Market Analysis and Insights: North America Industrial Display Market

Market Analysis and Insights: North America Industrial Display Market

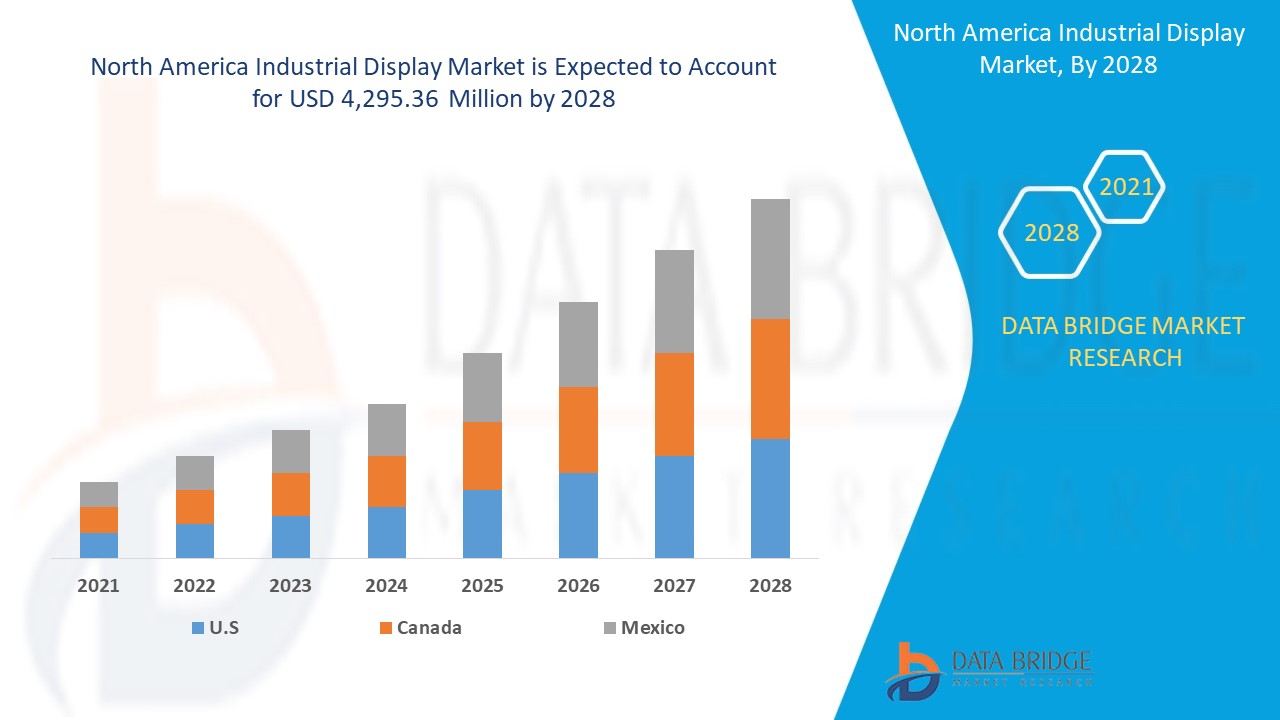

The industrial display market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with the CAGR of 6.5% in the forecast period of 2021 to 2028 and is expected to reach USD 4,295.36 million by 2028. Emergence of various technological developments and automated processes in industries are the major factors driving the growth of the industrial display market.

An industrial display system is a collection of machines used for displaying digital output. These machines include different kinds of TFT-display screens, monitors, digital signage and similar equipment. Industrial monitors or displays are designed for increased durability and to withstand the harsh environment conditions such as extreme temperatures, moisture, dust, dirt and others in industrial and commercial applications.

The rising demand for human machine interface (HMI) application in the manufacturing and process industries is propelling the growth of the industrial display market. High investments required for installing of industrial displays / panels which might hamper the growth of the industrial display market. Growing demand for digital signage applications in industries for displaying necessary information is creating opportunity for the industrial display market. Dependence of manufacturers on various suppliers to provide equipment and components is one of the biggest challenges for the industrial display market.

This industrial display market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the industrial display market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Industrial Display Market Scope and Market Size

Industrial Display Market Scope and Market Size

The industrial display market is segmented on the basis of type, panel size, technology, communication type, application and vertical. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the industrial display market is segmented into rugged displays, open frame monitors, multi-touch (P-cap) display, front display, USB type-C display, SDI display, rear mount display, panel-mount monitors, marine displays, video walls and others. In 2021, rugged displays segment holds the largest market share in industrial display market as it offers many different solutions for very harsh working environments and conditions where rough usage of technology is the norm.

- On the basis of panel size, the industrial display market is segmented into upto 14 inches, 14 inches to 21 inches, 21 to 40 inches and 40 inches and above. In 2021, upto 14 inches segment holds the largest market share in industrial display market as these components are expected to be increasingly used in small electronic devices such as smartwatches, tablet and laptops.

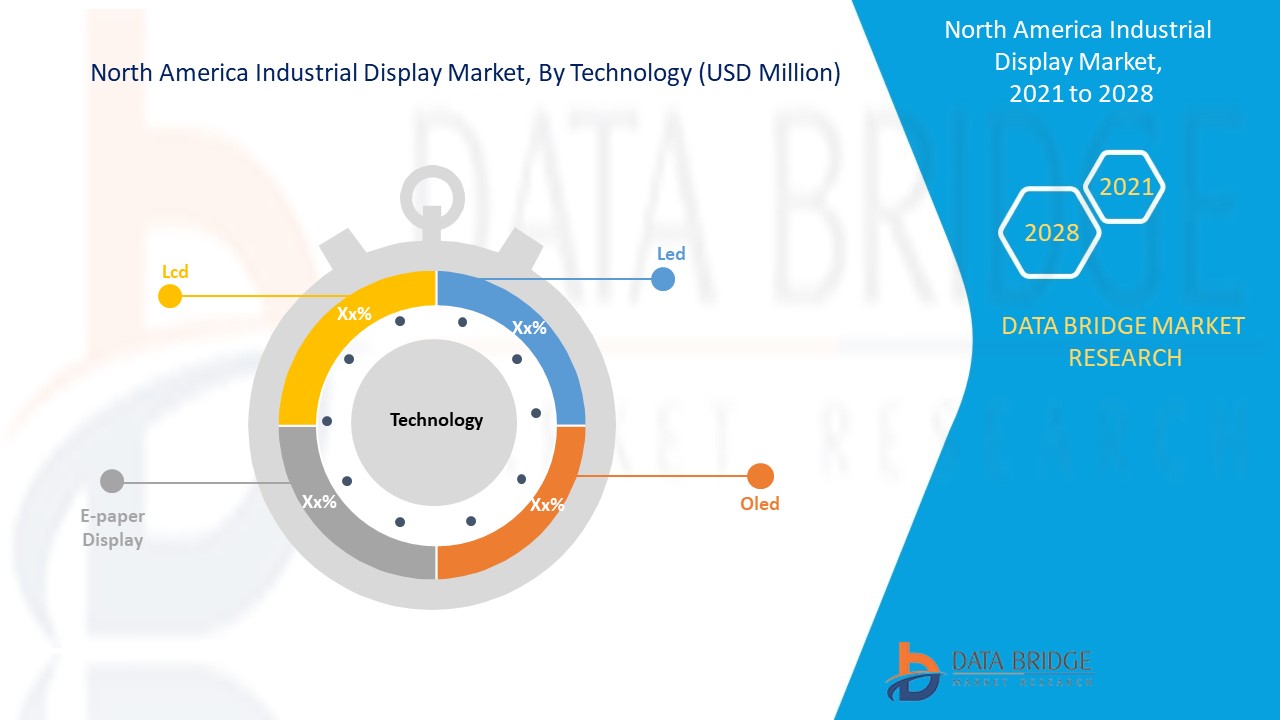

- On the basis of technology, the industrial display market is segmented into LCD, LED, OLED and e-paper display. In 2021, LCD technology holds the largest market share in industrial display market as LCD display have gaining acceptance owing to their advanced properties that include less power consumption, compact size and low price.

- On the basis of communication type, the industrial display market is segmented into serial, Ethernet, mobile network, industrial communication, RF/Zigbee/IR, Jason/MQTT and others. In 2021, serial segment holds the largest market share in industrial display market as serial communication is a communication method that uses one or two transmission lines to send and receive data and that data is continuously sent and received one bit at a time.

- On the basis of application, the industrial display market is segmented into up to HMI, remote application, interactive display, digital signage and imaging. In 2021, HMI segment holds the largest market share in industrial display market due to increasing adoption of industrial automation in manufacturing, oil & gas and process industries.

- On the basis of vertical, the industrial display market is segmented into manufacturing, energy & power, military & avionics, oil & gas, metals & mining, transportation and others. In 2021, manufacturing segment holds the largest market share in industrial display market due to increasing use of display in industries and technological shift and factory automation process.

North America Industrial Display Market Country Level Analysis

North America industrial display market is analysed and market size information is provided by the country, type, panel size, technology, communication type, application and vertical as referenced above.

The countries covered in the North America industrial display market report are the U.S., Canada and Mexico.

The U.S. has been accounted for the largest market share in the North America industrial display market owing to increased adoption of HMI application in the industries.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of HMI application

The industrial display market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in industrial display and changes in regulatory scenarios with their support for the industrial display market. The data is available for historic period 2011 to 2019.

Competitive Landscape and Industrial Display Market Share Analysis

The industrial display market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to North America industrial display market.

The major players covered in the North America industrial display market report are SAMSUNG ELECTRONICS CO., LTD., Rockwell Automation, Inc., Panasonic Corporation, Sharp NEC Display Solutions, Ltd. (a subsidiary of NEC Corporation), Japan Display Inc., General Digital Corporation, Schneider Electric, Siemens, General Electric, Emerson Electric Co., Advantech Co., Ltd., Innolux Corporation, Pepperl+Fuchs SE, Planar, AU Optronics Corp., LG Display Co., Ltd., BOE Technology UK Limited, TRICOMTEK CO.,LTD and Tianma Microelectronics Co., Ltd. among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments and acquisitions are initiated by the companies worldwide which are also accelerating the growth of industrial display market.

For instance,

- In February 2020, Sharp NEC Display Solutions, Ltd. has announced new Q Series Direct View LED Displays, an updated version of its Q Series of dvLED display products. It is launched for indoor and outdoor use for extreme environmental conditions such as dust-tight, it can operate in temperatures between minus 22 degrees and 122 degrees Fahrenheit and also can resist jets of water. With this new launch, the company has expanded its product portfolio.

Production expansion, new product development and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for industrial display.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INDUSTRIAL DISPLAY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 OVERVIEW OF VALUE CHAIN ANALYSIS OF INDUSTRIAL DISPLAY MARKET

4.2 STANDARD RATINGS FOR INDUSTRIAL DISPLAY MARKET

4.2.1 INGRESS PROTECTION (IP) RATING:

4.2.2 NATIONAL ELECTRICAL MANUFACTURERS ASSOCIATION (NEMA) RATINGS:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EMERGENCE OF VARIOUS TECHNOLOGICAL DEVELOPMENTS AND AUTOMATED PROCESSES IN INDUSTRIES

5.1.2 LED AND LCD BASED DISPLAY PRODUCTS REDUCES THE RISK OF EYE DAMAGE

5.1.3 RISING DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN MANUFACTURING AND PROCESS INDUSTRIES

5.1.4 INCREASING MANUFACTURING FACILITIES WORLDWIDE IS LEADING THE ADOPTION OF INDUSTRIAL DISPLAYS

5.1.5 AVAILABILITY OF ROBUST DISPLAY SCREEN AND WIRELESS CONNECTION

5.2 RESTRAINT

5.2.1 HIGH INVESTMENTS REQUIRED FOR INSTALLING OF INDUSTRIAL DISPLAYS / PANELS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR DIGITAL SIGNAGE APPLICATIONS IN INDUSTRIES FOR DISPLAYING NECESSARY INFORMATION

5.3.2 INCREASING DIGITALIZATION OF FACILITIES WITH INDUSTRY 4.0

5.3.3 RISING ADOPTION OF OLED DISPLAYS IN VARIOUS APPLICATIONS

5.3.4 COMPANIES ARE TRANSFORMING THEIR PROCESS FROM MANUAL TO DIGITAL

5.3.5 VARIOUS PARTNERSHIPS AND ACQUISITION IS LEADING FOR NEW PRODUCT DEVELOPMENTS AND BUSINESS EXPANSION

5.4 CHALLENGES

5.4.1 SUITABILITY OF INDUSTRIAL DISPLAY FOR ALL WEATHER CONDITIONS

5.4.2 DEPENDENCE OF MANUFACTURERS ON VARIOUS SUPPLIERS TO PROVIDE EQUIPMENT AND COMPONENTS

5.4.3 ECONOMIC CRISIS OCCURRED DUE TO VARIOUS FACTORS

6 IMPACT OF COVID-19 ON THE NORTH AMERICA INDUSTRIAL DISPLAY MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT ROLE

6.2 STRATEGIC DECISIONS FOR MARKET PLAYERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 IMPACT ON SUPPLY CHAIN

6.5 CONCLUSION

7 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY TYPE

7.1 OVERVIEW

7.2 RUGGED DISPLAY

7.2.1 TYPE

7.2.1.1 smartphone & handheld computer

7.2.1.2 tablet

7.2.1.3 laptop

7.2.1.4 mission critical display

7.2.1.5 avionic display

7.2.1.6 vehicle-mounted display

7.2.2 LEVEL OF RUGEDNESS

7.2.2.1 ultra-rugged

7.2.2.2 fully rugged

7.2.2.3 semi rugged

7.3 PANEL MOUNT MONITOR

7.4 VIDEO WALLS

7.5 OPEN FRAME MONITOR

7.6 FRONT DISPLAY

7.7 REAR MOUNT DISPLAY

7.8 MARINE DISPLAY

7.8.1 APPLICATION

7.8.1.1 hmi

7.8.1.2 digital signage

7.8.1.3 interactive display

7.8.1.4 remote monitoring

7.8.1.5 imaging

7.9 SDI DISPLAY

7.1 MULTI-TOUCH (P-CAP) DISPLAY

7.11 USB TYPE-C DISPLAY

7.12 OTHERS

8 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE

8.1 OVERVIEW

8.2 UP TO 14 INCHES

8.3 14 INCHES TO 21 INCHES

8.4 21 TO 40 INCHES

8.5 40 INCHES AND ABOVE

9 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 LCD

9.3 LED

9.3.1 FULL ARRAY

9.3.2 EDGE LIT

9.3.3 DIRECT LIT

9.4 OLED

9.4.1 AMOLED

9.4.2 PMOLED

9.5 E-PAPER DISPLAY

10 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE

10.1 OVERVIEW

10.2 SERIAL

10.3 ETHERNET

10.4 MOBILE NETWORK

10.5 INDUSTRIAL COMMUNICATION

10.6 RF/ZIGBEE/IR

10.7 JASON/MQTT

10.8 OTHERS

11 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 HMI

11.3 DIGITAL SIGNAGE

11.4 INTERACTIVE DISPLAY

11.5 REMOTE MONITORING

11.6 IMAGING

12 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 MANUFACTURING

12.2.1 LCD

12.2.2 LED

12.2.2.1 FULL ARRAY

12.2.2.2 EDGE LIT

12.2.2.3 DIRECT LIT

12.2.3 OLED

12.2.3.1 AMOLED

12.2.3.2 PMOLED

12.2.4 E-PAPER DISPLAY

12.3 ENERGY & POWER

12.3.1 LCD

12.3.2 LED

12.3.2.1 FULL ARRAY

12.3.2.2 EDGE LIT

12.3.2.3 DIRECT LIT

12.3.3 OLED

12.3.3.1 AMOLED

12.3.3.2 PMOLED

12.3.4 E-PAPER DISPLAY

12.4 MILITARY AND AVIONICS

12.4.1 LCD

12.4.2 LED

12.4.2.1 FULL ARRAY

12.4.2.2 EDGE LIT

12.4.2.3 DIRECT LIT

12.4.3 OLED

12.4.3.1 AMOLED

12.4.3.2 PMOLED

12.4.4 E-PAPER DISPLAY

12.5 OIL & GAS

12.5.1 LCD

12.5.2 LED

12.5.2.1 FULL ARRAY

12.5.2.2 EDGE LIT

12.5.2.3 DIRECT LIT

12.5.3 OLED

12.5.3.1 AMOLED

12.5.3.2 PMOLED

12.5.4 E-PAPER DISPLAY

12.6 TRANSPORTATION

12.6.1 LCD

12.6.2 LED

12.6.2.1 FULL ARRAY

12.6.2.2 EDGE LIT

12.6.2.3 DIRECT LIT

12.6.3 OLED

12.6.3.1 AMOLED

12.6.3.2 PMOLED

12.6.4 E-PAPER DISPLAY

12.7 METAL & MINING

12.7.1 LCD

12.7.2 LED

12.7.2.1 FULL ARRAY

12.7.2.2 EDGE LIT

12.7.2.3 DIRECT LIT

12.7.3 OLED

12.7.3.1 AMOLED

12.7.3.2 PMOLED

12.7.4 E-PAPER DISPLAY

12.8 OTHERS

12.8.1 LCD

12.8.2 LED

12.8.2.1 FULL ARRAY

12.8.2.2 EDGE LIT

12.8.2.3 DIRECT LIT

12.8.3 OLED

12.8.3.1 AMOLED

12.8.3.2 PMOLED

12.8.4 E-PAPER DISPLAY

13 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY REGION

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

14 COMPANY LAND SCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AU OPTRONICS CORP.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 BOE TECHNOLOGY UK LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 INNOLUX CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SAMSUNG ELECTRONICS CO., LTD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 LG DISPLAY CO., LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 TIANMA MICROELECTRONICS CO., LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ADVANTECH CO., LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 PANASONIC CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 EMERSON ELECTRIC CO.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 GENERAL DIGITAL CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL ELECTRIC

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 JAPAN DISPLAY INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 PEPPERL+FUCHS SE

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 PLANAR

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 ROCKWELL AUTOMATION, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 SCHNEIDER ELECTRIC

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 SHARP NEC DISPLAY SOLUTIONS, LTD. (A SUBSIDIARY OF NEC CORPORATION)

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 SHENZHEN TOPWAY TECHNOLOGY CO., LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 SIEMENS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 TRICOMTEK CO., LTD

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA PANEL MOUNT MONITOR IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA VIDEO WALLS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA OPEN FRAME MONITOR IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA FRONT DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA REAR MOUNT MONITOR IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA SDI DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA MULTI-TOUCH (P-CAP) DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA USB TYPE-C DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA UP TO 14 INCHES IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA 14 INCHES TO 21 INCHES IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA 21 TO 40 INCHES IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA 40 INCHES AND ABOVE IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA LCD IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA LED IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA OLED IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA E-PAPER DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA SERIAL IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA ETHERNET IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA MOBILE NETWORK IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA INDUSTRIAL COMMUNICATION IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA RF/ZIGBEE/IR IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA JASON/MQTT IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA HMI IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA DIGITAL SIGNAGE IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA INTERACTIVE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA REMOTE MONITORING IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA IMAGING IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 47 NORTH AMERICA ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 48 NORTH AMERICA ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 49 NORTH AMERICA ENERGY AND POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 50 NORTH AMERICA ENERGY AND POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 51 NORTH AMERICA MILITARY AND AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 52 NORTH AMERICA MILITARY AND AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 53 NORTH AMERICA MILITARY AND AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 54 NORTH AMERICA MILITARY AND AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 55 NORTH AMERICA OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 56 NORTH AMERICA OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 57 NORTH AMERICA OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 58 NORTH AMERICA OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 59 NORTH AMERICA TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 60 NORTH AMERICA TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 61 NORTH AMERICA TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 62 NORTH AMERICA TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 63 NORTH AMERICA METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 64 NORTH AMERICA METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 65 NORTH AMERICA METAL & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 66 NORTH AMERICA METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 67 NORTH AMERICA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 68 NORTH AMERICA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 69 NORTH AMERICA OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 71 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 72 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 73 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 74 NORTH AMERICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 75 NORTH AMERICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 76 NORTH AMERICA MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 77 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 78 NORTH AMERICA LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 79 NORTH AMERICA OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 80 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 81 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 82 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 83 NORTH AMERICA INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 84 NORTH AMERICA MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 85 NORTH AMERICA MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 86 NORTH AMERICA MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 87 NORTH AMERICA ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 88 NORTH AMERICA ENERGY & POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 89 NORTH AMERICA ENERGY & POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 90 NORTH AMERICA MILITARY & AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 91 NORTH AMERICA MILITARY & AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 92 NORTH AMERICA MILITARY & AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 93 NORTH AMERICA OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 94 NORTH AMERICA OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 95 NORTH AMERICA OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 96 NORTH AMERICA TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 97 NORTH AMERICA TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 98 NORTH AMERICA TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 99 NORTH AMERICA METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 100 NORTH AMERICA METAK & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 101 NORTH AMERICA METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 102 NORTH AMERICA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 103 NORTH AMERICA OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 104 NORTH AMERICA OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 105 U.S. INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 106 U.S. RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 107 U.S. RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 108 U.S. MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 109 U.S. INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 110 U.S. LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 111 U.S. OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 112 U.S. INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 113 U.S. INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 114 U.S. INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 115 U.S. INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 116 U.S. MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 117 U.S. MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 118 U.S. MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 119 U.S. ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 120 U.S. ENERGY & POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 121 U.S. ENERGY & POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 122 U.S. MILITARY & AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 123 U.S. MILITARY & AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 124 U.S. MILITARY & AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 125 U.S. OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 126 U.S. OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 127 U.S. OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 128 U.S. TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 129 U.S. TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 130 U.S. TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 131 U.S. METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 132 U.S. METAL & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 133 U.S. METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 134 U.S. OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 135 U.S. OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 136 U.S. OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 137 CANADA INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 138 CANADA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 139 CANADA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 140 CANADA MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 141 CANADA INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 142 CANADA LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 143 CANADA OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 144 CANADA INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 145 CANADA INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 146 CANADA INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 147 CANADA INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 148 CANADA MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 149 CANADA MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 150 CANADA MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 151 CANADA ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 152 CANADA ENERGY & POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 153 CANADA ENERGY & POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 154 CANADA MILITARY & AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 155 CANADA MILITARY & AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 156 CANADA MILITARY & AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 157 CANADA OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 158 CANADA OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 159 CANADA OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 160 CANADA TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 161 CANADA TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 162 CANADA TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 163 CANADA METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 164 CANADA METAL & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 165 CANADA METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 166 CANADA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 167 CANADA OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 168 CANADA OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 169 MEXICO INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 170 MEXICO RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 171 MEXICO RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 172 MEXICO MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 173 MEXICO INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 174 MEXICO LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 175 MEXICO OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 176 MEXICO INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 177 MEXICO INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 178 MEXICO INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 179 MEXICO INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 180 MEXICO MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 181 MEXICO MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 182 MEXICO MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 183 MEXICO ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 184 MEXICO ENERGY & POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 185 MEXICO ENERGY & POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 186 MEXICO MILITARY & AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 187 MEXICO MILITARY & AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 188 MEXICO MILITARY & AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 189 MEXICO OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 190 MEXICO OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 191 MEXICO OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 192 MEXICO TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 193 MEXICO TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 194 MEXICO TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 195 MEXICO METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 196 MEXICO METAL & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 197 MEXICO METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 198 MEXICO OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 199 MEXICO OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 200 MEXICO OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN MANUFACTURING AND PROCESS INDUSTRIES IS EXPECTED TO DRIVE THE NORTH AMERICA INDUSTRIAL DISPLAY MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 RUGGED DISPLAYS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA INDUSTRIAL DISPLAY MARKET IN 2021 & 2028

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE NORTH AMERICA INDUSTRIAL DISPLAY MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR INDUSTRIAL DISPLAY MANUFACTURERS IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 16 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA INDUSTRIAL DISPLAY MARKET

FIGURE 17 SHIPMENTS PROJECTION OF INSTALLATION BASED DIGITAL SIGNAGE DISPLAYS

FIGURE 18 OLED SMARTPHONE PANEL SHIPMENT

FIGURE 1 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY TYPE, 2020

FIGURE 2 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY PANEL SIZE, 2020

FIGURE 3 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY, 2020

FIGURE 4 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY COMMUNICATION TYPE, 2020

FIGURE 5 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY APPLICATION, 2020

FIGURE 6 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY VERTICAL, 2020

FIGURE 7 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: SNAPSHOT (2020)

FIGURE 8 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY REGION (2020)

FIGURE 9 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY REGION (2021 & 2028)

FIGURE 10 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY REGION (2020 & 2028)

FIGURE 11 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY TYPE (2021-2028)

FIGURE 12 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: SNAPSHOT (2020)

FIGURE 13 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020)

FIGURE 14 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2021 & 2028)

FIGURE 15 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020 & 2028)

FIGURE 16 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: BY TYPE (2021-2028)

FIGURE 17 NORTH AMERICA INDUSTRIAL DISPLAY MARKET: COMPANY SHARE 2020 (%)

North America Industrial Display Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Industrial Display Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Industrial Display Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.