North America Industrial Metrology Market

Market Size in USD Billion

CAGR :

%

USD

4.30 Billion

USD

7.12 Billion

2024

2032

USD

4.30 Billion

USD

7.12 Billion

2024

2032

| 2025 –2032 | |

| USD 4.30 Billion | |

| USD 7.12 Billion | |

|

|

|

|

North America Industrial Metrology Market Size

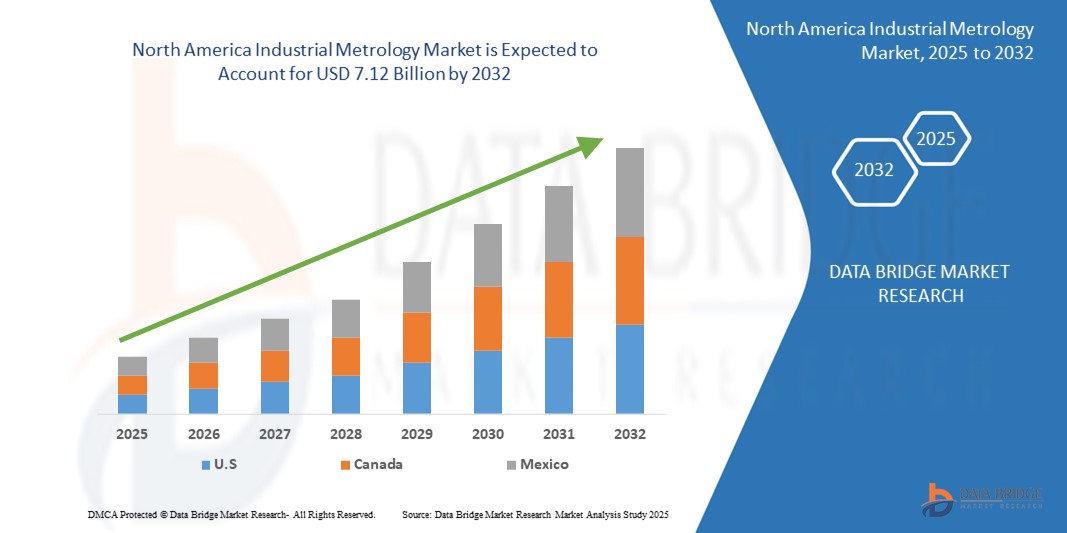

- The North America industrial metrology market size was valued at USD 4.30 billion in 2024 and is expected to reach USD 7.12 billion by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is largely fueled by the increasing adoption of precision measurement technologies across automotive, aerospace, semiconductor, and manufacturing industries, driven by the demand for accuracy, quality assurance, and compliance with international standards

- Furthermore, rising integration of advanced solutions such as 3D scanning, multisensor systems, and automated inspection into production lines is accelerating efficiency, reducing defects, and strengthening competitiveness, thereby significantly boosting the industry’s growth

North America Industrial Metrology Market Analysis

- Industrial metrology refers to the application of precision measurement technologies, including coordinate measuring machines (CMM), optical digitizers, scanners, and multisensor systems, to ensure dimensional accuracy, product reliability, and process optimization across industries

- The escalating demand for industrial metrology is primarily fueled by growing emphasis on quality control, increasing complexity of manufactured components, and the shift toward digital manufacturing and Industry 4.0 initiatives that require advanced inspection and measurement capabilities

- U.S. dominated the industrial metrology market in 2024, due to strong demand from the automotive, aerospace, and semiconductor industries where precision measurement and quality assurance are critical

- Canada is expected to be the fastest growing country in the industrial metrology market during the forecast period due to rising investments in advanced manufacturing and aerospace industries

- Hardware segment dominated the market with a market share of 59.5% in 2024, due to the widespread adoption of coordinate measuring machines, optical digitizers, scanners, and other precision instruments across industries. Hardware is considered the backbone of metrology as it enables accurate measurements essential for quality assurance and product validation. Continuous advancements in sensor technology, enhanced resolution, and portable metrology devices have further fueled hardware demand, particularly in automotive and aerospace sectors where tolerance precision is critical

Report Scope and North America Industrial Metrology Market Segmentation

|

Attributes |

North America Industrial Metrology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

North America Industrial Metrology Market Trends

Integration of Industrial Metrology with Industry 4.0 and Smart Manufacturing

- The integration of industrial metrology with Industry 4.0 and smart manufacturing is a key trend driving market advancement. Manufacturers are adopting advanced metrology systems as part of digital transformation initiatives to ensure precision, efficiency, and automation in production environments

- For instance, Hexagon AB has developed smart metrology solutions integrated with digital platforms, enabling seamless data collection and analysis in real time for manufacturing quality control. Similarly, ZEISS offers metrology systems with advanced connectivity and software integration capabilities that support automated inspection workflows within smart factories

- The shift toward Industry 4.0 has elevated demand for connected metrology solutions that feed measurement data directly into manufacturing systems, reducing errors and enabling predictive quality control. This integration improves process transparency, accelerates decision-making, and ensures higher production consistency

- Metrology tools such as coordinate measuring machines (CMMs), optical scanners, and 3D laser systems are now equipped with IoT-enabled monitoring and AI-based analytics, aligning with broader digital manufacturing ecosystems. These smart solutions allow companies to move from sampling-based inspection to continuous, in-line quality assurance

- Furthermore, industries such as aerospace, automotive, and electronics, which require extremely high precision tolerances, are increasingly integrating metrology solutions with robotic automation, supporting error-free assembly and reducing operational downtime

- In summary, the integration of industrial metrology with Industry 4.0 and smart manufacturing represents a major trend shaping the market. This shift toward digitalized precision measurement underscores the importance of metrology as a key enabler of efficient and data-driven industrial production systems

North America Industrial Metrology Market Dynamics

Driver

Increasing Demand for High-Precision Measurement Solutions

- The growing need for precise quality assurance across automotive, aerospace, electronics, and medical device industries is a critical driver for the industrial metrology market. As manufacturing complexity increases, companies are seeking measurement solutions capable of detecting micro-level deviations to ensure product reliability and compliance with stringent industry standards

- For instance, Nikon Metrology has expanded its optical and X-ray inspection systems for electronics and semiconductor applications, enabling manufacturers to achieve consistent micro-scale accuracy. Likewise, Mitutoyo Corporation provides advanced CMMs that deliver high repeatability and precision required in automotive engine production and aerospace component inspection

- Precision measurement is becoming increasingly vital in industries where even minor defects can lead to significant safety and performance issues. This is particularly critical in sectors such as aerospace and healthcare, where product reliability is non-negotiable

- The rising adoption of additive manufacturing is further amplifying the need for precision metrology, as complex geometries and advanced materials require exact inspection to validate production quality. Expanded use of nanotechnology and miniaturized electronics also reinforces demand for highly advanced metrology systems

- In conclusion, the market is being strongly driven by industries that cannot compromise on precision, accuracy, or quality. This demand ensures long-term relevance and expansion of high-precision metrology solutions globally

Restraint/Challenge

High Initial Investment

- One of the key challenges facing the industrial metrology market is the high upfront cost associated with procuring advanced metrology equipment. Sophisticated systems such as 3D laser scanners, CMMs, and X-ray inspection tools involve substantial capital investment, limiting accessibility for small and medium-sized enterprises (SMEs)

- For instance, advanced metrology solutions offered by ZEISS and Hexagon often represent significant capital expenditures for manufacturers, making adoption more feasible for large enterprises than for smaller companies operating under tight budget constraints

- In addition to equipment costs, implementation requires skilled personnel, specialized training, and integration with existing manufacturing systems, which further increase total expenses. These factors deter cost-sensitive businesses from investing in advanced metrology solutions despite their long-term benefits

- The rapid pace of technology upgrades also raises financial concerns, as manufacturers may struggle to justify recurring investments in order to keep systems up to date with evolving digital and automation trends

- As a result, high initial investment costs remain a significant restraint in the industrial metrology market, particularly for SMEs looking to balance cost efficiency with precision needs. To address this, vendors are increasingly offering modular solutions, leasing options, and cloud-enabled metrology services to ease affordability barriers and encourage broader adoption

North America Industrial Metrology Market Scope

The market is segmented on the basis of offering, equipment, application, and end user.

- By Offering

On the basis of offering, the industrial metrology market is segmented into hardware, software, and services. The hardware segment dominated the largest market revenue share of 59.5% in 2024, supported by the widespread adoption of coordinate measuring machines, optical digitizers, scanners, and other precision instruments across industries. Hardware is considered the backbone of metrology as it enables accurate measurements essential for quality assurance and product validation. Continuous advancements in sensor technology, enhanced resolution, and portable metrology devices have further fueled hardware demand, particularly in automotive and aerospace sectors where tolerance precision is critical.

The services segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for calibration, maintenance, and outsourced measurement services. As companies aim to optimize operational efficiency and reduce downtime, the reliance on third-party service providers for specialized expertise is increasing. The growing trend of metrology-as-a-service, supported by digital platforms, is also expanding service adoption, especially among small and mid-sized enterprises that lack in-house metrology infrastructure.

- By Equipment

On the basis of equipment, the industrial metrology market is segmented into CMM (Coordinate Measuring Machines), ODS (Optical Digitizers & Scanners), X-ray, and CT. The CMM segment dominated the market revenue share in 2024, primarily due to its established role in high-precision dimensional measurement across manufacturing and automotive applications. CMMs are widely trusted for their ability to provide repeatable and accurate data for complex parts, supporting both inline and offline inspection. Their versatility in probing techniques and integration with automation systems strengthens their leadership in the equipment category.

The ODS segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for non-contact measurement solutions and rapid digitization in manufacturing workflows. ODS systems offer speed, flexibility, and high-resolution 3D scanning capabilities, making them particularly attractive for reverse engineering, design validation, and prototyping. Their portability and ease of use further boost adoption, especially in aerospace and semiconductor industries where complex geometries require advanced scanning technologies.

- By Application

On the basis of application, the industrial metrology market is segmented into quality control & inspection, reverse engineering, mapping & modelling, and others. The quality control & inspection segment dominated the largest market revenue share in 2024, driven by its critical role in ensuring product compliance with stringent industry standards. Manufacturers across automotive, aerospace, and electronics sectors rely heavily on precise inspection to minimize defects, reduce recalls, and maintain brand reputation. The integration of advanced metrology systems in production lines further enhances efficiency, contributing to this segment’s leadership.

The reverse engineering segment is expected to register the fastest growth from 2025 to 2032, propelled by rising demand for product development, design optimization, and legacy part reproduction. With industries shifting toward customization and digital manufacturing, reverse engineering tools provide the foundation for rapid prototyping and innovation. The ability of metrology systems to capture accurate 3D models of existing products is particularly valuable in aerospace and automotive, where redesigning critical parts without original documentation is often necessary.

- By End User

On the basis of end user, the industrial metrology market is segmented into automotive, manufacturing, aerospace & defense, semiconductor, and others. The automotive sector dominated the market revenue share in 2024, owing to its high reliance on precision measurement for vehicle assembly, component testing, and compliance with safety standards. The growing trend of electric vehicles has further intensified demand for metrology solutions, as manufacturers need to validate complex battery systems, powertrains, and lightweight materials with extreme accuracy. The presence of established OEMs and large-scale production lines ensures steady adoption of advanced metrology equipment.

The semiconductor sector is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the increasing miniaturization of electronic components and the stringent need for nanoscale measurement accuracy. The complexity of semiconductor fabrication processes requires advanced metrology systems capable of analyzing microscopic patterns and ensuring defect-free production. As the demand for chips continues to surge across consumer electronics, 5G infrastructure, and AI applications, the semiconductor industry is emerging as a key driver of metrology innovation and rapid adoption.

Industrial Metrology Market Regional Analysis

- U.S. dominated the industrial metrology market with the largest revenue share in 2024, driven by strong demand from the automotive, aerospace, and semiconductor industries where precision measurement and quality assurance are critical

- The country’s leadership is reinforced by advanced R&D capabilities, widespread adoption of Industry 4.0 technologies, and significant investments in automated inspection systems

- Growing demand for high-accuracy measurement in electric vehicle production, semiconductor miniaturization, and aerospace component manufacturing further strengthens the U.S. position. The presence of leading metrology equipment providers, robust supply chains, and a highly developed manufacturing ecosystem continues to support U.S. dominance in the regional market

Canada Industrial Metrology Market Insight

Canada is projected to register the fastest CAGR in the North America market from 2025 to 2032, supported by rising investments in advanced manufacturing and aerospace industries. Growing adoption of smart factory solutions and non-contact inspection technologies is driving market expansion. Government support for innovation, combined with increasing collaborations between universities, research institutions, and metrology companies, is fostering technological advancement. Demand for high-precision systems in automotive, medical devices, and defense sectors further enhances Canada’s growth prospects.

Mexico Industrial Metrology Market Insight

Mexico is expected to witness steady growth between 2025 and 2032, fueled by the expansion of its automotive and electronics manufacturing sectors. Rising adoption of metrology systems for quality inspection, production efficiency, and compliance with export standards is boosting market penetration. The country’s growing role as a manufacturing hub for global OEMs, supported by low-cost labor and proximity to the U.S., strengthens demand for industrial metrology solutions. Increasing partnerships with international equipment providers and gradual integration of automation in local factories are further contributing to steady growth in Mexico’s market.

North America Industrial Metrology Market Share

The industrial metrology industry is primarily led by well-established companies, including:

- Bruker (U.S.)

- Baker Hughes Company (U.S.)

- Hexagon AB (Sweden)

- KEYENCE CORPORATION (Japan)

- Applied Materials, Inc. (U.S.)

- SGS Société Générale de Surveillance (Switzerland)

- FARO (U.S.)

- Intertek Group plc (U.K.)

- CREAFORM (Canada)

- Automated Precision Inc (API) (U.S.)

- Metrologic Group (France)

Latest Developments in North America Industrial Metrology Market

- In September 2024, Hexagon AB launched the Leica Absolute Tracker ATS800, integrating laser tracking and radar functionality to address inspection bottlenecks in large-scale manufacturing. By enabling precise, long-distance feature measurement and supporting tight assembly tolerances, the system enhanced efficiency in aerospace and automotive production lines. This innovation strengthened Hexagon AB’s competitive position in the industrial metrology market, demonstrating its commitment to advancing automated inspection technologies and meeting the growing demand for faster, more reliable quality control solutions

- In July 2024, Professors Andrew Webb and Bernhard Blumich were awarded the Richard R. Ernst Prize at EUROMAR 2024 for their significant contributions to nuclear magnetic resonance (NMR) and magnetic resonance research. Their recognition highlights the growing role of advanced scientific research in driving innovation within industrial metrology, particularly in non-destructive testing and material characterization. This achievement reflects how academic advancements are accelerating the development of new metrology applications and reinforcing the link between research excellence and industry progress

- In March 2023, KEYENCE CORPORATION introduced the LM-X multisensor measuring system, a high-precision platform combining optical, laser, and touch-probe measurements in a single unit. Designed to simplify workflows and eliminate time-consuming positioning, the system enabled manufacturers to achieve reliable, accurate inspection reports more efficiently. This launch boosted KEYENCE’s market standing by addressing the rising demand for multisensor solutions that improve productivity, streamline quality control, and reduce errors in diverse industrial environments

- In June 2022, Applied Materials, Inc. acquired Picosun Oy to strengthen its ICAPS (IoT, Communications, Automotive, Power, and Sensors) portfolio through Picosun’s expertise in atomic layer deposition technology. The acquisition enabled Applied Materials to better serve the growing demand for specialty semiconductors, expanding its reach into industries requiring ultra-thin coatings and nanoscale precision. This move enhanced the company’s metrology and inspection capabilities, reinforcing its position as a key player in the semiconductor manufacturing ecosystem

- In February 2021, Baker Hughes Company acquired ARMS Reliability to expand its Asset Performance Management (APM) portfolio and integrate advanced reliability solutions into its Bently Nevada platform. This acquisition enhanced Baker Hughes’ ability to deliver precise asset monitoring, lifecycle management, and predictive maintenance solutions across industries such as mining, power, and utilities. The move supported the company’s commitment to digital transformation in industrial metrology, improving operational efficiency and productivity for its global customer base

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.