments in digital health infrastructure are significantly contributing to market expansion. The widespread presence of major IoMT solution providers and innovative start-ups ensures continuous development and deployment of advanced monitoring and analytics solutions.

Canada Internet of Medical Things (IoMT) Market Insight

Canada is witnessing steady growth in the North America Internet of Medical Things (IoMT) market, driven by increasing adoption of remote patient monitoring devices and on-body medical sensors. Healthcare institutions are emphasizing preventive care, chronic disease management, and integration of IoMT devices with electronic health records (EHRs) for enhanced patient care. The Canadian government’s support for telehealth and digital health initiatives encourages the use of cloud-based IoMT platforms. In addition, the demand for homecare solutions and wearable monitoring devices is rising due to an aging population and increased focus on patient-centric healthcare delivery. The integration of IoMT solutions in hospitals and clinics, combined with technological advancements, is accelerating market penetration across the country.

Mexico Internet of Medical Things (IoMT) Market Insight

Mexico is emerging as a growing market in the North America Internet of Medical Things (IoMT) market, supported by increasing awareness of digital healthcare technologies and rising healthcare infrastructure investments. Hospitals and clinics are gradually adopting IoMT devices for monitoring patient vitals, managing chronic diseases, and improving operational workflows. Government initiatives promoting telemedicine and mobile health solutions are driving the adoption of cloud-based IoMT platforms. In addition, the rising prevalence of chronic illnesses and growing demand for remote healthcare services are encouraging healthcare providers to integrate connected medical devices into routine care. Increasing collaboration with IoMT solution providers and technology vendors is further strengthening the market’s growth potential.

North America Internet of Medical Things (IoMT) Market Share

The North America Internet of Medical Things (IoMT) industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Cisco Systems, Inc. (U.S.)

- IBM Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- Lenovo Group Ltd. (Hong Kong)

- Boston Scientific Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- BIOTRONIK SE & Co. KG (Germany)

- Unison Healthcare Group (Taiwan)

- Cadi Scientific (Singapore)

- imedtac Co., Ltd (Taiwan)

- Meril Life Sciences (India)

- Omron Healthcare Co., Ltd (Japan)

- Terumo Corporation (Japan)

- NIHON KOHDEN CORPORATION (Japan)

- Lepu Medical Technology Co., Ltd (China)

- Accuster Technologies Pvt Ltd (India)

- iHealth Labs, Inc. (U.S.)

What are the Recent Developments in North America Internet of Medical Things (IoMT) Market?

- In June 2025, Philips announced an enhanced multi‑year partnership with Medtronic to expand access to advanced patient monitoring solutions in the North American healthcare market, integrating Philips monitoring systems with Medtronic’s technologies to streamline procurement and support frontline clinical use, reinforcing IoMT‑enabled patient care infrastructure

- In April 2025, Medtronic announced it submitted 510(k) applications to the U.S. FDA for an interoperable insulin pump that would integrate with continuous glucose monitoring (CGM) systems, a key development in IoMT‑enabled diabetes management solutions that could enhance connectivity and remote patient monitoring

- In February 2025, Etiometry achieved its 10th FDA 510(k) clearance for an advanced critical care data platform that aggregates continuous data from multiple bedside IoMT devices into a unified clinician dashboard. This clearance enhances remote monitoring and real‑time analytics for critical patients in intensive care units across the U.S., marking a milestone in interoperable IoMT data solutions

- In January 2025, the U.S. Food and Drug Administration (FDA) identified serious cybersecurity vulnerabilities in certain IoMT‑connected patient monitoring devices used in hospitals and home care. The FDA warned that these devices could be accessed or manipulated remotely, potentially compromising both device operation and sensitive patient data, prompting healthcare facilities to take mitigation actions to secure IoMT networks

- In March 2024, the U.S. Food and Drug Administration (FDA) cleared the first over‑the‑counter continuous glucose monitor (CGM), the Dexcom Stelo Glucose Biosensor System, allowing adult consumers to purchase and use a connected IoMT device without a prescription. This clearance marked an important shift in making continuous, real‑time health monitoring accessible directly to consumers for broader wellness and chronic care insights

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.