North America Inorganic Scintillators Market

Market Size in USD Million

CAGR :

%

USD

157.90 Million

USD

238.67 Million

2025

2033

USD

157.90 Million

USD

238.67 Million

2025

2033

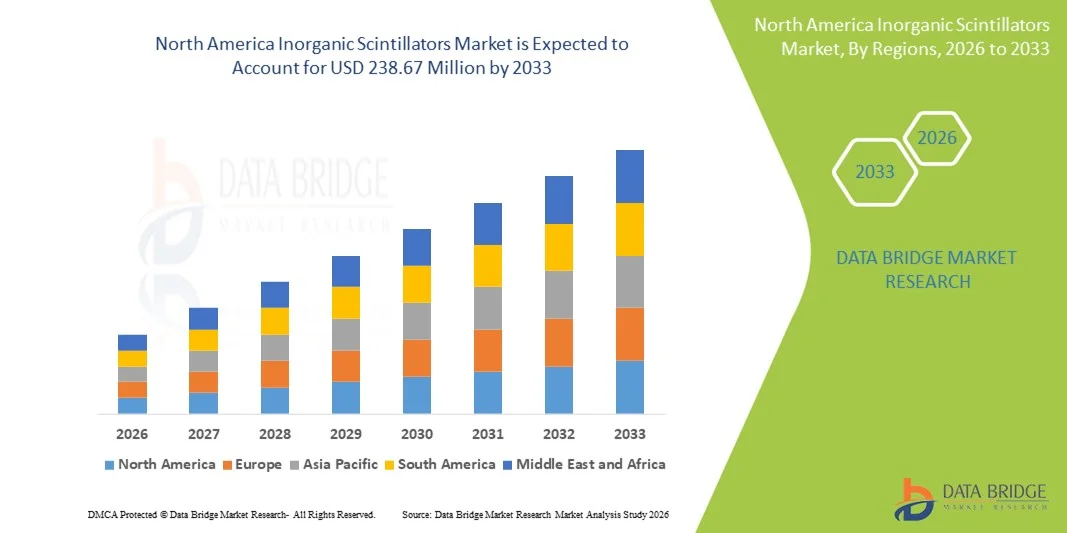

| 2026 –2033 | |

| USD 157.90 Million | |

| USD 238.67 Million | |

|

|

|

|

North America Inorganic Scintillators Market Size

- The North America inorganic scintillators market size was valued at USD 157.90 million in 2025 and is expected to reach USD 238.67 million by 2033, at a CAGR of 5.3% during the forecast period

- The market growth is largely propelled by increasing demand for advanced radiation detection and medical imaging systems, driven by expansions in healthcare infrastructure, growing investments in nuclear technology, and strong regulatory emphasis on radiation safety across the United States, Canada, and Mexico

- Furthermore, rising adoption of inorganic scintillator materials in applications such as PET/CT imaging, homeland security, and industrial monitoring paired with continual technological enhancements in scintillation crystal performance is establishing these solutions as essential components in modern detection systems. These converging factors are accelerating uptake of inorganic scintillators, thereby significantly boosting the industry’s regional growth trajectory.

North America Inorganic Scintillators Market Analysis

- Inorganic scintillators, providing high-efficiency radiation detection for medical imaging, nuclear security, and industrial monitoring, are increasingly vital components in North America due to their superior performance, reliability, and compatibility with advanced detection systems

- The escalating demand for inorganic scintillators is primarily fueled by growing investments in healthcare infrastructure, rising adoption of nuclear and security technologies, and the need for precise, high-resolution detection in medical and industrial applications

- The United States dominated the inorganic scintillators market with the largest revenue share of 72.6% in 2025, characterized by advanced healthcare facilities, strong R&D initiatives, and a significant presence of key industry players, with substantial growth in PET/CT imaging, radiation detection systems, and industrial monitoring applications, driven by innovations from both established manufacturers and startups focusing on high-performance scintillation crystals

- Canada is expected to be the fastest-growing country in the inorganic scintillators market during the forecast period due to increasing nuclear energy projects, expanding healthcare infrastructure, and rising government investments in radiation safety

- Cesium Iodide (CsI) segment dominated the North America inorganic scintillators market with a market share of 55.2% in 2025, driven by its high light output, excellent resolution, and widespread adoption in medical imaging and security detection systems

Report Scope and North America Inorganic Scintillators Market Segmentation

|

Attributes |

North America Inorganic Scintillators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Inorganic Scintillators Market Trends

Enhanced Performance Through High-Efficiency Materials

- A significant and accelerating trend in the North America inorganic scintillators market is the increasing adoption of high-performance materials such as Cesium Iodide (CsI) and Lutetium Oxyorthosilicate (LSO), which are enhancing detection efficiency, resolution, and reliability across medical, industrial, and security applications

- For instance, the CsI(Tl) scintillator is widely used in PET/CT scanners, providing superior light output and improved image quality for precise diagnostics, while LYSO crystals are gaining traction in high-end medical imaging systems for their fast decay time and radiation hardness

- Integration with digital detection systems and advanced imaging platforms enables real-time monitoring, improved signal processing, and automated calibration, allowing more accurate measurements and operational efficiency in hospitals, laboratories, and industrial facilities

- For instance, some modern PET scanners utilize CsI-based detectors combined with AI-assisted reconstruction algorithms to enhance diagnostic accuracy and reduce scan time, improving patient throughput and operational performance

- This trend towards higher sensitivity, better resolution, and enhanced material performance is fundamentally transforming user expectations in radiation detection, prompting manufacturers such as Saint-Gobain Crystals to develop advanced inorganic scintillators optimized for medical and security applications

- The demand for scintillators that deliver higher efficiency, reliability, and seamless integration with detection systems is growing rapidly across medical imaging, nuclear security, and industrial monitoring sectors as institutions prioritize precision and safety

- For instance, portable CsI-based detectors are being increasingly deployed at border control and industrial sites to enhance threat detection and ensure safety compliance.

North America Inorganic Scintillators Market Dynamics

Driver

Rising Demand Due to Healthcare Expansion and Security Applications

- The increasing investments in healthcare infrastructure, nuclear safety projects, and industrial monitoring solutions are a significant driver for the heightened demand for inorganic scintillators in North America

- For instance, in March 2025, a U.S.-based PET/CT imaging center expanded its use of CsI-based detectors to improve diagnostic accuracy and throughput, reflecting a broader trend of upgrading detection systems in healthcare facilities

- As hospitals, laboratories, and industrial facilities become more reliant on precise radiation detection, scintillators offer superior light output, resolution, and reliability, providing a compelling upgrade over conventional detectors

- Furthermore, growing emphasis on nuclear safety, homeland security, and industrial radiation monitoring is making inorganic scintillators an integral component of these systems, offering robust detection and compliance with regulatory requirements

- The combination of technological advancements, increasing government and private investments, and the rising demand for high-performance detection systems is propelling adoption in medical, industrial, and security sectors

- Advancements in scintillator manufacturing techniques, such as improved crystal growth and doping processes, are enabling better performance and scalability, further encouraging adoption in key applications

- For instance, high-purity CsI crystals with enhanced light yield and faster decay times are being increasingly implemented in high-resolution medical imaging and advanced industrial detection systems

Restraint/Challenge

High Material Costs and Regulatory Compliance Hurdles

- Concerns surrounding the high cost of high-performance inorganic scintillator materials, such as CsI and LYSO, pose a significant challenge to wider market adoption, particularly for budget-constrained facilities and small laboratories

- For instance, limited availability of large, defect-free CsI crystals can increase production costs, making some advanced detection systems expensive and less accessible for smaller institutions

- Addressing these cost and availability concerns through optimized crystal growth, supply chain improvements, and development of alternative materials is crucial for sustained adoption and market growth

- In addition, regulatory compliance and safety certifications for nuclear and medical applications can delay product deployment, creating hurdles for manufacturers and end-users seeking timely installation of advanced scintillator systems

- While technological advancements are ongoing, the combination of high material costs, limited supply, and stringent regulatory requirements continues to pose challenges, necessitating investment in R&D and cost-effective production strategies for long-term market expansion

- Fluctuations in raw material prices and dependency on rare elements, such as cesium and lutetium, can impact production costs and supply reliability, creating financial and operational challenges for manufacturers

- For instance, disruptions in the supply of high-purity cesium iodide due to geopolitical or mining constraints have previously led to delays in manufacturing and deployment of medical imaging detectors

North America Inorganic Scintillators Market Scope

The market is segmented on the basis of scintillation material, type, application, and end user.

- By Scintillation Material

On the basis of scintillation material, the market is segmented into Sodium Iodide (NaI), Cesium Iodide (CsI), Lutetium Oxyorthosilicate (LSO) & Lutetium–Yttrium Oxyorthosilicate (LYSO), Bismuth Germanate (BGO), Barium Fluoride, Lead Tungstate (PbWO4), Cadmium Tungstate (CdWO4), Cerium Bromide (CeBr3), Lanthanum Bromide (LaBr3), Gadolinium Orthosilicate (GSO), Yttrium Aluminum Garnet YAG (Ce), Gadolinium Oxysulfide (GOS), and other scintillation materials. The Cesium Iodide (CsI) segment dominated the market with the largest market revenue share of 55.2% in 2025, driven by its high light output, excellent resolution, and stability under prolonged radiation exposure. CsI is widely used in PET/CT scanners and industrial radiation detectors, providing precise measurements and consistent performance. The high efficiency and reliability of CsI crystals make them the preferred choice for healthcare facilities, nuclear research institutions, and industrial monitoring. In addition, their compatibility with digital imaging systems and integration with advanced detection technologies enhances their demand. Researchers and manufacturers also favor CsI due to scalable crystal growth techniques that ensure consistent quality. The segment benefits from strong adoption across medical imaging, security, and industrial sectors in the U.S., where advanced healthcare infrastructure supports deployment.

The Sodium Iodide (NaI) segment is expected to witness the fastest growth rate from 2026 to 2033, owing to its cost-effectiveness and widespread use in nuclear medicine, radioprotection, and homeland security applications. NaI detectors are preferred for gamma spectroscopy, radiation monitoring, and environmental applications due to their ease of use and reliable sensitivity. Growing adoption in industrial and defense sectors for portable radiation detection is also boosting the segment. Innovations in crystal doping and light-guiding technologies further enhance detection performance. Moreover, NaI’s affordability compared to CsI and LSO crystals attracts smaller laboratories and mid-sized facilities looking for high-performance yet economical solutions. Increasing awareness of radiation safety and expanding medical imaging infrastructure in the U.S. and Canada contribute to the rising demand.

- By Type

On the basis of type, the market is segmented into alkali halides, oxide compounds, and rare earth metals. The Alkali Halides segment dominated the market with the largest share in 2025, driven by materials such as CsI and NaI which exhibit high light yield, fast response, and established manufacturing techniques. Alkali halides are extensively used in PET/CT scanners, gamma cameras, and industrial radiation detectors, making them the most widely adopted type. The segment’s dominance is also supported by robust supply chains and proven integration with digital detection technologies. Researchers prefer alkali halides for their reproducibility, high efficiency, and cost-effectiveness in large-scale imaging systems. In addition, their compatibility with AI-assisted detection systems and automated calibration workflows boosts demand. Hospitals, security agencies, and nuclear facilities rely heavily on alkali halide-based scintillators for critical detection and monitoring operations.

The Rare Earth Metals segment is expected to witness the fastest growth from 2026 to 2033, propelled by advanced materials such as LSO, LYSO, and GSO which provide superior resolution and radiation hardness. These materials are increasingly adopted in high-end PET/CT scanners, industrial detectors, and homeland security applications requiring precision and durability. The segment growth is also fueled by rising demand for high-performance detectors in nuclear research, defense, and medical imaging. R&D investments in crystal engineering and doping technologies are enhancing scintillator performance. Furthermore, rare earth metal scintillators are compatible with compact, next-generation imaging devices that require high sensitivity and minimal decay time. Expansion of healthcare infrastructure in North America is expected to further accelerate adoption of these advanced materials.

- By Application

On the basis of application, the market is segmented into medical imaging, nuclear medicine, radioprotection, oil exploration, process industry, life sciences, and others. The Medical Imaging segment dominated the market with the largest share in 2025, driven by the growing use of PET/CT scanners, gamma cameras, and other imaging modalities in hospitals and diagnostic centers. Inorganic scintillators such as CsI and LSO are preferred for medical applications due to their high light output, resolution, and stability under repeated use. Adoption is further supported by the increasing prevalence of chronic diseases and the expansion of healthcare infrastructure in the U.S. Integration with AI-assisted imaging and digital reconstruction technologies enhances diagnostic accuracy, boosting demand. Hospitals and diagnostic chains increasingly prioritize advanced scintillator materials to improve patient outcomes. The segment benefits from continuous product innovations that increase efficiency, reduce scan times, and improve patient throughput.

The Nuclear Medicine segment is expected to witness the fastest growth from 2026 to 2033, owing to rising investments in PET imaging, radiopharmaceutical development, and radioprotection systems. Nuclear medicine applications require high-resolution, high-sensitivity detectors capable of accurate radiation measurement. Adoption in research hospitals, cancer treatment centers, and pharmaceutical labs is increasing. Advanced scintillators such as NaI, CsI, and LYSO are being integrated with automated imaging platforms. The growing awareness of nuclear diagnostic benefits, coupled with government funding for healthcare and security applications, supports rapid segment expansion.

- By End User

On the basis of end user, the market is segmented into healthcare, homeland security & defense, nuclear power plants, industrial applications, and others. The Healthcare segment dominated the market with the largest share in 2025, driven by rising demand for PET/CT scanners, gamma cameras, and radiotherapy equipment in hospitals, diagnostic centers, and research institutions. Scintillators such as CsI, LSO, and NaI are widely used due to their reliability, efficiency, and integration with digital imaging systems. Increasing prevalence of chronic diseases, expanding diagnostic infrastructure, and technological advancements are key growth factors. Hospitals prioritize high-performance detectors to enhance image quality, improve patient outcomes, and maintain operational efficiency. The segment also benefits from continuous R&D and deployment of AI-assisted imaging solutions. Healthcare institutions in the U.S., which lead the regional market, remain the largest adopters of inorganic scintillators.

The Homeland Security & Defense segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for radiation detection at ports, borders, airports, and defense installations. Advanced scintillators such as NaI, CsI, and LYSO are used in portable and fixed radiation detectors for security and threat monitoring. Growth is fueled by increasing government investments in border security, nuclear safety, and anti-terrorism initiatives. Adoption of compact, high-performance detectors integrated with real-time monitoring systems is rising. Furthermore, regulatory mandates and safety compliance requirements boost segment growth. Expansion of nuclear monitoring and industrial security programs in the U.S. is expected to sustain this trend.

North America Inorganic Scintillators Market Regional Analysis

- The United States dominated the inorganic scintillators market with the largest revenue share of 72.6% in 2025, characterized by advanced healthcare facilities, strong R&D initiatives, and a significant presence of key industry players

- Institutions and industries in the U.S. highly value the superior performance, high light output, and reliable resolution offered by scintillators such as Cesium Iodide (CsI), Lutetium Oxyorthosilicate (LSO), and Sodium Iodide (NaI), which are widely used in PET/CT scanners, gamma cameras, and industrial monitoring systems

- This widespread adoption is further supported by strong R&D capabilities, well-established supply chains, and a regulatory environment emphasizing safety and quality, establishing inorganic scintillators as essential components for medical, security, and industrial applications across the country

The U.S. Inorganic Scintillators Market Insight

The U.S. inorganic scintillators market captured the largest revenue share of 72.6% in 2025 within North America, fueled by the widespread adoption of advanced medical imaging systems, nuclear security detectors, and industrial radiation monitoring solutions. Institutions and industries are increasingly prioritizing high-performance scintillators such as Cesium Iodide (CsI), Lutetium Oxyorthosilicate (LSO), and Sodium Iodide (NaI) for accurate detection and enhanced operational efficiency. The growing demand for PET/CT scanners, gamma cameras, and radiation monitoring systems in hospitals, research labs, and industrial facilities further propels the market. In addition, the integration of scintillators with digital imaging platforms, AI-assisted reconstruction, and automated detection systems significantly contributes to market expansion. The U.S. benefits from strong R&D capabilities, a well-established supply chain, and supportive regulatory frameworks that encourage the deployment of advanced detection technologies.

Canada Inorganic Scintillators Market Insight

The Canada inorganic scintillators market is expected to grow at a substantial CAGR during the forecast period, primarily driven by investments in nuclear safety, healthcare infrastructure, and industrial radiation monitoring projects. Canadian institutions increasingly adopt high-efficiency scintillators such as CsI and LYSO to ensure precise detection and compliance with safety standards. Rising awareness about radiation safety, combined with government funding for healthcare and security programs, supports the adoption of inorganic scintillators. The integration of these materials into PET/CT imaging, gamma spectroscopy, and portable radiation detectors is gaining momentum. Moreover, research initiatives and collaborations with U.S. manufacturers facilitate the availability of advanced scintillation technologies across the country. Canada’s focus on high-quality, reliable detection systems is reinforcing market growth.

Mexico Inorganic Scintillators Market Insight

The Mexico inorganic scintillators market accounted for a significant market revenue share in 2025, supported by the expansion of industrial monitoring, nuclear research, and security applications. Mexican industries are increasingly adopting scintillators such as NaI, CsI, and LSO for radiation detection in industrial plants, power facilities, and border security programs. The country is witnessing growing investments in nuclear medicine and radioprotection infrastructure, boosting demand for high-performance scintillators. Integration with portable detectors and automated monitoring systems further drives adoption. Moreover, government regulations emphasizing safety and compliance encourage the deployment of advanced detection technologies. Collaborations with North American suppliers help expand access to reliable scintillator solutions, enhancing the country’s market growth trajectory

North America Inorganic Scintillators Market Share

The North America Inorganic Scintillators industry is primarily led by well-established companies, including:

- Hamamatsu Photonics K.K. (Japan)

- Hitachi High Tech Corporation (Japan)

- Mirion Technologies, Inc. (U.S.)

- Dynasil Corporation (U.S.)

- Scintacor (U.K.)

- Epic Crystal Co.,Ltd (China)

- Alpha Spectra, Inc. (U.S.)

- Radiation Monitoring Devices, Inc. (U.S.)

- Kromek Group plc (U.K.)

- Toshiba Materials Co., Ltd. (Japan)

- Scionix Holland B.V. (Netherlands)

- Hitachi Metals, Ltd. (Japan)

- Saint Gobain S.A. (France)

- Crytur a.s. (Czech Republic)

- Detec Electronic (Germany)

- Rexon Components, Inc. (U.S.)

- Eljen Technology (U.S.)

- Photonic Materials Ltd. (U.K.)

- Hilger Crystals Ltd. (U.K.)

What are the Recent Developments in North America Inorganic Scintillators Market?

- In August 2025, a physics preprint revealed research on real-time alpha-ray imaging using a synthetic diamond scintillator, demonstrating that diamond can serve as a high-performance scintillator material capable of capturing detailed alpha-ray tracks under ambient conditions an important step toward advanced radiation detectors

- In March 2025, an academic study outlined a custom setup for characterizing Ce-doped GAGG scintillators, providing researchers with enhanced feedback on light output and discrimination properties under varied conditions contributing to advanced detector material development

- In October 2024, research on large-scale self-assembled nanophotonic scintillators was published, showing a new fabrication method for nanophotonic scintillators with significantly enhanced light yield, potentially impacting future X-ray imaging and nondestructive testing technologies

- In May 2023, Florida State University researchers developed a new generation of hybrid scintillator materials designed to significantly improve image quality in X-ray, CT, and other radiation imaging applications by achieving much faster light emission (nanoseconds), which enables higher resolution and better contrast. The materials combine organic and inorganic components to optimize performance

- In May 2023, a related news release on EurekAlert! reported the same breakthrough from Florida State University, where the team filed patents on organic-inorganic hybrid scintillators and pursued commercialization partnerships to expand the use of these advanced materials in imaging and detector systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.