North America Industrial Sugar Market

Market Size in USD Million

CAGR :

%

USD

6,123.33 Million

USD

7,769.59 Million

2022

2030

USD

6,123.33 Million

USD

7,769.59 Million

2022

2030

| 2023 –2030 | |

| USD 6,123.33 Million | |

| USD 7,769.59 Million | |

|

|

|

North America Industrial Sugar Market Analysis and Size

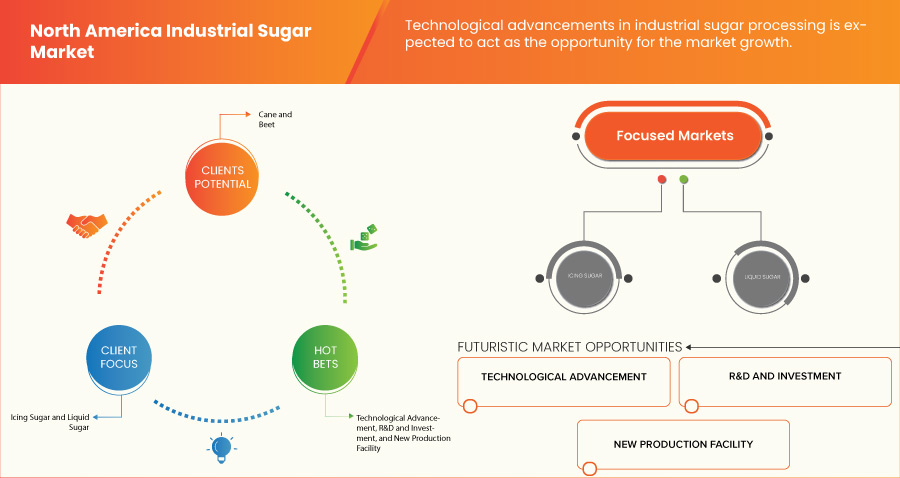

The North America industrial sugar market is being driven by increasing use of industrial sugar in drinks around the globe along with expansion of food processing industry. Also, rapid growth in the confectionary sector is likely to fuel the market's growth. In addition, the increasing adoption use of bio-fuel for production of sugar will open up more business potential for industrial sugar market in the forecast period of 2023 to 2030.

Data Bridge Market Research analyses that the North America industrial sugar market is expected to reach the value of USD 7,769.59 million by 2030 from USD 6,123.33 million in 2022, growing at a CAGR of 3.1% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customized to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million and Volume in Kilo Tons |

|

Segments Covered |

Type (White Sugar, Liquid Sugar, Brown Sugar, and Icing Sugar), Source (Cane and Beet), Form (Granulated, Syrup, and Powdered), Packaging Type (Sacks, Bag, Box, Tote Bags, and Others), Application (Food & Beverages, Pharmaceutical, Dietary Supplements, and Others), Distribution Channel (Direct and Indirect) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Südzucker AG, Michigan Sugar Company, Amalgamated Sugar., Associated British Foods, Lantic Inc., and AMERICAN CRYSTAL SUGAR, among others |

Market Definition

Industrial sugar, additionally referred to as bulk sugar or commercial sugar, is used in a variety of sectors and holds a significant market share. This highly refined sugar is mainly utilized for industrial purposes rather than direct consumption. Its versatile properties and wide range of applications make it an essential ingredient in a variety of industries, fueling a thriving industrial sugar market.

North America Industrial Sugar Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail below:

Drivers

- Increasing Food and Beverages Consumption

Sugary drink consumption has risen as a result of rapid urbanization, which has increased the North America consumption of food and beverages. Although refined sugar can be accepted as part of a healthy diet, sweetened drinks are widely advertised, inexpensive, and widely available. They include soft drinks, cordial, energy drinks, sports drinks, and flavored mineral water. Furthermore, the standard serving size has changed from 375 ML to 600 ML bottles, which has increased the amount of industrial sugar as drink consumption has increased over the forecast period.

Furthermore, the North America industrial sugar market has grown significantly in recent years, owing primarily to the increased use of industrial sugar in the beverage industry. Industrial sugar, derived from sugar cane or sugar beet, is used to sweeten a variety of beverages, including carbonated soft drinks, energy drinks, fruit juices, and ready-to-drink beverages. However, emerging economies, such as China, India, and Brazil, have witnessed a surge in beverage consumption due to factors such as rising disposable incomes and urbanization. As these markets expand, there is a corresponding increase in the use of industrial sugar in drinks to cater to the growing consumer demand. Thus, the increasing food and beverage consumption is expected to drive market growth.

- Increasing Adoption of Bio-Fuel for the Production of Industrial Sugar

The use of biofuels in the manufacturing process is undergoing a significant shift in the market. Biofuels are a sustainable replacement for fossil fuels because they are made from renewable resources such as sugarcane bagasse and beet pulp. The expanding food processing, confectionery, and beverage industries are driving up demand for industrial sugar. Traditionally, the machinery and equipment used in the production of sugar have been powered by fossil fuels. But the industry is moving toward the use of biofuels as sustainability and lowering carbon emissions become more important.

The growing emphasis on renewable energy and sustainability has prompted governments to implement incentives and support mechanisms for biofuel production. Industrial sugar producers can capitalize on these opportunities by collaborating with government agencies and accessing funding programs to facilitate the use of biofuels in their operations. The growing use of biofuels in the production of industrial sugar represents a significant opportunity for market growth. Industrial sugar manufacturers are shifting from fossil fuels to biofuels due to environmental sustainability, regulatory support, and cost efficiency. Industrial sugar producers can benefit from government incentives, enhanced brand image, and market differentiation. Market trends, such as the incorporation of bio-refineries and ongoing R&D, contribute to the expansion and sustainability of biofuel utilization.

As a result, it is expected that the increased use of biofuel in the production of industrial sugar is expected to drive market growth.

Restraint/Challenge

- Availability of Substitutes and Alternatives

The North America industrial sugar market is increasingly adopting substitutes and alternatives. This shift is being driven by a variety of factors, including shifting consumer preferences, health concerns, sustainability concerns, and regulatory changes. Sugar cane and sugar beet have traditionally been the primary sugar sources in the industrial sugar market. However, changing market dynamics and consumer demands have prompted the exploration and use of substitutes and alternatives to traditional industrial sugar.

Opportunity

- Increasing Demand for Natural and Organic Sweeteners

The worldwide industrial sugar industry is experiencing tremendous growth as a result of technological developments in sugar processing. As the demand for sugar continues to climb, manufacturers are looking into new technologies and methods to increase efficiency, improve quality, and meet consumers' changing expectations. Sugar processing traditionally relies on conventional methods such as milling, purification, and crystallization. However, advancements in technology have revolutionized the industry, introducing new techniques and equipment that streamline production, optimize resource utilization, and enhance product quality. These advancements are reshaping the North America industrial sugar market and creating opportunities for manufacturers to stay competitive in a rapidly changing landscape.

Sugar refineries are becoming intelligent factories, thanks to digitalization. Real-time data gathering, analysis, and remote monitoring are made possible by the deployment of sensors, Internet of Things (IoT) gadgets, and cloud-based platforms. This supply chain integration is made possible by digital transformation, which also increases operational effectiveness and makes predictive maintenance easier. The technological advancements in sugar processing have significant prospects for the industrial sugar sector.

Hence, the key market players are exploring opportunities to develop advancements in production technologies and launching new innovative products, thus offering a wide opportunity for market growth.

Recent Development

- In 2023, Snake River Sugar Company and The Amalgamated Sugar Company LLC merged to form Amalgamated Sugar Company, a grower-owned cooperative. This collaboration helped the organization foster innovation, expand resources, enhance expertise, and accelerate growth

North America Industrial Sugar Market Scope

The North America industrial sugar market is segmented into six notable segments based on type, source, form, packaging type, application, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- White Sugar

- Liquid Sugar

- Brown Sugar

- Icing Sugar

On the basis of type, the market is segmented into white sugar, liquid sugar, brown sugar, and icing sugar.

Source

- Cane

- Beet

On the basis of source, the market is segmented into cane and beet.

Form

- Granulated

- Syrup

- Powdered

On the basis of form, the market is segmented into granulated, syrup, and powdered.

Packaging Type

- Sacks

- Bag

- Box

- Tote Bags

- Others

On the basis of packaging type, the market is segmented into sacks, bag, box, tote bags, and others.

Application

- Food & Beverages

- Pharmaceutical

- Dietary Supplements

- Others

On the basis of application, the market is segmented into food & beverages, pharmaceutical, dietary supplements, and others.

Distribution Channel

- Direct

- Indirect

On the basis of distribution channel, the market is segmented into direct and indirect.

North America Industrial Sugar Market Regional Analysis/Insights

The North America industrial sugar market is analyzed and market size insights and trends are provided by country, type, source, form, packaging type, application, and distribution channel, as referenced above.

The countries covered in the North America industrial sugar market report are U.S., Canada, and Mexico.

The U.S. is expected to dominate in the North America industrial sugar market due to large production, easy availability of products, and increase in customer base.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Industrial Sugar Market Share Analysis

The North America industrial sugar market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the North America industrial sugar market.

Some of the major players operating in the North America industrial sugar market are Südzucker AG, Michigan Sugar Company, Amalgamated Sugar., Associated British Foods, Lantic Inc., and AMERICAN CRYSTAL SUGAR, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA INDUSTRIAL SUGAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN OF THE NORTH AMERICA INDUSTRIAL SUGAR MARKET

4.1.1 RAW MATERIAL PROCUREMENT

4.1.2 PREPARATION OF SUGAR IN SUGAR MILLS

4.1.3 MARKETING AND DISTRIBUTION

4.1.4 END USERS

4.2 BRAND OUTLOOK

4.2.1 COMPARATIVE BRAND ANALYSIS

4.2.2 PRODUCT VS BRAND OVERVIEW

4.3 IMPACT OF ECONOMIC SLOWDOWN

4.3.1 OVERVIEW

4.3.2 IMPACT ON PRICE

4.3.3 IMPACT ON SUPPLY CHAIN

4.3.4 IMPACT ON SHIPMENT

4.3.5 IMPACT ON COMPANY'S STRATEGIC DECISIONS

4.4 INDUSTRIAL CHAIN ANALYSIS

4.4.1 INDUSTRIAL PURCHASING MODE ANALYSIS

4.4.2 INDUSTRIAL RESPONSE TOWARDS FUEL PRODUCTION WITH SUGAR

4.5 PRICE INDEX SCENARIO

4.6 RAW MATERIAL COVERAGE

5 NORTH AMERICA INDUSTRIAL SUGAR MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING FOOD AND BEVERAGES CONSUMPTION

6.1.2 EXPANSION OF THE FOOD PROCESSING INDUSTRY

6.1.3 GROWTH IN THE CONFECTIONERY SECTOR

6.1.4 INCREASING ADOPTION OF BIO-FUEL FOR THE PRODUCTION OF INDUSTRIAL SUGAR

6.2 RESTRAINTS

6.2.1 AVAILABILITY OF SUBSTITUTES AND ALTERNATIVES

6.2.2 ENVIRONMENTAL CONCERNS

6.2.3 WATER SCARCITY AND LAND MANAGEMENT ISSUES

6.3 OPPORTUNITIES

6.3.1 INCREASING DEMAND FOR NATURAL AND ORGANIC SWEETENERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN INDUSTRIAL SUGAR PROCESSING

6.3.3 INTERNATIONAL TRADE EXPANSION

6.4 CHALLENGES

6.4.1 HEALTH CONCERNS RELATED TO INDUSTRIAL SUGAR PRODUCTION

6.4.2 INDUSTRIAL SUGAR PRODUCTION REGULATIONS

6.4.3 FLUCTUATING RAW MATERIAL PRICES

7 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY TYPE

7.1 OVERVIEW

7.2 WHITE SUGAR

7.3 LIQUID SUGAR

7.4 BROWN SUGAR

7.4.1 REGULAR BROWN SUGAR

7.4.2 LIGHT BROWN SUGAR

7.4.3 DARK BROWN SUGAR

7.5 ICING SUGAR

8 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY SOURCE

8.1 OVERVIEW

8.2 CANE

8.3 BEET

9 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY FORM

9.1 OVERVIEW

9.2 GRANULATED

9.3 SYRUP

9.4 POWDERED

10 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 SACKS

10.3 BAG

10.4 BOX

10.5 TOTE BAGS

10.6 OTHERS

11 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD & BEVERAGES

11.2.1 TABLE TOP SUGAR

11.2.2 BEVERAGES

11.2.2.1 DAIRY BASED DRINKS

11.2.2.1.1 REGULAR

11.2.2.1.2 PROCESSED MILK

11.2.2.1.3 MILK SHAKES

11.2.2.1.4 FLAVORED MILK

11.2.2.2 JUICES

11.2.3 SMOOTHIES

11.2.3.1 PLANT BASED MILK

11.2.3.2 ENERGY DRINKS

11.2.3.3 SPORTS DRINKS

11.2.3.4 OTHERS

11.2.4 CONFECTIONERY

11.2.4.1 HARD-BOILED SWEETS

11.2.4.2 MINTS

11.2.4.3 GUMS & JELLIES

11.2.4.4 CHOCOLATE

11.2.4.5 CHOCOLATE SYRUPS

11.2.4.6 CARAMELS & TOFFEES

11.2.4.7 OTHERS

11.2.5 BAKERY

11.2.5.1 BREAD & ROLLS

11.2.5.2 CAKES, PASTRIES & TRUFFLE

11.2.5.3 BISCUIT, COOKIES & CRACKERS

11.2.5.4 BROWNIES

11.2.5.5 TART & PIES

11.2.5.6 OTHERS

11.2.6 DAIRY PRODUCTS

11.2.6.1 YOGURT

11.2.6.2 ICE CREAM

11.2.6.3 CHEESE

11.2.6.4 OTHERS

11.2.7 FROZEN DESSERTS

11.2.7.1 GELATO

11.2.7.2 CUSTARD

11.2.7.3 OTHERS

11.2.8 PROCESSED FOOD

11.2.8.1 READY MEALS

11.2.8.2 JAMS, PRESERVES & MARMALADES

11.2.8.3 SAUCES, DRESSINGS AND CONDIMENTS

11.2.8.4 SOUPS

11.2.8.5 OTHERS

11.2.9 CONVENIENCE FOOD

11.2.9.1 INSTANT NOODLES

11.2.9.2 PIZZA & PASTA

11.2.9.3 SNACKS & EXTRUDED SNACKS

11.2.9.4 OTHERS

11.2.10 BREAKFAST CEREAL

11.2.11 INFANT FORMULA

11.2.11.1 FIRST INFANT FORMULA

11.2.11.2 ANTI-REFLUX (STAY DOWN) FORMULA

11.2.11.3 COMFORT FORMULA

11.2.11.4 HYPOALLERGENIC FORMULA

11.2.11.5 FOLLOW-ON FORMULA

11.2.11.6 OTHERS

11.2.12 NUTRITIONAL BARS

11.2.13 FUNCTIONAL FOOD

11.3 PHARMACEUTICAL

11.4 DIETARY SUPPLEMENTS

11.4.1 IMMUNITY SUPPLEMENTS

11.4.2 OVERALL WELLBEING SUPPLEMENTS

11.4.3 SKIN HEALTH SUPPLEMENTS

11.4.4 BONE AND JOINT HEALTH SUPPLEMENTS

11.4.5 BRAIN HEALTH SUPPLEMENTS

11.4.6 OTHERS

11.5 OTHERS

12 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT

12.3 INDIRECT

13 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY COUNTRY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 MEXICO

13.1.3 CANADA

14 NORTH AMERICA INDUSTRIAL SUGAR MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 SÜDZUCKER AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 AMALGAMATED SUGAR

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 LANTIC INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 ASSOCIATED BRITISH FOODS PLC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 AMERICAN CRYSTAL SUGAR

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 MICHIGAN SUGAR COMPANY

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (KILO TONS)

TABLE 3 NORTH AMERICA BROWN SUGAR IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 6 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY FORM, 2021-2030 (KILO TONS)

TABLE 8 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA FOOD & BEVERAGES IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA BEVERAGES IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA DAIRY BASED DRINKS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA CONFECTIONERY IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA BAKERY IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA DAIRY PRODUCTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FROZEN DESSERTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA PROCESSED FOOD IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA CONVENIENCE FOOD IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA INFANT FORMULA IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA DIETARY SUPPLEMENTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA INDUSTRIAL SUGAR MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 24 U.S. INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 U.S. INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (KILO TONS)

TABLE 26 U.S. BROWN SUGAR IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 U.S. INDUSTRIAL SUGAR MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 28 U.S. INDUSTRIAL SUGAR MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 29 U.S. INDUSTRIAL SUGAR MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 30 U.S. INDUSTRIAL SUGAR MARKET, BY FORM, 2021-2030 (KILO TONS)

TABLE 31 U.S. INDUSTRIAL SUGAR MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 32 U.S. INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 33 U.S. FOOD & BEVERAGES IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 U.S. BEVERAGES IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 U.S. DAIRY BASED DRINKS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 U.S. CONFECTIONERY IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. BAKERY IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.S. DAIRY PRODUCTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.S. FROZEN DESSERTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. PROCESSED FOOD IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 U.S. CONVENIENCE FOOD IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.S. INFANT FORMULA IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 U.S. DIETARY SUPPLEMENTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. INDUSTRIAL SUGAR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 45 MEXICO INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 MEXICO INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (KILO TONS)

TABLE 47 MEXICO BROWN SUGAR IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 MEXICO INDUSTRIAL SUGAR MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 49 MEXICO INDUSTRIAL SUGAR MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 50 MEXICO INDUSTRIAL SUGAR MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 51 MEXICO INDUSTRIAL SUGAR MARKET, BY FORM, 2021-2030 (KILO TONS)

TABLE 52 MEXICO INDUSTRIAL SUGAR MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 53 MEXICO INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 MEXICO FOOD & BEVERAGES IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 MEXICO BEVERAGES IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 MEXICO DAIRY BASED DRINKS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 MEXICO CONFECTIONERY IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 MEXICO BAKERY IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 MEXICO DAIRY PRODUCTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 MEXICO FROZEN DESSERTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 MEXICO PROCESSED FOOD IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 MEXICO CONVENIENCE FOOD IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 MEXICO INFANT FORMULA IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO DIETARY SUPPLEMENTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 MEXICO INDUSTRIAL SUGAR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 66 CANADA INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 CANADA INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (KILO TONS)

TABLE 68 CANADA BROWN SUGAR IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 CANADA INDUSTRIAL SUGAR MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 70 CANADA INDUSTRIAL SUGAR MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 71 CANADA INDUSTRIAL SUGAR MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 72 CANADA INDUSTRIAL SUGAR MARKET, BY FORM, 2021-2030 (KILO TONS)

TABLE 73 CANADA INDUSTRIAL SUGAR MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 74 CANADA INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 75 CANADA FOOD & BEVERAGES IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 CANADA BEVERAGES IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA DAIRY BASED DRINKS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA CONFECTIONERY IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 CANADA BAKERY IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA DAIRY PRODUCTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA FROZEN DESSERTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA PROCESSED FOOD IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 CANADA CONVENIENCE FOOD IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 CANADA INFANT FORMULA IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 CANADA DIETARY SUPPLEMENTS IN INDUSTRIAL SUGAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 CANADA INDUSTRIAL SUGAR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA INDUSTRIAL SUGAR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUSTRIAL SUGAR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUSTRIAL SUGAR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUSTRIAL SUGAR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUSTRIAL SUGAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUSTRIAL SUGAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INDUSTRIAL SUGAR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INDUSTRIAL SUGAR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA INDUSTRIAL SUGAR MARKET: SEGMENTATION

FIGURE 10 INCREASING FOOD AND BEVERAGES CONSUMPTION IS DRIVING THE GROWTH OF THE NORTH AMERICA INDUSTRIAL SUGAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE WHITE SUGAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INDUSTRIAL SUGAR MARKET IN 2023 & 2030

FIGURE 12 SUPPLY CHAIN OF INDUSTRIAL SUGAR

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INDUSTRIAL SUGAR MARKET

FIGURE 14 NORTH AMERICA INDUSTRIAL SUGAR MARKET: BY TYPE, 2022

FIGURE 15 NORTH AMERICA INDUSTRIAL SUGAR MARKET: BY SOURCE, 2022

FIGURE 16 NORTH AMERICA INDUSTRIAL SUGAR MARKET: BY FORM, 2022

FIGURE 17 NORTH AMERICA INDUSTRIAL SUGAR MARKET: BY PACKAGING TYPE, 2022

FIGURE 18 NORTH AMERICA INDUSTRIAL SUGAR MARKET: BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA INDUSTRIAL SUGAR MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 NORTH AMERICA INDUSTRIAL SUGAR MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA INDUSTRIAL SUGAR MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA INDUSTRIAL SUGAR MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA INDUSTRIAL SUGAR MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA INDUSTRIAL SUGAR MARKET: BY TYPE (2023 - 2030)

FIGURE 25 NORTH AMERICA INDUSTRIAL SUGAR MARKET: COMPANY SHARE 2022 (%)

North America Industrial Sugar Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Industrial Sugar Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Industrial Sugar Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.